Key Insights

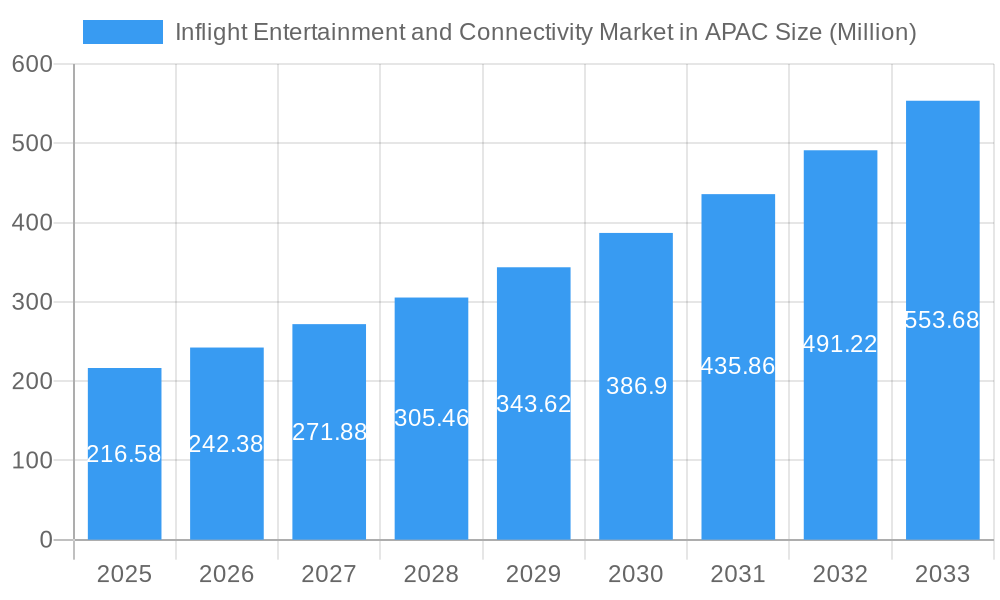

The Asia-Pacific (APAC) inflight entertainment and connectivity (IFC) market is experiencing robust growth, projected to reach \$216.58 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 12.02% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the burgeoning middle class across major APAC economies like China, India, and South Korea is driving increased air travel, creating a larger demand for enhanced IFC services. Secondly, technological advancements are leading to the adoption of higher bandwidth solutions, enabling streaming of high-definition video and faster internet access onboard. The shift towards higher-quality content offerings, including personalized entertainment options and interactive features, further boosts market appeal. Finally, increasing competition among airlines to improve the passenger experience is driving investment in upgraded IFC systems. The market segmentation reveals a strong preference for line-fit installations (factory-installed systems) over retrofit solutions, particularly in first and business classes, highlighting the prioritization of premium passenger experiences. While hardware remains a significant segment, the increasing demand for high-quality content and reliable connectivity are driving growth in these areas as well.

Inflight Entertainment and Connectivity Market in APAC Market Size (In Million)

The market's growth trajectory, however, is not without challenges. High initial investment costs for IFC system installations and maintenance can deter some airlines, particularly smaller carriers. Additionally, variations in regulatory frameworks and infrastructure across the region can pose logistical hurdles for implementing consistent service offerings. Furthermore, consistent and reliable connectivity across diverse APAC geographical regions remains a challenge, especially in remote areas. Nonetheless, the overall growth forecast remains positive, driven by continuous technological innovation, the rising demand for enhanced passenger experience, and the increasing affordability of IFC solutions over time. The strategic expansion of high-speed internet infrastructure and government support for the aviation industry further contribute to a positive outlook.

Inflight Entertainment and Connectivity Market in APAC Company Market Share

Inflight Entertainment and Connectivity Market in APAC: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Inflight Entertainment and Connectivity (IFEC) market in the Asia-Pacific (APAC) region, covering the period from 2019 to 2033. It delves into market dynamics, growth trends, dominant segments, and key players, offering valuable insights for industry professionals, investors, and strategic decision-makers. The report segments the market by fit (line-fit, retrofit), class (first class, business class, economy class), and product type (hardware, content, connectivity), providing a granular view of this rapidly evolving landscape. The market size is presented in million units.

Inflight Entertainment and Connectivity Market in APAC Market Dynamics & Structure

The APAC IFEC market is characterized by a moderately concentrated landscape, with several key players vying for market share. Technological innovation, particularly in high-speed broadband connectivity and personalized entertainment options, is a major driver. Regulatory frameworks concerning data privacy and in-flight communication are influencing market growth. The market witnesses competitive substitution, with airlines constantly seeking cost-effective and efficient IFEC solutions. End-user demographics, particularly the rising middle class and increased air travel, significantly impact demand. M&A activity is shaping the market structure with a predicted xx number of deals in the forecast period (2025-2033).

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on 5G, satellite broadband, and personalized content delivery systems.

- Regulatory Landscape: Stringent data privacy regulations and spectrum allocation policies influence adoption.

- Competitive Substitution: Airlines constantly evaluate cost-effectiveness and efficiency of solutions.

- End-User Demographics: Growth driven by rising middle class, increased air travel, and demand for better connectivity.

- M&A Activity: Predicted xx M&A deals between 2025 and 2033, leading to market consolidation.

Inflight Entertainment and Connectivity Market in APAC Growth Trends & Insights

The APAC IFEC market experienced significant growth between 2019 and 2024, driven by increasing passenger demand for high-speed internet and diverse entertainment options. The market is projected to continue this upward trajectory, with a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching a market size of xx million units by 2033. This growth is fueled by technological advancements such as the adoption of 5G technology, improved satellite connectivity, and the introduction of immersive entertainment experiences. Consumer behavior shifts towards increased reliance on digital media and a demand for personalized experiences are further contributing to market expansion. Market penetration is expected to increase from xx% in 2025 to xx% by 2033, with significant growth anticipated in emerging markets within the region. The shift towards streaming services and the increasing integration of mobile devices in the in-flight experience also play a significant role in shaping market growth.

Dominant Regions, Countries, or Segments in Inflight Entertainment and Connectivity Market in APAC

China and India are leading the APAC IFEC market, driven by robust air travel growth and government investments in infrastructure. The line-fit segment holds the largest market share, primarily due to the high initial investment in new aircraft. However, the retrofit segment is experiencing notable growth, as airlines upgrade their existing fleets to improve passenger experience and offer competitive advantages. Among classes, business class and first class demonstrate a higher adoption rate of premium IFEC solutions, while the economy class segment shows significant growth potential with increasing demand for improved connectivity. Hardware accounts for a significant portion of the market, followed by content and connectivity solutions.

- Key Growth Drivers:

- Expanding air travel sector in China and India.

- Government initiatives to boost aviation infrastructure.

- Increasing demand for high-speed internet access in-flight.

- Growing adoption of premium entertainment options across all classes.

- Dominant Segments:

- Region: China and India.

- Fit: Line-fit (largest share), Retrofit (highest growth).

- Class: Business and First Class (highest adoption), Economy Class (highest growth potential).

- Product Type: Hardware (largest share), followed by content and connectivity.

Inflight Entertainment and Connectivity Market in APAC Product Landscape

The IFEC market showcases constant innovation. We are seeing advancements in high-definition streaming, immersive 3D audio-visual experiences, and personalized content recommendations. The integration of augmented reality (AR) and virtual reality (VR) technologies for interactive entertainment is gaining traction. These innovations enhance the passenger experience and create unique selling propositions for airlines. Hardware improvements focus on miniaturization, energy efficiency, and robust network capabilities. The trend towards increased customization and integration of passenger mobile devices into the in-flight entertainment ecosystem is also noteworthy.

Key Drivers, Barriers & Challenges in Inflight Entertainment and Connectivity Market in APAC

Key Drivers: Increasing air passenger numbers, rising disposable incomes, demand for improved connectivity, and technological advancements in broadband technology and content delivery. Government support for aviation infrastructure development and supportive regulatory environments also contribute significantly.

Key Challenges: High initial investment costs for line-fit installations, limited availability of high-bandwidth satellite connectivity in certain regions, the complexity of integrating diverse IFEC systems, and the continuous need for content updates to retain passenger interest. The impact of these challenges can be quantified in terms of project delays and increased operational expenses for airlines. Cybersecurity concerns also pose a significant challenge.

Emerging Opportunities in Inflight Entertainment and Connectivity Market in APAC

Untapped opportunities exist in expanding IFEC adoption in low-cost carriers, integrating AI-powered personalization features, and offering interactive games and educational content. The growth of regional airlines also presents significant potential. Further exploration of VR/AR applications and the use of edge computing to improve content delivery efficiency offer promising avenues for market growth.

Growth Accelerators in the Inflight Entertainment and Connectivity Market in APAC Industry

Technological advancements in satellite communication and 5G technology are key growth accelerators. Strategic partnerships between airlines, IFEC providers, and content creators foster innovation and market expansion. The increasing adoption of cloud-based solutions for content management and delivery is driving efficiency and scalability. Government support for aviation infrastructure, coupled with initiatives to improve connectivity, is further propelling the market.

Key Players Shaping the Inflight Entertainment and Connectivity Market in APAC Market

- Honeywell International Inc

- Global Eagle

- Collins Aerospace (Raytheon Technologies)

- Envee Inflight Entertainment Co Ltd

- Inmarsat Global Limited

- Stellar Entertainment Group

- Viasat Inc

- Safran SA

- Thales Group

- Kontron S&T AG

- Gogo LLC

- Panasonic Corporation

Notable Milestones in Inflight Entertainment and Connectivity Market in APAC Sector

- 2021 Q4: Launch of a new 5G-enabled IFEC system by a major player.

- 2022 Q2: Partnership between an airline and an IFEC provider to introduce an enhanced streaming platform.

- 2023 Q1: Acquisition of a smaller IFEC company by a leading industry player. (More specific milestones would require further research)

In-Depth Inflight Entertainment and Connectivity Market in APAC Market Outlook

The future of the APAC IFEC market is bright. Continued advancements in connectivity technologies, coupled with growing passenger demand for premium in-flight entertainment, are poised to drive significant growth. Strategic partnerships and innovative product development will be crucial for success. The market will likely witness further consolidation, with larger players acquiring smaller companies to strengthen their market position. The focus will remain on improving passenger experience, increasing efficiency, and mitigating cybersecurity risks. Airlines will actively seek cost-effective and sustainable solutions to improve their in-flight offerings.

Inflight Entertainment and Connectivity Market in APAC Segmentation

-

1. Product Type

- 1.1. Hardware

- 1.2. Content

- 1.3. Connectivity

-

2. Fit

- 2.1. Line-fit

- 2.2. Retrofit

-

3. Class

- 3.1. First Class

- 3.2. Business Class

- 3.3. Economy Class

Inflight Entertainment and Connectivity Market in APAC Segmentation By Geography

-

1. Country

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Australia

- 1.6. Rest of Asia Pacific

Inflight Entertainment and Connectivity Market in APAC Regional Market Share

Geographic Coverage of Inflight Entertainment and Connectivity Market in APAC

Inflight Entertainment and Connectivity Market in APAC REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The First Class Segment is Expected to Experience the Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Inflight Entertainment and Connectivity Market in APAC Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Hardware

- 5.1.2. Content

- 5.1.3. Connectivity

- 5.2. Market Analysis, Insights and Forecast - by Fit

- 5.2.1. Line-fit

- 5.2.2. Retrofit

- 5.3. Market Analysis, Insights and Forecast - by Class

- 5.3.1. First Class

- 5.3.2. Business Class

- 5.3.3. Economy Class

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Country

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Global Eagle

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Collins Aerospace (Raytheon Technologies)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Envee Inflight Entertainment Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Inmarsat Global Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Stellar Entertainment Grou

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Viasat Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Safran SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Thales Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kontron S&T AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Gogo LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Panasonic Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Inflight Entertainment and Connectivity Market in APAC Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Country Inflight Entertainment and Connectivity Market in APAC Revenue (Million), by Product Type 2025 & 2033

- Figure 3: Country Inflight Entertainment and Connectivity Market in APAC Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Country Inflight Entertainment and Connectivity Market in APAC Revenue (Million), by Fit 2025 & 2033

- Figure 5: Country Inflight Entertainment and Connectivity Market in APAC Revenue Share (%), by Fit 2025 & 2033

- Figure 6: Country Inflight Entertainment and Connectivity Market in APAC Revenue (Million), by Class 2025 & 2033

- Figure 7: Country Inflight Entertainment and Connectivity Market in APAC Revenue Share (%), by Class 2025 & 2033

- Figure 8: Country Inflight Entertainment and Connectivity Market in APAC Revenue (Million), by Country 2025 & 2033

- Figure 9: Country Inflight Entertainment and Connectivity Market in APAC Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Inflight Entertainment and Connectivity Market in APAC Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Inflight Entertainment and Connectivity Market in APAC Revenue Million Forecast, by Fit 2020 & 2033

- Table 3: Global Inflight Entertainment and Connectivity Market in APAC Revenue Million Forecast, by Class 2020 & 2033

- Table 4: Global Inflight Entertainment and Connectivity Market in APAC Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Inflight Entertainment and Connectivity Market in APAC Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Inflight Entertainment and Connectivity Market in APAC Revenue Million Forecast, by Fit 2020 & 2033

- Table 7: Global Inflight Entertainment and Connectivity Market in APAC Revenue Million Forecast, by Class 2020 & 2033

- Table 8: Global Inflight Entertainment and Connectivity Market in APAC Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Inflight Entertainment and Connectivity Market in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Inflight Entertainment and Connectivity Market in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Japan Inflight Entertainment and Connectivity Market in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Inflight Entertainment and Connectivity Market in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Australia Inflight Entertainment and Connectivity Market in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of Asia Pacific Inflight Entertainment and Connectivity Market in APAC Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Inflight Entertainment and Connectivity Market in APAC?

The projected CAGR is approximately 12.02%.

2. Which companies are prominent players in the Inflight Entertainment and Connectivity Market in APAC?

Key companies in the market include Honeywell International Inc, Global Eagle, Collins Aerospace (Raytheon Technologies), Envee Inflight Entertainment Co Ltd, Inmarsat Global Limited, Stellar Entertainment Grou, Viasat Inc, Safran SA, Thales Group, Kontron S&T AG, Gogo LLC, Panasonic Corporation.

3. What are the main segments of the Inflight Entertainment and Connectivity Market in APAC?

The market segments include Product Type, Fit, Class.

4. Can you provide details about the market size?

The market size is estimated to be USD 216.58 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The First Class Segment is Expected to Experience the Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Inflight Entertainment and Connectivity Market in APAC," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Inflight Entertainment and Connectivity Market in APAC report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Inflight Entertainment and Connectivity Market in APAC?

To stay informed about further developments, trends, and reports in the Inflight Entertainment and Connectivity Market in APAC, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence