Key Insights

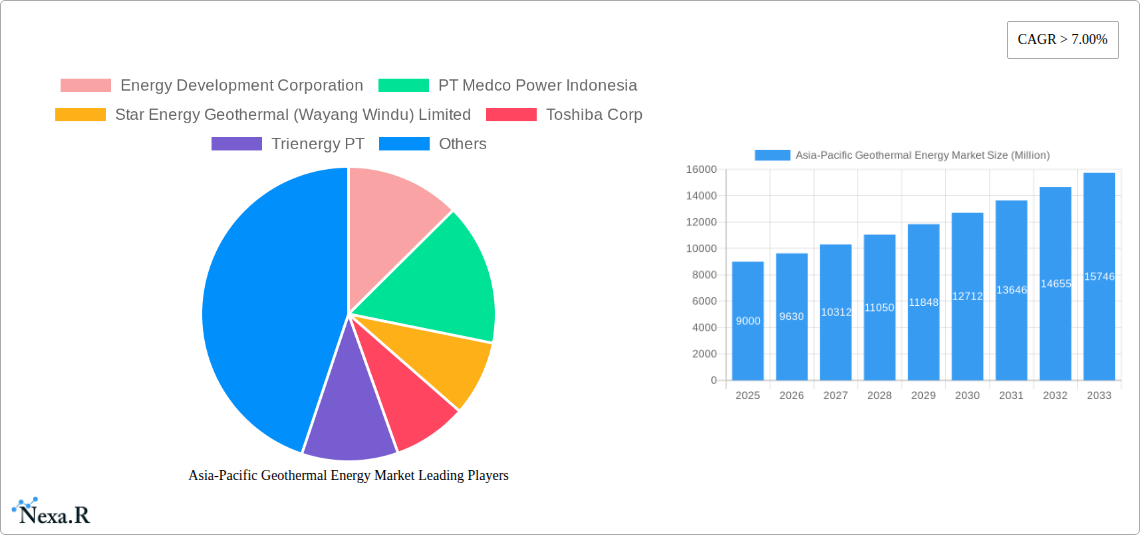

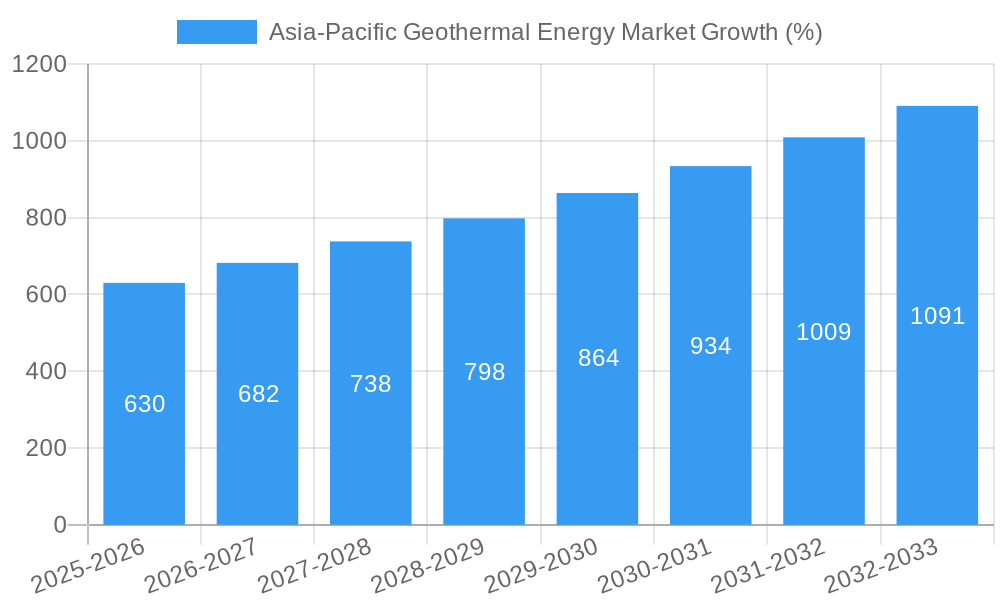

The Asia-Pacific geothermal energy market is experiencing robust growth, driven by increasing energy demand, supportive government policies promoting renewable energy sources, and the region's significant geothermal resources. A CAGR exceeding 7% from 2019 to 2033 indicates a substantial market expansion. While precise market size figures for 2019-2024 aren't provided, considering the substantial geothermal potential in countries like Indonesia, the Philippines, and Japan, alongside significant investments in geothermal power plants, a reasonable estimation places the 2025 market size in the range of $8-10 billion USD. This growth is fueled by several factors. Firstly, the region’s commitment to reducing carbon emissions and diversifying energy sources makes geothermal power an increasingly attractive option. Secondly, technological advancements in geothermal exploration and plant efficiency are lowering costs and increasing the viability of projects. Thirdly, consistent policy support, through subsidies, tax incentives, and streamlined permitting processes, is stimulating investment and project development across the Asia-Pacific region. However, challenges remain, including the high upfront capital costs associated with geothermal plant development and potential environmental concerns related to water usage and induced seismicity. Effective risk mitigation strategies and continued technological innovation are crucial to ensure the sustainable growth of the Asia-Pacific geothermal energy market. The segmentation by plant type (dry steam, flash, binary) reflects the diverse technological approaches employed, each with its own advantages and suitability depending on the specific geothermal resource characteristics. Major players like Energy Development Corporation, Pertamina Geothermal Energy, and others are leading the market expansion, driving innovation and competition.

The forecast period (2025-2033) promises further significant growth, particularly in countries with substantial untapped geothermal potential. The focus will likely shift towards optimizing existing plants, expanding into new geographical areas, and deploying advanced technologies to increase efficiency and reduce costs. Government regulations play a crucial role in navigating environmental considerations and ensuring the responsible development of geothermal energy resources. Strategic partnerships between governments, private investors, and technology providers will be essential for harnessing the vast potential of geothermal energy in the Asia-Pacific region. The continued focus on sustainability and renewable energy targets will solidify the position of geothermal energy as a key contributor to the region's energy mix in the coming years.

Asia-Pacific Geothermal Energy Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific geothermal energy market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report segments the market by Geothermal Power Plant Type (Dry Steam, Flash Plants, Binary Plants) and offers valuable insights for industry professionals, investors, and policymakers. Expected market size in Million units for 2025 is XX.

Asia-Pacific Geothermal Energy Market Market Dynamics & Structure

The Asia-Pacific geothermal energy market exhibits a moderately concentrated structure, with key players like Energy Development Corporation, PT Medco Power Indonesia, and Pertamina Geothermal Energy PT holding significant market share. Technological innovation, driven by advancements in drilling technologies and binary cycle power plants, is a key growth driver. Supportive government policies and regulations promoting renewable energy adoption further fuel market expansion. However, high upfront capital costs and geological risks remain significant barriers. The competitive landscape includes both established players and emerging companies. Mergers and acquisitions (M&A) activity remains moderate, with a focus on expanding operational capacity and geographical reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately XX% market share in 2025.

- Technological Innovation: Advancements in drilling and binary plant technologies are key drivers.

- Regulatory Framework: Supportive government policies promoting renewable energy adoption.

- Competitive Substitutes: Fossil fuels (coal, natural gas) and other renewables (solar, wind).

- End-User Demographics: Primarily utilities and independent power producers.

- M&A Trends: Moderate M&A activity focused on expansion and geographical diversification, with approximately XX deals in the last 5 years.

Asia-Pacific Geothermal Energy Market Growth Trends & Insights

The Asia-Pacific geothermal energy market is experiencing robust growth, driven by increasing electricity demand, rising environmental concerns, and supportive government initiatives. The market size is projected to expand significantly over the forecast period, with a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This growth is fueled by the adoption of advanced technologies, improved efficiency, and decreasing costs. Consumer behavior is shifting towards cleaner energy sources, further bolstering market demand. Significant technological disruptions, including advancements in Enhanced Geothermal Systems (EGS), are expected to further enhance market growth. Market penetration is expected to increase from XX% in 2025 to XX% by 2033.

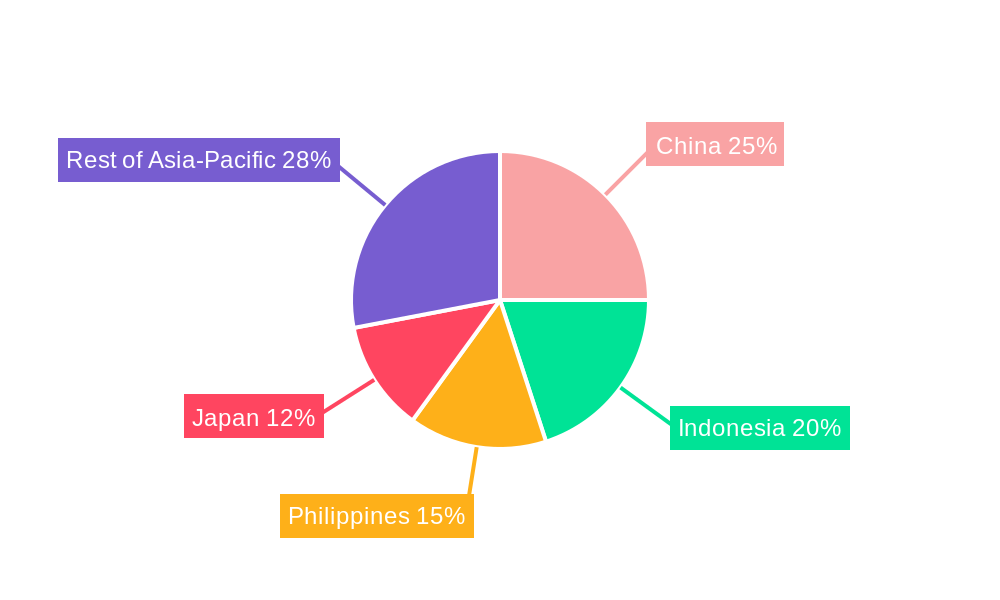

Dominant Regions, Countries, or Segments in Asia-Pacific Geothermal Energy Market

Indonesia and the Philippines are currently the dominant markets, driven by abundant geothermal resources, supportive government policies, and significant investments in geothermal power plant development. The Binary Plants segment is showing the strongest growth potential due to its ability to utilize lower-temperature resources.

- Indonesia: Abundant resources, supportive government policies, and large-scale projects drive significant growth.

- Philippines: Established geothermal industry with ongoing expansions and new projects.

- Geothermal Power Plant Type: Binary plants demonstrate the fastest growth due to their versatility in utilizing lower-temperature resources.

- Key Drivers: Government incentives, economic growth, and increasing energy demand.

Asia-Pacific Geothermal Energy Market Product Landscape

The market offers a range of geothermal power plant technologies, including dry steam, flash, and binary plants. Recent innovations focus on improving efficiency, reducing environmental impact, and expanding resource utilization. Key selling propositions include reliability, sustainability, and baseload power generation capabilities. Advancements in drilling technology and resource exploration techniques are further enhancing the market's potential.

Key Drivers, Barriers & Challenges in Asia-Pacific Geothermal Energy Market

Key Drivers:

- Increasing electricity demand

- Government support for renewable energy

- Technological advancements

- Environmental concerns

Key Barriers and Challenges:

- High upfront capital costs

- Geological risks and uncertainties

- Regulatory hurdles and permitting processes

- Supply chain constraints, leading to potential delays and cost overruns (estimated impact: XX% on project timelines in 2025).

Emerging Opportunities in Asia-Pacific Geothermal Energy Market

Untapped geothermal resources in several countries present significant opportunities for expansion. Innovative applications, such as direct use geothermal for heating and industrial processes, are gaining traction. The development of EGS technology holds immense potential for accessing deeper and hotter resources. Emerging markets and developing economies are expected to drive future growth.

Growth Accelerators in the Asia-Pacific Geothermal Energy Market Industry

Technological breakthroughs in drilling, resource exploration, and plant efficiency are key growth catalysts. Strategic partnerships between governments, private investors, and technology providers are facilitating project development. Market expansion strategies, including diversification into new geographical regions and applications, are driving further growth.

Key Players Shaping the Asia-Pacific Geothermal Energy Market Market

- Energy Development Corporation

- PT Medco Power Indonesia

- Star Energy Geothermal (Wayang Windu) Limited

- Toshiba Corp

- Trienergy PT

- Pertamina Geothermal Energy PT

- PT WIJAYA KARYA (Persero) Tbk

- Mercury NZ Ltd

- PT Bali Energy Ltd

- PT Supreme Energy

Notable Milestones in Asia-Pacific Geothermal Energy Market Sector

- 2021 (Q4): Kalinga Geothermal Power Plant (Philippines) enters well development phase, with construction slated for 2025 and commissioning in 2026.

- 2021 (Q2): PT Geo Dipa commences drilling operations for Patuha and Dieng 2 power plant expansion projects in Central Java, targeting completion by 2023.

In-Depth Asia-Pacific Geothermal Energy Market Market Outlook

The Asia-Pacific geothermal energy market is poised for significant growth over the next decade, driven by favorable government policies, technological advancements, and increasing demand for clean energy. Strategic partnerships and investments in research and development will further accelerate market expansion, creating lucrative opportunities for investors and industry players. The market's future potential is substantial, with untapped resources and innovative technologies offering exciting prospects for sustainable energy development.

Asia-Pacific Geothermal Energy Market Segmentation

-

1. Geothermal Power Plant Type

- 1.1. Dry Steam

- 1.2. Flash Plants

- 1.3. Binary Plants

-

2. Geography

- 2.1. Indonesia

- 2.2. Philippines

- 2.3. Japan

- 2.4. Rest of Asia-Pacific

Asia-Pacific Geothermal Energy Market Segmentation By Geography

- 1. Indonesia

- 2. Philippines

- 3. Japan

- 4. Rest of Asia Pacific

Asia-Pacific Geothermal Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Electricity Demand from Manufacturing

- 3.2.2 Construction

- 3.2.3 and Mining Industries4.; The Availability of a Broad Range of Fuel Sources for Electricity Generation

- 3.3. Market Restrains

- 3.3.1. 4.; Phasing Out of Coal-based Power Plants

- 3.4. Market Trends

- 3.4.1. Binary Plants Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 5.1.1. Dry Steam

- 5.1.2. Flash Plants

- 5.1.3. Binary Plants

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Indonesia

- 5.2.2. Philippines

- 5.2.3. Japan

- 5.2.4. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.3.2. Philippines

- 5.3.3. Japan

- 5.3.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 6. Indonesia Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 6.1.1. Dry Steam

- 6.1.2. Flash Plants

- 6.1.3. Binary Plants

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Indonesia

- 6.2.2. Philippines

- 6.2.3. Japan

- 6.2.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 7. Philippines Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 7.1.1. Dry Steam

- 7.1.2. Flash Plants

- 7.1.3. Binary Plants

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Indonesia

- 7.2.2. Philippines

- 7.2.3. Japan

- 7.2.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 8. Japan Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 8.1.1. Dry Steam

- 8.1.2. Flash Plants

- 8.1.3. Binary Plants

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Indonesia

- 8.2.2. Philippines

- 8.2.3. Japan

- 8.2.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 9. Rest of Asia Pacific Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 9.1.1. Dry Steam

- 9.1.2. Flash Plants

- 9.1.3. Binary Plants

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Indonesia

- 9.2.2. Philippines

- 9.2.3. Japan

- 9.2.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 10. China Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 11. Japan Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 12. India Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 13. South Korea Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 14. Taiwan Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 15. Australia Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Asia-Pacific Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Energy Development Corporation

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 PT Medco Power Indonesia

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Star Energy Geothermal (Wayang Windu) Limited

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Toshiba Corp

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Trienergy PT

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Pertamina Geothermal Energy PT

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 PT WIJAYA KARYA (Persero) Tbk

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Mercury NZ Ltd

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 PT Bali Energy Ltd *List Not Exhaustive

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 PT Supreme Energy

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 Energy Development Corporation

List of Figures

- Figure 1: Asia-Pacific Geothermal Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Geothermal Energy Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Geothermal Power Plant Type 2019 & 2032

- Table 4: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geothermal Power Plant Type 2019 & 2032

- Table 5: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 7: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 9: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 11: China Asia-Pacific Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China Asia-Pacific Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 13: Japan Asia-Pacific Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Asia-Pacific Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 15: India Asia-Pacific Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Asia-Pacific Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 17: South Korea Asia-Pacific Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia-Pacific Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 19: Taiwan Asia-Pacific Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Taiwan Asia-Pacific Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 21: Australia Asia-Pacific Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia-Pacific Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia-Pacific Asia-Pacific Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia-Pacific Asia-Pacific Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 25: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Geothermal Power Plant Type 2019 & 2032

- Table 26: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geothermal Power Plant Type 2019 & 2032

- Table 27: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 29: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 31: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Geothermal Power Plant Type 2019 & 2032

- Table 32: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geothermal Power Plant Type 2019 & 2032

- Table 33: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 35: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 37: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Geothermal Power Plant Type 2019 & 2032

- Table 38: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geothermal Power Plant Type 2019 & 2032

- Table 39: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 40: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 41: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 43: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Geothermal Power Plant Type 2019 & 2032

- Table 44: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geothermal Power Plant Type 2019 & 2032

- Table 45: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 46: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 47: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Geothermal Energy Market?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the Asia-Pacific Geothermal Energy Market?

Key companies in the market include Energy Development Corporation, PT Medco Power Indonesia, Star Energy Geothermal (Wayang Windu) Limited, Toshiba Corp, Trienergy PT, Pertamina Geothermal Energy PT, PT WIJAYA KARYA (Persero) Tbk, Mercury NZ Ltd, PT Bali Energy Ltd *List Not Exhaustive, PT Supreme Energy.

3. What are the main segments of the Asia-Pacific Geothermal Energy Market?

The market segments include Geothermal Power Plant Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Electricity Demand from Manufacturing. Construction. and Mining Industries4.; The Availability of a Broad Range of Fuel Sources for Electricity Generation.

6. What are the notable trends driving market growth?

Binary Plants Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Phasing Out of Coal-based Power Plants.

8. Can you provide examples of recent developments in the market?

In 2021, the Philippines's Kalinga Geothermal Power Plant developers Allfirst Kalinga, Aragorn Power and Energy and Guidance Management announced that the power plant is currently under well development phase after completing the exploration phase. The power plant construction is expected to start in 2025 and the commissioning is likely to take place in 2026.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Geothermal Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Geothermal Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Geothermal Energy Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Geothermal Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence