Key Insights

Europe's Chromatography Resins market is projected for significant expansion, with an estimated market size of $0.74 billion by 2025. Driven by a robust Compound Annual Growth Rate (CAGR) of 7.2%, the market anticipates sustained development throughout the forecast period of 2025-2033. Key growth drivers include the expanding pharmaceutical and biotechnology sectors, supported by advancements in drug discovery, development, and production. Increased demand for highly purified biopharmaceuticals and the growing necessity for efficient water and environmental monitoring solutions are further accelerating market growth. Emerging economies and increased R&D investments in Europe also contribute to this positive trend.

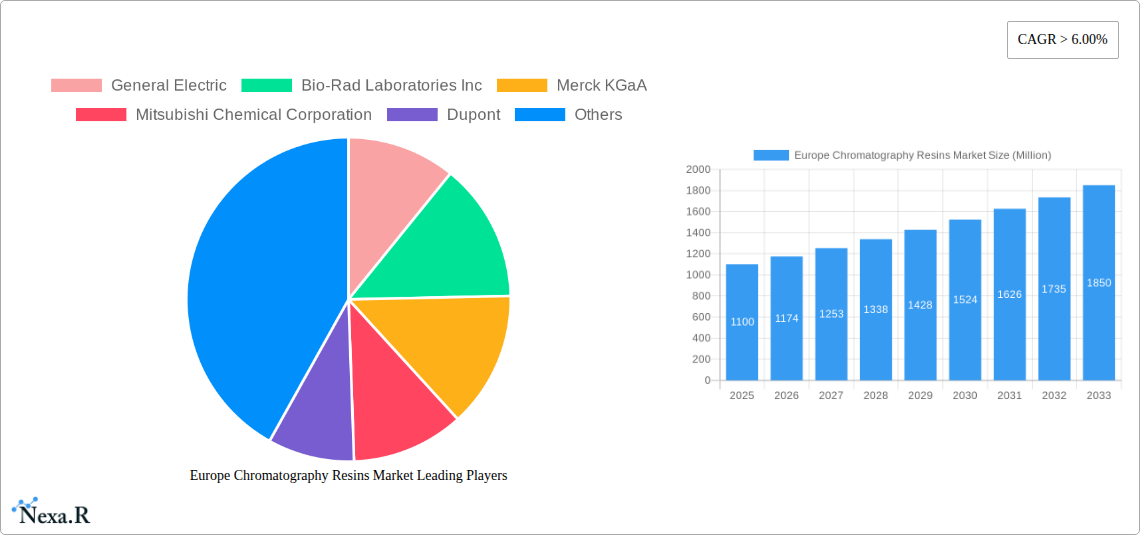

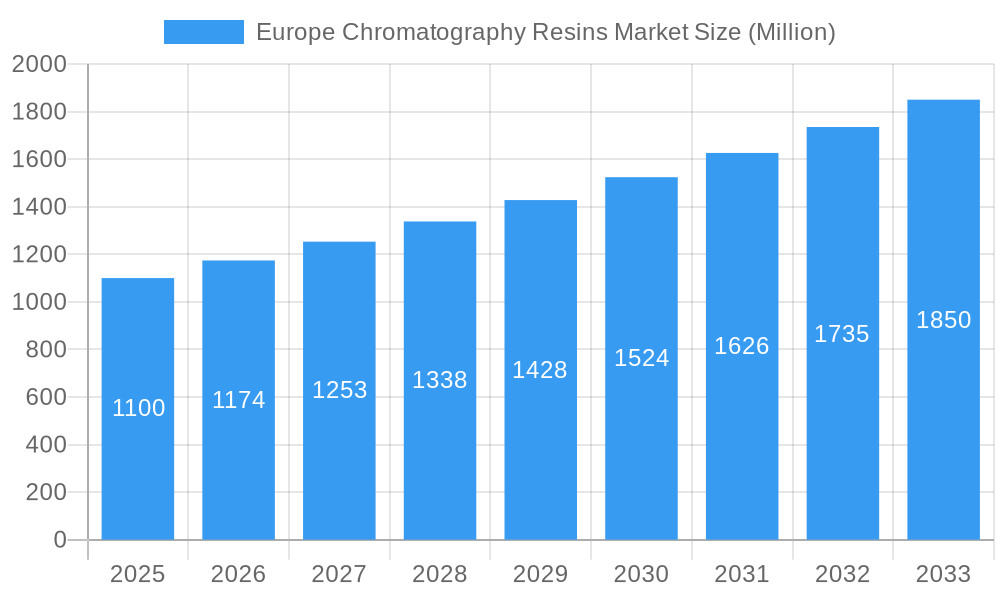

Europe Chromatography Resins Market Market Size (In Million)

The market segmentation reveals a dynamic landscape. Natural-based resins, such as Agarose and Dextran, maintain prominence due to their biocompatibility and specificity, especially in biopharmaceutical applications. However, synthetic-based resins, including Silica Gel and Polystyrene, are gaining traction for their enhanced stability and cost-effectiveness in broader industrial applications. Within technologies, Ion Exchange and Affinity Chromatography resins lead, addressing the precise separation needs of complex biological molecules. The Pharmaceuticals sector, encompassing Biotechnology and Drug Discovery, is the largest end-user industry, followed by Water and Environmental Agencies and the Food and Beverages industry. Leading players such as General Electric, Bio-Rad Laboratories Inc., Merck KGaA, and Thermo Fisher Scientific are actively shaping the competitive environment through innovation and strategic collaborations.

Europe Chromatography Resins Market Company Market Share

This comprehensive report offers an in-depth analysis of the Europe Chromatography Resins Market, providing critical insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, opportunities, and the competitive environment. With a study period from 2019 to 2033, including a base year of 2025 and a forecast period of 2025-2033, this report equips industry professionals with essential data and intelligence for navigating this evolving sector. The European chromatography resins market is a vital component of the global life sciences and chemical industries, propelled by advancements in biopharmaceuticals, stringent quality control in food and beverages, and expanding environmental monitoring initiatives.

Europe Chromatography Resins Market Market Dynamics & Structure

The Europe Chromatography Resins Market is characterized by a moderate to high level of concentration, with key players investing heavily in research and development to drive technological innovation. The increasing demand for high-purity biopharmaceuticals and novel drug discovery is a significant driver, pushing advancements in resin performance and specificity. Regulatory frameworks, particularly within pharmaceutical and environmental sectors, mandate strict quality standards, influencing the types of resins utilized and their validation processes. Competitive product substitutes, while present, often lag behind the specialized capabilities of advanced chromatography resins, especially in complex separation applications. End-user demographics are shifting towards a greater reliance on outsourced manufacturing and a demand for more efficient, high-throughput purification processes. Mergers and acquisitions (M&A) are a notable trend, with companies seeking to expand their product portfolios, geographical reach, and technological expertise. For instance, the acquisition of GE Healthcare's bioprocess business by Cytiva significantly reshaped the market landscape.

- Market Concentration: Dominated by a few large multinational corporations and specialized resin manufacturers.

- Technological Innovation Drivers: Advancements in bioprocessing, personalized medicine, and analytical techniques.

- Regulatory Frameworks: Stringent regulations from EMA and national bodies influence resin selection and validation.

- Competitive Product Substitutes: Limited for highly specialized applications; traditional methods offer lower efficiency.

- End-User Demographics: Growing pharmaceutical and biotechnology sectors, increasing outsourcing, and demand for sustainability.

- M&A Trends: Strategic acquisitions aimed at portfolio expansion and technological integration.

Europe Chromatography Resins Market Growth Trends & Insights

The Europe Chromatography Resins Market is poised for robust growth, driven by an escalating demand for highly purified biomolecules and the expanding pipeline of biopharmaceutical drugs. The market size is projected to witness a significant expansion from approximately $1,500 Million in 2025 to an estimated $2,800 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period. This growth is underpinned by the increasing adoption of advanced chromatography techniques in drug discovery, development, and manufacturing. Technological disruptions, such as the development of novel multimodal and surface-modified resins, are enhancing separation efficiency and enabling the purification of increasingly complex therapeutic proteins and antibodies. Consumer behavior shifts within the pharmaceutical industry are leaning towards more efficient, cost-effective, and sustainable purification solutions, favoring resins that offer higher binding capacities, improved resolution, and longer lifespans. The market penetration of advanced chromatography resins is steadily increasing across various sub-segments, particularly in biotechnology and pharmaceuticals, where the development of monoclonal antibodies, vaccines, and gene therapies necessitates highly specialized separation processes.

Dominant Regions, Countries, or Segments in Europe Chromatography Resins Market

Within the European Chromatography Resins Market, the Pharmaceuticals end-user industry, specifically Biotechnology and Drug Production, stands as the most dominant segment, projecting substantial growth and market share. This dominance is fueled by Europe's leading position in biopharmaceutical research, development, and manufacturing, supported by robust government funding and a skilled workforce. The region’s advanced healthcare infrastructure and the increasing prevalence of chronic diseases drive the demand for biologics and complex therapeutic agents, which heavily rely on sophisticated chromatography techniques for purification.

- Dominant End-user Industry: Pharmaceuticals (Biotechnology, Drug Discovery, Drug Production)

- Market Share Projection: Estimated to hold over 65% of the market share by 2033.

- Growth Drivers: Rapid growth in biologics, antibody-drug conjugates (ADCs), vaccines, and cell and gene therapies; stringent purity requirements for therapeutic agents; increasing investment in biopharmaceutical R&D.

- Key Countries: Germany, Switzerland, the United Kingdom, and France are at the forefront of pharmaceutical and biotechnology innovation, driving significant resin consumption.

- Dominant Technology Segment: Ion Exchange Chromatography Resins and Affinity Chromatography Resins are expected to lead the market.

- Ion Exchange Chromatography Resins: Essential for separating biomolecules based on charge, widely used in large-scale protein purification. The market for these resins is estimated to reach approximately $600 Million by 2033.

- Affinity Chromatography Resins: Offer high specificity and efficiency for purifying target molecules by exploiting specific binding interactions. Their market is projected to grow substantially, reaching an estimated $500 Million by 2033, driven by the purification of recombinant proteins and antibodies.

- Dominant Origin Segment: Synthetic-based resins, particularly Polystyrene and advanced polymer-based materials, are gaining prominence due to their versatility, cost-effectiveness, and ability to be modified for specific applications. While natural-based resins like Agarose remain critical for certain delicate biomolecules, synthetic alternatives offer broader application scope and scalability. The synthetic-based segment is anticipated to capture a larger market share, projected to reach over $900 Million by 2033.

Europe Chromatography Resins Market Product Landscape

The Europe Chromatography Resins Market is characterized by a dynamic product landscape marked by continuous innovation. Leading manufacturers are focused on developing resins with enhanced selectivity, higher binding capacities, improved flow rates, and greater stability under diverse process conditions. Key product innovations include the introduction of multimodal resins capable of binding molecules through various mechanisms simultaneously, offering superior purification efficiency. Surface-modified resins, such as those with engineered ligands or optimized pore structures, are crucial for the purification of increasingly complex biologics, including antibodies, enzymes, and viruses. The application scope of these resins spans from large-scale biopharmaceutical manufacturing to high-resolution analytical separations in drug discovery and quality control.

Key Drivers, Barriers & Challenges in Europe Chromatography Resins Market

Key Drivers:

- Growth of Biopharmaceutical Industry: The burgeoning demand for biologics, vaccines, and novel therapeutics is the primary catalyst.

- Technological Advancements: Development of highly selective and efficient resins, including multimodal and affinity resins.

- Stringent Quality Control: Increasing regulatory scrutiny in pharmaceuticals and food safety necessitates high-purity separations.

- Outsourcing Trends: Growth in contract manufacturing organizations (CMOs) and contract development and manufacturing organizations (CDMOs) driving resin demand.

Barriers & Challenges:

- High Cost of Development and Manufacturing: Advanced resins require significant R&D investment and specialized manufacturing.

- Regulatory Hurdles: Extensive validation processes for resins used in GMP environments can be time-consuming and costly.

- Competition from Existing Technologies: While advanced, resins compete with established separation methods.

- Supply Chain Disruptions: Geopolitical factors and raw material availability can impact production and pricing.

Emerging Opportunities in Europe Chromatography Resins Market

Emerging opportunities in the Europe Chromatography Resins Market lie in the development of resins for continuous chromatography processes, which promise enhanced efficiency and reduced footprint for biopharmaceutical manufacturing. The growing field of cell and gene therapies presents a significant untapped market, requiring specialized resins for viral vector purification and exosome separation. Furthermore, the demand for sustainable and eco-friendly chromatography solutions, including recyclable or biodegradable resins, is gaining traction. The expansion of personalized medicine will also drive the need for highly tailored separation resins for niche therapeutic molecules.

Growth Accelerators in the Europe Chromatography Resins Market Industry

Long-term growth in the Europe Chromatography Resins Market will be accelerated by several key factors. Technological breakthroughs in resin chemistry, leading to novel functionalities and improved performance characteristics, will be pivotal. Strategic partnerships and collaborations between resin manufacturers, equipment providers, and biopharmaceutical companies will foster innovation and expedite market adoption. The increasing focus on process intensification in biopharmaceutical manufacturing will further drive the demand for high-capacity and efficient chromatography resins. Moreover, market expansion strategies targeting emerging therapeutic areas and developing regions within Europe will contribute to sustained growth.

Key Players Shaping the Europe Chromatography Resins Market Market

- General Electric

- Bio-Rad Laboratories Inc

- Merck KGaA

- Mitsubishi Chemical Corporation

- Dupont

- Pall Corporation

- Tosoh Bioscience LLC

- Purolite

- Agilent Technologies

- Avantor Inc

- Thermo Fisher Scientific

Notable Milestones in Europe Chromatography Resins Market Sector

- 2022: Acquisition of GE Healthcare's bioprocess business by Cytiva, significantly consolidating the market and expanding Cytiva's resin portfolio.

- 2023 (Q1): Collaboration between Merck KGaA and Pall Corporation announced for the development of advanced single-use chromatography systems, aiming to improve flexibility and reduce cross-contamination in biopharmaceutical manufacturing.

- 2023 (Ongoing): Launch of new multimodal and surface-modified resins by several leading players, including Thermo Fisher Scientific and Purolite, offering enhanced selectivity and capacity for challenging biomolecule purifications.

In-Depth Europe Chromatography Resins Market Market Outlook

The future outlook for the Europe Chromatography Resins Market is exceptionally positive, driven by sustained innovation and the expanding applications of chromatography across diverse industries. Growth accelerators such as the relentless pursuit of process intensification, the development of next-generation biotherapeutics, and the increasing emphasis on sustainable manufacturing practices will continue to shape market trajectory. Strategic opportunities lie in the advancement of continuous chromatography technologies and the development of bespoke resins for niche applications like cell and gene therapies. The market is expected to witness substantial growth, with a projected market size of $2,800 Million by 2033, fueled by the region's strong pharmaceutical R&D ecosystem and stringent quality demands.

Europe Chromatography Resins Market Segmentation

-

1. Origin

-

1.1. Natural-based

- 1.1.1. Agarose

- 1.1.2. Dextran

-

1.2. Synthetic-based

- 1.2.1. Silica Gel

- 1.2.2. Aluminum Oxide

- 1.2.3. Polystyrene

- 1.2.4. Other Synthetic-based Resins

-

1.1. Natural-based

-

2. Technology

- 2.1. Ion Exchange Chromatography Resins

- 2.2. Affinity Chromatography Resins

- 2.3. Size Exclusion Chromatography Resins

- 2.4. Hydrophobic Interaction Chromatography Resins

- 2.5. Other Technologies

-

3. End-user Industry

-

3.1. Pharmaceuticals

- 3.1.1. Biotechnology

- 3.1.2. Drug Discovery

- 3.1.3. Drug Production

- 3.2. Water and Environmental Agencies

- 3.3. Food and Beverages

- 3.4. Other End-user Industries

-

3.1. Pharmaceuticals

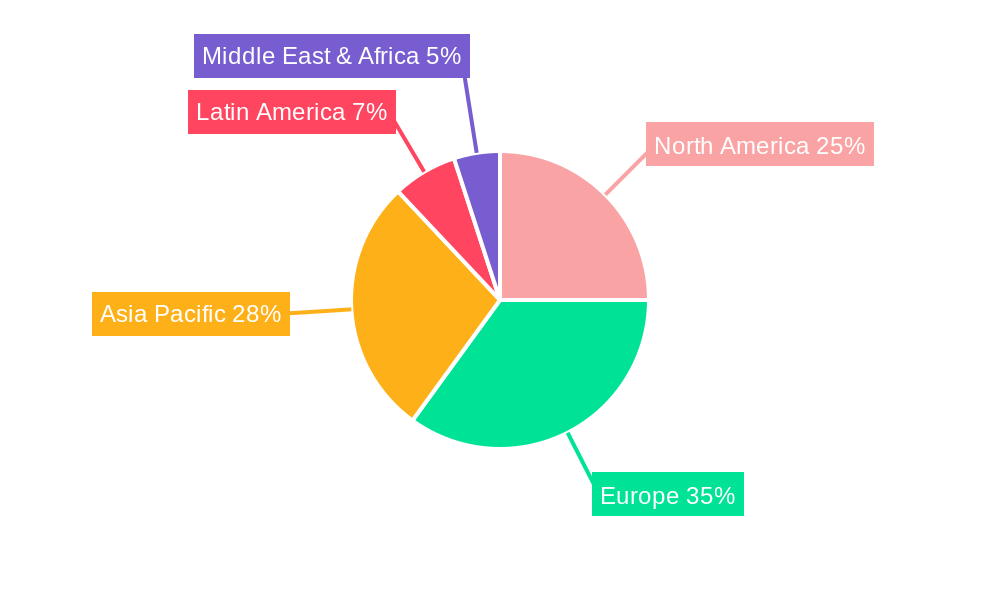

Europe Chromatography Resins Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Switzerland

- 6. Rest of Europe

Europe Chromatography Resins Market Regional Market Share

Geographic Coverage of Europe Chromatography Resins Market

Europe Chromatography Resins Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Academic and Commercial R&D Spending On Pharmaceuticals; Technological Advancements in Chromatography Resins

- 3.3. Market Restrains

- 3.3.1. ; High Costs vs. Productivity of Chromatography Systems

- 3.4. Market Trends

- 3.4.1. Increasing Usage of Ion Exchange Chromatography Resins Technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Chromatography Resins Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Origin

- 5.1.1. Natural-based

- 5.1.1.1. Agarose

- 5.1.1.2. Dextran

- 5.1.2. Synthetic-based

- 5.1.2.1. Silica Gel

- 5.1.2.2. Aluminum Oxide

- 5.1.2.3. Polystyrene

- 5.1.2.4. Other Synthetic-based Resins

- 5.1.1. Natural-based

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Ion Exchange Chromatography Resins

- 5.2.2. Affinity Chromatography Resins

- 5.2.3. Size Exclusion Chromatography Resins

- 5.2.4. Hydrophobic Interaction Chromatography Resins

- 5.2.5. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Pharmaceuticals

- 5.3.1.1. Biotechnology

- 5.3.1.2. Drug Discovery

- 5.3.1.3. Drug Production

- 5.3.2. Water and Environmental Agencies

- 5.3.3. Food and Beverages

- 5.3.4. Other End-user Industries

- 5.3.1. Pharmaceuticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Switzerland

- 5.4.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Origin

- 6. Germany Europe Chromatography Resins Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Origin

- 6.1.1. Natural-based

- 6.1.1.1. Agarose

- 6.1.1.2. Dextran

- 6.1.2. Synthetic-based

- 6.1.2.1. Silica Gel

- 6.1.2.2. Aluminum Oxide

- 6.1.2.3. Polystyrene

- 6.1.2.4. Other Synthetic-based Resins

- 6.1.1. Natural-based

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Ion Exchange Chromatography Resins

- 6.2.2. Affinity Chromatography Resins

- 6.2.3. Size Exclusion Chromatography Resins

- 6.2.4. Hydrophobic Interaction Chromatography Resins

- 6.2.5. Other Technologies

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Pharmaceuticals

- 6.3.1.1. Biotechnology

- 6.3.1.2. Drug Discovery

- 6.3.1.3. Drug Production

- 6.3.2. Water and Environmental Agencies

- 6.3.3. Food and Beverages

- 6.3.4. Other End-user Industries

- 6.3.1. Pharmaceuticals

- 6.1. Market Analysis, Insights and Forecast - by Origin

- 7. United Kingdom Europe Chromatography Resins Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Origin

- 7.1.1. Natural-based

- 7.1.1.1. Agarose

- 7.1.1.2. Dextran

- 7.1.2. Synthetic-based

- 7.1.2.1. Silica Gel

- 7.1.2.2. Aluminum Oxide

- 7.1.2.3. Polystyrene

- 7.1.2.4. Other Synthetic-based Resins

- 7.1.1. Natural-based

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Ion Exchange Chromatography Resins

- 7.2.2. Affinity Chromatography Resins

- 7.2.3. Size Exclusion Chromatography Resins

- 7.2.4. Hydrophobic Interaction Chromatography Resins

- 7.2.5. Other Technologies

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Pharmaceuticals

- 7.3.1.1. Biotechnology

- 7.3.1.2. Drug Discovery

- 7.3.1.3. Drug Production

- 7.3.2. Water and Environmental Agencies

- 7.3.3. Food and Beverages

- 7.3.4. Other End-user Industries

- 7.3.1. Pharmaceuticals

- 7.1. Market Analysis, Insights and Forecast - by Origin

- 8. France Europe Chromatography Resins Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Origin

- 8.1.1. Natural-based

- 8.1.1.1. Agarose

- 8.1.1.2. Dextran

- 8.1.2. Synthetic-based

- 8.1.2.1. Silica Gel

- 8.1.2.2. Aluminum Oxide

- 8.1.2.3. Polystyrene

- 8.1.2.4. Other Synthetic-based Resins

- 8.1.1. Natural-based

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Ion Exchange Chromatography Resins

- 8.2.2. Affinity Chromatography Resins

- 8.2.3. Size Exclusion Chromatography Resins

- 8.2.4. Hydrophobic Interaction Chromatography Resins

- 8.2.5. Other Technologies

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Pharmaceuticals

- 8.3.1.1. Biotechnology

- 8.3.1.2. Drug Discovery

- 8.3.1.3. Drug Production

- 8.3.2. Water and Environmental Agencies

- 8.3.3. Food and Beverages

- 8.3.4. Other End-user Industries

- 8.3.1. Pharmaceuticals

- 8.1. Market Analysis, Insights and Forecast - by Origin

- 9. Italy Europe Chromatography Resins Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Origin

- 9.1.1. Natural-based

- 9.1.1.1. Agarose

- 9.1.1.2. Dextran

- 9.1.2. Synthetic-based

- 9.1.2.1. Silica Gel

- 9.1.2.2. Aluminum Oxide

- 9.1.2.3. Polystyrene

- 9.1.2.4. Other Synthetic-based Resins

- 9.1.1. Natural-based

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Ion Exchange Chromatography Resins

- 9.2.2. Affinity Chromatography Resins

- 9.2.3. Size Exclusion Chromatography Resins

- 9.2.4. Hydrophobic Interaction Chromatography Resins

- 9.2.5. Other Technologies

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Pharmaceuticals

- 9.3.1.1. Biotechnology

- 9.3.1.2. Drug Discovery

- 9.3.1.3. Drug Production

- 9.3.2. Water and Environmental Agencies

- 9.3.3. Food and Beverages

- 9.3.4. Other End-user Industries

- 9.3.1. Pharmaceuticals

- 9.1. Market Analysis, Insights and Forecast - by Origin

- 10. Switzerland Europe Chromatography Resins Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Origin

- 10.1.1. Natural-based

- 10.1.1.1. Agarose

- 10.1.1.2. Dextran

- 10.1.2. Synthetic-based

- 10.1.2.1. Silica Gel

- 10.1.2.2. Aluminum Oxide

- 10.1.2.3. Polystyrene

- 10.1.2.4. Other Synthetic-based Resins

- 10.1.1. Natural-based

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Ion Exchange Chromatography Resins

- 10.2.2. Affinity Chromatography Resins

- 10.2.3. Size Exclusion Chromatography Resins

- 10.2.4. Hydrophobic Interaction Chromatography Resins

- 10.2.5. Other Technologies

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Pharmaceuticals

- 10.3.1.1. Biotechnology

- 10.3.1.2. Drug Discovery

- 10.3.1.3. Drug Production

- 10.3.2. Water and Environmental Agencies

- 10.3.3. Food and Beverages

- 10.3.4. Other End-user Industries

- 10.3.1. Pharmaceuticals

- 10.1. Market Analysis, Insights and Forecast - by Origin

- 11. Rest of Europe Europe Chromatography Resins Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Origin

- 11.1.1. Natural-based

- 11.1.1.1. Agarose

- 11.1.1.2. Dextran

- 11.1.2. Synthetic-based

- 11.1.2.1. Silica Gel

- 11.1.2.2. Aluminum Oxide

- 11.1.2.3. Polystyrene

- 11.1.2.4. Other Synthetic-based Resins

- 11.1.1. Natural-based

- 11.2. Market Analysis, Insights and Forecast - by Technology

- 11.2.1. Ion Exchange Chromatography Resins

- 11.2.2. Affinity Chromatography Resins

- 11.2.3. Size Exclusion Chromatography Resins

- 11.2.4. Hydrophobic Interaction Chromatography Resins

- 11.2.5. Other Technologies

- 11.3. Market Analysis, Insights and Forecast - by End-user Industry

- 11.3.1. Pharmaceuticals

- 11.3.1.1. Biotechnology

- 11.3.1.2. Drug Discovery

- 11.3.1.3. Drug Production

- 11.3.2. Water and Environmental Agencies

- 11.3.3. Food and Beverages

- 11.3.4. Other End-user Industries

- 11.3.1. Pharmaceuticals

- 11.1. Market Analysis, Insights and Forecast - by Origin

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 General Electric

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Bio-Rad Laboratories Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Merck KGaA

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Mitsubishi Chemical Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Dupont

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Pall Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Tosoh Bioscience LLC*List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Purolite

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Agilient Technologies

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Avantor Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Thermo Fisher Scientific

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 General Electric

List of Figures

- Figure 1: Europe Chromatography Resins Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Chromatography Resins Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Chromatography Resins Market Revenue billion Forecast, by Origin 2020 & 2033

- Table 2: Europe Chromatography Resins Market Volume K Tons Forecast, by Origin 2020 & 2033

- Table 3: Europe Chromatography Resins Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: Europe Chromatography Resins Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 5: Europe Chromatography Resins Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Europe Chromatography Resins Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 7: Europe Chromatography Resins Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Europe Chromatography Resins Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Europe Chromatography Resins Market Revenue billion Forecast, by Origin 2020 & 2033

- Table 10: Europe Chromatography Resins Market Volume K Tons Forecast, by Origin 2020 & 2033

- Table 11: Europe Chromatography Resins Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 12: Europe Chromatography Resins Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 13: Europe Chromatography Resins Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 14: Europe Chromatography Resins Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 15: Europe Chromatography Resins Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Chromatography Resins Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Europe Chromatography Resins Market Revenue billion Forecast, by Origin 2020 & 2033

- Table 18: Europe Chromatography Resins Market Volume K Tons Forecast, by Origin 2020 & 2033

- Table 19: Europe Chromatography Resins Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 20: Europe Chromatography Resins Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 21: Europe Chromatography Resins Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 22: Europe Chromatography Resins Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 23: Europe Chromatography Resins Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe Chromatography Resins Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Europe Chromatography Resins Market Revenue billion Forecast, by Origin 2020 & 2033

- Table 26: Europe Chromatography Resins Market Volume K Tons Forecast, by Origin 2020 & 2033

- Table 27: Europe Chromatography Resins Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 28: Europe Chromatography Resins Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 29: Europe Chromatography Resins Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 30: Europe Chromatography Resins Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 31: Europe Chromatography Resins Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Europe Chromatography Resins Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: Europe Chromatography Resins Market Revenue billion Forecast, by Origin 2020 & 2033

- Table 34: Europe Chromatography Resins Market Volume K Tons Forecast, by Origin 2020 & 2033

- Table 35: Europe Chromatography Resins Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 36: Europe Chromatography Resins Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 37: Europe Chromatography Resins Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 38: Europe Chromatography Resins Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 39: Europe Chromatography Resins Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Europe Chromatography Resins Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Europe Chromatography Resins Market Revenue billion Forecast, by Origin 2020 & 2033

- Table 42: Europe Chromatography Resins Market Volume K Tons Forecast, by Origin 2020 & 2033

- Table 43: Europe Chromatography Resins Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 44: Europe Chromatography Resins Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 45: Europe Chromatography Resins Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 46: Europe Chromatography Resins Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 47: Europe Chromatography Resins Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Europe Chromatography Resins Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 49: Europe Chromatography Resins Market Revenue billion Forecast, by Origin 2020 & 2033

- Table 50: Europe Chromatography Resins Market Volume K Tons Forecast, by Origin 2020 & 2033

- Table 51: Europe Chromatography Resins Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 52: Europe Chromatography Resins Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 53: Europe Chromatography Resins Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 54: Europe Chromatography Resins Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 55: Europe Chromatography Resins Market Revenue billion Forecast, by Country 2020 & 2033

- Table 56: Europe Chromatography Resins Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Chromatography Resins Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the Europe Chromatography Resins Market?

Key companies in the market include General Electric, Bio-Rad Laboratories Inc, Merck KGaA, Mitsubishi Chemical Corporation, Dupont, Pall Corporation, Tosoh Bioscience LLC*List Not Exhaustive, Purolite, Agilient Technologies, Avantor Inc, Thermo Fisher Scientific.

3. What are the main segments of the Europe Chromatography Resins Market?

The market segments include Origin, Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.74 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Academic and Commercial R&D Spending On Pharmaceuticals; Technological Advancements in Chromatography Resins.

6. What are the notable trends driving market growth?

Increasing Usage of Ion Exchange Chromatography Resins Technology.

7. Are there any restraints impacting market growth?

; High Costs vs. Productivity of Chromatography Systems.

8. Can you provide examples of recent developments in the market?

Acquisition of GE Healthcare's bioprocess business by Cytiva

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Chromatography Resins Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Chromatography Resins Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Chromatography Resins Market?

To stay informed about further developments, trends, and reports in the Europe Chromatography Resins Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence