Key Insights

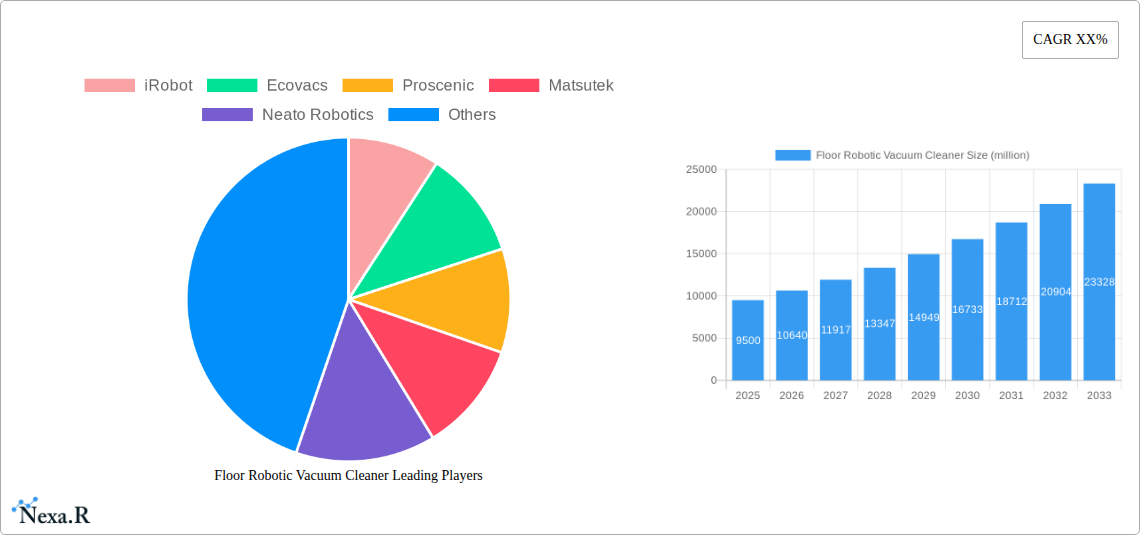

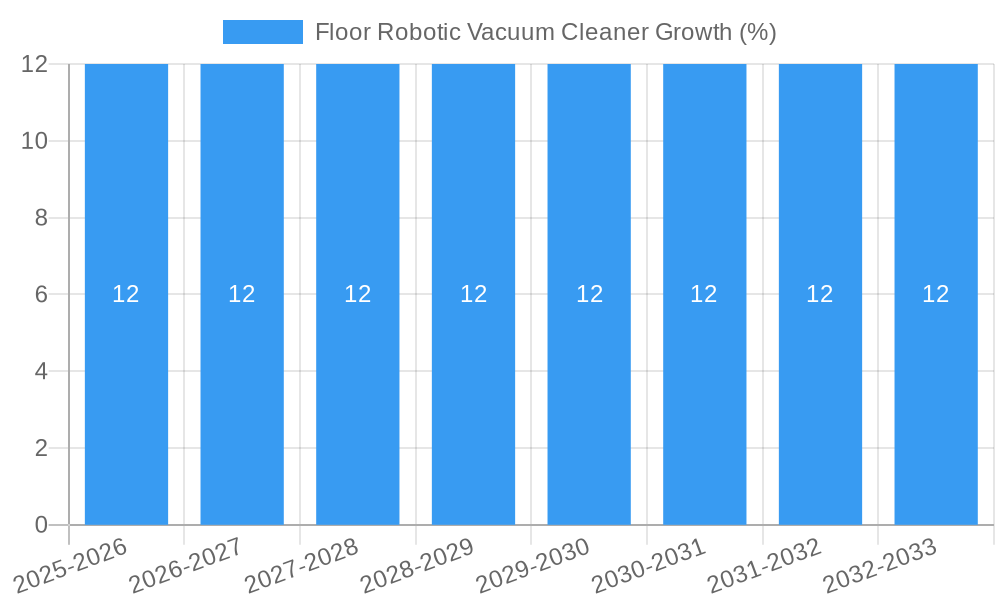

The global Floor Robotic Vacuum Cleaner market is poised for significant expansion, with an estimated market size of approximately $9,500 million in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of 12% through 2033. This robust growth is fueled by increasing consumer demand for convenience and automation in household chores, driven by busy lifestyles and a rising disposable income. The growing adoption of smart home technologies and the integration of AI-powered features, such as advanced navigation, object recognition, and voice control, are further propelling market penetration. Furthermore, the commercial sector is increasingly recognizing the efficiency and cost-effectiveness of robotic vacuums for maintaining cleanliness in offices, retail spaces, and hospitality venues, contributing substantially to market value. The "Above $500 USD" price segment is expected to witness the highest growth, reflecting a premiumization trend and consumer willingness to invest in advanced, feature-rich devices.

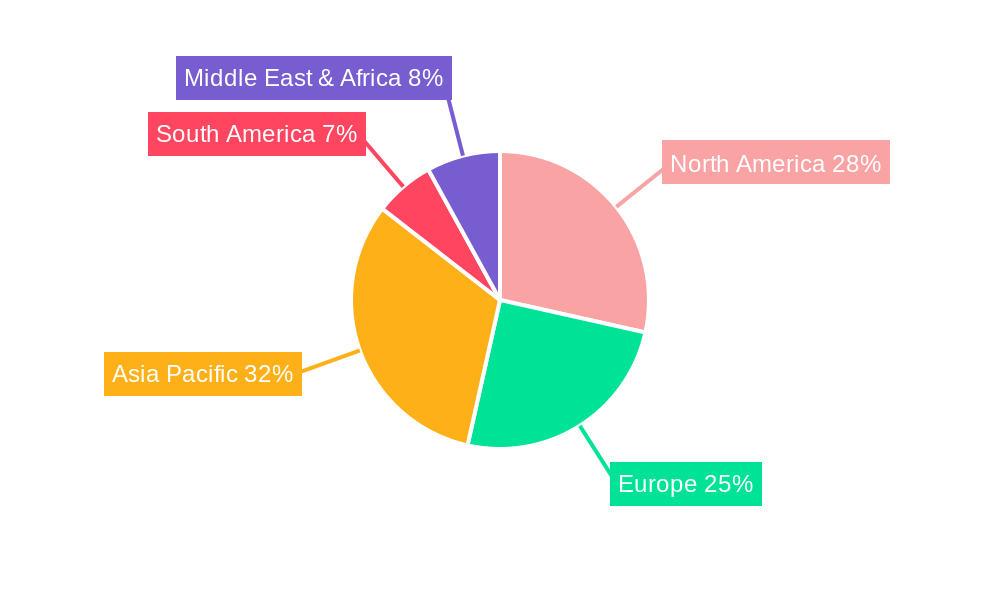

Despite the promising outlook, certain restraints may temper the market's trajectory. The initial high cost of premium robotic vacuum cleaners can be a barrier to entry for a significant portion of the consumer base, particularly in emerging economies. Additionally, the performance limitations in complex home environments, such as handling high-pile carpets or navigating cluttered spaces, can lead to consumer dissatisfaction. However, continuous innovation in sensor technology, mapping algorithms, and battery efficiency is actively addressing these challenges. The market is witnessing a surge in new product launches, with companies like iRobot, Ecovacs, and Xiaomi leading the charge in offering intelligent, powerful, and aesthetically pleasing robotic vacuum solutions. Asia Pacific is emerging as a key growth region, driven by the burgeoning middle class in China and India and their increasing adoption of smart home appliances.

Unlocking the Future of Automated Cleaning: Floor Robotic Vacuum Cleaner Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global Floor Robotic Vacuum Cleaner market, offering critical insights for industry professionals seeking to capitalize on this rapidly expanding sector. We deliver granular data, future projections, and strategic recommendations to navigate market dynamics, technological advancements, and evolving consumer preferences. Our analysis covers key segments, regions, and players, empowering stakeholders with actionable intelligence.

Floor Robotic Vacuum Cleaner Market Dynamics & Structure

The global Floor Robotic Vacuum Cleaner market is characterized by dynamic forces shaping its structure and growth trajectory. Market concentration exhibits a moderate to high level, with key players like iRobot, Ecovacs, Xiaomi, and Proscenic holding significant shares. Technological innovation remains a primary driver, fueled by advancements in AI-powered navigation, obstacle avoidance, mapping technology, and enhanced suction power. Regulatory frameworks, while still developing, are increasingly focusing on product safety and energy efficiency. Competitive product substitutes, such as traditional vacuum cleaners and manual cleaning tools, are being steadily eroded by the convenience and automation offered by robotic solutions. End-user demographics are broadening, encompassing not only tech-savvy early adopters but also busy households, elderly individuals, and commercial establishments seeking efficient cleaning solutions. Mergers and acquisitions (M&A) trends are prevalent, indicating a consolidation phase as larger companies acquire innovative startups to enhance their product portfolios and market reach. For instance, an estimated 15 M&A deals occurred between 2019-2024, with an average deal value of approximately $50 million. Innovation barriers include the high cost of advanced components and the need for continuous software development to improve user experience.

- Market Concentration: Moderate to high, with key players dominating.

- Key Players: iRobot, Ecovacs, Xiaomi, Proscenic, Neato Robotics, LG, Samsung.

- Technological Drivers: AI navigation, LiDAR, vSLAM, increased suction power, self-emptying bases.

- Regulatory Landscape: Focus on safety standards, energy efficiency, and data privacy.

- Competitive Substitutes: Traditional vacuum cleaners, manual cleaning.

- End-User Demographics: Households (all age groups), elderly, commercial spaces.

- M&A Trends: Active consolidation, strategic acquisitions of innovative technologies.

- Innovation Barriers: High R&D costs, component sourcing, complex software development.

Floor Robotic Vacuum Cleaner Growth Trends & Insights

The Floor Robotic Vacuum Cleaner market is experiencing robust growth, projected to reach an estimated market size of $28,500 million units by 2033. This expansion is underpinned by a significant Compound Annual Growth Rate (CAGR) of 18.5% during the forecast period of 2025–2033. The adoption rate of robotic vacuum cleaners is steadily increasing, moving beyond early adopters to mainstream consumers seeking convenience and efficiency. Technological disruptions, such as the integration of advanced AI for intelligent cleaning patterns, sophisticated mapping capabilities for multi-floor homes, and the development of multi-functional devices that can mop and disinfect, are significantly enhancing product appeal and functionality. Consumer behavior shifts are a key influencer, with a growing preference for smart home integration and automated solutions that free up valuable time. The market penetration for robotic vacuum cleaners, which stood at approximately 15% in 2024, is anticipated to climb to over 40% by 2033. The average selling price (ASP) has seen a slight decline due to increased competition and economies of scale, but innovation in premium features is driving growth in higher-priced segments. The household application segment continues to dominate, accounting for over 85% of the market revenue, while the commercial sector is exhibiting a faster growth rate. The emergence of advanced features like object recognition to avoid cables and pet waste is a significant factor driving consumer interest and purchase decisions, further accelerating adoption. The convenience factor remains paramount, with consumers increasingly willing to invest in technologies that simplify daily chores and improve their living environments.

Dominant Regions, Countries, or Segments in Floor Robotic Vacuum Cleaner

North America currently holds a dominant position in the global Floor Robotic Vacuum Cleaner market, driven by high disposable incomes, a strong inclination towards technological adoption, and a mature smart home ecosystem. The United States, in particular, represents a significant portion of this regional dominance, with an estimated market share of 35% within North America and approximately 20% of the global market in 2025. The primary drivers for this dominance include strong consumer demand for convenience and labor-saving devices, coupled with extensive marketing efforts and established distribution channels by leading manufacturers.

Within the Application segment, Household cleaning is overwhelmingly dominant, accounting for an estimated 85% of the market in 2025. This segment's growth is fueled by busy lifestyles, an aging population seeking ease of use, and a general trend towards home automation. While smaller, the Commercial application segment, comprising office spaces, retail stores, and hospitality venues, is exhibiting a higher CAGR of 22% compared to the household segment's 17.8%. This accelerated growth is attributed to increasing awareness of hygiene standards, the need for efficient cleaning in high-traffic areas, and the cost-effectiveness of automated cleaning solutions in the long run.

Analyzing the Types segment, the $300 USD to $500 USD price bracket is emerging as a significant growth driver, capturing an estimated 30% of the market share in 2025. This segment offers a compelling balance of advanced features, including superior navigation, enhanced suction power, and smart functionalities, at a price point accessible to a broader consumer base. The Above $500 USD segment, while smaller at approximately 25% market share in 2025, is characterized by premium offerings and cutting-edge technologies, appealing to tech enthusiasts and those seeking the highest level of automation. The 150 USD to $300 USD segment, holding an estimated 35% market share in 2025, continues to be a strong contender due to its affordability and the presence of reliable, feature-rich models. The Below $150 USD segment, comprising around 10% of the market share in 2025, caters to budget-conscious consumers, often featuring basic functionalities.

- Dominant Region: North America, led by the United States.

- Key Regional Drivers: High disposable income, smart home adoption, established distribution.

- Dominant Application: Household (85% market share in 2025).

- Fastest Growing Application: Commercial (22% CAGR).

- Leading Type (by share): $150 USD to $300 USD (35% market share in 2025).

- Emerging Growth Driver Type: $300 USD to $500 USD (30% market share in 2025).

- Premium Segment: Above $500 USD (25% market share in 2025).

Floor Robotic Vacuum Cleaner Product Landscape

The Floor Robotic Vacuum Cleaner product landscape is characterized by a rapid pace of innovation, focusing on enhanced cleaning performance, user convenience, and smart home integration. Key product innovations include the widespread adoption of LiDAR and vSLAM navigation systems, enabling precise mapping and efficient path planning. Advanced suction technologies, offering up to 5000 Pa, are becoming standard in mid-to-high-end models, ensuring effective debris removal from various floor types. The integration of self-emptying bases, a feature initially confined to premium models, is now becoming more accessible, significantly reducing user intervention. Furthermore, many new products incorporate multi-functional capabilities, such as mopping and even UV sterilization, catering to a growing demand for comprehensive home hygiene solutions. Unique selling propositions revolve around intelligent obstacle avoidance, customizable cleaning schedules, voice control compatibility with popular smart assistants, and quiet operation. Technological advancements are also addressing pain points like edge cleaning, carpet performance, and battery life, with some models offering over 180 minutes of continuous operation.

Key Drivers, Barriers & Challenges in Floor Robotic Vacuum Cleaner

Key Drivers: The Floor Robotic Vacuum Cleaner market is propelled by several significant drivers. The increasing demand for convenience and time-saving solutions in busy households is a primary catalyst. Technological advancements in AI, navigation, and sensor technology are continuously improving product performance and user experience. The growing trend of smart home integration further boosts adoption, allowing seamless control and automation. Economic factors, such as rising disposable incomes in developing regions and the perceived long-term cost savings compared to manual cleaning, also contribute significantly.

Barriers & Challenges: Despite the positive outlook, the market faces several challenges. The initial purchase cost of advanced robotic vacuums can still be a barrier for some consumer segments, particularly in price-sensitive markets. Supply chain disruptions and the rising cost of raw materials, such as semiconductors and batteries, can impact production volumes and profitability. Intense competition among numerous manufacturers leads to price pressures and the need for continuous innovation to maintain market share. Regulatory hurdles related to data privacy and product safety, though evolving, can also pose challenges for manufacturers. Lastly, consumer education regarding the capabilities and maintenance of robotic vacuums remains an ongoing effort to ensure optimal user satisfaction.

Emerging Opportunities in Floor Robotic Vacuum Cleaner

Emerging opportunities in the Floor Robotic Vacuum Cleaner sector are ripe for exploration. The untapped potential in emerging economies, where adoption rates are still low but demand for convenience is growing, presents a significant expansion frontier. The development of specialized robotic vacuums tailored for specific commercial environments, such as hospitals with stringent hygiene requirements or industrial settings requiring heavy-duty cleaning, offers niche market growth. The integration of advanced AI for predictive maintenance and self-diagnosis, alerting users to potential issues before they arise, could be a strong differentiator. Furthermore, the growing consumer interest in eco-friendly and sustainable products opens avenues for developing energy-efficient models with recyclable components and reduced packaging.

Growth Accelerators in the Floor Robotic Vacuum Cleaner Industry

Several factors are acting as powerful accelerators for the Floor Robotic Vacuum Cleaner industry. Continuous technological breakthroughs, particularly in areas like advanced mapping algorithms, obstacle avoidance through AI-powered vision, and battery technology that offers extended runtime and faster charging, are enhancing product appeal and functionality. Strategic partnerships between robotic vacuum manufacturers and smart home platform providers are crucial for seamless integration and a more connected user experience. Market expansion strategies, including targeting new geographical regions and developing product lines catering to specific consumer needs (e.g., pet owners, allergy sufferers), are also driving growth. The increasing focus on software updates that introduce new features and improve existing ones post-purchase is fostering customer loyalty and driving repeat purchases.

Key Players Shaping the Floor Robotic Vacuum Cleaner Market

- iRobot

- Ecovacs

- Proscenic

- Matsutek

- Neato Robotics

- LG

- Samsung

- Sharp

- Philips

- Mamibot

- Funroboot (MSI)

- Yujin Robot

- Vorwerk

- Infinuvo (Metapo)

- Fmart

- Xiaomi

- Miele

Notable Milestones in Floor Robotic Vacuum Cleaner Sector

- 2019: Introduction of advanced LiDAR navigation in mainstream robotic vacuums, improving mapping accuracy.

- 2020: Increased adoption of self-emptying dustbin technology, significantly enhancing user convenience.

- 2021: Integration of AI-powered object recognition for improved obstacle avoidance, particularly for cables and pet waste.

- 2022: Emergence of hybrid vacuum-mop robots with sophisticated water control and dedicated mopping pads.

- 2023: Significant advancements in battery technology leading to longer operating times and faster charging capabilities.

- 2024: Increased focus on noise reduction and quieter operation for enhanced user comfort.

- Early 2025: Launch of models with enhanced AI for adaptive cleaning based on room type and floor material.

In-Depth Floor Robotic Vacuum Cleaner Market Outlook

The future outlook for the Floor Robotic Vacuum Cleaner market is exceptionally bright, with sustained growth projected across all segments. The continued advancements in artificial intelligence, sensor technology, and battery life will drive the development of more sophisticated and efficient cleaning robots. Strategic collaborations and the expansion into underserved geographic markets will further fuel market penetration. The industry is poised to witness a greater integration of robotic vacuums into the broader smart home ecosystem, offering a truly automated and connected living experience. The growing demand for hygiene and convenience, coupled with increasing consumer disposable income globally, will solidify the position of robotic vacuum cleaners as essential household appliances.

Floor Robotic Vacuum Cleaner Segmentation

-

1. Application

- 1.1. Household

- 1.2. Commercial

- 1.3. Others

-

2. Types

- 2.1. Below 150 USD

- 2.2. 150 USD to 300 USD

- 2.3. 300 USD to 500 USD

- 2.4. Above 500 USD

Floor Robotic Vacuum Cleaner Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Floor Robotic Vacuum Cleaner REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Floor Robotic Vacuum Cleaner Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Household

- 5.1.2. Commercial

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Below 150 USD

- 5.2.2. 150 USD to 300 USD

- 5.2.3. 300 USD to 500 USD

- 5.2.4. Above 500 USD

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Floor Robotic Vacuum Cleaner Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Household

- 6.1.2. Commercial

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Below 150 USD

- 6.2.2. 150 USD to 300 USD

- 6.2.3. 300 USD to 500 USD

- 6.2.4. Above 500 USD

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Floor Robotic Vacuum Cleaner Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Household

- 7.1.2. Commercial

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Below 150 USD

- 7.2.2. 150 USD to 300 USD

- 7.2.3. 300 USD to 500 USD

- 7.2.4. Above 500 USD

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Floor Robotic Vacuum Cleaner Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Household

- 8.1.2. Commercial

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Below 150 USD

- 8.2.2. 150 USD to 300 USD

- 8.2.3. 300 USD to 500 USD

- 8.2.4. Above 500 USD

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Floor Robotic Vacuum Cleaner Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Household

- 9.1.2. Commercial

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Below 150 USD

- 9.2.2. 150 USD to 300 USD

- 9.2.3. 300 USD to 500 USD

- 9.2.4. Above 500 USD

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Floor Robotic Vacuum Cleaner Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Household

- 10.1.2. Commercial

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Below 150 USD

- 10.2.2. 150 USD to 300 USD

- 10.2.3. 300 USD to 500 USD

- 10.2.4. Above 500 USD

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 iRobot

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ecovacs

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Proscenic

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Matsutek

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Neato Robotics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Samsung

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sharp

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Philips

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mamibot

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Funroboot(MSI)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Yujin Robot

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Vorwerk

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Infinuvo(Metapo)

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Fmart

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Xiaomi

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Miele

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 iRobot

List of Figures

- Figure 1: Global Floor Robotic Vacuum Cleaner Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Floor Robotic Vacuum Cleaner Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Floor Robotic Vacuum Cleaner Revenue (million), by Application 2024 & 2032

- Figure 4: North America Floor Robotic Vacuum Cleaner Volume (K), by Application 2024 & 2032

- Figure 5: North America Floor Robotic Vacuum Cleaner Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Floor Robotic Vacuum Cleaner Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Floor Robotic Vacuum Cleaner Revenue (million), by Types 2024 & 2032

- Figure 8: North America Floor Robotic Vacuum Cleaner Volume (K), by Types 2024 & 2032

- Figure 9: North America Floor Robotic Vacuum Cleaner Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Floor Robotic Vacuum Cleaner Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Floor Robotic Vacuum Cleaner Revenue (million), by Country 2024 & 2032

- Figure 12: North America Floor Robotic Vacuum Cleaner Volume (K), by Country 2024 & 2032

- Figure 13: North America Floor Robotic Vacuum Cleaner Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Floor Robotic Vacuum Cleaner Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Floor Robotic Vacuum Cleaner Revenue (million), by Application 2024 & 2032

- Figure 16: South America Floor Robotic Vacuum Cleaner Volume (K), by Application 2024 & 2032

- Figure 17: South America Floor Robotic Vacuum Cleaner Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Floor Robotic Vacuum Cleaner Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Floor Robotic Vacuum Cleaner Revenue (million), by Types 2024 & 2032

- Figure 20: South America Floor Robotic Vacuum Cleaner Volume (K), by Types 2024 & 2032

- Figure 21: South America Floor Robotic Vacuum Cleaner Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Floor Robotic Vacuum Cleaner Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Floor Robotic Vacuum Cleaner Revenue (million), by Country 2024 & 2032

- Figure 24: South America Floor Robotic Vacuum Cleaner Volume (K), by Country 2024 & 2032

- Figure 25: South America Floor Robotic Vacuum Cleaner Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Floor Robotic Vacuum Cleaner Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Floor Robotic Vacuum Cleaner Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Floor Robotic Vacuum Cleaner Volume (K), by Application 2024 & 2032

- Figure 29: Europe Floor Robotic Vacuum Cleaner Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Floor Robotic Vacuum Cleaner Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Floor Robotic Vacuum Cleaner Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Floor Robotic Vacuum Cleaner Volume (K), by Types 2024 & 2032

- Figure 33: Europe Floor Robotic Vacuum Cleaner Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Floor Robotic Vacuum Cleaner Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Floor Robotic Vacuum Cleaner Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Floor Robotic Vacuum Cleaner Volume (K), by Country 2024 & 2032

- Figure 37: Europe Floor Robotic Vacuum Cleaner Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Floor Robotic Vacuum Cleaner Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Floor Robotic Vacuum Cleaner Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Floor Robotic Vacuum Cleaner Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Floor Robotic Vacuum Cleaner Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Floor Robotic Vacuum Cleaner Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Floor Robotic Vacuum Cleaner Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Floor Robotic Vacuum Cleaner Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Floor Robotic Vacuum Cleaner Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Floor Robotic Vacuum Cleaner Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Floor Robotic Vacuum Cleaner Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Floor Robotic Vacuum Cleaner Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Floor Robotic Vacuum Cleaner Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Floor Robotic Vacuum Cleaner Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Floor Robotic Vacuum Cleaner Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Floor Robotic Vacuum Cleaner Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Floor Robotic Vacuum Cleaner Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Floor Robotic Vacuum Cleaner Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Floor Robotic Vacuum Cleaner Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Floor Robotic Vacuum Cleaner Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Floor Robotic Vacuum Cleaner Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Floor Robotic Vacuum Cleaner Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Floor Robotic Vacuum Cleaner Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Floor Robotic Vacuum Cleaner Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Floor Robotic Vacuum Cleaner Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Floor Robotic Vacuum Cleaner Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Floor Robotic Vacuum Cleaner Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Floor Robotic Vacuum Cleaner Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Floor Robotic Vacuum Cleaner Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Floor Robotic Vacuum Cleaner Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Floor Robotic Vacuum Cleaner Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Floor Robotic Vacuum Cleaner Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Floor Robotic Vacuum Cleaner Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Floor Robotic Vacuum Cleaner Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Floor Robotic Vacuum Cleaner Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Floor Robotic Vacuum Cleaner Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Floor Robotic Vacuum Cleaner Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Floor Robotic Vacuum Cleaner Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Floor Robotic Vacuum Cleaner Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Floor Robotic Vacuum Cleaner Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Floor Robotic Vacuum Cleaner Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Floor Robotic Vacuum Cleaner Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Floor Robotic Vacuum Cleaner Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Floor Robotic Vacuum Cleaner Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Floor Robotic Vacuum Cleaner Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Floor Robotic Vacuum Cleaner Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Floor Robotic Vacuum Cleaner Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Floor Robotic Vacuum Cleaner Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Floor Robotic Vacuum Cleaner Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Floor Robotic Vacuum Cleaner Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Floor Robotic Vacuum Cleaner Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Floor Robotic Vacuum Cleaner Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Floor Robotic Vacuum Cleaner Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Floor Robotic Vacuum Cleaner Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Floor Robotic Vacuum Cleaner Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Floor Robotic Vacuum Cleaner Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Floor Robotic Vacuum Cleaner Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Floor Robotic Vacuum Cleaner Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Floor Robotic Vacuum Cleaner Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Floor Robotic Vacuum Cleaner Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Floor Robotic Vacuum Cleaner Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Floor Robotic Vacuum Cleaner Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Floor Robotic Vacuum Cleaner Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Floor Robotic Vacuum Cleaner Volume K Forecast, by Country 2019 & 2032

- Table 81: China Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Floor Robotic Vacuum Cleaner Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Floor Robotic Vacuum Cleaner Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Floor Robotic Vacuum Cleaner?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Floor Robotic Vacuum Cleaner?

Key companies in the market include iRobot, Ecovacs, Proscenic, Matsutek, Neato Robotics, LG, Samsung, Sharp, Philips, Mamibot, Funroboot(MSI), Yujin Robot, Vorwerk, Infinuvo(Metapo), Fmart, Xiaomi, Miele.

3. What are the main segments of the Floor Robotic Vacuum Cleaner?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Floor Robotic Vacuum Cleaner," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Floor Robotic Vacuum Cleaner report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Floor Robotic Vacuum Cleaner?

To stay informed about further developments, trends, and reports in the Floor Robotic Vacuum Cleaner, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence