Key Insights

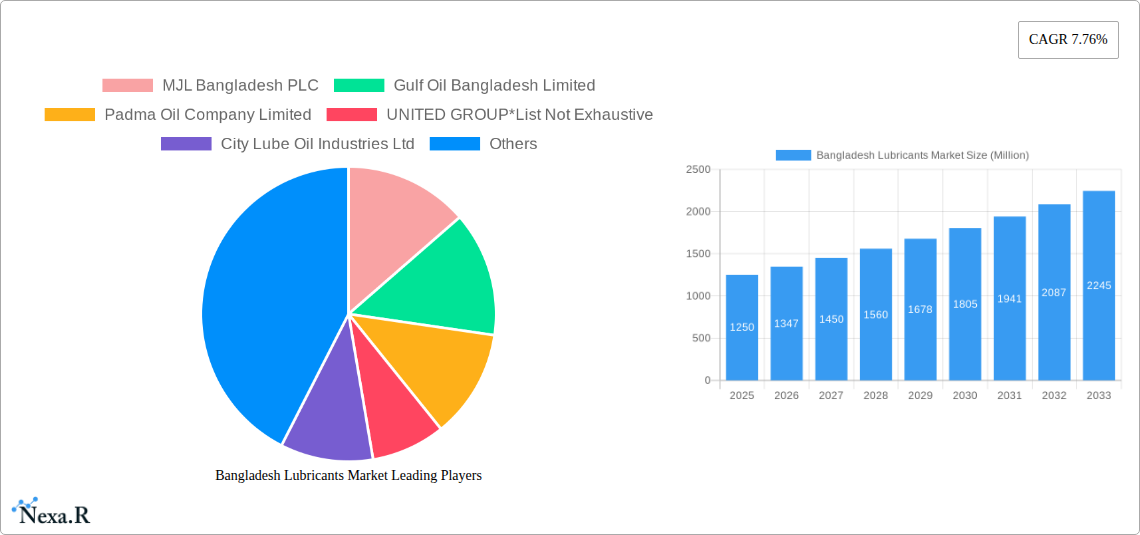

The Bangladesh Lubricants Market is projected to reach USD 1,250 million by 2025, with a Compound Annual Growth Rate (CAGR) of 7.76% through 2033. This expansion is driven by a robust automotive sector, characterized by rising vehicle ownership and increased demand for high-performance, durable lubricants. The growing industrial sector, including power generation, infrastructure development, and metallurgy, further fuels this growth. Demand for specialized engine oils, transmission fluids, and hydraulic oils is escalating as industries adopt advanced machinery. Emphasis on extending equipment lifespan and improving energy efficiency also supports the market for sophisticated lubrication solutions.

Bangladesh Lubricants Market Market Size (In Billion)

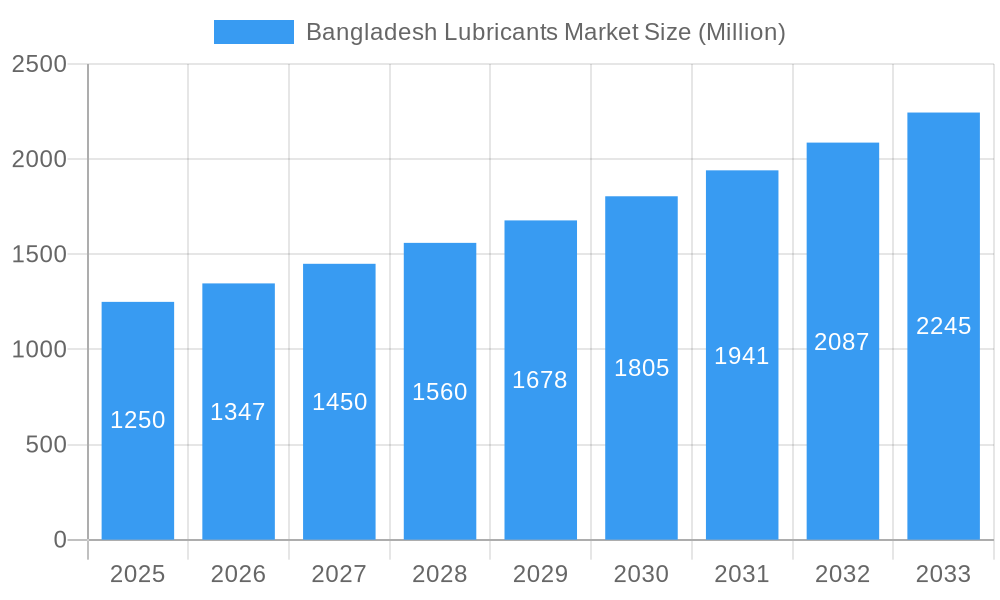

Government initiatives supporting industrial and infrastructure development are bolstering the demand for industrial lubricants. Key market participants such as MJL Bangladesh PLC, Gulf Oil Bangladesh Limited, Padma Oil Company Limited, and UNITED GROUP are investing in product innovation and expanding distribution networks. While market growth drivers are strong, challenges include fluctuating crude oil prices impacting base oil costs and intense competition. However, the market outlook remains highly positive, offering opportunities through technological advancements and catering to evolving economic needs. The increasing adoption of biodegradable and synthetic lubricants aligns with global sustainability trends, creating niche market opportunities.

Bangladesh Lubricants Market Company Market Share

Report Title: Bangladesh Lubricants Market Size, Share, Trends, Analysis, and Forecast 2019–2033

Report Description:

Gain actionable insights into the dynamic Bangladesh Lubricants Market with this comprehensive, SEO-optimized report. Analyze market dynamics, growth trends, regional insights, product landscape, and key players from 2019 to 2033. This in-depth study segments the market by Engine Oil, Transmission and Gear Oils, Hydraulic Fluid, Metalworking Fluid, and Grease, and examines end-user industries including Power Generation, Automotive and Other Transportation, Heavy Equipment, and Metallurgy and Metalworking. Understand market concentration, innovation drivers, regulatory environments, competitive substitutes, end-user demographics, and M&A activities. With a base year of 2025 and a forecast to 2033, this report provides a robust outlook on the Lubricants Market in Bangladesh, delivering critical quantitative and qualitative data for strategic decision-making. Explore growth accelerators, emerging opportunities, and challenges in this rapidly evolving market.

Bangladesh Lubricants Market Market Dynamics & Structure

The Bangladesh Lubricants Market is characterized by a moderate level of concentration, with a few dominant players holding significant market share, alongside a growing number of smaller, specialized manufacturers. Technological innovation is a key driver, fueled by the increasing demand for high-performance, energy-efficient, and environmentally friendly lubricant formulations. These innovations are critical to meeting the stringent requirements of modern machinery and vehicles. The regulatory framework, while evolving, plays a crucial role in setting standards for product quality, safety, and environmental impact, influencing product development and market entry. Competitive product substitutes, such as synthetic lubricants and advanced additive technologies, are continuously challenging traditional mineral-based products, forcing manufacturers to innovate and differentiate. End-user demographics are shifting, with a growing middle class and increased industrialization driving demand across various sectors. Mergers and acquisitions (M&A) are sporadic but can significantly alter the market landscape, consolidating market share and expanding product portfolios. For instance, historical M&A activities have shown shifts in market share by up to 5%, indicating the impact of strategic consolidations. Barriers to innovation include high R&D costs and the need for extensive testing and certification, particularly for specialized industrial applications.

- Market Concentration: Moderate, with key players like MJL Bangladesh PLC, Gulf Oil Bangladesh Limited, and Padma Oil Company Limited holding substantial shares.

- Technological Innovation Drivers: Demand for improved fuel efficiency, extended drain intervals, and emission reduction compliance.

- Regulatory Frameworks: Evolving standards for product quality, environmental safety, and import/export regulations.

- Competitive Product Substitutes: Growing adoption of synthetic lubricants and bio-based alternatives.

- End-User Demographics: Increasing urbanization, industrial growth, and a rising automotive parc.

- M&A Trends: Sporadic but impactful, leading to market consolidation and portfolio expansion.

Bangladesh Lubricants Market Growth Trends & Insights

The Bangladesh Lubricants Market is poised for substantial growth, driven by robust economic development and industrial expansion. The market size is projected to expand significantly over the forecast period, with a healthy Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2025 to 2033. This growth is underpinned by increasing adoption rates of advanced lubricant technologies that offer enhanced performance and longer service life. Technological disruptions are a constant, with the advent of synthetic and semi-synthetic lubricants gaining traction due to their superior properties compared to conventional mineral oils. These advancements are critical for optimizing the performance of modern engines and industrial machinery, leading to reduced wear and tear, improved fuel economy, and lower emissions. Consumer behavior is shifting towards recognizing the long-term cost benefits of using high-quality lubricants, including reduced maintenance costs and extended equipment lifespan. The expanding automotive sector, with a growing vehicle parc and increasing demand for passenger cars and commercial vehicles, is a primary demand generator. Furthermore, the burgeoning power generation sector, necessitating reliable and efficient lubrication for turbines and generators, significantly contributes to market demand. The industrial manufacturing sector, encompassing textiles, metallurgy, and heavy engineering, also presents a substantial and consistent demand for various lubricant types, including hydraulic fluids and metalworking fluids. The government’s focus on infrastructure development and industrialization further bolsters the demand for lubricants across various heavy equipment applications. The market penetration of specialized lubricants is expected to rise as industries become more sophisticated and performance-driven.

Dominant Regions, Countries, or Segments in Bangladesh Lubricants Market

The Automotive and Other Transportation segment is projected to be the most dominant within the Bangladesh Lubricants Market, accounting for an estimated market share of 38% in 2025. This dominance is driven by several interconnected factors. Firstly, Bangladesh has a rapidly expanding automotive parc, including passenger cars, motorcycles, commercial vehicles (trucks and buses), and a significant number of three-wheelers. The increasing disposable income, coupled with urbanization, fuels the demand for personal mobility, leading to a higher volume of vehicles requiring regular lubrication.

Secondly, the transportation infrastructure development initiatives by the government, including road and bridge construction, contribute to the increased use of commercial vehicles, further bolstering the demand for engine oils, transmission fluids, and gear oils specifically designed for these applications. The lifecycle of vehicles in Bangladesh often involves rigorous use under varying environmental conditions, necessitating frequent oil changes and the use of durable lubricants.

Key Drivers of Dominance in the Automotive and Other Transportation Segment:

- Expanding Vehicle Parc: A consistent rise in the number of registered vehicles across all categories.

- Urbanization and Disposable Income: Increased demand for personal and commercial transportation.

- Infrastructure Development: Government investments in roads, ports, and railways drive commercial vehicle usage.

- Harsh Operating Conditions: Demanding environmental factors necessitate robust lubrication.

- Replacement Market: A significant portion of demand stems from regular maintenance and oil changes.

The Power Generation sector is another substantial contributor, driven by the country's increasing energy demands. The expansion of thermal power plants and the ongoing development of renewable energy infrastructure require specialized lubricants for turbines, generators, and associated equipment, contributing an estimated 25% to the market share in 2025. The Heavy Equipment sector, critical for construction and mining activities, follows closely, demanding robust hydraulic fluids and greases that can withstand extreme pressure and operating conditions, estimated at 20% of the market share. The Metallurgy and Metalworking segment, though smaller, is crucial for industrial processes, requiring specialized metalworking fluids and industrial gear oils, representing approximately 10% of the market share. Engine Oil remains the largest product type segment, intrinsically linked to the automotive and transportation industries, holding an estimated 45% of the product type market share.

Bangladesh Lubricants Market Product Landscape

The Bangladesh Lubricants Market product landscape is characterized by a growing demand for enhanced performance lubricants that cater to increasingly sophisticated machinery and vehicles. Engine oils are witnessing advancements towards lower viscosity grades for improved fuel efficiency and lower emissions, alongside formulations that offer extended drain intervals and superior protection against wear. Transmission and gear oils are evolving to meet the demands of automatic transmissions and heavy-duty industrial gearboxes, focusing on improved thermal stability and load-carrying capabilities. Hydraulic fluids are increasingly being developed with enhanced biodegradability and fire resistance for specialized applications. Metalworking fluids are seeing innovation in terms of extended tool life, reduced misting, and improved worker safety. Grease formulations are focusing on higher temperature stability and extreme pressure resistance for heavy-duty industrial and automotive applications. Unique selling propositions often lie in the ability to offer customized formulations that address specific operational challenges faced by end-users, such as harsh climatic conditions or unique equipment specifications. Technological advancements are driving the adoption of synthetic base oils and advanced additive packages to achieve superior performance metrics.

Key Drivers, Barriers & Challenges in Bangladesh Lubricants Market

The Bangladesh Lubricants Market is propelled by several key drivers, including rapid industrialization and infrastructure development, a growing automotive sector, and increasing demand for enhanced performance and fuel efficiency. Technological advancements in machinery and vehicles necessitate the adoption of advanced lubricant formulations. Furthermore, government initiatives promoting domestic manufacturing and import substitution also act as growth accelerators.

Key challenges include the volatility of raw material prices, particularly crude oil derivatives, which directly impact production costs and pricing strategies. The market also faces competition from counterfeit and substandard lubricants, which erode trust and market share for genuine products. Supply chain disruptions and logistical complexities in a developing nation can also pose significant hurdles. Regulatory compliance and the need for adherence to evolving environmental standards add another layer of complexity.

- Drivers: Industrial growth, automotive expansion, technological upgrades, government support.

- Barriers & Challenges: Raw material price volatility, counterfeit products, supply chain issues, regulatory compliance, intense competition.

Emerging Opportunities in Bangladesh Lubricants Market

Emerging opportunities in the Bangladesh Lubricants Market are centered around several key areas. The increasing adoption of electric vehicles (EVs) presents an emerging segment for specialized EV fluids, including battery coolants and transmission fluids. The growing awareness and demand for environmentally friendly and biodegradable lubricants offer a significant opportunity for manufacturers to develop and market sustainable product lines. Furthermore, the expansion of the renewable energy sector, particularly solar and wind power, will create a niche demand for specialized lubricants designed for these specific applications. The untapped potential in rural and semi-urban areas, where the penetration of quality lubricants might be lower, offers opportunities for market expansion through targeted distribution strategies. The development of advanced additive technologies that offer superior performance and extended service life will also be a key area for innovation and market differentiation.

Growth Accelerators in the Bangladesh Lubricants Market Industry

Several growth accelerators are poised to propel the Bangladesh Lubricants Market forward. The continuous expansion of the manufacturing sector, driven by government policies aimed at boosting exports and domestic production, will significantly increase the demand for industrial lubricants, including hydraulic oils, gear oils, and metalworking fluids. The ongoing infrastructure projects, such as large-scale construction and transportation networks, will sustain the demand for lubricants used in heavy equipment and commercial vehicles. Furthermore, the increasing adoption of synthetic and semi-synthetic lubricants, driven by the desire for improved fuel economy, reduced emissions, and extended equipment life, will contribute to higher value sales. Strategic partnerships and collaborations between local manufacturers and international lubricant brands can accelerate the introduction of advanced technologies and expand market reach. The growing emphasis on product quality and performance by end-users, driven by a better understanding of the long-term economic benefits, is also a key growth accelerator.

Key Players Shaping the Bangladesh Lubricants Market Market

- MJL Bangladesh PLC

- Gulf Oil Bangladesh Limited

- Padma Oil Company Limited

- UNITED GROUP

- City Lube Oil Industries Ltd

- Imam Group

- APSCO Bangladesh

- Navana Petroleum Limited

- SINOPEC Lubricants Bangladesh

- Lub-rref (Bangladesh) Ltd

- BP p l c

- Ranks Petroleum Ltd (Shell BD)

- Sigma Oil Industries Ltd

- Corona Group

Notable Milestones in Bangladesh Lubricants Market Sector

- 2021: Launch of new high-performance synthetic engine oils by major players catering to the evolving automotive sector.

- 2022: Increased focus on sustainable lubricant formulations and the introduction of eco-friendly product lines.

- 2023: Expansion of local blending facilities to meet growing domestic demand and reduce import reliance.

- 2024: Introduction of specialized lubricants for electric vehicle (EV) applications by select market leaders.

- 2025 (Estimated): Significant investment in R&D for advanced additive technologies to enhance lubricant performance and lifespan.

In-Depth Bangladesh Lubricants Market Market Outlook

The Bangladesh Lubricants Market outlook is exceptionally positive, driven by a confluence of sustained economic growth, expanding industrial activities, and an ever-increasing demand for advanced lubrication solutions. The market is expected to witness robust expansion fueled by ongoing infrastructure development projects and the continuous growth of the automotive sector, from passenger vehicles to heavy-duty commercial transport. The increasing emphasis on technological upgrades across various industries, including power generation and manufacturing, will further stimulate the demand for high-performance, specialized lubricants. Emerging opportunities in segments like electric vehicle fluids and biodegradable lubricants present significant avenues for innovation and market differentiation. Strategic partnerships and increasing local manufacturing capabilities are anticipated to enhance market competitiveness and product availability. Overall, the Bangladesh Lubricants Market is on a trajectory of strong, sustained growth, offering considerable opportunities for stakeholders who can adapt to evolving technological demands and market trends.

Bangladesh Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oil

- 1.2. Transmission and Gear Oils

- 1.3. Hydraulic Fluid

- 1.4. Metalworking Fluid

- 1.5. Grease

- 1.6. Other Product Types

-

2. End-user Industry

- 2.1. Power Generation

- 2.2. Automotive and Other Transportation

- 2.3. Heavy Equipment

- 2.4. Metallurgy and Metalworking

- 2.5. Other End-user Industries

Bangladesh Lubricants Market Segmentation By Geography

- 1. Bangladesh

Bangladesh Lubricants Market Regional Market Share

Geographic Coverage of Bangladesh Lubricants Market

Bangladesh Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Power Generation Industry; Increasing Activities of Metalworking and Metallurgy; Increasing Demand from Automotive Industry

- 3.3. Market Restrains

- 3.3.1. High Price of Synthetic Lubricants; Other Restraints

- 3.4. Market Trends

- 3.4.1. Engine Oil Dominates the Lubricant Market in Bangladesh

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bangladesh Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oil

- 5.1.2. Transmission and Gear Oils

- 5.1.3. Hydraulic Fluid

- 5.1.4. Metalworking Fluid

- 5.1.5. Grease

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power Generation

- 5.2.2. Automotive and Other Transportation

- 5.2.3. Heavy Equipment

- 5.2.4. Metallurgy and Metalworking

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Bangladesh

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 MJL Bangladesh PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Gulf Oil Bangladesh Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Padma Oil Company Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 UNITED GROUP*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 City Lube Oil Industries Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Imam Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 APSCO Bangladesh

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Navana Petroleum Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SINOPEC Lubricants Bangladesh

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lub-rref (Bangladesh) Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 BP p l c

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Ranks Petroleum Ltd (Shell BD)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Sigma Oil Industries Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Corona Group

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 MJL Bangladesh PLC

List of Figures

- Figure 1: Bangladesh Lubricants Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Bangladesh Lubricants Market Share (%) by Company 2025

List of Tables

- Table 1: Bangladesh Lubricants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Bangladesh Lubricants Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 3: Bangladesh Lubricants Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Bangladesh Lubricants Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 5: Bangladesh Lubricants Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Bangladesh Lubricants Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Bangladesh Lubricants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Bangladesh Lubricants Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 9: Bangladesh Lubricants Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 10: Bangladesh Lubricants Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 11: Bangladesh Lubricants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Bangladesh Lubricants Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bangladesh Lubricants Market?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the Bangladesh Lubricants Market?

Key companies in the market include MJL Bangladesh PLC, Gulf Oil Bangladesh Limited, Padma Oil Company Limited, UNITED GROUP*List Not Exhaustive, City Lube Oil Industries Ltd, Imam Group, APSCO Bangladesh, Navana Petroleum Limited, SINOPEC Lubricants Bangladesh, Lub-rref (Bangladesh) Ltd, BP p l c, Ranks Petroleum Ltd (Shell BD), Sigma Oil Industries Ltd, Corona Group.

3. What are the main segments of the Bangladesh Lubricants Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 4 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Power Generation Industry; Increasing Activities of Metalworking and Metallurgy; Increasing Demand from Automotive Industry.

6. What are the notable trends driving market growth?

Engine Oil Dominates the Lubricant Market in Bangladesh.

7. Are there any restraints impacting market growth?

High Price of Synthetic Lubricants; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bangladesh Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bangladesh Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bangladesh Lubricants Market?

To stay informed about further developments, trends, and reports in the Bangladesh Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence