Key Insights

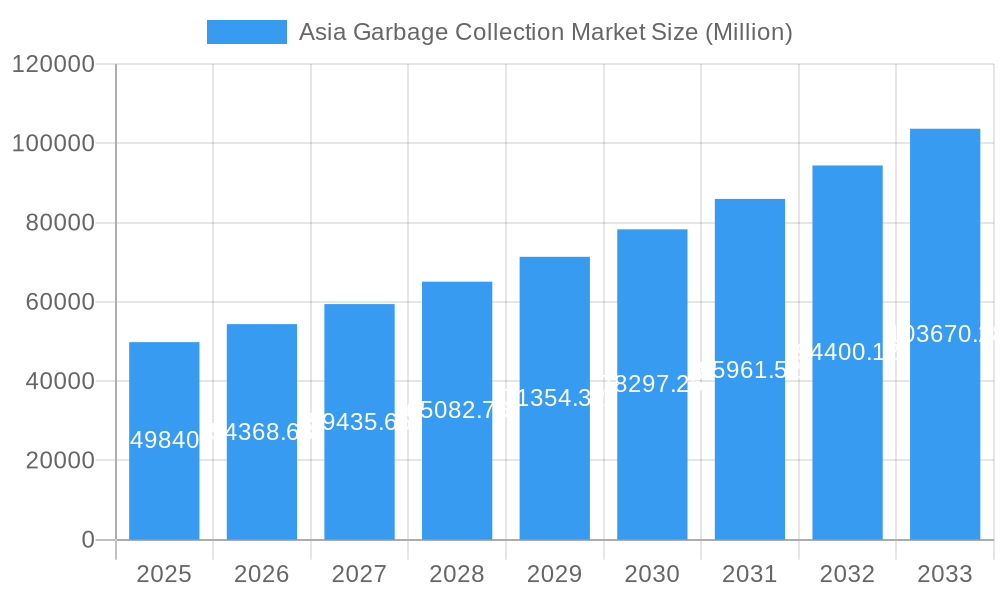

The Asia garbage collection market, valued at $49.84 billion in 2025, is projected to experience robust growth, driven by increasing urbanization, rising environmental awareness, and stringent government regulations on waste management. A Compound Annual Growth Rate (CAGR) of 8.97% from 2025 to 2033 indicates a significant expansion of this sector. Key growth drivers include the increasing generation of waste from burgeoning populations in major Asian economies like China, India, and Japan. Furthermore, the rising adoption of sustainable waste management practices, including recycling and waste-to-energy initiatives, fuels market expansion. The market is segmented by waste type (hazardous and non-hazardous), collection type (curbside, door-to-door, and community programs), end-user (municipal, healthcare, chemical, and mining industries), and product type (disposal and recycling equipment). The Asia-Pacific region dominates the market, with China, Japan, and India as leading contributors, reflecting their high population density and economic development. However, challenges remain, including insufficient infrastructure in some regions, a lack of awareness in certain communities, and the high costs associated with hazardous waste management. Companies operating in this space, such as Enviroserve, Secure Waste Management, and others, are strategically investing in technological advancements and partnerships to capitalize on the growing demand for efficient and sustainable waste collection solutions. This market's future trajectory is optimistic, driven by continuous urbanization, evolving consumer habits, and supportive government policies promoting environmentally responsible waste management.

Asia Garbage Collection Market Market Size (In Billion)

The competitive landscape is characterized by a mix of large multinational corporations and smaller, regional players. The market is witnessing increased consolidation through mergers and acquisitions, as companies seek to expand their geographic reach and service offerings. Technological advancements, such as smart bins and waste tracking systems, are enhancing efficiency and optimizing waste collection routes. Furthermore, the growing demand for sustainable solutions is leading to innovations in waste recycling and processing technologies, contributing to a more circular economy. The increasing focus on reducing landfill waste and promoting resource recovery is also shaping the future of the Asia garbage collection market. The market's expansion is expected to create new opportunities for waste management companies, equipment manufacturers, and technology providers, driving further growth and innovation in the coming years.

Asia Garbage Collection Market Company Market Share

Asia Garbage Collection Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia garbage collection market, covering its dynamics, growth trends, dominant segments, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and policymakers. The market is segmented by waste type (hazardous and non-hazardous), collection type (curbside pickup, door-to-door, community recycling programs), end-user (municipal, healthcare, chemical, mining), region (China, Japan, India, Rest of Asia), and product type (waste disposal equipment, waste recycling, sorting equipment). The market size is valued in Million units.

Asia Garbage Collection Market Dynamics & Structure

The Asia garbage collection market is characterized by a moderately fragmented landscape, with a few large players alongside numerous smaller regional operators. Technological innovation, particularly in waste sorting and recycling technologies, is a key driver, while stringent government regulations and increasing environmental concerns are further shaping market growth. The market is witnessing a surge in mergers and acquisitions (M&A) activity, as larger companies seek to expand their reach and consolidate their market share. Substitute products, such as incineration or landfilling, continue to compete, though their environmental impact is increasingly scrutinized. End-user demographics, particularly in rapidly urbanizing areas, are significantly influencing demand.

- Market Concentration: Moderately fragmented, with a xx% market share held by the top 5 players in 2025.

- Technological Innovation: Significant advancements in AI-powered waste sorting and automation are boosting efficiency and reducing costs.

- Regulatory Framework: Stringent environmental regulations and policies across several Asian nations are driving demand for efficient waste management solutions. However, inconsistent enforcement remains a challenge in some regions.

- Competitive Substitutes: Incineration and landfills remain prevalent, but face growing pressure due to environmental concerns.

- M&A Activity: An estimated xx M&A deals were completed in the Asia garbage collection sector between 2019 and 2024. This trend is projected to continue, driven by the desire for market consolidation and expansion.

- End-User Demographics: Rapid urbanization and population growth in major Asian cities are significantly driving demand for waste collection services.

Asia Garbage Collection Market Growth Trends & Insights

The Asia garbage collection market is experiencing robust growth, fueled by rising environmental awareness, increasing urbanization, and supportive government policies. The market size is projected to reach xx Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, such as the adoption of smart bins and automated waste collection systems, are further accelerating market expansion. Consumer behavior is shifting towards greater environmental responsibility, leading to increased participation in recycling and waste reduction initiatives. Market penetration rates for advanced waste management technologies remain relatively low, indicating substantial growth potential. The historical period (2019-2024) showed a CAGR of xx%.

Dominant Regions, Countries, or Segments in Asia Garbage Collection Market

China, India, and Japan represent the largest national markets within the Asia garbage collection sector, driven by high population density, rapid urbanization, and increasing environmental concerns. Within the segment breakdown, Non-Hazardous Waste management commands a larger market share compared to Hazardous Waste due to the sheer volume generated. Curbside pickup is the most prevalent collection type, though door-to-door and community recycling programs are growing rapidly. Municipal waste management is the leading end-user segment, followed by the healthcare and chemical sectors. The Rest of Asia region is exhibiting the highest CAGR, driven by investments in infrastructure and regulatory changes.

- Key Drivers:

- China: Stringent government regulations, substantial investment in waste management infrastructure, and a large population.

- India: Rapid urbanization, increasing environmental consciousness, and growing government focus on sanitation.

- Japan: Advanced waste management technology and high recycling rates.

- Rest of Asia: Significant infrastructure development and increasing investment in waste management solutions.

- Dominant Segments:

- Waste Type: Non-Hazardous Waste holds the largest market share.

- Collection Type: Curbside pickup is the dominant collection method.

- End User: Municipal waste management is the largest end-user segment.

Asia Garbage Collection Market Product Landscape

The Asia garbage collection market showcases a diverse range of products, including advanced waste disposal equipment, efficient waste recycling technologies, and intelligent sorting equipment. These products offer enhanced efficiency, reduced environmental impact, and improved resource recovery rates. Key innovations include AI-powered sorting systems, automated collection vehicles, and smart bins equipped with sensors to monitor waste levels and optimize collection routes. These advancements are improving waste management operations and driving market expansion.

Key Drivers, Barriers & Challenges in Asia Garbage Collection Market

Key Drivers: Rising environmental awareness, stringent government regulations, rapid urbanization, and technological advancements in waste management are propelling market growth. For example, China's stringent waste management regulations are driving significant investment in advanced waste processing technologies.

Key Challenges: Inadequate infrastructure in many regions, inconsistent regulatory enforcement, a lack of skilled workforce, and high initial investment costs for advanced technologies are key barriers to market growth. Supply chain disruptions due to the COVID-19 pandemic also impacted market performance.

Emerging Opportunities in Asia Garbage Collection Market

Untapped potential lies in rural areas and smaller cities, where waste management infrastructure is often underdeveloped. The adoption of sustainable waste management practices, coupled with increased recycling rates, presents significant growth opportunities. Evolving consumer preferences toward environmentally friendly products and services are further shaping market demand. Innovative business models, such as waste-to-energy initiatives, are gaining traction.

Growth Accelerators in the Asia Garbage Collection Market Industry

Technological breakthroughs, such as AI-powered waste sorting and automated collection systems, are driving efficiency and cost-effectiveness, thus accelerating market growth. Strategic partnerships between private companies and government bodies are facilitating infrastructure development and improving waste management services. Market expansion into underserved regions and the adoption of innovative waste-to-energy solutions offer further opportunities for accelerated growth.

Key Players Shaping the Asia Garbage Collection Market Market

- Enviroserve

- Se Cure Waste Management

- Blue Plane

- SEPCO

- All Recycling

- Cleanco Waste Treatment

- Attero

- Averda

- Remondis

Notable Milestones in Asia Garbage Collection Market Sector

- September 2023: Project STOP, in collaboration with Regent Ipuk Feliiantiandani, inaugurated one of Indonesia's largest Material Recovery Facilities in Songgon Town. This signifies a major advancement in Indonesia's circular waste management system.

- March 2023: ALBA Group Asia and VietCycle formed a joint venture to establish Vietnam's largest food-grade PET/HDPE plastic recycling facility, showcasing a significant investment in sustainable waste management.

In-Depth Asia Garbage Collection Market Market Outlook

The Asia garbage collection market is poised for sustained growth over the next decade, driven by continued urbanization, strengthening environmental regulations, and technological innovation. Strategic partnerships, investments in infrastructure, and the adoption of sustainable waste management practices will be crucial in realizing the market's full potential. Opportunities exist in expanding into underserved markets, developing advanced recycling technologies, and implementing waste-to-energy solutions. The market is expected to experience a robust expansion, driven by a combination of factors, promising significant returns for investors and stakeholders committed to sustainable waste management solutions.

Asia Garbage Collection Market Segmentation

-

1. Product Type

- 1.1. Waste Disposal Equipment

- 1.2. Waste Recycling

- 1.3. Sorting Equipment

-

2. Waste Type

- 2.1. Hazardous Waste

- 2.2. Non-Hazardous Waste

-

3. Collection Type

- 3.1. Curbside Pickup

- 3.2. Door-to-door Collection

- 3.3. Community Recycling Programs

-

4. End User

- 4.1. Municipal Waste Management

- 4.2. Healthcare

- 4.3. Chemical

- 4.4. Mining

Asia Garbage Collection Market Segmentation By Geography

-

1. Asia

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Indonesia

- 1.6. Malaysia

- 1.7. Singapore

- 1.8. Thailand

- 1.9. Vietnam

- 1.10. Philippines

- 1.11. Bangladesh

- 1.12. Pakistan

Asia Garbage Collection Market Regional Market Share

Geographic Coverage of Asia Garbage Collection Market

Asia Garbage Collection Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing awareness among consumers4.; Environment concerns and sustainability

- 3.3. Market Restrains

- 3.3.1. 4.; The cost of production and transportation4.; Regulations and quality standards

- 3.4. Market Trends

- 3.4.1. Non Hazardous segment dominating the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Garbage Collection Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Waste Disposal Equipment

- 5.1.2. Waste Recycling

- 5.1.3. Sorting Equipment

- 5.2. Market Analysis, Insights and Forecast - by Waste Type

- 5.2.1. Hazardous Waste

- 5.2.2. Non-Hazardous Waste

- 5.3. Market Analysis, Insights and Forecast - by Collection Type

- 5.3.1. Curbside Pickup

- 5.3.2. Door-to-door Collection

- 5.3.3. Community Recycling Programs

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Municipal Waste Management

- 5.4.2. Healthcare

- 5.4.3. Chemical

- 5.4.4. Mining

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Enviroserve

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Se Cure Waste Management

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Blue Plane

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SEPCO

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 All Recycling

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cleanco Waste Treatment

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Attero

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Averda

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Remondis

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Enviroserve

List of Figures

- Figure 1: Asia Garbage Collection Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Garbage Collection Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Garbage Collection Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Asia Garbage Collection Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: Asia Garbage Collection Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 4: Asia Garbage Collection Market Volume K Tons Forecast, by Waste Type 2020 & 2033

- Table 5: Asia Garbage Collection Market Revenue Million Forecast, by Collection Type 2020 & 2033

- Table 6: Asia Garbage Collection Market Volume K Tons Forecast, by Collection Type 2020 & 2033

- Table 7: Asia Garbage Collection Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Asia Garbage Collection Market Volume K Tons Forecast, by End User 2020 & 2033

- Table 9: Asia Garbage Collection Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Asia Garbage Collection Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 11: Asia Garbage Collection Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Asia Garbage Collection Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 13: Asia Garbage Collection Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 14: Asia Garbage Collection Market Volume K Tons Forecast, by Waste Type 2020 & 2033

- Table 15: Asia Garbage Collection Market Revenue Million Forecast, by Collection Type 2020 & 2033

- Table 16: Asia Garbage Collection Market Volume K Tons Forecast, by Collection Type 2020 & 2033

- Table 17: Asia Garbage Collection Market Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Asia Garbage Collection Market Volume K Tons Forecast, by End User 2020 & 2033

- Table 19: Asia Garbage Collection Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Asia Garbage Collection Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 21: China Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: China Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Japan Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Japan Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: South Korea Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: India Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Indonesia Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Indonesia Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Malaysia Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Malaysia Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Singapore Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Singapore Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Thailand Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Thailand Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 37: Vietnam Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Vietnam Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 39: Philippines Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Philippines Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 41: Bangladesh Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Bangladesh Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: Pakistan Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Pakistan Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Garbage Collection Market?

The projected CAGR is approximately 8.97%.

2. Which companies are prominent players in the Asia Garbage Collection Market?

Key companies in the market include Enviroserve, Se Cure Waste Management, Blue Plane, SEPCO, All Recycling, Cleanco Waste Treatment, Attero, Averda, Remondis.

3. What are the main segments of the Asia Garbage Collection Market?

The market segments include Product Type, Waste Type, Collection Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 49.84 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing awareness among consumers4.; Environment concerns and sustainability.

6. What are the notable trends driving market growth?

Non Hazardous segment dominating the market.

7. Are there any restraints impacting market growth?

4.; The cost of production and transportation4.; Regulations and quality standards.

8. Can you provide examples of recent developments in the market?

September 2023: Project STOP, in collaboration with Regent Ipuk Feliiantiandani, inaugurated one of Indonesia's largest Material Recovery Facilities in Songgon Town. This significant milestone, achieved in partnership with the Banyuwan Provincial Government, marks a major stride toward establishing Indonesia as the pioneer in regency-run systems for circular waste management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Garbage Collection Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Garbage Collection Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Garbage Collection Market?

To stay informed about further developments, trends, and reports in the Asia Garbage Collection Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence