Key Insights

The global Testing, Inspection, and Certification (TIC) market is poised for substantial expansion, fueled by escalating regulatory demands, a growing emphasis on product safety and quality, and the proliferation of international trade. Projections indicate a market size of $417.76 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 3.6%. This growth is propelled by the increasing implementation of rigorous quality and safety benchmarks, especially in emerging economies undergoing infrastructure and manufacturing development. The escalating complexity of products and supply chains further amplifies the need for comprehensive TIC solutions to ensure compliance and mitigate risks throughout the entire product lifecycle. Key sectors driving this demand include automotive, healthcare, food and beverage, and electronics, all reliant on TIC services for quality assurance and consumer confidence.

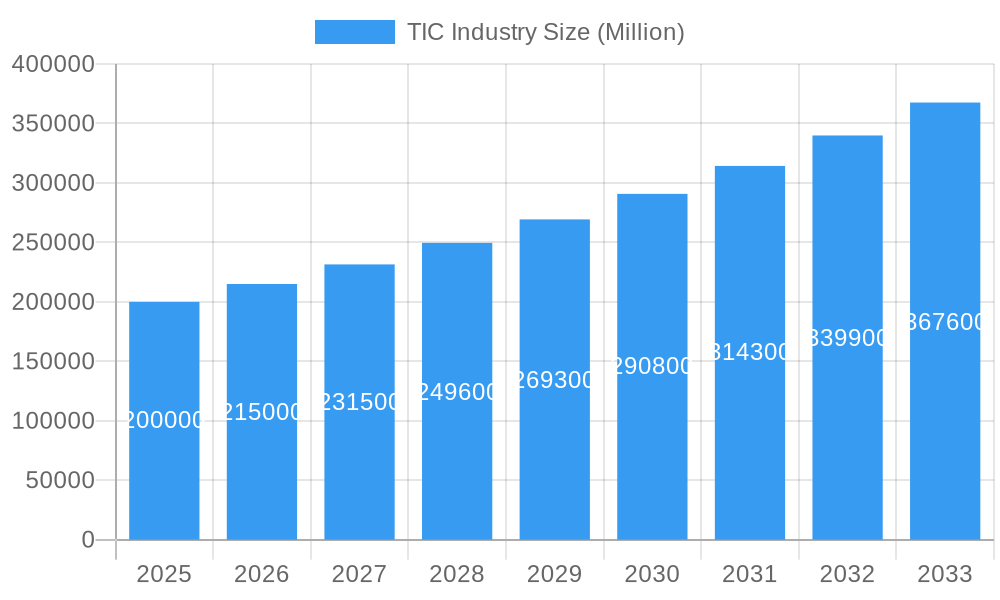

TIC Industry Market Size (In Billion)

The TIC landscape is characterized by market consolidation, with dominant players such as SGS Group, Bureau Veritas, Intertek, and TÜV SÜD. Nevertheless, specialized niche providers also find success by addressing specific industry segments or offering innovative solutions. Key industry trends encompass technological integration, including digitalization, automation, and the application of artificial intelligence and machine learning to optimize testing processes and data analysis. Furthermore, the rising commitment to sustainable practices and circular economy models is creating new opportunities for TIC services, particularly in environmental sustainability and responsible sourcing certifications. Despite potential headwinds from economic volatility and cybersecurity concerns, the TIC sector demonstrates a robust growth trajectory, signaling a promising future.

TIC Industry Company Market Share

TIC Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Testing, Inspection, and Certification (TIC) industry, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the estimated year 2025. It delves into various segments of the TIC market, including parent markets like manufacturing and construction and child markets such as textiles, food safety, and pharmaceuticals, offering invaluable insights for industry professionals and investors. The total market value in 2025 is estimated at xx Million.

TIC Industry Market Dynamics & Structure

The TIC industry is characterized by a moderately concentrated market structure, with major players like SGS Group, Bureau Veritas SA, and Intertek Group Plc holding significant market share. The market size in 2025 is estimated at xx Million. Technological innovation, driven by the adoption of AI, automation, and digitalization, is a major growth driver. Stringent regulatory frameworks, particularly concerning safety and environmental standards, further shape market dynamics. Competitive pressures arise from both established players and emerging niche providers. End-user demographics are diverse, spanning various industries with varying testing and certification needs. The historical period (2019-2024) witnessed a significant increase in M&A activity, with xx deals estimated to occur, indicating a push for consolidation and expansion.

- Market Concentration: High, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: AI-powered inspection systems, blockchain for traceability, and digital platforms for certification management.

- Regulatory Frameworks: Stringent safety and environmental standards driving demand for testing and certification services.

- Competitive Substitutes: Limited, due to the specialized nature of TIC services.

- End-User Demographics: Diverse, including manufacturing, construction, automotive, food & beverage, and healthcare.

- M&A Trends: xx M&A deals recorded in the historical period (2019-2024), indicating a trend of consolidation.

TIC Industry Growth Trends & Insights

The TIC industry experienced robust growth during the historical period (2019-2024), with a CAGR of xx%. This growth is projected to continue during the forecast period (2025-2033), driven by factors such as increasing globalization, rising consumer demand for quality and safety, and the expanding regulatory landscape. Technological disruptions, particularly the integration of digital technologies, are transforming the industry, leading to increased efficiency and new service offerings. Consumer behavior shifts towards greater awareness of product safety and sustainability are also significantly impacting market growth. Market penetration of digital TIC solutions is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in TIC Industry

North America and Europe currently hold the largest market share in the TIC industry, driven by robust economies, established regulatory frameworks, and high consumer awareness. However, Asia-Pacific is expected to exhibit the fastest growth rate during the forecast period, fueled by rapid industrialization, rising disposable incomes, and increasing emphasis on quality and safety standards. Within segments, the food safety and pharmaceutical sectors demonstrate significant growth potential due to heightened regulatory scrutiny and consumer concerns. The market value in North America in 2025 is estimated at xx Million, followed by Europe at xx Million, and Asia-Pacific at xx Million.

- Key Drivers in North America: Stringent regulatory compliance, established industrial base, high consumer awareness of safety and quality.

- Key Drivers in Europe: Similar to North America, with a focus on environmental sustainability.

- Key Drivers in Asia-Pacific: Rapid industrialization, rising middle class, and increasing government regulations.

TIC Industry Product Landscape

The TIC industry offers a diverse range of services, from product testing and inspection to certification and compliance auditing. Recent product innovations include AI-powered inspection systems, digital platforms for certification management, and blockchain solutions for supply chain traceability. These advancements improve efficiency, enhance accuracy, and enhance transparency across the value chain. The focus is on developing customized solutions tailored to specific industry needs and evolving regulatory requirements.

Key Drivers, Barriers & Challenges in TIC Industry

Key Drivers: Increased globalization, stringent regulatory environments, rising consumer demand for quality and safety, and technological advancements driving automation and efficiency. The increasing complexity of products and supply chains further fuels demand for sophisticated TIC services.

Key Challenges: Intense competition, regulatory changes and compliance costs, and the need for continuous investment in technology and skilled personnel. Supply chain disruptions can also impact service delivery. The estimated cost of regulatory compliance in 2025 for the entire industry is around xx Million.

Emerging Opportunities in TIC Industry

Emerging opportunities exist in developing markets, particularly in Africa and Latin America, where demand for TIC services is rapidly growing. The application of AI and machine learning in various areas, such as predictive maintenance and risk assessment, presents significant growth potential. The integration of blockchain technology for enhancing supply chain transparency and traceability also presents a significant opportunity.

Growth Accelerators in the TIC Industry Industry

Long-term growth in the TIC industry will be fueled by technological advancements, strategic partnerships, and expansion into new markets. The increasing adoption of digital technologies and the development of innovative service offerings tailored to specific industry needs will be key growth drivers. Strategic acquisitions and collaborations will also play a vital role in driving market expansion and consolidating market share.

Key Players Shaping the TIC Industry Market

- SGS Group

- Bureau Veritas SA

- Intertek Group Plc

- TUV SUD Group

- TUV Rheinland Group

- AsiaInspection Ltd

- British Standards Institution Group

- Keller-Frei Zurich

- Centre Testing International (CTI)

- Hohenstein Institute

- SAI Global Ltd

- TESTEX AG

- Eurofins Scientific (List Not Exhaustive)

Notable Milestones in TIC Industry Sector

- Jan 2022: SGS Group partners with Microsoft to develop a new digital TIC service.

- Mar 2022: TUV Rheinland partners with The BHive to offer a seamless approach to chemical testing and management for the textile and fashion industry.

In-Depth TIC Industry Market Outlook

The TIC industry is poised for significant growth in the coming years, driven by technological advancements, increasing regulatory scrutiny, and rising consumer demand for quality and safety. Strategic partnerships and acquisitions will continue to shape the market landscape. Companies that embrace innovation, invest in technology, and focus on providing value-added services will be best positioned for success. The future holds significant potential for market expansion in emerging economies and the development of specialized TIC solutions for various industries.

TIC Industry Segmentation

-

1. Application

- 1.1. Textile Testing

- 1.2. Textile Inspection

- 1.3. Textile Certification

TIC Industry Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. Latin America

- 5. Middle East

TIC Industry Regional Market Share

Geographic Coverage of TIC Industry

TIC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Trade of Textile Products Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global TIC Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Textile Testing

- 5.1.2. Textile Inspection

- 5.1.3. Textile Certification

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Asia Pacific

- 5.2.3. Europe

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America TIC Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Textile Testing

- 6.1.2. Textile Inspection

- 6.1.3. Textile Certification

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Asia Pacific TIC Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Textile Testing

- 7.1.2. Textile Inspection

- 7.1.3. Textile Certification

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe TIC Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Textile Testing

- 8.1.2. Textile Inspection

- 8.1.3. Textile Certification

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America TIC Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Textile Testing

- 9.1.2. Textile Inspection

- 9.1.3. Textile Certification

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East TIC Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Textile Testing

- 10.1.2. Textile Inspection

- 10.1.3. Textile Certification

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SGS Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bureau Veritas SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Intertek Group Plc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TUV SUD Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 TUV Rheinland Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AsiaInspection Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 British Standards Institution Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Keller-Frei Zurich

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Centre Testing International (CTI)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hohenstein Institute

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SAI Global Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 TESTEX AG

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Eurofins Scientific**List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 SGS Group

List of Figures

- Figure 1: Global TIC Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America TIC Industry Revenue (billion), by Application 2025 & 2033

- Figure 3: North America TIC Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America TIC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Asia Pacific TIC Industry Revenue (billion), by Application 2025 & 2033

- Figure 7: Asia Pacific TIC Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Asia Pacific TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Asia Pacific TIC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe TIC Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe TIC Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe TIC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America TIC Industry Revenue (billion), by Application 2025 & 2033

- Figure 15: Latin America TIC Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Latin America TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America TIC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East TIC Industry Revenue (billion), by Application 2025 & 2033

- Figure 19: Middle East TIC Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East TIC Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global TIC Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global TIC Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global TIC Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global TIC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global TIC Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global TIC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global TIC Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global TIC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global TIC Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global TIC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global TIC Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global TIC Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the TIC Industry?

The projected CAGR is approximately 3.6%.

2. Which companies are prominent players in the TIC Industry?

Key companies in the market include SGS Group, Bureau Veritas SA, Intertek Group Plc, TUV SUD Group, TUV Rheinland Group, AsiaInspection Ltd, British Standards Institution Group, Keller-Frei Zurich, Centre Testing International (CTI), Hohenstein Institute, SAI Global Ltd, TESTEX AG, Eurofins Scientific**List Not Exhaustive.

3. What are the main segments of the TIC Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 417.76 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Trade of Textile Products Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

Jan 2022: Switzerland-based testing and certification group SGS announced a partnership with Microsoft to develop a new digital TIC service. This collaboration will leverage Microsoft's cross-industry expertise, advanced data solutions and productivity platforms, integrated with SGS's global service network and leading industry capabilities to develop innovative solutions for customers in the Testing, Inspection and Certification (TIC) industry .

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "TIC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the TIC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the TIC Industry?

To stay informed about further developments, trends, and reports in the TIC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence