Key Insights

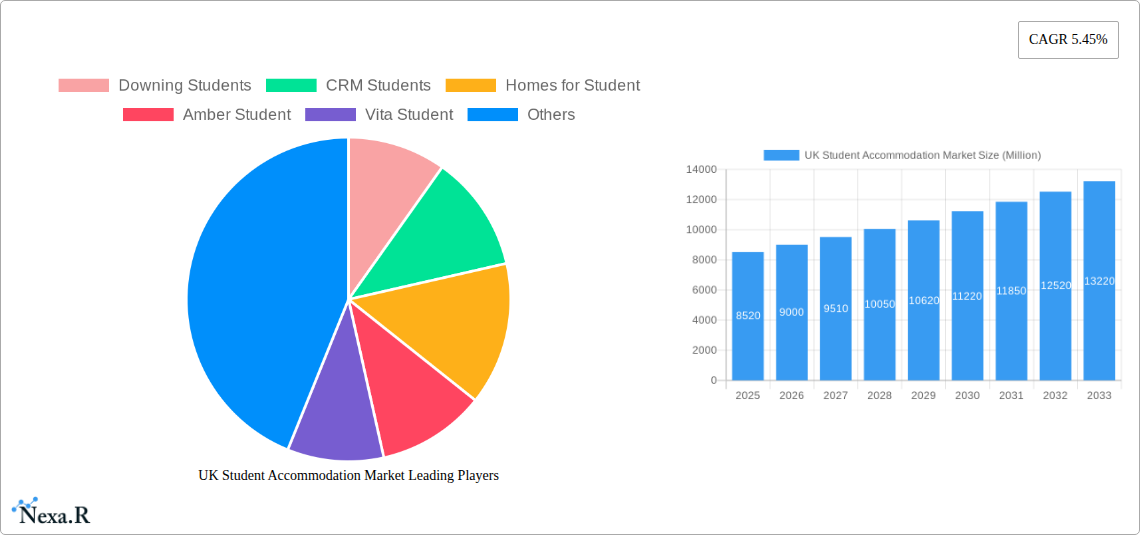

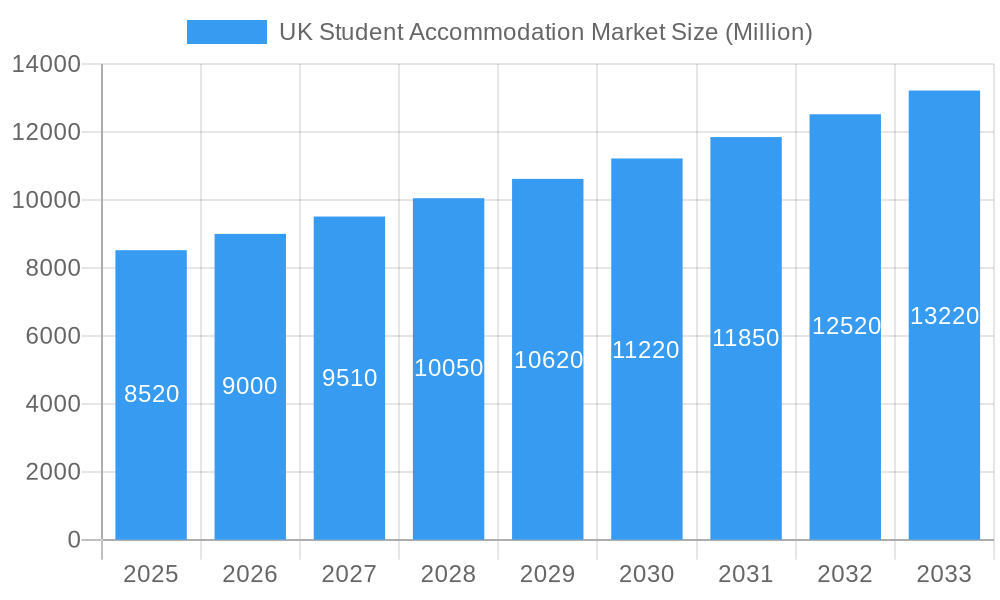

The UK student accommodation market, valued at £8.52 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.45% from 2025 to 2033. This expansion is driven by several key factors. Firstly, a consistently high number of university enrollments across England, Wales, Scotland, and Northern Ireland fuels demand for various accommodation types, including halls of residence, rented houses/rooms, and purpose-built private student accommodation (PBSA). Secondly, the increasing preference for convenient, modern, and amenity-rich living spaces is driving the growth of the PBSA segment, particularly in city centers. Online booking platforms are also contributing significantly to market growth by enhancing accessibility and transparency. Conversely, challenges exist, including fluctuating property prices impacting rental costs and potentially limiting affordability for some students, and regional disparities in supply and demand, with competitive pressure stronger in major city centers. The market segmentation reflects diverse student needs and preferences: basic rent versus total rent (inclusive of bills and services) caters to varying budgets, while online and offline booking methods offer choices for student convenience. Major players like Downing Students, Unite Group, and Fresh Student Living are shaping the market through strategic investments and innovative accommodation solutions. The forecast indicates continued growth throughout the forecast period, though the rate might be subject to macroeconomic influences and government policies affecting higher education funding.

UK Student Accommodation Market Market Size (In Billion)

The competitive landscape is dynamic, with established players alongside emerging companies vying for market share. The continued rise of PBSA, driven by student demand for high-quality, managed accommodation, presents significant opportunities for growth. However, potential constraints include regulatory changes concerning rental regulations, and the impact of economic fluctuations on student finances and investment in new accommodation developments. Regional variations persist, with city center locations generally commanding higher rental rates compared to the periphery, influencing investment strategies and competitive dynamics. Understanding these market dynamics is crucial for companies aiming to successfully navigate this growing sector. Future growth will likely hinge on adaptation to evolving student preferences, technological advancements in booking and property management, and successful navigation of economic uncertainties.

UK Student Accommodation Market Company Market Share

UK Student Accommodation Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UK student accommodation market, encompassing market dynamics, growth trends, key players, and future projections. With a focus on both parent and child market segments, this report is an essential resource for investors, industry professionals, and anyone seeking to understand this dynamic sector. The study period covers 2019-2033, with 2025 as the base and estimated year.

Study Period: 2019–2033 | Base Year: 2025 | Estimated Year: 2025 | Forecast Period: 2025–2033 | Historical Period: 2019–2024

UK Student Accommodation Market Market Dynamics & Structure

This section analyzes the UK student accommodation market's structure, examining market concentration, technological advancements, regulatory frameworks, competitive dynamics, and M&A activity. The market is characterized by a mix of large national players and smaller regional operators, leading to a moderately fragmented landscape.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025, indicating moderate concentration.

- Technological Innovation: Online booking platforms and smart-home technologies are driving efficiency and enhancing the student experience. However, barriers to innovation include high upfront investment costs and the need for consistent upgrades.

- Regulatory Framework: Regulations concerning health and safety, licensing, and tenant rights significantly impact market operations. Changes in these regulations can create both opportunities and challenges for operators.

- Competitive Landscape: The market faces competition from traditional private rentals, impacting the overall occupancy rates. Differentiation through amenities and services is key to attracting students.

- M&A Activity: Recent years have seen a rise in M&A activity, with larger players acquiring smaller portfolios to expand their market reach (e.g., Unite Group's sale of 4,500 beds in March 2022). The volume of deals is estimated at xx million units during the historical period (2019-2024).

- End-User Demographics: The market caters to a diverse student population with varying needs and preferences, influencing the demand for different accommodation types and price points.

UK Student Accommodation Market Growth Trends & Insights

This section details the evolution of the UK student accommodation market size, penetration rates, technological disruptions, and shifts in consumer behavior. The market has witnessed consistent growth over the historical period, fueled by increasing student enrollment and a preference for purpose-built student accommodation (PBSA).

The market size is projected to reach xx million units by 2025, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven by several factors, including: rising student numbers, increasing disposable income among students and their families, and the expansion of higher education provision. The adoption rate of online booking platforms is increasing steadily, transforming the way students search for and secure accommodation. Technological disruptions are revolutionizing the management and operation of student housing with smart building technologies and improved property management systems. Consumer behavior is also shifting towards flexible contracts and more value-added services.

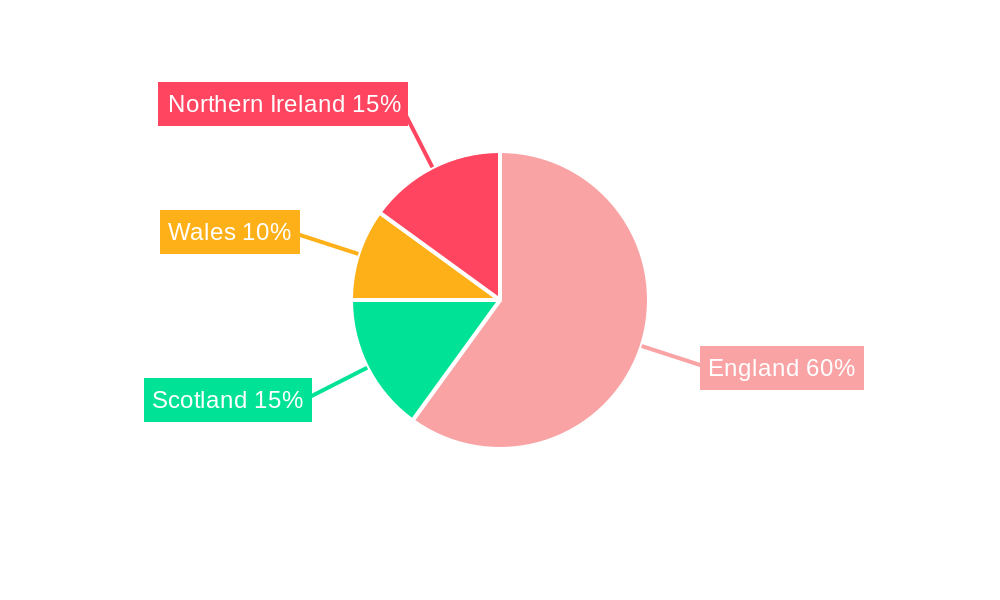

Dominant Regions, Countries, or Segments in UK Student Accommodation Market

This section identifies the leading regions and segments within the UK student accommodation market, focusing on drivers of growth and market share. The analysis is conducted across various segments: rent type, mode of booking, accommodation type, and location.

- By Rent Type: The total rent segment is dominant, showcasing the growing preference for premium facilities and services. Basic rent options continue to cater to budget-conscious students, retaining a substantial market share.

- By Mode: Online booking is experiencing rapid growth, accounting for xx% of bookings in 2025, reflecting the increasing digitalization of the student experience. Offline bookings still maintain a significant share, representing traditional methods and direct interactions with landlords.

- By Accommodation Type: Private student accommodation is the largest segment, indicating a growing preference for purpose-built facilities. Halls of Residence, while declining in relative market share, still retains a significant presence, especially for first-year students. Rented houses and rooms represent a considerable alternative housing option.

- By Location: City center properties command premium rental prices and higher occupancy rates, making them the dominant segment. However, periphery locations are witnessing growth driven by lower costs and improved connectivity.

Key drivers for growth vary across segments: city centers benefit from proximity to universities and amenities; online booking facilitates ease of access and transparency; private student accommodation offers better amenities and services.

UK Student Accommodation Market Product Landscape

The UK student accommodation market showcases a variety of products, ranging from traditional halls of residence to modern, purpose-built student accommodation complexes offering various amenities such as en-suite bathrooms, common rooms, gyms, study areas, and high-speed internet access. The market is witnessing a shift towards offering value-added services, including flexible rental terms, tailored packages for international students, and concierge services. Technological advancements focus on improving energy efficiency, enhancing safety features, and enhancing the overall student experience through smart home technologies. Unique selling propositions increasingly revolve around communal areas designed for social interaction, study spaces and wellbeing facilities.

Key Drivers, Barriers & Challenges in UK Student Accommodation Market

Key Drivers: The key drivers include rising student enrollment, increasing demand for quality accommodation, technological advancements, and favorable government policies promoting higher education.

Key Challenges: Challenges include high construction costs, regulatory compliance, competition from the private rental sector, and potential fluctuations in student demand due to economic or geopolitical uncertainties. The market also faces supply chain issues affecting construction materials and labor leading to project delays and potentially higher costs. This can be quantified by comparing average construction times and costs across the years.

Emerging Opportunities in UK Student Accommodation Market

Emerging opportunities include the growth of sustainable and eco-friendly accommodation, the increasing demand for flexible rental options, and the expansion of niche offerings such as student-specific co-living spaces. The market can further explore the untapped potential in smaller university towns and cities, which currently have lower accommodation provision compared to major urban areas.

Growth Accelerators in the UK Student Accommodation Market Industry

Long-term growth will be driven by strategic partnerships between developers and universities to address accommodation shortages. Further growth will be stimulated by the adoption of smart building technologies for better resource management and improved tenant experiences, as well as an increased focus on providing value-added services tailored to the specific needs of students. Market expansion into underserved areas and the development of more sustainable and environmentally responsible accommodation options are also key growth accelerators.

Key Players Shaping the UK Student Accommodation Market Market

- Downing Students

- CRM Students

- Homes for Students

- Amber Student

- Vita Student

- Unite Group

- Fresh Student Living

- University living

- Uni Acco

- Collegiate

- List Not Exhaustive

Notable Milestones in UK Student Accommodation Market Sector

- February 2023: Sunway RE Capital expanded its portfolio with the acquisition of Green Word Court in Southampton, adding 223 beds.

- March 2022: Unite Group sold a portfolio of 11 properties with almost 4,500 beds for over GBP 306 Mn.

In-Depth UK Student Accommodation Market Market Outlook

The UK student accommodation market is poised for continued growth, driven by sustained demand, technological advancements, and strategic investments. The focus on sustainable practices, innovative amenities, and flexible rental options will shape the future of the market, creating lucrative opportunities for investors and operators. The market is expected to continue its expansion, driven by the factors outlined above, and presenting significant potential for further growth and innovation.

UK Student Accommodation Market Segmentation

-

1. Accommodation Type

- 1.1. Halls of Residence

- 1.2. Rented Houses or Rooms

- 1.3. Private Student Accommodation

-

2. location

- 2.1. City Center

- 2.2. Periphery

-

3. Rent Type

- 3.1. Basic Rent

- 3.2. Total Rent

-

4. Mode

- 4.1. Online

- 4.2. Offline

UK Student Accommodation Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Student Accommodation Market Regional Market Share

Geographic Coverage of UK Student Accommodation Market

UK Student Accommodation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in the online travel agencies in Russia; Due to factors including digital trends and technical improvements

- 3.2.2 the online booking industry is undergoing significant transformation

- 3.3. Market Restrains

- 3.3.1. Booking Cancellation

- 3.4. Market Trends

- 3.4.1. Students admitted in colleges affecting student accommodation market in UK

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Student Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Accommodation Type

- 5.1.1. Halls of Residence

- 5.1.2. Rented Houses or Rooms

- 5.1.3. Private Student Accommodation

- 5.2. Market Analysis, Insights and Forecast - by location

- 5.2.1. City Center

- 5.2.2. Periphery

- 5.3. Market Analysis, Insights and Forecast - by Rent Type

- 5.3.1. Basic Rent

- 5.3.2. Total Rent

- 5.4. Market Analysis, Insights and Forecast - by Mode

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Accommodation Type

- 6. North America UK Student Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Accommodation Type

- 6.1.1. Halls of Residence

- 6.1.2. Rented Houses or Rooms

- 6.1.3. Private Student Accommodation

- 6.2. Market Analysis, Insights and Forecast - by location

- 6.2.1. City Center

- 6.2.2. Periphery

- 6.3. Market Analysis, Insights and Forecast - by Rent Type

- 6.3.1. Basic Rent

- 6.3.2. Total Rent

- 6.4. Market Analysis, Insights and Forecast - by Mode

- 6.4.1. Online

- 6.4.2. Offline

- 6.1. Market Analysis, Insights and Forecast - by Accommodation Type

- 7. South America UK Student Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Accommodation Type

- 7.1.1. Halls of Residence

- 7.1.2. Rented Houses or Rooms

- 7.1.3. Private Student Accommodation

- 7.2. Market Analysis, Insights and Forecast - by location

- 7.2.1. City Center

- 7.2.2. Periphery

- 7.3. Market Analysis, Insights and Forecast - by Rent Type

- 7.3.1. Basic Rent

- 7.3.2. Total Rent

- 7.4. Market Analysis, Insights and Forecast - by Mode

- 7.4.1. Online

- 7.4.2. Offline

- 7.1. Market Analysis, Insights and Forecast - by Accommodation Type

- 8. Europe UK Student Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Accommodation Type

- 8.1.1. Halls of Residence

- 8.1.2. Rented Houses or Rooms

- 8.1.3. Private Student Accommodation

- 8.2. Market Analysis, Insights and Forecast - by location

- 8.2.1. City Center

- 8.2.2. Periphery

- 8.3. Market Analysis, Insights and Forecast - by Rent Type

- 8.3.1. Basic Rent

- 8.3.2. Total Rent

- 8.4. Market Analysis, Insights and Forecast - by Mode

- 8.4.1. Online

- 8.4.2. Offline

- 8.1. Market Analysis, Insights and Forecast - by Accommodation Type

- 9. Middle East & Africa UK Student Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Accommodation Type

- 9.1.1. Halls of Residence

- 9.1.2. Rented Houses or Rooms

- 9.1.3. Private Student Accommodation

- 9.2. Market Analysis, Insights and Forecast - by location

- 9.2.1. City Center

- 9.2.2. Periphery

- 9.3. Market Analysis, Insights and Forecast - by Rent Type

- 9.3.1. Basic Rent

- 9.3.2. Total Rent

- 9.4. Market Analysis, Insights and Forecast - by Mode

- 9.4.1. Online

- 9.4.2. Offline

- 9.1. Market Analysis, Insights and Forecast - by Accommodation Type

- 10. Asia Pacific UK Student Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Accommodation Type

- 10.1.1. Halls of Residence

- 10.1.2. Rented Houses or Rooms

- 10.1.3. Private Student Accommodation

- 10.2. Market Analysis, Insights and Forecast - by location

- 10.2.1. City Center

- 10.2.2. Periphery

- 10.3. Market Analysis, Insights and Forecast - by Rent Type

- 10.3.1. Basic Rent

- 10.3.2. Total Rent

- 10.4. Market Analysis, Insights and Forecast - by Mode

- 10.4.1. Online

- 10.4.2. Offline

- 10.1. Market Analysis, Insights and Forecast - by Accommodation Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Downing Students

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CRM Students

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Homes for Student

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Amber Student

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vita Student

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Unite Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fresh Student Living*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 University living

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Uni Acco

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Collegiate

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Downing Students

List of Figures

- Figure 1: Global UK Student Accommodation Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UK Student Accommodation Market Revenue (Million), by Accommodation Type 2025 & 2033

- Figure 3: North America UK Student Accommodation Market Revenue Share (%), by Accommodation Type 2025 & 2033

- Figure 4: North America UK Student Accommodation Market Revenue (Million), by location 2025 & 2033

- Figure 5: North America UK Student Accommodation Market Revenue Share (%), by location 2025 & 2033

- Figure 6: North America UK Student Accommodation Market Revenue (Million), by Rent Type 2025 & 2033

- Figure 7: North America UK Student Accommodation Market Revenue Share (%), by Rent Type 2025 & 2033

- Figure 8: North America UK Student Accommodation Market Revenue (Million), by Mode 2025 & 2033

- Figure 9: North America UK Student Accommodation Market Revenue Share (%), by Mode 2025 & 2033

- Figure 10: North America UK Student Accommodation Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America UK Student Accommodation Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America UK Student Accommodation Market Revenue (Million), by Accommodation Type 2025 & 2033

- Figure 13: South America UK Student Accommodation Market Revenue Share (%), by Accommodation Type 2025 & 2033

- Figure 14: South America UK Student Accommodation Market Revenue (Million), by location 2025 & 2033

- Figure 15: South America UK Student Accommodation Market Revenue Share (%), by location 2025 & 2033

- Figure 16: South America UK Student Accommodation Market Revenue (Million), by Rent Type 2025 & 2033

- Figure 17: South America UK Student Accommodation Market Revenue Share (%), by Rent Type 2025 & 2033

- Figure 18: South America UK Student Accommodation Market Revenue (Million), by Mode 2025 & 2033

- Figure 19: South America UK Student Accommodation Market Revenue Share (%), by Mode 2025 & 2033

- Figure 20: South America UK Student Accommodation Market Revenue (Million), by Country 2025 & 2033

- Figure 21: South America UK Student Accommodation Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe UK Student Accommodation Market Revenue (Million), by Accommodation Type 2025 & 2033

- Figure 23: Europe UK Student Accommodation Market Revenue Share (%), by Accommodation Type 2025 & 2033

- Figure 24: Europe UK Student Accommodation Market Revenue (Million), by location 2025 & 2033

- Figure 25: Europe UK Student Accommodation Market Revenue Share (%), by location 2025 & 2033

- Figure 26: Europe UK Student Accommodation Market Revenue (Million), by Rent Type 2025 & 2033

- Figure 27: Europe UK Student Accommodation Market Revenue Share (%), by Rent Type 2025 & 2033

- Figure 28: Europe UK Student Accommodation Market Revenue (Million), by Mode 2025 & 2033

- Figure 29: Europe UK Student Accommodation Market Revenue Share (%), by Mode 2025 & 2033

- Figure 30: Europe UK Student Accommodation Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Europe UK Student Accommodation Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa UK Student Accommodation Market Revenue (Million), by Accommodation Type 2025 & 2033

- Figure 33: Middle East & Africa UK Student Accommodation Market Revenue Share (%), by Accommodation Type 2025 & 2033

- Figure 34: Middle East & Africa UK Student Accommodation Market Revenue (Million), by location 2025 & 2033

- Figure 35: Middle East & Africa UK Student Accommodation Market Revenue Share (%), by location 2025 & 2033

- Figure 36: Middle East & Africa UK Student Accommodation Market Revenue (Million), by Rent Type 2025 & 2033

- Figure 37: Middle East & Africa UK Student Accommodation Market Revenue Share (%), by Rent Type 2025 & 2033

- Figure 38: Middle East & Africa UK Student Accommodation Market Revenue (Million), by Mode 2025 & 2033

- Figure 39: Middle East & Africa UK Student Accommodation Market Revenue Share (%), by Mode 2025 & 2033

- Figure 40: Middle East & Africa UK Student Accommodation Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East & Africa UK Student Accommodation Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific UK Student Accommodation Market Revenue (Million), by Accommodation Type 2025 & 2033

- Figure 43: Asia Pacific UK Student Accommodation Market Revenue Share (%), by Accommodation Type 2025 & 2033

- Figure 44: Asia Pacific UK Student Accommodation Market Revenue (Million), by location 2025 & 2033

- Figure 45: Asia Pacific UK Student Accommodation Market Revenue Share (%), by location 2025 & 2033

- Figure 46: Asia Pacific UK Student Accommodation Market Revenue (Million), by Rent Type 2025 & 2033

- Figure 47: Asia Pacific UK Student Accommodation Market Revenue Share (%), by Rent Type 2025 & 2033

- Figure 48: Asia Pacific UK Student Accommodation Market Revenue (Million), by Mode 2025 & 2033

- Figure 49: Asia Pacific UK Student Accommodation Market Revenue Share (%), by Mode 2025 & 2033

- Figure 50: Asia Pacific UK Student Accommodation Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Asia Pacific UK Student Accommodation Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Student Accommodation Market Revenue Million Forecast, by Accommodation Type 2020 & 2033

- Table 2: Global UK Student Accommodation Market Revenue Million Forecast, by location 2020 & 2033

- Table 3: Global UK Student Accommodation Market Revenue Million Forecast, by Rent Type 2020 & 2033

- Table 4: Global UK Student Accommodation Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 5: Global UK Student Accommodation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global UK Student Accommodation Market Revenue Million Forecast, by Accommodation Type 2020 & 2033

- Table 7: Global UK Student Accommodation Market Revenue Million Forecast, by location 2020 & 2033

- Table 8: Global UK Student Accommodation Market Revenue Million Forecast, by Rent Type 2020 & 2033

- Table 9: Global UK Student Accommodation Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 10: Global UK Student Accommodation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global UK Student Accommodation Market Revenue Million Forecast, by Accommodation Type 2020 & 2033

- Table 15: Global UK Student Accommodation Market Revenue Million Forecast, by location 2020 & 2033

- Table 16: Global UK Student Accommodation Market Revenue Million Forecast, by Rent Type 2020 & 2033

- Table 17: Global UK Student Accommodation Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 18: Global UK Student Accommodation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Brazil UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global UK Student Accommodation Market Revenue Million Forecast, by Accommodation Type 2020 & 2033

- Table 23: Global UK Student Accommodation Market Revenue Million Forecast, by location 2020 & 2033

- Table 24: Global UK Student Accommodation Market Revenue Million Forecast, by Rent Type 2020 & 2033

- Table 25: Global UK Student Accommodation Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 26: Global UK Student Accommodation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: United Kingdom UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: France UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Spain UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Benelux UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Nordics UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global UK Student Accommodation Market Revenue Million Forecast, by Accommodation Type 2020 & 2033

- Table 37: Global UK Student Accommodation Market Revenue Million Forecast, by location 2020 & 2033

- Table 38: Global UK Student Accommodation Market Revenue Million Forecast, by Rent Type 2020 & 2033

- Table 39: Global UK Student Accommodation Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 40: Global UK Student Accommodation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Turkey UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Israel UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: GCC UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: North Africa UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: South Africa UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Global UK Student Accommodation Market Revenue Million Forecast, by Accommodation Type 2020 & 2033

- Table 48: Global UK Student Accommodation Market Revenue Million Forecast, by location 2020 & 2033

- Table 49: Global UK Student Accommodation Market Revenue Million Forecast, by Rent Type 2020 & 2033

- Table 50: Global UK Student Accommodation Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 51: Global UK Student Accommodation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 52: China UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: India UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: South Korea UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: ASEAN UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Oceania UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific UK Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Student Accommodation Market?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the UK Student Accommodation Market?

Key companies in the market include Downing Students, CRM Students, Homes for Student, Amber Student, Vita Student, Unite Group, Fresh Student Living*List Not Exhaustive, University living, Uni Acco, Collegiate.

3. What are the main segments of the UK Student Accommodation Market?

The market segments include Accommodation Type, location, Rent Type, Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the online travel agencies in Russia; Due to factors including digital trends and technical improvements. the online booking industry is undergoing significant transformation.

6. What are the notable trends driving market growth?

Students admitted in colleges affecting student accommodation market in UK.

7. Are there any restraints impacting market growth?

Booking Cancellation.

8. Can you provide examples of recent developments in the market?

February 2023: Sunway RE Capital expanded its student accommodation portfolio by acquiring Freehold purpose-built student accommodation, green word court, in Southampton, UK. The facility has 223 beds arranged as 217 non-en suites and 16 studios. The facility is just a few miles from the University of Southampton's Highfield and Bolderwood campuses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Student Accommodation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Student Accommodation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Student Accommodation Market?

To stay informed about further developments, trends, and reports in the UK Student Accommodation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence