Key Insights

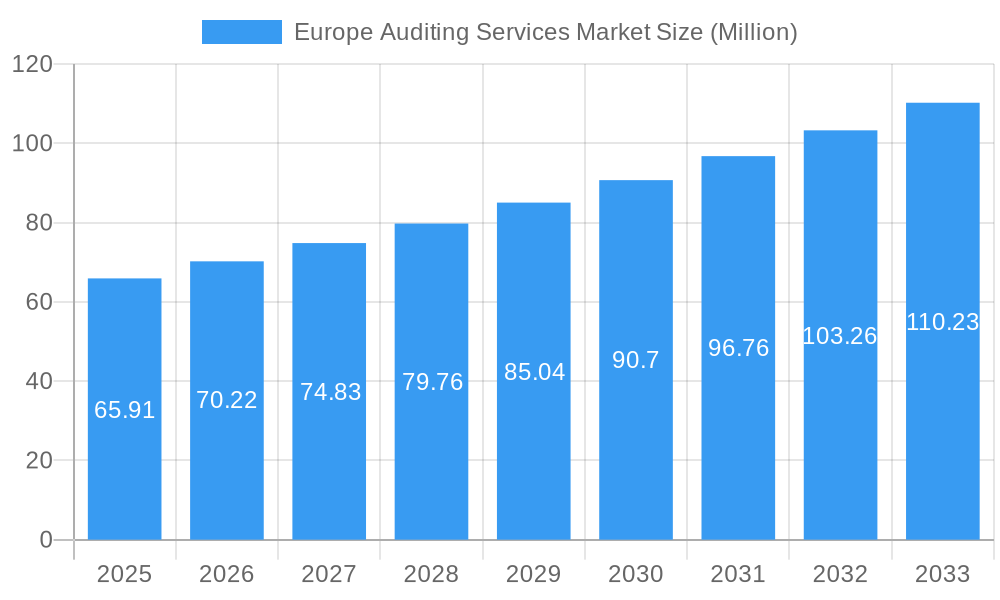

The Europe Auditing Services market, valued at €65.91 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.33% from 2025 to 2033. This expansion is driven by several key factors. Increasing regulatory scrutiny across various sectors, coupled with growing concerns about corporate governance and financial transparency, fuels the demand for comprehensive auditing services. Furthermore, the rising complexity of financial reporting standards and international accounting frameworks necessitates specialized expertise, boosting the market's growth. The growing adoption of advanced technologies like AI and data analytics within auditing firms is also a significant driver, enhancing efficiency and accuracy in audit processes. Finally, the increasing prevalence of cross-border transactions and global business operations further contributes to the demand for skilled auditing professionals capable of navigating diverse regulatory landscapes.

Europe Auditing Services Market Market Size (In Million)

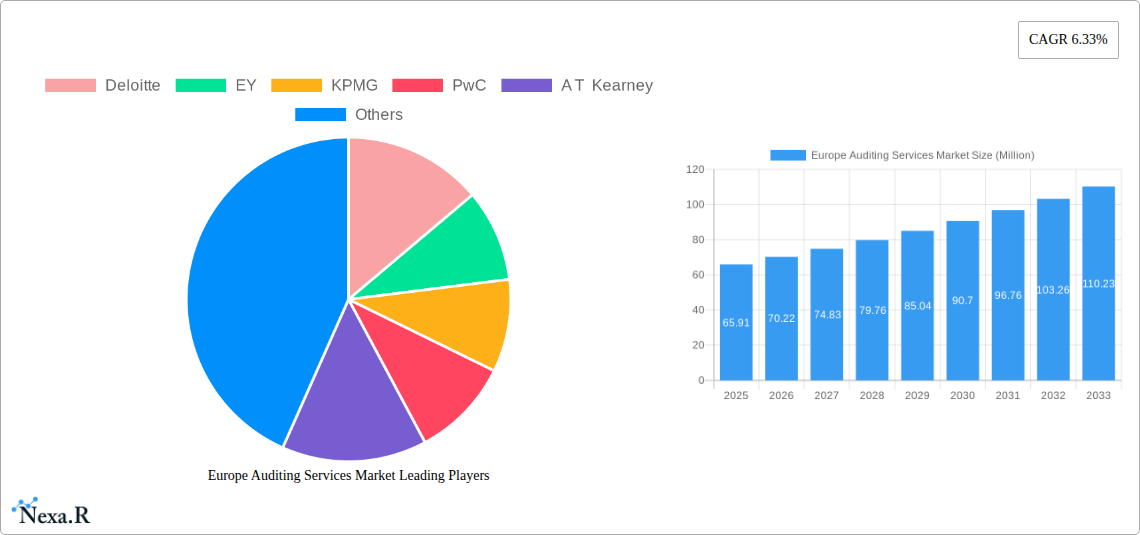

The market's segmentation, while unspecified, likely includes industry verticals such as banking, finance, energy, and manufacturing. Key players like Deloitte, EY, KPMG, PwC, and others dominate the market landscape, leveraging their established global networks and expertise. Competitive pressures will likely continue, driven by the need to innovate and offer specialized services to maintain market share. Potential restraints could include economic downturns impacting client spending on professional services and the increasing competition from smaller, specialized auditing firms. Regional variations within Europe's market are expected, reflecting economic differences and regulatory environments across various member states. Future growth will likely be influenced by evolving regulatory requirements, technological advancements, and the overall economic health of European nations.

Europe Auditing Services Market Company Market Share

Europe Auditing Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Auditing Services Market, encompassing market dynamics, growth trends, regional performance, key players, and future outlook. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The report analyzes the parent market of professional services and the child market of auditing services within Europe, offering granular insights for informed decision-making. The total market value in 2025 is estimated at xx Million.

Europe Auditing Services Market Dynamics & Structure

The European auditing services market is a highly concentrated landscape dominated by a few large players, namely Deloitte, EY, KPMG, and PwC ("The Big Four"). These firms hold a significant market share, estimated at xx% collectively in 2025, benefiting from economies of scale and extensive global networks. However, mid-tier firms like Grant Thornton LLP, BDO USA, and others, are also actively competing, particularly in niche segments. Market concentration is further influenced by stringent regulatory frameworks like those from the European Union, aiming to enhance audit quality and independence. Technological innovation, primarily driven by the adoption of AI and data analytics, is transforming the auditing process, increasing efficiency and enhancing the accuracy of audits. Mergers and acquisitions (M&A) activity is another key dynamic; the past few years have witnessed several significant deals, reflecting consolidation trends within the industry.

- Market Concentration: High, with the Big Four holding a dominant xx% market share in 2025.

- Technological Innovation: AI and data analytics are key drivers, improving efficiency and accuracy.

- Regulatory Framework: Stringent EU regulations influence market dynamics and competition.

- M&A Activity: Significant consolidation observed, with deals increasing the market share of large players.

- Competitive Landscape: Intense competition among the Big Four and mid-tier firms.

- End-User Demographics: Primarily large corporations, SMEs, and public sector entities.

Europe Auditing Services Market Growth Trends & Insights

The European auditing services market is poised for robust and sustained growth throughout the forecast period (2025-2033). Analysts project a significant Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This upward trajectory is fueled by a confluence of factors, including heightened regulatory oversight, the continuous expansion of corporate operations across the continent, and an escalating demand for comprehensive assurance services across a diverse range of industries. The transformative impact of technological advancements is also a key growth stimulant, empowering auditors with more efficient, data-driven methodologies. While large corporations are demonstrating a high adoption rate for advanced technologies such as AI-powered audit tools, the adoption by Small and Medium-sized Enterprises (SMEs) remains comparatively slower. This presents a substantial opportunity for future market expansion within the SME segment. Established markets like Germany and the UK exhibit high penetration, offering limited scope for organic growth but presenting significant potential for mergers, acquisitions, and strategic market share expansion.

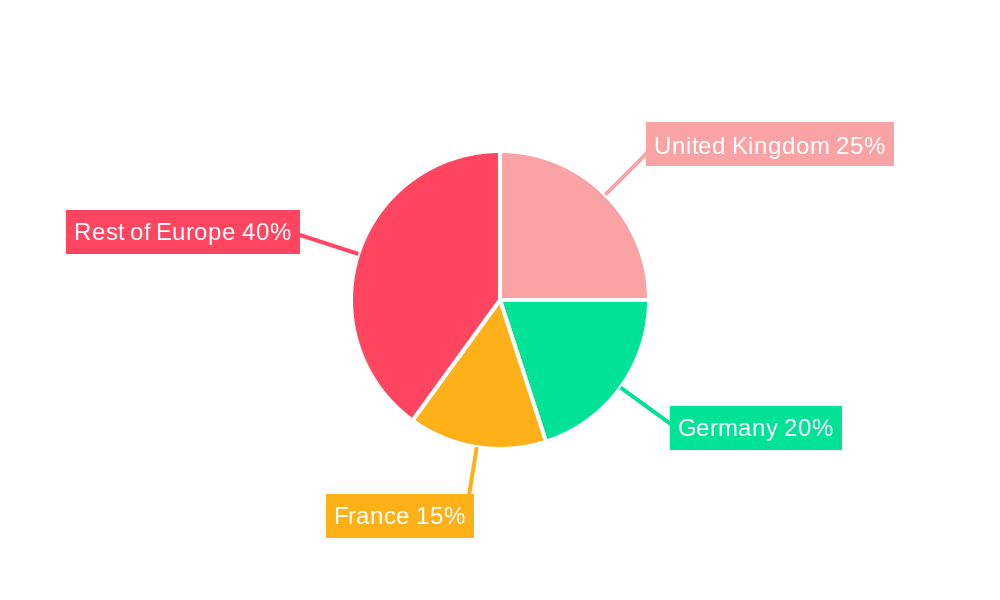

Dominant Regions, Countries, or Segments in Europe Auditing Services Market

Germany and the UK currently represent the largest markets for auditing services in Europe, accounting for a combined xx% of the total market value in 2025. This dominance is primarily attributed to their robust economies, highly developed financial sectors, and large populations of corporations requiring auditing services. These countries also benefit from well-established regulatory frameworks and a sophisticated business environment. Other significant markets include France, Italy, and Spain, each showcasing unique market characteristics influenced by economic policies, levels of infrastructure and the concentration of large corporations. The growth potential in these and other smaller European markets is particularly promising, primarily driven by anticipated GDP growth and increased foreign direct investment.

- Germany: Strong economy, large corporate base, established regulatory framework.

- UK: Developed financial sector, significant number of multinational companies.

- France: Significant market size, growing regulatory pressures.

- Other key countries: Italy, Spain, and the Nordics.

Europe Auditing Services Market Product Landscape

The European auditing services market is characterized by a dynamic and evolving product landscape. While traditional financial statement audits continue to form the bedrock of service offerings, there's a clear trend towards augmenting these core services with cutting-edge technology-enabled solutions. These enhancements include sophisticated data analytics for more precise risk assessment, the development of specialized industry-focused audits tailored to sectors like pharmaceuticals and energy, and the expansion of advisory services that leverage deep auditing expertise to inform broader business strategy. For service providers, the primary differentiators in this competitive arena are increasingly defined by the quality and depth of their industry-specific knowledge and their technological capabilities, ensuring the timely and accurate delivery of comprehensive audit outcomes.

Key Drivers, Barriers & Challenges in Europe Auditing Services Market

Key Drivers: Increased regulatory scrutiny, particularly post-financial crises, demands higher quality auditing. The growth of complex business structures and transactions further necessitates robust auditing practices. Technological advancements such as AI and machine learning enhance efficiency and accuracy, driving increased demand.

Key Challenges: Intense competition, particularly from the Big Four firms, creates pricing pressures. Maintaining auditor independence while also catering to client expectations can be challenging. Keeping pace with rapid technological advancements demands substantial investment and talent acquisition. Brexit has also affected the provision of services from UK based providers to the rest of Europe.

Emerging Opportunities in Europe Auditing Services Market

The increasing demand for sustainability reporting and ESG (environmental, social, and governance) audits presents a significant opportunity. Expanding into underserved segments such as smaller and medium-sized enterprises (SMEs) through digital platforms or strategic partnerships provides growth avenues. The adoption of blockchain technology and cybersecurity audits also presents opportunities as businesses face evolving data privacy regulations.

Growth Accelerators in the Europe Auditing Services Market Industry

Future growth in the Europe Auditing Services Market will be significantly propelled by strategic alliances with technology firms, facilitating the seamless integration of Artificial Intelligence (AI) and advanced data analytics into core auditing processes. Furthermore, substantial investment in upskilling and reskilling the existing workforce to effectively adapt to these technological shifts will be crucial for enhancing service capabilities and retaining top talent. The exploration and penetration of niche markets, driven by the development of specialized expertise and highly tailored service offerings, will also unlock significant additional growth avenues for market players.

Notable Milestones in Europe Auditing Services Market Sector

- April 2023: PwC Switzerland strategically acquired Avoras, a move that significantly expanded its SAP-enabled business transformation services portfolio and market reach.

- June 2023: KPMG enhanced its technological capabilities by acquiring QuadriO, a prominent German IT consultancy renowned for its expertise in SAP solutions specifically for the banking sector.

In-Depth Europe Auditing Services Market Market Outlook

The outlook for the European auditing services market is exceptionally promising, underpinned by the relentless pace of technological innovation, the increasing complexity inherent in modern business operations, and a continuously strengthening imperative for robust assurance services. To maintain a competitive edge, firms must prioritize strategic acquisitions, make substantial investments in talent development, and actively explore emerging technologies. The long-term prosperity of the market is intrinsically linked to its ability to adapt swiftly to evolving regulatory frameworks and to consistently meet the dynamic and often sophisticated demands of its clients. The ongoing integration of advanced technology with specialized expertise is expected to drive further market consolidation and foster a fertile ground for groundbreaking innovation.

Europe Auditing Services Market Segmentation

-

1. Type

- 1.1. Internal Audit

- 1.2. External Audit

-

2. Service Line

- 2.1. Operational Audits

- 2.2. Financial Audits

- 2.3. Advisory and Consulting

- 2.4. Investigation Audits

- 2.5. Information System Audits

- 2.6. Compliance Audits

- 2.7. Other Service Lines

Europe Auditing Services Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Auditing Services Market Regional Market Share

Geographic Coverage of Europe Auditing Services Market

Europe Auditing Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Complexity of Business Operations Driving Demand for Market; Increasing Use of Technology in Financial Reporting Driving Demand for Market

- 3.3. Market Restrains

- 3.3.1. Growing Complexity of Business Operations Driving Demand for Market; Increasing Use of Technology in Financial Reporting Driving Demand for Market

- 3.4. Market Trends

- 3.4.1. External Audit is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Auditing Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Internal Audit

- 5.1.2. External Audit

- 5.2. Market Analysis, Insights and Forecast - by Service Line

- 5.2.1. Operational Audits

- 5.2.2. Financial Audits

- 5.2.3. Advisory and Consulting

- 5.2.4. Investigation Audits

- 5.2.5. Information System Audits

- 5.2.6. Compliance Audits

- 5.2.7. Other Service Lines

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Deloitte

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 EY

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KPMG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PwC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 A T Kearney

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Grant Thornton LLP

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bain & Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BDO USA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rodl and Partners

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Alvarez & Marsal**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Deloitte

List of Figures

- Figure 1: Europe Auditing Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Auditing Services Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Auditing Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Auditing Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Europe Auditing Services Market Revenue Million Forecast, by Service Line 2020 & 2033

- Table 4: Europe Auditing Services Market Volume Billion Forecast, by Service Line 2020 & 2033

- Table 5: Europe Auditing Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Auditing Services Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Europe Auditing Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Europe Auditing Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Europe Auditing Services Market Revenue Million Forecast, by Service Line 2020 & 2033

- Table 10: Europe Auditing Services Market Volume Billion Forecast, by Service Line 2020 & 2033

- Table 11: Europe Auditing Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Auditing Services Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: France Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Auditing Services Market?

The projected CAGR is approximately 6.33%.

2. Which companies are prominent players in the Europe Auditing Services Market?

Key companies in the market include Deloitte, EY, KPMG, PwC, A T Kearney, Grant Thornton LLP, Bain & Company, BDO USA, Rodl and Partners, Alvarez & Marsal**List Not Exhaustive.

3. What are the main segments of the Europe Auditing Services Market?

The market segments include Type, Service Line.

4. Can you provide details about the market size?

The market size is estimated to be USD 65.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Complexity of Business Operations Driving Demand for Market; Increasing Use of Technology in Financial Reporting Driving Demand for Market.

6. What are the notable trends driving market growth?

External Audit is Driving the Market.

7. Are there any restraints impacting market growth?

Growing Complexity of Business Operations Driving Demand for Market; Increasing Use of Technology in Financial Reporting Driving Demand for Market.

8. Can you provide examples of recent developments in the market?

In April 2023, PwC Switzerland pursued an expansion strategy by acquiring Avoras, a renowned SAP-enabled business transformation services provider for the pharmaceutical and life sciences industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Auditing Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Auditing Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Auditing Services Market?

To stay informed about further developments, trends, and reports in the Europe Auditing Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence