Key Insights

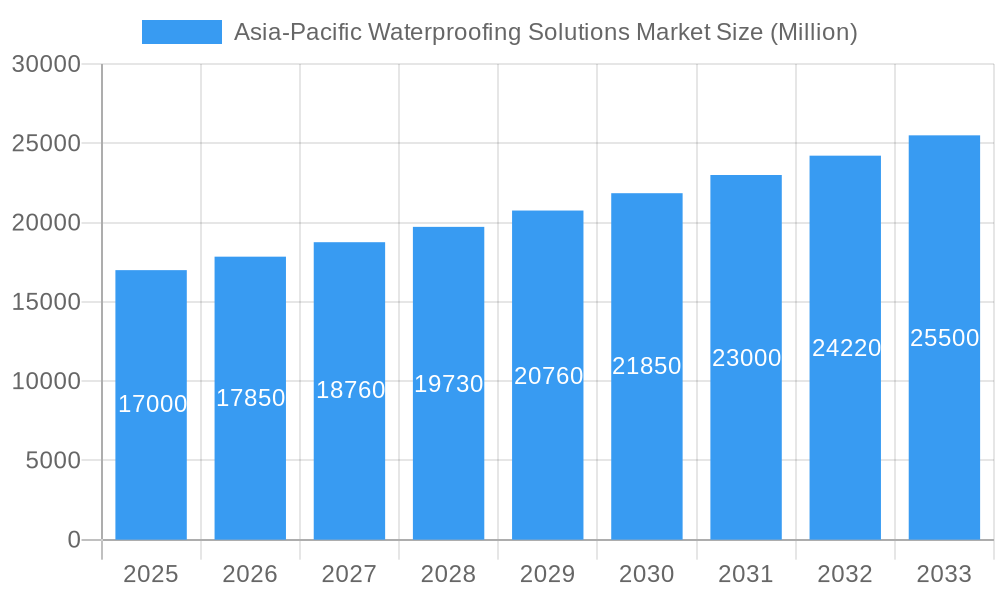

The Asia-Pacific waterproofing solutions market is poised for significant expansion, driven by accelerating urbanization, robust infrastructure development, and a heightened awareness of building longevity and resilience. The region's varied climatic conditions, susceptible to heavy precipitation, flooding, and seismic events, underscore the critical need for effective waterproofing across residential, commercial, and industrial applications. Furthermore, increasingly stringent building codes promoting sustainable and eco-friendly materials are fueling market demand. The market size was valued at $15.04 billion in 2025, with a projected CAGR of 7.4% for the forecast period (2025-2033). This growth is anticipated to be propelled by the rising adoption of innovative, high-performance waterproofing materials such as polyurethane membranes, liquid-applied coatings, and modified bitumen systems, aligning with the growing preference for green building practices.

Asia-Pacific Waterproofing Solutions Market Market Size (In Billion)

Future market dynamics will be shaped by government initiatives supporting sustainable infrastructure, raw material price volatility, and ongoing technological advancements. Key industry players are prioritizing product innovation, strategic alliances, and market expansion to strengthen their competitive positions. The ongoing commitment to sustainable development, combined with expanding construction activities in emerging Asia-Pacific economies, ensures sustained growth for the waterproofing solutions market. Challenges such as skilled labor availability and potential supply chain disruptions require strategic management to ensure continued expansion. The market is segmented by product type, including membranes, coatings, and sealants; by application, such as roofing, basements, and facades; and by end-user sectors, including residential, commercial, and industrial.

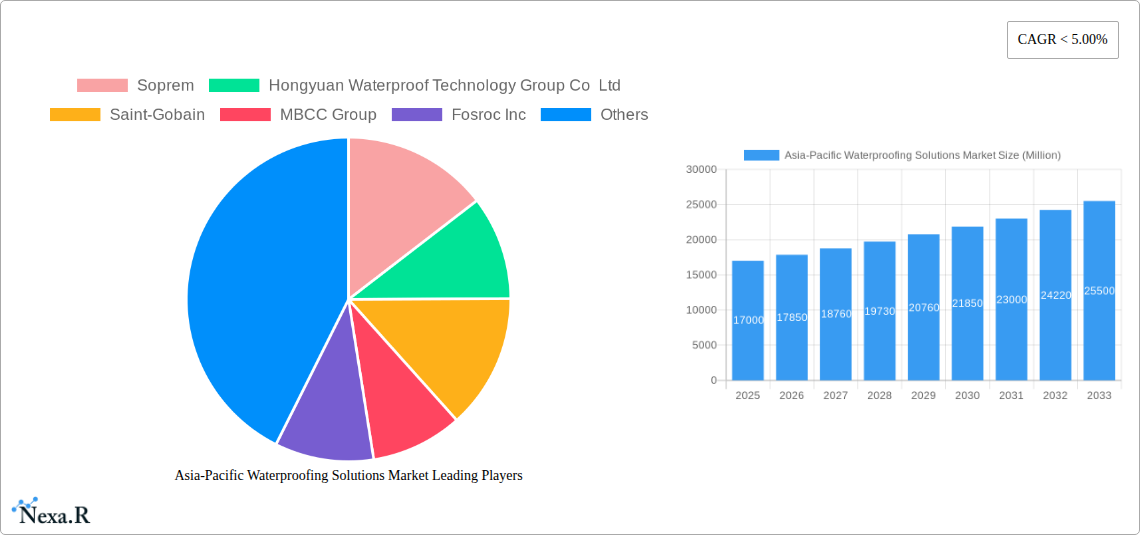

Asia-Pacific Waterproofing Solutions Market Company Market Share

This comprehensive report delivers an in-depth analysis of the Asia-Pacific waterproofing solutions market, detailing market dynamics, growth trajectories, dominant segments, product innovations, leading players, and future projections. The analysis spans the period 2019-2033, with 2025 serving as the base year. Market valuations are presented in billions of USD. This report is an essential resource for industry professionals, investors, and strategic decision-makers seeking a thorough understanding of this dynamic and rapidly evolving market.

Asia-Pacific Waterproofing Solutions Market Market Dynamics & Structure

The Asia-Pacific waterproofing solutions market is characterized by a moderately consolidated structure with several key players dominating the landscape. Market concentration is influenced by factors such as technological innovation, regulatory changes, and the presence of substitute products. The market is witnessing robust growth driven by rising infrastructure development, increasing urbanization, and stringent building codes focusing on water resistance. Mergers and acquisitions (M&A) activities are frequent, reflecting consolidation efforts and expansion strategies by major players.

Quantitative Insights:

- Market size in 2025 (Estimated): xx Million

- Market CAGR (2025-2033): xx%

- Top 5 players' combined market share in 2025 (Estimated): xx%

- Number of M&A deals in the last 5 years: xx

Qualitative Factors:

- High barriers to entry due to technological expertise and capital investment requirements.

- Stringent environmental regulations influencing product development and manufacturing processes.

- Growing demand for sustainable and eco-friendly waterproofing solutions.

- Increased competition from regional and local players.

Asia-Pacific Waterproofing Solutions Market Growth Trends & Insights

The Asia-Pacific waterproofing solutions market has experienced significant growth over the historical period (2019-2024), driven by factors such as rapid urbanization, infrastructural development, and rising disposable incomes. This growth trend is projected to continue during the forecast period (2025-2033), albeit at a slightly moderated pace. The adoption rate of advanced waterproofing technologies, such as polyurethane-based and epoxy-based systems, is increasing, driven by their superior performance characteristics. Consumer behavior is shifting towards premium, high-performance solutions that offer enhanced durability, longevity, and sustainability. Technological disruptions, like the emergence of smart waterproofing systems, are further shaping the market trajectory.

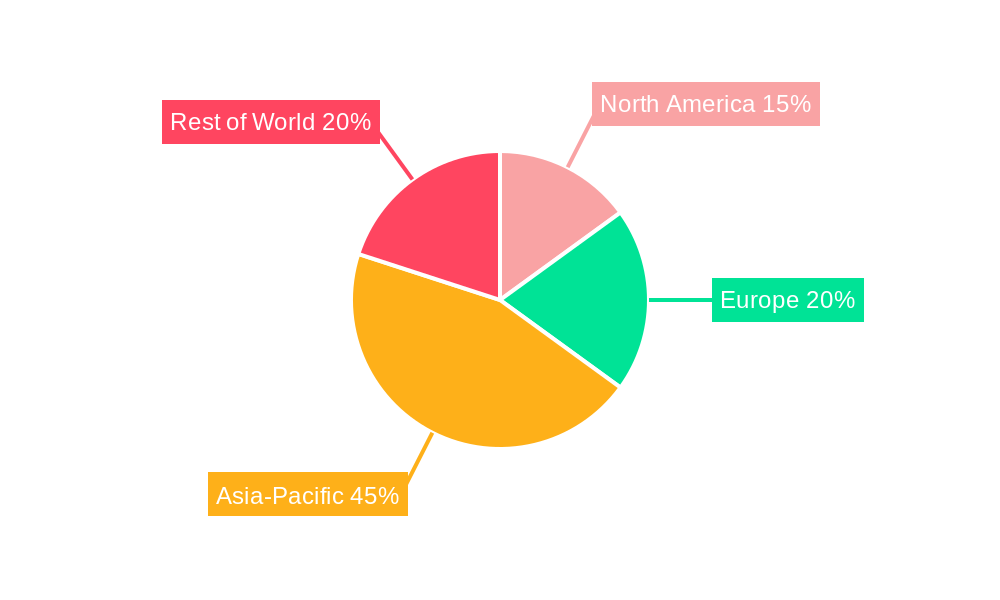

Dominant Regions, Countries, or Segments in Asia-Pacific Waterproofing Solutions Market

China and India are the leading countries within the Asia-Pacific region driving market growth. The commercial, industrial, and institutional segment holds a significant market share due to large-scale construction projects. Infrastructure development is a major catalyst, particularly in high-growth economies. Within the sub-product segment, membranes (both sheet and liquid-applied) account for a larger market share compared to chemicals.

Key Drivers:

- Rapid urbanization and infrastructure development across several countries in the region.

- Government initiatives and supportive policies promoting construction and housing development.

- Rising disposable incomes, leading to greater spending on home improvement and new construction.

Dominant Segments:

- End-Use Sector: Commercial, Industrial and Institutional

- Sub-Product: Membranes (Cold Liquid Applied, Fully Adhered Sheet)

Asia-Pacific Waterproofing Solutions Market Product Landscape

The Asia-Pacific waterproofing solutions market offers a diverse range of products, including membranes (cold liquid applied, fully adhered sheet, hot liquid applied, loose laid sheet) and chemicals (epoxy-based, polyurethane-based, water-based, other technologies). Continuous innovation focuses on improving performance characteristics, such as durability, flexibility, and sustainability. Key selling propositions include enhanced longevity, reduced maintenance costs, and eco-friendly formulations. Technological advancements are leading to the introduction of smart waterproofing systems that offer real-time monitoring and predictive maintenance capabilities.

Key Drivers, Barriers & Challenges in Asia-Pacific Waterproofing Solutions Market

Key Drivers:

- Rapid infrastructure development and urbanization across the Asia-Pacific region.

- Stringent building codes and regulations promoting the use of high-performance waterproofing solutions.

- Growing demand for sustainable and eco-friendly waterproofing materials.

Challenges:

- Fluctuations in raw material prices impacting product costs and profitability.

- Intense competition from both established multinational companies and local manufacturers.

- Supply chain disruptions due to geopolitical events and economic uncertainty.

Emerging Opportunities in Asia-Pacific Waterproofing Solutions Market

- Growing demand for sustainable and environmentally friendly waterproofing solutions.

- Expanding applications in green building and infrastructure projects.

- Emergence of smart waterproofing technologies offering remote monitoring and predictive maintenance.

Growth Accelerators in the Asia-Pacific Waterproofing Solutions Market Industry

The Asia-Pacific waterproofing solutions market is poised for robust growth driven by several key factors. Technological advancements, resulting in more efficient and sustainable products, are a significant catalyst. Strategic partnerships and collaborations among market players are fostering innovation and market expansion. Furthermore, favorable government policies supporting infrastructure development and green building initiatives are creating a conducive environment for growth.

Key Players Shaping the Asia-Pacific Waterproofing Solutions Market Market

- Soprem

- Hongyuan Waterproof Technology Group Co Ltd

- Saint-Gobain

- MBCC Group

- Fosroc Inc

- Ardex Group

- Sika AG

- Keshun Waterproof Technology Co ltd

- Lonseal Corporation

- Oriental Yuhong

Notable Milestones in Asia-Pacific Waterproofing Solutions Market Sector

- May 2023: Oriental Yuhong signed a strategic cooperation agreement with Hebei Aorun Shunda Group, boosting R&D in waterproofing membranes and thermal insulation.

- May 2023: Sika's acquisition of MBCC Group significantly expanded its market presence and product portfolio.

- March 2023: Oriental Yuhong's strategic cooperation with Luoyang Longfeng Construction Investment Co., Ltd. further strengthened its position in the building products market.

In-Depth Asia-Pacific Waterproofing Solutions Market Market Outlook

The Asia-Pacific waterproofing solutions market is set for continued growth, driven by ongoing urbanization, rising infrastructure spending, and increasing adoption of advanced technologies. Strategic partnerships, technological innovation, and expansion into untapped markets present significant opportunities for market players. The focus on sustainability and eco-friendly solutions will further shape the market landscape in the coming years.

Asia-Pacific Waterproofing Solutions Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Sub Product

-

2.1. Chemicals

-

2.1.1. By Technology

- 2.1.1.1. Epoxy-based

- 2.1.1.2. Polyurethane-based

- 2.1.1.3. Water-based

- 2.1.1.4. Other Technologies

-

2.1.1. By Technology

-

2.2. Membranes

- 2.2.1. Cold Liquid Applied

- 2.2.2. Fully Adhered Sheet

- 2.2.3. Hot Liquid Applied

- 2.2.4. Loose Laid Sheet

-

2.1. Chemicals

Asia-Pacific Waterproofing Solutions Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Waterproofing Solutions Market Regional Market Share

Geographic Coverage of Asia-Pacific Waterproofing Solutions Market

Asia-Pacific Waterproofing Solutions Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Banning/ Limiting Use of Plastics used in packaging applications

- 3.3. Market Restrains

- 3.3.1. ; Harmful Amines in Dyes; Paperless Green Initiatives

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Sub Product

- 5.2.1. Chemicals

- 5.2.1.1. By Technology

- 5.2.1.1.1. Epoxy-based

- 5.2.1.1.2. Polyurethane-based

- 5.2.1.1.3. Water-based

- 5.2.1.1.4. Other Technologies

- 5.2.1.1. By Technology

- 5.2.2. Membranes

- 5.2.2.1. Cold Liquid Applied

- 5.2.2.2. Fully Adhered Sheet

- 5.2.2.3. Hot Liquid Applied

- 5.2.2.4. Loose Laid Sheet

- 5.2.1. Chemicals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Soprem

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hongyuan Waterproof Technology Group Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Saint-Gobain

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MBCC Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fosroc Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ardex Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sika AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Keshun Waterproof Technology Co ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lonseal Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Oriental Yuhong

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Soprem

List of Figures

- Figure 1: Asia-Pacific Waterproofing Solutions Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Waterproofing Solutions Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Waterproofing Solutions Market Revenue billion Forecast, by End Use Sector 2020 & 2033

- Table 2: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 3: Asia-Pacific Waterproofing Solutions Market Revenue billion Forecast, by Sub Product 2020 & 2033

- Table 4: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Sub Product 2020 & 2033

- Table 5: Asia-Pacific Waterproofing Solutions Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Waterproofing Solutions Market Revenue billion Forecast, by End Use Sector 2020 & 2033

- Table 8: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 9: Asia-Pacific Waterproofing Solutions Market Revenue billion Forecast, by Sub Product 2020 & 2033

- Table 10: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Sub Product 2020 & 2033

- Table 11: Asia-Pacific Waterproofing Solutions Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: China Asia-Pacific Waterproofing Solutions Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: China Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Japan Asia-Pacific Waterproofing Solutions Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Japan Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: South Korea Asia-Pacific Waterproofing Solutions Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: South Korea Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: India Asia-Pacific Waterproofing Solutions Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: India Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Australia Asia-Pacific Waterproofing Solutions Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Australia Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: New Zealand Asia-Pacific Waterproofing Solutions Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: New Zealand Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Indonesia Asia-Pacific Waterproofing Solutions Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Malaysia Asia-Pacific Waterproofing Solutions Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Malaysia Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Singapore Asia-Pacific Waterproofing Solutions Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Singapore Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Thailand Asia-Pacific Waterproofing Solutions Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Thailand Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Vietnam Asia-Pacific Waterproofing Solutions Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Vietnam Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Philippines Asia-Pacific Waterproofing Solutions Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Philippines Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Waterproofing Solutions Market?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the Asia-Pacific Waterproofing Solutions Market?

Key companies in the market include Soprem, Hongyuan Waterproof Technology Group Co Ltd, Saint-Gobain, MBCC Group, Fosroc Inc, Ardex Group, Sika AG, Keshun Waterproof Technology Co ltd, Lonseal Corporation, Oriental Yuhong.

3. What are the main segments of the Asia-Pacific Waterproofing Solutions Market?

The market segments include End Use Sector, Sub Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.04 billion as of 2022.

5. What are some drivers contributing to market growth?

; Banning/ Limiting Use of Plastics used in packaging applications.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Harmful Amines in Dyes; Paperless Green Initiatives.

8. Can you provide examples of recent developments in the market?

May 2023: Oriental Yuhong signed a strategic cooperation agreement with Hebei Aorun Shunda Group to collaborate on multi-dimensional research in the fields of waterproofing membranes and thermal insulation coatings, among other solutions.May 2023: Sika, a global leader in construction chemicals, acquired the MBCC Group, including its waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with the exception of its concrete admixture operations in Europe, North America, Australia, and New Zealand.March 2023: To further develop its portfolio of building products, including waterproofing solutions, Oriental Yuhong initiated a strategic cooperation agreement with Luoyang Longfeng Construction Investment Co., Ltd. This agreement is expected to result in the exchange of resources in the field of construction materials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Waterproofing Solutions Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Waterproofing Solutions Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Waterproofing Solutions Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Waterproofing Solutions Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence