Key Insights

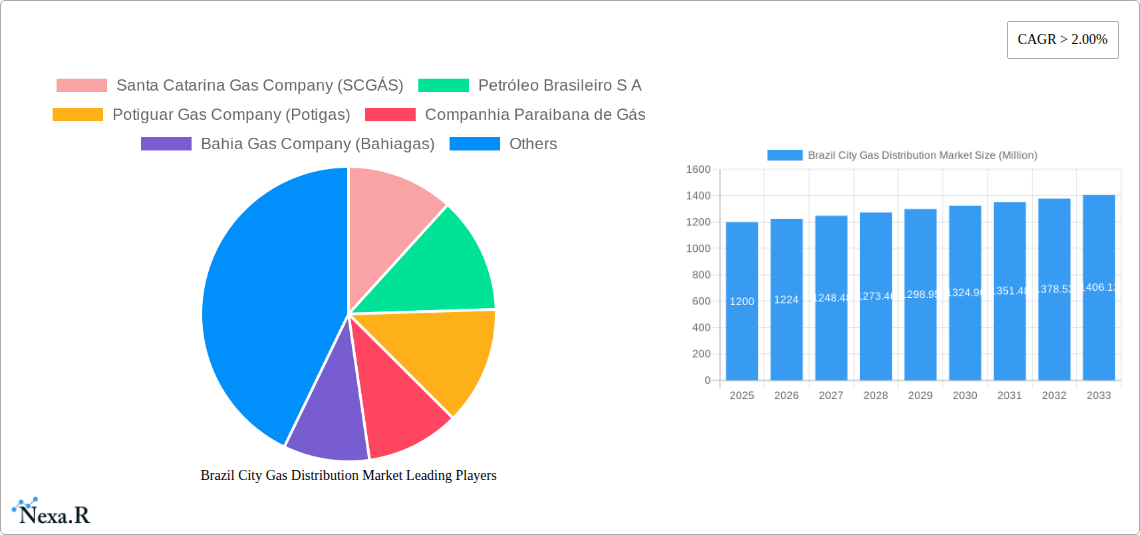

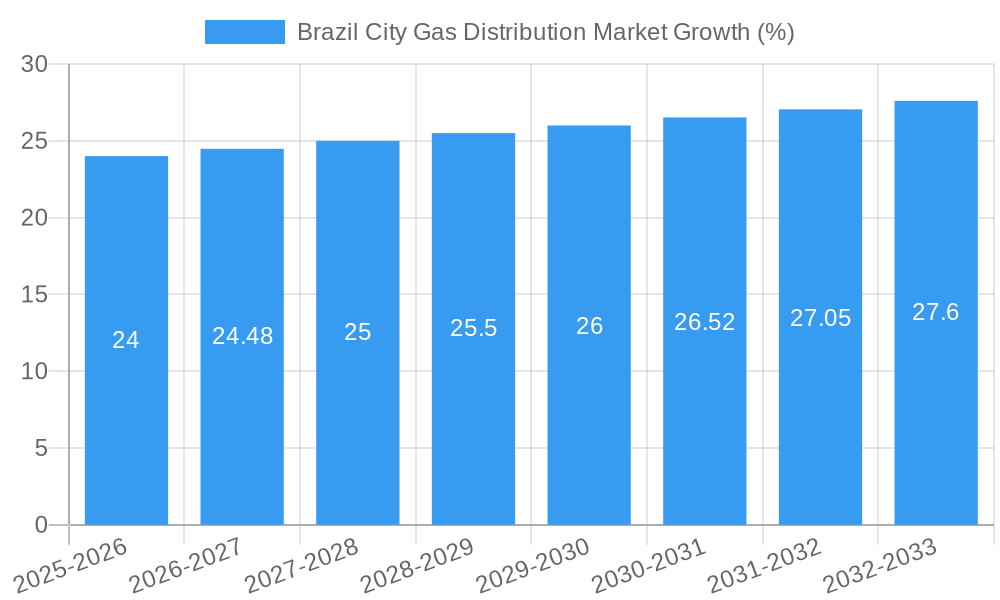

The Brazil city gas distribution market presents a compelling investment opportunity, projected to experience robust growth over the forecast period (2025-2033). With a current market size exceeding $1 billion (estimated based on typical market size relative to CAGR and other Latin American nations), and a compound annual growth rate (CAGR) exceeding 2%, the market is poised for significant expansion. This growth is driven by increasing urbanization, industrialization, and government initiatives promoting cleaner energy sources to reduce reliance on fossil fuels. The power sector and industrial segments are key drivers, with rising energy demands from manufacturing and power generation facilities fueling consumption. Further growth is anticipated from expansion into the residential and commercial sectors, particularly in underserved areas, as infrastructure improves and gas connections become more widespread. While challenges exist, including potential infrastructure limitations and price volatility, the overall outlook for the Brazilian city gas distribution market remains positive. The consistent growth in gas consumption, coupled with government support for infrastructure development, mitigates the impact of these restraints. Key players like SCGÁS, Petrobras, and Comgás are strategically positioned to capitalize on this expanding market, leveraging their existing infrastructure and expertise. The market segmentation by end-user (industrial, power, residential & commercial, transportation) and gas type (CNG, PNG) allows for targeted investments and strategic planning.

The market's robust trajectory is underpinned by a supportive regulatory environment that incentivizes gas distribution expansion. Government policies focusing on energy security and diversification are vital in promoting the adoption of natural gas as a cleaner and more efficient energy source. The ongoing investments in pipeline infrastructure are expected to further enhance accessibility and reliability, boosting market penetration. The competitive landscape features a mix of both state-owned and private companies, creating a dynamic environment that drives innovation and efficiency improvements. However, the market's future growth will heavily depend on the successful implementation of infrastructure projects and sustained economic growth in Brazil. Continuous monitoring of regulatory changes and potential shifts in energy policy will be crucial for stakeholders to navigate this evolving market.

Brazil City Gas Distribution Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Brazil city gas distribution market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report caters to industry professionals, investors, and stakeholders seeking a detailed understanding of this dynamic sector. The parent market is the broader Brazilian energy sector, while the child market is city gas distribution, specifically focusing on CNG and PNG segments.

Brazil City Gas Distribution Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends influencing the Brazilian city gas distribution market. The market is characterized by a mix of large, established players and smaller regional distributors. Market concentration is moderate, with a few dominant players holding significant market share. Technological innovation, particularly in CNG infrastructure and transportation, is a key driver of growth. Regulatory frameworks, while generally supportive of gas expansion, pose some challenges concerning permitting and infrastructure development. The rise of renewable energy sources represents a competitive substitute, particularly for power generation. End-user demographics, with a growing industrial and transportation sector, are fueling demand. M&A activity in the sector has been moderate but is expected to increase as companies consolidate to enhance efficiency and expand market reach.

- Market Concentration: Moderate, with top 5 players holding xx% market share in 2025.

- Technological Innovation: Focus on CNG infrastructure and pipeline expansion.

- Regulatory Framework: Supportive, but with challenges concerning permitting and infrastructure development.

- Competitive Substitutes: Renewable energy sources.

- M&A Activity: xx deals in the last 5 years; forecast for xx deals in the next 5 years.

- Innovation Barriers: High capital expenditure required for infrastructure development, regulatory complexities.

Brazil City Gas Distribution Market Growth Trends & Insights

The Brazilian city gas distribution market is experiencing robust growth driven by increasing energy demand, government initiatives to diversify energy sources, and industrial expansion. Market size, currently estimated at xx Million units in 2025, is projected to reach xx Million units by 2033, exhibiting a CAGR of xx%. Adoption rates are high in urban areas but remain relatively lower in rural regions. Technological disruptions, particularly improvements in CNG compression and transportation technologies, are accelerating growth. Consumer behavior is shifting towards cleaner energy sources, favoring natural gas over traditional fuels. The residential and commercial segment shows consistent growth due to increasing urbanization and higher living standards.

Dominant Regions, Countries, or Segments in Brazil City Gas Distribution Market

São Paulo state is the dominant region, accounting for xx% of the market share in 2025. The Industrial segment is the largest end-user, followed by the Transportation sector with significant potential due to government's focus on cleaner transportation. Pipeline Natural Gas (PNG) currently dominates the market, but Compressed Natural Gas (CNG) is showing rapid growth. Key growth drivers include:

- São Paulo State: Strong industrial base, well-established infrastructure.

- Industrial Segment: High energy demand, consistent growth.

- Transportation Segment: Government incentives for CNG vehicles, rising fuel costs.

- PNG: Established infrastructure, widespread availability.

- CNG: Growing popularity, government support for cleaner transportation.

Brazil City Gas Distribution Market Product Landscape

The market is primarily characterized by pipeline natural gas (PNG) and compressed natural gas (CNG). Recent innovations focus on enhancing the efficiency and safety of CNG transportation and storage. Improved CNG compression technologies are reducing costs and improving delivery capabilities. The focus is on creating efficient, cost-effective, and environmentally friendly solutions.

Key Drivers, Barriers & Challenges in Brazil City Gas Distribution Market

Key Drivers:

- Increasing energy demand from industrial and transportation sectors.

- Government initiatives to promote natural gas as a cleaner fuel source.

- Expansion of CNG infrastructure.

- Growing focus on reducing carbon emissions.

Key Challenges:

- High capital expenditure for infrastructure development.

- Regulatory hurdles and permitting processes.

- Competition from renewable energy sources.

- Supply chain disruptions impacting the cost and availability of natural gas. (estimated impact of xx% on market growth).

Emerging Opportunities in Brazil City Gas Distribution Market

- Expansion into underserved rural areas.

- Development of CNG fueling stations along major transportation routes.

- Growing demand for natural gas in power generation.

- Opportunities to offer integrated gas supply and management solutions.

Growth Accelerators in the Brazil City Gas Distribution Market Industry

Long-term growth will be propelled by continued infrastructure investment, technological advancements in CNG technology, strategic partnerships between gas distributors and transportation companies, and expansion into new geographic markets. Government support and favorable regulatory environments will also significantly contribute to market growth.

Key Players Shaping the Brazil City Gas Distribution Market Market

- Santa Catarina Gas Company (SCGÁS)

- Petróleo Brasileiro S A (Petrobras) - Global Website

- Potiguar Gas Company (Potigas)

- Companhia Paraibana de Gás

- Bahia Gas Company (Bahiagas)

- Companhia de Gás de São Paulo (Comgás)

- Naturgy Energy Group S A

Notable Milestones in Brazil City Gas Distribution Market Sector

- September 2021: Comgás expands CNG supply with a new filling station in Taboão.

- May 2022: Compagas and NEOgas launch a pilot project for CNG transport via natural gas-fueled trucks.

In-Depth Brazil City Gas Distribution Market Market Outlook

The Brazilian city gas distribution market is poised for significant growth over the forecast period. Continued investment in infrastructure, technological advancements, supportive government policies, and the rising demand for cleaner energy sources will drive market expansion. Strategic partnerships and diversification into new segments will also create significant opportunities for market players. The market is expected to witness robust growth, driven by the factors discussed throughout this report.

Brazil City Gas Distribution Market Segmentation

-

1. End-User

- 1.1. Industrial

- 1.2. Power Sector

- 1.3. Residential and Commercial

- 1.4. Transportation

-

2. Type

- 2.1. Compressed Natural Gas (CNG)

- 2.2. Pipeline Natural Gas (PNG)

Brazil City Gas Distribution Market Segmentation By Geography

- 1. Brazil

Brazil City Gas Distribution Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Clean Power Sources

- 3.4. Market Trends

- 3.4.1. Growing Demand for Natural Gas To Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil City Gas Distribution Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Industrial

- 5.1.2. Power Sector

- 5.1.3. Residential and Commercial

- 5.1.4. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Compressed Natural Gas (CNG)

- 5.2.2. Pipeline Natural Gas (PNG)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Santa Catarina Gas Company (SCGÁS)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Petróleo Brasileiro S A

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Potiguar Gas Company (Potigas)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Companhia Paraibana de Gás

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bahia Gas Company (Bahiagas)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Companhia de Gás de São Paulo (Comgás)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Naturgy Energy Group S A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Santa Catarina Gas Company (SCGÁS)

List of Figures

- Figure 1: Brazil City Gas Distribution Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil City Gas Distribution Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil City Gas Distribution Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil City Gas Distribution Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 3: Brazil City Gas Distribution Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Brazil City Gas Distribution Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Brazil City Gas Distribution Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil City Gas Distribution Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 7: Brazil City Gas Distribution Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Brazil City Gas Distribution Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil City Gas Distribution Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the Brazil City Gas Distribution Market?

Key companies in the market include Santa Catarina Gas Company (SCGÁS), Petróleo Brasileiro S A, Potiguar Gas Company (Potigas), Companhia Paraibana de Gás, Bahia Gas Company (Bahiagas), Companhia de Gás de São Paulo (Comgás), Naturgy Energy Group S A.

3. What are the main segments of the Brazil City Gas Distribution Market?

The market segments include End-User, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities.

6. What are the notable trends driving market growth?

Growing Demand for Natural Gas To Drive the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Clean Power Sources.

8. Can you provide examples of recent developments in the market?

In September 2021, Companhia de Gás de São Paulo (Comgás) was expanding the supply of compressed natural gas (CNG) for vehicles in Brazil with a launch of a new CNG filling station in Taboão, on the border between São Paulo and Curitiba. The main connecting route between São Paulo and Curitiba will have the largest network for gas-powered cargo transportation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil City Gas Distribution Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil City Gas Distribution Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil City Gas Distribution Market?

To stay informed about further developments, trends, and reports in the Brazil City Gas Distribution Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence