Key Insights

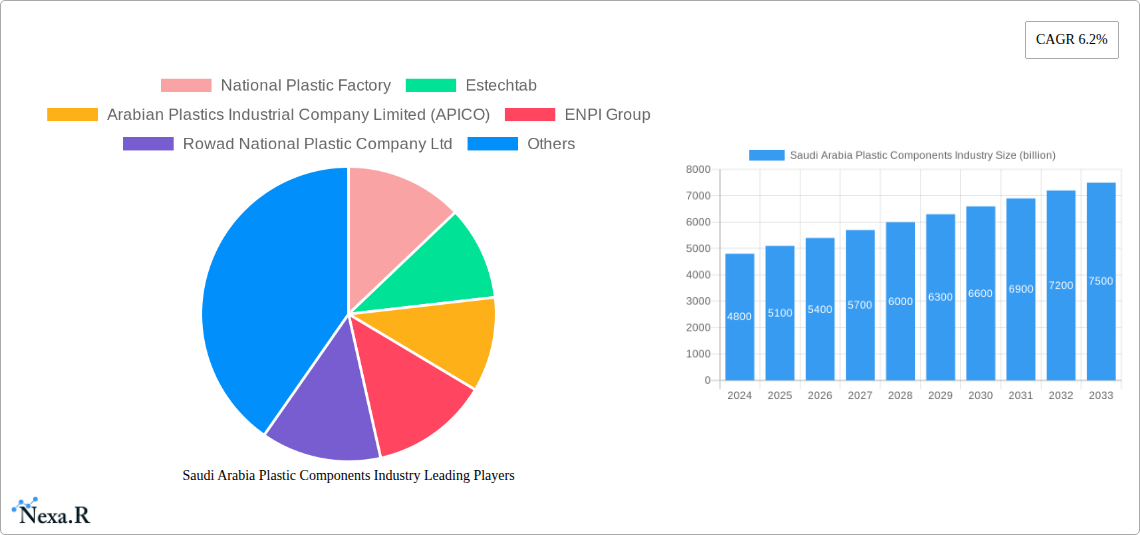

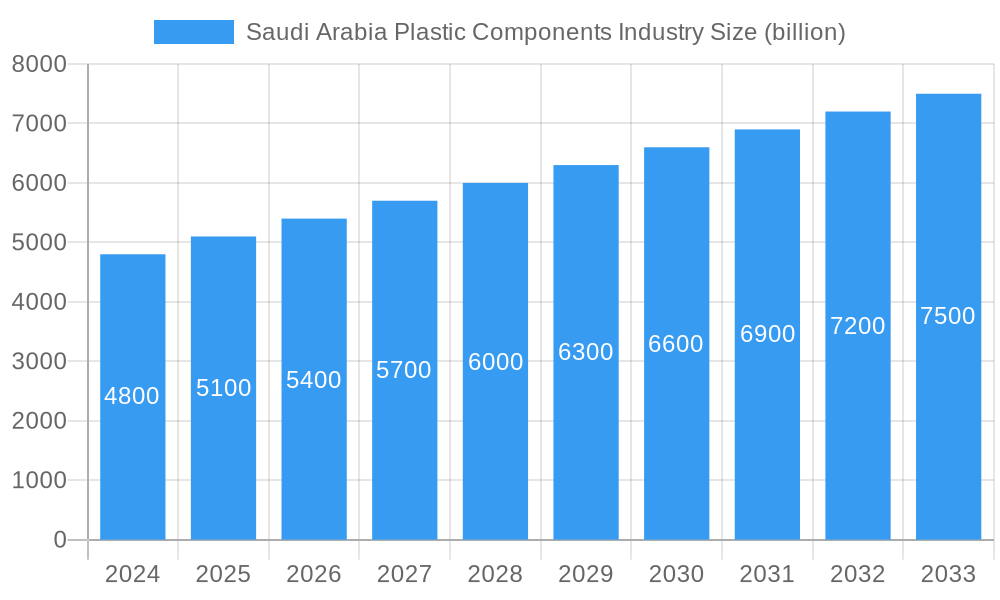

The Saudi Arabia Plastic Components Industry is poised for significant expansion, currently valued at an estimated $4.8 billion in 2024. This robust growth is driven by a compelling CAGR of 6.2% through 2033, indicating a dynamic and expanding market. Key growth catalysts include the burgeoning building and construction sector, fueled by Vision 2030 initiatives and large-scale infrastructure projects, as well as the ever-increasing demand from the consumer goods segment. Furthermore, the expanding life sciences sector, with its growing need for specialized plastic packaging and components, and the food and beverage industry's reliance on versatile and safe plastic solutions, are also major contributors to this upward trajectory. Emerging applications in sectors like aerospace, though currently smaller in share, represent future growth avenues. The industry's ability to adapt and innovate in product types, from specialized sheets, films, and plates to intricate tubes and household articles, will be crucial in capturing market share and meeting diverse end-user needs.

Saudi Arabia Plastic Components Industry Market Size (In Billion)

Despite the promising outlook, the industry faces certain challenges that warrant strategic attention. These restraints, which may include evolving environmental regulations, increasing raw material price volatility, and the need for significant investment in advanced manufacturing technologies to maintain competitiveness, could temper the pace of growth. However, the strong underlying demand, coupled with government support for industrial diversification, is expected to largely offset these challenges. Companies like National Plastic Factory, Estechtab, and Rowad National Plastic Company Ltd are strategically positioned to capitalize on these opportunities, investing in capacity expansion and product innovation. The trend towards sustainable and recyclable plastic solutions is also gaining traction, presenting both a challenge and an opportunity for manufacturers to develop eco-friendly alternatives. Overall, the Saudi Arabia Plastic Components Industry demonstrates a strong potential for sustained growth, driven by diversification and robust end-user demand.

Saudi Arabia Plastic Components Industry Company Market Share

Comprehensive Report: Saudi Arabia Plastic Components Industry – Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This in-depth report offers a definitive analysis of the Saudi Arabia Plastic Components Industry, providing critical insights into market dynamics, growth trajectories, and future potential. Covering the study period from 2019 to 2033, with a base and estimated year of 2025, this report leverages extensive data to guide strategic decision-making for industry stakeholders. The report details the parent and child market landscape, offering a granular view of sub-segments and their interdependencies, with all values presented in billion units.

Saudi Arabia Plastic Components Industry Market Dynamics & Structure

The Saudi Arabia plastic components market exhibits a moderate concentration, with a few key players dominating significant shares, notably National Plastic Factory, Estechtab, Arabian Plastics Industrial Company Limited (APICO), ENPI Group, Rowad National Plastic Company Ltd, Zamil Plastics Industries Limited, Tamam Plastic Factory, Takween Advanced Industries, Saudi Can Co Ltd, PCC, Al Watania Plastics, Rayan Plastic Factory Company, and Saudi Plastic Products Company Ltd. Technological innovation is a significant driver, fueled by advancements in materials science, automation, and sustainable processing techniques. The regulatory framework is evolving, with increasing emphasis on environmental compliance and circular economy initiatives. Competitive product substitutes, primarily from traditional materials like metal and glass, pose a challenge, but the inherent advantages of plastics in terms of cost, versatility, and performance continue to sustain demand. End-user demographics are shifting, with a growing middle class and an increasing demand for durable and aesthetically pleasing plastic products across various applications. Merger and acquisition (M&A) trends are observed, reflecting a consolidation strategy among larger entities to enhance market reach and operational efficiency. For instance, M&A deal volumes are estimated to be around 5-10 major transactions annually, impacting market concentration. Barriers to innovation include high initial investment costs for advanced machinery and R&D, as well as stringent quality control requirements.

- Market Concentration: Moderate, with key players holding substantial market influence.

- Technological Innovation: Driven by material science, automation, and sustainable practices.

- Regulatory Framework: Evolving towards environmental sustainability and circular economy principles.

- Competitive Landscape: Plastic components face competition from metal and glass alternatives.

- End-user Demographics: Shifting towards higher disposable income segments and demand for premium products.

- M&A Trends: Active consolidation to gain market share and operational synergy.

- Innovation Barriers: High capital expenditure for advanced technology and stringent quality standards.

Saudi Arabia Plastic Components Industry Growth Trends & Insights

The Saudi Arabia plastic components industry is poised for robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2019 to 2033. The market size, estimated to be around $15.5 billion in 2025, is expected to surge significantly by the end of the forecast period. This expansion is underpinned by increasing adoption rates across diverse end-user industries, propelled by the nation's ambitious economic diversification strategies and mega-projects. Technological disruptions, such as the advancement of smart manufacturing, additive manufacturing (3D printing), and the development of bio-based and recycled plastics, are reshaping production processes and product offerings. Consumer behavior shifts are also playing a crucial role; there's a growing preference for lightweight, durable, and customizable plastic solutions, especially in sectors like packaging, automotive, and consumer goods. Market penetration of advanced plastic components is rising, particularly in high-value applications. The integration of digital technologies like AI and IoT in manufacturing is enhancing efficiency and product quality, further contributing to market growth. The increasing demand for sustainable packaging solutions, driven by both consumer awareness and government regulations, is a significant growth accelerator. Furthermore, the burgeoning e-commerce sector necessitates sophisticated and resilient plastic packaging solutions, expanding the market's reach. The development of specialized plastic compounds with enhanced properties, such as heat resistance and chemical inertness, is opening up new avenues in industries like life sciences and aerospace. The overall market evolution is characterized by a transition towards higher value-added products and more sustainable manufacturing practices.

Dominant Regions, Countries, or Segments in Saudi Arabia Plastic Components Industry

Within the Saudi Arabia Plastic Components Industry, the Building and Construction end-user industry is a dominant force driving market growth. This segment is projected to account for a significant portion of the market share, estimated at over 30% in 2025, with a strong CAGR of approximately 6.0% during the forecast period. The Kingdom's Vision 2030 plan has initiated unprecedented infrastructure development and urban expansion, leading to a massive surge in demand for plastic components in construction.

- Building and Construction: This segment is the primary growth engine, fueled by massive infrastructure projects like NEOM, Red Sea Project, and Qiddiya.

- Market Share: Estimated at over 30% in 2025.

- Growth Potential: High, driven by ongoing and planned mega-projects.

- Key Drivers: Government investment in infrastructure, urbanization, and the need for durable, cost-effective building materials.

- Product Applications: Plastic pipes, window profiles, insulation materials, flooring, wall coverings, and structural components.

- Sheets, Film, and Plates: This product type is intrinsically linked to the construction sector, serving as a critical component for various applications.

- Market Share: Significant, with a strong demand for high-performance sheets for roofing, cladding, and protective layers.

- Growth Potential: Moderate to high, directly influenced by construction activity.

- Key Drivers: Demand for lightweight, weather-resistant, and customizable material solutions in building envelopes.

- Product Applications: Polycarbonate sheets for skylights, PVC films for waterproofing, and specialized plates for facade systems.

The dominance of the Building and Construction sector is further amplified by supportive economic policies and significant government expenditure on infrastructure development. The Saudi government's commitment to diversifying the economy away from oil has led to substantial investments in real estate and construction, creating a sustained demand for a wide array of plastic components. The inherent advantages of plastics, such as their lightweight nature, corrosion resistance, ease of installation, and cost-effectiveness compared to traditional materials like steel and concrete, make them highly sought after in this industry. Furthermore, the increasing focus on energy efficiency in buildings drives the demand for advanced insulation materials and high-performance window profiles, areas where plastics excel. The growing adoption of prefabricated construction methods also favors the use of plastic components due to their precision and ease of assembly.

Saudi Arabia Plastic Components Industry Product Landscape

The Saudi Arabia plastic components industry is characterized by a diverse product landscape, with innovations focused on enhanced functionality, sustainability, and specialized applications. Sheets, film, and plates are crucial, offering superior properties for building and construction, packaging, and industrial uses, with advancements in UV resistance and fire retardancy. Tubes are seeing increased demand in infrastructure, agriculture, and specialized fluid handling, with innovations in high-pressure and chemical-resistant materials. Containers, ranging from industrial drums to consumer packaging, are evolving with smart features and improved barrier properties for food and beverage safety. Household articles benefit from new designs, durable materials, and eco-friendly options. Floor and wall coverings are experiencing a shift towards more aesthetically pleasing, durable, and easy-to-maintain plastic alternatives. Textile fabrics made from plastic fibers are gaining traction in technical textiles for automotive and industrial applications. Other products encompass a wide range of custom-molded parts for various sectors. Unique selling propositions often lie in lightweighting, cost-effectiveness, and recyclability, with technological advancements enabling the development of high-performance, specialized polymers that meet stringent industry standards.

Key Drivers, Barriers & Challenges in Saudi Arabia Plastic Components Industry

Key Drivers: The Saudi Arabia plastic components industry is propelled by several significant drivers. The robust growth in the Building and Construction sector, fueled by government-led mega-projects and urbanization, is a primary catalyst. Increasing disposable incomes and a growing consumer base are boosting demand for Consumer Goods, particularly in packaging and household items. Technological advancements in material science and manufacturing processes, including automation and the adoption of Industry 4.0 principles, are enhancing production efficiency and product quality. The Food and Beverage industry's expansion necessitates sophisticated and safe plastic packaging solutions. Furthermore, supportive government policies and initiatives aimed at diversifying the economy and promoting local manufacturing contribute significantly to market growth.

Barriers & Challenges: Despite the positive outlook, the industry faces several challenges. Environmental concerns and increasing regulatory pressures regarding plastic waste and single-use plastics necessitate significant investment in sustainable alternatives and recycling infrastructure. Fluctuations in raw material prices, primarily petrochemical derivatives, can impact profit margins and create supply chain volatility. Intense competition from both domestic and international players, as well as from alternative materials, puts pressure on pricing and market share. Technological adoption barriers, particularly for smaller enterprises, due to high initial investment costs for advanced machinery and R&D, can hinder innovation. Supply chain disruptions, as experienced globally, also pose a risk to timely delivery and production continuity. The estimated impact of regulatory changes on operational costs could be in the range of 5-15% for companies not yet fully compliant with new waste management mandates.

Emerging Opportunities in Saudi Arabia Plastic Components Industry

Emerging opportunities in the Saudi Arabia plastic components industry are multifaceted. The Life Sciences sector presents a growing avenue for specialized plastic components used in medical devices, diagnostics, and pharmaceutical packaging, driven by increasing healthcare investments. The Aerospace industry, with its stringent requirements for lightweight yet high-strength materials, offers potential for advanced composite plastic components. The global push for sustainability is creating a significant opportunity for companies investing in recycled plastics, bioplastics, and circular economy models, aligning with Vision 2030's environmental goals. The expansion of the e-commerce landscape drives demand for innovative, protective, and customized plastic packaging solutions. Furthermore, the development of smart plastic components with embedded sensors and IoT capabilities for various applications, from smart packaging to industrial monitoring, represents a significant future growth area.

Growth Accelerators in the Saudi Arabia Plastic Components Industry Industry

Several catalysts are accelerating long-term growth in the Saudi Arabia plastic components industry. The continued commitment to Vision 2030 translates into sustained government investment in infrastructure, manufacturing, and diversification, directly benefiting the sector. Technological breakthroughs in advanced materials, such as high-performance polymers and nanocomposites, are enabling the creation of superior plastic components with enhanced properties, opening up new application frontiers. Strategic partnerships and collaborations between local manufacturers, international technology providers, and research institutions are fostering knowledge transfer and accelerating innovation. Market expansion strategies, including increasing export capabilities and tapping into regional markets, are crucial for sustained growth. The increasing focus on recycling and circular economy initiatives is not only a response to regulatory pressures but also a significant opportunity for innovation and market differentiation, driving demand for recycled plastic feedstocks and sustainable product designs.

Key Players Shaping the Saudi Arabia Plastic Components Industry Market

- National Plastic Factory

- Estechtab

- Arabian Plastics Industrial Company Limited (APICO)

- ENPI Group

- Rowad National Plastic Company Ltd

- Zamil Plastics Industries Limited

- Tamam Plastic Factory

- Takween Advanced Industries

- Saudi Can Co Ltd

- PCC

- Al Watania Plastics

- Rayan Plastic Factory Company

- Saudi Plastic Products Company Ltd

Notable Milestones in Saudi Arabia Plastic Components Industry Sector

- 2019: Launch of several new sustainable packaging initiatives by major players, reflecting growing environmental awareness.

- 2020: Increased investment in automation and Industry 4.0 technologies by leading companies to enhance efficiency and competitiveness amidst global supply chain disruptions.

- 2021: Expansion of production capacity for plastic pipes and fittings by key manufacturers to meet the escalating demand from infrastructure projects.

- 2022: Introduction of advanced composite plastic materials for automotive and aerospace applications by innovative firms.

- 2023: Significant growth in the recycling of plastic waste and the development of recycled plastic content products, driven by regulatory support and consumer preference.

- 2024: Establishment of new joint ventures focused on specialized plastic component manufacturing for niche industries like life sciences.

In-Depth Saudi Arabia Plastic Components Industry Market Outlook

The future outlook for the Saudi Arabia plastic components industry is highly promising, driven by a confluence of strategic initiatives and market trends. The continued momentum of Vision 2030's diversification agenda will fuel sustained demand across key sectors like construction and consumer goods. Growth accelerators such as technological advancements in material science and sustainable manufacturing practices will enable the industry to develop higher value-added products and embrace circular economy principles. Strategic partnerships and increased investment in R&D will further bolster innovation and competitiveness. The industry is expected to witness a significant shift towards smart and sustainable plastic solutions, catering to evolving consumer preferences and stringent environmental regulations. Opportunities in emerging sectors like life sciences and aerospace, coupled with the expansion of e-commerce, will open new avenues for growth and market penetration, solidifying Saudi Arabia's position as a regional hub for advanced plastic component manufacturing. The estimated market potential for sustainable plastic solutions alone is projected to reach $5-7 billion by 2033.

Saudi Arabia Plastic Components Industry Segmentation

-

1. Product Type

- 1.1. Sheets, Film, and Plates

- 1.2. Tubes

- 1.3. Containers

- 1.4. Household Articles

- 1.5. Floor Cover and Wall Cover

- 1.6. Textile Fabrics

- 1.7. Other Products

-

2. End-user Industry

- 2.1. Building and Construction

- 2.2. Consumer Goods

- 2.3. Life Sciences

- 2.4. Aerospace

- 2.5. Food and Beverage

- 2.6. Other Applications

Saudi Arabia Plastic Components Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Plastic Components Industry Regional Market Share

Geographic Coverage of Saudi Arabia Plastic Components Industry

Saudi Arabia Plastic Components Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Government Spending on Construction Activities; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Slowdown in Automotive Industry Growth; Unfavorable Conditions Arising Due to COVID-19 Outbreak

- 3.4. Market Trends

- 3.4.1 Sheets

- 3.4.2 Film

- 3.4.3 and Plates to Dominate the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Plastic Components Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Sheets, Film, and Plates

- 5.1.2. Tubes

- 5.1.3. Containers

- 5.1.4. Household Articles

- 5.1.5. Floor Cover and Wall Cover

- 5.1.6. Textile Fabrics

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Building and Construction

- 5.2.2. Consumer Goods

- 5.2.3. Life Sciences

- 5.2.4. Aerospace

- 5.2.5. Food and Beverage

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 National Plastic Factory

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Estechtab

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arabian Plastics Industrial Company Limited (APICO)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ENPI Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rowad National Plastic Company Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zamil Plastics Industries Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tamam Plastic Factory

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Takween Advanced Industries

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saudi Can Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PCC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Al Watania Plastics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Rayan Plastic Factory Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Saudi Plastic Products Company Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 National Plastic Factory

List of Figures

- Figure 1: Saudi Arabia Plastic Components Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Plastic Components Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Plastic Components Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Saudi Arabia Plastic Components Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 5: Saudi Arabia Plastic Components Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Saudi Arabia Plastic Components Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 9: Saudi Arabia Plastic Components Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 10: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 11: Saudi Arabia Plastic Components Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Plastic Components Industry?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Saudi Arabia Plastic Components Industry?

Key companies in the market include National Plastic Factory, Estechtab, Arabian Plastics Industrial Company Limited (APICO), ENPI Group, Rowad National Plastic Company Ltd, Zamil Plastics Industries Limited, Tamam Plastic Factory, Takween Advanced Industries, Saudi Can Co Ltd, PCC, Al Watania Plastics, Rayan Plastic Factory Company, Saudi Plastic Products Company Ltd.

3. What are the main segments of the Saudi Arabia Plastic Components Industry?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.8 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Government Spending on Construction Activities; Other Drivers.

6. What are the notable trends driving market growth?

Sheets. Film. and Plates to Dominate the market.

7. Are there any restraints impacting market growth?

; Slowdown in Automotive Industry Growth; Unfavorable Conditions Arising Due to COVID-19 Outbreak.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3,950, USD 4,950, and USD 6,950 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Plastic Components Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Plastic Components Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Plastic Components Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Plastic Components Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence