Key Insights

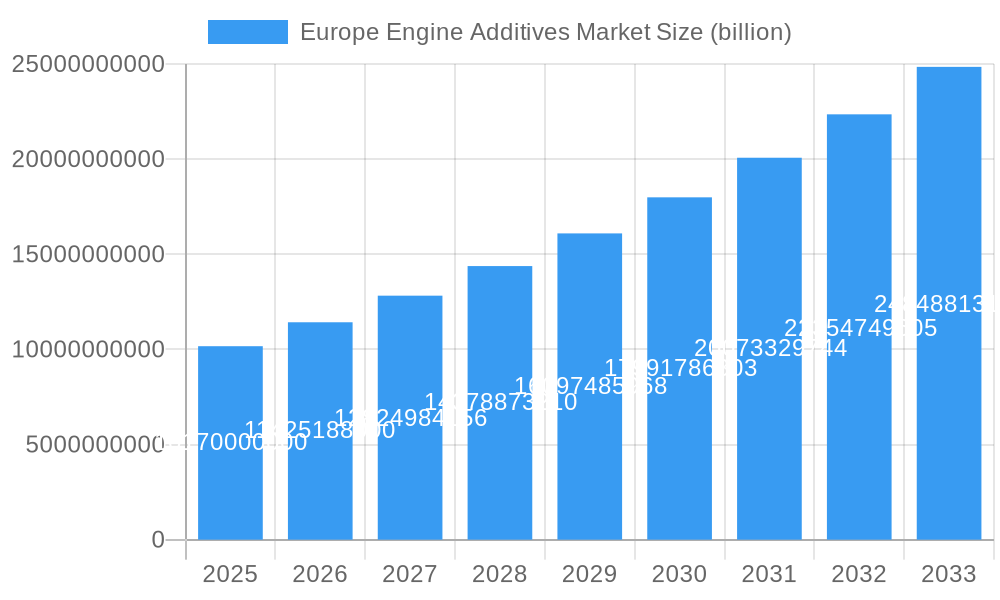

The Europe Engine Additives Market is poised for significant expansion, projected to reach $10.17 billion in 2025 and exhibit a robust Compound Annual Growth Rate (CAGR) of 12.44% through 2033. This impressive growth is propelled by several critical factors. A primary driver is the increasing demand for enhanced fuel efficiency and performance across the automotive and industrial sectors, directly correlating with the need for advanced engine additive solutions. Stringent environmental regulations across Europe are compelling manufacturers to develop and adopt cleaner and more efficient engine technologies, which in turn fuels the demand for specialized additives that reduce emissions and improve combustion. Furthermore, the growing emphasis on extending the lifespan of engines and reducing maintenance costs for both consumers and fleet operators is a substantial catalyst for market growth. The market is segmented across various product types, including Deposit Control, Cetane Improvers, Lubricity Additives, Antioxidants, Anticorrosion, Cold Flow Improvers, and Antiknock Agents, each catering to specific performance and protection needs. Applications span Diesel, Gasoline, and Jet Fuel, indicating the broad utility of these additives across the transportation and aviation industries.

Europe Engine Additives Market Market Size (In Billion)

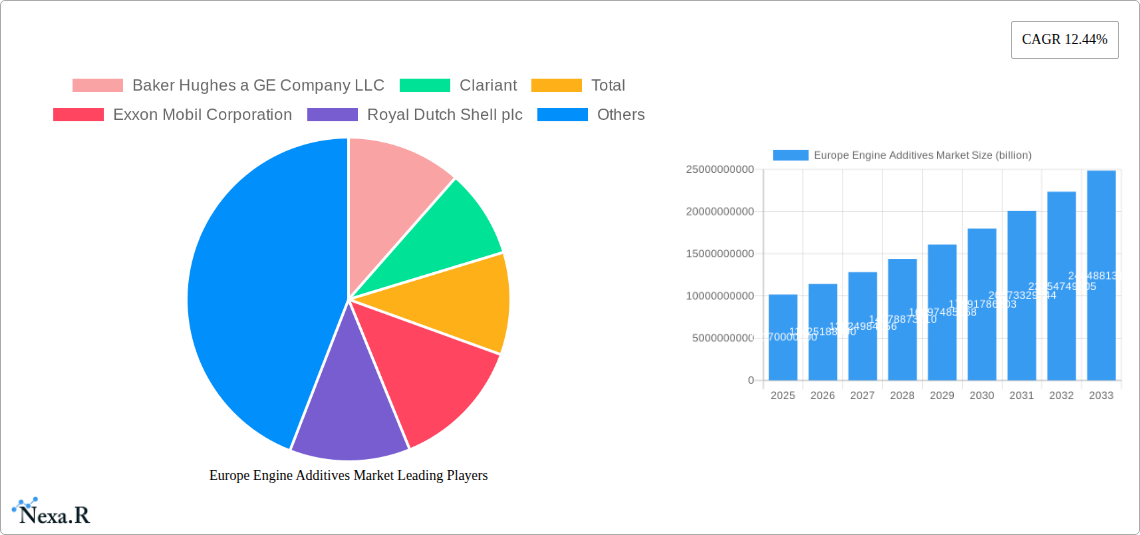

The market's trajectory is further influenced by emerging trends such as the development of bio-based and sustainable engine additives, driven by environmental consciousness and a push towards a circular economy. Innovations in additive formulations to meet the demands of newer engine technologies, including those in hybrid and electric vehicles (even for their internal combustion components or specific ancillary systems), are also shaping the market landscape. While the market exhibits strong growth potential, certain restraints exist, including the fluctuating raw material prices, which can impact manufacturing costs and profitability. Moreover, the development and adoption of alternative fuels and propulsion systems, though still in nascent stages for widespread replacement, could pose a long-term challenge. However, the overwhelming demand for improved engine performance, fuel economy, and emission control, coupled with continuous innovation from key players like Baker Hughes a GE Company LLC, Clariant, Total, Exxon Mobil Corporation, and Royal Dutch Shell plc, strongly indicates a sustained and dynamic growth phase for the Europe Engine Additives Market.

Europe Engine Additives Market Company Market Share

Europe Engine Additives Market Report Description

This comprehensive report, "Europe Engine Additives Market: Dynamics, Trends, and Future Outlook (2019-2033)", offers an in-depth analysis of the evolving European engine additives sector. With a study period spanning 2019 to 2033, a base and estimated year of 2025, and a forecast period from 2025 to 2033, this report provides crucial insights for stakeholders navigating this dynamic market. It delves into key product types like Deposit Control, Cetane Improvers, Lubricity Additives, Antioxidants, Anticorrosion, Cold Flow Improvers, Antiknock Agents, and Other Product Types, as well as primary applications including Diesel, Gasoline, Jet Fuel, and Other Applications. The report presents all quantitative values in billions of currency units, ensuring clarity and comparability.

The market features a mix of prominent global players and specialized manufacturers. Key companies analyzed include Baker Hughes a GE Company LLC, Clariant, Total, Exxon Mobil Corporation, Royal Dutch Shell plc, Evonik Industries AG, VeryOne SaS (EURENCO)*List Not Exhaustive, LANXESS, Croda International Plc, BASF SE, Chevron Corporation, The Lubrizol Corporation, Eni SpA, and Afton Chemical. Industry developments and their impact are thoroughly examined.

This report is an indispensable resource for chemical manufacturers, additive suppliers, automotive companies, fuel distributors, research institutions, and investors seeking to understand market drivers, competitive landscapes, technological advancements, and future growth trajectories in the European engine additives industry.

Europe Engine Additives Market Market Dynamics & Structure

The Europe engine additives market is characterized by a moderate to high degree of market concentration, with several global giants holding significant market share. Technological innovation is a primary driver, fueled by the continuous pursuit of enhanced fuel efficiency, reduced emissions, and extended engine lifespan. Stringent regulatory frameworks, particularly those set by the European Union concerning emissions standards and fuel quality, significantly shape product development and market entry. Competition is intense, with established players and emerging companies vying for dominance. The presence of numerous competitive product substitutes, ranging from advanced fuel formulations to alternative engine technologies, necessitates constant innovation and differentiation. End-user demographics are shifting, with an increasing demand for high-performance, environmentally friendly additives from both commercial fleet operators and individual consumers. Mergers and acquisition (M&A) trends are prevalent, as larger companies seek to consolidate their market positions, acquire cutting-edge technologies, and expand their product portfolios. For instance, the historical period saw several strategic acquisitions aimed at bolstering R&D capabilities and expanding geographical reach.

- Market Concentration: Dominated by a few key global players, with a growing presence of specialized additive manufacturers.

- Technological Innovation: Driven by emission reduction mandates, fuel economy improvements, and extended engine life requirements.

- Regulatory Frameworks: EU emissions directives (e.g., Euro 7) and fuel quality standards are critical influencing factors.

- Competitive Product Substitutes: Advanced fuel blends, electric vehicle adoption, and alternative powertrain technologies present ongoing competition.

- End-User Demographics: Increasing demand for sustainability, performance, and cost-effectiveness from diverse user groups.

- M&A Trends: Strategic consolidations and acquisitions to enhance market share, technology access, and product diversification.

Europe Engine Additives Market Growth Trends & Insights

The Europe engine additives market is projected for robust growth, propelled by a confluence of factors that are reshaping the automotive and fuel industries. The market size is expected to witness a significant upward trajectory, driven by an increasing focus on improving engine performance and compliance with stringent environmental regulations. Adoption rates for advanced additive packages, particularly those designed for emission control and fuel efficiency, are on a steady rise. Technological disruptions, such as the development of novel chemical formulations and improved additive delivery systems, are continuously enhancing the efficacy and appeal of engine additives. Consumer behavior is also evolving, with a growing awareness among vehicle owners about the benefits of using high-quality engine additives for long-term engine health and optimal fuel consumption. The estimated market size for 2025 stands at xx billion, with a projected Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period (2025-2033). Market penetration for specialized additives, especially within the diesel segment, is expected to deepen as stricter emissions standards come into effect. The transition towards more sustainable fuel options also presents opportunities and challenges, necessitating the development of additives compatible with biofuels and synthetic fuels. Furthermore, the increasing average age of the vehicle fleet in certain European countries contributes to a sustained demand for maintenance and performance-enhancing additives. The overarching trend is towards a more sophisticated additive market, where performance, environmental impact, and cost-effectiveness are paramount considerations for both manufacturers and end-users. The demand for additives that mitigate the effects of lower sulfur content in fuels and enhance the lubricity of modern diesel formulations remains a key growth driver. Additionally, the rising popularity of performance vehicles and the aftermarket segment for car enthusiasts further contribute to the market's expansion. The continuous investment in research and development by leading chemical companies is expected to introduce next-generation additives that offer superior protection against wear, corrosion, and deposit formation, thereby solidifying the market's growth trajectory.

Dominant Regions, Countries, or Segments in Europe Engine Additives Market

The Diesel segment is currently the dominant force in the Europe engine additives market, playing a pivotal role in driving overall growth and defining market trends. This dominance is largely attributable to the significant presence of diesel-powered vehicles in commercial fleets, including trucks, buses, and industrial machinery, across major European economies. The stringent emissions regulations implemented across the European Union, such as the Euro 6 and upcoming Euro 7 standards, have necessitated the widespread adoption of advanced diesel fuel additives, including Cetane Improvers and Lubricity Additives, to ensure compliance and optimize engine performance. The demand for Deposit Control Additives and Anticorrosion Additives is also exceptionally high within the diesel segment, aimed at maintaining engine cleanliness and preventing damage caused by impurities and water condensation.

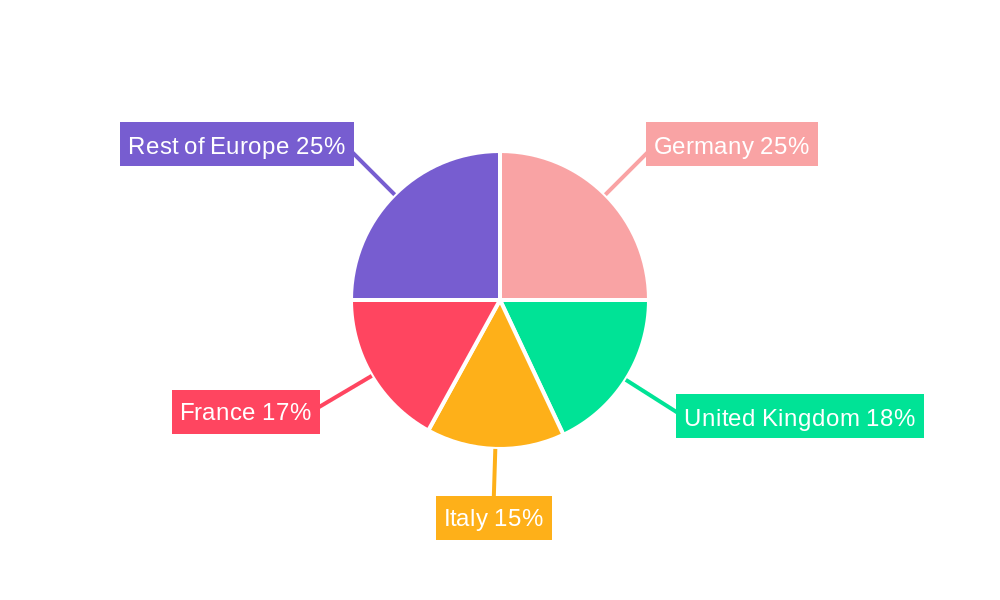

Germany stands out as the leading country within the European engine additives market, driven by its robust automotive industry, significant production of diesel engines, and a strong emphasis on technological innovation and environmental compliance. The country's advanced manufacturing capabilities and extensive research and development infrastructure provide a fertile ground for the development and adoption of high-performance engine additives.

Among the product types, Deposit Control Additives are witnessing substantial growth, directly addressing the need to maintain engine efficiency and reduce harmful emissions. These additives are crucial for preventing the buildup of carbon deposits on critical engine components like injectors, valves, and piston rings, thereby ensuring optimal combustion and fuel economy. The increasing sophistication of modern engine designs further amplifies the importance of these additives in preserving engine longevity and performance.

- Dominant Application Segment: Diesel, driven by commercial vehicle fleets and stringent emission standards.

- Key drivers: Cetane Improvers, Lubricity Additives, Deposit Control Additives, Anticorrosion Additives.

- Impact of regulations: Euro 6 and Euro 7 compliance is a major catalyst.

- Leading Country: Germany, owing to its strong automotive manufacturing base and R&D focus.

- Contribution: High demand for advanced additives due to vehicle parc and environmental consciousness.

- Key Product Type Growth: Deposit Control Additives, essential for maintaining engine cleanliness and efficiency.

- Significance: Crucial for modern engine designs and fuel economy improvements.

- Other Contributing Factors: Economic policies supporting efficient transportation, infrastructure development for fuel distribution, and growing awareness of engine maintenance benefits.

Europe Engine Additives Market Product Landscape

The Europe engine additives market is characterized by a dynamic product landscape focused on enhancing fuel efficiency, reducing emissions, and extending engine lifespan. Deposit Control Additives are at the forefront, utilizing advanced chemistries to prevent and remove carbon deposits on fuel injectors, intake valves, and combustion chambers, ensuring optimal engine performance. Cetane Improvers are crucial for diesel fuels, boosting ignition quality for smoother combustion and reduced emissions, particularly important with the increasing use of biodiesel blends. Lubricity Additives are vital for ultra-low sulfur diesel (ULSD) fuels, restoring the natural lubricity to protect fuel injection systems from wear. Antioxidants combat fuel degradation caused by oxidation, extending fuel storage life and preventing gum formation. Anticorrosion Additives protect fuel system components from rust and corrosion, especially in the presence of water. Cold Flow Improvers are essential for diesel fuels in colder climates, preventing wax crystallization and maintaining fuel flow. Antiknock Agents are primarily for gasoline, enhancing octane ratings to prevent engine knocking and allowing for higher compression ratios. The market continually sees innovation in formulations, aiming for multi-functional additives that offer synergistic benefits and improved environmental profiles, meeting increasingly stringent performance and regulatory demands.

Key Drivers, Barriers & Challenges in Europe Engine Additives Market

Key Drivers: The Europe engine additives market is propelled by stringent environmental regulations, such as Euro 7 emissions standards, mandating cleaner combustion and reduced pollutants. The continuous drive for improved fuel efficiency and cost savings in both commercial and passenger vehicles fuels the demand for additives that optimize engine performance. Furthermore, the increasing complexity of modern engines and the trend towards higher performance vehicles necessitate specialized additives for protection and longevity. The growing awareness among consumers regarding the benefits of engine additives for maintaining vehicle health and resale value also acts as a significant driver.

- Regulatory Push: EU emissions directives and fuel quality standards.

- Fuel Efficiency Mandates: Economic incentives and operational cost reduction.

- Technological Advancements: Development of high-performance and multi-functional additives.

- Consumer Awareness: Growing understanding of additive benefits for engine health.

Barriers & Challenges: Despite positive growth prospects, the market faces several hurdles. The increasing adoption of electric vehicles (EVs) poses a long-term threat to the demand for traditional engine additives, particularly in passenger car segments. Fluctuations in raw material prices, such as crude oil derivatives, can impact production costs and pricing strategies. The complex and often fragmented regulatory landscape across different European countries can also create compliance challenges for manufacturers. Furthermore, counterfeit products and inconsistent quality in some aftermarket segments can erode consumer trust and impact legitimate players. Supply chain disruptions, as experienced in recent global events, can lead to material shortages and increased lead times, affecting production schedules and market availability.

- EV Adoption: Long-term shift away from internal combustion engines.

- Raw Material Volatility: Price fluctuations affecting production costs.

- Regulatory Fragmentation: Varying standards across European nations.

- Counterfeit Products: Impact on market integrity and consumer trust.

- Supply Chain Disruptions: Material shortages and delivery delays.

Emerging Opportunities in Europe Engine Additives Market

Emerging opportunities in the Europe engine additives market lie in the development of sustainable and bio-based additive formulations that align with the EU's green initiatives. The growing demand for additives compatible with alternative fuels, such as biofuels, synthetic fuels, and hydrogen, presents a significant untapped market. Innovations in nano-additives and advanced synthetic chemistries offering superior performance, such as enhanced wear protection and extreme temperature stability, are also gaining traction. The aftermarket segment for specialized performance additives and the industrial sector requiring robust solutions for heavy-duty machinery represent further areas for growth. Furthermore, the focus on the circular economy and the development of additives that can facilitate fuel recycling and waste reduction are emerging as key areas for strategic focus and investment.

Growth Accelerators in the Europe Engine Additives Market Industry

Several key catalysts are accelerating the growth of the Europe engine additives market. The relentless pursuit of higher fuel efficiency and lower emissions by automotive manufacturers, driven by both regulatory pressures and consumer demand, ensures a consistent need for advanced additive solutions. Technological breakthroughs in additive chemistry are enabling the development of more potent, multi-functional additives that can address a wider range of engine challenges. Strategic partnerships between additive manufacturers, fuel companies, and original equipment manufacturers (OEMs) are crucial for co-developing and validating new products tailored to specific engine technologies and fuel types. Market expansion strategies, including entry into emerging European economies and the development of customized solutions for niche applications, are further driving growth. The increasing emphasis on engine longevity and reduced maintenance costs among fleet operators also acts as a significant growth accelerator.

Key Players Shaping the Europe Engine Additives Market Market

- Baker Hughes a GE Company LLC

- Clariant

- Total

- Exxon Mobil Corporation

- Royal Dutch Shell plc

- Evonik Industries AG

- VeryOne SaS (EURENCO)

- LANXESS

- Croda International Plc

- BASF SE

- Chevron Corporation

- The Lubrizol Corporation

- Eni SpA

- Afton Chemical

Notable Milestones in Europe Engine Additives Market Sector

- 2019: Increased focus on Deposit Control Additives due to stricter fuel injector cleaning requirements.

- 2020: Growing demand for Lubricity Additives as ultra-low sulfur diesel (ULSD) became more prevalent across Europe.

- 2021: Significant R&D investments in Anticorrosion Additives to combat the effects of increased biofuel blends.

- 2022: Emergence of interest in Cold Flow Improvers for enhanced performance in historically mild winters, anticipating future climate shifts.

- 2023: Launch of new Cetane Improver formulations designed for higher efficiency and lower NOx emissions.

- 2024 (Early): Strategic partnerships formed between major fuel producers and additive suppliers to develop next-generation additives for emerging fuel standards.

- 2025 (Projected): Anticipated stricter emission regulations (Euro 7) driving further innovation in Deposit Control and Antiknock Agents.

In-Depth Europe Engine Additives Market Market Outlook

The Europe engine additives market outlook remains exceptionally positive, driven by sustained demand for performance enhancement and emission reduction in internal combustion engines. Growth accelerators, including stringent environmental regulations, continuous technological innovation in additive chemistry, and the increasing complexity of modern engine designs, will continue to shape the market trajectory. Strategic partnerships between key industry players will foster the development of advanced, multi-functional additives, catering to both established and emerging fuel types. The aftermarket segment and industrial applications will also contribute significantly to market expansion, offering lucrative opportunities for specialized solutions. The market is poised for sustained growth, with a strong emphasis on sustainability and efficiency as overarching themes.

Europe Engine Additives Market Segmentation

-

1. Product Type

- 1.1. Deposit Control

- 1.2. Cetane Improvers

- 1.3. Lubricity Additives

- 1.4. Antioxidants

- 1.5. Anticorrosion

- 1.6. Cold Flow Improvers

- 1.7. Antiknock Agents

- 1.8. Other Product Types

-

2. Application

- 2.1. Diesel

- 2.2. Gasoline

- 2.3. Jet Fuel

- 2.4. Other Applications

Europe Engine Additives Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. Italy

- 4. France

- 5. Rest of Europe

Europe Engine Additives Market Regional Market Share

Geographic Coverage of Europe Engine Additives Market

Europe Engine Additives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Enactment of Stringent Environmental Regulations; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Increasing Demand and Penetration of Battery Electric Vehicles (BEVs); High Costs of R&D Activities

- 3.4. Market Trends

- 3.4.1. Gasoline to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Engine Additives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Deposit Control

- 5.1.2. Cetane Improvers

- 5.1.3. Lubricity Additives

- 5.1.4. Antioxidants

- 5.1.5. Anticorrosion

- 5.1.6. Cold Flow Improvers

- 5.1.7. Antiknock Agents

- 5.1.8. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Diesel

- 5.2.2. Gasoline

- 5.2.3. Jet Fuel

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. Italy

- 5.3.4. France

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Engine Additives Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Deposit Control

- 6.1.2. Cetane Improvers

- 6.1.3. Lubricity Additives

- 6.1.4. Antioxidants

- 6.1.5. Anticorrosion

- 6.1.6. Cold Flow Improvers

- 6.1.7. Antiknock Agents

- 6.1.8. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Diesel

- 6.2.2. Gasoline

- 6.2.3. Jet Fuel

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Europe Engine Additives Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Deposit Control

- 7.1.2. Cetane Improvers

- 7.1.3. Lubricity Additives

- 7.1.4. Antioxidants

- 7.1.5. Anticorrosion

- 7.1.6. Cold Flow Improvers

- 7.1.7. Antiknock Agents

- 7.1.8. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Diesel

- 7.2.2. Gasoline

- 7.2.3. Jet Fuel

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Italy Europe Engine Additives Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Deposit Control

- 8.1.2. Cetane Improvers

- 8.1.3. Lubricity Additives

- 8.1.4. Antioxidants

- 8.1.5. Anticorrosion

- 8.1.6. Cold Flow Improvers

- 8.1.7. Antiknock Agents

- 8.1.8. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Diesel

- 8.2.2. Gasoline

- 8.2.3. Jet Fuel

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. France Europe Engine Additives Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Deposit Control

- 9.1.2. Cetane Improvers

- 9.1.3. Lubricity Additives

- 9.1.4. Antioxidants

- 9.1.5. Anticorrosion

- 9.1.6. Cold Flow Improvers

- 9.1.7. Antiknock Agents

- 9.1.8. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Diesel

- 9.2.2. Gasoline

- 9.2.3. Jet Fuel

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Europe Europe Engine Additives Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Deposit Control

- 10.1.2. Cetane Improvers

- 10.1.3. Lubricity Additives

- 10.1.4. Antioxidants

- 10.1.5. Anticorrosion

- 10.1.6. Cold Flow Improvers

- 10.1.7. Antiknock Agents

- 10.1.8. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Diesel

- 10.2.2. Gasoline

- 10.2.3. Jet Fuel

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Baker Hughes a GE Company LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Clariant

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Total

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Exxon Mobil Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Royal Dutch Shell plc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Evonik Industries AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 VeryOne SaS (EURENCO)*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LANXESS

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Croda International Plc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BASF SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Chevron Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 The Lubrizol Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Eni SpA

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Afton Chemical

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Baker Hughes a GE Company LLC

List of Figures

- Figure 1: Europe Engine Additives Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Engine Additives Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Engine Additives Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Europe Engine Additives Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Europe Engine Additives Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Engine Additives Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Europe Engine Additives Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Europe Engine Additives Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe Engine Additives Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Europe Engine Additives Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Europe Engine Additives Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Engine Additives Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 11: Europe Engine Additives Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Europe Engine Additives Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Engine Additives Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Europe Engine Additives Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Europe Engine Additives Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Engine Additives Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: Europe Engine Additives Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Europe Engine Additives Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Engine Additives Market?

The projected CAGR is approximately 12.44%.

2. Which companies are prominent players in the Europe Engine Additives Market?

Key companies in the market include Baker Hughes a GE Company LLC, Clariant, Total, Exxon Mobil Corporation, Royal Dutch Shell plc, Evonik Industries AG, VeryOne SaS (EURENCO)*List Not Exhaustive, LANXESS, Croda International Plc, BASF SE, Chevron Corporation, The Lubrizol Corporation, Eni SpA, Afton Chemical.

3. What are the main segments of the Europe Engine Additives Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.17 billion as of 2022.

5. What are some drivers contributing to market growth?

; Enactment of Stringent Environmental Regulations; Other Drivers.

6. What are the notable trends driving market growth?

Gasoline to Dominate the Market.

7. Are there any restraints impacting market growth?

; Increasing Demand and Penetration of Battery Electric Vehicles (BEVs); High Costs of R&D Activities.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Engine Additives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Engine Additives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Engine Additives Market?

To stay informed about further developments, trends, and reports in the Europe Engine Additives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence