Key Insights

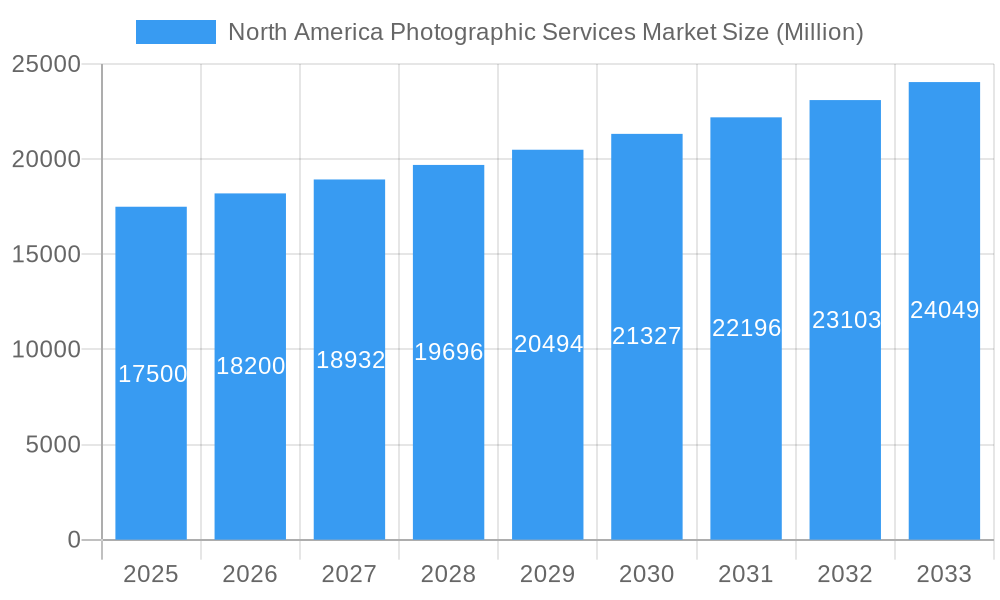

The North America photographic services market, currently experiencing robust growth, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4.00% from 2025 to 2033. This expansion is fueled by several key factors. The increasing demand for high-quality professional photography across various sectors, including commercial advertising, e-commerce product photography, and personal events like weddings and family portraits, is a significant driver. Technological advancements, such as the proliferation of high-resolution cameras and sophisticated image editing software, are also contributing to market growth by enhancing accessibility and quality. Furthermore, the rise of social media platforms necessitates high-quality visual content, further boosting the demand for professional photographic services. The market is segmented into various specialized areas, encompassing wedding photography, corporate photography, real estate photography, and more, allowing for diverse service offerings and catering to specific customer needs. While precise market sizing data is unavailable, based on industry reports and comparable markets, a reasonable estimate for the North American photographic services market in 2025 could be placed in the range of $15 billion to $20 billion USD. This figure is supported by the presence of established players such as Getty Images, Meero, and others indicating a substantial market volume.

North America Photographic Services Market Market Size (In Billion)

However, the market also faces certain restraints. Increasing competition from freelance photographers and amateur photographers offering lower prices presents a challenge. Fluctuations in economic conditions can also impact spending on non-essential services like professional photography. Despite these challenges, the overall positive trends in the market are expected to overcome these obstacles. The continuous evolution of photographic technology and the growing importance of visual content across all industries ensure that the demand for professional photographic services will remain high, leading to a sustained period of growth in the forecast period of 2025 to 2033. The continued success of established players and the emergence of new specialized photography services cater to the diversified need for high-quality photography across diverse sectors within North America.

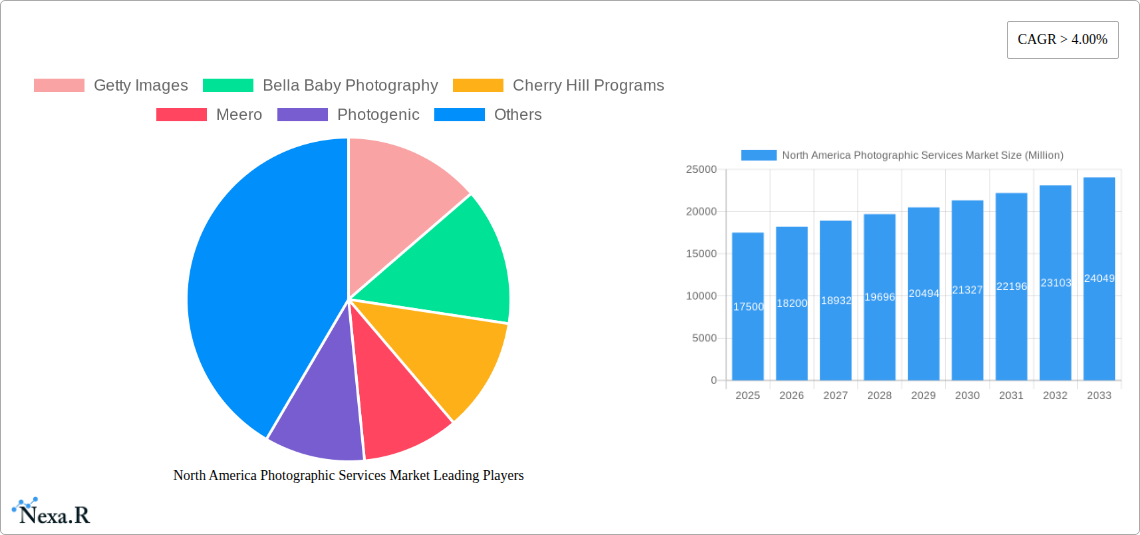

North America Photographic Services Market Company Market Share

North America Photographic Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America photographic services market, encompassing market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report leverages extensive data analysis to offer valuable insights for industry professionals, investors, and strategic decision-makers. This report covers the parent market of Imaging and Photography Services and its child market, Photographic Services. The market size is predicted to be XX million units in 2025.

North America Photographic Services Market Dynamics & Structure

The North America photographic services market is characterized by a moderately fragmented landscape with a mix of large multinational corporations and smaller specialized firms. Market concentration is moderate, with the top five players holding an estimated xx% market share in 2025. Technological innovation, particularly in areas like AI-powered image enhancement and drone photography, is a key driver. Regulatory frameworks concerning data privacy and copyright protection significantly influence market operations. The market experiences competition from substitute services like digital art creation and video production. End-user demographics are diverse, encompassing individuals, businesses (e.g., real estate, e-commerce), and government agencies. Mergers and acquisitions (M&A) activity has been relatively low in recent years, with approximately xx deals recorded between 2019 and 2024.

- Market Concentration: Moderately fragmented (Top 5 players: xx% market share in 2025)

- Technological Innovation: AI-powered image enhancement, drone photography, 360° imaging.

- Regulatory Landscape: Data privacy regulations (e.g., CCPA, GDPR), copyright laws.

- Competitive Substitutes: Digital art creation, video production services.

- End-User Demographics: Individuals, businesses, government agencies.

- M&A Activity: Approximately xx deals between 2019 and 2024.

- Innovation Barriers: High initial investment costs for advanced technology, skilled labor shortage.

North America Photographic Services Market Growth Trends & Insights

The North America photographic services market experienced significant growth during the historical period (2019-2024), driven by increasing demand for professional photography across various sectors. Adoption rates have steadily increased, particularly in areas like e-commerce product photography and real estate marketing. Technological disruptions, such as the rise of smartphone photography and AI-based editing tools, have impacted the market, creating both challenges and opportunities. Consumer behavior has shifted towards convenience and affordability, leading to a growth in online booking platforms and subscription-based services. The market is projected to maintain a CAGR of xx% during the forecast period (2025-2033), reaching an estimated value of XX million units by 2033. Market penetration remains relatively high in urban areas, with opportunities for expansion in rural regions.

- Market Size Evolution: Steady growth from XX million units in 2019 to an estimated XX million units in 2025.

- Adoption Rates: Increasing demand across various sectors.

- Technological Disruptions: Smartphone photography, AI-based editing tools.

- Consumer Behavior Shifts: Preference for convenience, affordability, and online platforms.

- CAGR (Forecast Period): xx%

- Market Penetration: High in urban areas, potential for growth in rural regions.

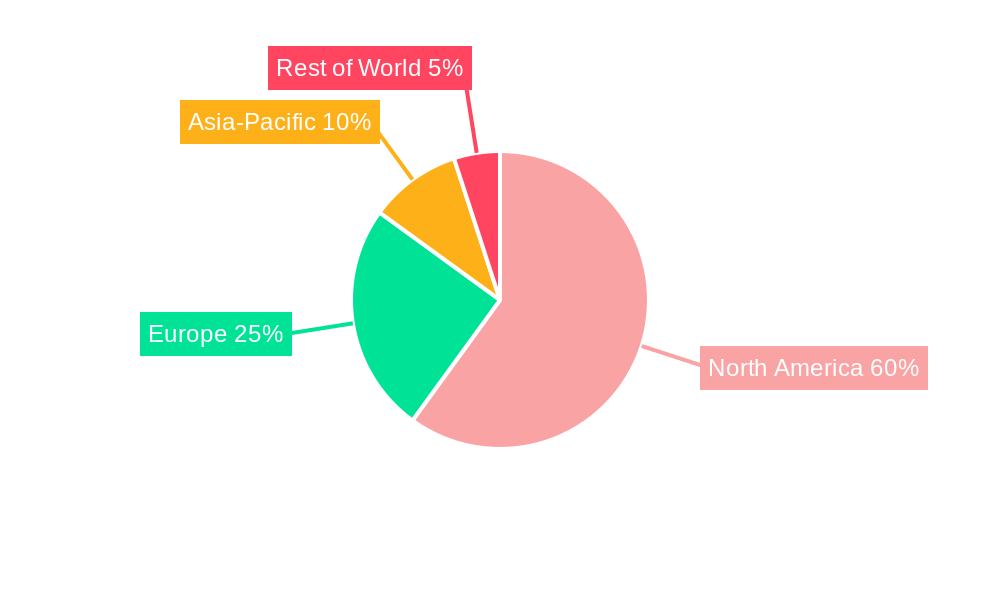

Dominant Regions, Countries, or Segments in North America Photographic Services Market

The Northeastern United States currently dominates the North America photographic services market, driven by factors such as high population density, a robust economy, and a strong concentration of businesses in key sectors like media and entertainment. Other significant regions include California and major metropolitan areas across Canada.

- Key Drivers (Northeastern US): High population density, strong economy, concentration of businesses, established infrastructure.

- Dominance Factors: High demand for professional photography, significant presence of key players, advanced infrastructure supporting the industry.

- Growth Potential: Continued growth in urban areas, expansion into underserved rural markets.

- Market Share (2025): Northeastern US: xx%, California: xx%, Canada (Major Cities): xx%

North America Photographic Services Market Product Landscape

The North America photographic services market offers a diverse range of products, including traditional photography services, specialized photography (e.g., aerial, event, product), photo editing and retouching, and digital asset management solutions. Innovation is evident in areas like high-resolution imaging, virtual reality (VR) and augmented reality (AR) photography, and AI-powered image analysis. The unique selling propositions of many providers lie in their specialized skills, niche expertise, and rapid turnaround times.

Key Drivers, Barriers & Challenges in North America Photographic Services Market

Key Drivers: The increasing demand for high-quality visual content across diverse industries (e.g., e-commerce, marketing, real estate) drives market growth. Technological advancements (AI-powered tools, improved cameras) enhance efficiency and quality. Government initiatives supporting the creative industries also stimulate growth.

Key Barriers & Challenges: Intense competition, fluctuating pricing pressures, and the need to stay ahead of technological advancements pose considerable challenges. The economic impacts of the pandemic also caused decreased demand in certain segments, while skilled labor shortages remain a significant constraint.

Emerging Opportunities in North America Photographic Services Market

Untapped markets exist in rural areas and emerging industries. Innovative applications of virtual and augmented reality in photography open new avenues for growth. Evolving consumer preferences for personalized and unique photographic experiences create opportunities for customized services.

Growth Accelerators in the North America Photographic Services Market Industry

Technological breakthroughs, such as advanced AI-powered tools, continue to improve efficiency and image quality. Strategic partnerships between photography services providers and businesses (e.g., e-commerce platforms, marketing agencies) create new revenue streams and market reach. Expansion strategies targeting emerging markets and untapped niches drive further growth.

Key Players Shaping the North America Photographic Services Market Market

- Getty Images

- Bella Baby Photography

- Cherry Hill Programs

- Meero

- Photogenic

- WorldWide Photography

- Classic Photographers

- Telescope Pictures

- GradImages

- Enchanted Fairies

List Not Exhaustive

Notable Milestones in North America Photographic Services Market Sector

- February 2023: Aputure launched new lighting products, enhancing professional photography capabilities. This boosts the quality and efficiency of photographic services.

- September 2022: Cherry Hill Programs' fundraising campaign for St. Jude Children's Research Hospital demonstrates corporate social responsibility, potentially enhancing brand image and attracting customers.

In-Depth North America Photographic Services Market Market Outlook

The North America photographic services market is poised for continued growth, driven by technological advancements, strategic partnerships, and the ongoing demand for high-quality visual content across multiple sectors. The market presents significant opportunities for established players and new entrants alike, emphasizing innovation, strategic market expansion, and a customer-centric approach. The predicted market size in 2033 is XX million units, signifying substantial growth potential.

North America Photographic Services Market Segmentation

-

1. Type Outlook

- 1.1. Shooting service

- 1.2. After-sales service

-

2. Application

- 2.1. Portrait Studio Services

- 2.2. Commercial Studios

North America Photographic Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Photographic Services Market Regional Market Share

Geographic Coverage of North America Photographic Services Market

North America Photographic Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Revenue of Photographic Services in the United states

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Photographic Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type Outlook

- 5.1.1. Shooting service

- 5.1.2. After-sales service

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Portrait Studio Services

- 5.2.2. Commercial Studios

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type Outlook

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Getty Images

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bella Baby Photography

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cherry Hill Programs

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Meero

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Photogenic

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 WorldWide Photography

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Classic Photographers

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Telescope Pictures

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GradImages

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Enchanted Fairies**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Getty Images

List of Figures

- Figure 1: North America Photographic Services Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Photographic Services Market Share (%) by Company 2025

List of Tables

- Table 1: North America Photographic Services Market Revenue undefined Forecast, by Type Outlook 2020 & 2033

- Table 2: North America Photographic Services Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: North America Photographic Services Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: North America Photographic Services Market Revenue undefined Forecast, by Type Outlook 2020 & 2033

- Table 5: North America Photographic Services Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: North America Photographic Services Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States North America Photographic Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Photographic Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Photographic Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Photographic Services Market?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the North America Photographic Services Market?

Key companies in the market include Getty Images, Bella Baby Photography, Cherry Hill Programs, Meero, Photogenic, WorldWide Photography, Classic Photographers, Telescope Pictures, GradImages, Enchanted Fairies**List Not Exhaustive.

3. What are the main segments of the North America Photographic Services Market?

The market segments include Type Outlook, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Revenue of Photographic Services in the United states.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Aputure announced various new lighting products, including its first RGBWW full-color LED pixel bar, a four-foot battery-powered pixel tube, a smaller portable one-foot battery-powered pixel tube, and an improved 200-watt (W) bi-color Bowens Mount point-source light.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Photographic Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Photographic Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Photographic Services Market?

To stay informed about further developments, trends, and reports in the North America Photographic Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence