Key Insights

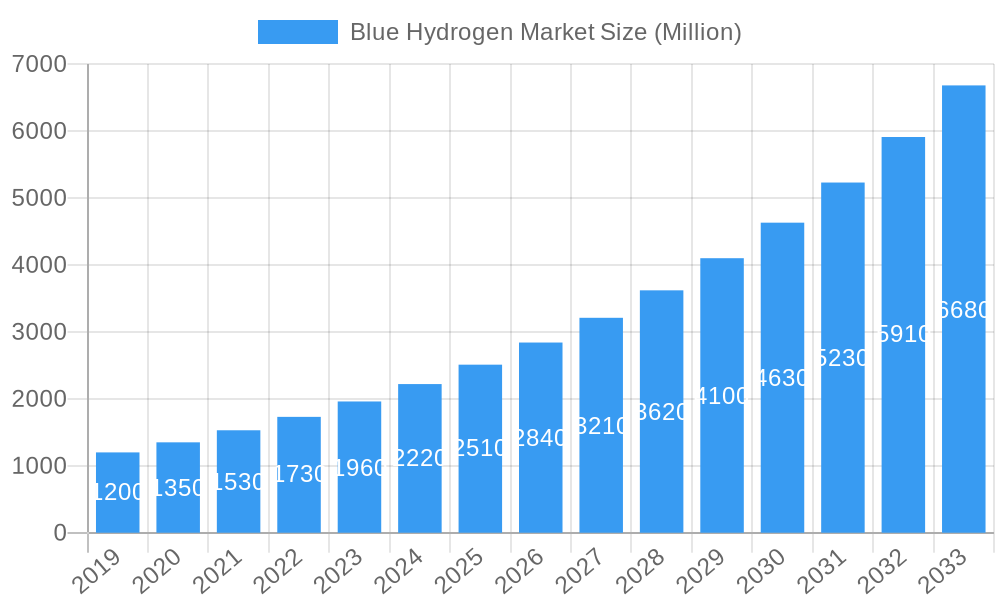

The global Blue Hydrogen market is poised for substantial expansion, projected to reach an estimated XX million by 2025 and exhibit a robust Compound Annual Growth Rate (CAGR) exceeding 11.00% through 2033. This impressive growth is primarily fueled by the escalating demand for low-carbon energy solutions across various industrial sectors. Key drivers include stringent environmental regulations, the urgent need to decarbonize heavy industries, and the strategic investments being made by major energy players in hydrogen production infrastructure. The refining, chemicals, and iron and steel industries are at the forefront of adopting blue hydrogen, recognizing its potential to significantly reduce their carbon footprints. Furthermore, the transportation sector's increasing interest in hydrogen fuel cells, coupled with government incentives for clean energy, is creating a powerful demand pull. Emerging trends like the development of advanced carbon capture, utilization, and storage (CCUS) technologies are enhancing the viability and efficiency of blue hydrogen production, addressing a critical environmental concern.

Blue Hydrogen Market Market Size (In Billion)

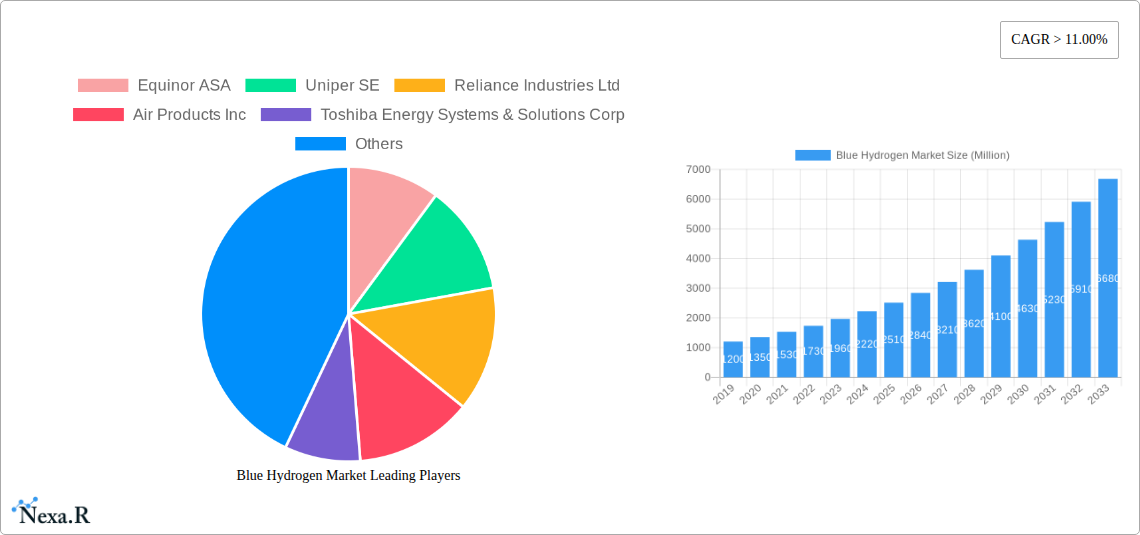

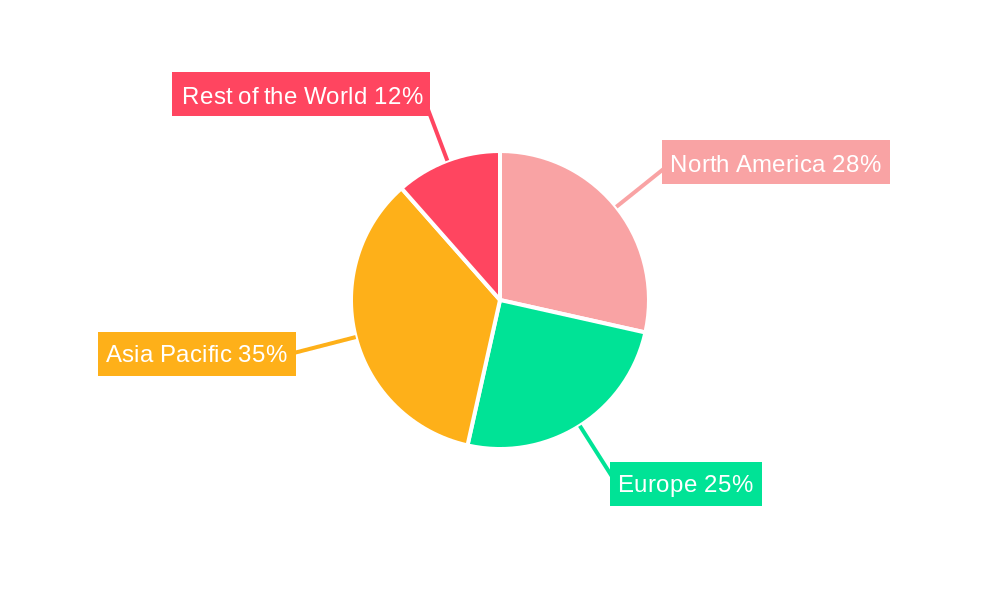

Despite its promising outlook, the market faces certain restraints that require strategic mitigation. High upfront capital investment for blue hydrogen production facilities, including the associated CCUS infrastructure, remains a significant barrier. Fluctuations in natural gas prices, a key feedstock for blue hydrogen, can impact production costs and market competitiveness. Additionally, the complexity of regulatory frameworks and the need for standardized safety protocols for hydrogen transportation and storage present challenges. However, ongoing research and development, coupled with increasing global collaboration, are expected to overcome these hurdles. Key companies such as Equinor ASA, Uniper SE, Reliance Industries Ltd, Air Products Inc., Linde plc, and Shell Plc are actively investing in and developing blue hydrogen projects, indicating strong industry confidence and a commitment to scaling up production and addressing market challenges. The Asia Pacific region, led by China and India, is anticipated to emerge as a dominant force, driven by rapid industrialization and government-led clean energy initiatives.

Blue Hydrogen Market Company Market Share

Blue Hydrogen Market: Comprehensive Industry Analysis & Future Outlook (2019–2033)

This in-depth report offers a definitive analysis of the global Blue Hydrogen Market, examining its intricate dynamics, growth trajectories, and future potential. Spanning from 2019–2024 (historical) and projecting to 2025–2033 (forecast), with a base and estimated year of 2025, this study provides critical insights for stakeholders seeking to navigate this rapidly evolving sector. The report covers parent and child market perspectives, detailing market size, segmentation by end-user industry, regional dominance, technological advancements, and key player strategies, all presented in million units.

Blue Hydrogen Market Dynamics & Structure

The Blue Hydrogen Market exhibits a moderately concentrated structure, with key players investing heavily in scaling production and carbon capture technologies. Technological innovation remains a primary driver, particularly in enhancing the efficiency of methane reforming processes and improving the reliability of carbon capture, utilization, and storage (CCUS) solutions. Regulatory frameworks, including government incentives and carbon pricing mechanisms, are increasingly shaping market adoption. Competitive product substitutes, such as green hydrogen and conventional grey hydrogen, present ongoing challenges, but blue hydrogen's cost-competitiveness and existing natural gas infrastructure offer a distinct advantage. End-user demographics are shifting towards industrial sectors prioritizing decarbonization and energy security. Mergers and acquisitions (M&A) are anticipated to play a significant role in consolidating market share and accelerating project development. For instance, recent investments in blue hydrogen production facilities by major energy companies underscore a strategic push towards lower-carbon energy solutions. Barriers to innovation include the high upfront capital expenditure for CCUS infrastructure and the need for standardized certification processes for blue hydrogen.

- Market Concentration: Dominated by a few large integrated energy companies and industrial gas suppliers.

- Technological Innovation Drivers: Advancements in auto-thermal reforming (ATR), steam methane reforming (SMR) with CCUS, and hydrogen liquefaction/transportation.

- Regulatory Frameworks: Impact of subsidies for low-carbon hydrogen production and carbon emission targets.

- Competitive Product Substitutes: Competition from green hydrogen, grey hydrogen, and other alternative fuels.

- End-User Demographics: Growing demand from refining, chemicals, and iron and steel industries for decarbonization.

- M&A Trends: Potential for consolidation and strategic partnerships to secure market position.

Blue Hydrogen Market Growth Trends & Insights

The Blue Hydrogen Market is poised for significant expansion, driven by global decarbonization mandates and the urgent need for cleaner industrial fuels. Leveraging advanced analytics and market modeling, this report forecasts a robust Compound Annual Growth Rate (CAGR) from 2025–2033. The market size is projected to grow from an estimated xx million units in 2025 to xx million units by 2033. Adoption rates are accelerating as industries recognize blue hydrogen's role in achieving net-zero targets while mitigating the intermittency challenges associated with renewable energy sources. Technological disruptions are focused on reducing the cost of CCUS and increasing the efficiency of hydrogen production. Consumer behavior shifts are evident in the increasing preference for products manufactured using low-carbon processes, thereby incentivizing industries to adopt cleaner energy solutions. The market penetration of blue hydrogen is expected to rise substantially as large-scale projects move from planning to operational phases.

- Market Size Evolution: Projected growth from xx million units in 2025 to xx million units by 2033.

- Adoption Rates: Increasing adoption driven by government policies and corporate sustainability goals.

- Technological Disruptions: Focus on cost reduction in CCUS and efficiency improvements in production.

- Consumer Behavior Shifts: Growing demand for sustainably produced goods influencing industrial energy choices.

- Market Penetration: Significant increase in the share of blue hydrogen in the industrial gas market.

- CAGR: Estimated CAGR of xx% for the forecast period 2025–2033.

Dominant Regions, Countries, or Segments in Blue Hydrogen Market

North America, particularly the United States, is emerging as a dominant region in the Blue Hydrogen Market, propelled by substantial government incentives, a well-established natural gas infrastructure, and aggressive industrial decarbonization targets. The refining and chemicals sectors are leading the demand for blue hydrogen in this region, driven by their significant greenhouse gas emissions and the economic viability of integrating blue hydrogen into existing operations. The "Other End-user Industries" segment, encompassing sectors like power generation and heavy industry, is also showing strong growth potential as these industries seek to reduce their carbon footprint. Key drivers for North America's dominance include supportive policy frameworks like the Inflation Reduction Act (IRA), which provides substantial tax credits for clean hydrogen production. Furthermore, significant investments are being made in developing the necessary CO2 transportation and storage infrastructure. The presence of major players like Air Products Inc. and Linde plc, actively investing in large-scale blue hydrogen facilities, further solidifies North America's leading position. The country's commitment to developing a robust hydrogen economy, coupled with advancements in CCUS technology, positions it for sustained market leadership.

- Leading Region: North America, with the United States at the forefront.

- Dominant End-user Industry: Refining and Chemicals, followed by Iron and Steel.

- Key Drivers in North America:

- Supportive government policies and tax incentives (e.g., IRA).

- Extensive natural gas infrastructure.

- Growing investments in CCUS technology and infrastructure.

- Aggressive corporate sustainability goals.

- Market Share & Growth Potential: High market share in current blue hydrogen production and significant growth potential due to ongoing project pipelines.

Blue Hydrogen Market Product Landscape

The blue hydrogen product landscape is characterized by its application in decarbonizing high-emission industrial processes and as a feedstock for various chemical syntheses. Product innovations are focused on improving the purity of hydrogen produced through steam methane reforming coupled with carbon capture. Key applications include use in ammonia and methanol production, which are critical for the fertilizer and chemical industries, respectively. Furthermore, blue hydrogen is being explored for direct use in steelmaking, offering a viable alternative to traditional blast furnace methods. Performance metrics emphasize reduced lifecycle greenhouse gas emissions compared to grey hydrogen, making it an attractive option for industries striving to meet stringent environmental regulations. The unique selling proposition lies in its ability to leverage existing natural gas infrastructure while significantly lowering carbon intensity.

Key Drivers, Barriers & Challenges in Blue Hydrogen Market

Key Drivers:

- Decarbonization Mandates: Global pressure to reduce greenhouse gas emissions is a primary driver.

- Energy Security: Blue hydrogen offers a pathway to diversify energy sources and reduce reliance on volatile fossil fuel markets.

- Cost Competitiveness: Compared to green hydrogen, blue hydrogen production can be more cost-effective in the short to medium term due to established natural gas infrastructure.

- Technological Advancements in CCUS: Improvements in carbon capture efficiency and storage solutions are making blue hydrogen more viable.

Barriers & Challenges:

- High Capital Investment: Significant upfront costs for blue hydrogen production facilities and CCUS infrastructure.

- Regulatory Uncertainty: Evolving regulations and certification standards for low-carbon hydrogen can create market ambiguity.

- Public Perception and Social License: Concerns regarding methane leakage and the long-term safety of CO2 storage can impact public acceptance.

- Infrastructure Development: The need for extensive CO2 transportation and storage networks requires substantial investment and planning.

- Competition from Green Hydrogen: As renewable energy costs decline, green hydrogen is becoming increasingly competitive.

Emerging Opportunities in Blue Hydrogen Market

Emerging opportunities in the Blue Hydrogen Market lie in the development of large-scale integrated hydrogen hubs that combine production, transportation, and utilization. There is significant potential for blue hydrogen to decarbonize hard-to-abate sectors such as cement and glass manufacturing. Furthermore, innovative applications in long-duration energy storage and as a component in synthetic fuels for aviation and shipping are gaining traction. The increasing focus on establishing robust CO2 transport and storage infrastructure also presents opportunities for specialized service providers and technology developers.

Growth Accelerators in the Blue Hydrogen Market Industry

Long-term growth in the Blue Hydrogen Market will be accelerated by breakthroughs in CCUS technologies that further reduce capture costs and improve efficiency. Strategic partnerships between upstream energy producers, industrial consumers, and technology providers are crucial for de-risking large-scale projects and ensuring integrated supply chains. Market expansion strategies will likely involve developing dedicated CO2 pipelines and storage sites to support widespread blue hydrogen production. The increasing demand for low-carbon industrial products will also act as a significant market expansion driver.

Key Players Shaping the Blue Hydrogen Market Market

- Equinor ASA

- Uniper SE

- Reliance Industries Ltd

- Air Products Inc.

- Toshiba Energy Systems & Solutions Corp

- Suncor Energy Inc.

- Royal Dutch Shell Plc

- Linde plc

- CertifHy Canada Inc.

- Cummins Inc.

- Xebec Adsorption Inc.

- Saudi Aramco

- Siemens Energy

- Air Liquide

- ATCO Ltd.

Notable Milestones in Blue Hydrogen Market Sector

- February 2023: Linde announced plans to build a USD 1.8 billion blue hydrogen facility on the Texas Gulf Coast designed to supply ammonia production. The company plans to begin production in 2025. The Linde facility will produce blue hydrogen using auto thermal reforming, which produces hydrogen by reacting methane with oxygen and steam, paired with carbon capture.

- February 2023: Linde signed a long-term agreement to supply clean hydrogen and other industrial gases to OCI's new world-scale blue ammonia plant in Beaumont, Texas.

- April 2022: Uniper signed an agreement with Shell to progress plans to produce blue hydrogen at Uniper's Killingholme power station site in East England. The Humber Hub Blue Project includes plans for a blue hydrogen production facility with a capacity of up to 720 megawatts (MW), using gas reformation technology with carbon capture and storage (CCS).

In-Depth Blue Hydrogen Market Market Outlook

The future outlook for the Blue Hydrogen Market is exceptionally promising, driven by a confluence of supportive government policies, technological advancements, and a growing global commitment to decarbonization. Growth accelerators will be primarily fueled by the scaling of CCUS infrastructure and the development of large-scale, integrated hydrogen production facilities. Strategic partnerships are key to de-risking investments and fostering innovation across the value chain. The increasing demand for low-carbon industrial products will further propel market expansion, creating opportunities for companies to develop specialized blue hydrogen solutions for hard-to-abate sectors. Continued investment in research and development to enhance production efficiency and reduce costs will be critical for sustained market growth and competitiveness.

Blue Hydrogen Market Segmentation

-

1. End-user Industry

- 1.1. Refining

- 1.2. Chemicals

- 1.3. Iron and Steel

- 1.4. Transportation

- 1.5. Other End-user Industries

Blue Hydrogen Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Blue Hydrogen Market Regional Market Share

Geographic Coverage of Blue Hydrogen Market

Blue Hydrogen Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 11.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surging Application of Blue Hydrogen in Fuel Cell Electric Vehicles; Rising Demand from the Chemical Sector

- 3.3. Market Restrains

- 3.3.1. Loss of Energy During Hydrogen Production; Other Market Restraints

- 3.4. Market Trends

- 3.4.1. Surging Application of Blue Hydrogen in Fuel Cell Electric Vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Blue Hydrogen Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Refining

- 5.1.2. Chemicals

- 5.1.3. Iron and Steel

- 5.1.4. Transportation

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Asia Pacific Blue Hydrogen Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Refining

- 6.1.2. Chemicals

- 6.1.3. Iron and Steel

- 6.1.4. Transportation

- 6.1.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. North America Blue Hydrogen Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Refining

- 7.1.2. Chemicals

- 7.1.3. Iron and Steel

- 7.1.4. Transportation

- 7.1.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Europe Blue Hydrogen Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Refining

- 8.1.2. Chemicals

- 8.1.3. Iron and Steel

- 8.1.4. Transportation

- 8.1.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Rest of the World Blue Hydrogen Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Refining

- 9.1.2. Chemicals

- 9.1.3. Iron and Steel

- 9.1.4. Transportation

- 9.1.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Equinor ASA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Uniper SE

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Reliance Industries Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Air Products Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Toshiba Energy Systems & Solutions Corp

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Suncor Energy Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Royal Dutch Shell Plc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Linde plc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 CertifHy Canada Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Cummins Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Xebec Adsorption Inc *List Not Exhaustive

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Saudi Aramco

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Siemens Energy

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Air Liquide

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 ATCO Ltd

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Equinor ASA

List of Figures

- Figure 1: Global Blue Hydrogen Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Blue Hydrogen Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 3: Asia Pacific Blue Hydrogen Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: Asia Pacific Blue Hydrogen Market Revenue (Million), by Country 2025 & 2033

- Figure 5: Asia Pacific Blue Hydrogen Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America Blue Hydrogen Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Blue Hydrogen Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Blue Hydrogen Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Blue Hydrogen Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Blue Hydrogen Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Blue Hydrogen Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Blue Hydrogen Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Blue Hydrogen Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Blue Hydrogen Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Rest of the World Blue Hydrogen Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Rest of the World Blue Hydrogen Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Blue Hydrogen Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Blue Hydrogen Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Blue Hydrogen Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Blue Hydrogen Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Blue Hydrogen Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: China Blue Hydrogen Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: India Blue Hydrogen Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Japan Blue Hydrogen Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: South Korea Blue Hydrogen Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of Asia Pacific Blue Hydrogen Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Blue Hydrogen Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Blue Hydrogen Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United States Blue Hydrogen Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Canada Blue Hydrogen Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Mexico Blue Hydrogen Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Blue Hydrogen Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Blue Hydrogen Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Germany Blue Hydrogen Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Blue Hydrogen Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: France Blue Hydrogen Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Blue Hydrogen Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Blue Hydrogen Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Blue Hydrogen Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Blue Hydrogen Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: South America Blue Hydrogen Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Middle East and Africa Blue Hydrogen Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Blue Hydrogen Market?

The projected CAGR is approximately > 11.00%.

2. Which companies are prominent players in the Blue Hydrogen Market?

Key companies in the market include Equinor ASA, Uniper SE, Reliance Industries Ltd, Air Products Inc, Toshiba Energy Systems & Solutions Corp, Suncor Energy Inc, Royal Dutch Shell Plc, Linde plc, CertifHy Canada Inc, Cummins Inc, Xebec Adsorption Inc *List Not Exhaustive, Saudi Aramco, Siemens Energy, Air Liquide, ATCO Ltd.

3. What are the main segments of the Blue Hydrogen Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Surging Application of Blue Hydrogen in Fuel Cell Electric Vehicles; Rising Demand from the Chemical Sector.

6. What are the notable trends driving market growth?

Surging Application of Blue Hydrogen in Fuel Cell Electric Vehicles.

7. Are there any restraints impacting market growth?

Loss of Energy During Hydrogen Production; Other Market Restraints.

8. Can you provide examples of recent developments in the market?

February 2023: Linde announced plans to build a USD 1.8 billion blue hydrogen facility on the Texas Gulf Coast designed to supply ammonia production. The company plans to begin production in 2025. The Linde facility will produce blue hydrogen using auto thermal reforming, which produces hydrogen by reacting methane with oxygen and steam, paired with carbon capture.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Blue Hydrogen Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Blue Hydrogen Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Blue Hydrogen Market?

To stay informed about further developments, trends, and reports in the Blue Hydrogen Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence