Key Insights

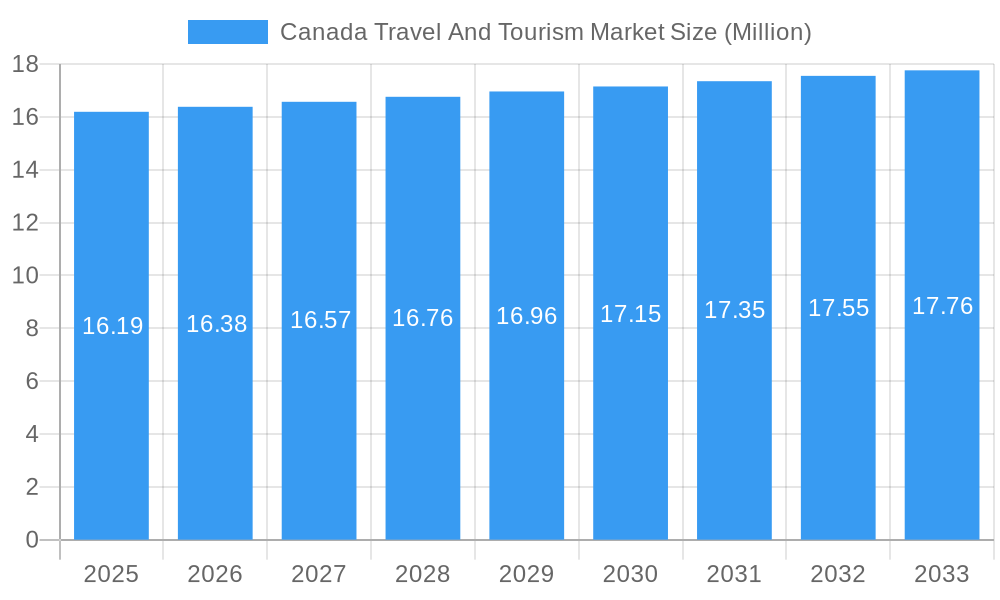

The Canada Travel and Tourism market is poised for steady growth, projected to reach a significant valuation with a Compound Annual Growth Rate (CAGR) of 1.17% during the forecast period. This indicates a mature market with sustained demand, driven by a diverse range of segments catering to both leisure and business travelers. Key growth drivers include the increasing disposable incomes among Canadians, a growing interest in experiential travel, and the robust inbound tourism from international visitors attracted to Canada's natural beauty and cultural attractions. The resurgence of business travel post-pandemic, coupled with the expansion of medical tourism and educational exchanges, further solidifies the market's upward trajectory. Online booking platforms have become increasingly dominant, reflecting a shift in consumer preference towards convenience and accessibility in travel planning.

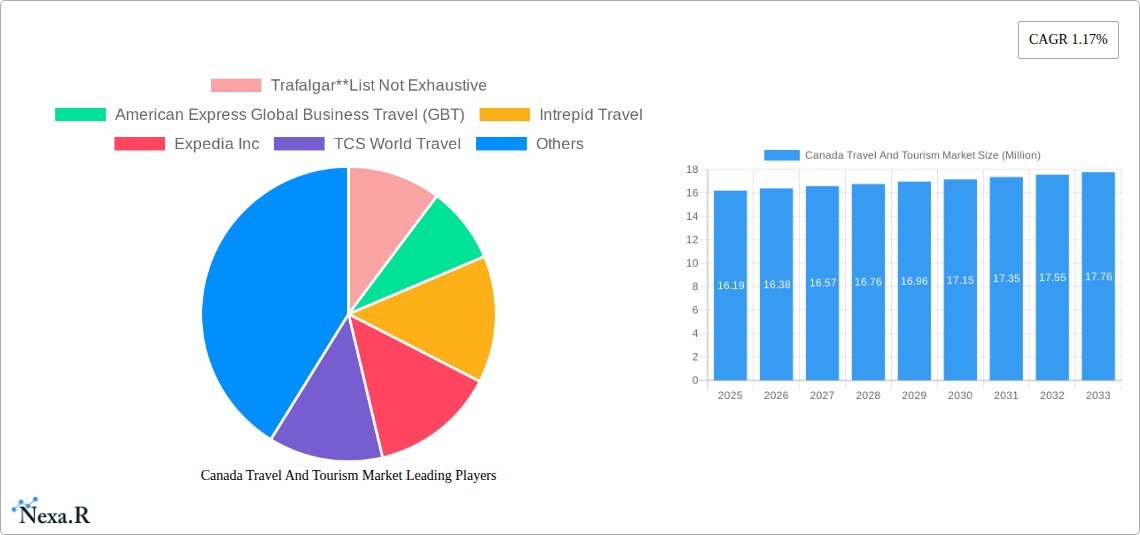

Canada Travel And Tourism Market Market Size (In Million)

Furthermore, the market is characterized by a dynamic interplay of trends and restraints. While outbound tourism from Canada contributes significantly to the overall travel ecosystem, the domestic segment is expected to witness substantial expansion as Canadians explore their own vast and diverse country. Investments in infrastructure, the development of niche tourism offerings, and government initiatives to promote tourism are vital trends supporting this growth. However, potential restraints such as economic uncertainties, currency fluctuations impacting international travel costs, and environmental concerns could influence the market's pace. The competitive landscape features established players and emerging entities, all vying for market share by offering innovative packages and personalized experiences across various travel types, from adventure sports to educational tours and sophisticated business travel solutions.

Canada Travel And Tourism Market Company Market Share

Gain a comprehensive understanding of the Canadian travel and tourism landscape with our in-depth market report. Covering 2019-2033, this analysis provides critical data, future projections, and strategic intelligence for industry stakeholders. Explore market dynamics, growth trends, dominant segments, product innovations, and key players shaping the future of Canadian tourism.

Canada Travel And Tourism Market Market Dynamics & Structure

The Canada Travel And Tourism Market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share. Technological innovation is a key driver, evidenced by the increasing adoption of online booking platforms and the integration of AI for personalized travel experiences. Regulatory frameworks, including visa policies and destination marketing initiatives, play a crucial role in shaping market access and visitor numbers. Competitive product substitutes are emerging, particularly in niche segments like adventure tourism and ecotourism, challenging traditional offerings. End-user demographics are shifting, with a growing demand for authentic, sustainable, and experiential travel. Mergers and acquisitions (M&A) are also a notable trend, as companies seek to expand their service portfolios and market reach.

- Market Concentration: Dominated by a mix of large international tour operators and online travel agencies, with a growing presence of specialized niche providers.

- Technological Innovation: Rapid advancements in AI-powered booking systems, virtual reality (VR) pre-trip experiences, and personalized itinerary planning tools.

- Regulatory Frameworks: Government investments in tourism infrastructure and marketing campaigns are crucial for sustained growth.

- Competitive Product Substitutes: Rise of independent travel planners, experience-focused platforms, and alternative accommodation providers.

- End-User Demographics: Increasing focus on younger demographics seeking adventure, cultural immersion, and eco-friendly options, alongside a resilient senior travel segment.

- M&A Trends: Strategic acquisitions aimed at consolidating market share, enhancing technological capabilities, and diversifying service offerings.

Canada Travel And Tourism Market Growth Trends & Insights

The Canada Travel And Tourism Market is poised for robust growth, driven by an evolving consumer appetite for diverse travel experiences and strategic governmental support. The market size is projected to expand significantly from its 2025 estimated value of USD 250,000 Million. Adoption rates for digital booking channels are consistently high, with online bookings accounting for an estimated 70% of total transactions. Technological disruptions are continuously reshaping the industry; for instance, the integration of contactless payment solutions and augmented reality (AR) for destination discovery are becoming mainstream. Consumer behavior shifts are notably leaning towards personalized itineraries, sustainable travel practices, and an increased demand for local, authentic experiences. This evolving preference, coupled with investments in sustainable tourism infrastructure, is expected to fuel a Compound Annual Growth Rate (CAGR) of approximately 6.5% between 2025 and 2033. Market penetration for unique adventure and eco-tourism packages is anticipated to rise, appealing to a global audience seeking immersive Canadian landscapes and cultural encounters. The market is also witnessing a resurgence in business travel, bolstered by strategic partnerships and technology advancements designed to streamline corporate travel management. The total market value is expected to reach USD 420,000 Million by 2033.

Dominant Regions, Countries, or Segments in Canada Travel And Tourism Market

Within the Canada Travel And Tourism Market, the Leisure segment is the dominant driver of growth, accounting for an estimated 65% of the overall market value. This dominance is underpinned by Canada's vast natural beauty, diverse cultural offerings, and well-established infrastructure catering to vacationers. International travel applications are particularly significant, contributing approximately 55% to the market revenue, with key source markets including the United States, the United Kingdom, and China. Online booking channels also command a substantial share, representing around 70% of all bookings, reflecting the convenience and accessibility offered by digital platforms.

Leisure Segment Dominance:

- Market Share: Estimated 65% of the total market value.

- Key Drivers: Iconic natural landscapes (Rocky Mountains, Niagara Falls, national parks), vibrant urban centers (Toronto, Vancouver, Montreal), diverse cultural festivals, and extensive outdoor recreational activities.

- Growth Potential: Continued interest in adventure tourism, ecotourism, and experiential travel fuels sustained demand.

International Application Significance:

- Market Share: Approximately 55% of market revenue.

- Key Source Countries: United States (largest), United Kingdom, China, France, Germany.

- Drivers: Proximity to the US market, attractive exchange rates, Canada's reputation for safety and natural beauty.

Online Booking Channel Preference:

- Market Share: Around 70% of all bookings.

- Drivers: Convenience, price comparison tools, real-time availability, ease of access to a wide range of travel products and services.

- Technological Advancements: Mobile booking, personalized recommendations, and seamless payment gateways further solidify online dominance.

Canada Travel And Tourism Market Product Landscape

The Canada Travel And Tourism Market product landscape is rich and diversified, encompassing a wide array of offerings designed to cater to varied traveler preferences. Innovations are continuously enhancing the appeal of these products. Leisure travel products dominate, including adventure tours, cultural heritage experiences, and scenic cruises, with an estimated market size of USD 162,500 Million in 2025. The application of international travel bookings is also a significant contributor, valued at USD 137,500 Million in 2025. Online booking platforms offer a seamless user experience, facilitating access to these diverse products. Unique selling propositions often lie in the unparalleled natural beauty of destinations, the richness of indigenous cultures, and the safety and cleanliness of Canadian cities. Technological advancements, such as AR-enhanced city tours and personalized AI-driven itinerary planning, are further augmenting the appeal and performance of these travel products.

Key Drivers, Barriers & Challenges in Canada Travel And Tourism Market

Key Drivers:

The Canada Travel And Tourism Market is propelled by a confluence of factors. Government initiatives aimed at promoting tourism, such as investments in infrastructure and marketing campaigns, are critical accelerators. The nation's stunning natural landscapes and diverse cultural heritage continue to be a primary draw for both domestic and international tourists. Technological advancements in online booking platforms and personalized travel planning enhance accessibility and user experience. The increasing global demand for authentic and sustainable travel experiences perfectly aligns with Canada's offerings, further driving market growth.

Barriers & Challenges:

Despite its strengths, the market faces certain barriers and challenges. The seasonality of some tourism activities can lead to fluctuations in demand and revenue. High operational costs, including labor and transportation, can impact profitability for businesses. Intense competition from other global destinations necessitates continuous innovation and marketing efforts. Furthermore, extreme weather conditions in certain regions during specific times of the year can pose logistical challenges and deter some travelers. Supply chain disruptions, though less prevalent in services, can indirectly affect the availability and cost of tourism-related goods.

Emerging Opportunities in Canada Travel And Tourism Market

Emerging opportunities in the Canada Travel And Tourism Market are centered around niche segments and evolving consumer preferences. The burgeoning medical tourism sector, driven by high-quality healthcare and unique post-treatment recovery options in scenic locations, presents significant untapped potential, estimated to grow by 15% annually. Education tourism, particularly for international students seeking English and French language programs or specialized academic courses, is another area ripe for expansion. The demand for sustainable and responsible tourism is also a growing opportunity, with travelers increasingly seeking eco-friendly accommodations and low-impact travel experiences. Furthermore, the development of Indigenous tourism experiences offers a unique and culturally rich avenue for growth, attracting travelers seeking authentic encounters.

Growth Accelerators in the Canada Travel And Tourism Market Industry

Several catalysts are accelerating long-term growth within the Canada Travel And Tourism Market industry. Technological breakthroughs, such as the widespread adoption of AI for personalized customer journeys and the implementation of blockchain for secure travel transactions, are enhancing efficiency and customer satisfaction. Strategic partnerships between airlines, hotels, and tour operators are creating more integrated and attractive travel packages, increasing booking values and customer loyalty. Market expansion strategies, including targeting emerging source markets and developing new tourism products, are crucial for sustained growth. Investments in infrastructure, particularly in underserved regions, and initiatives to promote year-round tourism are also vital for unlocking the industry's full potential.

Key Players Shaping the Canada Travel And Tourism Market Market

- Trafalgar

- American Express Global Business Travel (GBT)

- Intrepid Travel

- Expedia Inc

- TCS World Travel

- BCD Travel

- Topdeck Travel Ltd

- Exodus Travels Ltd

- Abercrombie & Kent USA LLC

- Booking Holdings Inc

Notable Milestones in Canada Travel And Tourism Market Sector

- October 2023: The Government of Canada invested USD 500,000 in tourism across British Columbia, with a specific allocation to the Aboriginal Tourism Association of British Columbia to bolster Indigenous tourism development and its "Invest in Iconic" strategy with Destination BC.

- October 2022: Sabre and BCD Travel announced a significant, long-term technology partnership aimed at driving growth and innovation in corporate travel, with BCD Travel expecting to increase booking levels with Sabre and jointly investing in advanced solutions for the corporate travel ecosystem.

In-Depth Canada Travel And Tourism Market Market Outlook

The future outlook for the Canada Travel And Tourism Market is exceptionally promising, driven by a combination of evolving consumer desires and strategic industry advancements. Growth accelerators such as the continued digitalization of travel services, from booking to in-destination experiences, will enhance efficiency and personalization. The increasing demand for sustainable and ethical travel presents a significant opportunity for Canada to leverage its natural assets responsibly. Furthermore, strategic investments in niche markets like medical and education tourism, coupled with the ongoing development of Indigenous tourism experiences, are set to diversify revenue streams and attract new traveler segments. The market is poised for sustained growth, fueled by innovation, strategic collaborations, and a strong appeal to a global audience seeking authentic and memorable journeys.

Canada Travel And Tourism Market Segmentation

-

1. Type

- 1.1. Leisure

- 1.2. Education

- 1.3. Business

- 1.4. Sports

- 1.5. Medical Tourism

- 1.6. Other Types

-

2. Application

- 2.1. International

- 2.2. Domestic

-

3. Booking

- 3.1. Online

- 3.2. Offline

Canada Travel And Tourism Market Segmentation By Geography

- 1. Canada

Canada Travel And Tourism Market Regional Market Share

Geographic Coverage of Canada Travel And Tourism Market

Canada Travel And Tourism Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Domestic Travel Driving the Market; Growing Tourist Footfall Driving the Market

- 3.3. Market Restrains

- 3.3.1. Restrictions on Purchases of Number of Products; Customs Regulations and Taxation Policies

- 3.4. Market Trends

- 3.4.1. Increasing Interest in Multi-Day Tours is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Travel And Tourism Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Leisure

- 5.1.2. Education

- 5.1.3. Business

- 5.1.4. Sports

- 5.1.5. Medical Tourism

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. International

- 5.2.2. Domestic

- 5.3. Market Analysis, Insights and Forecast - by Booking

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Trafalgar**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 American Express Global Business Travel (GBT)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Intrepid Travel

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Expedia Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TCS World Travel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BCD Travel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Topdeck Travel Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Exodus Travels Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Abercrombie & Kent USA LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Booking Holdings Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Trafalgar**List Not Exhaustive

List of Figures

- Figure 1: Canada Travel And Tourism Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Travel And Tourism Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Travel And Tourism Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Canada Travel And Tourism Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Canada Travel And Tourism Market Revenue Million Forecast, by Booking 2020 & 2033

- Table 4: Canada Travel And Tourism Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Canada Travel And Tourism Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Canada Travel And Tourism Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Canada Travel And Tourism Market Revenue Million Forecast, by Booking 2020 & 2033

- Table 8: Canada Travel And Tourism Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Travel And Tourism Market?

The projected CAGR is approximately 1.17%.

2. Which companies are prominent players in the Canada Travel And Tourism Market?

Key companies in the market include Trafalgar**List Not Exhaustive, American Express Global Business Travel (GBT), Intrepid Travel, Expedia Inc, TCS World Travel, BCD Travel, Topdeck Travel Ltd, Exodus Travels Ltd, Abercrombie & Kent USA LLC, Booking Holdings Inc.

3. What are the main segments of the Canada Travel And Tourism Market?

The market segments include Type, Application, Booking.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Domestic Travel Driving the Market; Growing Tourist Footfall Driving the Market.

6. What are the notable trends driving market growth?

Increasing Interest in Multi-Day Tours is Driving the Market.

7. Are there any restraints impacting market growth?

Restrictions on Purchases of Number of Products; Customs Regulations and Taxation Policies.

8. Can you provide examples of recent developments in the market?

October 2023: The Government of Canada invested in tourism across British Columbia to attract new visitors and stimulate local economies. Funding of USD 500,000 has been provided to the Aboriginal Tourism Association of British Columbia to help Indigenous Tourism BC develop its "Invest in Iconic" tourism strategy with Destination BC to grow the Indigenous tourism sector in British Columbia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Travel And Tourism Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Travel And Tourism Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Travel And Tourism Market?

To stay informed about further developments, trends, and reports in the Canada Travel And Tourism Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence