Key Insights

The North America performing arts companies market, projected to reach $193.38 million by 2025, is forecast for substantial expansion. Anticipated to grow at a compound annual growth rate (CAGR) of 5.67% from 2025 to 2033, this market's upward trajectory is propelled by several key drivers. A significant factor is the resurgence in demand for live entertainment experiences post-pandemic, amplified by increasing disposable incomes across key consumer demographics, leading to enhanced ticket sales and revenue. Furthermore, the performing arts sector's proactive adoption of technological innovations, such as immersive performances, virtual reality integration, and advanced digital marketing, is successfully attracting a wider and younger audience. The proliferation of high-quality performance streaming services, while indirectly influencing the live-event model, broadens the market's overall reach. Continuous investment in emerging talent and innovative programming further solidifies the sector's sustained appeal and creative dynamism. Leading entities like Disney, Live Nation, and Cirque du Soleil continue to influence market dynamics through strategic acquisitions, global expansion, and diversified service portfolios.

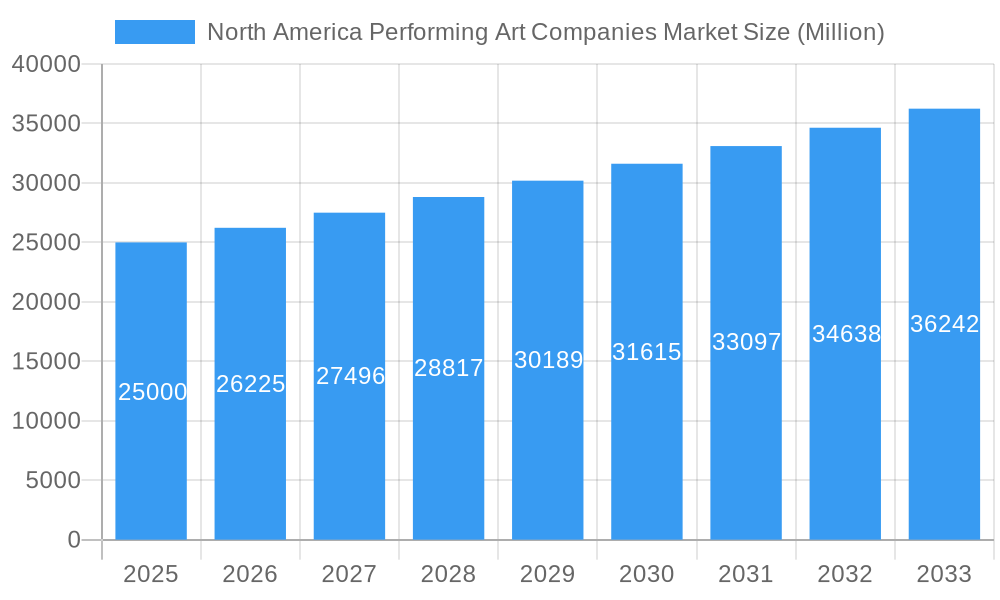

North America Performing Art Companies Market Market Size (In Million)

Despite positive growth indicators, the market faces persistent challenges. Escalating operational expenditures, including venue leasing, artist remuneration, and marketing investment, present considerable obstacles to profitability. Competition from alternative entertainment forms, such as digital streaming and video gaming, mandates continuous innovation and a strategic emphasis on delivering distinctive, high-caliber experiences to retain market share. The industry also navigates the complexities of economic volatility and fluctuating consumer spending, requiring agile business strategies and robust risk mitigation. The market exhibits significant segmentation, with diverse revenue streams and target demographics characterizing Broadway productions, live music concerts, and various other performing arts disciplines. Regional demand disparities also impact overall market performance, with major urban centers typically generating higher revenues than smaller markets. Sustained growth hinges on effectively addressing these challenges and leveraging emerging opportunities within the digital landscape.

North America Performing Art Companies Market Company Market Share

North America Performing Arts Companies Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America Performing Arts Companies market, encompassing market dynamics, growth trends, regional performance, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period spanning 2025-2033. The report's findings are invaluable for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic sector. The total market size is predicted to reach xx Million by 2033.

North America Performing Art Companies Market Dynamics & Structure

This section delves into the intricate structure of the North America Performing Arts Companies market, examining market concentration, technological advancements, regulatory landscapes, competitive dynamics, and consumer demographics. The analysis incorporates both quantitative data (market share, M&A activity) and qualitative insights (innovation barriers, competitive pressures).

Market Concentration: The North American performing arts market exhibits a moderately concentrated structure, with a few large players like The Walt Disney Company and Live Nation Entertainment commanding significant market share, while numerous smaller independent companies cater to niche segments. The overall market share of the top 5 players is estimated at xx%.

Technological Innovation: Technological advancements, including virtual reality (VR), augmented reality (AR), and high-definition streaming technologies, are transforming the delivery and consumption of performing arts. However, high implementation costs and the need for specialized skills pose significant barriers to adoption.

Regulatory Frameworks: Regulatory frameworks governing copyright, licensing, and labor practices vary across states and provinces, creating complexities for companies operating nationally or internationally.

Competitive Landscape: Intense competition exists between established players and emerging companies, driven by factors such as audience acquisition, content exclusivity, and pricing strategies. The threat of substitution from alternative forms of entertainment (e.g., streaming services, video games) is also a considerable factor.

End-User Demographics: The market is served by a diverse demographic group with varying preferences and consumption patterns. Targeting specific demographic segments effectively is critical for success.

M&A Trends: Consolidation within the industry is evident through mergers and acquisitions (M&A) activities. The volume of M&A deals averaged xx per year during the historical period (2019-2024). Factors driving M&A include expansion into new markets, diversification of offerings, and access to intellectual property.

North America Performing Art Companies Market Growth Trends & Insights

This section analyzes the historical and projected growth of the North America Performing Arts Companies market, considering factors such as market size evolution, adoption rates, technological disruptions, and shifts in consumer behavior.

The market experienced a period of disruption during the COVID-19 pandemic (2020-2021), with significant declines in attendance and revenue. However, a strong recovery is observed with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, driven by factors such as increased consumer spending, the reopening of venues, and the adoption of new technologies. Market penetration of digital distribution channels is expected to reach xx% by 2033. Changes in consumer behavior, including a growing demand for immersive experiences and personalized content, further shape the market trajectory. The growing interest in diverse cultural performances is also fueling market expansion.

Dominant Regions, Countries, or Segments in North America Performing Art Companies Market

This section identifies the leading regions, countries, or segments within the North American Performing Arts Companies market based on factors such as market size, growth rate, and key drivers.

Leading Region: The Northeastern United States currently holds the largest market share, driven by high population density, a strong cultural heritage, and numerous established performing arts venues.

Key Drivers: The presence of major metropolitan areas with significant cultural infrastructure contributes to high demand for performing arts events. Government support for arts and culture through grants and subsidies also plays a vital role. Furthermore, supportive economic policies and strong tourism contribute to the robust market performance in this region.

Growth Potential: While the Northeast maintains a dominant position, significant growth potential exists in the Southern and Western United States, fueled by population growth and increasing disposable income.

Market Share: The Northeastern region accounts for approximately xx% of the total market share in North America. California and New York are the two largest state-level markets.

North America Performing Art Companies Market Product Landscape

The North American performing arts market encompasses a diverse range of products and services, from theatrical productions and musical concerts to dance performances and opera. Continuous innovation in staging, lighting, sound, and digital technologies enhances the audience experience. Companies are increasingly focusing on creating immersive and interactive experiences to attract and retain audiences, leveraging unique selling propositions like exclusive content and VIP packages. Advancements in streaming technology allow broader access to live performances and pre-recorded content.

Key Drivers, Barriers & Challenges in North America Performing Art Companies Market

Key Drivers:

- Growing disposable income and increased consumer spending on entertainment.

- Rising popularity of diverse cultural performances and events.

- Technological advancements that enhance audience experience and accessibility.

- Government initiatives supporting arts and culture.

Key Challenges and Restraints:

- High operating costs, including venue rentals, artist fees, and marketing expenses.

- Competition from other forms of entertainment, such as streaming services and video games.

- Economic downturns and uncertainty impacting consumer spending.

- The impact of unforeseen events (like pandemics) on audience attendance and revenue. The COVID-19 pandemic resulted in a xx% decline in revenue in 2020.

Emerging Opportunities in North America Performing Art Companies Market

Emerging opportunities include expanding into underserved markets, creating new forms of immersive experiences, and integrating digital technologies to enhance audience engagement. The integration of virtual and augmented reality could revolutionize the audience experience, offering more interactive and engaging performances. Furthermore, the growing demand for diverse and inclusive content presents opportunities for companies to cater to niche audiences.

Growth Accelerators in the North America Performing Art Companies Market Industry

Long-term growth will be fueled by technological innovation, strategic partnerships, and market expansion strategies. Companies are investing in cutting-edge technologies to create immersive and interactive experiences. Strategic alliances between performing arts companies and technology firms are creating new opportunities for content distribution and audience engagement. Expanding into new geographic markets and diversifying offerings (e.g., adding educational programs) are key growth strategies.

Key Players Shaping the North America Performing Art Companies Market Market

- The Walt Disney Company

- Live Nation Entertainment

- Cirque du Soleil

- Paramount Global

- Comcast Corporation

- The Madison Square Garden Company

- Broadway Across America

- The Shubert Organization

- The Second City

- The Metropolitan Opera

Notable Milestones in North America Performing Art Companies Market Sector

February 2023: Segerstrom Center for the Arts presents the North American Premiere of Christopher Wheeldon's ballet, Like Water for Chocolate, showcasing the continued demand for high-quality live performances and the willingness of venues to invest in new productions.

November 2022: The renewal of the Met: Live in HD series demonstrates the enduring appeal of live performance and the successful adaptation of traditional arts to digital distribution channels. This partnership demonstrates the continued growth of the digital streaming market segment within the performing arts.

In-Depth North America Performing Art Companies Market Market Outlook

The North American performing arts market is poised for robust growth in the coming years. Continued technological innovation, strategic partnerships, and an expanding consumer base will drive market expansion. Companies that successfully adapt to evolving consumer preferences and embrace digital technologies will be best positioned to capitalize on future growth opportunities. The market's resilience in the face of economic challenges underscores its long-term potential.

North America Performing Art Companies Market Segmentation

-

1. Type of Performing Arts

- 1.1. Theatre

- 1.2. Music and Opera

- 1.3. Dance

- 1.4. Circus and Other Art Forms

-

2. Venue Type

- 2.1. Concert Halls

- 2.2. Theatres

- 2.3. Stadiums

-

3. Ticket Pricing

- 3.1. Premium

- 3.2. Mid-Range

- 3.3. Economy

North America Performing Art Companies Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Performing Art Companies Market Regional Market Share

Geographic Coverage of North America Performing Art Companies Market

North America Performing Art Companies Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rise in the Use of Online Platforms

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Performing Art Companies Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Performing Arts

- 5.1.1. Theatre

- 5.1.2. Music and Opera

- 5.1.3. Dance

- 5.1.4. Circus and Other Art Forms

- 5.2. Market Analysis, Insights and Forecast - by Venue Type

- 5.2.1. Concert Halls

- 5.2.2. Theatres

- 5.2.3. Stadiums

- 5.3. Market Analysis, Insights and Forecast - by Ticket Pricing

- 5.3.1. Premium

- 5.3.2. Mid-Range

- 5.3.3. Economy

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type of Performing Arts

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Walt Disney Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Live Nation Entertainment

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cirque du Soleil

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Paramount Global

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Comcast Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Madison Square Garden Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Broadway Across America

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Shubert Organization

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The Second City

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Metropolitan Opera**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Walt Disney Company

List of Figures

- Figure 1: North America Performing Art Companies Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Performing Art Companies Market Share (%) by Company 2025

List of Tables

- Table 1: North America Performing Art Companies Market Revenue million Forecast, by Type of Performing Arts 2020 & 2033

- Table 2: North America Performing Art Companies Market Revenue million Forecast, by Venue Type 2020 & 2033

- Table 3: North America Performing Art Companies Market Revenue million Forecast, by Ticket Pricing 2020 & 2033

- Table 4: North America Performing Art Companies Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: North America Performing Art Companies Market Revenue million Forecast, by Type of Performing Arts 2020 & 2033

- Table 6: North America Performing Art Companies Market Revenue million Forecast, by Venue Type 2020 & 2033

- Table 7: North America Performing Art Companies Market Revenue million Forecast, by Ticket Pricing 2020 & 2033

- Table 8: North America Performing Art Companies Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States North America Performing Art Companies Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Performing Art Companies Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Performing Art Companies Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Performing Art Companies Market?

The projected CAGR is approximately 5.67%.

2. Which companies are prominent players in the North America Performing Art Companies Market?

Key companies in the market include The Walt Disney Company, Live Nation Entertainment, Cirque du Soleil, Paramount Global, Comcast Corporation, The Madison Square Garden Company, Broadway Across America, The Shubert Organization, The Second City, The Metropolitan Opera**List Not Exhaustive.

3. What are the main segments of the North America Performing Art Companies Market?

The market segments include Type of Performing Arts, Venue Type, Ticket Pricing.

4. Can you provide details about the market size?

The market size is estimated to be USD 193.38 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rise in the Use of Online Platforms.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Costa Mesa, CA Segerstrom Center for the Arts presents the North American Premiere of Christopher Wheeldon's latest ballet, Like Water for Chocolate, from American Ballet Theatre for six performances from Wednesday, March 29 through Sunday, April 2. Center audiences will be the first in the country to experience this magical Mexican love story, with the stellar dancers of ABT translating this richly layered story.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Performing Art Companies Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Performing Art Companies Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Performing Art Companies Market?

To stay informed about further developments, trends, and reports in the North America Performing Art Companies Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence