Key Insights

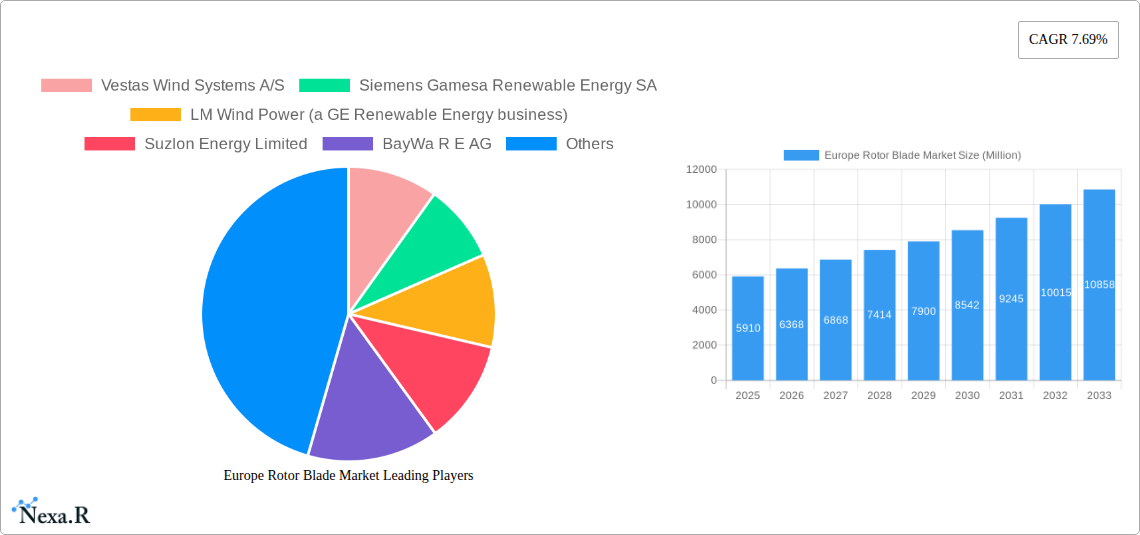

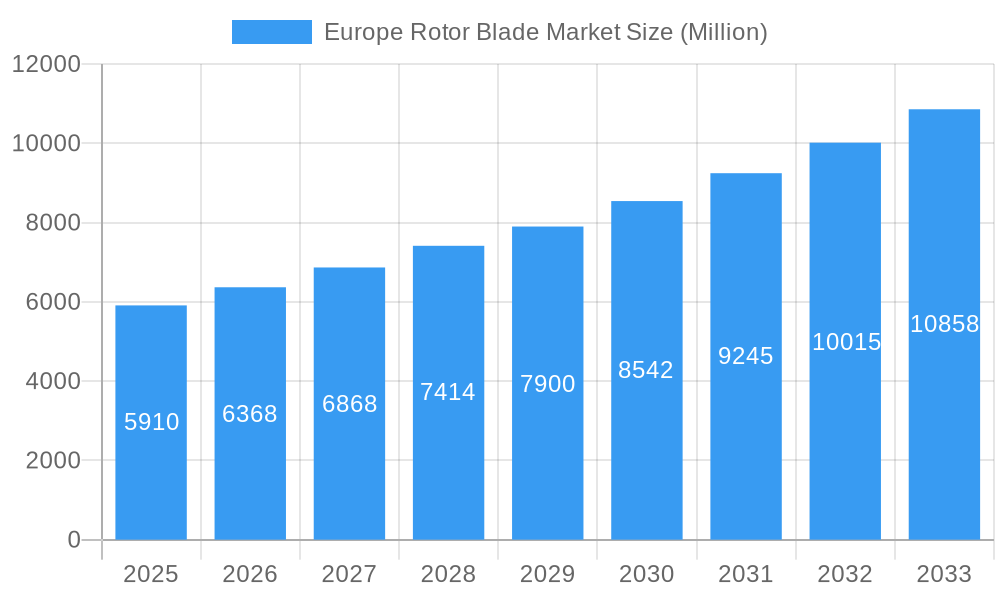

The European rotor blade market, valued at €5.91 billion in 2025, is projected to experience robust growth, driven by the increasing demand for renewable energy sources and supportive government policies across major European nations. A compound annual growth rate (CAGR) of 7.69% from 2025 to 2033 indicates a significant expansion of the market, reaching an estimated €11.5 billion by 2033. Key drivers include the ambitious renewable energy targets set by various European Union member states, a growing focus on reducing carbon emissions, and technological advancements leading to more efficient and cost-effective rotor blades. The onshore segment currently dominates the market, benefiting from readily available land and established infrastructure, although the offshore segment is expected to witness substantial growth due to its potential for large-scale wind energy projects. The use of carbon fiber blades is gaining traction due to their superior strength and lightweight properties compared to glass fiber, though glass fiber remains a significant segment due to its cost-effectiveness. Market restraints include fluctuating raw material prices, the need for skilled labor for installation and maintenance, and the potential environmental impacts associated with blade manufacturing and disposal. Leading players like Vestas, Siemens Gamesa, and LM Wind Power are investing heavily in research and development to overcome these challenges and maintain their market positions, while also focusing on strategic partnerships and acquisitions to expand their geographic reach and product portfolios.

Europe Rotor Blade Market Market Size (In Billion)

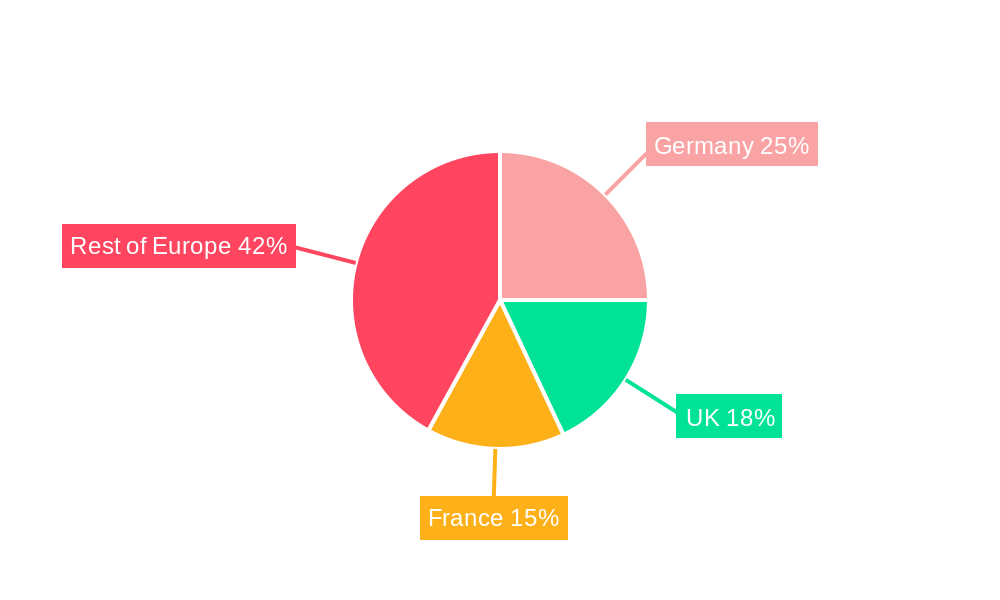

Germany, France, the UK, and other key European nations are major contributors to the market’s growth, spurred by substantial investments in wind energy projects both onshore and offshore. The market's segmentation by location (onshore vs. offshore) and blade material (carbon fiber, glass fiber, and others) allows for a granular understanding of the market’s dynamics. Competition among leading manufacturers is intense, leading to innovation in blade design, manufacturing techniques, and lifecycle management. The market is expected to witness increased consolidation in the coming years, with larger players absorbing smaller companies to gain market share and access newer technologies. This trend will further drive growth and efficiency within the European rotor blade market.

Europe Rotor Blade Market Company Market Share

Europe Rotor Blade Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Rotor Blade Market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report leverages extensive primary and secondary research to deliver actionable insights for industry professionals, investors, and stakeholders. The European rotor blade market, a critical component of the broader European wind energy market, is segmented by location of deployment (onshore and offshore) and blade material (carbon fiber, glass fiber, and other materials). The market is expected to reach XX Million units by 2033.

Europe Rotor Blade Market Dynamics & Structure

The European rotor blade market exhibits a moderately concentrated structure, with key players like Vestas, Siemens Gamesa, and LM Wind Power holding significant market share. Technological innovation, driven by the need for larger, more efficient blades, is a primary growth driver. Stringent environmental regulations and the EU's ambitious renewable energy targets are also pushing market expansion. Competitive substitutes, such as alternative energy technologies, pose a challenge, though wind energy remains a dominant force. The market is witnessing increased M&A activity, as larger companies consolidate their position and acquire specialized technologies.

- Market Concentration: High, with the top 5 players accounting for approximately 65% of the market share in 2024.

- Technological Innovation: Focus on lightweight yet robust materials (e.g., advanced carbon fiber composites), improved blade designs for higher energy capture, and optimized manufacturing processes.

- Regulatory Framework: Supportive policies promoting renewable energy adoption, with varying regulations across different European countries.

- Competitive Substitutes: Solar power, hydropower, and other renewable energy sources compete for investment and market share.

- End-User Demographics: Primarily wind energy developers, independent power producers (IPPs), and utility companies.

- M&A Trends: Increasing consolidation, with larger players acquiring smaller specialized companies to expand their technological capabilities and geographical reach. The number of M&A deals in the sector reached xx in 2024.

Europe Rotor Blade Market Growth Trends & Insights

The European rotor blade market experienced significant growth during the historical period (2019-2024), driven by increasing wind energy installations across onshore and offshore sites. The market size expanded from XX Million units in 2019 to XX Million units in 2024, registering a CAGR of xx%. This growth is expected to continue in the forecast period (2025-2033), albeit at a slightly moderated pace, fueled by continuous advancements in wind turbine technology, supportive government policies, and the escalating demand for clean energy. Technological disruptions, such as the adoption of larger rotor blades and innovative materials, are reshaping the market landscape. Consumer behavior shifts towards environmentally conscious energy choices further reinforce this growth trend. The market penetration rate for wind energy in Europe is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Europe Rotor Blade Market

Germany, the UK, and Denmark are currently the leading countries in the European rotor blade market, driven by substantial wind energy installations and supportive government policies. The offshore segment demonstrates the most significant growth potential due to higher energy yields and increasing government incentives. Carbon fiber blades are gaining traction due to their superior performance and durability, though glass fiber remains a cost-effective option.

Key Drivers:

- Germany: Strong government support for renewable energy, robust grid infrastructure, and a significant installed wind energy capacity.

- UK: Ambitious offshore wind energy targets, substantial investment in renewable energy projects, and a supportive policy environment.

- Denmark: Long history of wind energy adoption, technological expertise in wind turbine manufacturing, and a well-developed supply chain.

- Offshore Segment: Higher energy yield compared to onshore wind farms, increasing government incentives, and technological advancements reducing the levelized cost of energy.

- Carbon Fiber Blades: Superior performance characteristics, including higher strength-to-weight ratio and improved durability, driving adoption in higher-capacity wind turbines.

Dominance Factors: Market size, installed wind capacity, government policies, technological advancements, and supply chain infrastructure.

Europe Rotor Blade Market Product Landscape

The European rotor blade market showcases continuous product innovation, characterized by the development of longer, lighter, and more efficient blades. These advancements leverage advanced materials like carbon fiber composites and optimized aerodynamic designs to maximize energy capture. Manufacturers are focusing on improving blade durability, reducing maintenance costs, and enhancing overall performance. Unique selling propositions encompass longer lifespans, reduced weight for easier transportation and installation, and enhanced resistance to extreme weather conditions.

Key Drivers, Barriers & Challenges in Europe Rotor Blade Market

Key Drivers: The increasing demand for renewable energy, supportive government policies (e.g., subsidies, tax incentives), technological advancements leading to improved blade efficiency and cost reductions, and the expansion of offshore wind farms are the primary drivers.

Key Challenges and Restraints: The high capital expenditure involved in manufacturing advanced rotor blades, supply chain disruptions impacting raw material availability and transportation costs, intense competition among manufacturers, and the fluctuating prices of raw materials pose challenges. Regulatory hurdles and permitting processes can also delay project implementation. The estimated impact of supply chain issues on market growth is around xx% in 2024.

Emerging Opportunities in Europe Rotor Blade Market

Emerging opportunities lie in the expanding offshore wind energy sector, with larger blade sizes and higher capacities. Innovative blade materials, such as recycled composites, and the development of more efficient and durable blades present significant growth prospects. The untapped potential in several Eastern European countries presents further opportunities for market expansion.

Growth Accelerators in the Europe Rotor Blade Market Industry

Technological advancements in blade design, materials, and manufacturing processes are significant growth accelerators. Strategic partnerships between manufacturers and wind turbine developers facilitate innovation and streamline the supply chain. The expanding offshore wind market and supportive government policies are creating further impetus for growth.

Key Players Shaping the Europe Rotor Blade Market Market

- Vestas Wind Systems A/S

- Siemens Gamesa Renewable Energy SA

- LM Wind Power (a GE Renewable Energy business)

- Suzlon Energy Limited

- BayWa R E AG

- Enercon GmbH

- Nordex SE

Notable Milestones in Europe Rotor Blade Market Sector

- September 2023: Memmingham launched its new RBC-D50.1 installation yoke, improving efficiency in blade installation.

- January 2024: Vestas announced a new blade factory in Poland to produce blades for its V236-15.0 MW offshore turbine, signifying investment in offshore wind capacity.

In-Depth Europe Rotor Blade Market Market Outlook

The European rotor blade market is poised for substantial growth in the coming years, driven by the increasing demand for renewable energy, technological advancements, and supportive government policies. The expansion of offshore wind farms and the adoption of larger, more efficient blades will be key growth drivers. Strategic partnerships and continuous innovation in materials and manufacturing processes will shape the future market landscape, presenting significant opportunities for market participants.

Europe Rotor Blade Market Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

-

2. Blade Material

- 2.1. Carbon Fiber

- 2.2. Glass Fiber

- 2.3. Other Blade Materials

Europe Rotor Blade Market Segmentation By Geography

- 1. Germany

- 2. France

- 3. Spain

- 4. United Kingdom

- 5. Italy

- 6. NORDIC

- 7. Turkery

- 8. Russia

- 9. Rest of Europe

Europe Rotor Blade Market Regional Market Share

Geographic Coverage of Europe Rotor Blade Market

Europe Rotor Blade Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing number of offshore and onshore wind energy installations4.; Declining cost of wind energy

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Competition from Alternate Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. Offshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Rotor Blade Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Blade Material

- 5.2.1. Carbon Fiber

- 5.2.2. Glass Fiber

- 5.2.3. Other Blade Materials

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. France

- 5.3.3. Spain

- 5.3.4. United Kingdom

- 5.3.5. Italy

- 5.3.6. NORDIC

- 5.3.7. Turkery

- 5.3.8. Russia

- 5.3.9. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. Germany Europe Rotor Blade Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.2. Market Analysis, Insights and Forecast - by Blade Material

- 6.2.1. Carbon Fiber

- 6.2.2. Glass Fiber

- 6.2.3. Other Blade Materials

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7. France Europe Rotor Blade Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.2. Market Analysis, Insights and Forecast - by Blade Material

- 7.2.1. Carbon Fiber

- 7.2.2. Glass Fiber

- 7.2.3. Other Blade Materials

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8. Spain Europe Rotor Blade Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.2. Market Analysis, Insights and Forecast - by Blade Material

- 8.2.1. Carbon Fiber

- 8.2.2. Glass Fiber

- 8.2.3. Other Blade Materials

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9. United Kingdom Europe Rotor Blade Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.1.1. Onshore

- 9.1.2. Offshore

- 9.2. Market Analysis, Insights and Forecast - by Blade Material

- 9.2.1. Carbon Fiber

- 9.2.2. Glass Fiber

- 9.2.3. Other Blade Materials

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10. Italy Europe Rotor Blade Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10.1.1. Onshore

- 10.1.2. Offshore

- 10.2. Market Analysis, Insights and Forecast - by Blade Material

- 10.2.1. Carbon Fiber

- 10.2.2. Glass Fiber

- 10.2.3. Other Blade Materials

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 11. NORDIC Europe Rotor Blade Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 11.1.1. Onshore

- 11.1.2. Offshore

- 11.2. Market Analysis, Insights and Forecast - by Blade Material

- 11.2.1. Carbon Fiber

- 11.2.2. Glass Fiber

- 11.2.3. Other Blade Materials

- 11.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 12. Turkery Europe Rotor Blade Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 12.1.1. Onshore

- 12.1.2. Offshore

- 12.2. Market Analysis, Insights and Forecast - by Blade Material

- 12.2.1. Carbon Fiber

- 12.2.2. Glass Fiber

- 12.2.3. Other Blade Materials

- 12.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 13. Russia Europe Rotor Blade Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 13.1.1. Onshore

- 13.1.2. Offshore

- 13.2. Market Analysis, Insights and Forecast - by Blade Material

- 13.2.1. Carbon Fiber

- 13.2.2. Glass Fiber

- 13.2.3. Other Blade Materials

- 13.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 14. Rest of Europe Europe Rotor Blade Market Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 14.1.1. Onshore

- 14.1.2. Offshore

- 14.2. Market Analysis, Insights and Forecast - by Blade Material

- 14.2.1. Carbon Fiber

- 14.2.2. Glass Fiber

- 14.2.3. Other Blade Materials

- 14.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2025

- 15.2. Company Profiles

- 15.2.1 Vestas Wind Systems A/S

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Siemens Gamesa Renewable Energy SA

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 LM Wind Power (a GE Renewable Energy business)

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Suzlon Energy Limited

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 BayWa R E AG

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Enercon GmbH

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Nordex SE

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.1 Vestas Wind Systems A/S

List of Figures

- Figure 1: Europe Rotor Blade Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Rotor Blade Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Rotor Blade Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 2: Europe Rotor Blade Market Volume K Unit Forecast, by Location of Deployment 2020 & 2033

- Table 3: Europe Rotor Blade Market Revenue Million Forecast, by Blade Material 2020 & 2033

- Table 4: Europe Rotor Blade Market Volume K Unit Forecast, by Blade Material 2020 & 2033

- Table 5: Europe Rotor Blade Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Rotor Blade Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Europe Rotor Blade Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 8: Europe Rotor Blade Market Volume K Unit Forecast, by Location of Deployment 2020 & 2033

- Table 9: Europe Rotor Blade Market Revenue Million Forecast, by Blade Material 2020 & 2033

- Table 10: Europe Rotor Blade Market Volume K Unit Forecast, by Blade Material 2020 & 2033

- Table 11: Europe Rotor Blade Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Rotor Blade Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Europe Rotor Blade Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 14: Europe Rotor Blade Market Volume K Unit Forecast, by Location of Deployment 2020 & 2033

- Table 15: Europe Rotor Blade Market Revenue Million Forecast, by Blade Material 2020 & 2033

- Table 16: Europe Rotor Blade Market Volume K Unit Forecast, by Blade Material 2020 & 2033

- Table 17: Europe Rotor Blade Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Europe Rotor Blade Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Europe Rotor Blade Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 20: Europe Rotor Blade Market Volume K Unit Forecast, by Location of Deployment 2020 & 2033

- Table 21: Europe Rotor Blade Market Revenue Million Forecast, by Blade Material 2020 & 2033

- Table 22: Europe Rotor Blade Market Volume K Unit Forecast, by Blade Material 2020 & 2033

- Table 23: Europe Rotor Blade Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Europe Rotor Blade Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Europe Rotor Blade Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 26: Europe Rotor Blade Market Volume K Unit Forecast, by Location of Deployment 2020 & 2033

- Table 27: Europe Rotor Blade Market Revenue Million Forecast, by Blade Material 2020 & 2033

- Table 28: Europe Rotor Blade Market Volume K Unit Forecast, by Blade Material 2020 & 2033

- Table 29: Europe Rotor Blade Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Europe Rotor Blade Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Europe Rotor Blade Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 32: Europe Rotor Blade Market Volume K Unit Forecast, by Location of Deployment 2020 & 2033

- Table 33: Europe Rotor Blade Market Revenue Million Forecast, by Blade Material 2020 & 2033

- Table 34: Europe Rotor Blade Market Volume K Unit Forecast, by Blade Material 2020 & 2033

- Table 35: Europe Rotor Blade Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Europe Rotor Blade Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Europe Rotor Blade Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 38: Europe Rotor Blade Market Volume K Unit Forecast, by Location of Deployment 2020 & 2033

- Table 39: Europe Rotor Blade Market Revenue Million Forecast, by Blade Material 2020 & 2033

- Table 40: Europe Rotor Blade Market Volume K Unit Forecast, by Blade Material 2020 & 2033

- Table 41: Europe Rotor Blade Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Europe Rotor Blade Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: Europe Rotor Blade Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 44: Europe Rotor Blade Market Volume K Unit Forecast, by Location of Deployment 2020 & 2033

- Table 45: Europe Rotor Blade Market Revenue Million Forecast, by Blade Material 2020 & 2033

- Table 46: Europe Rotor Blade Market Volume K Unit Forecast, by Blade Material 2020 & 2033

- Table 47: Europe Rotor Blade Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Europe Rotor Blade Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 49: Europe Rotor Blade Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 50: Europe Rotor Blade Market Volume K Unit Forecast, by Location of Deployment 2020 & 2033

- Table 51: Europe Rotor Blade Market Revenue Million Forecast, by Blade Material 2020 & 2033

- Table 52: Europe Rotor Blade Market Volume K Unit Forecast, by Blade Material 2020 & 2033

- Table 53: Europe Rotor Blade Market Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Europe Rotor Blade Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 55: Europe Rotor Blade Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 56: Europe Rotor Blade Market Volume K Unit Forecast, by Location of Deployment 2020 & 2033

- Table 57: Europe Rotor Blade Market Revenue Million Forecast, by Blade Material 2020 & 2033

- Table 58: Europe Rotor Blade Market Volume K Unit Forecast, by Blade Material 2020 & 2033

- Table 59: Europe Rotor Blade Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Europe Rotor Blade Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Rotor Blade Market?

The projected CAGR is approximately 7.69%.

2. Which companies are prominent players in the Europe Rotor Blade Market?

Key companies in the market include Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy SA, LM Wind Power (a GE Renewable Energy business), Suzlon Energy Limited, BayWa R E AG, Enercon GmbH, Nordex SE.

3. What are the main segments of the Europe Rotor Blade Market?

The market segments include Location of Deployment, Blade Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.91 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing number of offshore and onshore wind energy installations4.; Declining cost of wind energy.

6. What are the notable trends driving market growth?

Offshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Competition from Alternate Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

January 2024: Vestas announced its decision to establish a new blade factory in Szczecin region of Poland that is planned to produce blades for Vestas flagship offshore wind turbine, the V236-15.0 MW, and is expected to start operations in 2026.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Rotor Blade Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Rotor Blade Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Rotor Blade Market?

To stay informed about further developments, trends, and reports in the Europe Rotor Blade Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence