Key Insights

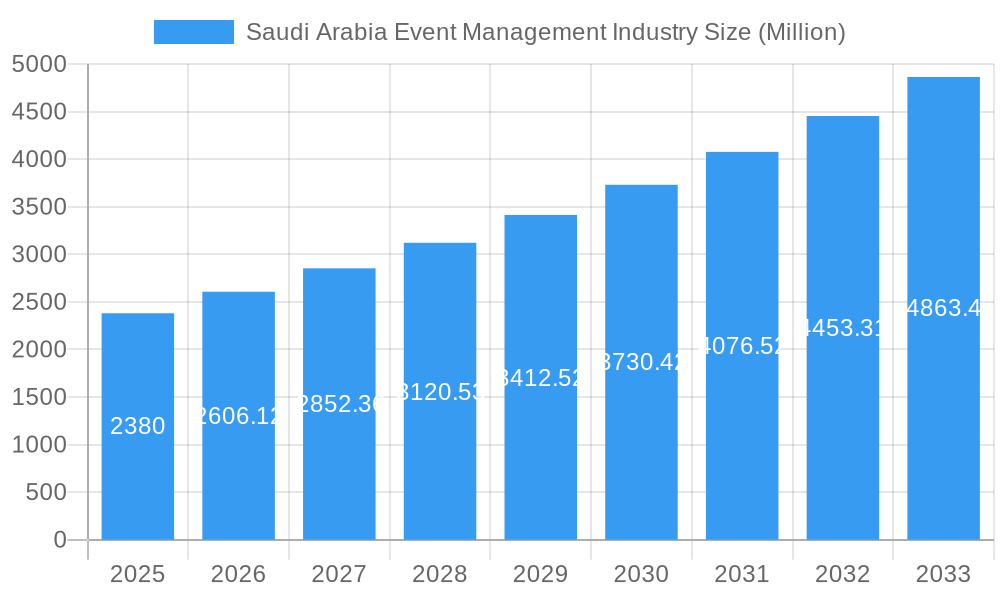

The Saudi Arabian event management industry is experiencing robust growth, fueled by the nation's Vision 2030 initiative and its ambitious diversification plans. With a 2025 market size of $2.38 billion and a compound annual growth rate (CAGR) of 9.74% projected from 2025 to 2033, the sector presents significant opportunities for both established players and new entrants. This expansion is driven by increasing government investment in tourism and infrastructure, a burgeoning MICE (Meetings, Incentives, Conferences, and Exhibitions) sector, and a growing young population with a high disposable income. Key drivers include the rising popularity of large-scale events, conferences, and exhibitions, attracting both domestic and international participation. Furthermore, the government's focus on promoting cultural events and entertainment contributes to market growth. Challenges, however, include maintaining sustainable practices and managing the logistical complexities of hosting major events in a rapidly developing market. The sector's segmentation likely includes sub-sectors such as corporate events, conferences, exhibitions, festivals, and weddings, each with its own growth trajectory.

Saudi Arabia Event Management Industry Market Size (In Billion)

The competitive landscape is dynamic, with both local and international companies vying for market share. Key players like SoundKraft LLC, Global Event Management, and Riyadh Exhibitions Company Ltd are establishing strong positions, often specializing in specific niches within the event management space. The industry's future hinges on its ability to leverage technological advancements, enhance sustainability initiatives, and adapt to evolving consumer preferences. Continued investment in infrastructure, including state-of-the-art venues and improved transportation networks, will further stimulate market growth. Effective collaboration between the public and private sectors is also crucial to creating a supportive ecosystem for this burgeoning industry. We project that the market will continue its strong growth trajectory, driven by the factors mentioned above, further solidifying Saudi Arabia's position as a prominent hub for events in the Middle East and beyond.

Saudi Arabia Event Management Industry Company Market Share

Saudi Arabia Event Management Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Saudi Arabia event management industry, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategic planners. The report analyzes both the parent market (Event Management) and child markets (e.g., Conferences, Exhibitions, Corporate Events, etc.) to provide a holistic understanding of this rapidly evolving sector. The market size is projected to reach xx Million by 2033.

Saudi Arabia Event Management Industry Market Dynamics & Structure

The Saudi Arabian event management market is experiencing significant growth driven by Vision 2030's diversification efforts and increased government spending on entertainment and tourism. Market concentration is moderate, with several large players and a number of smaller, specialized firms. Technological innovation, particularly in virtual and hybrid event platforms, is transforming the industry. Regulatory frameworks are becoming increasingly supportive, facilitating ease of doing business. While traditional events remain dominant, substitutes such as online webinars and virtual conferences are gaining traction.

- Market Concentration: Moderate, with a few dominant players controlling approximately xx% of the market share.

- Technological Innovation: Adoption of VR/AR technologies, AI-powered event management platforms, and data analytics is driving efficiency and engagement. Barriers include high initial investment costs and a skills gap in adopting new technologies.

- Regulatory Framework: Supportive government policies and streamlined licensing processes are boosting growth.

- Competitive Substitutes: Online events are a growing substitute, particularly for smaller-scale gatherings.

- End-User Demographics: A growing young population with increasing disposable income is driving demand for diverse event experiences.

- M&A Trends: A moderate level of M&A activity is observed, with larger companies acquiring smaller specialized firms to expand their service offerings. xx M&A deals were recorded between 2019 and 2024.

Saudi Arabia Event Management Industry Growth Trends & Insights

The Saudi Arabia event management industry has witnessed robust growth in the historical period (2019-2024), exhibiting a CAGR of xx%. This growth is attributed to factors such as increasing government spending on entertainment and tourism, rising disposable incomes, and a surge in corporate events and conferences. The market size reached xx Million in 2024 and is projected to reach xx Million in 2025, driven by the increasing number of large-scale events and the expanding tourism sector. Technological advancements like AI-powered event management software and virtual event platforms are accelerating adoption rates and enhancing customer experience. Consumer behavior shifts indicate a preference for experiential events and personalized service. The forecast period (2025-2033) is expected to see continued growth, with a projected CAGR of xx%, driven by Vision 2030 initiatives and the expansion of the entertainment sector. Market penetration is currently at xx% and is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Saudi Arabia Event Management Industry

Riyadh and Jeddah are the dominant regions, accounting for approximately xx% of the market share, fueled by their robust infrastructure, concentration of businesses, and high population density. The conferences and exhibitions segment is the largest, followed by corporate events and entertainment events.

- Key Drivers in Riyadh and Jeddah:

- Strong infrastructure and venue availability.

- High concentration of businesses and corporate headquarters.

- Large and affluent population base.

- Government support for major events and tourism initiatives.

- Growth Potential: Smaller cities like Dammam and Al Khobar present significant untapped potential.

Saudi Arabia Event Management Industry Product Landscape

The product landscape is characterized by a diverse range of services, from planning and logistics to on-site management and technology integration. Innovations include AI-driven event planning tools, virtual and hybrid event platforms, and personalized event experiences. Key performance metrics include client satisfaction, event attendance, and return on investment (ROI). Unique selling propositions focus on delivering seamless, technologically advanced events with a high level of customization.

Key Drivers, Barriers & Challenges in Saudi Arabia Event Management Industry

Key Drivers:

- Vision 2030: Government initiatives to diversify the economy and boost tourism are creating significant opportunities.

- Increased Government Spending: Investment in infrastructure and entertainment is driving demand.

- Rising Disposable Incomes: A growing middle class with greater spending power fuels event participation.

Key Challenges:

- Competition: A relatively competitive landscape with both local and international players.

- Supply Chain Issues: Logistics and sourcing of resources can pose challenges for event management companies.

- Regulatory Hurdles: Navigating regulatory requirements can sometimes be complex, impacting operational efficiency.

Emerging Opportunities in Saudi Arabia Event Management Industry

- Untapped Markets: Smaller cities and regions offer substantial growth potential.

- Niche Events: Focus on specialized events, such as sustainability-focused conferences, can attract new clientele.

- Experiential Events: Demand for unique and immersive experiences is increasing.

Growth Accelerators in the Saudi Arabia Event Management Industry

The long-term growth of the Saudi Arabia event management industry is driven by Vision 2030's continued focus on tourism and diversification. Strategic partnerships between local and international companies are fostering innovation and knowledge transfer. The expansion of event infrastructure and the development of new technologies, such as AI-powered event planning tools and virtual event platforms, will further enhance market growth.

Key Players Shaping the Saudi Arabia Event Management Industry Market

- SoundKraft LLC

- Global Event Management

- Alpha Conferences & Exhibitions

- Masaahaat

- Addenterprise

- SELA

- Luxury KSA

- Heights

- Benchmark Events

- Riyadh Exhibitions Company Ltd

- Markable General Trading LLC

- KonozRetaj

Notable Milestones in Saudi Arabia Event Management Industry Sector

- December 2023: Comma partnered with ALTER, expanding UK-based event management expertise in Saudi Arabia.

- January 2024: dmg events announced the Saudi Sports and Leisure Facilities (SSLF) Expo and Sports Build Show, indicating a focus on specialized events.

In-Depth Saudi Arabia Event Management Industry Market Outlook

The Saudi Arabia event management industry is poised for continued growth, driven by the long-term effects of Vision 2030, increased government investment, and technological advancements. Strategic partnerships and the expansion into niche markets represent significant opportunities for companies operating in this dynamic sector. The continued growth of the tourism sector and the increasing number of international events held in Saudi Arabia will continue to support the sector's growth in the forecast period.

Saudi Arabia Event Management Industry Segmentation

-

1. End User

- 1.1. Corporate

- 1.2. Individual

- 1.3. Public

-

2. Type

- 2.1. Music Concert

- 2.2. Festivals

- 2.3. Sports

- 2.4. Exhibitions and Conferences

- 2.5. Corporate Events and Seminars

- 2.6. Other Types

-

3. Revenue Source

- 3.1. Ticket Sale

- 3.2. Sponsorship

- 3.3. Other Revenue Sources

Saudi Arabia Event Management Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Event Management Industry Regional Market Share

Geographic Coverage of Saudi Arabia Event Management Industry

Saudi Arabia Event Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Number of Events and Conference in the Country; Raise in Disposable Income and Lifestyle

- 3.3. Market Restrains

- 3.3.1. Increase in the Number of Events and Conference in the Country; Raise in Disposable Income and Lifestyle

- 3.4. Market Trends

- 3.4.1. The Market is Influenced by Major International Events Being Held in Saudi Arabia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Event Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Corporate

- 5.1.2. Individual

- 5.1.3. Public

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Music Concert

- 5.2.2. Festivals

- 5.2.3. Sports

- 5.2.4. Exhibitions and Conferences

- 5.2.5. Corporate Events and Seminars

- 5.2.6. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Revenue Source

- 5.3.1. Ticket Sale

- 5.3.2. Sponsorship

- 5.3.3. Other Revenue Sources

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SoundKraft LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Global Event Management

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Alpha Conferences & Exhibitions

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Masaahaat

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Addenterprise

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SELA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Luxury KSA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Heights

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Benchmark Events

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Riyadh Exhibitions Company Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Markable General Trading LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 KonozRetaj **List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 SoundKraft LLC

List of Figures

- Figure 1: Saudi Arabia Event Management Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Event Management Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Event Management Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 2: Saudi Arabia Event Management Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 3: Saudi Arabia Event Management Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Saudi Arabia Event Management Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 5: Saudi Arabia Event Management Industry Revenue Million Forecast, by Revenue Source 2020 & 2033

- Table 6: Saudi Arabia Event Management Industry Volume Billion Forecast, by Revenue Source 2020 & 2033

- Table 7: Saudi Arabia Event Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Saudi Arabia Event Management Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Saudi Arabia Event Management Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Saudi Arabia Event Management Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 11: Saudi Arabia Event Management Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Saudi Arabia Event Management Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 13: Saudi Arabia Event Management Industry Revenue Million Forecast, by Revenue Source 2020 & 2033

- Table 14: Saudi Arabia Event Management Industry Volume Billion Forecast, by Revenue Source 2020 & 2033

- Table 15: Saudi Arabia Event Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Saudi Arabia Event Management Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Event Management Industry?

The projected CAGR is approximately 9.74%.

2. Which companies are prominent players in the Saudi Arabia Event Management Industry?

Key companies in the market include SoundKraft LLC, Global Event Management, Alpha Conferences & Exhibitions, Masaahaat, Addenterprise, SELA, Luxury KSA, Heights, Benchmark Events, Riyadh Exhibitions Company Ltd, Markable General Trading LLC, KonozRetaj **List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Event Management Industry?

The market segments include End User, Type, Revenue Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Number of Events and Conference in the Country; Raise in Disposable Income and Lifestyle.

6. What are the notable trends driving market growth?

The Market is Influenced by Major International Events Being Held in Saudi Arabia.

7. Are there any restraints impacting market growth?

Increase in the Number of Events and Conference in the Country; Raise in Disposable Income and Lifestyle.

8. Can you provide examples of recent developments in the market?

January 2024 - dmg events, an international exhibition organizer, is preparing to introduce two upcoming events in Saudi Arabia: the Saudi Sports and Leisure Facilities (SSLF) Expo and Sports Build Show.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Event Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Event Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Event Management Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Event Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence