Key Insights

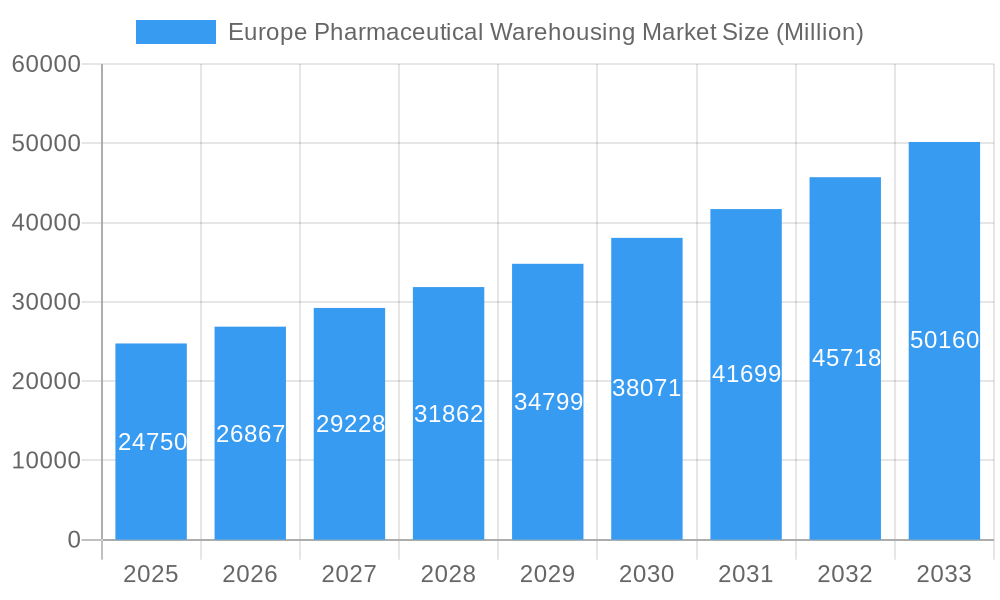

The European pharmaceutical warehousing market, valued at €24.75 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 8.26% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for temperature-sensitive pharmaceutical products, coupled with stringent regulatory requirements for storage and handling, necessitates sophisticated warehousing solutions. Growth in the pharmaceutical industry itself, including the development and launch of new medications and biologics, fuels this demand. Furthermore, the rise of e-commerce in pharmaceuticals and the need for efficient last-mile delivery are creating opportunities for specialized warehousing services. The market is segmented by warehouse type (cold chain and non-cold chain) and application (pharmaceutical factories, pharmacies, hospitals, and others), with cold chain warehousing expected to dominate due to the prevalence of temperature-sensitive medications. Key players like DB Schenker, UPS, and FedEx are actively investing in advanced technologies and expanding their network capacity to meet the growing demand. The European market is particularly strong, with Germany, France, the UK, and Italy representing significant portions of the overall market due to their established pharmaceutical industries and robust healthcare infrastructure. However, challenges remain including the need for substantial capital investment in infrastructure, particularly in cold chain facilities, and the complexity of regulatory compliance across different European countries.

Europe Pharmaceutical Warehousing Market Market Size (In Billion)

The forecast period of 2025-2033 will likely see continued market consolidation, with larger logistics providers acquiring smaller, specialized firms to expand their service offerings and geographical reach. Technological advancements, such as automation, robotics, and AI-driven inventory management systems, are expected to improve efficiency and reduce operational costs. The focus on sustainability and reducing the environmental impact of pharmaceutical logistics will also drive innovation in warehousing practices. Regions within Europe will witness varying rates of growth depending on factors such as economic conditions, healthcare spending, and regulatory environment. The market's trajectory suggests a bright outlook for pharmaceutical warehousing in Europe, driven by continuous innovation and the expanding pharmaceutical industry.

Europe Pharmaceutical Warehousing Market Company Market Share

Europe Pharmaceutical Warehousing Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Europe Pharmaceutical Warehousing Market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report segments the market by Type (Cold Chain Warehouse, Non-Cold Chain Warehouse) and Application (Pharmaceutical Factory, Pharmacy, Hospital, Others), providing granular insights for informed decision-making. The total market size is projected to reach xx Million units by 2033.

Europe Pharmaceutical Warehousing Market Dynamics & Structure

The European pharmaceutical warehousing market is characterized by a moderately concentrated landscape with several large players and numerous smaller regional operators. Market concentration is influenced by factors such as economies of scale, technological capabilities, and geographical reach. The market is experiencing significant technological innovation driven by the need for enhanced temperature control, automation, and data analytics in cold chain warehousing. Stringent regulatory frameworks concerning drug storage, handling, and distribution, particularly within the EU's Good Distribution Practice (GDP) guidelines, significantly impact market dynamics. Competitive substitutes include alternative logistics providers and direct-to-consumer delivery models, although the specialized nature of pharmaceutical warehousing limits their immediate impact. M&A activity is relatively frequent, as larger players seek to expand their market share and service offerings through strategic acquisitions.

- Market Concentration: Moderately concentrated, with a Herfindahl-Hirschman Index (HHI) of xx.

- Technological Innovation: Focus on automation, IoT, AI, and advanced temperature monitoring systems.

- Regulatory Framework: Stringent GDP guidelines and data security regulations.

- M&A Activity: Significant M&A activity observed in the past 5 years, with xx deals recorded (average deal value: xx Million units).

Europe Pharmaceutical Warehousing Market Growth Trends & Insights

The European pharmaceutical warehousing market has exhibited steady growth over the historical period (2019-2024), driven primarily by the expanding pharmaceutical industry, increasing demand for temperature-sensitive drug storage, and growing focus on supply chain efficiency. The market size has grown at a CAGR of xx% during this period and is expected to maintain a steady CAGR of xx% during the forecast period (2025-2033). Adoption rates for advanced technologies like automated guided vehicles (AGVs) and warehouse management systems (WMS) are increasing, further augmenting market growth. Shifts in consumer behavior, including the rise of e-commerce for pharmaceuticals, are also impacting warehousing requirements, leading to greater demand for flexible and scalable solutions.

Dominant Regions, Countries, or Segments in Europe Pharmaceutical Warehousing Market

Germany, France, and the UK are currently the dominant markets in Europe, driven by their robust pharmaceutical industries, advanced logistics infrastructure, and high regulatory standards. The cold chain warehousing segment holds a significant market share, owing to the growing demand for temperature-sensitive pharmaceuticals. Within applications, the pharmaceutical factory segment currently dominates, followed by hospitals and pharmacies.

- Germany: Strong pharmaceutical manufacturing base and advanced logistics networks.

- France: Significant presence of large pharmaceutical companies and well-developed infrastructure.

- UK: High demand for pharmaceutical warehousing due to a large population and established healthcare system.

- Cold Chain Warehousing: Fastest-growing segment due to increasing demand for temperature-sensitive drugs.

- Pharmaceutical Factories: Largest application segment due to high volumes of storage and distribution.

Europe Pharmaceutical Warehousing Market Product Landscape

The market offers a range of warehousing solutions, from basic storage facilities to advanced temperature-controlled warehouses with integrated automation systems. Product innovations focus on improving temperature control accuracy, enhancing traceability and data security, and optimizing warehouse operations through automation. Unique selling propositions include integrated technology solutions, advanced security features, and customized service offerings tailored to specific pharmaceutical needs. Technological advancements include the adoption of blockchain technology for enhanced supply chain visibility and the integration of AI-powered analytics for improved inventory management.

Key Drivers, Barriers & Challenges in Europe Pharmaceutical Warehousing Market

Key Drivers: Rising demand for temperature-sensitive pharmaceuticals, increasing focus on supply chain efficiency, and stringent regulatory compliance drive market growth. Technological advancements, such as automation and advanced tracking systems, also contribute to this growth. Government initiatives supporting the pharmaceutical industry further bolster the market.

Challenges: High initial investment costs for advanced technologies, stringent regulatory compliance requirements, and competitive pressures from established logistics providers pose challenges to market growth. Supply chain disruptions due to geopolitical factors or unforeseen events like pandemics can cause significant impact, demanding robust contingency planning.

Emerging Opportunities in Europe Pharmaceutical Warehousing Market

Untapped markets in Eastern Europe present significant opportunities for expansion. The growing demand for specialized services, such as personalized medicine warehousing and clinical trial material handling, offers substantial growth potential. The increasing integration of technology into warehousing operations creates opportunities for innovative solutions that enhance efficiency and safety.

Growth Accelerators in the Europe Pharmaceutical Warehousing Market Industry

Technological advancements in temperature-controlled storage, automation, and data analytics are primary growth accelerators. Strategic partnerships between pharmaceutical companies and logistics providers are crucial for improving supply chain efficiency. Market expansion into less-developed regions of Europe will further accelerate market growth.

Key Players Shaping the Europe Pharmaceutical Warehousing Market Market

Notable Milestones in Europe Pharmaceutical Warehousing Market Sector

- June 2023: ViaPharma signed a 20-year lease agreement with CTP for two Czech CTParks, adding almost 27,000 sq m of pharmaceutical warehousing space. This expansion significantly increases capacity in a key European market.

- August 2022: UPS's acquisition of BomiGroup added temperature-controlled facilities across 14 countries, significantly strengthening its position in the European pharmaceutical logistics market.

In-Depth Europe Pharmaceutical Warehousing Market Outlook

The future of the European pharmaceutical warehousing market looks promising, driven by continued growth in the pharmaceutical industry, increasing demand for specialized services, and technological advancements. Strategic partnerships and investments in innovative technologies will be key factors in achieving long-term success. The market's potential for growth is substantial, with opportunities for both established players and new entrants to capture significant market share. The increasing focus on sustainability and reducing carbon footprint in the logistics industry presents further opportunities for innovation and market differentiation.

Europe Pharmaceutical Warehousing Market Segmentation

-

1. Type

- 1.1. Cold Chain Warehouse

- 1.2. Non-Cold Chain Warehouse

-

2. Application

- 2.1. Pharmaceutical Factory

- 2.2. Pharmacy

- 2.3. Hospital

- 2.4. Others

Europe Pharmaceutical Warehousing Market Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. UK

- 1.3. France

- 1.4. Russia

- 1.5. Spain

- 1.6. Rest of Europe

Europe Pharmaceutical Warehousing Market Regional Market Share

Geographic Coverage of Europe Pharmaceutical Warehousing Market

Europe Pharmaceutical Warehousing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 8.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The rise in demand for outsourcing pharmaceutical warehousing services; The demand for efficiency

- 3.2.2 visibility

- 3.2.3 and product safety from pharmaceutical companies

- 3.3. Market Restrains

- 3.3.1. Lack of efficient logistics support in emerging economies

- 3.4. Market Trends

- 3.4.1. Rise in the demand Pharmaceutical

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cold Chain Warehouse

- 5.1.2. Non-Cold Chain Warehouse

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Pharmaceutical Factory

- 5.2.2. Pharmacy

- 5.2.3. Hospital

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 United Parcel Service Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hellmann Worldwide Logistics SE and Co KG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Alloga

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FedEx Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rhenus SE and Co KG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bio Pharma Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kuehne Nagel Management AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 XPO Logistics Inc **List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GEODIS SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 KRC Logistics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Europe Pharmaceutical Warehousing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Pharmaceutical Warehousing Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Germany Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: UK Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Russia Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pharmaceutical Warehousing Market?

The projected CAGR is approximately > 8.26%.

2. Which companies are prominent players in the Europe Pharmaceutical Warehousing Market?

Key companies in the market include DB Schenker, United Parcel Service Inc, Hellmann Worldwide Logistics SE and Co KG, Alloga, FedEx Corp, Rhenus SE and Co KG, Bio Pharma Logistics, Kuehne Nagel Management AG, XPO Logistics Inc **List Not Exhaustive, GEODIS SA, KRC Logistics.

3. What are the main segments of the Europe Pharmaceutical Warehousing Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.75 Million as of 2022.

5. What are some drivers contributing to market growth?

The rise in demand for outsourcing pharmaceutical warehousing services; The demand for efficiency. visibility. and product safety from pharmaceutical companies.

6. What are the notable trends driving market growth?

Rise in the demand Pharmaceutical.

7. Are there any restraints impacting market growth?

Lack of efficient logistics support in emerging economies.

8. Can you provide examples of recent developments in the market?

June 2023: ViaPharma signed a 20-year lease agreement with the developer CTP for two Czech CTParks. CTP will prepare and hand over the premises, with a total area of almost 27,000 sq m and several specific modifications for the pharmaceutical industry, at the end of 2023. CTPark Ostrava Poruba and CTPark Brno Líšeň will be the next locations of cooperation. ViaPharma already leased three warehouses in Romania, including the largest ever pharmaceutical warehouse in the country with an area of 35,000 sq m in CTPark Mogosoaia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pharmaceutical Warehousing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pharmaceutical Warehousing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pharmaceutical Warehousing Market?

To stay informed about further developments, trends, and reports in the Europe Pharmaceutical Warehousing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence