Key Insights

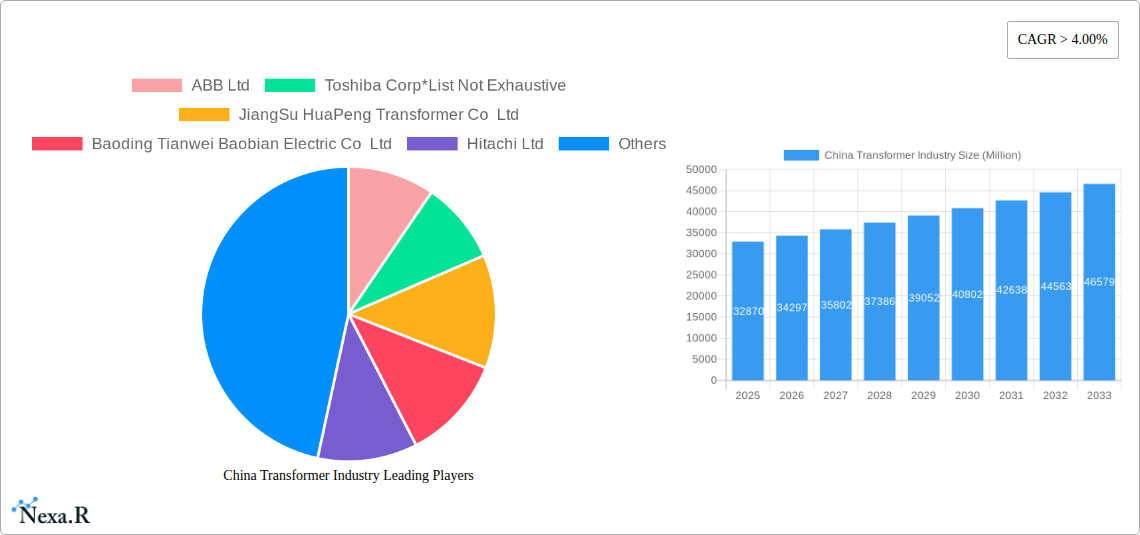

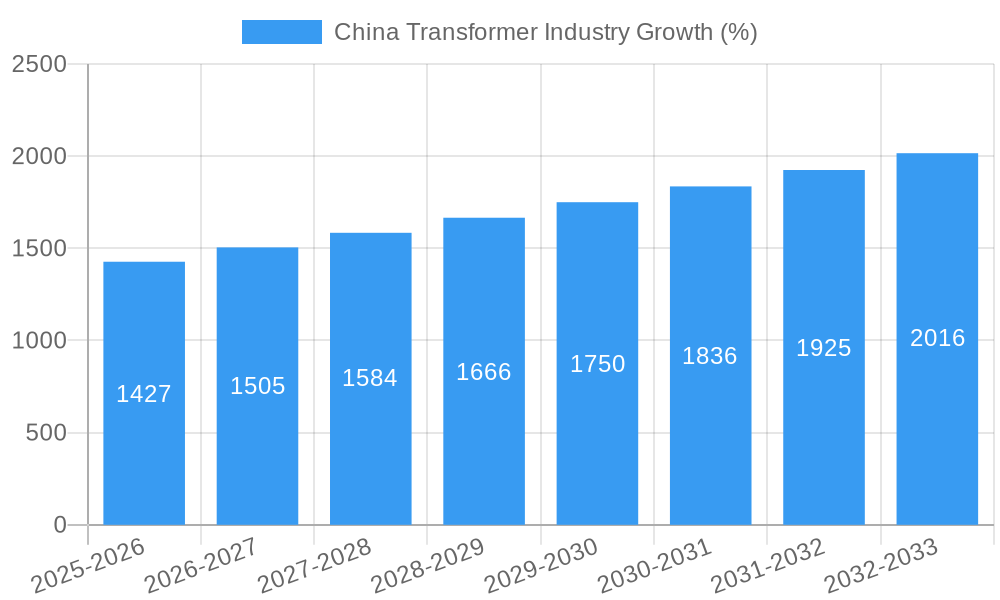

The China transformer industry, valued at $32.87 billion in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4.00% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, China's substantial investment in infrastructure development, particularly in renewable energy sources like solar and wind power, necessitates a significant increase in transformer capacity for efficient power transmission and distribution. Secondly, the ongoing urbanization and industrialization within China are placing increasing demands on the electrical grid, driving the need for advanced and higher-capacity transformers. Thirdly, government initiatives promoting energy efficiency and smart grid technologies are further stimulating market growth. The market is segmented by power rating (small, medium, large), cooling type (air-cooled, oil-cooled), and transformer type (power, distribution). While air-cooled transformers currently dominate the market due to lower costs, oil-cooled transformers are gaining traction due to their superior efficiency and capacity for handling higher voltages. The distribution transformer segment holds a larger market share than the power transformer segment due to the widespread deployment of electricity infrastructure across the country. Major players such as ABB, Toshiba, Hitachi, Siemens, and Schneider Electric are actively competing in this dynamic market, continuously innovating to meet evolving customer needs and regulatory standards.

The market faces certain restraints, including potential fluctuations in raw material prices (like copper and steel) and increasing environmental regulations related to transformer manufacturing and disposal. However, the long-term outlook remains positive, driven by continued infrastructure development and the nation's commitment to clean energy transition. The increasing adoption of smart grid technologies and the rising demand for advanced transformer solutions, such as those with higher efficiency ratings and improved reliability, represent significant opportunities for market participants. This growth will likely be concentrated in regions experiencing rapid economic expansion and industrial growth within China, leading to regional variations in market share. Competition is intense, with both domestic and international companies vying for market share through product innovation, technological advancements, and strategic partnerships.

China Transformer Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the China transformer industry, covering market dynamics, growth trends, key players, and future outlook. With a focus on power and distribution transformers, this report is essential for industry professionals, investors, and anyone seeking to understand this rapidly evolving market. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033.

China Transformer Industry Market Dynamics & Structure

The China transformer industry is characterized by a dynamic interplay of technological innovation, stringent regulatory frameworks, and intense competition. Market concentration is moderate, with several large domestic and international players vying for market share. The market is segmented by power rating (small, medium, large), cooling type (air-cooled, oil-cooled), and transformer type (power transformer, distribution transformer). Significant M&A activity has been observed, particularly amongst smaller players seeking to consolidate their market position. Innovation is driven by the need for greater efficiency, improved reliability, and the integration of smart grid technologies. However, barriers to innovation include high R&D costs and the need for robust testing and certification procedures. The increasing adoption of renewable energy sources is driving demand for specific transformer types, while the government's focus on grid modernization is creating new opportunities.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share in 2024 (estimated).

- Technological Innovation: Driven by smart grid integration, higher efficiency requirements, and renewable energy integration.

- Regulatory Framework: Stringent safety and quality standards influence technology adoption and market access.

- Competitive Substitutes: Limited direct substitutes, but alternative technologies (e.g., power electronics) pose indirect competition.

- End-User Demographics: Primarily driven by utilities, industrial users, and renewable energy developers.

- M&A Trends: xx number of deals recorded in the past five years, primarily focused on consolidation amongst smaller players.

China Transformer Industry Growth Trends & Insights

The China transformer market experienced robust growth during the historical period (2019-2024), driven by substantial investments in infrastructure development and grid modernization. The market size reached xx million units in 2024, exhibiting a CAGR of xx% during this period. This growth is expected to continue, albeit at a moderated pace, during the forecast period (2025-2033), reaching xx million units by 2033, driven by sustained demand from the power sector, industrial expansion and the ongoing expansion of renewable energy infrastructure. Technological disruptions, such as the adoption of advanced materials and digital technologies, are enhancing transformer efficiency and performance, driving market penetration. Consumer behavior shifts towards greater preference for energy-efficient and environmentally friendly solutions are further contributing to market growth. The market penetration of smart transformers is expected to increase significantly during the forecast period.

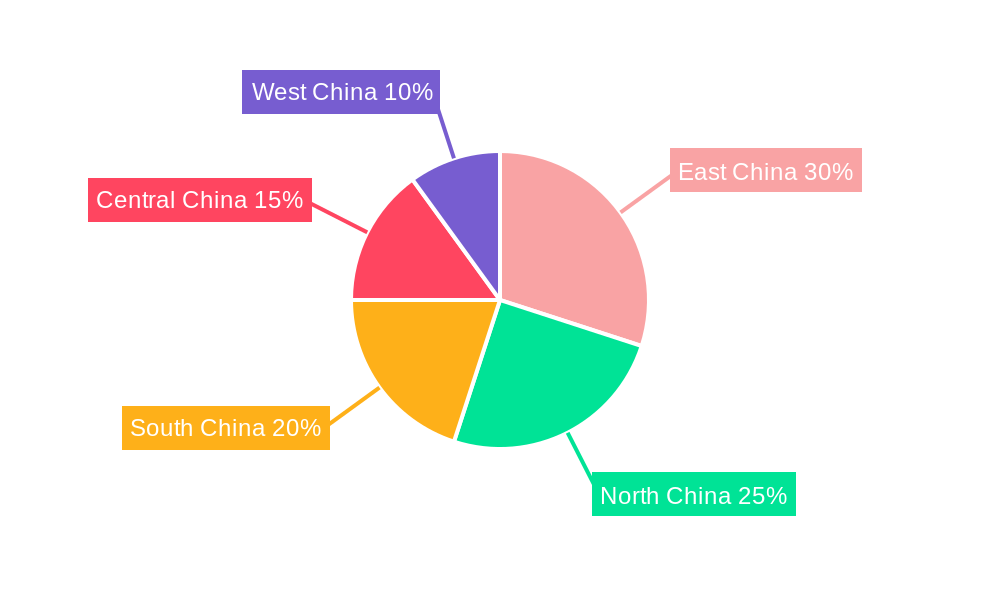

Dominant Regions, Countries, or Segments in China Transformer Industry

The eastern coastal regions of China, including Jiangsu, Guangdong, and Zhejiang provinces, are the dominant markets for transformers, fueled by high levels of industrial activity and concentrated energy consumption. Within the segment breakdown, the large power transformer segment displays significant growth potential, due to ongoing investments in large-scale power transmission projects and renewable energy integration. The oil-cooled transformer segment also dominates due to its higher efficiency and better performance in demanding environments.

- Key Drivers: Government investments in infrastructure, industrial expansion, increasing urbanization, and the growth of renewable energy.

- Dominant Regions: Jiangsu, Guangdong, Zhejiang provinces (and other eastern coastal regions) show highest market share and growth.

- Dominant Segment: Large power transformers and oil-cooled transformers demonstrate the highest market share and growth potential.

China Transformer Industry Product Landscape

The China transformer industry offers a diverse range of products, catering to varied power ratings, cooling requirements, and application needs. Innovations focus on improving efficiency, reliability, and smart grid integration. Key advancements include the use of advanced materials, improved insulation systems, and the integration of digital technologies for monitoring and control. Unique selling propositions often center on customized solutions tailored to specific customer requirements, and adherence to stringent quality and safety standards.

Key Drivers, Barriers & Challenges in China Transformer Industry

Key Drivers:

- Increasing electricity demand fueled by economic growth and urbanization.

- Government initiatives promoting grid modernization and renewable energy integration.

- Technological advancements leading to higher efficiency and reliability.

Challenges and Restraints:

- Intense competition, particularly from international players.

- Fluctuations in raw material prices.

- Stringent environmental regulations.

- Supply chain disruptions impacting production costs and timelines. These disruptions impacted production by an estimated xx% in 2022.

Emerging Opportunities in China Transformer Industry

Emerging opportunities exist in the growing renewable energy sector, particularly in wind and solar power generation. The increasing demand for smart grid technologies presents significant growth potential for intelligent transformers equipped with advanced monitoring and control systems. Furthermore, the expansion of high-voltage direct current (HVDC) transmission lines creates opportunities for specialized HVDC transformers.

Growth Accelerators in the China Transformer Industry Industry

Technological advancements in materials science and digital technologies will continue to drive efficiency improvements and cost reductions. Strategic partnerships between domestic and international players are facilitating technology transfer and market expansion. Continued investments in grid modernization and renewable energy integration will sustain market growth throughout the forecast period.

Key Players Shaping the China Transformer Industry Market

- ABB Ltd

- Toshiba Corp

- Jiangsu HuaPeng Transformer Co Ltd

- Baoding Tianwei Baobian Electric Co Ltd

- Hitachi Ltd

- Mitsubishi Electric Corporation

- Siemens AG

- Schneider Electric SE

- General Electric Company

- Panasonic Corporation

Notable Milestones in China Transformer Industry Sector

- November 2022: Successful installation of the first domestically produced converter transformer with on-load tap changers in a major west-to-east power transmission project in Guangdong Province. This marked a significant breakthrough in high-end transformer technology.

- March 2022: The State Grid Corporation of China (SGCC) ordered two EconiQ™ power transformers from Hitachi Energy for an innovative substation project in Jiangsu Province, showcasing a commitment to sustainable technology.

In-Depth China Transformer Industry Market Outlook

The China transformer industry is poised for continued growth, driven by robust infrastructure development, renewable energy expansion, and technological advancements. Strategic partnerships and investments in R&D will play a key role in shaping the future of the market. The focus on smart grid technologies and energy efficiency will continue to drive demand for advanced transformer solutions, presenting significant opportunities for both domestic and international players.

China Transformer Industry Segmentation

-

1. Power Rating

- 1.1. Small

- 1.2. Large

- 1.3. Medium

-

2. Cooling Type

- 2.1. Air-Cooled

- 2.2. Oil-Cooled

-

3. Transformer Type

- 3.1. Power Transformer

- 3.2. Distribution Transformer

China Transformer Industry Segmentation By Geography

- 1. China

China Transformer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Shift toward Renewable Energy

- 3.4. Market Trends

- 3.4.1. Distribution Transformer Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Transformer Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Rating

- 5.1.1. Small

- 5.1.2. Large

- 5.1.3. Medium

- 5.2. Market Analysis, Insights and Forecast - by Cooling Type

- 5.2.1. Air-Cooled

- 5.2.2. Oil-Cooled

- 5.3. Market Analysis, Insights and Forecast - by Transformer Type

- 5.3.1. Power Transformer

- 5.3.2. Distribution Transformer

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Power Rating

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Toshiba Corp*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 JiangSu HuaPeng Transformer Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Baoding Tianwei Baobian Electric Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hitachi Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsubishi Electric Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Siemens AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Schneider Electric SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 General Electric Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: China Transformer Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Transformer Industry Share (%) by Company 2024

List of Tables

- Table 1: China Transformer Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Transformer Industry Revenue Million Forecast, by Power Rating 2019 & 2032

- Table 3: China Transformer Industry Revenue Million Forecast, by Cooling Type 2019 & 2032

- Table 4: China Transformer Industry Revenue Million Forecast, by Transformer Type 2019 & 2032

- Table 5: China Transformer Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: China Transformer Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Transformer Industry Revenue Million Forecast, by Power Rating 2019 & 2032

- Table 8: China Transformer Industry Revenue Million Forecast, by Cooling Type 2019 & 2032

- Table 9: China Transformer Industry Revenue Million Forecast, by Transformer Type 2019 & 2032

- Table 10: China Transformer Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Transformer Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the China Transformer Industry?

Key companies in the market include ABB Ltd, Toshiba Corp*List Not Exhaustive, JiangSu HuaPeng Transformer Co Ltd, Baoding Tianwei Baobian Electric Co Ltd, Hitachi Ltd, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, General Electric Company, Panasonic Corporation.

3. What are the main segments of the China Transformer Industry?

The market segments include Power Rating, Cooling Type, Transformer Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.87 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development.

6. What are the notable trends driving market growth?

Distribution Transformer Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Shift toward Renewable Energy.

8. Can you provide examples of recent developments in the market?

November 2022: An major west-to-east power transmission project in Guangdong Province, South China, successfully installed the first convertor transformer using on-load tap changers built in China. This signifies that China has successfully overcome the limitations imposed by this key technology in high-end electric equipment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Transformer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Transformer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Transformer Industry?

To stay informed about further developments, trends, and reports in the China Transformer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence