Key Insights

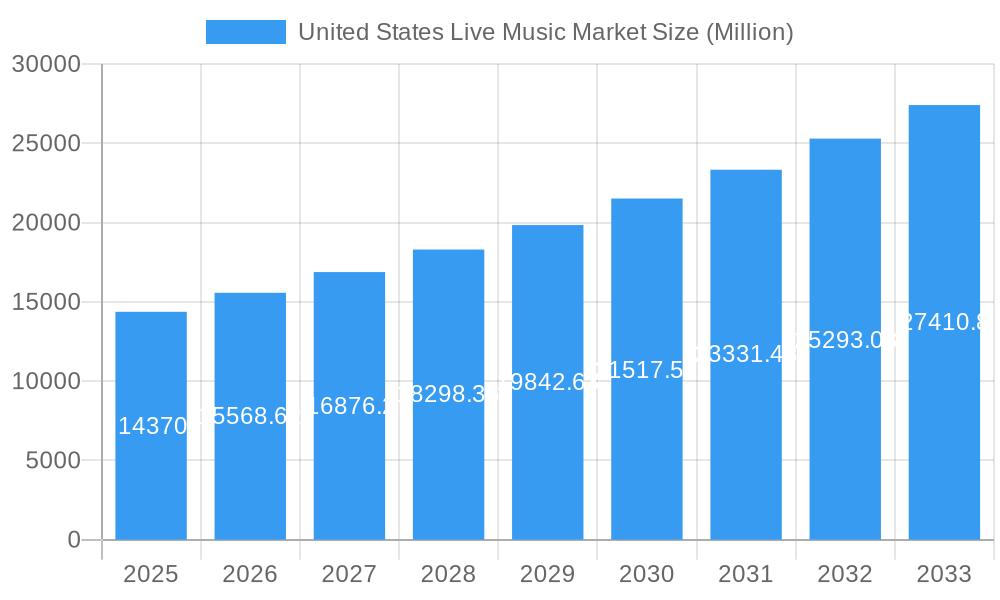

The United States live music market, valued at $14.37 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.56% from 2025 to 2033. This expansion is fueled by several key drivers. Increased disposable income among millennials and Gen Z, coupled with a resurgence in live entertainment post-pandemic, significantly boosts demand for concerts and festivals. Technological advancements, such as improved streaming services and enhanced ticketing platforms, contribute to easier access and increased ticket sales. The rise of social media marketing and influencer collaborations further amplify event visibility and attract wider audiences. Furthermore, diversification in genres and formats, encompassing everything from intimate club shows to massive stadium tours, caters to a broad range of musical preferences and expands the market's reach. While the industry faces challenges such as rising venue costs and potential economic downturns, the inherent appeal of live music experiences and the continued innovation within the sector suggest a strong trajectory for growth.

United States Live Music Market Market Size (In Billion)

Major players like Live Nation Entertainment, AEG Presents, and Ticketmaster dominate the market, leveraging their extensive networks and resources to secure high-profile artists and manage large-scale events. However, smaller independent promoters and venues also play a crucial role, contributing to the market's diversity and dynamism. Geographic distribution within the US is likely uneven, with major metropolitan areas like New York, Los Angeles, and Chicago holding significant market share due to their large populations and established music scenes. The market segmentation likely includes various genres (rock, pop, country, hip-hop, etc.), venue sizes (small clubs, arenas, stadiums), and event types (concerts, festivals, tours). Future growth will likely be influenced by factors such as evolving consumer preferences, technological innovations, and the overall economic climate, presenting both opportunities and challenges for industry stakeholders.

United States Live Music Market Company Market Share

United States Live Music Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States live music market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report is essential for investors, industry professionals, and anyone seeking to understand this dynamic and rapidly evolving sector. The parent market is the broader entertainment industry, while the child market is specifically live music events (concerts, festivals, etc.). The total market value in 2025 is estimated at xx Million.

United States Live Music Market Market Dynamics & Structure

The US live music market is characterized by high concentration at the top, with a few major players dominating the landscape. This oligopolistic structure is evident in the significant market share held by companies such as Live Nation Entertainment, AEG Presents, and Ticketmaster. Technological innovation, particularly in ticketing, streaming, and event production, significantly influences market dynamics. Regulatory frameworks, including licensing, zoning, and public safety regulations, also play a crucial role. Competitive substitutes, such as online streaming concerts and recorded music, are impacting the traditional live music experience. End-user demographics, encompassing age, income, and location, significantly determine market demand. Finally, M&A activity within the industry has consolidated the market share of major players, leading to increased vertical integration.

- Market Concentration: Highly concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Driving efficiency in ticketing, streaming, and event management. Major barriers include high initial investment costs for new technologies.

- Regulatory Framework: Varied across states and localities, impacting event permits and licensing.

- Competitive Substitutes: Streaming services and recorded music pose a threat, particularly to smaller venues.

- End-User Demographics: Millennials and Gen Z represent a significant portion of the audience, with evolving preferences affecting venue choices and event types.

- M&A Trends: High volume of mergers and acquisitions in recent years, leading to vertical integration and market consolidation. xx M&A deals were recorded between 2019 and 2024.

United States Live Music Market Growth Trends & Insights

The US live music market exhibited significant growth between 2019 and 2024, driven by increasing disposable incomes, a resurgence in live events post-pandemic, and technological advancements that enhanced the fan experience. The market experienced a temporary downturn in 2020 due to COVID-19 restrictions but has rebounded strongly, exceeding pre-pandemic levels by 2023. Growth is further fueled by the rise of niche genres and festivals attracting targeted audiences, leading to higher ticket prices and increased spending per capita. The adoption rate of new technologies, such as cashless payment systems and enhanced security measures, continues to improve. Consumer behavior is shifting towards experiences over material goods, bolstering the demand for live music events.

- Market Size: xx Million in 2019, experienced a decline in 2020 (xx Million), and recovered significantly, reaching xx Million in 2024. Projected to reach xx Million in 2033.

- CAGR (2025-2033): xx%

- Market Penetration: xx% in 2024, projected to increase to xx% by 2033.

Dominant Regions, Countries, or Segments in United States Live Music Market

The largest segment within the US live music market is large-scale concerts and festivals, predominantly found in major metropolitan areas such as New York, Los Angeles, Chicago, and Las Vegas. These regions benefit from robust infrastructure, established venue networks, and large, diverse populations with high disposable incomes. Strong economic performance in these areas coupled with supportive government policies toward the arts and tourism further fuels market growth. Other significant segments include smaller venue concerts and club shows, which cater to a broader range of musical tastes and demographics.

- Key Drivers:

- High population density and disposable income in major metropolitan areas.

- Well-established infrastructure (venues, transportation, accommodation).

- Supportive government policies and tourism infrastructure.

- Strong local economies.

- Dominant Regions: California, New York, Texas, Florida, and Illinois are significant contributors.

United States Live Music Market Product Landscape

The live music market offers a diverse range of products, including concerts featuring major artists, smaller-scale performances in clubs and bars, and large-scale music festivals. Technological advancements are driving innovation in areas such as high-fidelity audio systems, immersive lighting effects, and interactive fan experiences, enhancing audience engagement. Unique selling propositions often involve exclusive artist performances, themed events, and premium ticketing packages.

Key Drivers, Barriers & Challenges in United States Live Music Market

Key Drivers:

- Rising Disposable Incomes: Increased spending on entertainment and experiences.

- Technological Advancements: Enhanced fan experience through improved audio-visual technology and seamless ticketing.

- Growing Popularity of Music Festivals: Diverse range of genres and immersive experiences.

Challenges and Restraints:

- Economic Downturns: Reduced consumer spending impacting ticket sales.

- Venue Availability & Costs: Competition for venues and increasing operational costs.

- Competition from Streaming Services: Shifting consumer preferences and reduced demand for live performances.

- Supply Chain Disruptions: Impacting event production and logistics (estimated 5% reduction in events in 2023 due to supply issues).

Emerging Opportunities in United States Live Music Market

- Expansion into Smaller Markets: Untapped potential in secondary and tertiary cities.

- Virtual and Hybrid Events: Reaching a broader audience through online and combined live/online performances.

- Hyper-Personalization: Tailored experiences based on individual preferences through data analytics.

- Integration of new technologies: immersive experiences through VR/AR.

Growth Accelerators in the United States Live Music Market Industry

The long-term growth of the US live music market will be driven by continued technological innovation, strategic partnerships between artists, promoters, and technology companies, and expansion into new geographic markets and audience segments. Further developments in virtual and hybrid event formats will also increase market reach and revenue streams.

Key Players Shaping the United States Live Music Market Market

- Live Nation Entertainment

- AEG Presents

- Warner Music Group

- Ticketmaster

- Sony Music Entertainment

- C3 Presents

- Wasserman Music

- Anschutz Entertainment Group (AEG)

- Goldenvoice

- Bandsintown

Notable Milestones in United States Live Music Market Sector

- July 2023: Sony Corporation launched its "For The Music" campaign, highlighting its commitment to audio quality and potentially driving increased adoption of high-fidelity audio experiences at live events.

- February 2024: The BMAC and Live Nation partnership announced a music business intensive course and internship program, promoting diversity and inclusion within the industry and potentially increasing the long-term talent pool.

In-Depth United States Live Music Market Market Outlook

The US live music market is poised for continued growth, driven by a strong economic recovery, increased consumer spending on entertainment, and ongoing technological advancements. Strategic partnerships, market expansion, and innovative event formats will be crucial for maintaining momentum in the long term. The market is expected to see significant expansion in the next decade, driven by the younger generation's affinity towards live music events and a consistent flow of new artists and genres.

United States Live Music Market Segmentation

-

1. Application

- 1.1. Concerts

- 1.2. Festivals

- 1.3. Theater

- 1.4. Corporate Events

- 1.5. Weddings

-

2. Revenue

- 2.1. Tickets

- 2.2. Sponsorship

- 2.3. Merchandising

-

3. Age Group

- 3.1. Children

- 3.2. Teenagers

- 3.3. Adults

- 3.4. Seniors

-

4. Venue Size

- 4.1. Small

- 4.2. Medium

- 4.3. Large

United States Live Music Market Segmentation By Geography

- 1. United States

United States Live Music Market Regional Market Share

Geographic Coverage of United States Live Music Market

United States Live Music Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Consumer Preference for Live Music Events and Experiences; Diverse Range of Events

- 3.2.2 Including Concerts

- 3.2.3 Festivals

- 3.2.4 and Special Performances

- 3.3. Market Restrains

- 3.3.1 Growing Consumer Preference for Live Music Events and Experiences; Diverse Range of Events

- 3.3.2 Including Concerts

- 3.3.3 Festivals

- 3.3.4 and Special Performances

- 3.4. Market Trends

- 3.4.1. The Live Music Ticket Sales Type is Thriving in the US Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Live Music Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Concerts

- 5.1.2. Festivals

- 5.1.3. Theater

- 5.1.4. Corporate Events

- 5.1.5. Weddings

- 5.2. Market Analysis, Insights and Forecast - by Revenue

- 5.2.1. Tickets

- 5.2.2. Sponsorship

- 5.2.3. Merchandising

- 5.3. Market Analysis, Insights and Forecast - by Age Group

- 5.3.1. Children

- 5.3.2. Teenagers

- 5.3.3. Adults

- 5.3.4. Seniors

- 5.4. Market Analysis, Insights and Forecast - by Venue Size

- 5.4.1. Small

- 5.4.2. Medium

- 5.4.3. Large

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Live Nation Entertainment

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AEG Presents

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Warner Music Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ticketmaster

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sony Music Entertainment

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 C3 Presents

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wasserman Music

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Anschutz Entertainment Group (AEG)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Goldenvoice

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bandsintown**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Live Nation Entertainment

List of Figures

- Figure 1: United States Live Music Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Live Music Market Share (%) by Company 2025

List of Tables

- Table 1: United States Live Music Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: United States Live Music Market Volume Billion Forecast, by Application 2020 & 2033

- Table 3: United States Live Music Market Revenue Million Forecast, by Revenue 2020 & 2033

- Table 4: United States Live Music Market Volume Billion Forecast, by Revenue 2020 & 2033

- Table 5: United States Live Music Market Revenue Million Forecast, by Age Group 2020 & 2033

- Table 6: United States Live Music Market Volume Billion Forecast, by Age Group 2020 & 2033

- Table 7: United States Live Music Market Revenue Million Forecast, by Venue Size 2020 & 2033

- Table 8: United States Live Music Market Volume Billion Forecast, by Venue Size 2020 & 2033

- Table 9: United States Live Music Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: United States Live Music Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: United States Live Music Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: United States Live Music Market Volume Billion Forecast, by Application 2020 & 2033

- Table 13: United States Live Music Market Revenue Million Forecast, by Revenue 2020 & 2033

- Table 14: United States Live Music Market Volume Billion Forecast, by Revenue 2020 & 2033

- Table 15: United States Live Music Market Revenue Million Forecast, by Age Group 2020 & 2033

- Table 16: United States Live Music Market Volume Billion Forecast, by Age Group 2020 & 2033

- Table 17: United States Live Music Market Revenue Million Forecast, by Venue Size 2020 & 2033

- Table 18: United States Live Music Market Volume Billion Forecast, by Venue Size 2020 & 2033

- Table 19: United States Live Music Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: United States Live Music Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Live Music Market?

The projected CAGR is approximately 8.56%.

2. Which companies are prominent players in the United States Live Music Market?

Key companies in the market include Live Nation Entertainment, AEG Presents, Warner Music Group, Ticketmaster, Sony Music Entertainment, C3 Presents, Wasserman Music, Anschutz Entertainment Group (AEG), Goldenvoice, Bandsintown**List Not Exhaustive.

3. What are the main segments of the United States Live Music Market?

The market segments include Application, Revenue, Age Group, Venue Size.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.37 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumer Preference for Live Music Events and Experiences; Diverse Range of Events. Including Concerts. Festivals. and Special Performances.

6. What are the notable trends driving market growth?

The Live Music Ticket Sales Type is Thriving in the US Market.

7. Are there any restraints impacting market growth?

Growing Consumer Preference for Live Music Events and Experiences; Diverse Range of Events. Including Concerts. Festivals. and Special Performances.

8. Can you provide examples of recent developments in the market?

February 2024: The Black Music Action Coalition (BMAC) and Live Nation announced the launch of a music business intensive course and paid internship program for Summer 2024. Aimed at aspiring music professionals nationwide, it includes a week-long Los Angeles course, keynote talks, and opportunities for internships and apprenticeships with Live Nation to foster industry access and equity.July 2023: Sony Corporation, a subsidiary of Sony Music Entertainment, a leading advocate of creative freedom, unveiled its latest brand platform and campaign, "For The Music," highlighting its top-notch audio offerings and services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Live Music Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Live Music Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Live Music Market?

To stay informed about further developments, trends, and reports in the United States Live Music Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence