Key Insights

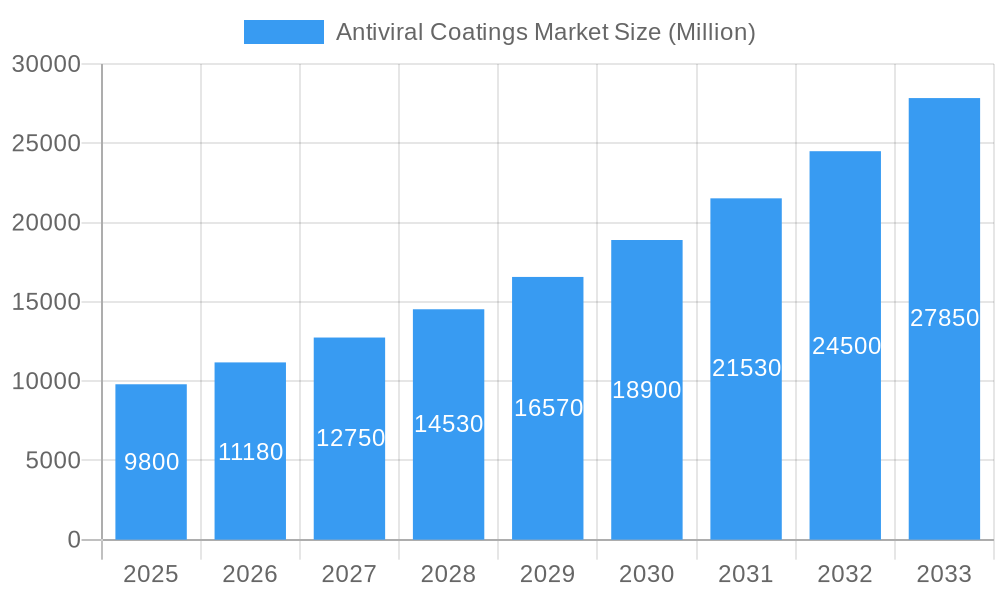

The Antiviral Coatings Market is projected to reach USD 9.8 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 14.00% through 2033. This significant growth is driven by increasing global hygiene awareness and demand for infection control, amplified by recent public health events. Industries, including construction, home appliances, healthcare, and textiles, are adopting antiviral coatings to enhance safety and mitigate pathogen transmission. Innovations in copper, graphene, and silver-based coatings are improving efficacy and durability, expanding application possibilities.

Antiviral Coatings Market Market Size (In Billion)

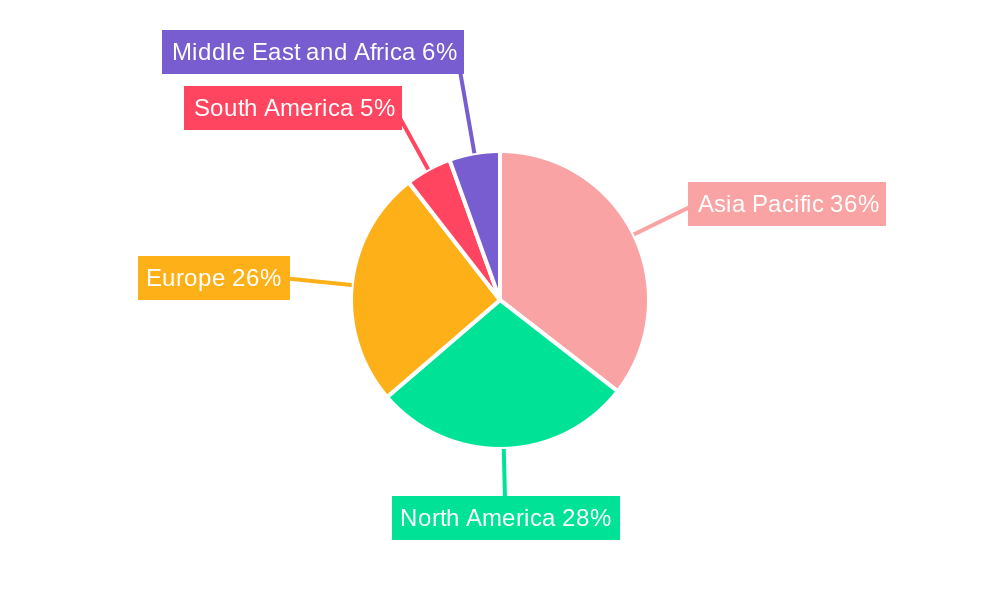

The Antiviral Coatings Market exhibits strong adoption across various applications, supported by continuous material innovation. Challenges like initial implementation costs and regulatory approvals may influence adoption in specific niches. However, the persistent need for improved public health infrastructure and product differentiation is expected to drive market expansion. Asia Pacific, particularly China and India, is a leading region due to its manufacturing capabilities and healthcare investments. North America and Europe are also key markets, driven by R&D and stringent hygiene standards. The market is also influenced by the development of sustainable and eco-friendly coating solutions.

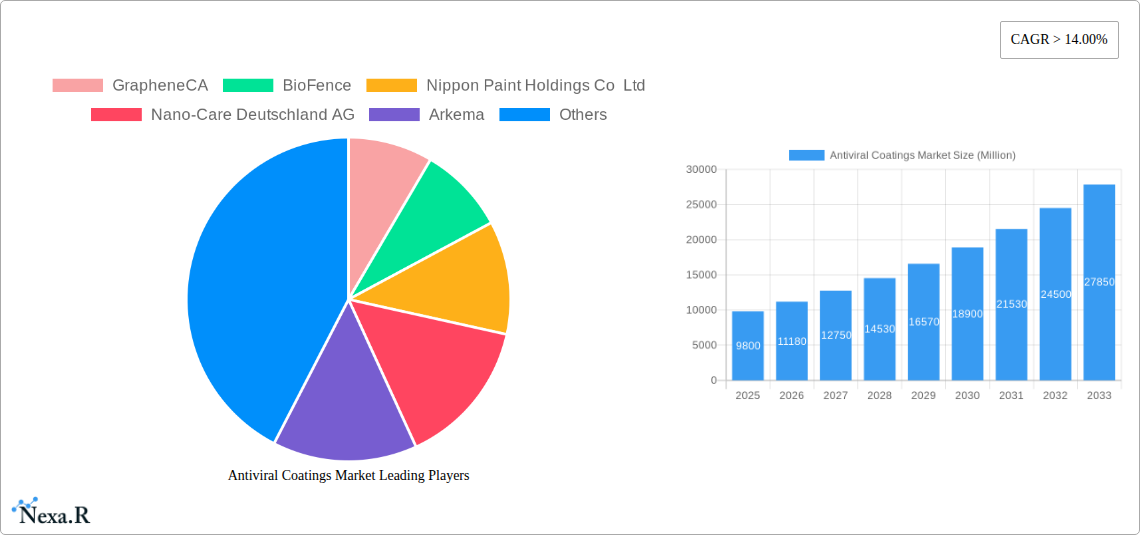

Antiviral Coatings Market Company Market Share

This report offers a comprehensive analysis of the global antiviral coatings market, a sector experiencing rapid growth fueled by heightened health awareness and the demand for germ-free environments. Discover market dynamics, growth drivers, key strategies, and emerging opportunities. Gain essential insights into the market size, the antiviral paint market, the antimicrobial coatings market, and the influence of copper coatings, graphene coatings, and silver coatings.

Antiviral Coatings Market Market Dynamics & Structure

The antiviral coatings market is characterized by dynamic interplay between technological innovation and evolving regulatory landscapes. Market concentration is moderately fragmented, with a mix of established chemical giants and specialized nanomaterial innovators vying for market share. Key drivers include the increasing incidence of infectious diseases, a growing emphasis on public health infrastructure, and a rising consumer demand for safer living and working spaces. Technological innovation is paramount, with advancements in material science enabling more effective and durable antiviral solutions. Regulatory frameworks, particularly those related to health and safety certifications, play a crucial role in market entry and product adoption. Competitive product substitutes include traditional disinfectants and less advanced antimicrobial treatments, but advanced antiviral coatings offer superior longevity and passive protection. End-user demographics are expanding, encompassing healthcare facilities, public transportation, educational institutions, and residential buildings. Mergers and acquisitions (M&A) activity is expected to increase as larger players seek to acquire innovative technologies and expand their product portfolios. For instance, PPG Industries Inc. and Nippon Paint Holdings Co Ltd are actively expanding their antiviral offerings.

- Market Concentration: Moderately fragmented with key players like GrapheneCA, BioFence, Nippon Paint Holdings Co Ltd, Nano-Care Deutschland AG, Arkema, Hydromer, Grand Polycoats, Novapura AG, Kastus Technologies Company Limited, Bio Gate AG, KOBE STEEL LTD, PPG Industries Inc.

- Technological Innovation: Driven by nanocoatings, advanced material science, and enhanced durability.

- Regulatory Frameworks: Stringent health and safety standards are emerging globally.

- Competitive Substitutes: Traditional disinfectants, basic antimicrobial treatments.

- End-User Demographics: Expanding beyond healthcare to include commercial, residential, and public spaces.

- M&A Trends: Expected to rise as companies seek to consolidate and acquire innovative technologies.

Antiviral Coatings Market Growth Trends & Insights

The global antiviral coatings market is experiencing robust growth, projected to reach significant market value in the coming years. This expansion is fueled by a paradigm shift in public and commercial perception towards proactively maintaining hygienic environments. The market size evolution is directly linked to the increasing recognition of the long-term efficacy and cost-effectiveness of antiviral coatings compared to traditional, labor-intensive disinfection methods. Adoption rates are accelerating across various sectors, particularly post-pandemic, as industries prioritize the health and safety of their employees and customers. Technological disruptions are central to this growth, with ongoing research and development yielding novel materials and application techniques. Consumer behavior shifts are evident, with a greater preference for products and services that demonstrably contribute to well-being. Market penetration is deepening as awareness of the benefits of antiviral surfaces spreads, leading to wider acceptance and integration into building materials, textiles, and consumer goods. The CAGR for this market is expected to be substantial, reflecting the sustained demand and innovative advancements. The market is driven by a need for continuous protection, reducing the risk of pathogen transmission and fostering confidence in public spaces. The increasing investment in smart buildings and advanced materials further propels the adoption of these protective coatings.

Dominant Regions, Countries, or Segments in Antiviral Coatings Market

The healthcare sector consistently emerges as a dominant segment within the antiviral coatings market, driven by the paramount need for infection control and patient safety. Regions with robust healthcare infrastructure and proactive health regulations, such as North America and Europe, are leading this segment. However, the construction sector is rapidly gaining traction, especially with the growing trend of incorporating antiviral properties into building materials for commercial spaces, offices, and residential properties, particularly in Asia-Pacific and emerging economies.

- Dominant Segment - Healthcare:

- High demand for infection prevention in hospitals, clinics, and laboratories.

- Stringent regulatory requirements for medical device coatings and facility surfaces.

- Advancements in specialized antiviral coatings for surgical instruments and patient care areas.

- Market share in this segment is substantial due to its established need and continuous demand.

- Emerging Segment - Construction:

- Integration into paints, wall coverings, flooring, and façade materials.

- Increased application in high-traffic public spaces such as airports, train stations, and shopping malls.

- Government initiatives promoting healthier building standards are a significant growth accelerator.

- Growth potential is immense as developers prioritize occupant well-being.

- Leading Material - Copper Coatings:

- Copper's inherent antimicrobial and antiviral properties are well-established, offering a proven solution.

- Used extensively in high-touch surfaces in healthcare and public areas.

- Growing interest in its aesthetic appeal and durability in architectural applications.

- Significant market share attributed to its long history of efficacy.

- Emerging Material - Graphene Coatings:

- Offers exceptional durability, conductivity, and potential for broad-spectrum antiviral activity.

- Enabling innovative applications in electronics and advanced materials.

- Ongoing research is unlocking its full potential, promising a significant future market share.

- Key Dominance Factors:

- Economic Policies: Government investments in public health and infrastructure development.

- Infrastructure: Development of new buildings and retrofitting of existing ones with advanced materials.

- Consumer Awareness: Growing public demand for healthier living environments.

- Technological Advancements: Development of novel, highly effective antiviral coating formulations.

Antiviral Coatings Market Product Landscape

The product landscape of the antiviral coatings market is characterized by continuous innovation, with a focus on developing coatings that offer broad-spectrum antiviral efficacy, long-lasting protection, and ease of application. Leading products utilize advanced materials like copper, silver nanoparticles, and graphene, engineered to disrupt viral membranes or inhibit replication upon contact. Unique selling propositions often lie in the durability of the antiviral effect, with many coatings providing protection for months or even years. Technological advancements include self-cleaning properties, enhanced scratch resistance, and integration with smart technologies for real-time monitoring of surface contamination. Applications span across critical sectors, including antimicrobial paints for healthcare facilities, antiviral textiles for apparel and linens, and self-sanitizing coatings for consumer electronics and high-touch surfaces in public spaces.

Key Drivers, Barriers & Challenges in Antiviral Coatings Market

Key Drivers:

- Heightened Global Health Awareness: The pandemic has permanently elevated the importance of hygiene and infection control, driving demand for proactive solutions.

- Technological Advancements: Development of novel nanomaterials and coating technologies offering superior efficacy and durability.

- Government Initiatives & Regulations: Increasing focus on public health and safety standards in public spaces and infrastructure.

- Growing Demand for Long-Lasting Protection: Antiviral coatings offer continuous, passive protection, reducing the need for frequent manual disinfection.

Barriers & Challenges:

- Cost of Implementation: Initial investment in advanced antiviral coatings can be higher than traditional alternatives, impacting adoption in price-sensitive markets.

- Regulatory Hurdles & Certification: Obtaining necessary certifications and approvals for antiviral claims can be a complex and time-consuming process, especially for novel technologies.

- Durability and Longevity Concerns: Ensuring the sustained effectiveness of antiviral properties over extended periods and under various environmental conditions remains a key challenge.

- Public Perception and Education: Educating consumers and businesses about the benefits and reliability of antiviral coatings is crucial for wider market acceptance.

- Supply Chain Disruptions: Availability and cost fluctuations of key raw materials, particularly specialized nanoparticles, can impact production and pricing.

Emerging Opportunities in Antiviral Coatings Market

Emerging opportunities within the antiviral coatings market are vast, driven by evolving consumer preferences and technological breakthroughs. The integration of antiviral coatings into everyday consumer products, such as smartphone screens, car interiors, and children's toys, presents a significant untapped market. Furthermore, the development of biodegradable and environmentally friendly antiviral coatings is gaining momentum, aligning with growing sustainability concerns. The application of these coatings in high-traffic public transportation systems – including trains, buses, and airplanes – offers immense potential for reducing pathogen transmission. The expansion of smart building technologies also opens doors for antiviral coatings that can integrate with sensor systems to monitor surface cleanliness and effectiveness.

Growth Accelerators in the Antiviral Coatings Market Industry

The antiviral coatings market is poised for accelerated growth driven by several key factors. Technological breakthroughs in nanotechnology and material science are continuously yielding more effective, durable, and cost-efficient antiviral solutions. Strategic partnerships between coating manufacturers and material suppliers are fostering innovation and expanding product portfolios. Market expansion strategies, including geographical penetration into emerging economies with increasing healthcare spending and infrastructure development, will further fuel growth. The rising demand for self-sanitizing surfaces in commercial and residential spaces, coupled with a global emphasis on preventative healthcare, acts as a powerful catalyst. The successful commercialization of new antiviral technologies and their integration into mainstream applications will significantly contribute to long-term market expansion.

Key Players Shaping the Antiviral Coatings Market Market

- GrapheneCA

- BioFence

- Nippon Paint Holdings Co Ltd

- Nano-Care Deutschland AG

- Arkema

- Hydromer

- Grand Polycoats

- Novapura AG

- Kastus Technologies Company Limited

- Bio Gate AG

- KOBE STEEL LTD

- PPG Industries Inc

Notable Milestones in Antiviral Coatings Market Sector

- August 2022: PPG announced that two of its industry-leading antimicrobial and antiviral products, Copper Armor antimicrobial paint by PPG with Corning Guardiant technology and Comex Vinimex Total antiviral and antibacterial paint, were recognized with 2022 R&D 100 awards.

- February 2022: Nippon Paint added two new antiviral water-based paint products to its lineup, the PROTECTON brand, designed for floors and interior walls.

In-Depth Antiviral Coatings Market Market Outlook

The future outlook for the antiviral coatings market is exceptionally bright, driven by sustained global demand for enhanced hygiene and proactive infection control. Growth accelerators include the ongoing advancements in nanomaterial science, leading to more potent and versatile antiviral solutions. Strategic collaborations between chemical companies, research institutions, and end-users will expedite the development and commercialization of innovative products. The increasing focus on creating healthier built environments, coupled with rising consumer awareness, will propel market expansion across diverse applications, from healthcare and construction to textiles and consumer electronics. Emerging markets represent significant opportunities for penetration, as governments and industries invest in upgrading their infrastructure and public health measures. The continuous pursuit of advanced materials and application technologies ensures a dynamic and expanding market.

Antiviral Coatings Market Segmentation

-

1. Material

- 1.1. Copper

- 1.2. Graphene

- 1.3. Silver

- 1.4. Other Material Types

-

2. Application

- 2.1. Construction

- 2.2. Home Appliances

- 2.3. Healthcare

- 2.4. Textiles and Apparel

- 2.5. Other Applications

Antiviral Coatings Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Antiviral Coatings Market Regional Market Share

Geographic Coverage of Antiviral Coatings Market

Antiviral Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Demand from the Construction Sector; Other Drivers

- 3.3. Market Restrains

- 3.3.1. High Demand from the Construction Sector; Other Drivers

- 3.4. Market Trends

- 3.4.1. High Demand from Construction Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Antiviral Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Copper

- 5.1.2. Graphene

- 5.1.3. Silver

- 5.1.4. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Construction

- 5.2.2. Home Appliances

- 5.2.3. Healthcare

- 5.2.4. Textiles and Apparel

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Asia Pacific Antiviral Coatings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Copper

- 6.1.2. Graphene

- 6.1.3. Silver

- 6.1.4. Other Material Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Construction

- 6.2.2. Home Appliances

- 6.2.3. Healthcare

- 6.2.4. Textiles and Apparel

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. North America Antiviral Coatings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Copper

- 7.1.2. Graphene

- 7.1.3. Silver

- 7.1.4. Other Material Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Construction

- 7.2.2. Home Appliances

- 7.2.3. Healthcare

- 7.2.4. Textiles and Apparel

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Europe Antiviral Coatings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Copper

- 8.1.2. Graphene

- 8.1.3. Silver

- 8.1.4. Other Material Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Construction

- 8.2.2. Home Appliances

- 8.2.3. Healthcare

- 8.2.4. Textiles and Apparel

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. South America Antiviral Coatings Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Copper

- 9.1.2. Graphene

- 9.1.3. Silver

- 9.1.4. Other Material Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Construction

- 9.2.2. Home Appliances

- 9.2.3. Healthcare

- 9.2.4. Textiles and Apparel

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East and Africa Antiviral Coatings Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Copper

- 10.1.2. Graphene

- 10.1.3. Silver

- 10.1.4. Other Material Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Construction

- 10.2.2. Home Appliances

- 10.2.3. Healthcare

- 10.2.4. Textiles and Apparel

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 GrapheneCA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BioFence

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nippon Paint Holdings Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nano-Care Deutschland AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Arkema

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hydromer

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Grand Polycoats

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Novapura AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kastus Technologies Company Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bio Gate AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 KOBE STEEL LTD

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 PPG Industries Inc *List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 GrapheneCA

List of Figures

- Figure 1: Global Antiviral Coatings Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Antiviral Coatings Market Revenue (billion), by Material 2025 & 2033

- Figure 3: Asia Pacific Antiviral Coatings Market Revenue Share (%), by Material 2025 & 2033

- Figure 4: Asia Pacific Antiviral Coatings Market Revenue (billion), by Application 2025 & 2033

- Figure 5: Asia Pacific Antiviral Coatings Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Antiviral Coatings Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Antiviral Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Antiviral Coatings Market Revenue (billion), by Material 2025 & 2033

- Figure 9: North America Antiviral Coatings Market Revenue Share (%), by Material 2025 & 2033

- Figure 10: North America Antiviral Coatings Market Revenue (billion), by Application 2025 & 2033

- Figure 11: North America Antiviral Coatings Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Antiviral Coatings Market Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Antiviral Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Antiviral Coatings Market Revenue (billion), by Material 2025 & 2033

- Figure 15: Europe Antiviral Coatings Market Revenue Share (%), by Material 2025 & 2033

- Figure 16: Europe Antiviral Coatings Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Europe Antiviral Coatings Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Antiviral Coatings Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Antiviral Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Antiviral Coatings Market Revenue (billion), by Material 2025 & 2033

- Figure 21: South America Antiviral Coatings Market Revenue Share (%), by Material 2025 & 2033

- Figure 22: South America Antiviral Coatings Market Revenue (billion), by Application 2025 & 2033

- Figure 23: South America Antiviral Coatings Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Antiviral Coatings Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Antiviral Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Antiviral Coatings Market Revenue (billion), by Material 2025 & 2033

- Figure 27: Middle East and Africa Antiviral Coatings Market Revenue Share (%), by Material 2025 & 2033

- Figure 28: Middle East and Africa Antiviral Coatings Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Antiviral Coatings Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Antiviral Coatings Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Antiviral Coatings Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Antiviral Coatings Market Revenue billion Forecast, by Material 2020 & 2033

- Table 2: Global Antiviral Coatings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Antiviral Coatings Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Antiviral Coatings Market Revenue billion Forecast, by Material 2020 & 2033

- Table 5: Global Antiviral Coatings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Antiviral Coatings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Antiviral Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Antiviral Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Antiviral Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Antiviral Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Antiviral Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Antiviral Coatings Market Revenue billion Forecast, by Material 2020 & 2033

- Table 13: Global Antiviral Coatings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Antiviral Coatings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United States Antiviral Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Antiviral Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Antiviral Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Antiviral Coatings Market Revenue billion Forecast, by Material 2020 & 2033

- Table 19: Global Antiviral Coatings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Global Antiviral Coatings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Germany Antiviral Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Antiviral Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Italy Antiviral Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: France Antiviral Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Antiviral Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global Antiviral Coatings Market Revenue billion Forecast, by Material 2020 & 2033

- Table 27: Global Antiviral Coatings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Global Antiviral Coatings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Brazil Antiviral Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Argentina Antiviral Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Antiviral Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Antiviral Coatings Market Revenue billion Forecast, by Material 2020 & 2033

- Table 33: Global Antiviral Coatings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Antiviral Coatings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Antiviral Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: South Africa Antiviral Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Antiviral Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Antiviral Coatings Market?

The projected CAGR is approximately 10.4%.

2. Which companies are prominent players in the Antiviral Coatings Market?

Key companies in the market include GrapheneCA, BioFence, Nippon Paint Holdings Co Ltd, Nano-Care Deutschland AG, Arkema, Hydromer, Grand Polycoats, Novapura AG, Kastus Technologies Company Limited, Bio Gate AG, KOBE STEEL LTD, PPG Industries Inc *List Not Exhaustive.

3. What are the main segments of the Antiviral Coatings Market?

The market segments include Material, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.4 billion as of 2022.

5. What are some drivers contributing to market growth?

High Demand from the Construction Sector; Other Drivers.

6. What are the notable trends driving market growth?

High Demand from Construction Segment.

7. Are there any restraints impacting market growth?

High Demand from the Construction Sector; Other Drivers.

8. Can you provide examples of recent developments in the market?

August 2022: PPG announced that two of its industry-leading antimicrobial and antiviral products were recognized with 2022 R&D 100 awards in the mechanical/materials category - The company stated that the Copper Armor antimicrobial paint by PPG with Corning Guardiant technology and Comex Vinimex Total antiviral and antibacterial paint were both honored with the award

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Antiviral Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Antiviral Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Antiviral Coatings Market?

To stay informed about further developments, trends, and reports in the Antiviral Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence