Key Insights

The bio-ketones market is poised for substantial expansion, driven by escalating demand for sustainable, high-performance ingredients across diverse industries. Projections indicate a Compound Annual Growth Rate (CAGR) of 5.9% from 2025 to 2033, expanding the market size to 24.25 billion by 2025. Key growth catalysts include heightened consumer awareness of the health benefits of ketones, particularly within sports nutrition and dietary supplements, and the broader industry shift towards bio-based products in cosmetics, pharmaceuticals, and food & beverage sectors. Technological innovations in bio-fermentation and synthetic biology are enhancing production efficiency and cost-effectiveness, strengthening the competitive position of bio-ketones. Leading companies are actively investing in research, development, strategic partnerships, and capacity expansion to capitalize on these opportunities. Market segmentation encompasses various ketone types, application areas, and geographic regions, reflecting the market's versatility. Despite ongoing challenges in production scalability and cost competitiveness for certain niche applications, the bio-ketones market demonstrates a highly positive outlook.

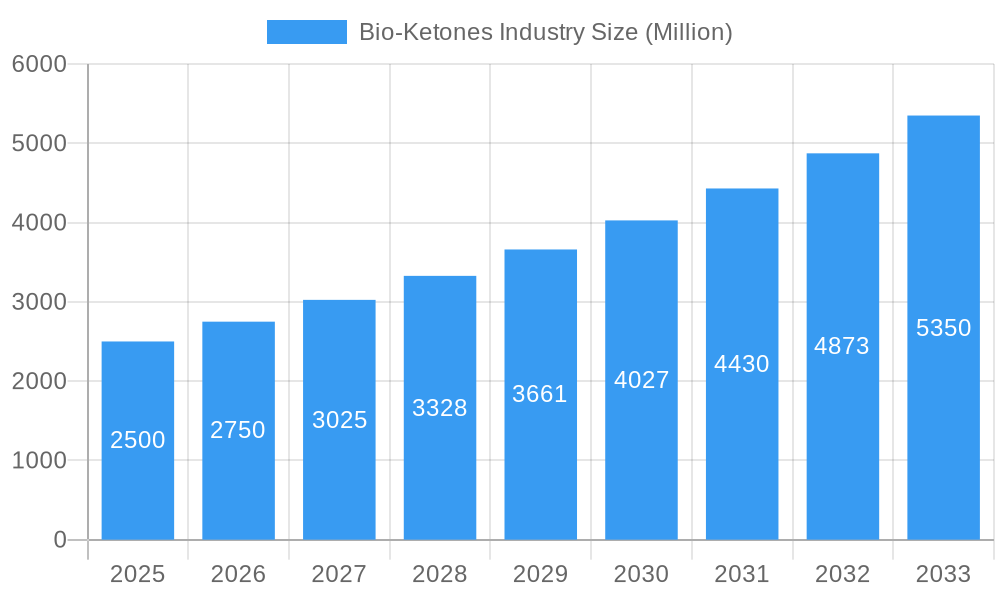

Bio-Ketones Industry Market Size (In Billion)

The forecast period from 2025 to 2033 anticipates sustained market growth, propelled by ongoing technological advancements, expansion into emerging markets, and increasing consumer adoption. Novel applications in biodegradable plastics and advanced materials are expected to be significant drivers of this expansion. The competitive landscape will likely be shaped by continued mergers, acquisitions, and strategic alliances among key market participants. While North America and Europe are projected to maintain substantial market shares, emerging economies in Asia-Pacific present considerable growth potential. Adapting to evolving regulatory frameworks and consumer preferences will be crucial for maintaining a competitive advantage in this dynamic market.

Bio-Ketones Industry Company Market Share

Bio-Ketones Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Bio-Ketones industry, encompassing market dynamics, growth trends, regional dominance, product landscape, and key players. The study period covers 2019-2033, with 2025 as the base and estimated year. The report offers invaluable insights for industry professionals, investors, and strategists seeking to navigate this rapidly evolving market. The parent market is the broader biochemicals market, while the child market is specifically bio-based ketone production. This report projects the market to reach XX Million by 2033.

Bio-Ketones Industry Market Dynamics & Structure

This section analyzes the competitive landscape of the bio-ketones market, focusing on market concentration, technological innovation, regulatory influences, and industry consolidation. The market is currently characterized by a moderately fragmented structure, with several key players competing alongside smaller niche players. The report quantifies market share held by major players and explores the impact of M&A activity. The overall market value in 2025 is estimated at 150 Million.

- Market Concentration: Moderately Fragmented (HHI: xx)

- Technological Innovation: Focus on improving production efficiency and reducing costs through bio-fermentation and synthetic biology.

- Regulatory Frameworks: Varying regulations across regions concerning food and beverage applications and environmental impact assessment influence market growth.

- Competitive Substitutes: Chemically synthesized ketones and other energy sources pose competition.

- End-User Demographics: Primary demand is driven by the food & beverage, sports nutrition, and pharmaceutical industries.

- M&A Trends: Consolidation is expected to increase, driving market concentration. xx M&A deals were recorded between 2019 and 2024.

Bio-Ketones Industry Growth Trends & Insights

The global bio-ketones market exhibited substantial growth from 2019 to 2024 and is poised for continued expansion, projected to maintain a robust Compound Annual Growth Rate (CAGR) of [Insert Specific CAGR Percentage]% during the forecast period (2025-2033). This upward trajectory is fueled by several key factors: a surge in consumer demand for health and wellness products, the enduring popularity of ketogenic diets, and significant technological advancements that enhance bio-ketone production efficiency and reduce costs. Market analysts predict the market size will reach [Insert Specific Market Size in Millions] by 2033. Detailed analysis reveals varying adoption rates across diverse end-user segments, highlighting the impact of technological innovations such as advanced fermentation techniques and the evolving consumer preference for health-conscious lifestyles. Specifically, the sports nutrition and dietary supplement sectors are expected to experience particularly strong growth.

Dominant Regions, Countries, or Segments in Bio-Ketones Industry

North America currently holds the largest market share in the bio-ketones industry, driven by strong demand from the health and wellness sector. Europe is also a significant market, with growing interest in sustainable and bio-based products. The Asia-Pacific region presents considerable growth potential due to rising disposable incomes and increasing health awareness.

- Key Drivers in North America: Strong regulatory support, high consumer spending on health products, established supply chains.

- Key Drivers in Europe: Focus on sustainable products, stringent environmental regulations pushing bio-based solutions, high adoption rates of ketogenic diets.

- Key Drivers in Asia-Pacific: Rising disposable incomes, increasing health awareness, growing demand for functional foods and beverages.

Bio-Ketones Industry Product Landscape

Bio-ketones are predominantly produced via microbial fermentation, yielding high-purity products suitable for a wide array of applications. Ongoing innovations are focused on optimizing production yields, minimizing costs, and expanding the product portfolio. The market offers diverse product formats, including powders, liquids, and capsules. Key advancements involve the development of more efficient microbial strains and refined fermentation processes, resulting in superior product quality and reduced production expenses. This includes exploring novel fermentation strategies to improve yield and reduce reliance on costly substrates.

Key Drivers, Barriers & Challenges in Bio-Ketones Industry

Key Drivers:

- The escalating consumer demand for health and wellness products, significantly driven by the sustained popularity of ketogenic diets and the increasing awareness of the benefits of ketosis for weight management, athletic performance, and cognitive function.

- Remarkable advancements in biotechnology, leading to increased production efficiency and substantial cost reductions in bio-ketone manufacturing. This includes the development of novel strains and improved fermentation processes.

- A growing emphasis on sustainable and bio-based alternatives within the food and beverage industry, aligning with broader environmental concerns and consumer preferences.

Key Challenges:

- Historically high production costs compared to chemically synthesized ketones, though this gap is narrowing due to ongoing technological improvements.

- Navigating regulatory hurdles and inconsistencies in regulations across various geographical regions, requiring strategic compliance planning and market-specific approaches.

- Intense competition from established players in the food and beverage and dietary supplement industries, impacting market penetration. Strategies to differentiate bio-ketones and highlight their unique benefits are crucial for mitigating this challenge.

Emerging Opportunities in Bio-Ketones Industry

Significant opportunities exist in expanding into new application areas, such as pharmaceuticals and cosmetics, leveraging the unique properties of bio-ketones. Further development of bio-ketone utilization in functional foods and beverages holds immense potential. Untapped markets in developing economies present considerable growth prospects, requiring targeted market entry strategies. Furthermore, exploration of personalized nutrition approaches and the development of innovative delivery systems could unlock substantial market expansion and cater to a wider range of consumer needs.

Growth Accelerators in the Bio-Ketones Industry

Strategic partnerships between biotechnology companies and established food and beverage companies will drive industry growth. Technological advancements in fermentation and downstream processing will continue to lower production costs and enhance product quality. Increased consumer awareness and education regarding the benefits of bio-ketones will further accelerate market expansion.

Key Players Shaping the Bio-Ketones Industry Market

- Bio Brands LLC

- Caldic B V

- Eastman Chemical Company

- Fitz Chem LLC

- Genomatica Inc

- Green Biologics Limited

- LANZATECH

- Merck KGaA

- List Not Exhaustive

Notable Milestones in Bio-Ketones Industry Sector

- 2021 Q4: Genomatica announces successful pilot-scale production of a novel bio-ketone.

- 2022 Q2: Bio Brands LLC secures significant funding for expansion of bio-ketone production facilities.

- 2023 Q1: Eastman Chemical Company launches a new line of bio-ketone-based ingredients for food and beverage applications.

- Further milestones to be included in the final report

In-Depth Bio-Ketones Industry Market Outlook

The bio-ketones market is poised for significant growth over the next decade, driven by several factors including technological advancements, increasing consumer demand, and strategic partnerships. The market is expected to witness further consolidation and expansion into new applications. Strategic players should focus on R&D to further improve production efficiency, expand into new geographical markets, and strengthen their brand positioning to capitalize on this exciting market opportunity.

Bio-Ketones Industry Segmentation

-

1. Product Type

- 1.1. Bio MEK

- 1.2. Bio PEEK

- 1.3. Bio Acetone

- 1.4. Other Product Types

-

2. End-user Industry

- 2.1. Paints and Coatings

- 2.2. Automobile

- 2.3. Infrastructure

- 2.4. Pharmaceutical

- 2.5. Other End-user Industries

Bio-Ketones Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. ASEAN Countries

- 1.6. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Bio-Ketones Industry Regional Market Share

Geographic Coverage of Bio-Ketones Industry

Bio-Ketones Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand from Cosmetics and Personal Care Industry; Supporting Government Regulations for the Use of Bio-products

- 3.3. Market Restrains

- 3.3.1. ; Increasing Demand from Cosmetics and Personal Care Industry; Supporting Government Regulations for the Use of Bio-products

- 3.4. Market Trends

- 3.4.1. Bio PEEK to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bio-Ketones Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Bio MEK

- 5.1.2. Bio PEEK

- 5.1.3. Bio Acetone

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Paints and Coatings

- 5.2.2. Automobile

- 5.2.3. Infrastructure

- 5.2.4. Pharmaceutical

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Asia Pacific Bio-Ketones Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Bio MEK

- 6.1.2. Bio PEEK

- 6.1.3. Bio Acetone

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Paints and Coatings

- 6.2.2. Automobile

- 6.2.3. Infrastructure

- 6.2.4. Pharmaceutical

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. North America Bio-Ketones Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Bio MEK

- 7.1.2. Bio PEEK

- 7.1.3. Bio Acetone

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Paints and Coatings

- 7.2.2. Automobile

- 7.2.3. Infrastructure

- 7.2.4. Pharmaceutical

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Bio-Ketones Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Bio MEK

- 8.1.2. Bio PEEK

- 8.1.3. Bio Acetone

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Paints and Coatings

- 8.2.2. Automobile

- 8.2.3. Infrastructure

- 8.2.4. Pharmaceutical

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Bio-Ketones Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Bio MEK

- 9.1.2. Bio PEEK

- 9.1.3. Bio Acetone

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Paints and Coatings

- 9.2.2. Automobile

- 9.2.3. Infrastructure

- 9.2.4. Pharmaceutical

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Bio-Ketones Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Bio MEK

- 10.1.2. Bio PEEK

- 10.1.3. Bio Acetone

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Paints and Coatings

- 10.2.2. Automobile

- 10.2.3. Infrastructure

- 10.2.4. Pharmaceutical

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bio Brands LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Caldic B V

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Eastman Chemical Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fitz Chem LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Genomatica Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Green Biologics Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LANZATECH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Merck KGaA*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Bio Brands LLC

List of Figures

- Figure 1: Global Bio-Ketones Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Bio-Ketones Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: Asia Pacific Bio-Ketones Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Asia Pacific Bio-Ketones Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Bio-Ketones Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Bio-Ketones Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Bio-Ketones Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Bio-Ketones Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 9: North America Bio-Ketones Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: North America Bio-Ketones Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: North America Bio-Ketones Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Bio-Ketones Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Bio-Ketones Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Bio-Ketones Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Europe Bio-Ketones Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Bio-Ketones Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Europe Bio-Ketones Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Bio-Ketones Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Bio-Ketones Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Bio-Ketones Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 21: South America Bio-Ketones Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Bio-Ketones Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: South America Bio-Ketones Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Bio-Ketones Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Bio-Ketones Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Bio-Ketones Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Bio-Ketones Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Bio-Ketones Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Bio-Ketones Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Bio-Ketones Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Bio-Ketones Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bio-Ketones Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Bio-Ketones Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Bio-Ketones Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Bio-Ketones Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Bio-Ketones Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Bio-Ketones Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Bio-Ketones Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Bio-Ketones Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Bio-Ketones Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Bio-Ketones Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: ASEAN Countries Bio-Ketones Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of Asia Pacific Bio-Ketones Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Bio-Ketones Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global Bio-Ketones Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Bio-Ketones Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: United States Bio-Ketones Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Canada Bio-Ketones Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Bio-Ketones Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Bio-Ketones Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Global Bio-Ketones Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 21: Global Bio-Ketones Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Germany Bio-Ketones Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: United Kingdom Bio-Ketones Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Italy Bio-Ketones Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France Bio-Ketones Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Bio-Ketones Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Global Bio-Ketones Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 28: Global Bio-Ketones Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 29: Global Bio-Ketones Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Brazil Bio-Ketones Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Argentina Bio-Ketones Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Rest of South America Bio-Ketones Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Global Bio-Ketones Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 34: Global Bio-Ketones Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Bio-Ketones Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Saudi Arabia Bio-Ketones Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Africa Bio-Ketones Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Bio-Ketones Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bio-Ketones Industry?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the Bio-Ketones Industry?

Key companies in the market include Bio Brands LLC, Caldic B V, Eastman Chemical Company, Fitz Chem LLC, Genomatica Inc, Green Biologics Limited, LANZATECH, Merck KGaA*List Not Exhaustive.

3. What are the main segments of the Bio-Ketones Industry?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.25 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand from Cosmetics and Personal Care Industry; Supporting Government Regulations for the Use of Bio-products.

6. What are the notable trends driving market growth?

Bio PEEK to Dominate the Market.

7. Are there any restraints impacting market growth?

; Increasing Demand from Cosmetics and Personal Care Industry; Supporting Government Regulations for the Use of Bio-products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bio-Ketones Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bio-Ketones Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bio-Ketones Industry?

To stay informed about further developments, trends, and reports in the Bio-Ketones Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence