Key Insights

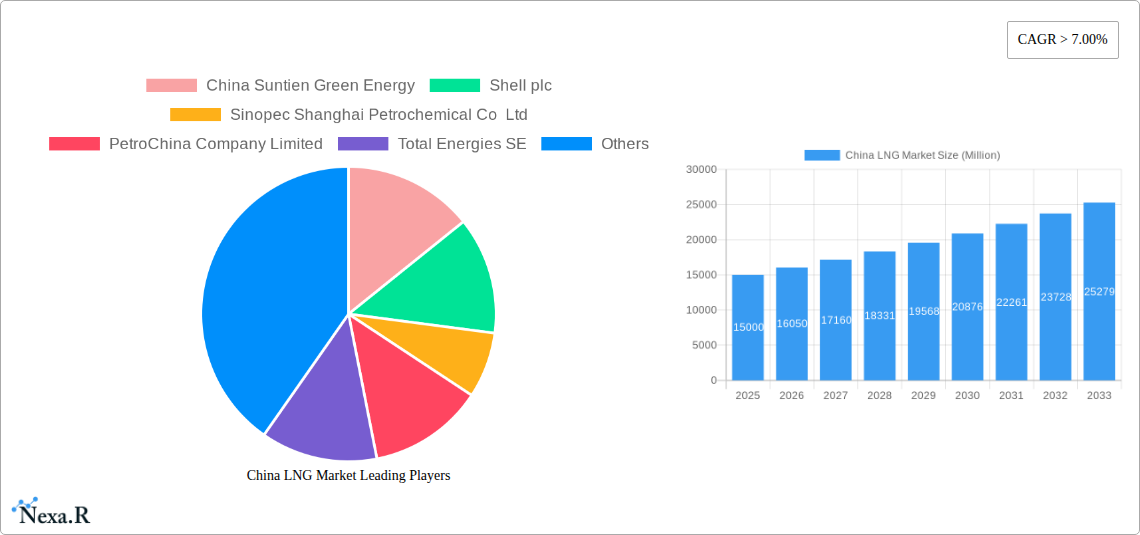

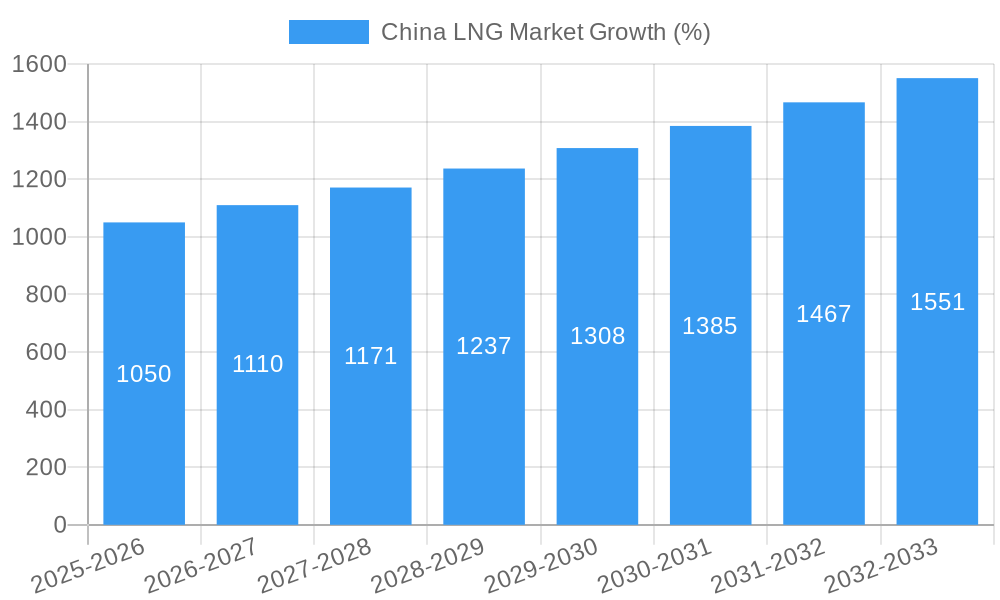

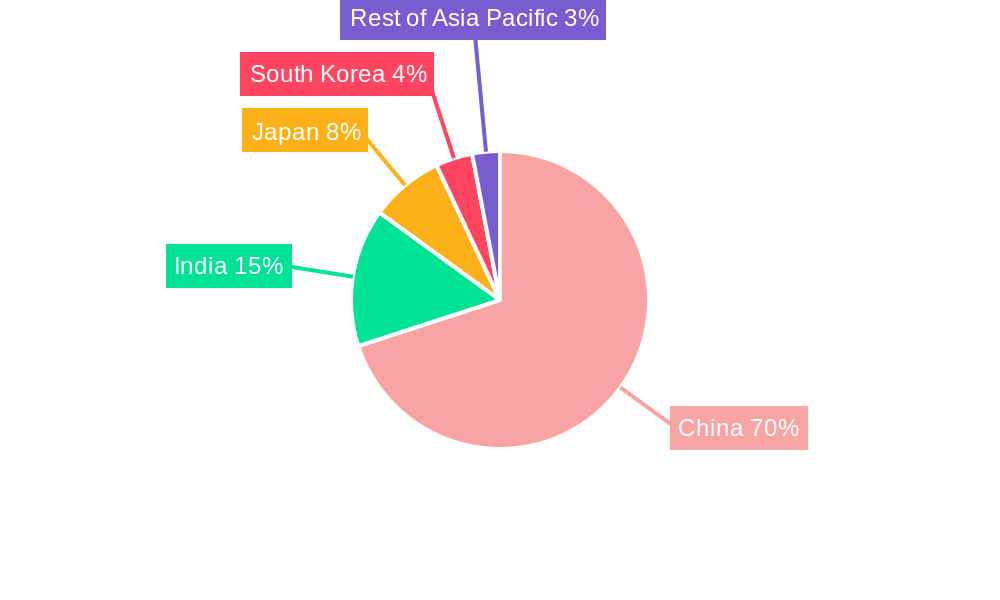

The China LNG market is experiencing robust growth, driven by increasing energy demand, stringent environmental regulations promoting cleaner fuels, and the government's push for energy security diversification away from coal. The market, valued at approximately $XX million in 2025 (assuming a reasonable market size based on global trends and Asia-Pacific growth), is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 7% through 2033. This expansion is fueled by significant investments in LNG infrastructure, including liquefaction and regasification plants, complemented by a burgeoning LNG shipping sector. Key players like China Suntien Green Energy, Shell plc, Sinopec, PetroChina, and Total Energies are actively shaping the market landscape through strategic partnerships, capacity expansions, and technological advancements. The Asia-Pacific region, particularly China, India, Japan, and South Korea, constitutes a significant portion of this growth, driven by rising industrialization and urbanization, leading to increased energy consumption.

While the market exhibits considerable potential, challenges remain. These include potential volatility in global LNG prices, the need for continuous investment in infrastructure to support growing demand, and ensuring efficient and reliable supply chains. Furthermore, technological advancements in LNG production and transportation are crucial to maintain cost competitiveness and environmental sustainability. Despite these restraints, the long-term outlook for the China LNG market remains positive, with continued growth expected as the country strives to meet its energy needs while transitioning toward a lower-carbon economy. The strategic focus on LNG infrastructure development, coupled with proactive government policies and the engagement of major international and domestic players, positions China as a significant force within the global LNG market.

China LNG Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China LNG market, encompassing market dynamics, growth trends, dominant segments, and key players. With a focus on the parent market (China Energy Market) and child markets (LNG Infrastructure: Liquefaction, Regasification, Shipping), this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period covers 2019-2024. Market values are presented in million units.

China LNG Market Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Chinese LNG sector. We examine market concentration, identifying the leading players and their market share percentages. The analysis delves into technological innovation drivers, including advancements in liquefaction and regasification technologies, and assesses the impact of regulatory frameworks on market growth. Further exploration includes competitive product substitutes, end-user demographics (power generation, industrial users, etc.), and recent mergers and acquisitions (M&A) activities within the market. We estimate that M&A deal volume in the period 2019-2024 reached xx million USD.

- Market Concentration: Highly concentrated market with top 5 players holding xx% market share in 2024.

- Technological Innovation: Focus on efficiency improvements in LNG liquefaction and regasification, and development of advanced shipping technologies.

- Regulatory Framework: Government policies promoting LNG adoption as a cleaner fuel source, but facing challenges in infrastructure development and environmental concerns.

- Competitive Substitutes: Coal and other fossil fuels remain major competitors, influencing market share and pricing.

- End-User Demographics: Power generation is the largest end-user segment, followed by industrial applications.

- M&A Trends: Strategic acquisitions and joint ventures driving consolidation and expansion within the sector.

China LNG Market Growth Trends & Insights

This section provides a detailed analysis of the China LNG market's growth trajectory, leveraging a comprehensive data set to identify key growth drivers and market trends. We analyze market size evolution from 2019 to 2024, projecting a CAGR of xx% during the forecast period (2025-2033). The analysis covers technological disruptions impacting market dynamics and consumer behavior shifts influencing demand patterns. The report also provides insights into market penetration rates across various end-use segments.

(This section will contain 600 words of detailed analysis based on the provided data, including specific CAGR and penetration metrics)

Dominant Regions, Countries, or Segments in China LNG Market

This section identifies the leading regions, countries, and segments within the China LNG market driving overall growth. We focus specifically on LNG infrastructure, including liquefaction plants, regasification plants, and LNG shipping. The analysis will identify the dominant regions based on capacity additions, investment levels, and market share.

- LNG Liquefaction Plants: Coastal regions with access to natural gas resources and export capabilities show significant growth.

- LNG Regasification Plants: Major port cities and industrial hubs are witnessing rapid expansion of regasification infrastructure.

- LNG Shipping: Increased demand for LNG transportation fuels growth in shipping capacity and associated services.

(This section will contain 600 words of detailed analysis of the dominant regions and segments, including market share, growth potential, and key drivers such as economic policies and infrastructure development.)

China LNG Market Product Landscape

The Chinese LNG market features a range of products catering to diverse needs, from large-scale liquefaction plants to smaller-scale regasification terminals. Innovations focus on efficiency improvements in liquefaction and regasification processes, reducing energy consumption and environmental impact. Advanced technologies enhance safety and reliability, while new applications expand into diverse sectors like transportation and power generation. Key performance indicators include energy efficiency, environmental footprint, and overall cost-effectiveness.

Key Drivers, Barriers & Challenges in China LNG Market

Key Drivers:

- Increasing demand for cleaner energy sources due to environmental concerns.

- Government policies promoting LNG as a transition fuel.

- Growth of power generation and industrial sectors.

Challenges & Restraints:

- High upfront capital investment required for LNG infrastructure development.

- Potential supply chain disruptions affecting LNG availability.

- Competition from other fuels, especially coal.

- Regulatory hurdles and permitting processes.

Emerging Opportunities in China LNG Market

Emerging opportunities include expansion into underserved regions, development of small-scale LNG infrastructure for remote areas, and the growing adoption of LNG as a fuel in transportation. Furthermore, technological advancements in LNG bunkering and the potential for LNG-based power generation in decentralized locations offer promising avenues for growth.

Growth Accelerators in the China LNG Market Industry

Long-term growth will be accelerated by technological breakthroughs in LNG liquefaction and regasification technologies, strategic partnerships between domestic and international players, and the continued expansion of LNG infrastructure across the country. Government support and investment in clean energy initiatives will further propel market growth.

Key Players Shaping the China LNG Market Market

- China Suntien Green Energy

- Shell plc

- Sinopec Shanghai Petrochemical Co Ltd

- PetroChina Company Limited

- Total Energies SE

Notable Milestones in China LNG Market Sector

- March 2021: Tianjin LNG terminal construction commenced (5 million tons/annum capacity); secured USD 500 million from Asian Investment Bank and EUR 430 million from New Development Bank.

- September 2021: Sinopec begins construction of Longkou LNG regasification terminal (6.5 million tons/annum capacity), expected to commission by October 2023.

In-Depth China LNG Market Market Outlook

The future of the China LNG market is bright, driven by sustained economic growth, increasing energy demand, and a strong commitment to cleaner energy sources. Strategic investments in infrastructure, technological advancements, and supportive government policies will create significant opportunities for growth and innovation. The market is poised for considerable expansion over the forecast period, presenting attractive prospects for both domestic and international players.

China LNG Market Segmentation

-

1. LNG Infrastructure

- 1.1. LNG Liquefaction Plants

- 1.2. LNG Regasification Plants

- 1.3. LNG Shipping

- 2. LNG Trades

China LNG Market Segmentation By Geography

- 1. China

China LNG Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. LNG regasification will dominate the market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China LNG Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by LNG Infrastructure

- 5.1.1. LNG Liquefaction Plants

- 5.1.2. LNG Regasification Plants

- 5.1.3. LNG Shipping

- 5.2. Market Analysis, Insights and Forecast - by LNG Trades

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by LNG Infrastructure

- 6. China China LNG Market Analysis, Insights and Forecast, 2019-2031

- 7. India China LNG Market Analysis, Insights and Forecast, 2019-2031

- 8. Japan China LNG Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea China LNG Market Analysis, Insights and Forecast, 2019-2031

- 10. Rest of Asia Pacific China LNG Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 China Suntien Green Energy

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Shell plc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sinopec Shanghai Petrochemical Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PetroChina Company Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Total Energies SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 China Suntien Green Energy

List of Figures

- Figure 1: China LNG Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China LNG Market Share (%) by Company 2024

List of Tables

- Table 1: China LNG Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China LNG Market Volume Metric Tonnes Forecast, by Region 2019 & 2032

- Table 3: China LNG Market Revenue Million Forecast, by LNG Infrastructure 2019 & 2032

- Table 4: China LNG Market Volume Metric Tonnes Forecast, by LNG Infrastructure 2019 & 2032

- Table 5: China LNG Market Revenue Million Forecast, by LNG Trades 2019 & 2032

- Table 6: China LNG Market Volume Metric Tonnes Forecast, by LNG Trades 2019 & 2032

- Table 7: China LNG Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: China LNG Market Volume Metric Tonnes Forecast, by Region 2019 & 2032

- Table 9: China LNG Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: China LNG Market Volume Metric Tonnes Forecast, by Country 2019 & 2032

- Table 11: China China LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China China LNG Market Volume (Metric Tonnes) Forecast, by Application 2019 & 2032

- Table 13: India China LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: India China LNG Market Volume (Metric Tonnes) Forecast, by Application 2019 & 2032

- Table 15: Japan China LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan China LNG Market Volume (Metric Tonnes) Forecast, by Application 2019 & 2032

- Table 17: South Korea China LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea China LNG Market Volume (Metric Tonnes) Forecast, by Application 2019 & 2032

- Table 19: Rest of Asia Pacific China LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Asia Pacific China LNG Market Volume (Metric Tonnes) Forecast, by Application 2019 & 2032

- Table 21: China LNG Market Revenue Million Forecast, by LNG Infrastructure 2019 & 2032

- Table 22: China LNG Market Volume Metric Tonnes Forecast, by LNG Infrastructure 2019 & 2032

- Table 23: China LNG Market Revenue Million Forecast, by LNG Trades 2019 & 2032

- Table 24: China LNG Market Volume Metric Tonnes Forecast, by LNG Trades 2019 & 2032

- Table 25: China LNG Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: China LNG Market Volume Metric Tonnes Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China LNG Market?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the China LNG Market?

Key companies in the market include China Suntien Green Energy, Shell plc, Sinopec Shanghai Petrochemical Co Ltd, PetroChina Company Limited, Total Energies SE.

3. What are the main segments of the China LNG Market?

The market segments include LNG Infrastructure, LNG Trades.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas.

6. What are the notable trends driving market growth?

LNG regasification will dominate the market..

7. Are there any restraints impacting market growth?

4.; High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

In 2022, the Tianjin LNG terminal went under construction with a capacity of 5 metric tons per annum. The project received a sovereign loan from Asian Investment Bank (USD 500 million) and New Development Bank (EUR 430 million) in March 2021.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Metric Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China LNG Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China LNG Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China LNG Market?

To stay informed about further developments, trends, and reports in the China LNG Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence