Key Insights

The European Fluid Catalytic Cracking (FCC) catalyst market is projected for robust expansion, driven by sustained demand for transportation fuels and petrochemicals. The market, valued at approximately $43.6 billion in the 2025 base year, is forecast to grow at a Compound Annual Growth Rate (CAGR) of 4.3%. This growth is underpinned by several key factors: ongoing refinery upgrades to meet stringent fuel specifications, increasing adoption of advanced catalyst technologies for enhanced yields and reduced emissions, and supportive governmental regulations incentivizing refinery modernization. FCC catalysts, vital for gasoline and petrochemical production, are experiencing particularly high demand.

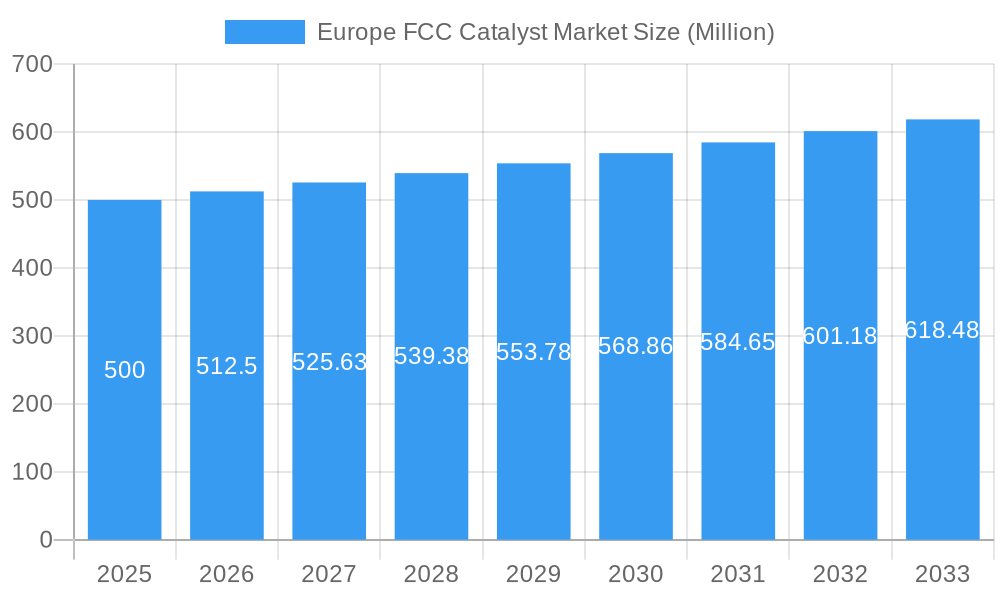

Europe FCC Catalyst Market Market Size (In Billion)

Challenges include crude oil price volatility impacting refinery investment and competition from alternative catalyst technologies and sustainable fuels. Zeolite-based FCC catalysts dominate demand, with reforming and hydrotreating catalysts also contributing significantly. Leading players such as Haldor Topsoe, Axens, Honeywell, and Clariant are investing in R&D to boost performance and market share. Germany, France, the United Kingdom, and Italy are key European markets due to their established refining sectors.

Europe FCC Catalyst Market Company Market Share

Europe FCC Catalyst Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe FCC Catalyst market, encompassing market dynamics, growth trends, regional dominance, product landscape, and key player strategies. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report segments the market by Ingredient (Zeolite, Metal, Chemical Compounds) and Type (Fluid Catalytic Cracking Catalysts, Reforming Catalysts, Hydrotreating Catalysts, Hydrocracking Catalysts, Isomerization Catalysts, Alkylation Catalysts). The market size is presented in million units.

Europe FCC Catalyst Market Market Dynamics & Structure

The Europe FCC Catalyst market, valued at approximately USD [Insert Value] million in 2024, is characterized by a moderately concentrated landscape where leading manufacturers command a substantial share. This dynamic is influenced by a confluence of factors including rapid technological advancements in catalyst design, increasingly stringent environmental regulations mandating lower emissions, and a persistent demand for cleaner, higher-quality fuels. The market is actively experiencing a surge in mergers and acquisitions (M&A), primarily fueled by strategic imperatives for companies to broaden their product portfolios, enhance their geographical footprint, and consolidate their market positions. Nonetheless, robust competitive pressures persist, not only from direct competitors but also from the emergence of substitute products and alternative technologies that prioritize cost-effectiveness and operational efficiency.

- Market Concentration: The top five key players collectively held an estimated [Insert Percentage]% of the market share in 2024, indicating a moderately concentrated market structure.

- Technological Innovation: A primary focus for market players is the continuous development of high-performance catalysts, emphasizing improvements in activity, selectivity, and extended lifespan to optimize refining operations.

- Regulatory Landscape: Stringent emission standards and environmental directives across European nations are a significant catalyst driving the demand for advanced and compliant FCC catalysts.

- Competitive Substitutes: The evolving landscape includes the emergence of alternative refining technologies and catalyst types, posing a challenge and encouraging innovation within the traditional FCC catalyst segment.

- End-User Demographics: The primary consumers of FCC catalysts are the refining and petrochemical industries, reflecting their critical role in fuel production and chemical manufacturing.

- M&A Activity: Between 2019 and 2024, approximately [Insert Number] M&A deals were recorded within the Europe region, with an average deal value estimated at USD [Insert Value] million, signaling consolidation and strategic expansion.

- Innovation Barriers: Significant hurdles to rapid innovation include the substantial investment required for research and development (R&D) and the lengthy, rigorous testing and validation procedures essential for new catalyst introductions.

Europe FCC Catalyst Market Growth Trends & Insights

The Europe FCC Catalyst market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx million units by 2033. This growth is fueled by the expanding refining capacity, increasing demand for transportation fuels, and the adoption of stricter environmental regulations. Technological disruptions, particularly in catalyst design and manufacturing processes, are accelerating market expansion. Consumer behavior, driven by the growing preference for cleaner fuels and sustainable practices, further contributes to market growth. Market penetration is expected to increase from xx% in 2024 to xx% by 2033, driven by the increasing adoption of advanced catalyst technologies across various refining processes.

Dominant Regions, Countries, or Segments in Europe FCC Catalyst Market

Western Europe stands as the predominant force in the Europe FCC Catalyst market, with countries like Germany, the Netherlands, and France leading the charge. This dominance is underpinned by their substantial refining capacities and the implementation of some of the region's most rigorous environmental regulations. Examining the segment breakdown reveals key areas of focus:

- Ingredient: Zeolite-based catalysts command the largest market share, largely attributable to their superior catalytic activity, high selectivity, and inherent cost-effectiveness in comparison to other catalyst components.

- Type: Fluid Catalytic Cracking (FCC) catalysts constitute the most significant segment by type, driven by their widespread and indispensable application in modern oil refineries globally.

Key Drivers:

- Robust Refining Infrastructure: The presence of numerous large-scale, technologically advanced refineries across Europe provides a consistent and substantial demand for FCC catalysts.

- Stringent Environmental Regulations: Increasingly strict environmental policies and emission standards are compelling refineries to adopt cleaner and more efficient catalyst technologies.

- Economic Growth & Energy Demand: Sustained economic activity and an ongoing demand for refined petroleum products and petrochemicals are fundamental drivers for the FCC catalyst market.

Dominance Factors:

- High Refining Capacity: Western European nations possess a concentration of highly developed and large-scale refining operations, creating a significant installed base for FCC catalysts.

- Government Support & Incentives: Supportive government policies and targeted incentives for adopting cleaner technologies and enhancing energy efficiency further bolster the market.

- Technological Advancement & R&D Investments: A strong commitment to research and development, coupled with significant investments in advanced catalyst technology, fosters innovation and market leadership.

Europe FCC Catalyst Market Product Landscape

The Europe FCC Catalyst market is characterized by a sophisticated and diverse product portfolio, encompassing advanced FCC catalysts, reforming catalysts, and hydrotreating catalysts. Each product category is meticulously engineered to cater to the specific operational requirements and efficiency targets of various refining processes. The trajectory of product innovation is sharply focused on enhancing catalyst activity, improving selectivity towards desired products, and extending catalyst lifespan, all of which are critical for boosting refining efficiency and reducing overall operating expenditures. Notable advancements include the development of metal-modified zeolites for enhanced performance, novel metal oxide systems designed for specific catalytic functions, and sophisticated catalyst formulations engineered for superior efficiency and stringent environmental compliance. The unique selling propositions (USPs) prominently feature increased yields of valuable products, substantial reductions in harmful emissions, and marked improvements in overall process efficiency.

Key Drivers, Barriers & Challenges in Europe FCC Catalyst Market

Key Drivers:

- Growing demand for high-quality transportation fuels.

- Stringent environmental regulations promoting cleaner refining processes.

- Technological advancements leading to more efficient catalysts.

Challenges & Restraints:

- Fluctuations in crude oil prices impacting profitability.

- Stringent regulatory compliance requirements and associated costs.

- Intense competition among established players and emerging entrants, impacting pricing and profitability. This competition reduces profit margins by approximately xx% annually.

Emerging Opportunities in Europe FCC Catalyst Market

The future of the Europe FCC Catalyst market is rich with emerging opportunities, particularly in the development of next-generation catalysts that offer unparalleled performance and sustainability. This forward-looking approach involves exploring novel catalyst materials with unique properties, optimizing catalyst design for highly specialized applications, and advancing sophisticated catalyst characterization techniques for deeper insights into their behavior. Furthermore, the burgeoning demand for biofuels and bio-refining processes presents a significant avenue for the development of tailored catalysts that can efficiently process renewable feedstocks, contributing to a more sustainable energy future.

Growth Accelerators in the Europe FCC Catalyst Market Industry

Long-term growth is driven by the continued expansion of the refining sector, technological advancements leading to higher catalyst efficiency, and the growing focus on sustainability in the industry. Strategic partnerships between catalyst manufacturers and refinery operators are crucial for accelerating market growth. This collaboration helps refine catalyst performance to meet specific needs and reduce deployment costs.

Key Players Shaping the Europe FCC Catalyst Market Market

Notable Milestones in Europe FCC Catalyst Sector

- 2020, Q4: Haldor Topsoe launches a new generation of FCC catalyst with enhanced performance.

- 2022, Q1: Axens and a major refinery operator announce a strategic partnership for catalyst development.

- 2023, Q3: A significant merger between two catalyst manufacturers reshapes the competitive landscape. (Further details on the merger would require additional research.)

In-Depth Europe FCC Catalyst Market Market Outlook

The Europe FCC Catalyst market is firmly positioned for sustained and robust growth in the coming years. This optimistic outlook is underpinned by the continuous momentum of technological advancements, the unwavering commitment to stringent environmental regulations across the continent, and the ongoing expansion and modernization of refining capacities. Strategic collaborations and partnerships, coupled with substantial and focused investments in research and development, alongside the proactive exploration of novel catalyst materials, will be instrumental in shaping the market's trajectory. A paramount focus on sustainability will increasingly drive the demand for catalysts that minimize environmental impact and contribute to a circular economy, ensuring a healthy and expanding market for FCC catalysts throughout the next decade and beyond.

Europe FCC Catalyst Market Segmentation

-

1. Ingredient

- 1.1. Zeolite

- 1.2. Metal

- 1.3. Chemical Compounds

-

2. Type

- 2.1. Fluid Catalytic Cracking Catalysts

- 2.2. Reforming Catalysts

- 2.3. Hydrotreating Catalysts

- 2.4. Hydrocracking Catalysts

- 2.5. Isomerization Catalysts

- 2.6. Alkylation Catalysts

Europe FCC Catalyst Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. Italy

- 4. France

- 5. Spain

- 6. Russia

- 7. Rest of Europe

Europe FCC Catalyst Market Regional Market Share

Geographic Coverage of Europe FCC Catalyst Market

Europe FCC Catalyst Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Accelerating Demand For Higher Octane Fuels; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Volatility in Precious Metal Prices; Other Restraints

- 3.4. Market Trends

- 3.4.1. Fluid Catalytic Cracking (FCC) Catalysts to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe FCC Catalyst Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredient

- 5.1.1. Zeolite

- 5.1.2. Metal

- 5.1.3. Chemical Compounds

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Fluid Catalytic Cracking Catalysts

- 5.2.2. Reforming Catalysts

- 5.2.3. Hydrotreating Catalysts

- 5.2.4. Hydrocracking Catalysts

- 5.2.5. Isomerization Catalysts

- 5.2.6. Alkylation Catalysts

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. Italy

- 5.3.4. France

- 5.3.5. Spain

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Ingredient

- 6. Germany Europe FCC Catalyst Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredient

- 6.1.1. Zeolite

- 6.1.2. Metal

- 6.1.3. Chemical Compounds

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Fluid Catalytic Cracking Catalysts

- 6.2.2. Reforming Catalysts

- 6.2.3. Hydrotreating Catalysts

- 6.2.4. Hydrocracking Catalysts

- 6.2.5. Isomerization Catalysts

- 6.2.6. Alkylation Catalysts

- 6.1. Market Analysis, Insights and Forecast - by Ingredient

- 7. United Kingdom Europe FCC Catalyst Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredient

- 7.1.1. Zeolite

- 7.1.2. Metal

- 7.1.3. Chemical Compounds

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Fluid Catalytic Cracking Catalysts

- 7.2.2. Reforming Catalysts

- 7.2.3. Hydrotreating Catalysts

- 7.2.4. Hydrocracking Catalysts

- 7.2.5. Isomerization Catalysts

- 7.2.6. Alkylation Catalysts

- 7.1. Market Analysis, Insights and Forecast - by Ingredient

- 8. Italy Europe FCC Catalyst Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredient

- 8.1.1. Zeolite

- 8.1.2. Metal

- 8.1.3. Chemical Compounds

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Fluid Catalytic Cracking Catalysts

- 8.2.2. Reforming Catalysts

- 8.2.3. Hydrotreating Catalysts

- 8.2.4. Hydrocracking Catalysts

- 8.2.5. Isomerization Catalysts

- 8.2.6. Alkylation Catalysts

- 8.1. Market Analysis, Insights and Forecast - by Ingredient

- 9. France Europe FCC Catalyst Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Ingredient

- 9.1.1. Zeolite

- 9.1.2. Metal

- 9.1.3. Chemical Compounds

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Fluid Catalytic Cracking Catalysts

- 9.2.2. Reforming Catalysts

- 9.2.3. Hydrotreating Catalysts

- 9.2.4. Hydrocracking Catalysts

- 9.2.5. Isomerization Catalysts

- 9.2.6. Alkylation Catalysts

- 9.1. Market Analysis, Insights and Forecast - by Ingredient

- 10. Spain Europe FCC Catalyst Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Ingredient

- 10.1.1. Zeolite

- 10.1.2. Metal

- 10.1.3. Chemical Compounds

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Fluid Catalytic Cracking Catalysts

- 10.2.2. Reforming Catalysts

- 10.2.3. Hydrotreating Catalysts

- 10.2.4. Hydrocracking Catalysts

- 10.2.5. Isomerization Catalysts

- 10.2.6. Alkylation Catalysts

- 10.1. Market Analysis, Insights and Forecast - by Ingredient

- 11. Russia Europe FCC Catalyst Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Ingredient

- 11.1.1. Zeolite

- 11.1.2. Metal

- 11.1.3. Chemical Compounds

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. Fluid Catalytic Cracking Catalysts

- 11.2.2. Reforming Catalysts

- 11.2.3. Hydrotreating Catalysts

- 11.2.4. Hydrocracking Catalysts

- 11.2.5. Isomerization Catalysts

- 11.2.6. Alkylation Catalysts

- 11.1. Market Analysis, Insights and Forecast - by Ingredient

- 12. Rest of Europe Europe FCC Catalyst Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Ingredient

- 12.1.1. Zeolite

- 12.1.2. Metal

- 12.1.3. Chemical Compounds

- 12.2. Market Analysis, Insights and Forecast - by Type

- 12.2.1. Fluid Catalytic Cracking Catalysts

- 12.2.2. Reforming Catalysts

- 12.2.3. Hydrotreating Catalysts

- 12.2.4. Hydrocracking Catalysts

- 12.2.5. Isomerization Catalysts

- 12.2.6. Alkylation Catalysts

- 12.1. Market Analysis, Insights and Forecast - by Ingredient

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Haldor Topsoe A/S

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Axens

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Honeywell International Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Clariant

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Exxon Mobil Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Evonik Industries AG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 W R Grace & Co -Conn

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 BASF SE

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Chevron Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 DuPont

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 JGC C & C

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Johnson Matthey

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Albemarle Corporation

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.1 Haldor Topsoe A/S

List of Figures

- Figure 1: Europe FCC Catalyst Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe FCC Catalyst Market Share (%) by Company 2025

List of Tables

- Table 1: Europe FCC Catalyst Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 2: Europe FCC Catalyst Market Volume K Tons Forecast, by Ingredient 2020 & 2033

- Table 3: Europe FCC Catalyst Market Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Europe FCC Catalyst Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 5: Europe FCC Catalyst Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe FCC Catalyst Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Europe FCC Catalyst Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 8: Europe FCC Catalyst Market Volume K Tons Forecast, by Ingredient 2020 & 2033

- Table 9: Europe FCC Catalyst Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Europe FCC Catalyst Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 11: Europe FCC Catalyst Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe FCC Catalyst Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: Europe FCC Catalyst Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 14: Europe FCC Catalyst Market Volume K Tons Forecast, by Ingredient 2020 & 2033

- Table 15: Europe FCC Catalyst Market Revenue billion Forecast, by Type 2020 & 2033

- Table 16: Europe FCC Catalyst Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 17: Europe FCC Catalyst Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Europe FCC Catalyst Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 19: Europe FCC Catalyst Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 20: Europe FCC Catalyst Market Volume K Tons Forecast, by Ingredient 2020 & 2033

- Table 21: Europe FCC Catalyst Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Europe FCC Catalyst Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 23: Europe FCC Catalyst Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe FCC Catalyst Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Europe FCC Catalyst Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 26: Europe FCC Catalyst Market Volume K Tons Forecast, by Ingredient 2020 & 2033

- Table 27: Europe FCC Catalyst Market Revenue billion Forecast, by Type 2020 & 2033

- Table 28: Europe FCC Catalyst Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 29: Europe FCC Catalyst Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Europe FCC Catalyst Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 31: Europe FCC Catalyst Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 32: Europe FCC Catalyst Market Volume K Tons Forecast, by Ingredient 2020 & 2033

- Table 33: Europe FCC Catalyst Market Revenue billion Forecast, by Type 2020 & 2033

- Table 34: Europe FCC Catalyst Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 35: Europe FCC Catalyst Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Europe FCC Catalyst Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 37: Europe FCC Catalyst Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 38: Europe FCC Catalyst Market Volume K Tons Forecast, by Ingredient 2020 & 2033

- Table 39: Europe FCC Catalyst Market Revenue billion Forecast, by Type 2020 & 2033

- Table 40: Europe FCC Catalyst Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 41: Europe FCC Catalyst Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Europe FCC Catalyst Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 43: Europe FCC Catalyst Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 44: Europe FCC Catalyst Market Volume K Tons Forecast, by Ingredient 2020 & 2033

- Table 45: Europe FCC Catalyst Market Revenue billion Forecast, by Type 2020 & 2033

- Table 46: Europe FCC Catalyst Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 47: Europe FCC Catalyst Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Europe FCC Catalyst Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe FCC Catalyst Market?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Europe FCC Catalyst Market?

Key companies in the market include Haldor Topsoe A/S, Axens, Honeywell International Inc, Clariant, Exxon Mobil Corporation, Evonik Industries AG, W R Grace & Co -Conn , BASF SE, Chevron Corporation, DuPont, JGC C & C, Johnson Matthey, Albemarle Corporation.

3. What are the main segments of the Europe FCC Catalyst Market?

The market segments include Ingredient, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 43.6 billion as of 2022.

5. What are some drivers contributing to market growth?

; Accelerating Demand For Higher Octane Fuels; Other Drivers.

6. What are the notable trends driving market growth?

Fluid Catalytic Cracking (FCC) Catalysts to Dominate the Market.

7. Are there any restraints impacting market growth?

; Volatility in Precious Metal Prices; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3,950, USD 4,950, and USD 6,950 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe FCC Catalyst Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe FCC Catalyst Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe FCC Catalyst Market?

To stay informed about further developments, trends, and reports in the Europe FCC Catalyst Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence