Key Insights

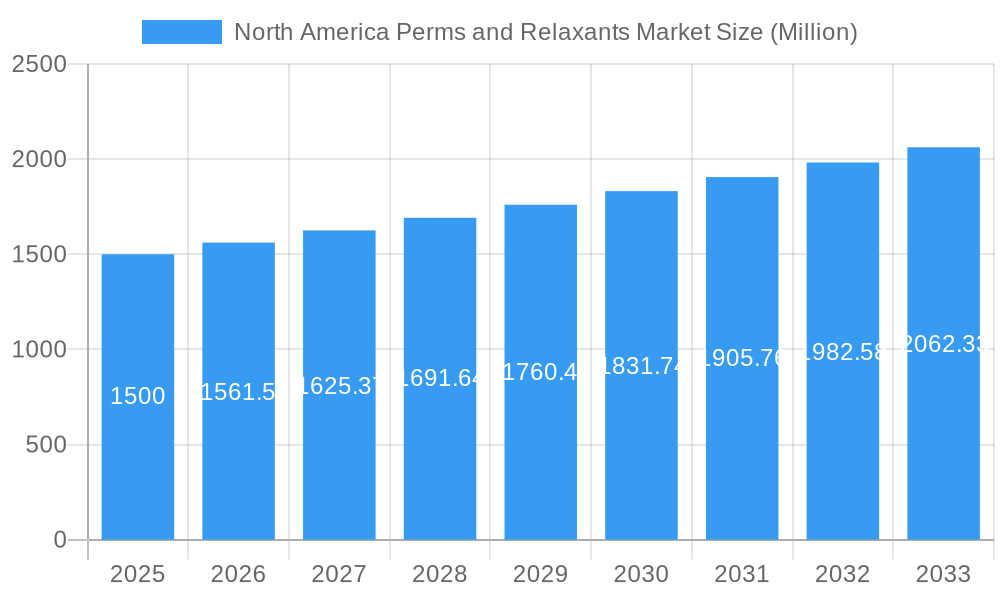

The North American Perms and Relaxants Market, projected to reach $287.02 billion by 2033 with a Compound Annual Growth Rate (CAGR) of 5.21% from a base year of 2024, is poised for significant expansion. Key growth drivers include escalating demand for advanced hair styling solutions among younger demographics and increasing consumer purchasing power across the region. Innovations in product development, focusing on gentler formulations and enhanced efficacy, are broadening consumer appeal. The proliferation of e-commerce channels further amplifies market accessibility and revenue streams.

North America Perms and Relaxants Market Market Size (In Billion)

Conversely, growing consumer awareness regarding potential hair damage and the burgeoning natural hair care movement present challenges to market growth. Segmentation analysis indicates a stronger performance within the 'perms' category compared to 'relaxants,' influenced by evolving style trends and wider applicability across various hair types. Supermarkets and hypermarkets remain the dominant distribution channels, followed by specialty stores and online platforms. Leading market participants, including L'Oreal S.A., Henkel AG & Co. KGaA, and Procter & Gamble Co., are actively driving competition through continuous product innovation, targeted marketing strategies, and diversified distribution networks. Future market trajectory will be shaped by the development of safer, more effective products and an adaptation to consumer preferences leaning towards natural and sustainable hair care. Granular regional analysis within North America (United States, Canada, Mexico) is vital for pinpointing specific market dynamics and growth opportunities.

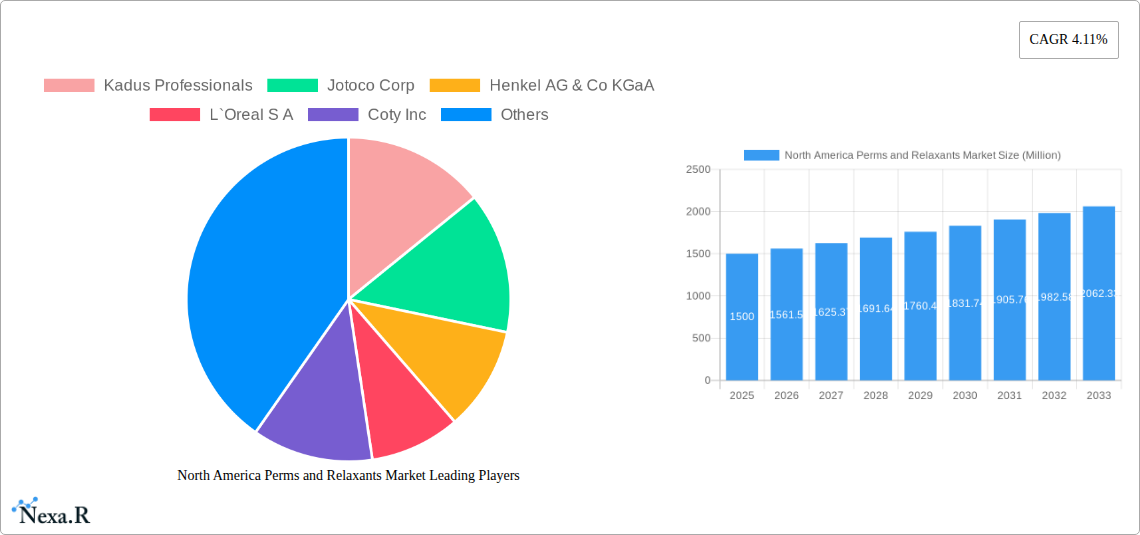

North America Perms and Relaxants Market Company Market Share

North America Perms and Relaxants Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America perms and relaxants market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with 2025 as the base year and estimated year. This analysis is crucial for industry professionals, investors, and anyone seeking to understand this dynamic sector within the broader Hair Care market. The market is segmented by product type (perms and relaxants) and distribution channel (supermarkets/hypermarkets, convenience stores, specialist retailers, online stores, and other distribution channels).

North America Perms and Relaxants Market Market Dynamics & Structure

The North American perms and relaxants market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. The market is characterized by continuous technological innovation, driven by consumer demand for safer, more effective, and gentler products. Stringent regulatory frameworks governing the composition and safety of these products significantly influence market dynamics. The market experiences competition from alternative hair styling methods, such as keratin treatments and other chemical-free options. The demographic shift towards a more diverse population and increasing awareness of hair health are key end-user factors influencing market growth. Mergers and acquisitions (M&A) activity has been moderate in recent years, primarily focused on consolidating market share and expanding product portfolios.

- Market Concentration: Moderately Concentrated (xx% market share held by top 5 players in 2025).

- Technological Innovation: Focus on gentler formulations, improved efficacy, and reduced damage.

- Regulatory Framework: Stringent safety standards and labeling regulations impact product development and launch.

- Competitive Substitutes: Keratin treatments, natural hair styling methods.

- End-User Demographics: Growing demand driven by diverse hair types and increasing awareness of hair care.

- M&A Activity: Moderate level of consolidation, with xx M&A deals in the past 5 years. (approx. value xx Million USD)

North America Perms and Relaxants Market Growth Trends & Insights

The North America perms and relaxants market experienced [XXX - insert specific growth data here, e.g., a steady growth trajectory] during the historical period (2019-2024), driven by [XXX - insert specific drivers e.g., increasing consumer spending on personal care products and the growing popularity of salon treatments]. The market size is estimated at xx million units in 2025, and is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). The adoption rate of perms has seen a slight decline, while relaxants show a more consistent growth, fueled by increasing demand for straightening treatments. Technological disruptions, such as the introduction of gentler chemical formulations and improved application techniques, have contributed positively to market growth. Consumer behavior shifts toward more natural and ethically sourced products are also influencing product development and marketing strategies. Market penetration is highest in urban areas, with significant growth potential remaining in rural regions and underserved demographics. Further data analysis into consumer preferences and evolving trends will be crucial for future projections.

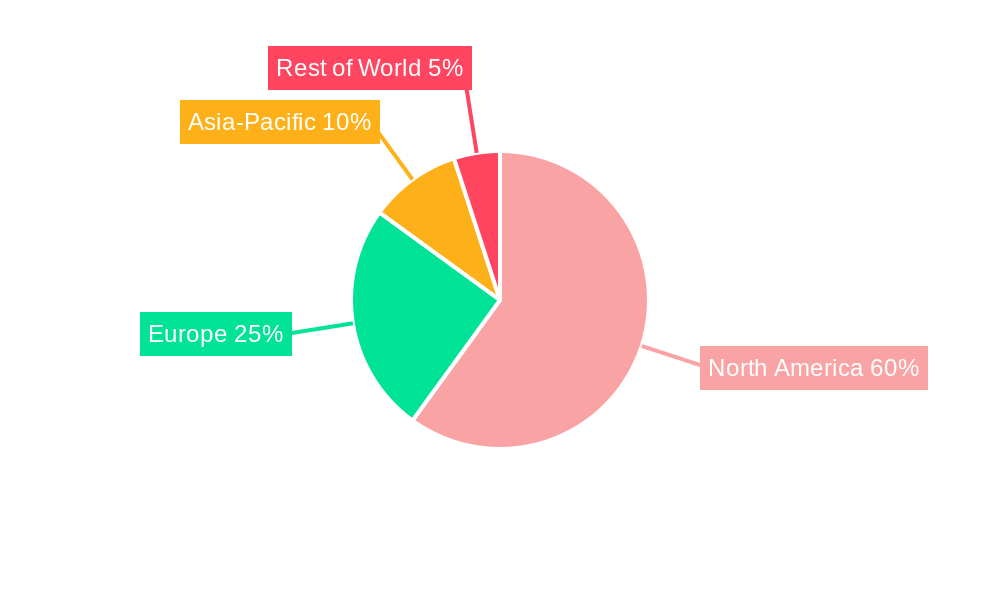

Dominant Regions, Countries, or Segments in North America Perms and Relaxants Market

The [Specify dominant region, e.g., US] leads the North America perms and relaxants market, accounting for the largest market share (xx%) in 2025. This dominance is driven by factors such as higher disposable incomes, greater awareness of hair care, and a more established salon culture. The perms segment currently holds a larger market share (xx%) compared to relaxants (xx%), but the relaxants segment is projected to experience faster growth over the forecast period driven by [State specific reasons for relaxant segment's growth].

By Product Type:

- Perms: High market share due to established popularity and wide availability.

- Relaxants: Faster growth rate driven by increasing demand for straight hair styles.

By Distribution Channel:

- Specialist Retailers: Dominant due to professional advice and wider product variety.

- Supermarkets/Hypermarkets: Significant share, offering convenience and affordability.

- Online Stores: Growing rapidly, driven by e-commerce penetration and convenience.

Key Drivers:

- High disposable income levels in major metropolitan areas.

- Growing adoption of sophisticated salon treatments.

- The increasing influence of social media on consumer preferences.

- The growing preference for convenient solutions for various hair types.

North America Perms and Relaxants Market Product Landscape

The North American perms and relaxants market offers a range of products catering to different hair types and desired outcomes. Innovations focus on minimizing hair damage, reducing harsh chemical exposure, and providing longer-lasting results. Products incorporating natural ingredients and advanced conditioning technologies are gaining traction. Key performance metrics include curl definition, straightening effectiveness, hair damage minimization, and ease of application. Unique selling propositions often highlight aspects like gentler formulas, specific hair type targeting, or advanced conditioning benefits. Recent advancements include the introduction of at-home kits and tools optimized for these treatments.

Key Drivers, Barriers & Challenges in North America Perms and Relaxants Market

Key Drivers:

The growing popularity of styling options, coupled with increasing disposable incomes and a rising emphasis on personal appearance, fuels market expansion. Advancements in product technology, resulting in gentler formulas and more effective treatments, further stimulate growth. Moreover, expanding professional salon services and convenient at-home kits contribute to market expansion.

Key Challenges and Restraints:

The market faces challenges from increasing consumer awareness of the potential damaging effects of chemical treatments. Stringent regulations regarding ingredient safety and product labeling add to developmental costs. Competition from natural alternatives and non-chemical straightening methods poses a significant challenge. Furthermore, fluctuations in raw material costs and supply chain disruptions can impact pricing and availability. The estimated financial impact of these challenges is a reduction in annual growth by approximately xx% in the next five years.

Emerging Opportunities in North America Perms and Relaxants Market

Growing interest in organic and sustainably sourced ingredients presents significant opportunities. The market can tap into untapped markets by creating products catering to specific ethnic hair types or addressing niche needs. Development of hybrid products that blend chemical treatments with natural conditioners offers a substantial growth path. Evolving consumer preferences towards customization and personalized treatments opens new avenues for growth, including developing products for specific hair problems and lifestyles.

Growth Accelerators in the North America Perms and Relaxants Market Industry

Technological innovations in gentler chemical formulations and advanced delivery systems are major catalysts. Strategic partnerships between manufacturers, salons, and retailers enhance product reach and distribution efficiency. Expanding into untapped regional markets, particularly within diverse demographic groups, provides ample opportunity for growth. Focusing on personalized treatments tailored to individual hair needs can further expand market share.

Key Players Shaping the North America Perms and Relaxants Market Market

- Kadus Professionals

- Jotoco Corp

- Henkel AG & Co KGaA

- L'Oreal S A

- Coty Inc

- Makarizo International

- Procter & Gamble Co *List Not Exhaustive

Notable Milestones in North America Perms and Relaxants Market Sector

- 2020: Increased focus on sustainability in product packaging and ingredients.

- 2021: Launch of several new at-home perm and relaxer kits by major players.

- 2022: Introduction of innovative technology reducing hair damage during treatments.

- 2023: Several M&A activities to consolidate market share. (Specific details of M&As can be added here if available).

- 2024: Growing preference for natural ingredients in formulation. (Specific Examples can be added here if available)

In-Depth North America Perms and Relaxants Market Market Outlook

The North America perms and relaxants market is poised for continued growth, driven by ongoing technological innovations, increasing consumer demand, and strategic market expansions by key players. The focus on gentler formulas, personalized treatments, and sustainable practices will shape future market dynamics. Opportunities exist in tapping into underserved demographics and exploring new product formulations that cater to evolving consumer preferences. Strategic partnerships and market consolidation will continue to reshape the competitive landscape, offering further opportunities for growth and innovation.

North America Perms and Relaxants Market Segmentation

-

1. Product Type

- 1.1. Perms

- 1.2. Relaxants

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Retailers

- 2.4. Online Stores

- 2.5. Other Distribution Channels

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Perms and Relaxants Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Perms and Relaxants Market Regional Market Share

Geographic Coverage of North America Perms and Relaxants Market

North America Perms and Relaxants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Natural/Organic Products; Increased Focus on Facial Care Regimes

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products Restraints Growth

- 3.4. Market Trends

- 3.4.1. Relaxants dominate the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Perms and Relaxants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Perms

- 5.1.2. Relaxants

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Retailers

- 5.2.4. Online Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Perms and Relaxants Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Perms

- 6.1.2. Relaxants

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Specialist Retailers

- 6.2.4. Online Stores

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Perms and Relaxants Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Perms

- 7.1.2. Relaxants

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Specialist Retailers

- 7.2.4. Online Stores

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Perms and Relaxants Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Perms

- 8.1.2. Relaxants

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Specialist Retailers

- 8.2.4. Online Stores

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Perms and Relaxants Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Perms

- 9.1.2. Relaxants

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Specialist Retailers

- 9.2.4. Online Stores

- 9.2.5. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Kadus Professionals

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Jotoco Corp

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Henkel AG & Co KGaA

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 L`Oreal S A

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Coty Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Makarizo International

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Procter & Gamble Co*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Kadus Professionals

List of Figures

- Figure 1: North America Perms and Relaxants Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Perms and Relaxants Market Share (%) by Company 2025

List of Tables

- Table 1: North America Perms and Relaxants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America Perms and Relaxants Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: North America Perms and Relaxants Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Perms and Relaxants Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: North America Perms and Relaxants Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Perms and Relaxants Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 7: North America Perms and Relaxants Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: North America Perms and Relaxants Market Volume K Units Forecast, by Region 2020 & 2033

- Table 9: North America Perms and Relaxants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: North America Perms and Relaxants Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 11: North America Perms and Relaxants Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: North America Perms and Relaxants Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 13: North America Perms and Relaxants Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: North America Perms and Relaxants Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 15: North America Perms and Relaxants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Perms and Relaxants Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: North America Perms and Relaxants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: North America Perms and Relaxants Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 19: North America Perms and Relaxants Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 20: North America Perms and Relaxants Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 21: North America Perms and Relaxants Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: North America Perms and Relaxants Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 23: North America Perms and Relaxants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: North America Perms and Relaxants Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: North America Perms and Relaxants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: North America Perms and Relaxants Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 27: North America Perms and Relaxants Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 28: North America Perms and Relaxants Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 29: North America Perms and Relaxants Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: North America Perms and Relaxants Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 31: North America Perms and Relaxants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: North America Perms and Relaxants Market Volume K Units Forecast, by Country 2020 & 2033

- Table 33: North America Perms and Relaxants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 34: North America Perms and Relaxants Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 35: North America Perms and Relaxants Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 36: North America Perms and Relaxants Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 37: North America Perms and Relaxants Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: North America Perms and Relaxants Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: North America Perms and Relaxants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: North America Perms and Relaxants Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Perms and Relaxants Market?

The projected CAGR is approximately 5.21%.

2. Which companies are prominent players in the North America Perms and Relaxants Market?

Key companies in the market include Kadus Professionals, Jotoco Corp, Henkel AG & Co KGaA, L`Oreal S A, Coty Inc, Makarizo International, Procter & Gamble Co*List Not Exhaustive.

3. What are the main segments of the North America Perms and Relaxants Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 287.02 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Natural/Organic Products; Increased Focus on Facial Care Regimes.

6. What are the notable trends driving market growth?

Relaxants dominate the market.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products Restraints Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Perms and Relaxants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Perms and Relaxants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Perms and Relaxants Market?

To stay informed about further developments, trends, and reports in the North America Perms and Relaxants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence