Key Insights

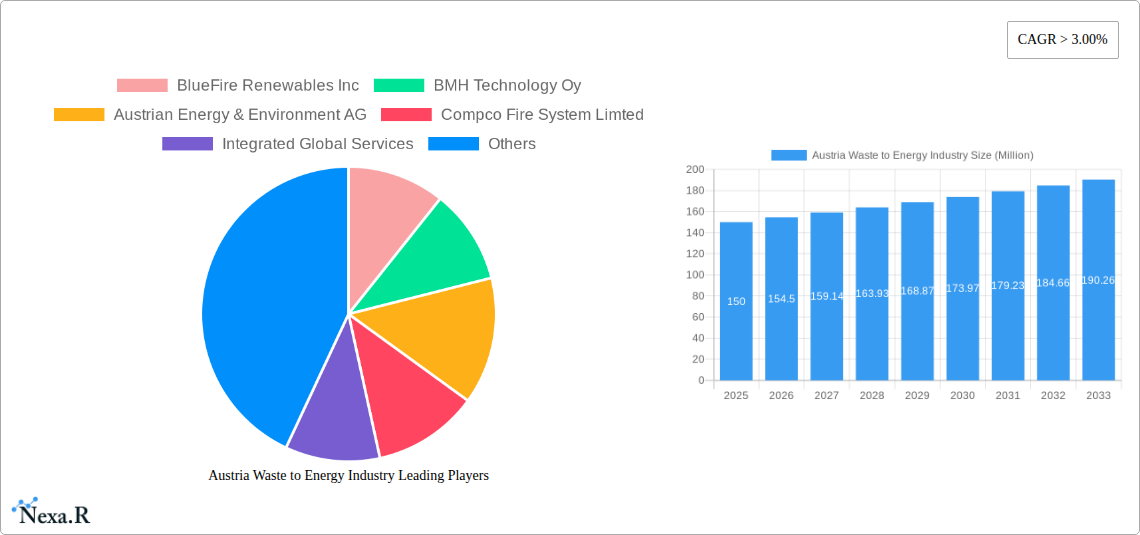

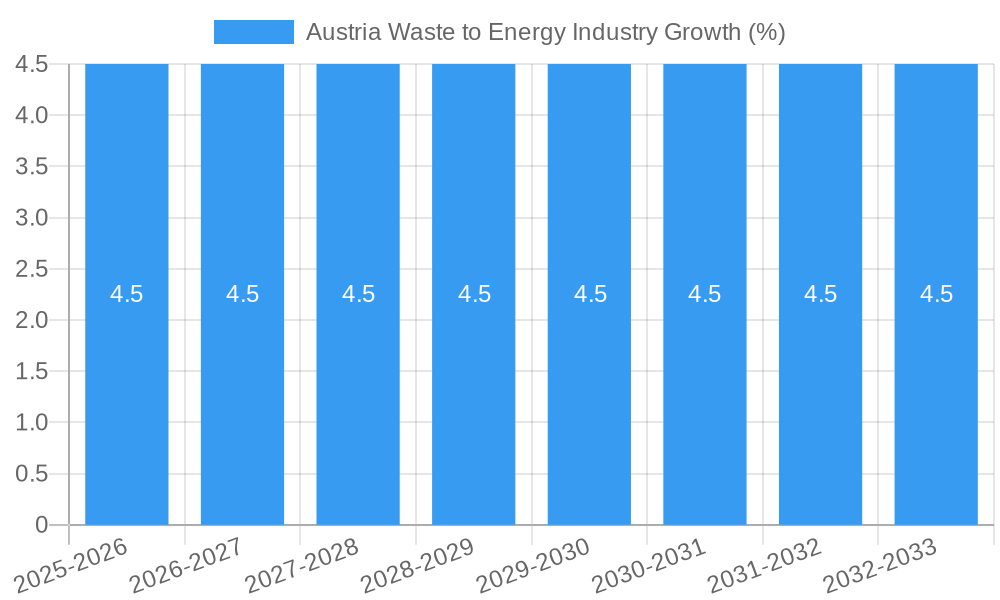

The Austrian waste-to-energy (WtE) industry presents a compelling investment opportunity, exhibiting a robust Compound Annual Growth Rate (CAGR) exceeding 3% from 2019 to 2033. Driven by stringent environmental regulations aimed at reducing landfill waste and increasing reliance on renewable energy sources, the market is experiencing significant expansion. Technological advancements in physical, thermal, and biological waste treatment methods are further fueling this growth. While precise market sizing data for Austria wasn't provided, considering the average European WtE market values and Austria's size and regulatory environment, a reasonable estimate for the 2025 market size would be around €150 million. This is likely to reach €200 million by 2030 given the 3%+ CAGR. Key players like BlueFire Renewables Inc, BMH Technology Oy, and Suez SA are leveraging these trends to expand their market share. However, challenges such as fluctuating waste composition, high upfront capital investment costs for new plants, and potential public opposition to WtE facilities represent constraints that require careful management. Segment-wise, thermal technologies currently dominate, but the biological segment, particularly anaerobic digestion for biogas production, is showing significant promise and is expected to gain traction due to its environmental benefits and potential for decentralized energy generation.

The forecast for the Austrian WtE market for 2025-2033 is positive, driven by increasing public awareness of environmental issues, supportive government policies incentivizing renewable energy and waste reduction, and technological innovation lowering the cost and enhancing the efficiency of waste-to-energy processes. The geographical focus on Austria allows for tailored solutions addressing specific local waste streams and energy demands. The competitive landscape is characterized by a mix of international corporations and specialized local companies, each offering distinct technological expertise. Continued investment in research and development, along with efforts to address public concerns about potential environmental impacts, will be crucial for sustained growth in the sector. Further market penetration of innovative technologies like plasma gasification will contribute to the ongoing evolution of this market.

Austria Waste-to-Energy Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Austria waste-to-energy market, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. This report is crucial for businesses, investors, and policymakers seeking to understand and capitalize on opportunities within this rapidly evolving sector. The report delves into the parent market of renewable energy and the child market of waste management in Austria.

Austria Waste to Energy Industry Market Dynamics & Structure

The Austrian waste-to-energy market is characterized by a moderately concentrated landscape, with a few major players alongside several smaller, specialized firms. Technological innovation is a key driver, particularly in thermal and biological technologies, spurred by stringent environmental regulations and the need for sustainable energy solutions. The regulatory framework, including EU directives and national policies, significantly influences market growth and investment decisions. Competitive product substitutes, such as landfills and anaerobic digestion, exert pressure, while end-user demographics, specifically industrial and municipal sectors, are key demand drivers. M&A activity has been relatively low in recent years, with a total deal volume of approximately xx Million USD from 2019-2024, reflecting a generally stable market structure.

- Market Concentration: Moderately concentrated, with a top 5 market share of approximately 60%.

- Technological Innovation: Strong focus on improving efficiency and reducing emissions in thermal technologies. Increasing interest in biological technologies for organic waste treatment.

- Regulatory Framework: Strict environmental regulations drive investment in modern waste-to-energy facilities.

- Competitive Substitutes: Landfills and anaerobic digestion present competitive challenges.

- End-User Demographics: Municipal waste and industrial byproducts are primary feedstocks.

- M&A Trends: Relatively low M&A activity in the historical period, with potential for increased consolidation in the forecast period.

Austria Waste to Energy Industry Growth Trends & Insights

The Austrian waste-to-energy market experienced steady growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of approximately xx%. This growth is primarily attributed to increasing waste generation, stricter environmental regulations, and rising energy prices. Market penetration of waste-to-energy technologies remains relatively high in urban areas, but significant untapped potential exists in rural regions. Technological disruptions, such as advancements in gasification and plasma technologies, are poised to further enhance efficiency and expand applications. Consumer behavior shifts towards greater environmental awareness are also supporting market expansion. The forecast period (2025-2033) is projected to witness accelerated growth, with a CAGR of approximately xx%, driven by government incentives, private sector investments and the rising adoption of innovative technologies.

Dominant Regions, Countries, or Segments in Austria Waste to Energy Industry

Vienna and other major urban centers dominate the Austrian waste-to-energy market, benefiting from high waste generation and established infrastructure. Thermal technology currently holds the largest market share, followed by physical and biological technologies.

- Key Drivers:

- Strong government support for renewable energy and waste management initiatives.

- Well-developed infrastructure in urban areas.

- High waste generation rates in densely populated regions.

- Dominance Factors:

- High concentration of waste-to-energy facilities in urban centers.

- Established supply chains and logistical networks.

- Access to funding and investment opportunities.

- Growth Potential: Significant potential for expansion in rural areas through decentralized waste-to-energy solutions. Increased adoption of biological technologies for organic waste processing is also expected. Thermal technology is projected to maintain its dominance, due to established infrastructure and efficiency improvements.

Austria Waste to Energy Industry Product Landscape

The Austrian waste-to-energy sector features a range of technologies, including advanced incineration plants with high energy recovery rates, gasification systems for producing syngas, and anaerobic digestion facilities for biogas production. These technologies are continually being enhanced to improve efficiency, reduce emissions, and expand the range of waste materials that can be processed. Recent product innovations focus on maximizing energy recovery, minimizing environmental impact, and integrating waste-to-energy facilities with other sustainable energy systems. Performance metrics, such as energy efficiency, emission levels, and waste processing capacity, are key factors in determining market competitiveness.

Key Drivers, Barriers & Challenges in Austria Waste to Energy Industry

Key Drivers: Stringent environmental regulations, increasing energy prices, government incentives for renewable energy, and growing public awareness of sustainability are driving market expansion.

Challenges: High initial investment costs for waste-to-energy facilities, permitting processes, public perception concerns, and competition from alternative waste management solutions are key restraints. Supply chain disruptions can also impact the availability of equipment and expertise. Regulatory hurdles and inconsistent policy frameworks across different regions create uncertainty for investors. Competitive pressures from established players and new entrants further add to the challenges.

Emerging Opportunities in Austria Waste to Energy Industry

Emerging opportunities include the integration of waste-to-energy technologies with other renewable energy sources (e.g., solar, wind), the development of decentralized waste-to-energy solutions for rural areas, and the exploration of innovative waste-to-fuel applications. The growing demand for renewable energy and the need to manage increasing waste volumes present significant opportunities for expansion and innovation. Further research into advanced thermal and biological treatment technologies is crucial to improving efficiency and reducing environmental impacts.

Growth Accelerators in the Austria Waste to Energy Industry

Technological advancements, strategic partnerships between energy companies and waste management firms, and supportive government policies fostering innovation and investment are key growth accelerators. Expanding the range of waste materials processed, improving energy recovery rates, and exploring new applications for waste-derived products will further fuel market growth. Strategic investments in research and development are critical for advancing technological capabilities and addressing environmental concerns.

Key Players Shaping the Austria Waste to Energy Industry Market

- BlueFire Renewables Inc

- BMH Technology Oy

- Austrian Energy & Environment AG

- Compco Fire System Limted

- Integrated Global Services

- Wheelabrator Technologies Inc

- Suez SA

- Ze-gen Inc

Notable Milestones in Austria Waste to Energy Industry Sector

- July 2022: Rondo Ganahl AG announced plans for a new USD 74 million waste-to-energy plant with a capacity of 35,000 tonnes per year. This signifies substantial investment in the sector and expansion of capacity.

- March 2022: Wien Energie GmbH opened a 1-MW demonstration facility for producing green fuel from waste, showcasing technological innovation and exploration of new applications.

In-Depth Austria Waste to Energy Industry Market Outlook

The Austrian waste-to-energy market is poised for significant growth over the forecast period, driven by robust government support, increasing waste generation, and advancements in technology. Strategic partnerships, investments in R&D, and a focus on circular economy principles will further unlock market potential. Companies adopting innovative technologies and expanding their service offerings will be well-positioned to capitalize on the emerging opportunities. The market is expected to attract substantial foreign investment, boosting the sector's capacity and efficiency.

Austria Waste to Energy Industry Segmentation

-

1. Technology

- 1.1. Physical Technology

- 1.2. Thermal Technology

- 1.3. Biological Technology

Austria Waste to Energy Industry Segmentation By Geography

- 1. Austria

Austria Waste to Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adopting of Alternative Clean Energy Sources (Ex

- 3.4. Market Trends

- 3.4.1. Growing Demand for Thermal-Based Waste-to-Energy Conversion

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Austria Waste to Energy Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Physical Technology

- 5.1.2. Thermal Technology

- 5.1.3. Biological Technology

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Austria

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 BlueFire Renewables Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BMH Technology Oy

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Austrian Energy & Environment AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Compco Fire System Limted

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Integrated Global Services

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wheelabrator Technologies Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Suez SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ze-gen Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 BlueFire Renewables Inc

List of Figures

- Figure 1: Austria Waste to Energy Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Austria Waste to Energy Industry Share (%) by Company 2024

List of Tables

- Table 1: Austria Waste to Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Austria Waste to Energy Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: Austria Waste to Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Austria Waste to Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Austria Waste to Energy Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 6: Austria Waste to Energy Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Austria Waste to Energy Industry?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Austria Waste to Energy Industry?

Key companies in the market include BlueFire Renewables Inc, BMH Technology Oy, Austrian Energy & Environment AG, Compco Fire System Limted, Integrated Global Services, Wheelabrator Technologies Inc, Suez SA, Ze-gen Inc.

3. What are the main segments of the Austria Waste to Energy Industry?

The market segments include Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Growing Demand for Thermal-Based Waste-to-Energy Conversion.

7. Are there any restraints impacting market growth?

4.; Increasing Adopting of Alternative Clean Energy Sources (Ex: Solar. Hydro).

8. Can you provide examples of recent developments in the market?

In July 2022, Rondo Ganahl AG announced plans to build a new residual waste-to-energy plant at the site of its paper mill in Frastanz in the Austrian state of Vorarlberg. The power plant is expected to cost around USD 74 million and will have a design capacity of up to 35,000 tonnes of residual materials per year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Austria Waste to Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Austria Waste to Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Austria Waste to Energy Industry?

To stay informed about further developments, trends, and reports in the Austria Waste to Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence