Key Insights

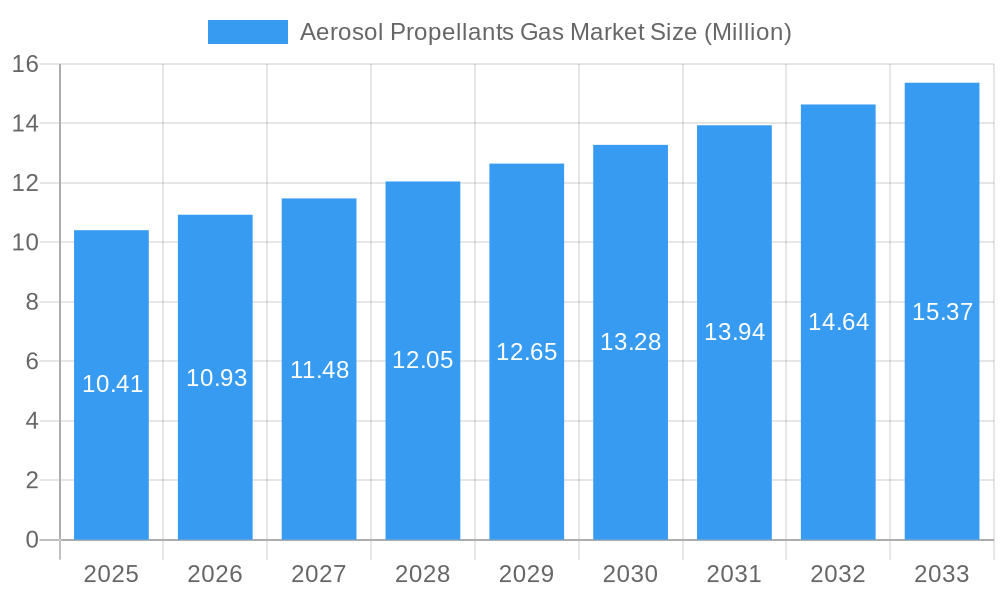

The global Aerosol Propellants Gas Market is poised for robust expansion, projected to reach a valuation of $10.41 billion. This significant growth is driven by a compound annual growth rate (CAGR) exceeding 5.00%, indicating sustained demand across diverse applications. A primary catalyst for this upward trajectory is the increasing consumer preference for convenient and user-friendly product formats, particularly within the personal care and household sectors. The rising disposable incomes and evolving lifestyles globally are further fueling the adoption of aerosolized products, from deodorants and hairsprays to cleaning agents and insecticides. Moreover, advancements in propellant technology, including the development of more environmentally sustainable options like Hydrofluoro Olefins (HFOs), are not only addressing regulatory pressures but also opening new market avenues. The shift towards greener alternatives is a critical trend, as manufacturers increasingly seek propellants with lower global warming potential (GWP) and ozone depletion potential (ODP). This proactive approach by industry leaders is a key determinant of future market dynamics.

Aerosol Propellants Gas Market Market Size (In Million)

The market's growth is further bolstered by its expanding application base. While personal care and household segments remain dominant, the medical and automotive industries are emerging as significant growth engines. In the medical field, aerosol propellants are vital for the delivery of metered-dose inhalers and topical sprays. In the automotive sector, their use extends to specialized maintenance sprays, lubricants, and cleaning solutions. Key players like Shell PLC, Honeywell International Inc., and Arkema Group are at the forefront of innovation, investing heavily in research and development to introduce novel propellant formulations and improve existing ones. However, the market also faces certain restraints, including stringent environmental regulations concerning certain legacy propellants and potential price volatility of raw materials. Despite these challenges, the ongoing innovation in product development and the expanding geographical reach, especially in the Asia Pacific region driven by China and India, are expected to ensure a dynamic and growing Aerosol Propellants Gas Market for the foreseeable future.

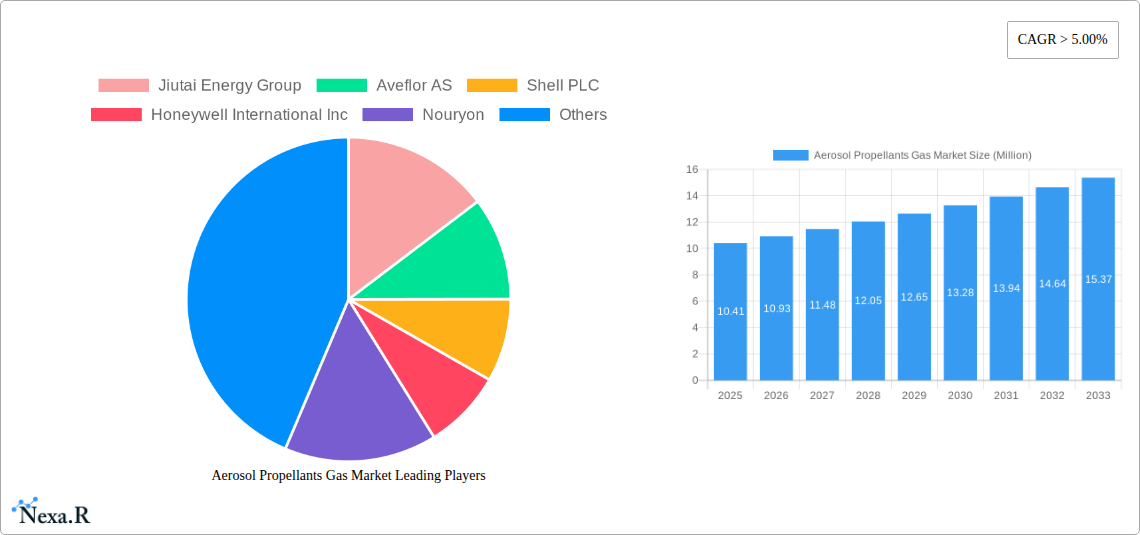

Aerosol Propellants Gas Market Company Market Share

Aerosol Propellants Gas Market: Comprehensive Insights, Trends, and Future Outlook (2019-2033)

This in-depth report provides a thorough analysis of the global Aerosol Propellants Gas Market, offering strategic insights for industry stakeholders. Spanning the historical period of 2019–2024, with a base year of 2025 and a forecast period extending to 2033, this study delivers a 360-degree view of market dynamics, growth drivers, regional dominance, and key player strategies. Our analysis leverages advanced research methodologies to present quantitative data and qualitative assessments, ensuring actionable intelligence. The market is segmented by type into Dimethyl Ether (DME), Hydrofluorocarbons (HFC), Hydrofluoro Olefins (HFO), and Others, and by application into Personal Care, Household, Medical, Automotive, and Others. All values are presented in Million units.

Aerosol Propellants Gas Market Dynamics & Structure

The Aerosol Propellants Gas Market is characterized by a moderate to high level of concentration, with key players like Jiutai Energy Group, Shell PLC, Honeywell International Inc, and Arkema Group holding significant market share. Technological innovation is a primary driver, with ongoing research focused on developing more environmentally friendly propellants, particularly HFOs, to meet stringent regulatory frameworks. The shift away from ozone-depleting substances and high global warming potential (GWP) HFCs is a major factor shaping innovation. Regulatory frameworks, such as the F-Gas Regulation in Europe and similar mandates globally, are pushing manufacturers towards sustainable alternatives. Competitive product substitutes are emerging, including hydrocarbon blends and compressed gases, which offer cost advantages but may have performance limitations. End-user demographics are evolving, with growing demand for convenience and sustainable products in personal care and household applications. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with larger companies acquiring smaller innovators to expand their product portfolios and market reach. For instance, recent M&A activities have focused on companies with expertise in HFO technology.

- Market Concentration: Moderate to high, with significant influence from major chemical manufacturers.

- Technological Innovation Drivers: Development of low-GWP propellants, increased flammability control, and enhanced safety features.

- Regulatory Frameworks: Strict regulations on HFCs and ozone-depleting substances are pushing the adoption of greener alternatives.

- Competitive Product Substitutes: Hydrocarbon blends, compressed gases, and emerging bio-based propellants.

- End-User Demographics: Growing demand for personal care and household products, coupled with an increasing preference for eco-friendly options.

- M&A Trends: Consolidation to gain market share, acquire new technologies, and expand geographical presence.

Aerosol Propellants Gas Market Growth Trends & Insights

The Aerosol Propellants Gas Market has witnessed consistent growth, driven by evolving consumer preferences and industrial applications. The market size is projected to expand at a notable CAGR of approximately 4.8% during the forecast period (2025-2033). This growth is underpinned by the sustained demand for convenience products across various sectors. The adoption rate of newer, environmentally friendly propellants like Hydrofluoro Olefins (HFOs) is steadily increasing as regulatory pressures intensify and public awareness of climate change grows. Technological disruptions, such as advancements in propellant formulations for specialized applications like medical inhalers and fire suppression systems, are further stimulating market expansion. Consumer behavior shifts, including a growing preference for aerosol products that are perceived as safer and more sustainable, are directly impacting purchasing decisions. The market penetration of HFOs is expected to rise significantly, displacing traditional HFCs due to their favorable environmental profiles. For example, the increasing use of HFOs in personal care products like deodorants and hairsprays highlights this trend. The estimated market size for 2025 is xx Million units, with projections indicating a substantial increase by 2033.

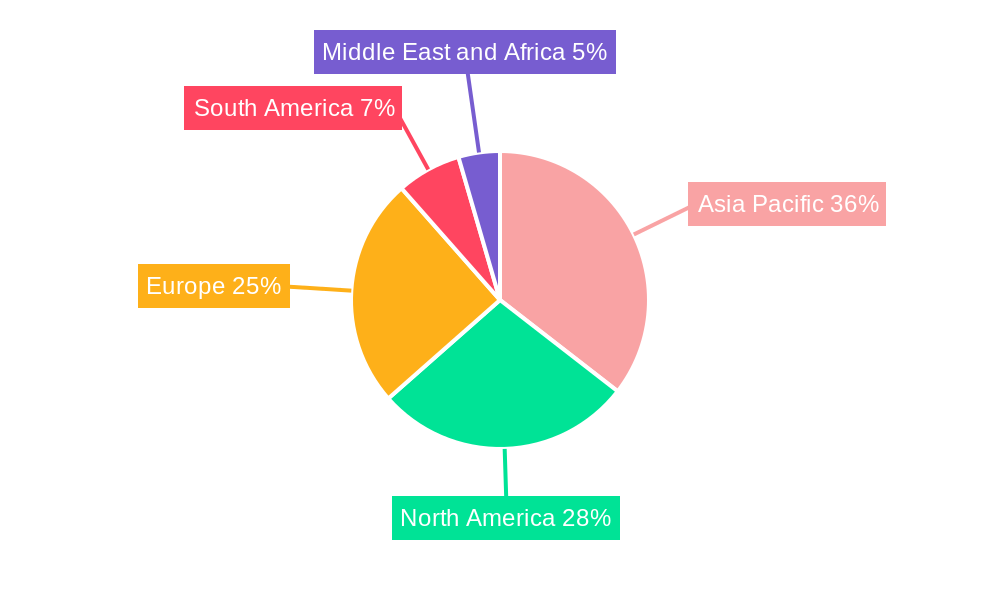

Dominant Regions, Countries, or Segments in Aerosol Propellants Gas Market

The Asia Pacific region is emerging as a dominant force in the Aerosol Propellants Gas Market, propelled by rapid industrialization, a burgeoning middle class, and increasing disposable incomes. Countries like China and India are major contributors to this growth, driven by their expanding manufacturing bases and significant consumer markets for personal care, household, and automotive products. The dominance of the Asia Pacific region is further amplified by supportive government policies aimed at promoting domestic manufacturing and innovation in the chemical industry. From a segment perspective, Dimethyl Ether (DME) currently holds a substantial market share due to its cost-effectiveness, versatility, and relatively lower environmental impact compared to some HFCs, making it a popular choice for household and personal care applications. However, Hydrofluoro Olefins (HFOs) are exhibiting the highest growth potential, driven by their ultra-low Global Warming Potential (GWP) and zero Ozone Depletion Potential (ODP), making them the propellants of choice for environmentally conscious applications and those subject to stringent regulations, particularly in developed markets. The Personal Care application segment also plays a pivotal role, accounting for a significant portion of the market demand due to the widespread use of aerosols in products such as deodorants, hairsprays, and shaving creams.

- Regional Dominance: Asia Pacific, fueled by economic growth and robust manufacturing capabilities in countries like China and India.

- Key Country Drivers: Favorable economic policies, significant consumer demand, and growing industrial output.

- Dominant Segment (Type): Dimethyl Ether (DME) for its cost-effectiveness and wide application range.

- High Growth Segment (Type): Hydrofluoro Olefins (HFOs) due to environmental regulations and sustainability trends.

- Dominant Segment (Application): Personal Care, driven by the ubiquitous use of aerosol products in daily routines.

Aerosol Propellants Gas Market Product Landscape

The product landscape of the Aerosol Propellants Gas Market is evolving rapidly, with a strong emphasis on developing propellants that balance performance with environmental responsibility. Dimethyl Ether (DME) remains a workhorse due to its excellent solvency and spray characteristics, finding widespread use in personal care and household aerosols. Hydrofluorocarbons (HFCs), while effective, are facing phase-downs due to their high GWP. This has accelerated the development and adoption of Hydrofluoro Olefins (HFOs), such as HFO-1234ze and HFO-1336mzz, which offer significantly lower GWP and improved safety profiles, making them ideal for new product formulations and replacements for legacy HFCs. Innovations are also focused on optimizing propellant blends to achieve specific spray patterns, foam densities, and product delivery efficiencies across diverse applications, from fine mist perfumes to industrial coatings.

Key Drivers, Barriers & Challenges in Aerosol Propellants Gas Market

The Aerosol Propellants Gas Market is propelled by several key drivers. Increasing consumer demand for convenience and the widespread use of aerosol products in personal care, household, and medical applications are primary growth engines. The development of new, environmentally sustainable propellants like HFOs, driven by stringent regulations and corporate sustainability goals, is another significant catalyst. Technological advancements leading to improved product efficacy and safety in aerosol formulations further boost the market.

However, the market faces notable barriers and challenges. Stringent environmental regulations, particularly concerning the phase-down of HFCs with high GWP, necessitate significant investment in research and development for alternatives. The flammability of certain hydrocarbon propellants and the safety concerns associated with their handling pose challenges. Supply chain disruptions and fluctuating raw material prices can impact production costs and availability. Intense competition from alternative delivery systems, such as pump sprays and tubes, also presents a restraint.

Key Drivers:

- Growing consumer demand for convenience products.

- Advancements in environmentally friendly propellants (HFOs).

- Strict regulatory mandates for GWP reduction.

- Innovation in aerosol formulation for enhanced product performance.

Barriers & Challenges:

- Regulatory compliance and phase-down of high-GWP HFCs.

- Safety concerns related to flammability of hydrocarbon propellants.

- Volatile raw material prices and supply chain complexities.

- Competition from non-aerosol dispensing technologies.

Emerging Opportunities in Aerosol Propellants Gas Market

Emerging opportunities in the Aerosol Propellants Gas Market lie in the expanding application of propellants in niche and high-growth sectors. The medical industry presents a significant opportunity with the increasing demand for metered-dose inhalers (MDIs) and other medical aerosols, where precise delivery and safety are paramount. The automotive sector's demand for specialty aerosols, such as tire inflators and engine cleaners, also offers substantial growth potential. Furthermore, the ongoing development of bio-based and renewable propellants caters to the growing consumer preference for sustainable products, opening new avenues for market penetration. The increasing adoption of HFOs in developing economies, driven by similar environmental concerns and regulatory trends seen in developed nations, represents a substantial untapped market.

Growth Accelerators in the Aerosol Propellants Gas Market Industry

Several growth accelerators are propelling the Aerosol Propellants Gas Market forward. Technological breakthroughs in propellant synthesis, leading to propellants with ultra-low GWP and improved safety profiles, are a primary driver. Strategic partnerships between propellant manufacturers and aerosol product formulators are fostering innovation and accelerating market adoption of new solutions. The increasing global focus on sustainability and environmental protection is creating a favorable market environment for greener propellants. Furthermore, the expansion of the middle class in emerging economies is leading to increased consumption of products that utilize aerosol technology, thereby fueling market growth.

Key Players Shaping the Aerosol Propellants Gas Market Market

- Jiutai Energy Group

- Aveflor AS

- Shell PLC

- Honeywell International Inc

- Nouryon

- Emirates Gas LLC

- Diversified CPC International

- BOC

- Arkema Group

- The Chemours Company

- Aeropres Corporation

- Shanghai Cal Custom Manufacturing & Aerosol Propellant Co Ltd

- Grillo Werke AG

Notable Milestones in Aerosol Propellants Gas Market Sector

- 2023: Honeywell launches new generations of low-GWP Solstice® propellants, further enhancing their portfolio for various aerosol applications.

- 2023: Arkema Group expands its production capacity for specialty fluorinated products, including propellants, to meet growing demand.

- 2023: The Chemours Company continues to invest in its Opteon™ portfolio of low-GWP propellants, focusing on sustainable solutions.

- 2023: Jiutai Energy Group announces strategic investments in R&D for next-generation DME production technologies.

- 2022: Diversified CPC International acquires a leading producer of hydrocarbon propellants, strengthening its market position.

- 2022: Emirates Gas LLC explores partnerships for the development of more sustainable propellant solutions in the Middle East.

- 2021: Grillo Werke AG focuses on enhancing the safety and environmental performance of its existing propellant offerings.

- 2021: Nouryon introduces innovative propellant blends designed for enhanced performance in specific application areas.

In-Depth Aerosol Propellants Gas Market Market Outlook

The Aerosol Propellants Gas Market is poised for sustained growth, driven by ongoing technological advancements and a global imperative for sustainability. The increasing adoption of Hydrofluoro Olefins (HFOs) and the continuous innovation in Dimethyl Ether (DME) formulations will define the market's trajectory. Strategic collaborations and M&A activities are expected to further consolidate the market, fostering greater efficiency and innovation. Emerging economies present significant untapped potential, particularly in sectors like personal care and household products. The industry's ability to navigate evolving regulatory landscapes and consumer preferences for eco-friendly solutions will be crucial for future success, positioning the market for robust expansion in the coming years.

Aerosol Propellants Gas Market Segmentation

-

1. Type

- 1.1. Dimethyl Ether (DME)

- 1.2. Hyrdofluorocarbons (HFC)

- 1.3. Hydrofluoro Olefins (HFO)

- 1.4. Other Ty

-

2. Application

- 2.1. Personal Care

- 2.2. Household

- 2.3. Medical

- 2.4. Automotive

- 2.5. Other Ap

Aerosol Propellants Gas Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Malaysia

- 1.6. Indonesia

- 1.7. Thailand

- 1.8. Vietnam

- 1.9. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Spain

- 3.6. Russia

- 3.7. Turkey

- 3.8. NORDIC Countries

- 3.9. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Aerosol Propellants Gas Market Regional Market Share

Geographic Coverage of Aerosol Propellants Gas Market

Aerosol Propellants Gas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Personal Care Industry; Increasing Applications of Aerosol Propellants in the Food and Beverage Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations on the Use of Aerosol; Other Restraints

- 3.4. Market Trends

- 3.4.1. Personal Care Application to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aerosol Propellants Gas Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Dimethyl Ether (DME)

- 5.1.2. Hyrdofluorocarbons (HFC)

- 5.1.3. Hydrofluoro Olefins (HFO)

- 5.1.4. Other Ty

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Personal Care

- 5.2.2. Household

- 5.2.3. Medical

- 5.2.4. Automotive

- 5.2.5. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Aerosol Propellants Gas Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Dimethyl Ether (DME)

- 6.1.2. Hyrdofluorocarbons (HFC)

- 6.1.3. Hydrofluoro Olefins (HFO)

- 6.1.4. Other Ty

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Personal Care

- 6.2.2. Household

- 6.2.3. Medical

- 6.2.4. Automotive

- 6.2.5. Other Ap

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Aerosol Propellants Gas Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Dimethyl Ether (DME)

- 7.1.2. Hyrdofluorocarbons (HFC)

- 7.1.3. Hydrofluoro Olefins (HFO)

- 7.1.4. Other Ty

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Personal Care

- 7.2.2. Household

- 7.2.3. Medical

- 7.2.4. Automotive

- 7.2.5. Other Ap

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Aerosol Propellants Gas Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Dimethyl Ether (DME)

- 8.1.2. Hyrdofluorocarbons (HFC)

- 8.1.3. Hydrofluoro Olefins (HFO)

- 8.1.4. Other Ty

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Personal Care

- 8.2.2. Household

- 8.2.3. Medical

- 8.2.4. Automotive

- 8.2.5. Other Ap

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Aerosol Propellants Gas Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Dimethyl Ether (DME)

- 9.1.2. Hyrdofluorocarbons (HFC)

- 9.1.3. Hydrofluoro Olefins (HFO)

- 9.1.4. Other Ty

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Personal Care

- 9.2.2. Household

- 9.2.3. Medical

- 9.2.4. Automotive

- 9.2.5. Other Ap

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Aerosol Propellants Gas Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Dimethyl Ether (DME)

- 10.1.2. Hyrdofluorocarbons (HFC)

- 10.1.3. Hydrofluoro Olefins (HFO)

- 10.1.4. Other Ty

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Personal Care

- 10.2.2. Household

- 10.2.3. Medical

- 10.2.4. Automotive

- 10.2.5. Other Ap

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Jiutai Energy Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aveflor AS

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shell PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Honeywell International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nouryon

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Emirates Gas LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Diversified CPC International

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BOC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Arkema Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Chemours Company*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Aeropres Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Shanghai Cal Custom Manufacturing & Aerosol Propellant Co Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Grillo Werke AG

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Jiutai Energy Group

List of Figures

- Figure 1: Global Aerosol Propellants Gas Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Aerosol Propellants Gas Market Revenue (Million), by Type 2025 & 2033

- Figure 3: Asia Pacific Aerosol Propellants Gas Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Aerosol Propellants Gas Market Revenue (Million), by Application 2025 & 2033

- Figure 5: Asia Pacific Aerosol Propellants Gas Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Aerosol Propellants Gas Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Aerosol Propellants Gas Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Aerosol Propellants Gas Market Revenue (Million), by Type 2025 & 2033

- Figure 9: North America Aerosol Propellants Gas Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Aerosol Propellants Gas Market Revenue (Million), by Application 2025 & 2033

- Figure 11: North America Aerosol Propellants Gas Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Aerosol Propellants Gas Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Aerosol Propellants Gas Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Aerosol Propellants Gas Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Aerosol Propellants Gas Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Aerosol Propellants Gas Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe Aerosol Propellants Gas Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Aerosol Propellants Gas Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Aerosol Propellants Gas Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Aerosol Propellants Gas Market Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Aerosol Propellants Gas Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Aerosol Propellants Gas Market Revenue (Million), by Application 2025 & 2033

- Figure 23: South America Aerosol Propellants Gas Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Aerosol Propellants Gas Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Aerosol Propellants Gas Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Aerosol Propellants Gas Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Aerosol Propellants Gas Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Aerosol Propellants Gas Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Aerosol Propellants Gas Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Aerosol Propellants Gas Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Aerosol Propellants Gas Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Malaysia Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Indonesia Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Thailand Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Vietnam Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Asia Pacific Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United States Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Mexico Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Germany Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Italy Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: France Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Spain Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Russia Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Turkey Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: NORDIC Countries Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Europe Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Type 2020 & 2033

- Table 35: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Brazil Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Type 2020 & 2033

- Table 41: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Application 2020 & 2033

- Table 42: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Saudi Arabia Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: South Africa Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of Middle East and Africa Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aerosol Propellants Gas Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Aerosol Propellants Gas Market?

Key companies in the market include Jiutai Energy Group, Aveflor AS, Shell PLC, Honeywell International Inc, Nouryon, Emirates Gas LLC, Diversified CPC International, BOC, Arkema Group, The Chemours Company*List Not Exhaustive, Aeropres Corporation, Shanghai Cal Custom Manufacturing & Aerosol Propellant Co Ltd, Grillo Werke AG.

3. What are the main segments of the Aerosol Propellants Gas Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Personal Care Industry; Increasing Applications of Aerosol Propellants in the Food and Beverage Industry; Other Drivers.

6. What are the notable trends driving market growth?

Personal Care Application to Dominate the Market.

7. Are there any restraints impacting market growth?

Stringent Government Regulations on the Use of Aerosol; Other Restraints.

8. Can you provide examples of recent developments in the market?

The recent developments pertaining to the major players in the market are being covered in the complete study.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aerosol Propellants Gas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aerosol Propellants Gas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aerosol Propellants Gas Market?

To stay informed about further developments, trends, and reports in the Aerosol Propellants Gas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence