Key Insights

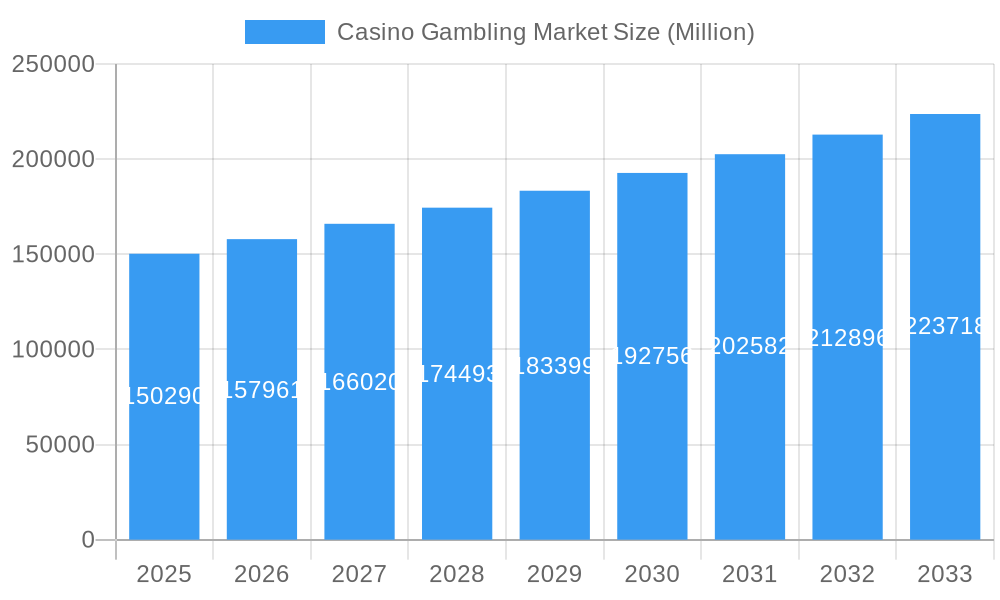

The global casino gambling market, valued at $150.29 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 4.95% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing popularity of online casino gaming and the expansion of mobile gaming platforms are attracting a wider demographic, particularly younger players. Secondly, the legalization and regulation of online gambling in various jurisdictions are creating new avenues for growth and attracting significant investment. Technological advancements, such as virtual reality and augmented reality integration, are enhancing the overall gaming experience, further stimulating market demand. The rise of esports betting and the integration of loyalty programs also contribute to this upward trajectory. Different game types within the casino market demonstrate varied growth rates; while slots traditionally dominate, live casino games are experiencing a surge in popularity, thanks to technological improvements in live-streaming and interactive gameplay.

Casino Gambling Market Market Size (In Billion)

However, the market faces certain challenges. Stringent regulations and licensing requirements in some regions can hinder market expansion. Concerns over problem gambling and the need for responsible gaming initiatives necessitate proactive measures from industry stakeholders. Economic fluctuations can also impact consumer spending on leisure activities like casino gambling. Despite these headwinds, the long-term outlook for the casino gambling market remains positive, driven by technological innovation, changing consumer preferences, and strategic market expansions by major players like Caesars Entertainment, Melco Resorts & Entertainment, and others. Regional growth will vary, with North America and Asia-Pacific expected to be leading contributors, fueled by established markets and burgeoning economies, respectively. Diversification of game offerings and strategic partnerships will play a significant role in the future success of casino gambling operators.

Casino Gambling Market Company Market Share

Casino Gambling Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Casino Gambling Market, encompassing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). The report segments the market by type (Live Casino, Baccarat, Blackjack, Poker, Slots, Others Casino Games) and analyzes key players such as Caesars Entertainment, Melco Resorts & Entertainment, SJM Holdings, Las Vegas Sands, Genting Group, Wynn Resorts, Boyd Gaming, Galaxy Entertainment Group, MGM Resorts International, and Hard Rock International (list not exhaustive). The analysis covers market dynamics, growth trends, regional dominance, product landscapes, key drivers and barriers, emerging opportunities, and notable milestones. This report is essential for industry professionals, investors, and anyone seeking a detailed understanding of this dynamic market. The total market size is predicted to reach xx Million by 2033.

Casino Gambling Market Dynamics & Structure

The casino gambling market is characterized by a moderately concentrated structure, with a few major players holding significant market share. Technological innovation, particularly in online and mobile gaming, is a key driver, alongside regulatory frameworks that vary significantly across jurisdictions. Competitive substitutes include other forms of entertainment and online gaming platforms. The end-user demographic is diverse, encompassing a broad range of age groups and socioeconomic backgrounds. Mergers and acquisitions (M&A) activity is frequent, reflecting consolidation within the industry.

- Market Concentration: The top 5 players hold approximately xx% of the global market share in 2025.

- Technological Innovation: The rise of online casinos, mobile gaming apps, and virtual reality (VR) experiences are transforming the industry.

- Regulatory Frameworks: Differing regulations across countries impact market growth and investment.

- Competitive Substitutes: The entertainment industry offers a wide array of alternatives, impacting market penetration.

- End-User Demographics: The market caters to diverse demographics, influencing product development and marketing strategies.

- M&A Trends: A significant number of M&A deals have taken place in the past five years (xx deals in 2024 alone, predicted to increase to xx by 2033), reflecting consolidation and expansion strategies.

Casino Gambling Market Growth Trends & Insights

The global casino gambling market experienced substantial growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. The market is expected to continue its expansion during the forecast period (2025-2033), driven by increasing disposable incomes, the expansion of online gaming, technological advancements, and the growing popularity of casino games among younger demographics. However, regulatory changes and economic downturns could impact market growth. Market penetration in key regions is projected to reach xx% by 2033, with a major driver being the increasing adoption of mobile gaming. Technological disruptions, such as the integration of blockchain technology and AI, are expected to further revolutionize the industry. Consumer behavior shifts towards online and mobile gaming continue to shape the market, pushing for more innovative and interactive experiences.

Dominant Regions, Countries, or Segments in Casino Gambling Market

The [Region Name - predicted to be North America] region is currently the dominant market for casino gambling, holding the largest market share (xx% in 2025) followed by Asia-Pacific (xx%). This dominance is fueled by factors such as well-established infrastructure, favourable regulatory environments, and high levels of disposable income. Within the "By Type" segment, Slots remains the most popular game, contributing xx% to the total market revenue in 2025, followed by Online Casino Games at xx%.

Key Drivers in North America:

- Well-established casino infrastructure.

- High levels of disposable income.

- Favorable regulatory environments (in some states).

Key Drivers in Asia-Pacific:

- Rapid economic growth in several countries.

- Increasing tourism and the rise of integrated resorts.

- Growing popularity of online and mobile gaming.

Growth Potential: While North America maintains dominance, significant growth potential exists in Asia-Pacific and other emerging markets. The "Others Casino Games" segment is expected to show high growth due to the introduction of new and innovative games.

Casino Gambling Market Product Landscape

The casino gambling market offers a diverse range of products, including traditional casino games like slots, blackjack, baccarat, and poker, as well as innovative online and mobile gaming platforms. Recent advancements include immersive virtual reality (VR) gaming experiences, enhanced mobile apps with seamless integration, and the development of new game mechanics and themes to attract diverse player demographics. Unique selling propositions include improved user interfaces, loyalty programs, and exclusive content. Many companies are focusing on personalization and customization options to enhance customer engagement.

Key Drivers, Barriers & Challenges in Casino Gambling Market

Key Drivers: Technological advancements (e.g., VR/AR, mobile gaming), increasing disposable incomes in emerging markets, and the legalization of online gambling in certain jurisdictions are key drivers. The growing popularity of esports is also having a positive influence.

Key Challenges: Stringent regulatory frameworks in various regions, competition from alternative entertainment options, concerns about problem gambling, and potential economic downturns pose significant challenges. Supply chain disruptions can also impact the availability of gaming equipment. The potential impact of these challenges could result in a xx% reduction in market growth in the worst case scenario.

Emerging Opportunities in Casino Gambling Market

The growing popularity of eSports and integrating gaming elements within the metaverse offer significant growth opportunities. Expansion into untapped markets in Africa and Latin America presents further opportunities. The increasing focus on responsible gaming practices and personalized gaming experiences is expected to contribute to a positive growth trajectory.

Growth Accelerators in the Casino Gambling Market Industry

Technological breakthroughs such as AI-powered game development and personalized recommendations, coupled with strategic partnerships between gaming companies and technology providers, are accelerating market growth. Expansion strategies targeting new geographic markets and demographic segments are also expected to drive long-term growth.

Key Players Shaping the Casino Gambling Market Market

- Caesars Entertainment

- Melco Resorts & Entertainment

- SJM Holdings

- Las Vegas Sands

- Genting Group

- Wynn Resorts

- Boyd Gaming

- Galaxy Entertainment Group

- MGM Resorts International

- Hard Rock International

Notable Milestones in Casino Gambling Market Sector

- May 2023: MGM Resorts International's acquisition of Push Gaming Holding Limited strengthens LeoVegas' content creation capabilities.

- April 2023: Caesars Entertainment's reopening of Tropicana Online Casino in New Jersey expands its online presence.

In-Depth Casino Gambling Market Market Outlook

The casino gambling market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and strategic market expansion. The increasing adoption of mobile and online gaming, coupled with the development of immersive gaming experiences, creates exciting opportunities for market players. Strategic partnerships and investments in innovative technologies will further shape the future of the industry, offering significant potential for long-term growth and profitability.

Casino Gambling Market Segmentation

-

1. Type

- 1.1. Live Casino

- 1.2. Baccarat

- 1.3. Blackjack

- 1.4. Poker

- 1.5. Slots

- 1.6. Others Casino Games

Casino Gambling Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Casino Gambling Market Regional Market Share

Geographic Coverage of Casino Gambling Market

Casino Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Number of Domestic & International Tourists Arrivals in Europe; Increasing Corporate Workplace Wellness Tourism is Driving the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled and Trained Staff; Lack of Awareness and Understanding the Benefits of Wellness

- 3.4. Market Trends

- 3.4.1. Growing Online Gambling Trends Is Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Live Casino

- 5.1.2. Baccarat

- 5.1.3. Blackjack

- 5.1.4. Poker

- 5.1.5. Slots

- 5.1.6. Others Casino Games

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Live Casino

- 6.1.2. Baccarat

- 6.1.3. Blackjack

- 6.1.4. Poker

- 6.1.5. Slots

- 6.1.6. Others Casino Games

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Live Casino

- 7.1.2. Baccarat

- 7.1.3. Blackjack

- 7.1.4. Poker

- 7.1.5. Slots

- 7.1.6. Others Casino Games

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Live Casino

- 8.1.2. Baccarat

- 8.1.3. Blackjack

- 8.1.4. Poker

- 8.1.5. Slots

- 8.1.6. Others Casino Games

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Live Casino

- 9.1.2. Baccarat

- 9.1.3. Blackjack

- 9.1.4. Poker

- 9.1.5. Slots

- 9.1.6. Others Casino Games

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Live Casino

- 10.1.2. Baccarat

- 10.1.3. Blackjack

- 10.1.4. Poker

- 10.1.5. Slots

- 10.1.6. Others Casino Games

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Caesars Entertainment

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Melco Resorts & Entertainment**List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SJM Holdings

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Las Vegas Sands

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Genting Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Wynn Resorts

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Boyd Gaming

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Galaxy Entertainment Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MGM Resorts International

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hard Rock International

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Caesars Entertainment

List of Figures

- Figure 1: Global Casino Gambling Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 7: Europe Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Asia Pacific Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Latin America Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Latin America Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Middle East and Africa Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Middle East and Africa Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Casino Gambling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Casino Gambling Market?

The projected CAGR is approximately 4.95%.

2. Which companies are prominent players in the Casino Gambling Market?

Key companies in the market include Caesars Entertainment, Melco Resorts & Entertainment**List Not Exhaustive, SJM Holdings, Las Vegas Sands, Genting Group, Wynn Resorts, Boyd Gaming, Galaxy Entertainment Group, MGM Resorts International, Hard Rock International.

3. What are the main segments of the Casino Gambling Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 150.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Number of Domestic & International Tourists Arrivals in Europe; Increasing Corporate Workplace Wellness Tourism is Driving the Growth of the Market.

6. What are the notable trends driving market growth?

Growing Online Gambling Trends Is Driving The Market.

7. Are there any restraints impacting market growth?

Lack of Skilled and Trained Staff; Lack of Awareness and Understanding the Benefits of Wellness.

8. Can you provide examples of recent developments in the market?

May 2023: MGM Resorts International announced the acquisition of most game developer Push Gaming Holding Limited and its subsidiaries by its wholly owned subsidiary, LeoVegas. This is Leo Vegas' first significant investment since joining MGM Resorts last year. Push Gaming's patented technology, intellectual property, and development experience are expected to strengthen LeoVegas' content creation capabilities and assist its expansion objectives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Casino Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Casino Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Casino Gambling Market?

To stay informed about further developments, trends, and reports in the Casino Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence