Key Insights

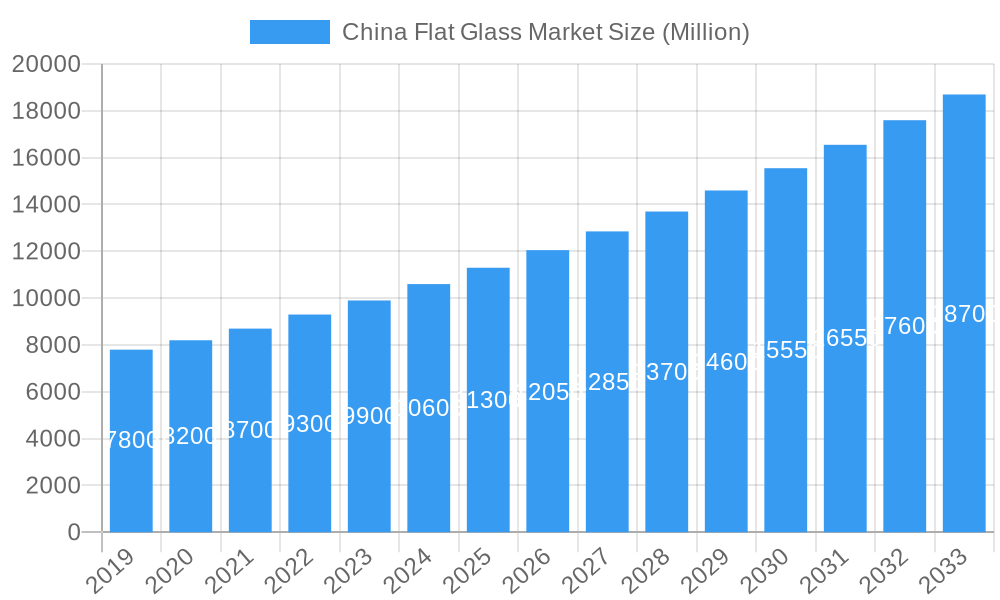

The China Flat Glass Market is projected for significant expansion, propelled by robust demand from the construction and automotive sectors. The market is estimated at $156.2 billion in 2025 and is forecasted to grow at a Compound Annual Growth Rate (CAGR) of 8.6% through 2033. Key growth drivers include escalating urbanization, rising disposable incomes, and government initiatives promoting energy-efficient buildings and advanced automotive manufacturing. The adoption of innovative glass types, such as coated and reflective glass, is a significant trend, addressing the demand for enhanced thermal insulation, UV protection, and aesthetic appeal in residential and commercial constructions. Additionally, the expanding solar energy sector is creating substantial opportunities for specialized solar glass, further contributing to market growth.

China Flat Glass Market Market Size (In Billion)

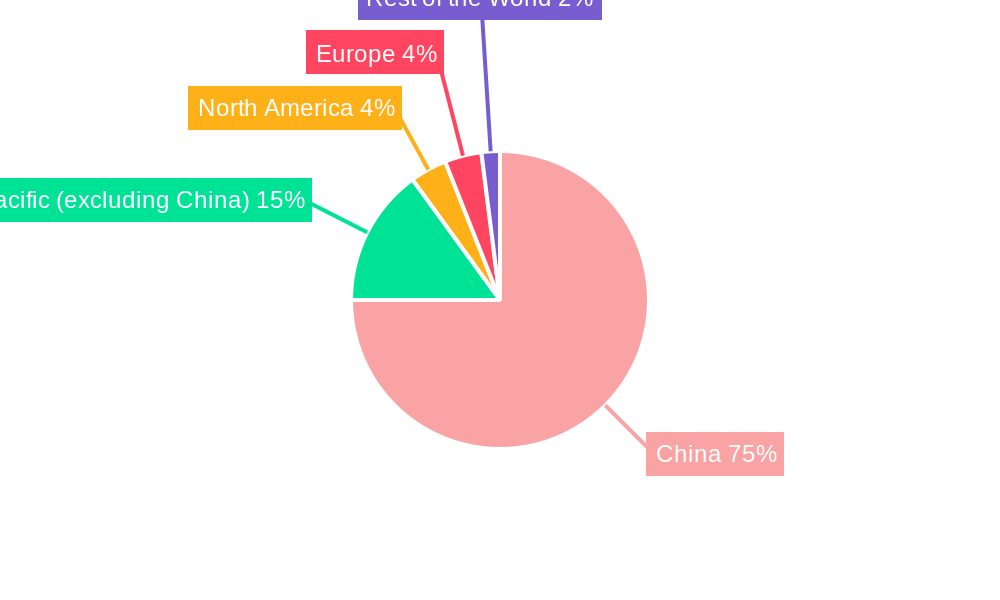

While strong drivers are in play, challenges may arise from fluctuating raw material prices and evolving environmental regulations. However, substantial domestic consumption and significant export potential provide a solid foundation for sustained growth. Leading players are actively investing in research and development to introduce advanced flat glass solutions, including processed glass and mirrors, to meet diverse application needs. Technological advancements and strategic collaborations characterize the market's dynamic landscape, underscoring its resilience and promising outlook. China's dominance in the global flat glass market is expected to continue, supported by its manufacturing capabilities and extensive domestic market.

China Flat Glass Market Company Market Share

This comprehensive report offers a strategic analysis of the China Flat Glass Market, detailing historical trends, current dynamics, and future projections from 2019 to 2033. Utilizing advanced analytical methodologies and extensive industry insights, the report provides a granular view of market segmentation, key players, and growth trajectories. All values are presented in billions.

China Flat Glass Market Market Dynamics & Structure

The China Flat Glass Market is characterized by a moderate to high level of market concentration, with a few key players holding significant market share. Technological innovation is a primary driver, fueled by a strong demand for advanced materials in construction and automotive sectors. Regulatory frameworks, while evolving, aim to promote sustainable manufacturing practices and energy efficiency. Competitive product substitutes, though present, often fall short in offering the specialized properties of advanced flat glass. End-user demographics are increasingly sophisticated, seeking aesthetically pleasing and high-performance solutions. Mergers and acquisitions (M&A) activity has been a notable trend, as companies aim to consolidate their market position, expand product portfolios, and gain technological advantages. For instance, the recent partnership between AGC and Saint-Gobain underscores a strategic move towards sustainability and innovation.

- Market Concentration: Dominated by a few large enterprises, but with increasing fragmentation in niche segments.

- Technological Innovation: Driven by demand for energy-efficient glass, smart glass, and specialized coatings.

- Regulatory Frameworks: Focus on environmental protection, energy efficiency standards, and building codes.

- Competitive Product Substitutes: While alternatives exist, they often lack the performance and application versatility of advanced flat glass.

- End-User Demographics: Growing demand from high-end residential construction, premium automotive segments, and renewable energy sectors.

- M&A Trends: Strategic alliances and acquisitions aimed at increasing production capacity, R&D capabilities, and market reach.

China Flat Glass Market Growth Trends & Insights

The China Flat Glass Market is poised for robust growth, projected to expand at a significant Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). This expansion is primarily fueled by sustained demand from the burgeoning Building and Construction sector, which accounts for a substantial XX% market share. The increasing urbanization rate, coupled with government initiatives promoting green building standards and energy-efficient infrastructure, are key enablers. The Automotive sector also represents a critical growth segment, driven by rising vehicle production and the integration of advanced glass technologies like panoramic sunroofs and smart displays.

The Solar Glass segment is witnessing accelerated adoption, propelled by China's commitment to renewable energy targets and substantial investments in solar power generation. This segment's market penetration is expected to rise from XX% in the base year (2025) to XX% by 2033. Technological disruptions, such as the development of low-emissivity (low-E) glass, self-cleaning glass, and fire-resistant glass, are enhancing product value and driving market penetration across various applications. Consumer behavior is shifting towards prioritizing sustainability, aesthetics, and enhanced functionality in their building and automotive choices, directly influencing demand for premium flat glass products.

The market size is estimated to reach USD XXX Million in 2025 and is projected to grow to USD XXX Million by 2033. This growth is underpinned by increasing per capita consumption of flat glass in China, which, while still lower than developed nations, shows a strong upward trend. The adoption rates for coated and processed glass are particularly high, driven by their superior performance characteristics in insulation, UV protection, and safety. The shift from basic annealed glass to more sophisticated variants reflects the evolving needs of modern construction and manufacturing. The development of smart glass technologies, offering dynamic tinting and energy-saving capabilities, represents a frontier of innovation that will further shape market dynamics. The report will delve into the specific impact of these trends on market size evolution and consumer preferences.

Dominant Regions, Countries, or Segments in China Flat Glass Market

The Building and Construction end-user industry stands as the dominant force driving growth in the China Flat Glass Market. This segment is projected to command a significant market share, estimated at XX% in 2025, and is expected to maintain its lead throughout the forecast period (2025-2033). This dominance is attributed to several interconnected factors, including China's rapid urbanization, ongoing infrastructure development projects, and a growing emphasis on modern architectural designs that heavily incorporate glass elements. Government policies promoting green buildings and energy-efficient structures further bolster demand for specialized flat glass products like low-E glass and insulated glass units (IGUs).

Within the product types, Annealed Glass (Including Tinted Glass) is expected to retain a substantial market share due to its widespread use in various construction applications and its cost-effectiveness. However, Coater Glass is anticipated to exhibit the highest growth rate, driven by increasing demand for high-performance glass with enhanced thermal insulation, solar control, and aesthetic properties. The market share of Coater Glass is projected to grow from XX% in 2025 to XX% by 2033.

Geographically, Eastern China is the leading region, accounting for an estimated XX% of the total market revenue in 2025. This is due to the concentration of major construction activities, manufacturing hubs, and a higher disposable income for premium building materials. Provinces like Jiangsu, Zhejiang, and Shandong are key contributors. The strong economic performance of these regions, coupled with favorable government policies supporting industrial development, creates a fertile ground for the flat glass market.

- Dominant End-user Industry: Building and Construction - driven by urbanization, infrastructure projects, and green building initiatives.

- Leading Product Segment: Annealed Glass (Including Tinted Glass) holds significant share, but Coater Glass shows the highest growth potential due to performance demands.

- Dominant Region: Eastern China - characterized by high economic activity, major construction hubs, and advanced manufacturing capabilities.

- Key Drivers: Economic policies supporting construction and renewable energy, advancements in glass technology for energy efficiency, and evolving architectural trends.

- Market Share & Growth Potential: Eastern China and the Building & Construction segment are expected to continue their dominance, with rapid growth in specialized segments like Coater Glass and Solar Glass.

China Flat Glass Market Product Landscape

The product landscape of the China Flat Glass Market is characterized by continuous innovation and diversification to meet evolving industry demands. Annealed Glass, including its tinted variants, remains a foundational product, widely used for its clarity, affordability, and ease of fabrication in various building and automotive applications. Coater Glass, such as low-emissivity (low-E) and solar control glass, is gaining significant traction due to its superior energy efficiency and comfort-enhancing properties, ideal for modern sustainable buildings and energy-saving vehicles. Reflective Glass offers aesthetic appeal and solar heat reduction benefits, finding application in commercial buildings and facades. Processed Glass, encompassing tempered, laminated, and insulated glass, is crucial for safety, security, and enhanced thermal performance in construction and transportation. Mirrors, while a smaller segment, continue to be relevant in interior design and automotive applications. Recent advancements focus on integrating smart functionalities, such as self-cleaning coatings and electrochromic technologies that allow for adjustable tinting.

Key Drivers, Barriers & Challenges in China Flat Glass Market

Key Drivers:

- Robust Construction Sector: Continued urbanization and infrastructure development in China drive demand for flat glass in residential, commercial, and public buildings.

- Growing Automotive Industry: Increased vehicle production and the trend towards lighter, more sophisticated vehicle designs fuel demand for automotive glass.

- Renewable Energy Expansion: Government support for solar power generation significantly boosts the demand for solar glass.

- Technological Advancements: Innovations in coated, processed, and smart glass enhance performance, leading to wider adoption.

- Energy Efficiency Mandates: Stricter building codes and environmental regulations promote the use of energy-saving glass solutions.

Barriers & Challenges:

- Intense Competition & Price Sensitivity: A highly competitive market can lead to price wars, impacting profitability for manufacturers.

- Raw Material Volatility: Fluctuations in the prices of key raw materials like silica sand and soda ash can affect production costs.

- Environmental Regulations: Increasing stringency of environmental protection laws and the need for investment in sustainable manufacturing processes.

- Supply Chain Disruptions: Potential disruptions in raw material sourcing or finished product distribution can impact market stability.

- Trade Policies & Tariffs: International trade policies and potential tariffs can influence export markets and import costs.

Emerging Opportunities in China Flat Glass Market

Emerging opportunities in the China Flat Glass Market lie in the rapidly expanding sectors of smart cities and smart buildings. The demand for intelligent glass solutions, such as dynamic tinting, integrated displays, and energy-harvesting glass, is set to surge. The residential renovation and refurbishment market also presents a significant opportunity, as homeowners increasingly opt for energy-efficient and aesthetically pleasing upgrades. Furthermore, the ongoing global push towards decarbonization and renewable energy will continue to drive substantial growth in the solar glass segment. Innovations in architectural glass for high-rise buildings, focusing on enhanced safety, acoustics, and aesthetic appeal, will also create new avenues for market penetration. The development of specialized glass for healthcare facilities and educational institutions, prioritizing hygiene and advanced functionality, represents another nascent but promising area.

Growth Accelerators in the China Flat Glass Market Industry

The China Flat Glass Market industry is propelled by several key growth accelerators. Technological breakthroughs in areas like nanotechnology for advanced coatings and the development of ultra-clear, high-strength glass are expanding application possibilities and driving premium product demand. Strategic partnerships and collaborations, exemplified by the AGC and Saint-Gobain initiative for CO2 emission reduction, are crucial for fostering innovation and sustainability, leading to new product development and market entry strategies. Government initiatives and policy support, particularly in promoting energy efficiency, renewable energy adoption, and green building practices, create a favorable market environment. Finally, market expansion strategies, including increasing production capacity, diversifying product portfolios, and exploring export markets, are critical for sustained long-term growth and enhancing competitive advantages.

Key Players Shaping the China Flat Glass Market Market

- Qingdao Laurel Glass Technology Co Ltd

- Nippon Sheet Glass Co Ltd

- China National Building Material Group Corporation

- Qingdao REXI Industries Co Ltd

- Saint-Gobain

- Sisecam

- Fuyao Glass Industry Group Co Ltd

- SCHOTT

- China Yaohua Glass Co Ltd

- China Glass Holdings Limited

- Taiwan Glass Ind Corp

- AGC Inc

Notable Milestones in China Flat Glass Market Sector

- February 2023: AGC and Saint-Gobain partnered to create a revolutionary pilot flat glass line with drastic CO2 emissions reduction. The new technology is expected to be implemented on the patterned glass line by the end of 2024.

In-Depth China Flat Glass Market Market Outlook

The future outlook for the China Flat Glass Market remains exceptionally positive, driven by a confluence of strong fundamental growth drivers and emerging technological opportunities. The market is set to benefit from the continued expansion of the construction and automotive sectors, alongside China's aggressive pursuit of renewable energy goals, which will sustain robust demand for solar glass. Innovations in smart glass technologies and sustainable manufacturing practices are expected to redefine product offerings and create new revenue streams. Strategic initiatives by key players to enhance production efficiency, reduce environmental impact, and develop high-value-added products will be crucial for navigating the competitive landscape. The market is poised for sustained growth, offering significant potential for both established enterprises and new entrants focused on innovation and sustainability.

China Flat Glass Market Segmentation

-

1. Product Type

- 1.1. Annealed Glass (Including Tinted Glass)

- 1.2. Coater Glass

- 1.3. Reflective Glass

- 1.4. Processed Glass

- 1.5. Mirrors

-

2. End-user Industry

- 2.1. Building and Construction

- 2.2. Automotive

- 2.3. Solar Glass

- 2.4. Other En

China Flat Glass Market Segmentation By Geography

- 1. China

China Flat Glass Market Regional Market Share

Geographic Coverage of China Flat Glass Market

China Flat Glass Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Construction Industry; Growing Demand for Electronic Displays; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Fluctuating Prices of Raw Materials; Government Regulations on Carbon Emission

- 3.4. Market Trends

- 3.4.1. Annealed Glass to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Flat Glass Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Annealed Glass (Including Tinted Glass)

- 5.1.2. Coater Glass

- 5.1.3. Reflective Glass

- 5.1.4. Processed Glass

- 5.1.5. Mirrors

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Building and Construction

- 5.2.2. Automotive

- 5.2.3. Solar Glass

- 5.2.4. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Qingdao Laurel Glass Technology Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nippon Sheet Glass Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China National Building Material Group Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Qingdao REXI Industries Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Saint-Gobain

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sisecam

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fuyao Glass Industry Group Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SCHOTT

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 China Yaohua Glass Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Glass Holdings Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Taiwan Glass Ind Corp *List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 AGC Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Qingdao Laurel Glass Technology Co Ltd

List of Figures

- Figure 1: China Flat Glass Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Flat Glass Market Share (%) by Company 2025

List of Tables

- Table 1: China Flat Glass Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: China Flat Glass Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: China Flat Glass Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Flat Glass Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: China Flat Glass Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: China Flat Glass Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Flat Glass Market?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the China Flat Glass Market?

Key companies in the market include Qingdao Laurel Glass Technology Co Ltd, Nippon Sheet Glass Co Ltd, China National Building Material Group Corporation, Qingdao REXI Industries Co Ltd, Saint-Gobain, Sisecam, Fuyao Glass Industry Group Co Ltd, SCHOTT, China Yaohua Glass Co Ltd, China Glass Holdings Limited, Taiwan Glass Ind Corp *List Not Exhaustive, AGC Inc.

3. What are the main segments of the China Flat Glass Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 156.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Construction Industry; Growing Demand for Electronic Displays; Other Drivers.

6. What are the notable trends driving market growth?

Annealed Glass to Dominate the Market.

7. Are there any restraints impacting market growth?

Fluctuating Prices of Raw Materials; Government Regulations on Carbon Emission.

8. Can you provide examples of recent developments in the market?

February 2023: AGC and Saint-Gobain partnered to create a revolutionary pilot flat glass line with drastic CO2 emissions reduction. The new technology is expected to be implemented on the patterned glass line by the end of 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Flat Glass Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Flat Glass Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Flat Glass Market?

To stay informed about further developments, trends, and reports in the China Flat Glass Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence