Key Insights

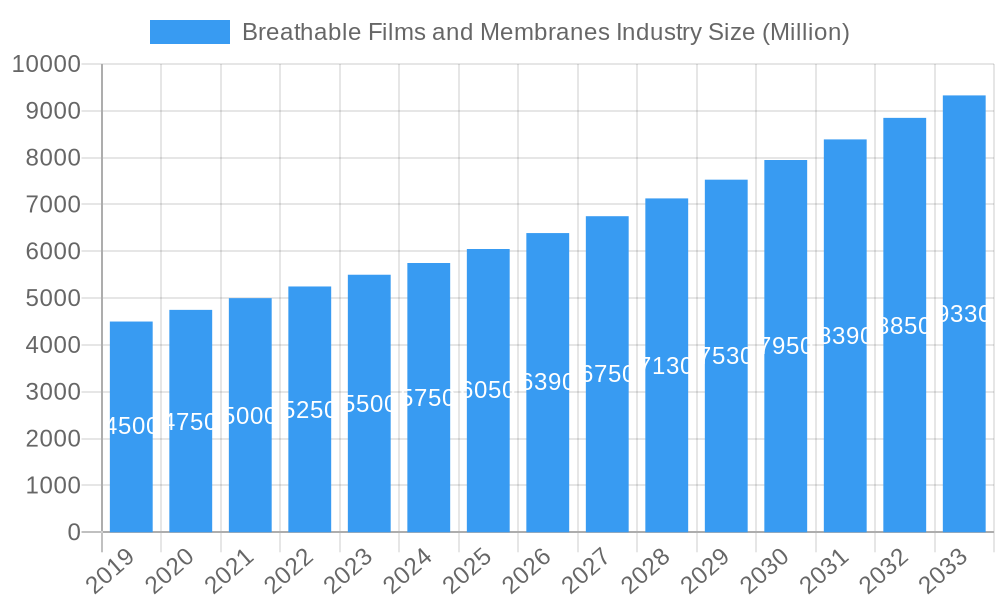

The global Breathable Films and Membranes market is poised for significant expansion, driven by robust demand across diverse end-use industries. With a substantial market size projected to reach approximately $6,500 Million in 2025, the industry is expected to witness a compelling Compound Annual Growth Rate (CAGR) exceeding 7.00% throughout the forecast period (2025-2033). This sustained growth trajectory is primarily fueled by the increasing adoption of breathable films in hygiene products, where enhanced comfort and moisture management are paramount. The medical sector also presents a strong growth avenue, with a rising need for advanced wound care dressings and surgical gowns that promote healing and reduce infection risks. Furthermore, the food packaging industry is increasingly leveraging breathable films to extend shelf life and maintain product freshness by controlling respiration rates of packaged goods.

Breathable Films and Membranes Industry Market Size (In Billion)

Key drivers underpinning this market surge include ongoing technological advancements in material science, leading to the development of more sophisticated and cost-effective breathable film solutions. Innovations in polymer formulations, such as advanced polyurethanes and polyethylenes, are enhancing breathability, barrier properties, and durability. Emerging trends like the growing consumer preference for sustainable and eco-friendly packaging solutions are also influencing the market, with manufacturers exploring biodegradable and recyclable breathable films. While the market exhibits strong growth, certain restraints such as the high initial investment costs for advanced manufacturing technologies and fluctuating raw material prices could pose challenges. However, the expansive application across segments like construction for vapor-permeable membranes and the fabric industry for waterproof yet breathable textiles, coupled with a dynamic competitive landscape featuring key players like Berry Global Inc. and NITTO DENKO CORPORATION, indicates a resilient and thriving market. Asia Pacific, particularly China and India, is anticipated to be a dominant region due to rapid industrialization and increasing disposable incomes.

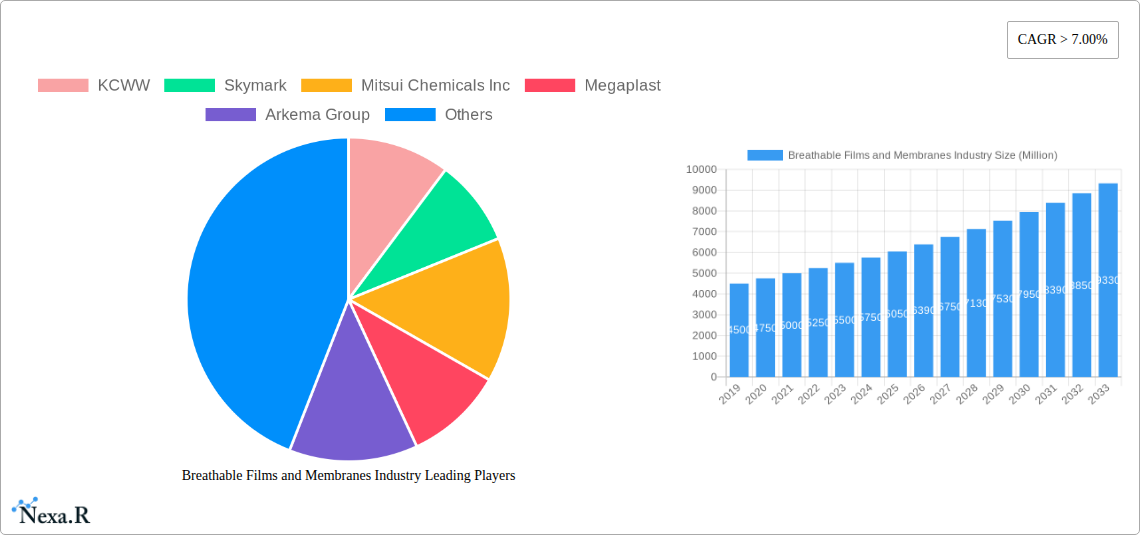

Breathable Films and Membranes Industry Company Market Share

This in-depth report provides a thorough analysis of the global Breathable Films and Membranes Industry, covering market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, opportunities, and future outlook. It leverages high-traffic keywords for maximum search engine visibility and engages industry professionals with concise, insight-rich content. The report includes detailed quantitative and qualitative data, focusing on the period from 2019 to 2033, with a base and estimated year of 2025.

Breathable Films and Membranes Industry Market Dynamics & Structure

The Breathable Films and Membranes Industry exhibits a moderately concentrated market structure, with a blend of established global players and specialized regional manufacturers. Technological innovation is a primary driver, particularly in developing advanced materials with enhanced breathability, durability, and barrier properties. Key innovation areas include nanostructured membranes, bio-based polymers, and functionalized film surfaces. Regulatory frameworks, such as those governing medical device materials and food contact applications, significantly influence product development and market entry. For instance, stringent biocompatibility standards for medical applications mandate extensive testing and validation. Competitive product substitutes, while present in some niche applications, are generally outcompeted by the superior performance characteristics of breathable films and membranes in their core segments. End-user demographics are diverse, ranging from healthcare providers seeking advanced wound care solutions to consumers demanding comfortable and protective apparel. Mergers and acquisitions (M&A) trends are indicative of market consolidation and strategic expansion, with companies seeking to broaden their product portfolios and geographic reach. In the historical period (2019-2024), approximately 8 M&A deals with an undisclosed aggregate value were observed, signaling a strategic interest in acquiring specialized technologies and market access. Innovation barriers primarily revolve around the high cost of R&D for novel material development and the lengthy validation processes required for certain end-use industries.

- Market Concentration: Moderate, with key players holding significant shares in specialized segments.

- Technological Innovation: Driven by advancements in material science, nanotechnology, and sustainable polymer development.

- Regulatory Frameworks: Critical for market access in medical, hygiene, and food packaging sectors, influencing product design and approval timelines.

- Competitive Product Substitutes: Limited in high-performance applications due to superior breathability and barrier properties.

- End-User Demographics: Diverse, spanning healthcare, apparel, construction, and packaging industries.

- M&A Trends: Active, focused on portfolio expansion and market consolidation.

- Innovation Barriers: High R&D costs, extended validation periods, and capital intensity for advanced manufacturing.

Breathable Films and Membranes Industry Growth Trends & Insights

The global Breathable Films and Membranes Industry is poised for robust growth, driven by increasing demand across its diverse application spectrum. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.8% from 2025 to 2033, reaching an estimated value of $22,500 million units by 2033. This growth is underpinned by rising adoption rates in the medical sector, where breathable films are crucial for wound dressings, ostomy bags, and surgical drapes, contributing to patient comfort and infection control. The hygiene segment, particularly for disposable diapers and feminine hygiene products, also represents a substantial and growing market share, driven by increasing disposable incomes and hygiene awareness in emerging economies. Technological disruptions, such as the development of advanced microporous and monolithic membranes, are enabling enhanced performance and opening new application avenues. For instance, advances in electrospinning have led to the creation of ultrathin, highly porous membranes with exceptional breathability. Consumer behavior shifts are also playing a significant role, with a growing preference for sustainable and eco-friendly materials influencing product development and material sourcing. This includes a rising demand for recyclable and biodegradable breathable films. The market penetration of breathable films in construction applications, for example, in breathable wall membranes and roofing underlays, is steadily increasing due to their role in moisture management and energy efficiency, contributing to the overall market size evolution. The estimated market size for 2025 stands at $13,000 million units, with a projected growth trajectory that indicates strong investment potential and market expansion.

- Market Size Evolution: Projected to grow from an estimated $13,000 million units in 2025 to $22,500 million units by 2033.

- Adoption Rates: Steadily increasing across medical, hygiene, and construction sectors due to enhanced performance and regulatory compliance.

- Technological Disruptions: Innovations in membrane science (e.g., microporous, monolithic, electrospun) are expanding application possibilities and improving efficacy.

- Consumer Behavior Shifts: Growing demand for sustainable, eco-friendly, and high-performance materials is a key market influencer.

- Market Penetration: Deepening in established segments like hygiene and medical, with significant growth potential in construction and technical textiles.

- CAGR (2025-2033): Estimated at 6.8%.

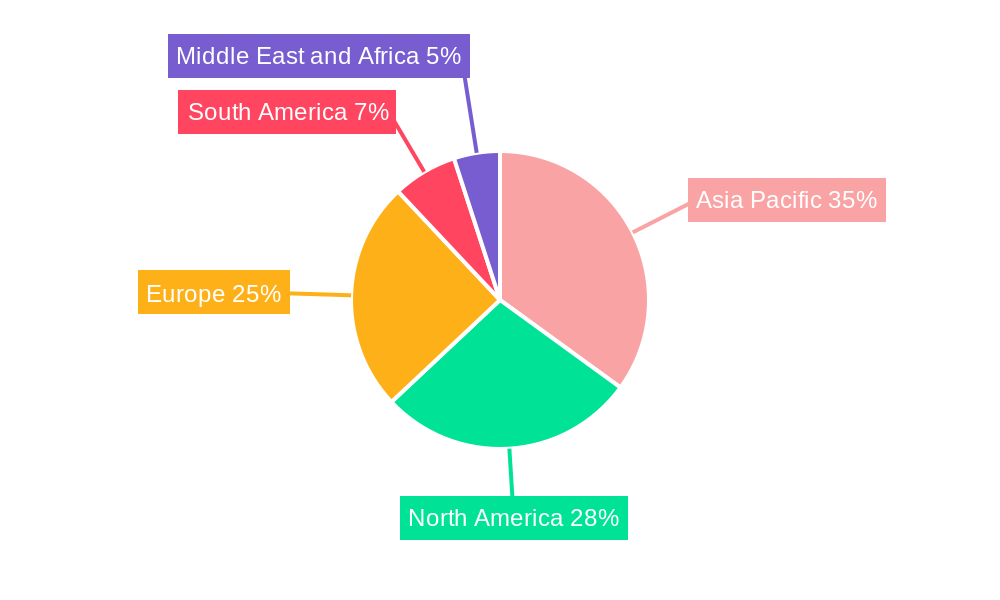

Dominant Regions, Countries, or Segments in Breathable Films and Membranes Industry

The Hygiene segment, particularly within the Polyethylene Type, is currently the dominant force driving growth in the global Breathable Films and Membranes Industry. This dominance is attributed to several key factors, including robust population growth, increasing disposable incomes in developing economies, and a heightened awareness of personal hygiene standards worldwide. The sheer volume of disposable diapers, sanitary napkins, and adult incontinence products manufactured globally translates into substantial demand for high-quality, cost-effective breathable polyethylene films. For example, North America and Europe have long been mature markets for hygiene products, exhibiting consistent demand, while Asia-Pacific is witnessing rapid expansion due to its large population and burgeoning middle class.

In terms of regions, Asia-Pacific is emerging as a significant growth accelerator, driven by industrial expansion, favorable government policies promoting manufacturing, and a rapidly growing consumer base. The region's strong presence in textile manufacturing and increasing investments in healthcare infrastructure further bolster the demand for breathable films and membranes. Key countries within this region, such as China, India, and Southeast Asian nations, are experiencing substantial growth in applications ranging from medical textiles to high-performance sportswear.

The Medical application segment is also a critical growth driver, characterized by high-value products and stringent performance requirements. The demand for breathable films in advanced wound care, surgical gowns, and medical device packaging is on the rise, fueled by an aging global population, increased prevalence of chronic diseases, and advancements in medical technology. Countries with advanced healthcare systems, such as the United States and Germany, are leading this segment.

- Dominant Segment: Hygiene (driven by Polyethylene films)

- Key Drivers: Global population growth, rising disposable incomes, enhanced hygiene awareness, and continuous product innovation.

- Market Share: Accounts for approximately 35-40% of the total breathable films and membranes market.

- Growth Potential: Strong in both mature and emerging economies, with ongoing demand for improved product comfort and absorbency.

- Dominant Region: Asia-Pacific

- Key Drivers: Rapid industrialization, supportive government initiatives, growing middle-class population, and expanding healthcare and textile sectors.

- Market Share: Projected to capture a significant share of market growth in the forecast period.

- Growth Potential: High, driven by increasing per capita consumption and manufacturing capabilities.

- Key Application Drivers:

- Medical: Advancements in wound care, surgical applications, and medical device protection.

- Construction: Increasing use in weather-resistant building envelopes and moisture management systems.

- Fabric (Apparel): Growing demand for performance sportswear and protective clothing with enhanced comfort and functionality.

Breathable Films and Membranes Industry Product Landscape

The product landscape of breathable films and membranes is characterized by continuous innovation focused on enhancing performance, sustainability, and versatility. Key product developments include advanced microporous polyethylene (PE) films offering superior moisture vapor transmission rates (MVTR) for hygiene and medical applications, and expanded polytetrafluoroethylene (ePTFE) membranes renowned for their exceptional breathability and barrier properties in high-performance apparel and filtration. Polyurethane (PU) films are gaining traction for their flexibility and biocompatibility in wound dressings and medical devices. Innovations also extend to bio-based and biodegradable breathable films, addressing the growing demand for environmentally conscious solutions. Furthermore, advancements in surface treatments and nano-structuring are enabling tunable breathability and specific functional properties, such as antimicrobial or flame-retardant capabilities.

Key Drivers, Barriers & Challenges in Breathable Films and Membranes Industry

Key Drivers:

- Growing Demand in Hygiene and Medical Sectors: Increasing global populations, aging demographics, and rising hygiene standards are propelling demand for disposable hygiene products and advanced medical applications.

- Technological Advancements: Development of high-performance, sustainable, and functional breathable films and membranes is expanding application scope and improving product efficacy.

- Increasing Disposable Incomes: Especially in emerging economies, leading to higher consumption of premium hygiene and apparel products.

- Focus on Sustainability: Drive for eco-friendly materials and processes, creating opportunities for bio-based and recyclable breathable films.

Barriers & Challenges:

- High Manufacturing Costs: The complex manufacturing processes for advanced breathable films and membranes can result in higher production costs, impacting affordability.

- Regulatory Hurdles: Stringent regulations in medical and food contact applications require extensive testing and certification, leading to longer product development cycles and increased compliance costs.

- Competition from Traditional Materials: In some less demanding applications, traditional non-breathable films may still offer a cost-effective alternative.

- Supply Chain Volatility: Fluctuations in raw material prices and availability, particularly for specialized polymers, can impact production and profitability.

- Energy Intensity of Production: Some manufacturing processes for breathable films are energy-intensive, leading to higher operational costs and environmental concerns.

Emerging Opportunities in Breathable Films and Membranes Industry

Emerging opportunities in the Breathable Films and Membranes Industry lie in the expansion of applications into new and niche markets. The growing demand for smart textiles and wearable electronics presents a significant avenue for advanced breathable films with integrated sensing capabilities and improved comfort for prolonged wear. The construction sector is increasingly exploring breathable membranes for green building initiatives, offering enhanced energy efficiency and indoor air quality. Furthermore, the development of biodegradable and compostable breathable films made from renewable resources is a significant opportunity driven by consumer and regulatory pressure for sustainability. The burgeoning demand for advanced filtration solutions in water purification and air filtration systems also presents a fertile ground for the application of specialized breathable membranes.

Growth Accelerators in the Breathable Films and Membranes Industry Industry

The long-term growth of the Breathable Films and Membranes Industry will be significantly accelerated by ongoing technological breakthroughs in material science, leading to the development of thinner, stronger, and more breathable films with tailored functionalities. Strategic partnerships between raw material suppliers, film manufacturers, and end-product developers will foster innovation and accelerate market penetration. Market expansion into under-penetrated regions, particularly in developing economies with growing consumer bases, will also serve as a key growth accelerator. The increasing focus on circular economy principles and the development of recycling technologies for breathable films will further enhance their sustainability profile and market attractiveness.

Key Players Shaping the Breathable Films and Membranes Industry Market

- KCWW

- Skymark

- Mitsui Chemicals Inc

- Megaplast

- Arkema Group

- Trioplast Industrier AB

- 4titude

- RKW Group

- SWM Group

- Fatra a s

- NITTO DENKO CORPORATION

- Berry Global Inc

- AMERICAN POLYFILM INC

- Porelle Membranes

Notable Milestones in Breathable Films and Membranes Industry Sector

- 2019: Launch of novel bio-based breathable films by leading manufacturers addressing sustainability concerns.

- 2020: Increased R&D investment in breathable membranes for advanced wound care applications amidst the global health crisis.

- 2021: Significant M&A activity as companies sought to consolidate market share and expand technological capabilities.

- 2022: Development of thinner and more cost-effective breathable polyethylene films for mass-market hygiene products.

- 2023: Introduction of advanced functional coatings for breathable membranes, enhancing properties like antimicrobial resistance and UV protection.

- 2024: Growing emphasis on circular economy initiatives with companies exploring recycling solutions for end-of-life breathable films.

In-Depth Breathable Films and Membranes Industry Market Outlook

The outlook for the Breathable Films and Membranes Industry remains exceptionally positive, driven by a confluence of sustained demand across core applications and emerging growth frontiers. Future market potential is substantial, with ongoing innovation in material science and manufacturing processes promising enhanced performance and cost-effectiveness. Strategic opportunities abound in expanding into rapidly growing economies, catering to the increasing consumer demand for advanced hygiene and comfort products. The industry's commitment to sustainability will be a key differentiator, with companies investing in eco-friendly materials and circular economy solutions. Therefore, a dynamic and expanding market awaits, offering significant prospects for stakeholders willing to embrace innovation and adapt to evolving market demands.

Breathable Films and Membranes Industry Segmentation

-

1. Type

- 1.1. Polyethylene

- 1.2. Polyurethane

- 1.3. Polypropylene

- 1.4. Other Types

-

2. Application

- 2.1. Hygiene

- 2.2. Medical

- 2.3. Food Packaging

- 2.4. Construction

- 2.5. Fabric

- 2.6. Other Applications

Breathable Films and Membranes Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Breathable Films and Membranes Industry Regional Market Share

Geographic Coverage of Breathable Films and Membranes Industry

Breathable Films and Membranes Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Demand for Hygiene Products; Increasing Demand from Buildings and Construction Sector

- 3.3. Market Restrains

- 3.3.1. ; Environmental Effects Regarding Diaper Degradation; Other Restraints

- 3.4. Market Trends

- 3.4.1. Medical Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Breathable Films and Membranes Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Polyethylene

- 5.1.2. Polyurethane

- 5.1.3. Polypropylene

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Hygiene

- 5.2.2. Medical

- 5.2.3. Food Packaging

- 5.2.4. Construction

- 5.2.5. Fabric

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Breathable Films and Membranes Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Polyethylene

- 6.1.2. Polyurethane

- 6.1.3. Polypropylene

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Hygiene

- 6.2.2. Medical

- 6.2.3. Food Packaging

- 6.2.4. Construction

- 6.2.5. Fabric

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Breathable Films and Membranes Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Polyethylene

- 7.1.2. Polyurethane

- 7.1.3. Polypropylene

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Hygiene

- 7.2.2. Medical

- 7.2.3. Food Packaging

- 7.2.4. Construction

- 7.2.5. Fabric

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Breathable Films and Membranes Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Polyethylene

- 8.1.2. Polyurethane

- 8.1.3. Polypropylene

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Hygiene

- 8.2.2. Medical

- 8.2.3. Food Packaging

- 8.2.4. Construction

- 8.2.5. Fabric

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Breathable Films and Membranes Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Polyethylene

- 9.1.2. Polyurethane

- 9.1.3. Polypropylene

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Hygiene

- 9.2.2. Medical

- 9.2.3. Food Packaging

- 9.2.4. Construction

- 9.2.5. Fabric

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Breathable Films and Membranes Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Polyethylene

- 10.1.2. Polyurethane

- 10.1.3. Polypropylene

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Hygiene

- 10.2.2. Medical

- 10.2.3. Food Packaging

- 10.2.4. Construction

- 10.2.5. Fabric

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 KCWW

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Skymark

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mitsui Chemicals Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Megaplast

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Arkema Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Trioplast Industrier AB*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 4titude

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 RKW Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SWM Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fatra a s

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 NITTO DENKO CORPORATION

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Berry Global Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 AMERICAN POLYFILM INC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Porelle Membranes

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 KCWW

List of Figures

- Figure 1: Global Breathable Films and Membranes Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Breathable Films and Membranes Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: Asia Pacific Breathable Films and Membranes Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Breathable Films and Membranes Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: Asia Pacific Breathable Films and Membranes Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Breathable Films and Membranes Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Breathable Films and Membranes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Breathable Films and Membranes Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: North America Breathable Films and Membranes Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Breathable Films and Membranes Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: North America Breathable Films and Membranes Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Breathable Films and Membranes Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Breathable Films and Membranes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Breathable Films and Membranes Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Breathable Films and Membranes Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Breathable Films and Membranes Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe Breathable Films and Membranes Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Breathable Films and Membranes Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Breathable Films and Membranes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Breathable Films and Membranes Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Breathable Films and Membranes Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Breathable Films and Membranes Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: South America Breathable Films and Membranes Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Breathable Films and Membranes Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Breathable Films and Membranes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Breathable Films and Membranes Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Breathable Films and Membranes Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Breathable Films and Membranes Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Breathable Films and Membranes Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Breathable Films and Membranes Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Breathable Films and Membranes Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Breathable Films and Membranes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Breathable Films and Membranes Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Breathable Films and Membranes Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Breathable Films and Membranes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Breathable Films and Membranes Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Breathable Films and Membranes Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Breathable Films and Membranes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Breathable Films and Membranes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Breathable Films and Membranes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Breathable Films and Membranes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Breathable Films and Membranes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Breathable Films and Membranes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Breathable Films and Membranes Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Breathable Films and Membranes Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Breathable Films and Membranes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Breathable Films and Membranes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Breathable Films and Membranes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Breathable Films and Membranes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Breathable Films and Membranes Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Breathable Films and Membranes Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Breathable Films and Membranes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Breathable Films and Membranes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Italy Breathable Films and Membranes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Breathable Films and Membranes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Breathable Films and Membranes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Breathable Films and Membranes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global Breathable Films and Membranes Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Breathable Films and Membranes Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Brazil Breathable Films and Membranes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Breathable Films and Membranes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Breathable Films and Membranes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Breathable Films and Membranes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global Breathable Films and Membranes Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Breathable Films and Membranes Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Breathable Films and Membranes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Breathable Films and Membranes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Breathable Films and Membranes Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Breathable Films and Membranes Industry?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the Breathable Films and Membranes Industry?

Key companies in the market include KCWW, Skymark, Mitsui Chemicals Inc, Megaplast, Arkema Group, Trioplast Industrier AB*List Not Exhaustive, 4titude, RKW Group, SWM Group, Fatra a s, NITTO DENKO CORPORATION, Berry Global Inc, AMERICAN POLYFILM INC, Porelle Membranes.

3. What are the main segments of the Breathable Films and Membranes Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Rising Demand for Hygiene Products; Increasing Demand from Buildings and Construction Sector.

6. What are the notable trends driving market growth?

Medical Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

; Environmental Effects Regarding Diaper Degradation; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Breathable Films and Membranes Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Breathable Films and Membranes Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Breathable Films and Membranes Industry?

To stay informed about further developments, trends, and reports in the Breathable Films and Membranes Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence