Key Insights

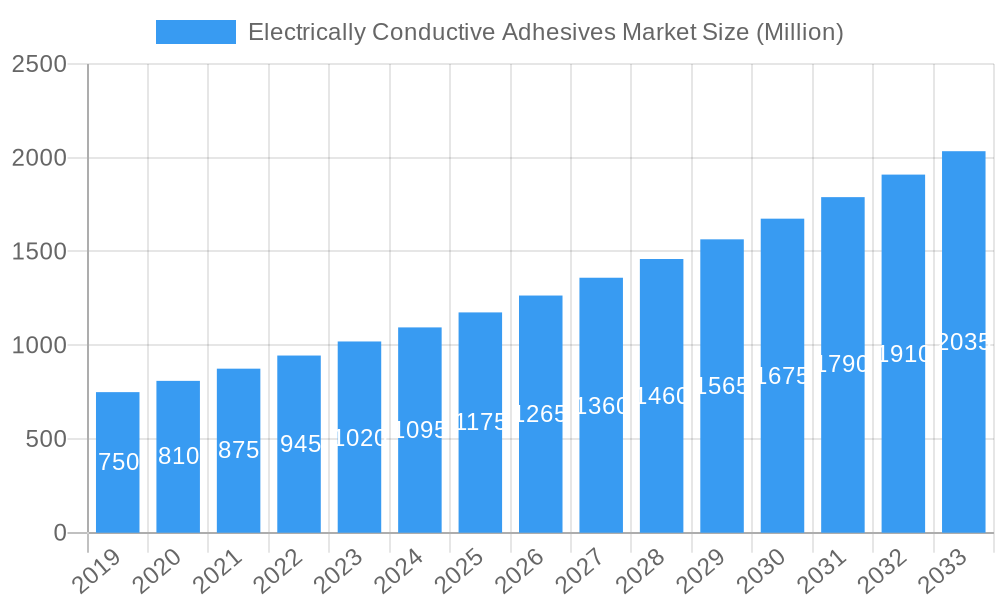

The global Electrically Conductive Adhesives (ECAs) market is poised for significant expansion. Projections indicate a market size of $1712 million by 2025, driven by a Compound Annual Growth Rate (CAGR) of 1.4% throughout the forecast period of 2025-2033. This growth is underpinned by the increasing demand for miniaturized, high-performance electronic devices and the critical need for robust interconnectivity solutions. ECAs offer superior alternatives to conventional soldering, providing advantages such as lower processing temperatures, flexibility, and compatibility with dissimilar materials. These attributes make them essential in the production of smartphones, wearable technology, automotive electronics, and advanced medical devices. The automotive sector, particularly the burgeoning electric vehicle (EV) and autonomous driving segments, represents a key growth driver, necessitating lightweight and sophisticated conductive bonding for batteries, sensors, and electronic control units. Additionally, the expanding use of flexible and printed electronics in smart packaging, IoT devices, and displays presents substantial opportunities for ECAs, enabling seamless integration of conductive pathways.

Electrically Conductive Adhesives Market Market Size (In Billion)

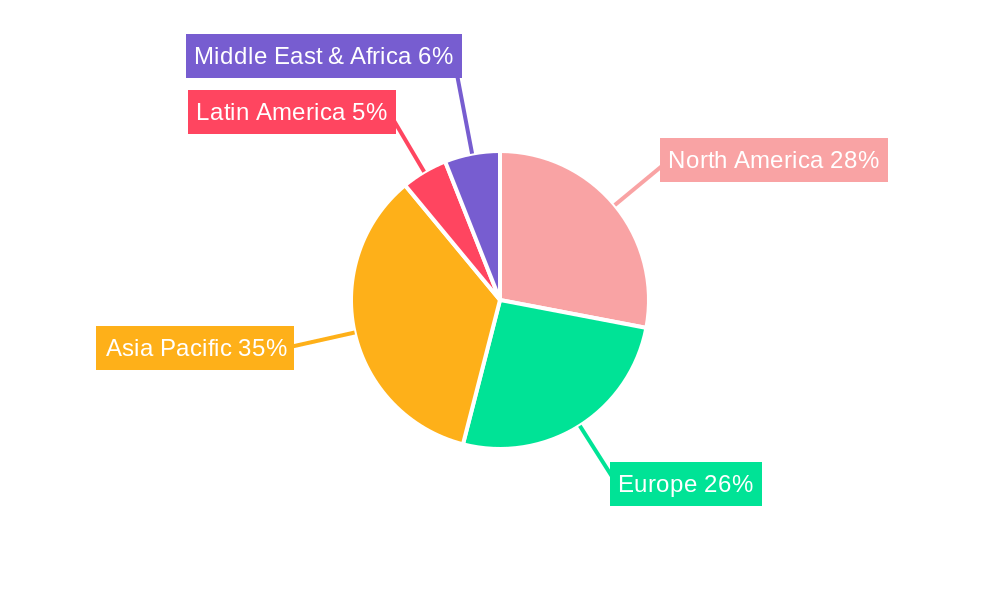

The forecast period (2025-2033) is expected to see sustained market growth for ECAs, further propelled by advancements in material science. Innovations in higher performance, cost-effectiveness, improved conductivity, enhanced durability, and greater environmental resistance are continuously emerging, meeting the evolving demands of high-tech industries. The ongoing focus on energy efficiency and the drive for lighter electronic components across consumer electronics and transportation will continue to boost ECA adoption. Geographically, North America and Europe are expected to maintain market leadership due to their strong advanced manufacturing and R&D presence in electronics and automotive. However, the Asia-Pacific region is anticipated to experience the fastest growth, fueled by its role as a global electronics manufacturing hub and a rapidly expanding automotive sector, especially in the EV segment. Continuous innovation and a broad range of applications highlight the vital role of electrically conductive adhesives in shaping the future of electronics.

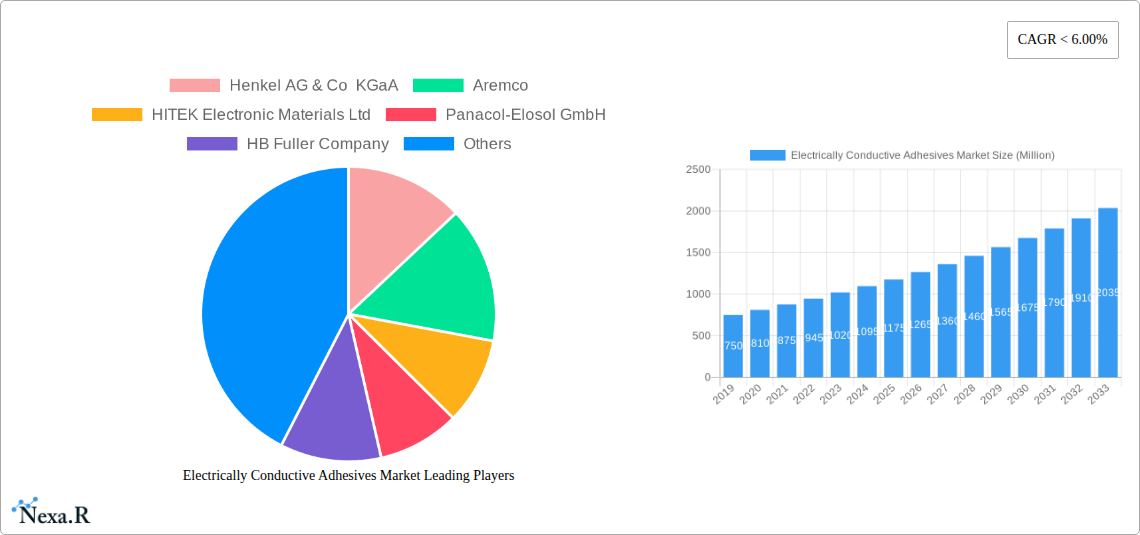

Electrically Conductive Adhesives Market Company Market Share

Electrically Conductive Adhesives Market: Comprehensive Market Analysis and Future Outlook (2019-2033)

This in-depth report provides a detailed analysis of the global Electrically Conductive Adhesives (ECAs) market, examining key growth drivers, prevailing trends, competitive landscape, and future opportunities. The study encompasses a comprehensive historical period (2019-2024), a base year analysis (2025), and a robust forecast period (2025-2033), offering invaluable insights for industry stakeholders. We explore the parent market, encompassing all adhesive technologies, and the child market, specifically focusing on electrically conductive formulations, to provide a holistic view. The report utilizes high-traffic keywords relevant to "electrically conductive adhesives," "conductive inks," "EMI shielding," "thermal conductivity," "electronic assembly," and specific application areas like "automotive electronics," "LED lighting," and "solar cells." All quantitative values are presented in Million Units.

Electrically Conductive Adhesives Market Dynamics & Structure

The Electrically Conductive Adhesives market is characterized by a moderate to highly concentrated structure, with key players like Henkel AG & Co KGaA, 3M, and Dow holding significant market shares. Technological innovation is a primary driver, fueled by the increasing demand for miniaturization, higher performance, and advanced functionalities in electronic devices. Regulatory frameworks, particularly those concerning environmental impact and material safety, are evolving and influencing product development. Competitive product substitutes, such as traditional soldering and other joining methods, pose a challenge, but ECAs offer distinct advantages in flexibility, thermal management, and automated assembly. End-user demographics are shifting towards a younger, tech-savvy population demanding innovative and reliable electronic products across diverse sectors. Mergers and acquisitions (M&A) are active, with companies seeking to expand their product portfolios, gain market access, and acquire specialized technological capabilities. For instance, several small to medium-sized enterprises specializing in niche conductive adhesive formulations have been acquired by larger chemical conglomerates. Barriers to innovation include the high cost of R&D for advanced conductive materials and the need for rigorous testing and qualification processes to meet stringent industry standards.

- Market Concentration: Moderate to High, with key players dominating the landscape.

- Technological Innovation Drivers: Miniaturization, enhanced conductivity, thermal management, flexible electronics, advanced manufacturing processes.

- Regulatory Frameworks: Evolving environmental regulations (e.g., REACH, RoHS) and safety standards impacting material composition and usage.

- Competitive Product Substitutes: Traditional soldering, conductive epoxies (non-formulated), specialized conductive inks, anisotropic conductive films (ACFs).

- End-User Demographics: Growth driven by consumer electronics, wearable technology, and the increasing adoption of smart devices.

- M&A Trends: Strategic acquisitions to enhance product offerings and market reach.

- Innovation Barriers: High R&D investment, lengthy qualification cycles, material cost fluctuations.

Electrically Conductive Adhesives Market Growth Trends & Insights

The global Electrically Conductive Adhesives market is poised for significant expansion, driven by the relentless pace of technological advancement and the increasing integration of electronic components across various industries. The market size is projected to experience a robust Compound Annual Growth Rate (CAGR) of approximately 7.8% during the forecast period. This growth is attributed to the rising adoption of ECAs in applications requiring lightweight, flexible, and high-performance bonding solutions. Technological disruptions, such as the development of novel conductive fillers (e.g., graphene, silver nanowires) and advanced curing mechanisms, are enhancing the performance characteristics of ECAs, including conductivity, adhesion strength, and thermal management. Consumer behavior shifts are also playing a crucial role, with a growing demand for more sophisticated and integrated electronic devices, from smartphones and wearables to advanced automotive systems and IoT devices. Market penetration is deepening as manufacturers recognize the cost-effectiveness and efficiency benefits of using ECAs over traditional methods like soldering, especially in high-volume production environments. The increasing prevalence of flexible printed circuit boards (FPCBs) and the demand for robust EMI shielding solutions further accelerate adoption. The estimated market size for 2025 stands at USD 1,500 Million.

Dominant Regions, Countries, or Segments in Electrically Conductive Adhesives Market

The Asia Pacific region is a dominant force in the Electrically Conductive Adhesives market, driven by its strong manufacturing base in electronics, automotive, and consumer goods. Countries like China, South Korea, and Taiwan are at the forefront, owing to substantial investments in research and development, favorable government policies, and a rapidly growing demand for advanced electronic components. Within the Chemistry Type segment, Epoxy-based electrically conductive adhesives hold a significant market share due to their excellent adhesion, mechanical strength, and chemical resistance. However, Silicone and Polyurethane based ECAs are gaining traction, especially in applications requiring flexibility and high-temperature resistance. In terms of Type, Anisotropic conductive adhesives are witnessing rapid growth, particularly in display assembly and semiconductor packaging, where precise electrical conductivity in one direction is crucial. The Application segment of Automotive Electronics is a major growth engine, fueled by the increasing electrification of vehicles, the adoption of advanced driver-assistance systems (ADAS), and the growing demand for in-car entertainment and connectivity. The Printed Circuit Boards (PCBs) and LED Lighting segments also contribute significantly to market demand, driven by the proliferation of electronic devices and energy-efficient lighting solutions.

- Dominant Region: Asia Pacific (China, South Korea, Taiwan).

- Key Drivers in Asia Pacific: Robust electronics manufacturing, government support, growing demand for advanced electronics.

- Dominant Chemistry Type: Epoxy (strong adhesion, chemical resistance).

- Gaining Traction Chemistry Types: Silicone (flexibility), Polyurethane (high-temperature performance).

- Dominant Type: Anisotropic (precise directional conductivity).

- Dominant Application Segments: Automotive Electronics, Printed Circuit Boards, LED Lighting.

- Growth Drivers in Dominant Applications: Vehicle electrification, ADAS, smart devices, energy-efficient solutions.

Electrically Conductive Adhesives Market Product Landscape

The product landscape of the Electrically Conductive Adhesives market is dynamic, with continuous innovation focused on enhancing performance and expanding application possibilities. Manufacturers are developing ECAs with superior electrical conductivity, improved thermal management capabilities, and greater flexibility to meet the demands of next-generation electronic devices. Innovations include the incorporation of advanced conductive fillers like carbon nanotubes and metal nanowires, offering lower resistance and higher current carrying capacities. The development of UV-curable and fast-curing ECAs is also a key trend, enabling higher throughput in manufacturing processes. Unique selling propositions often lie in specific formulations tailored for challenging environments, such as high-temperature or high-humidity applications, or for sensitive electronic components. Technological advancements are also leading to the creation of transparent conductive adhesives and novel materials for flexible and wearable electronics, further broadening their utility.

Key Drivers, Barriers & Challenges in Electrically Conductive Adhesives Market

The Electrically Conductive Adhesives market is propelled by several key drivers. The increasing miniaturization of electronic devices necessitates more compact and efficient assembly methods, where ECAs excel. The burgeoning demand for electric vehicles (EVs) and advanced driver-assistance systems (ADAS) requires reliable, lightweight, and thermally conductive bonding solutions. The growth of the Internet of Things (IoT) ecosystem, with its proliferation of connected devices, further fuels the need for sophisticated conductive interconnects. Technological advancements in conductive fillers and formulations are continuously improving performance metrics like conductivity and adhesion.

- Key Drivers: Miniaturization of electronics, growth of EVs and ADAS, expansion of IoT ecosystem, advancements in conductive fillers, demand for lightweight and flexible assembly.

However, the market faces several challenges and restraints. The high cost of certain conductive fillers, such as silver, can impact the overall price competitiveness of ECAs. Stringent regulatory requirements concerning material composition and environmental impact can necessitate significant R&D investment and compliance efforts. Supply chain disruptions for critical raw materials can lead to price volatility and availability issues. Furthermore, the well-established infrastructure and expertise in traditional soldering techniques present a competitive hurdle, requiring extensive education and validation for wider ECA adoption.

- Key Barriers & Challenges: High cost of conductive fillers, stringent regulatory requirements, supply chain volatility, established soldering infrastructure, technical expertise gap.

Emerging Opportunities in Electrically Conductive Adhesives Market

Emerging opportunities in the Electrically Conductive Adhesives market are abundant, driven by the continuous evolution of technology and consumer demands. The rapid growth of wearable technology, including smartwatches, fitness trackers, and medical wearables, presents a significant avenue for flexible and biocompatible ECAs. The development of advanced displays, such as flexible OLEDs and micro-LEDs, requires specialized conductive adhesives for seamless integration and enhanced performance. The expansion of 5G infrastructure and the increasing adoption of high-frequency communication devices will drive demand for ECAs with superior electromagnetic interference (EMI) shielding properties. Furthermore, the growing focus on sustainable and recyclable electronics opens doors for eco-friendly ECA formulations. The aerospace and defense sectors, with their stringent reliability requirements and demand for lightweight materials, also represent a substantial untapped market.

Growth Accelerators in the Electrically Conductive Adhesives Market Industry

Several catalysts are accelerating long-term growth in the Electrically Conductive Adhesives industry. Technological breakthroughs in nanomaterial science are leading to the development of highly conductive and cost-effective fillers, such as graphene and carbon nanotubes, significantly enhancing ECA performance. Strategic partnerships between adhesive manufacturers and electronics component suppliers are fostering innovation and accelerating product development cycles. Market expansion strategies, including the penetration of emerging economies and the development of customized solutions for niche applications, are broadening the market reach. The increasing focus on smart manufacturing and Industry 4.0 principles, which emphasize automation and precision assembly, favors the adoption of ECAs. Furthermore, ongoing research into novel curing technologies, such as high-intensity UV and electron beam curing, is enabling faster processing times and improved manufacturing efficiency.

Key Players Shaping the Electrically Conductive Adhesives Market Market

- Henkel AG & Co KGaA

- Aremco

- HITEK Electronic Materials Ltd

- Panacol-Elosol GmbH

- HB Fuller Company

- 3M

- Master Bond Inc

- Dow

- Creative Materials Inc

- Permabond

- MG Chemicals

- Parker Hannifin Corp

Notable Milestones in Electrically Conductive Adhesives Market Sector

- 2022: Henkel AG & Co KGaA launched a new line of low-viscosity, high-performance conductive adhesives for advanced semiconductor packaging applications, enabling finer pitch connections and improved heat dissipation.

- 2023: 3M introduced a novel anisotropic conductive film (ACF) with enhanced adhesion and reliability for flexible display integration in consumer electronics.

- 2023: Dow announced the development of novel silicone-based electrically conductive adhesives offering improved thermal conductivity for EV battery applications.

- 2024: HB Fuller Company expanded its portfolio with the acquisition of a specialized conductive adhesives manufacturer, strengthening its presence in the industrial electronics segment.

- 2024: Master Bond Inc unveiled a new series of electrically conductive epoxy adhesives with excellent flexibility and low outgassing properties, suitable for aerospace and medical device applications.

In-Depth Electrically Conductive Adhesives Market Market Outlook

The Electrically Conductive Adhesives market is projected for sustained and robust growth, driven by the indispensable role these materials play in modern electronics manufacturing. The ongoing miniaturization of devices, coupled with the increasing demand for high-performance, reliable, and flexible interconnects, will continue to fuel market expansion. Strategic opportunities lie in the development of cost-effective, high-conductivity materials and in catering to the burgeoning needs of the electric vehicle, renewable energy, and advanced display sectors. The market is expected to witness further consolidation through strategic mergers and acquisitions as companies seek to broaden their product offerings and geographical reach. The focus on sustainable materials and advanced curing technologies will also be critical for future success, ensuring compliance with environmental regulations and improving manufacturing efficiency. The estimated market size for 2033 is projected to reach USD 3,500 Million.

Electrically Conductive Adhesives Market Segmentation

-

1. Chemistry Type

- 1.1. Epoxy

- 1.2. Silicone

- 1.3. Polyurethane

- 1.4. Acrylic

- 1.5. Other Chemistry Types

-

2. Type

- 2.1. Isotropic

- 2.2. Anisotropic

-

3. Application

- 3.1. Solar Cells

- 3.2. Automotive Electronics

- 3.3. LED Lighting

- 3.4. Printed Circuit Boards

- 3.5. LCD Displays

- 3.6. Other Applications

Electrically Conductive Adhesives Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. US

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. UK

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Electrically Conductive Adhesives Market Regional Market Share

Geographic Coverage of Electrically Conductive Adhesives Market

Electrically Conductive Adhesives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Application in Power Electronics; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Other Restraints

- 3.4. Market Trends

- 3.4.1. Epoxy Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electrically Conductive Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Chemistry Type

- 5.1.1. Epoxy

- 5.1.2. Silicone

- 5.1.3. Polyurethane

- 5.1.4. Acrylic

- 5.1.5. Other Chemistry Types

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Isotropic

- 5.2.2. Anisotropic

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Solar Cells

- 5.3.2. Automotive Electronics

- 5.3.3. LED Lighting

- 5.3.4. Printed Circuit Boards

- 5.3.5. LCD Displays

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Chemistry Type

- 6. Asia Pacific Electrically Conductive Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Chemistry Type

- 6.1.1. Epoxy

- 6.1.2. Silicone

- 6.1.3. Polyurethane

- 6.1.4. Acrylic

- 6.1.5. Other Chemistry Types

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Isotropic

- 6.2.2. Anisotropic

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Solar Cells

- 6.3.2. Automotive Electronics

- 6.3.3. LED Lighting

- 6.3.4. Printed Circuit Boards

- 6.3.5. LCD Displays

- 6.3.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Chemistry Type

- 7. North America Electrically Conductive Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Chemistry Type

- 7.1.1. Epoxy

- 7.1.2. Silicone

- 7.1.3. Polyurethane

- 7.1.4. Acrylic

- 7.1.5. Other Chemistry Types

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Isotropic

- 7.2.2. Anisotropic

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Solar Cells

- 7.3.2. Automotive Electronics

- 7.3.3. LED Lighting

- 7.3.4. Printed Circuit Boards

- 7.3.5. LCD Displays

- 7.3.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Chemistry Type

- 8. Europe Electrically Conductive Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Chemistry Type

- 8.1.1. Epoxy

- 8.1.2. Silicone

- 8.1.3. Polyurethane

- 8.1.4. Acrylic

- 8.1.5. Other Chemistry Types

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Isotropic

- 8.2.2. Anisotropic

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Solar Cells

- 8.3.2. Automotive Electronics

- 8.3.3. LED Lighting

- 8.3.4. Printed Circuit Boards

- 8.3.5. LCD Displays

- 8.3.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Chemistry Type

- 9. South America Electrically Conductive Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Chemistry Type

- 9.1.1. Epoxy

- 9.1.2. Silicone

- 9.1.3. Polyurethane

- 9.1.4. Acrylic

- 9.1.5. Other Chemistry Types

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Isotropic

- 9.2.2. Anisotropic

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Solar Cells

- 9.3.2. Automotive Electronics

- 9.3.3. LED Lighting

- 9.3.4. Printed Circuit Boards

- 9.3.5. LCD Displays

- 9.3.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Chemistry Type

- 10. Middle East and Africa Electrically Conductive Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Chemistry Type

- 10.1.1. Epoxy

- 10.1.2. Silicone

- 10.1.3. Polyurethane

- 10.1.4. Acrylic

- 10.1.5. Other Chemistry Types

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Isotropic

- 10.2.2. Anisotropic

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Solar Cells

- 10.3.2. Automotive Electronics

- 10.3.3. LED Lighting

- 10.3.4. Printed Circuit Boards

- 10.3.5. LCD Displays

- 10.3.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Chemistry Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Henkel AG & Co KGaA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aremco

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 HITEK Electronic Materials Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Panacol-Elosol GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 HB Fuller Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 3M

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Master Bond Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dow

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Creative Materials Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Permabond*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 MG Chemicals

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Parker Hannifin Corp

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Global Electrically Conductive Adhesives Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Electrically Conductive Adhesives Market Revenue (million), by Chemistry Type 2025 & 2033

- Figure 3: Asia Pacific Electrically Conductive Adhesives Market Revenue Share (%), by Chemistry Type 2025 & 2033

- Figure 4: Asia Pacific Electrically Conductive Adhesives Market Revenue (million), by Type 2025 & 2033

- Figure 5: Asia Pacific Electrically Conductive Adhesives Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Electrically Conductive Adhesives Market Revenue (million), by Application 2025 & 2033

- Figure 7: Asia Pacific Electrically Conductive Adhesives Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Asia Pacific Electrically Conductive Adhesives Market Revenue (million), by Country 2025 & 2033

- Figure 9: Asia Pacific Electrically Conductive Adhesives Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Electrically Conductive Adhesives Market Revenue (million), by Chemistry Type 2025 & 2033

- Figure 11: North America Electrically Conductive Adhesives Market Revenue Share (%), by Chemistry Type 2025 & 2033

- Figure 12: North America Electrically Conductive Adhesives Market Revenue (million), by Type 2025 & 2033

- Figure 13: North America Electrically Conductive Adhesives Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: North America Electrically Conductive Adhesives Market Revenue (million), by Application 2025 & 2033

- Figure 15: North America Electrically Conductive Adhesives Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: North America Electrically Conductive Adhesives Market Revenue (million), by Country 2025 & 2033

- Figure 17: North America Electrically Conductive Adhesives Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Electrically Conductive Adhesives Market Revenue (million), by Chemistry Type 2025 & 2033

- Figure 19: Europe Electrically Conductive Adhesives Market Revenue Share (%), by Chemistry Type 2025 & 2033

- Figure 20: Europe Electrically Conductive Adhesives Market Revenue (million), by Type 2025 & 2033

- Figure 21: Europe Electrically Conductive Adhesives Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Electrically Conductive Adhesives Market Revenue (million), by Application 2025 & 2033

- Figure 23: Europe Electrically Conductive Adhesives Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Electrically Conductive Adhesives Market Revenue (million), by Country 2025 & 2033

- Figure 25: Europe Electrically Conductive Adhesives Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Electrically Conductive Adhesives Market Revenue (million), by Chemistry Type 2025 & 2033

- Figure 27: South America Electrically Conductive Adhesives Market Revenue Share (%), by Chemistry Type 2025 & 2033

- Figure 28: South America Electrically Conductive Adhesives Market Revenue (million), by Type 2025 & 2033

- Figure 29: South America Electrically Conductive Adhesives Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: South America Electrically Conductive Adhesives Market Revenue (million), by Application 2025 & 2033

- Figure 31: South America Electrically Conductive Adhesives Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: South America Electrically Conductive Adhesives Market Revenue (million), by Country 2025 & 2033

- Figure 33: South America Electrically Conductive Adhesives Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Electrically Conductive Adhesives Market Revenue (million), by Chemistry Type 2025 & 2033

- Figure 35: Middle East and Africa Electrically Conductive Adhesives Market Revenue Share (%), by Chemistry Type 2025 & 2033

- Figure 36: Middle East and Africa Electrically Conductive Adhesives Market Revenue (million), by Type 2025 & 2033

- Figure 37: Middle East and Africa Electrically Conductive Adhesives Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East and Africa Electrically Conductive Adhesives Market Revenue (million), by Application 2025 & 2033

- Figure 39: Middle East and Africa Electrically Conductive Adhesives Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Electrically Conductive Adhesives Market Revenue (million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Electrically Conductive Adhesives Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Chemistry Type 2020 & 2033

- Table 2: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Type 2020 & 2033

- Table 3: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Application 2020 & 2033

- Table 4: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Chemistry Type 2020 & 2033

- Table 6: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Type 2020 & 2033

- Table 7: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Application 2020 & 2033

- Table 8: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: China Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: India Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Japan Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Chemistry Type 2020 & 2033

- Table 15: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Type 2020 & 2033

- Table 16: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Country 2020 & 2033

- Table 18: US Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Canada Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Mexico Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Chemistry Type 2020 & 2033

- Table 22: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Type 2020 & 2033

- Table 23: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Application 2020 & 2033

- Table 24: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Country 2020 & 2033

- Table 25: Germany Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: UK Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: France Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Italy Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Chemistry Type 2020 & 2033

- Table 31: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Type 2020 & 2033

- Table 32: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Application 2020 & 2033

- Table 33: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Country 2020 & 2033

- Table 34: Brazil Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: Argentina Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Chemistry Type 2020 & 2033

- Table 38: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Type 2020 & 2033

- Table 39: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Application 2020 & 2033

- Table 40: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: South Africa Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electrically Conductive Adhesives Market?

The projected CAGR is approximately 1.4%.

2. Which companies are prominent players in the Electrically Conductive Adhesives Market?

Key companies in the market include Henkel AG & Co KGaA, Aremco, HITEK Electronic Materials Ltd, Panacol-Elosol GmbH, HB Fuller Company, 3M, Master Bond Inc, Dow, Creative Materials Inc, Permabond*List Not Exhaustive, MG Chemicals, Parker Hannifin Corp.

3. What are the main segments of the Electrically Conductive Adhesives Market?

The market segments include Chemistry Type, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1712 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Application in Power Electronics; Other Drivers.

6. What are the notable trends driving market growth?

Epoxy Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Other Restraints.

8. Can you provide examples of recent developments in the market?

The recent developments pertaining to the major players in the market are covered in the complete study.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electrically Conductive Adhesives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electrically Conductive Adhesives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electrically Conductive Adhesives Market?

To stay informed about further developments, trends, and reports in the Electrically Conductive Adhesives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence