Key Insights

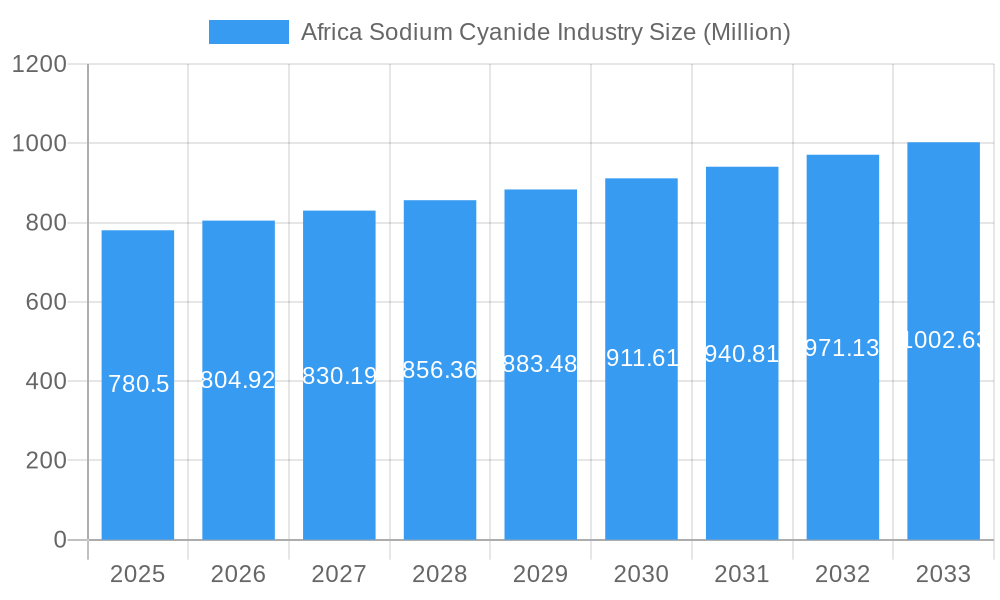

The Africa Sodium Cyanide market is projected for significant expansion, forecasting a market size of 36.58 million by 2033, driven by a Compound Annual Growth Rate (CAGR) of 4.5% from the base year of 2024. This growth is predominantly fueled by the continent's expanding mining sector, especially gold extraction, where sodium cyanide is a critical recovery reagent. Increased foreign investment and enhanced mining infrastructure across Africa are expected to elevate demand for high-purity sodium cyanide. Additionally, expanding applications within the chemical industry, including plastics, synthetic fibers, and metal treatment, will bolster market performance. Key markets include South Africa, Ghana, and Tanzania, owing to their substantial mineral reserves and established industrial sectors.

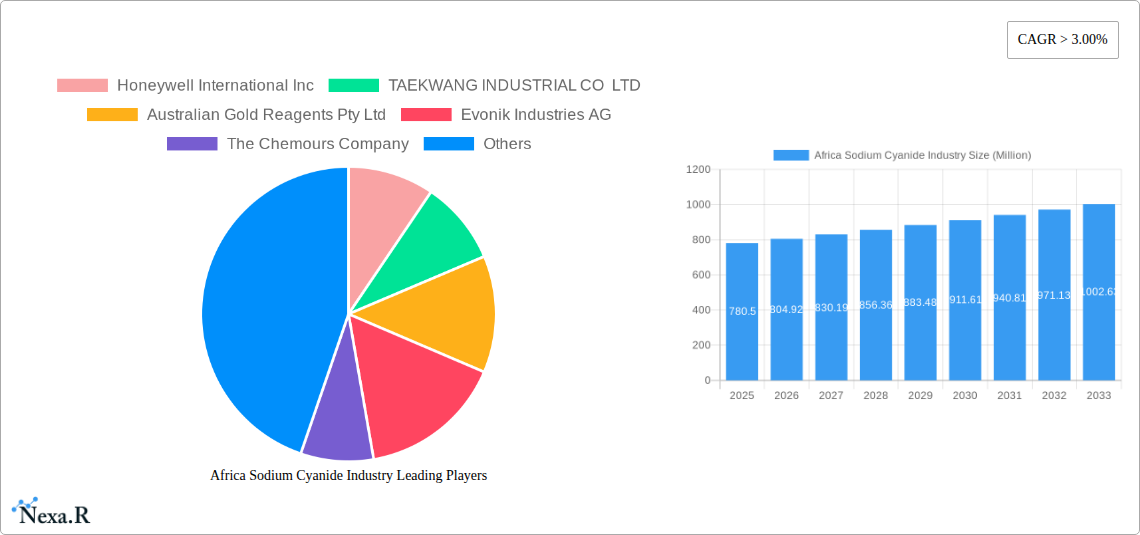

Africa Sodium Cyanide Industry Market Size (In Million)

The market is competitive, featuring global players like Honeywell International Inc., Evonik Industries AG, and The Chemours Company, alongside regional participants. Strategic initiatives include capacity expansion, supply chain optimization, and R&D investment to address evolving demands for safer, more efficient sodium cyanide products. Potential challenges include stringent environmental regulations for cyanide handling and transportation, and commodity price volatility, particularly for gold, which can influence demand. Nevertheless, a growing emphasis on sustainable mining and the development of alternative extraction methods are shaping the market's future, creating opportunities for innovation and product diversification.

Africa Sodium Cyanide Industry Company Market Share

Africa Sodium Cyanide Industry Market Report 2019-2033: Growth, Trends, and Opportunities

Gain unparalleled insights into the Africa Sodium Cyanide Industry with this comprehensive market report. Covering the period from 2019 to 2033, with a base year of 2025, this analysis delves into market dynamics, growth trajectories, dominant segments, product innovations, key drivers, barriers, and emerging opportunities. Essential for stakeholders seeking to understand the evolving landscape of sodium cyanide production and consumption across the African continent, particularly within the critical mining and chemical sectors. All values are presented in millions.

Africa Sodium Cyanide Industry Market Dynamics & Structure

The Africa Sodium Cyanide industry is characterized by a moderately concentrated market structure, with key players like Orica Limited, Evonik Industries AG, and Honeywell International Inc. holding significant market shares. Technological innovation is primarily driven by advancements in production efficiency, safety protocols, and waste management solutions for sodium cyanide handling. Regulatory frameworks, particularly concerning environmental impact and transportation safety, play a crucial role in shaping market entry and operational strategies. Competitive product substitutes are limited in their effectiveness for gold and silver extraction, the primary applications of sodium cyanide. End-user demographics are heavily skewed towards the mining sector, with a growing interest from chemical manufacturers for specialized applications. Merger and acquisition (M&A) trends are indicative of strategic consolidation and expansion, particularly by established global players seeking to enhance their African footprint. For instance, recent M&A activities, while not publicly quantified for Africa specifically, reflect a global trend where major companies acquire regional players to secure supply chains and market access. The barrier to innovation often lies in the high capital investment required for new production facilities and the stringent safety regulations that necessitate advanced technological adoption.

- Market Concentration: Moderately concentrated, dominated by a few global and regional manufacturers.

- Technological Innovation Drivers: Enhanced production efficiency, advanced safety features, and environmentally responsible waste treatment.

- Regulatory Frameworks: Strict adherence to safety and environmental standards for production, transportation, and usage.

- Competitive Product Substitutes: Limited viable alternatives for large-scale precious metal extraction.

- End-User Demographics: Primarily driven by the mining industry, with emerging applications in the chemical sector.

- M&A Trends: Strategic consolidation and expansion to secure market share and enhance supply chain capabilities.

Africa Sodium Cyanide Industry Growth Trends & Insights

The Africa Sodium Cyanide industry is poised for significant expansion, projected to witness a robust Compound Annual Growth Rate (CAGR) through the forecast period of 2025-2033. This growth is intrinsically linked to the burgeoning mining sector across the continent, particularly gold extraction, which relies heavily on sodium cyanide for its efficacy. Market size evolution is anticipated to be driven by increasing investment in exploration and mining operations in resource-rich African nations. Adoption rates for advanced sodium cyanide technologies are on an upward trajectory, spurred by the need for greater operational efficiency and adherence to evolving environmental regulations. Technological disruptions, while not revolutionary, are focused on improving the purity of sodium cyanide, developing safer handling and transportation methods, and exploring more sustainable production processes. Consumer behavior shifts within the mining sector are leaning towards suppliers offering reliable, high-quality sodium cyanide with comprehensive technical support and a strong emphasis on safety and environmental stewardship. The market penetration of sodium cyanide is expected to deepen as new mining projects commence and existing ones scale up their operations.

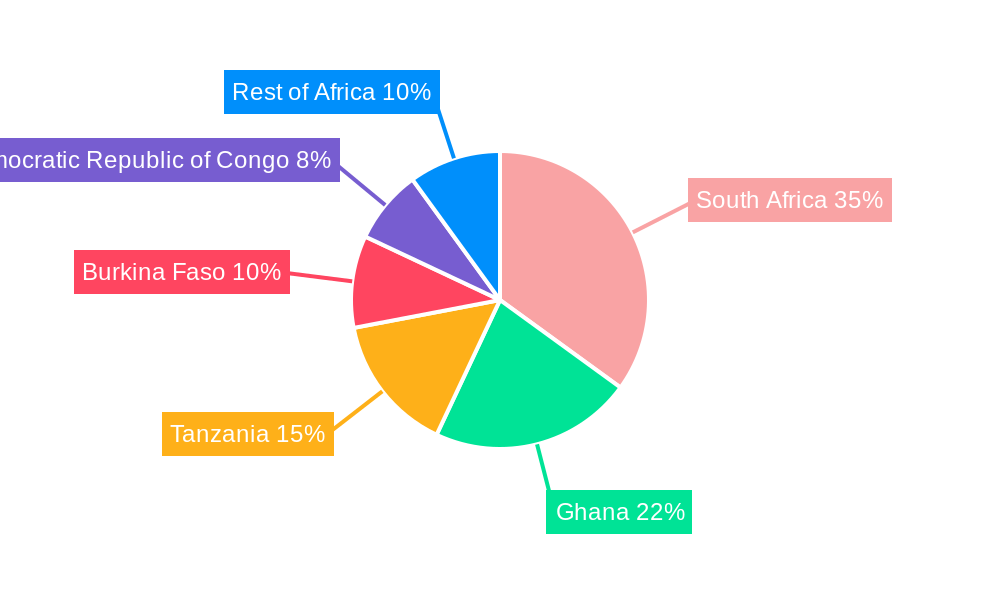

Dominant Regions, Countries, or Segments in Africa Sodium Cyanide Industry

The Mining end-user industry stands as the undisputed dominant segment driving growth within the Africa Sodium Cyanide industry. This dominance is fueled by the continent's vast and largely untapped mineral resources, particularly gold, a precious metal whose extraction process is critically dependent on the chemical properties of sodium cyanide. Countries like South Africa, Ghana, and Tanzania are leading the charge in gold production, thereby creating substantial demand for sodium cyanide.

- Key Drivers for Mining Dominance:

- Rich Mineral Reserves: Africa's vast reserves of gold, diamonds, and other precious metals present a consistent demand for cyanide-based extraction processes.

- Foreign Direct Investment (FDI): Significant global investment in African mining projects directly translates to increased demand for essential mining chemicals like sodium cyanide.

- Economic Policies: Favorable mining policies and incentives in several African nations encourage exploration and production, boosting cyanide consumption. For instance, revised mining codes in countries like Ghana aim to attract more investment.

- Infrastructure Development: Improved logistics and infrastructure, though still a challenge in some areas, are crucial for the efficient transportation of sodium cyanide to remote mining sites.

- Technological Adoption: Large-scale mining operations are increasingly adopting efficient and safe cyanide leaching technologies, further cementing its role.

- Market Share: The mining segment accounts for an estimated 80-85% of the total sodium cyanide consumption in Africa, with gold mining alone representing the lion's share.

- Growth Potential: The untapped potential of various mineral deposits across the continent suggests sustained and strong growth for the mining sector's cyanide demand for at least the next decade.

The Chemical segment, while smaller, plays a supportive role and is also experiencing growth, driven by its use in various industrial chemical processes beyond mining, such as the production of plastics, dyes, and pharmaceuticals. However, its current market share is significantly lower than mining, estimated to be around 10-15%. "Other End-user Industries" represent a niche segment with a minimal market share. The continuous expansion of the mining sector, coupled with efforts to diversify economic activities and leverage Africa's mineral wealth, ensures that the mining end-user industry will remain the primary growth engine for the Africa Sodium Cyanide market.

Africa Sodium Cyanide Industry Product Landscape

The product landscape of the Africa Sodium Cyanide industry is characterized by the supply of solid sodium cyanide, primarily in granular or briquette forms, renowned for its high purity (typically 98% and above) essential for efficient gold and silver leaching. Applications are predominantly focused on the cyanidation process in precious metal mining. Performance metrics are measured by dissolution rates, purity, and consistency, directly impacting the recovery rates of gold and silver. Unique selling propositions include specialized packaging for enhanced safety during transport and storage, and options for tailored granulations to suit specific mining operations. Technological advancements are subtly improving production processes to ensure lower impurity levels and more sustainable manufacturing, reducing the environmental footprint.

Key Drivers, Barriers & Challenges in Africa Sodium Cyanide Industry

The Africa Sodium Cyanide industry is propelled by several key drivers, most notably the robust global demand for gold and other precious metals, directly correlating with increased mining activities across the African continent. Favorable economic conditions and substantial foreign investment in African mining projects are significant economic drivers. Technological advancements in extraction processes continue to rely on the efficiency of sodium cyanide.

- Key Drivers:

- Surge in gold prices and sustained demand for precious metals.

- Exploration and expansion of mining operations in resource-rich African nations.

- Increased foreign investment in the African mining sector.

- Technological advancements in precious metal recovery.

Conversely, the industry faces substantial barriers and challenges. Stringent environmental regulations and the inherent hazardous nature of sodium cyanide necessitate significant investment in safety infrastructure and compliance, acting as a primary barrier to entry. Supply chain complexities, including the logistical challenges of transporting hazardous materials across vast distances in Africa, and potential disruptions due to political instability or infrastructure deficits, pose significant operational hurdles. Competitive pressures from established global players and the risk of price volatility in raw materials also contribute to market challenges.

- Key Barriers & Challenges:

- Strict environmental and safety regulations.

- Logistical challenges in transportation of hazardous materials.

- Potential for supply chain disruptions due to infrastructure and political factors.

- High capital expenditure for production facilities and safety compliance.

- Price volatility of raw materials and finished products.

Emerging Opportunities in Africa Sodium Cyanide Industry

Emerging opportunities within the Africa Sodium Cyanide industry lie in the development and adoption of more sustainable production methods, including enhanced cyanide recovery and recycling technologies, which can reduce environmental impact and operational costs. Furthermore, the untapped potential of certain mineral deposits across the continent presents opportunities for increased market penetration and demand growth. Innovations in safer handling and transportation solutions, along with the potential for new applications in niche chemical industries, also represent areas for future expansion and market diversification.

Growth Accelerators in the Africa Sodium Cyanide Industry Industry

Long-term growth in the Africa Sodium Cyanide industry is being significantly accelerated by continuous advancements in mining technology that enhance the efficiency and safety of cyanide leaching processes. Strategic partnerships between global chemical manufacturers and local African mining companies are crucial for ensuring consistent supply chains and providing technical expertise. Furthermore, the ongoing exploration and discovery of new, high-grade mineral deposits across various African regions are creating new demand centers and driving market expansion. The increasing emphasis on responsible mining practices is also leading to the adoption of more advanced, environmentally conscious cyanide management solutions, which, while requiring investment, ultimately support sustained growth.

Key Players Shaping the Africa Sodium Cyanide Industry Market

- Honeywell International Inc

- TAEKWANG INDUSTRIAL CO LTD

- Australian Gold Reagents Pty Ltd

- Evonik Industries AG

- The Chemours Company

- Sasol

- HeBei ChengXin

- TSPC

- Orica Limited

Notable Milestones in Africa Sodium Cyanide Industry Sector

- January 2023: Shortages of sodium cyanide in Tanzania have hampered the country's large and medium-scale miners.

- April 2022: Australian Gold Reagents (AGR) announced plans to expand its sodium cyanide production at its Kwinana, Western Australia facility to support the growing global demand for gold. It will increase AGR's production capacity by circa 30,000 tons per annum from its existing production of more than 90,000 tons annually, with sodium cyanide to be used in gold mining operations across Australia, Asia, Africa, the Americas, and the Middle East.

In-Depth Africa Sodium Cyanide Industry Market Outlook

The Africa Sodium Cyanide industry outlook remains highly positive, driven by the enduring global demand for gold and the continent's rich mineral endowment. Growth accelerators such as technological innovations in mining efficiency and the increasing focus on sustainable practices will continue to fuel demand. Strategic collaborations between key players and local mining entities are expected to solidify supply chains and foster market penetration. The exploration of new mineral deposits and the potential diversification into related chemical applications present exciting avenues for future market expansion, ensuring a robust and dynamic growth trajectory for the Africa Sodium Cyanide market.

Africa Sodium Cyanide Industry Segmentation

-

1. End-user Industry

- 1.1. Mining

- 1.2. Chemical

- 1.3. Other End-user Industries

Africa Sodium Cyanide Industry Segmentation By Geography

- 1. Ghana

- 2. Burkina Faso

- 3. Egypt

- 4. Tanzania

- 5. Zimbabwe

- 6. Mali

- 7. Democratic Republic of Congo

- 8. Sudan

- 9. Guinea

- 10. South Africa

- 11. Rest of Africa

Africa Sodium Cyanide Industry Regional Market Share

Geographic Coverage of Africa Sodium Cyanide Industry

Africa Sodium Cyanide Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Gold Mining Activities; Increasing Demand for Use in Chemical and Polymer Synthesis

- 3.3. Market Restrains

- 3.3.1. Toxicity of Sodium Cyanide

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Mining Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Sodium Cyanide Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Mining

- 5.1.2. Chemical

- 5.1.3. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Ghana

- 5.2.2. Burkina Faso

- 5.2.3. Egypt

- 5.2.4. Tanzania

- 5.2.5. Zimbabwe

- 5.2.6. Mali

- 5.2.7. Democratic Republic of Congo

- 5.2.8. Sudan

- 5.2.9. Guinea

- 5.2.10. South Africa

- 5.2.11. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Ghana Africa Sodium Cyanide Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Mining

- 6.1.2. Chemical

- 6.1.3. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. Burkina Faso Africa Sodium Cyanide Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Mining

- 7.1.2. Chemical

- 7.1.3. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Egypt Africa Sodium Cyanide Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Mining

- 8.1.2. Chemical

- 8.1.3. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Tanzania Africa Sodium Cyanide Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Mining

- 9.1.2. Chemical

- 9.1.3. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Zimbabwe Africa Sodium Cyanide Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Mining

- 10.1.2. Chemical

- 10.1.3. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Mali Africa Sodium Cyanide Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11.1.1. Mining

- 11.1.2. Chemical

- 11.1.3. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by End-user Industry

- 12. Democratic Republic of Congo Africa Sodium Cyanide Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by End-user Industry

- 12.1.1. Mining

- 12.1.2. Chemical

- 12.1.3. Other End-user Industries

- 12.1. Market Analysis, Insights and Forecast - by End-user Industry

- 13. Sudan Africa Sodium Cyanide Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by End-user Industry

- 13.1.1. Mining

- 13.1.2. Chemical

- 13.1.3. Other End-user Industries

- 13.1. Market Analysis, Insights and Forecast - by End-user Industry

- 14. Guinea Africa Sodium Cyanide Industry Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - by End-user Industry

- 14.1.1. Mining

- 14.1.2. Chemical

- 14.1.3. Other End-user Industries

- 14.1. Market Analysis, Insights and Forecast - by End-user Industry

- 15. South Africa Africa Sodium Cyanide Industry Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - by End-user Industry

- 15.1.1. Mining

- 15.1.2. Chemical

- 15.1.3. Other End-user Industries

- 15.1. Market Analysis, Insights and Forecast - by End-user Industry

- 16. Rest of Africa Africa Sodium Cyanide Industry Analysis, Insights and Forecast, 2020-2032

- 16.1. Market Analysis, Insights and Forecast - by End-user Industry

- 16.1.1. Mining

- 16.1.2. Chemical

- 16.1.3. Other End-user Industries

- 16.1. Market Analysis, Insights and Forecast - by End-user Industry

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2025

- 17.2. Company Profiles

- 17.2.1 Honeywell International Inc

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 TAEKWANG INDUSTRIAL CO LTD

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Australian Gold Reagents Pty Ltd

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Evonik Industries AG

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 The Chemours Company

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Sasol

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 HeBei ChengXin

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 TSPC

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Orica Limited

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.1 Honeywell International Inc

List of Figures

- Figure 1: Africa Sodium Cyanide Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Africa Sodium Cyanide Industry Share (%) by Company 2025

List of Tables

- Table 1: Africa Sodium Cyanide Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 2: Africa Sodium Cyanide Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 3: Africa Sodium Cyanide Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Africa Sodium Cyanide Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: Africa Sodium Cyanide Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 6: Africa Sodium Cyanide Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 7: Africa Sodium Cyanide Industry Revenue million Forecast, by Country 2020 & 2033

- Table 8: Africa Sodium Cyanide Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 9: Africa Sodium Cyanide Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 10: Africa Sodium Cyanide Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 11: Africa Sodium Cyanide Industry Revenue million Forecast, by Country 2020 & 2033

- Table 12: Africa Sodium Cyanide Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: Africa Sodium Cyanide Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 14: Africa Sodium Cyanide Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 15: Africa Sodium Cyanide Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: Africa Sodium Cyanide Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Africa Sodium Cyanide Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 18: Africa Sodium Cyanide Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 19: Africa Sodium Cyanide Industry Revenue million Forecast, by Country 2020 & 2033

- Table 20: Africa Sodium Cyanide Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 21: Africa Sodium Cyanide Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 22: Africa Sodium Cyanide Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 23: Africa Sodium Cyanide Industry Revenue million Forecast, by Country 2020 & 2033

- Table 24: Africa Sodium Cyanide Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Africa Sodium Cyanide Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 26: Africa Sodium Cyanide Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 27: Africa Sodium Cyanide Industry Revenue million Forecast, by Country 2020 & 2033

- Table 28: Africa Sodium Cyanide Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 29: Africa Sodium Cyanide Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 30: Africa Sodium Cyanide Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 31: Africa Sodium Cyanide Industry Revenue million Forecast, by Country 2020 & 2033

- Table 32: Africa Sodium Cyanide Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: Africa Sodium Cyanide Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 34: Africa Sodium Cyanide Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 35: Africa Sodium Cyanide Industry Revenue million Forecast, by Country 2020 & 2033

- Table 36: Africa Sodium Cyanide Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 37: Africa Sodium Cyanide Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 38: Africa Sodium Cyanide Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 39: Africa Sodium Cyanide Industry Revenue million Forecast, by Country 2020 & 2033

- Table 40: Africa Sodium Cyanide Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Africa Sodium Cyanide Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 42: Africa Sodium Cyanide Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 43: Africa Sodium Cyanide Industry Revenue million Forecast, by Country 2020 & 2033

- Table 44: Africa Sodium Cyanide Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 45: Africa Sodium Cyanide Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 46: Africa Sodium Cyanide Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 47: Africa Sodium Cyanide Industry Revenue million Forecast, by Country 2020 & 2033

- Table 48: Africa Sodium Cyanide Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Sodium Cyanide Industry?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Africa Sodium Cyanide Industry?

Key companies in the market include Honeywell International Inc, TAEKWANG INDUSTRIAL CO LTD, Australian Gold Reagents Pty Ltd, Evonik Industries AG, The Chemours Company, Sasol, HeBei ChengXin, TSPC, Orica Limited.

3. What are the main segments of the Africa Sodium Cyanide Industry?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 36.58 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Gold Mining Activities; Increasing Demand for Use in Chemical and Polymer Synthesis.

6. What are the notable trends driving market growth?

Increasing Demand from Mining Industry.

7. Are there any restraints impacting market growth?

Toxicity of Sodium Cyanide.

8. Can you provide examples of recent developments in the market?

January 2023: Shortages of sodium cyanide in Tanzania has hampered the country's large and medium sclae miners.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Sodium Cyanide Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Sodium Cyanide Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Sodium Cyanide Industry?

To stay informed about further developments, trends, and reports in the Africa Sodium Cyanide Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence