Key Insights

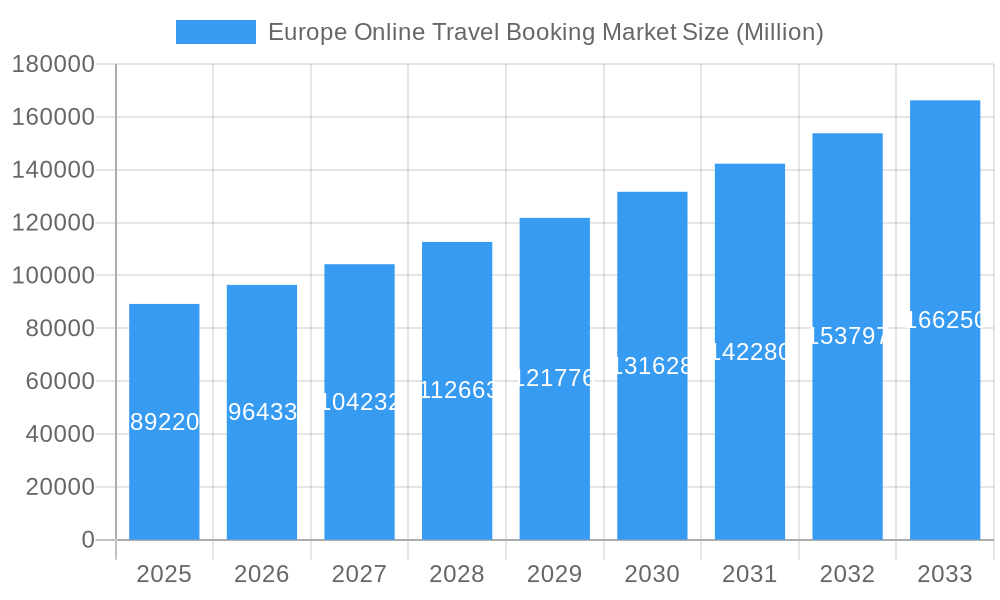

The European online travel booking market, valued at €89.22 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.14% from 2025 to 2033. This expansion is driven by several key factors. The increasing penetration of smartphones and readily available high-speed internet access across Europe fuels the convenience and accessibility of online booking platforms. A rising preference for personalized travel experiences, coupled with the growing popularity of budget travel and last-minute bookings, further stimulates market growth. Furthermore, the continuous innovation within the online travel sector, including the integration of artificial intelligence for personalized recommendations and enhanced customer service, contributes to the market's upward trajectory. The dominance of online travel agencies (OTAs) such as Booking.com, Expedia, and eDreams is expected to continue, although competition from direct travel suppliers and niche platforms catering to specific travel styles (e.g., Unique Villas for luxury accommodations) is intensifying.

Europe Online Travel Booking Market Market Size (In Billion)

Significant regional variations exist within the European market. Germany, France, the United Kingdom, and Italy represent the largest national markets, reflecting their substantial populations and robust tourism sectors. However, growth opportunities are also present in other European countries, particularly as internet penetration and disposable incomes increase. The market segmentation by service type (transportation, accommodation, packages) and booking type (OTA vs. direct) offers further avenues for market players to specialize and cater to diverse customer preferences. The ongoing challenge for market participants will be to differentiate themselves through superior customer service, innovative technology, and competitive pricing, while navigating evolving consumer behavior and regulatory landscapes. The forecast period anticipates sustained growth driven by technological advancements and evolving travel patterns, reinforcing the online travel booking market's position as a key sector within the broader European tourism economy.

Europe Online Travel Booking Market Company Market Share

Europe Online Travel Booking Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe online travel booking market, covering the period 2019-2033. It delves into market dynamics, growth trends, dominant segments, key players, and emerging opportunities, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report utilizes data from 2019-2024 as the historical period, 2025 as the base and estimated year, and projects the market outlook from 2025 to 2033. The market is segmented by service type (Transportation, Travel Accommodation, Vacation Packages, Other Service Types), booking type (Online Travel Agencies, Direct Travel Suppliers), platform (Desktop, Mobile), and country (United Kingdom, Germany, France, Italy, Rest of Europe). The total market size in 2025 is estimated at xx Million.

Europe Online Travel Booking Market Market Dynamics & Structure

The European online travel booking market is characterized by high competition, rapid technological advancements, and evolving consumer preferences. Market concentration is moderate, with several major players holding significant shares, but a number of smaller niche players also contributing. Technological innovation, particularly in areas such as AI-powered personalization and mobile-first booking experiences, is a key driver. Regulatory frameworks, including data privacy regulations (GDPR) and consumer protection laws, significantly impact market operations. The rise of alternative accommodation options (e.g., Airbnb) presents a competitive substitute to traditional hotels and packages. The end-user demographic is diverse, encompassing both leisure and business travelers across various age groups and income levels. M&A activity has been moderate in recent years, with larger players consolidating market share.

- Market Concentration: Moderate, with top 5 players holding approximately xx% of the market share in 2025.

- Technological Innovation: AI-powered personalization, mobile optimization, and blockchain technology for secure transactions are key drivers.

- Regulatory Framework: GDPR and consumer protection laws influence data usage and booking processes.

- Competitive Substitutes: Airbnb and other alternative accommodation platforms pose a significant competitive threat.

- End-User Demographics: A mix of leisure and business travelers across various age groups and income levels.

- M&A Trends: xx M&A deals completed in the past five years, indicating consolidation among larger players.

Europe Online Travel Booking Market Growth Trends & Insights

The European online travel booking market has witnessed robust growth over the past few years and is expected to continue its expansion throughout the forecast period. Driven by increasing internet and smartphone penetration, rising disposable incomes, and a growing preference for convenient online booking, the market experienced a CAGR of xx% from 2019 to 2024. This growth is expected to moderate slightly in the forecast period, with a projected CAGR of xx% from 2025 to 2033, reaching a market size of xx Million by 2033. Technological disruptions, such as the rise of metasearch engines and the increasing adoption of mobile booking platforms, significantly shape market dynamics. Consumer behavior is shifting towards personalized travel experiences, sustainable tourism options, and flexible booking policies. The market penetration of online travel booking is expected to increase from xx% in 2025 to xx% in 2033.

Dominant Regions, Countries, or Segments in Europe Online Travel Booking Market

The United Kingdom, Germany, and France are the leading markets in Europe for online travel booking, driven by high internet penetration, strong tourism sectors, and a large base of online shoppers. Within the service type segment, travel accommodation and vacation packages contribute the highest market share. Online Travel Agencies (OTAs) dominate the booking type segment. Mobile platforms are experiencing rapid growth.

- Key Drivers: Strong tourism sector, high internet penetration, favourable economic conditions, and well-developed infrastructure.

- United Kingdom: High market share due to its significant tourism industry and tech-savvy population. Estimated Market Share in 2025: xx%

- Germany: Large market size driven by a substantial population and increasing online travel adoption. Estimated Market Share in 2025: xx%

- France: High market share due to strong tourism and a growing preference for online booking. Estimated Market Share in 2025: xx%

- Italy: Growing market driven by increasing online travel adoption and tourism growth. Estimated Market Share in 2025: xx%

- Rest of Europe: Shows significant growth potential driven by rising internet penetration and increasing tourism in this region. Estimated Market Share in 2025: xx%

Europe Online Travel Booking Market Product Landscape

The online travel booking market offers a diverse range of products, including flight tickets, hotel reservations, car rentals, vacation packages, and travel insurance. Continuous innovation focuses on improving user experience, offering personalized recommendations, and integrating innovative technologies like AI and VR/AR for immersive travel planning. Unique selling propositions include competitive pricing, loyalty programs, comprehensive travel management tools, and 24/7 customer support. Recent technological advancements include personalized travel recommendations, seamless booking processes, and enhanced mobile app features.

Key Drivers, Barriers & Challenges in Europe Online Travel Booking Market

Key Drivers: Rising disposable incomes, increased internet and smartphone penetration, growing preference for online booking, and the expansion of low-cost carriers are key factors driving market growth. Government initiatives promoting tourism also contribute positively.

Challenges & Restraints: Fluctuations in currency exchange rates, economic downturns, increased competition, and data security concerns present significant challenges. Stringent regulations around data privacy and consumer protection also impact market dynamics. Supply chain disruptions can affect the availability of flights and accommodation, impacting operations and customer satisfaction. The quantified impact of these restraints is estimated at a reduction of xx Million in market value in 2025.

Emerging Opportunities in Europe Online Travel Booking Market

The increasing demand for sustainable and eco-friendly travel options presents a significant opportunity for the market. The growth of niche travel segments, such as adventure tourism and wellness travel, also creates new opportunities. Personalized travel experiences and AI-powered travel planning tools hold high growth potential.

Growth Accelerators in the Europe Online Travel Booking Market Industry

Strategic partnerships between OTAs and travel providers, investments in technological innovation, expansion into untapped markets, and the development of innovative travel products are significant growth catalysts. The adoption of advanced analytics for better understanding and targeting customer preferences is also a key accelerator.

Key Players Shaping the Europe Online Travel Booking Market Market

- Opodo

- DER com

- Agoda

- Booking.com

- Hostelworld Group Plc

- HRS

- Orbitz

- Airbnb

- lastminute.com

- Unique Villas

- Expedia

- eDreams

- ZenHotels.com

- TUI AG List Not Exhaustive

Notable Milestones in Europe Online Travel Booking Market Sector

- May 2022: lastminute.com launched its first physical gift card, expanding its reach into offline retail channels.

- July 27, 2022: Booking.com launched the Ultimate Pride Amsterdam Experience, enhancing its brand image and targeting a specific demographic.

- 2nd February 2022: eDreams ODIGEO signed an NDC agreement with British Airways and Iberia, improving its flight offering and competitiveness.

- 15th November 2022: Booking.com announced new features for accommodation, car rental, and flights, emphasizing its commitment to sustainability.

In-Depth Europe Online Travel Booking Market Market Outlook

The European online travel booking market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and increasing tourism activity. The focus on personalization, sustainability, and seamless mobile experiences will shape future market dynamics. Strategic partnerships and investments in innovative technologies will play a critical role in determining market leadership and capturing significant market share in the coming years. The market presents lucrative opportunities for both established players and new entrants.

Europe Online Travel Booking Market Segmentation

-

1. Service Type

- 1.1. Transportation

- 1.2. Travel Accommodation

- 1.3. Vacation Packages

- 1.4. Other Service Types

-

2. Booking Type

- 2.1. Online Travel Agencies

- 2.2. Direct Travel Suppliers

-

3. Platform

- 3.1. Desktop

- 3.2. Mobile

Europe Online Travel Booking Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Online Travel Booking Market Regional Market Share

Geographic Coverage of Europe Online Travel Booking Market

Europe Online Travel Booking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Airbnb in United States is Dominating the Market; The US Online Accommodation Market is Booming due to an Increase in Domestic Trips

- 3.3. Market Restrains

- 3.3.1. Booking Cancellation

- 3.4. Market Trends

- 3.4.1. Shift towards Mobile Phones for Travel Booking

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Online Travel Booking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Transportation

- 5.1.2. Travel Accommodation

- 5.1.3. Vacation Packages

- 5.1.4. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Online Travel Agencies

- 5.2.2. Direct Travel Suppliers

- 5.3. Market Analysis, Insights and Forecast - by Platform

- 5.3.1. Desktop

- 5.3.2. Mobile

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Opodo

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DER com

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Agoda

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Booking com

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hostelworld Group Plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 HRS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Orbitz

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Airbnb

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 lastminute com

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Unique Villas

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Expedia

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 eDreams

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 ZenHotels com

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 TUI AG**List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Opodo

List of Figures

- Figure 1: Europe Online Travel Booking Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Online Travel Booking Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Online Travel Booking Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Europe Online Travel Booking Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 3: Europe Online Travel Booking Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: Europe Online Travel Booking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Online Travel Booking Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: Europe Online Travel Booking Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 7: Europe Online Travel Booking Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 8: Europe Online Travel Booking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Online Travel Booking Market?

The projected CAGR is approximately 8.14%.

2. Which companies are prominent players in the Europe Online Travel Booking Market?

Key companies in the market include Opodo, DER com, Agoda, Booking com, Hostelworld Group Plc, HRS, Orbitz, Airbnb, lastminute com, Unique Villas, Expedia, eDreams, ZenHotels com, TUI AG**List Not Exhaustive.

3. What are the main segments of the Europe Online Travel Booking Market?

The market segments include Service Type, Booking Type, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 89.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Airbnb in United States is Dominating the Market; The US Online Accommodation Market is Booming due to an Increase in Domestic Trips.

6. What are the notable trends driving market growth?

Shift towards Mobile Phones for Travel Booking.

7. Are there any restraints impacting market growth?

Booking Cancellation.

8. Can you provide examples of recent developments in the market?

15th November 2022: Booking.com, the leading digital travel platform, announced a series of new features for accommodation, car rental, and flights, to mark the one-year anniversary of its sustainability program launched in 2021.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Online Travel Booking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Online Travel Booking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Online Travel Booking Market?

To stay informed about further developments, trends, and reports in the Europe Online Travel Booking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence