Key Insights

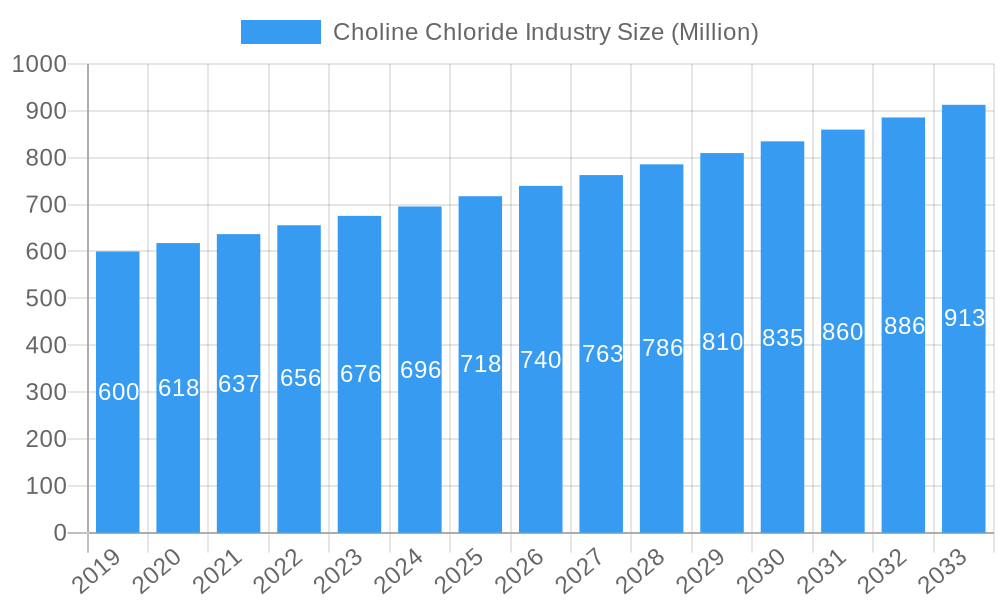

The global Choline Chloride market is poised for significant expansion, projected to reach approximately USD 750 million by 2025 and demonstrating a robust Compound Annual Growth Rate (CAGR) exceeding 4.00% through 2033. This impressive growth is primarily fueled by the escalating demand from the animal feed sector, specifically for poultry and swine, where choline chloride is a vital nutrient for growth, metabolism, and overall health. As global meat consumption continues to rise, driven by population growth and increasing disposable incomes in emerging economies, the need for efficient animal husbandry practices intensifies, directly benefiting the choline chloride market. Furthermore, evolving feed formulations that prioritize animal well-being and performance are incorporating higher levels of essential nutrients like choline chloride, reinforcing its market position. The application in human nutrition, though currently smaller, is also experiencing a steady ascent due to growing awareness of choline's health benefits, including cognitive function and liver health, leading to its inclusion in dietary supplements and functional foods.

Choline Chloride Industry Market Size (In Million)

Key drivers such as the increasing adoption of advanced animal feed technologies, a growing preference for fortified animal feed products, and a burgeoning interest in health and wellness products for human consumption are shaping the trajectory of the choline chloride market. While the market enjoys strong tailwinds, certain restraints need to be navigated. Fluctuations in raw material prices, particularly those associated with trimethylamine and ethylene oxide, can impact manufacturing costs and profitability. Additionally, stringent regulatory frameworks governing the production and application of feed additives in different regions may present compliance challenges for market players. Nevertheless, the industry is witnessing significant trends towards the development of more sustainable and cost-effective production methods, alongside innovations in product formulations to enhance bioavailability and efficacy. Companies are actively investing in research and development to cater to specialized market needs and expand their global footprint, positioning the choline chloride market for sustained and dynamic growth in the coming years.

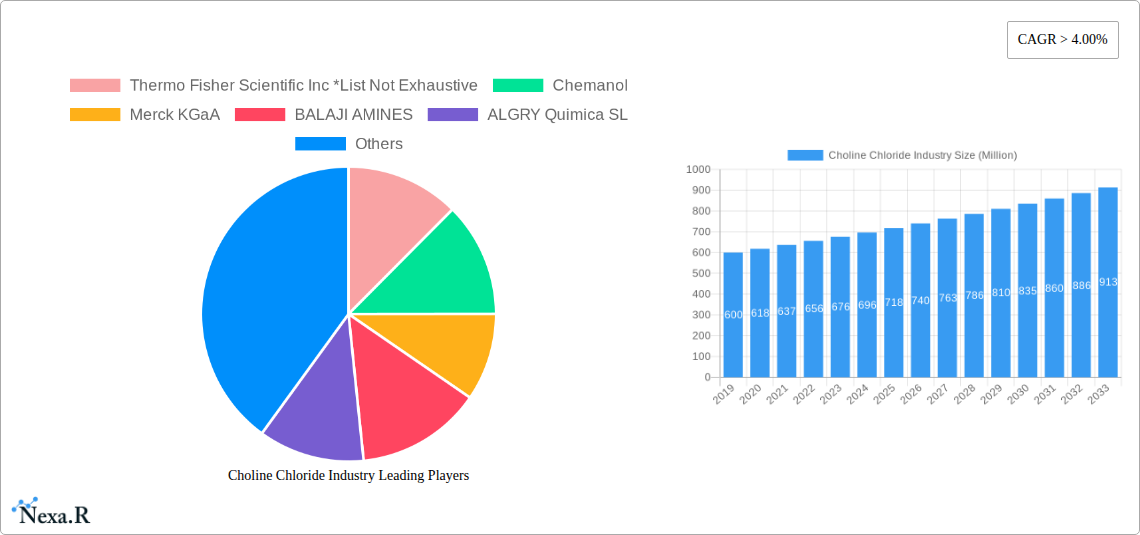

Choline Chloride Industry Company Market Share

Choline Chloride Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019–2033)

This comprehensive report delves into the dynamic choline chloride market, a crucial nutrient with widespread applications across animal feed, human nutrition, and industrial sectors. Analyzing the global choline chloride market size from 2019–2033, with a base and estimated year of 2025, this study provides unparalleled insights into market dynamics, growth trajectories, and future potential. The report leverages extensive data to detail market concentration, technological innovation drivers, regulatory frameworks, competitive product substitutes, end-user demographics, and M&A trends. It further dissects market evolution, adoption rates, technological disruptions, and consumer behavior shifts, offering specific metrics like CAGR and market penetration. Identify dominant regions, countries, and choline chloride applications like poultry feed, swine feed, pet feed, and human nutrition, alongside oil and gas sector utilization. Uncover product innovations, performance metrics, and unique selling propositions. This analysis pinpoints key drivers, barriers, and challenges, including supply chain complexities and regulatory hurdles, while highlighting emerging opportunities and growth accelerators. Detailed company profiles of key players such as Thermo Fisher Scientific Inc, Chemanol, Merck KGaA, BALAJI AMINES, ALGRY Quimica SL, SDA Products, Liaoning Biochem Co Ltd, Spectrum Chemical, Neobiótica SA, BASF SE, NB Group Co Ltd, IMPERIAL GROUP LIMITED, Eastman Chemical Company, Impextraco NV, Tokyo Chemical Industry, Kemin Industries Inc, Balchem Inc, Muby Chemicals of Mubychem Group, and GHW International are provided, along with a timeline of notable industry milestones.

Choline Chloride Industry Market Dynamics & Structure

The global choline chloride market is characterized by moderate to high market concentration, with a few key players dominating production and distribution. Technological innovation remains a significant driver, particularly in enhancing product purity, stability, and bioavailability for various choline chloride applications. Regulatory frameworks, primarily focused on animal feed safety and human dietary supplements, influence product development and market access. Competitive product substitutes, though present, often lack the comprehensive efficacy of choline chloride in its primary applications, particularly in poultry feed and swine feed. End-user demographics are increasingly diverse, driven by growing demand for animal protein and a rising awareness of nutritional supplements. Mergers and acquisitions (M&A) trends are evident as companies seek to expand their market reach, integrate supply chains, and diversify their product portfolios. For instance, the agreement between Methanol Chemicals Company (Chemanol) and Saudi GDI for specialty chemicals production, including choline chloride, valued at nearly USD 1.33 million, exemplifies strategic expansion.

- Market Concentration: Dominated by a blend of multinational corporations and specialized regional manufacturers.

- Technological Innovation: Focus on advanced synthesis methods, encapsulation technologies for improved stability, and higher purity grades for pharmaceutical and food applications.

- Regulatory Landscape: Stringent quality control measures and certifications required for feed additives and nutritional ingredients.

- Competitive Landscape: While some alternatives exist, choline chloride remains a preferred choice due to its cost-effectiveness and proven benefits.

- End-User Evolution: Increasing demand from developing economies for animal nutrition and growing interest in choline chloride for human nutrition and cognitive health.

- M&A Activity: Strategic acquisitions aimed at consolidating market share, gaining access to new technologies, and expanding geographical presence.

Choline Chloride Industry Growth Trends & Insights

The choline chloride market is poised for robust growth, driven by a confluence of evolving industry trends and increasing demand across its diverse application spectrum. The global choline chloride market size is projected to experience a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period of 2025–2033, reaching an estimated value of USD xx million by 2033. This expansion is underpinned by steadily increasing adoption rates in animal nutrition, where choline chloride is an essential nutrient for growth, metabolism, and reproductive health in livestock and poultry. The poultry feed segment, in particular, continues to be a primary growth engine, accounting for an estimated xx% of the total market share in 2025. Similarly, the swine feed segment is demonstrating significant growth, fueled by the increasing global demand for pork.

Technological disruptions are playing a pivotal role, with ongoing research into novel delivery systems and enhanced formulations that improve choline chloride's efficacy and reduce wastage. The development of liquid and dry forms of choline chloride, each tailored for specific feeding systems, further caters to industry needs. Consumer behavior shifts, especially concerning health and wellness, are indirectly benefiting the choline chloride market through increased demand for fortified foods and dietary supplements. The growing awareness of choline chloride's importance in human nutrition, particularly for brain development and cognitive function, is opening new avenues for market penetration beyond traditional feed applications. The pet feed sector is also witnessing substantial growth, as pet owners increasingly seek premium, nutritionally complete diets for their companions. The overall market penetration of choline chloride is expected to rise from xx% in 2024 to xx% by 2033, reflecting its expanding utility and indispensable role in various industries.

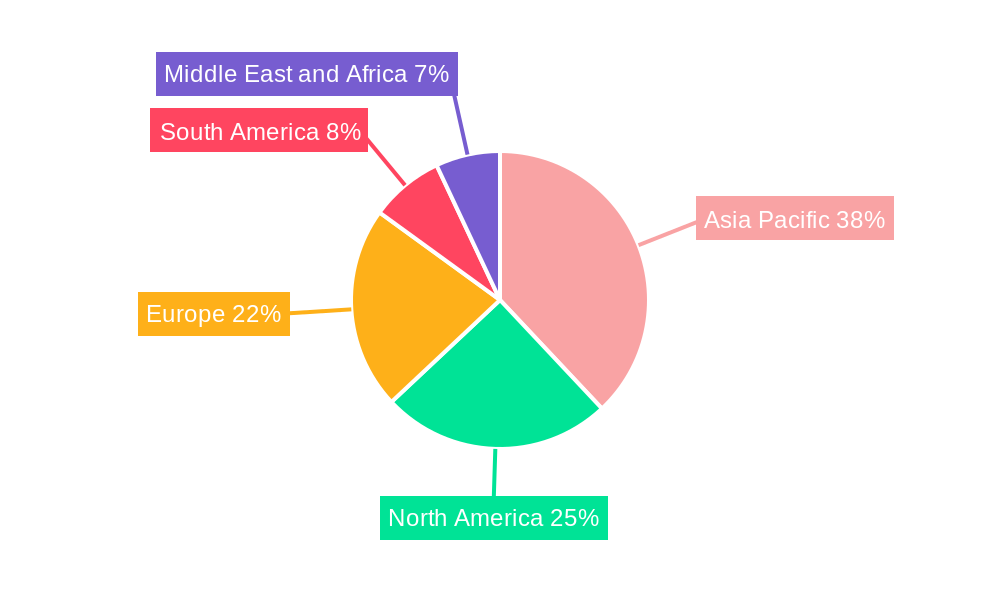

Dominant Regions, Countries, or Segments in Choline Chloride Industry

The choline chloride industry is experiencing significant growth and dominance by specific regions and application segments. Poultry feed stands out as the most dominant application, consistently driving market expansion due to the sheer scale of global poultry production and the critical role of choline chloride in avian health, growth, and egg production. This segment alone is estimated to command approximately xx% of the total market share in 2025. Key drivers for this dominance include the rising global consumption of poultry meat, coupled with advancements in intensive farming practices that necessitate precise nutritional inputs. Economic policies in major poultry-producing nations, such as the United States, China, and Brazil, which support agricultural output and exports, further bolster demand. Infrastructure development in these regions, facilitating efficient feed production and distribution, also plays a crucial role.

Following closely is the swine feed segment, which is projected to witness substantial growth, driven by increasing global demand for pork, particularly in Asian markets. The market share for swine feed is estimated at xx% in 2025, with strong potential for future expansion. The human nutrition segment, while smaller in comparison to animal feed, is exhibiting a remarkable growth trajectory. Increasing consumer awareness regarding the health benefits of choline chloride, such as its role in brain health, fetal development, and liver function, is fueling demand for dietary supplements and fortified foods. This segment is expected to capture xx% of the market share by 2033.

Geographically, North America and Asia-Pacific are the leading regions in the choline chloride market. North America's dominance is attributed to its mature animal feed industry, advanced agricultural technologies, and high per capita consumption of animal protein. The United States, a major producer of poultry and swine, is a significant market for choline chloride. The Asia-Pacific region, on the other hand, is the fastest-growing market, propelled by its rapidly expanding population, increasing disposable incomes, and a growing middle class that drives demand for animal protein and nutritional supplements. Countries like China and India are emerging as key growth hubs within this region. The oil and gas sector, though a niche application, also contributes to overall market dynamics through its use in drilling fluids.

Choline Chloride Industry Product Landscape

The choline chloride product landscape is marked by continuous innovation aimed at enhancing its efficacy and versatility across diverse applications. Manufacturers offer choline chloride in various forms, including granular, liquid, and powder, each optimized for specific handling and incorporation into feed formulations. Key product innovations focus on improving stability, reducing hygroscopicity, and ensuring higher bioavailability. For instance, coated and encapsulated choline chloride products are gaining traction, offering extended shelf life and controlled release properties, particularly beneficial in complex feed matrices. Performance metrics are rigorously monitored to ensure purity levels, typically exceeding 98% for feed-grade and higher for pharmaceutical-grade products. Unique selling propositions often revolve around product consistency, ease of handling, and tailored solutions for specific animal species or dietary needs. Technological advancements are also leading to the development of more sustainable production methods, reducing environmental impact while meeting stringent quality standards.

Key Drivers, Barriers & Challenges in Choline Chloride Industry

Key Drivers:

- Growing global demand for animal protein: The increasing population and rising disposable incomes worldwide are escalating the consumption of meat, eggs, and dairy products, directly boosting the demand for choline chloride in animal feed.

- Expansion of the human nutrition sector: Growing awareness of choline chloride's health benefits, including its role in cognitive function and prenatal health, is driving its use in dietary supplements and fortified foods.

- Technological advancements in animal husbandry: Modern farming practices necessitate optimized nutrition for livestock, making choline chloride an indispensable supplement for improved growth rates and health.

- Increasing pet ownership: The booming pet feed market, with owners seeking premium and nutritionally complete diets, is creating new demand for choline chloride.

Barriers & Challenges:

- Fluctuations in raw material prices: The cost of key raw materials, such as methanol and ethylene oxide, can significantly impact production costs and profit margins for choline chloride manufacturers.

- Stringent regulatory compliance: Adhering to diverse and evolving regulatory standards for feed additives and food ingredients across different regions can be complex and costly.

- Supply chain disruptions: Global events, geopolitical instability, and logistical challenges can disrupt the supply of raw materials and the distribution of finished products.

- Intense competition: The choline chloride market is competitive, with numerous global and regional players vying for market share, potentially leading to price pressures.

Emerging Opportunities in Choline Chloride Industry

Emerging opportunities in the choline chloride industry lie in the expanding human nutrition segment, driven by a growing understanding of its crucial role in cognitive health and fetal development. The development of specialized choline chloride formulations for specific life stages and health conditions presents a significant avenue. Furthermore, the increasing demand for high-quality, sustainable animal feed in developing economies offers substantial growth potential. Innovations in encapsulation technologies to improve choline chloride's stability and delivery in challenging feed environments, as well as its potential applications in the aquaculture sector, represent untapped markets. Exploring novel industrial applications beyond oil and gas could also unlock new revenue streams.

Growth Accelerators in the Choline Chloride Industry Industry

Several key factors are accelerating the growth of the choline chloride industry. The continuous innovation in animal nutrition, leading to more efficient and targeted feed formulations, is a major catalyst. Strategic partnerships between feed manufacturers and choline chloride producers are facilitating market penetration and product development. Market expansion into underserved regions, particularly in developing countries with growing livestock industries, is a significant growth accelerator. Furthermore, the increasing focus on health and wellness is propelling the demand for choline chloride in dietary supplements, creating a synergistic growth effect. Research into novel applications and improved production technologies will continue to fuel expansion.

Key Players Shaping the Choline Chloride Industry Market

- Thermo Fisher Scientific Inc

- Chemanol

- Merck KGaA

- BALAJI AMINES

- ALGRY Quimica SL

- SDA Products

- Liaoning Biochem Co Ltd

- Spectrum Chemical

- Neobiótica SA

- BASF SE

- NB Group Co Ltd

- IMPERIAL GROUP LIMITED

- Eastman Chemical Company

- Impextraco NV

- Tokyo Chemical Industry

- Kemin Industries Inc

- Balchem Inc

- Muby Chemicals of Mubychem Group

- GHW International

Notable Milestones in Choline Chloride Industry Sector

- October 2022: Methanol Chemicals Company (Chemanol) signed an agreement worth nearly USD 1.33 million with Saudi GDI for the production of specialty chemicals that include choline chloride as well as methyl diethanolamine. This strategic alliance aims to expand production capacity and product offerings in the specialty chemicals sector.

- January 2021: Balchem, a leading producer of choline products for use in animal nutrition, launched a new line of choline chloride products for Europe, the Middle East, Africa, and Asia. This expansion broadened their global reach and product availability to key international markets.

In-Depth Choline Chloride Industry Market Outlook

The future outlook for the choline chloride industry is exceptionally promising, fueled by robust growth accelerators and emerging opportunities. The expanding global demand for animal protein will continue to drive the poultry feed and swine feed segments, cementing their positions as core market pillars. Simultaneously, the increasing consumer focus on preventative healthcare and cognitive well-being is poised to significantly elevate the human nutrition segment, creating new frontiers for specialized choline chloride applications. Advancements in production technologies, leading to higher purity, enhanced stability, and more sustainable manufacturing processes, will further bolster market competitiveness and adoption. Strategic collaborations and market expansion into high-growth developing economies will be critical for players seeking to capitalize on the projected USD xx million market size by 2033, offering substantial long-term growth potential and strategic advantages.

Choline Chloride Industry Segmentation

-

1. Application

- 1.1. Poultry Feed

- 1.2. Swine Feed

- 1.3. Pet Feed

- 1.4. Human Nutrition

- 1.5. Oil and Gas

- 1.6. Other Applications

Choline Chloride Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Choline Chloride Industry Regional Market Share

Geographic Coverage of Choline Chloride Industry

Choline Chloride Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapidly Growing Demand from the Poultry Industry; Increased Intake as Human Nutrition Supplements

- 3.3. Market Restrains

- 3.3.1. Animal Disease Outbreaks

- 3.4. Market Trends

- 3.4.1. High Demand from Poultry Feed Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Choline Chloride Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Poultry Feed

- 5.1.2. Swine Feed

- 5.1.3. Pet Feed

- 5.1.4. Human Nutrition

- 5.1.5. Oil and Gas

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Choline Chloride Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Poultry Feed

- 6.1.2. Swine Feed

- 6.1.3. Pet Feed

- 6.1.4. Human Nutrition

- 6.1.5. Oil and Gas

- 6.1.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America Choline Chloride Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Poultry Feed

- 7.1.2. Swine Feed

- 7.1.3. Pet Feed

- 7.1.4. Human Nutrition

- 7.1.5. Oil and Gas

- 7.1.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Choline Chloride Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Poultry Feed

- 8.1.2. Swine Feed

- 8.1.3. Pet Feed

- 8.1.4. Human Nutrition

- 8.1.5. Oil and Gas

- 8.1.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Choline Chloride Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Poultry Feed

- 9.1.2. Swine Feed

- 9.1.3. Pet Feed

- 9.1.4. Human Nutrition

- 9.1.5. Oil and Gas

- 9.1.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Choline Chloride Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Poultry Feed

- 10.1.2. Swine Feed

- 10.1.3. Pet Feed

- 10.1.4. Human Nutrition

- 10.1.5. Oil and Gas

- 10.1.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Thermo Fisher Scientific Inc *List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Chemanol

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Merck KGaA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BALAJI AMINES

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ALGRY Quimica SL

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SDA Products

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Liaoning Biochem Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Spectrum Chemical

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Neobiótica SA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BASF SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 NB Group Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 IMPERIAL GROUP LIMITED

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Eastman Chemical Company

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Impextraco NV

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Tokyo Chemical Industry

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Kemin Industries Inc

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Balchem Inc

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Muby Chemicals of Mubychem Group

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 GHW International

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Thermo Fisher Scientific Inc *List Not Exhaustive

List of Figures

- Figure 1: Global Choline Chloride Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Choline Chloride Industry Revenue (undefined), by Application 2025 & 2033

- Figure 3: Asia Pacific Choline Chloride Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: Asia Pacific Choline Chloride Industry Revenue (undefined), by Country 2025 & 2033

- Figure 5: Asia Pacific Choline Chloride Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America Choline Chloride Industry Revenue (undefined), by Application 2025 & 2033

- Figure 7: North America Choline Chloride Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Choline Chloride Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Choline Chloride Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Choline Chloride Industry Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe Choline Chloride Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Choline Chloride Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Choline Chloride Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Choline Chloride Industry Revenue (undefined), by Application 2025 & 2033

- Figure 15: South America Choline Chloride Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America Choline Chloride Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America Choline Chloride Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Choline Chloride Industry Revenue (undefined), by Application 2025 & 2033

- Figure 19: Middle East and Africa Choline Chloride Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa Choline Chloride Industry Revenue (undefined), by Country 2025 & 2033

- Figure 21: Middle East and Africa Choline Chloride Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Choline Chloride Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Choline Chloride Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Choline Chloride Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Choline Chloride Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: China Choline Chloride Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: India Choline Chloride Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Japan Choline Chloride Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: South Korea Choline Chloride Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Rest of Asia Pacific Choline Chloride Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Choline Chloride Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Choline Chloride Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: United States Choline Chloride Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Canada Choline Chloride Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Mexico Choline Chloride Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Global Choline Chloride Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 16: Global Choline Chloride Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Germany Choline Chloride Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Choline Chloride Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy Choline Chloride Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: France Choline Chloride Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Choline Chloride Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Choline Chloride Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: Global Choline Chloride Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Brazil Choline Chloride Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Argentina Choline Chloride Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Rest of South America Choline Chloride Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Global Choline Chloride Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: Global Choline Chloride Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Saudi Arabia Choline Chloride Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Africa Choline Chloride Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa Choline Chloride Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Choline Chloride Industry?

The projected CAGR is approximately 7.6%.

2. Which companies are prominent players in the Choline Chloride Industry?

Key companies in the market include Thermo Fisher Scientific Inc *List Not Exhaustive, Chemanol, Merck KGaA, BALAJI AMINES, ALGRY Quimica SL, SDA Products, Liaoning Biochem Co Ltd, Spectrum Chemical, Neobiótica SA, BASF SE, NB Group Co Ltd, IMPERIAL GROUP LIMITED, Eastman Chemical Company, Impextraco NV, Tokyo Chemical Industry, Kemin Industries Inc, Balchem Inc, Muby Chemicals of Mubychem Group, GHW International.

3. What are the main segments of the Choline Chloride Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rapidly Growing Demand from the Poultry Industry; Increased Intake as Human Nutrition Supplements.

6. What are the notable trends driving market growth?

High Demand from Poultry Feed Segment.

7. Are there any restraints impacting market growth?

Animal Disease Outbreaks.

8. Can you provide examples of recent developments in the market?

October 2022: Methanol Chemicals Company (Chemanol) signed an agreement worth nearly USD 1.33 million with Saudi GDI for the production of specialty chemicals that include choline chloride as well as methyl diethanolamine.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Choline Chloride Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Choline Chloride Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Choline Chloride Industry?

To stay informed about further developments, trends, and reports in the Choline Chloride Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence