Key Insights

The Turkish 3PL (Third-Party Logistics) services market exhibits robust growth, driven by the nation's expanding e-commerce sector, increasing manufacturing output, and the need for efficient supply chain management across various industries. The market's Compound Annual Growth Rate (CAGR) exceeding 8.50% from 2019 to 2024 indicates a significant upward trajectory. Key drivers include the rising demand for optimized logistics solutions from manufacturing and automotive companies, the oil, gas, and chemicals sector, and the burgeoning e-commerce segment within distributive trade. The growing complexity of global supply chains further fuels the adoption of 3PL services, particularly in international transportation management. Value-added warehousing and distribution services are also gaining traction, emphasizing the shift towards integrated and technologically advanced logistics solutions. While specific market size figures for previous years are unavailable, projecting forward using the provided CAGR of over 8.5%, a conservative estimate places the 2025 market size at approximately €4 billion (assuming a starting point from 2019 and considering market fluctuations). This substantial market value underscores the importance of efficient logistics in Turkey's economic growth.

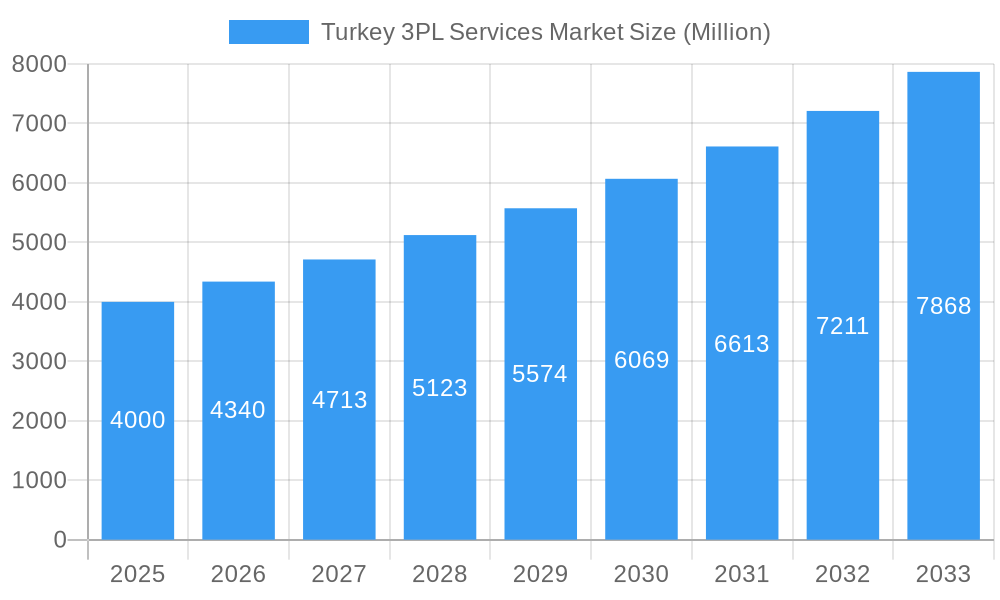

Turkey 3PL Services Market Market Size (In Billion)

The competitive landscape is shaped by a blend of international giants like DB Schenker, Maersk, UPS, and DHL Supply Chain, alongside prominent local players such as D B Deniz Nakliyati Ticaret and Istanbul Express. These companies offer a range of services tailored to diverse industry needs. The market's segmentation by end-user and service type highlights the versatility and scalability of 3PL solutions. While growth is expected to continue, potential restraints could include geopolitical uncertainties, economic fluctuations impacting consumer spending, and the need for continuous investment in technological infrastructure to maintain efficiency and competitiveness. However, the long-term outlook for the Turkish 3PL market remains positive, driven by continued economic expansion and the increasing adoption of advanced logistics technologies.

Turkey 3PL Services Market Company Market Share

Turkey 3PL Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Turkey 3PL (Third-Party Logistics) services market, covering market dynamics, growth trends, key players, and future outlook. The report segments the market by end-user (Manufacturing & Automotive, Oil, Gas & Chemicals, Distributive Trade, Pharma & Healthcare, Construction, Other) and services (Domestic Transportation Management, International Transportation Management, Value-added Warehousing & Distribution), offering a granular understanding of this dynamic sector. The study period spans 2019-2033, with 2025 as the base year and forecast period extending to 2033. Key players analyzed include DB Schenker, Maersk, Neta International Transportation, United Parcel Service, D B Deniz Nakliyati Ticaret, GEFCO, CEVA, Istanbul Express, GAC Turkey, DHL Supply Chain, and DSV Panalpina. This is not an exhaustive list.

Turkey 3PL Services Market Dynamics & Structure

The Turkish 3PL market is characterized by a moderately consolidated structure, with both global giants and local players competing fiercely. Market concentration is estimated at xx% in 2025, driven by the presence of established international players. Technological innovation, particularly in areas like warehouse automation and supply chain visibility software, is a significant driver. The regulatory framework, including customs regulations and transportation laws, impacts operational efficiency and costs. While some product substitutes exist (e.g., in-house logistics), the outsourcing trend continues to grow, favoring 3PL providers. The end-user demographics show a strong presence of manufacturing and automotive, with growing demand from e-commerce. M&A activity is moderate, with approximately xx deals recorded in the past five years.

- Market Concentration: xx% in 2025 (estimated)

- Key Innovation Drivers: Warehouse automation, IoT integration, AI-powered route optimization.

- Regulatory Impacts: Customs procedures, transportation regulations, data privacy laws.

- M&A Activity: Approximately xx deals (2020-2024).

- End-User Demographics: Manufacturing & Automotive leads, followed by Distributive Trade showing significant growth.

Turkey 3PL Services Market Growth Trends & Insights

The Turkish 3PL market exhibited a CAGR of xx% during the historical period (2019-2024). This growth is fueled by rising e-commerce penetration, increasing manufacturing activity, and the growing need for efficient supply chain management among businesses. The adoption rate of advanced technologies is accelerating, improving logistics efficiency and cost reduction. Consumer behavior shifts towards faster delivery expectations further drive the demand for sophisticated 3PL services. Market size is projected to reach xx million in 2025, expanding to xx million by 2033, indicating a robust growth trajectory.

- Historical CAGR (2019-2024): xx%

- Market Size (2025): xx million

- Market Size (2033): xx million

- Projected CAGR (2025-2033): xx%

- Key Technological Disruptions: Blockchain implementation, drone delivery trials, autonomous vehicles.

Dominant Regions, Countries, or Segments in Turkey 3PL Services Market

The Istanbul region dominates the Turkish 3PL market, benefiting from its strong infrastructure and proximity to major ports. Among end-users, Manufacturing & Automotive and Distributive Trade (particularly e-commerce) are the leading segments, accounting for approximately xx% and xx% of the market share respectively, in 2025. In terms of services, Value-added Warehousing and Distribution are experiencing rapid growth driven by increasing e-commerce fulfillment needs. International Transportation Management also shows substantial growth potential fueled by Turkey’s increasing global trade activities.

- Dominant Region: Istanbul

- Leading End-User Segments: Manufacturing & Automotive, Distributive Trade (e-commerce).

- Fastest Growing Service: Value-added Warehousing and Distribution

- Key Drivers: Government investment in infrastructure, growth of e-commerce, expanding industrial base.

Turkey 3PL Services Market Product Landscape

The Turkish 3PL market offers a diverse range of services, from basic transportation and warehousing to highly specialized solutions like temperature-controlled logistics for pharmaceuticals and specialized handling for hazardous materials. Recent innovations include the integration of advanced technologies such as AI and machine learning for route optimization and predictive maintenance, further enhancing efficiency and reducing operational costs. Value-added services such as inventory management, customs brokerage, and reverse logistics are increasingly in demand, particularly by e-commerce businesses.

Key Drivers, Barriers & Challenges in Turkey 3PL Services Market

Key Drivers: Growth of e-commerce, increased manufacturing output, government support for logistics infrastructure development, rising foreign direct investment.

Key Challenges: Fluctuating currency exchange rates, geopolitical risks, infrastructure limitations in certain regions, skilled labor shortages, competition from smaller, agile logistics providers. These challenges potentially reduce growth by xx% in the forecast period (a predicted value).

Emerging Opportunities in Turkey 3PL Services Market

The growing cold chain logistics sector, driven by the expansion of the pharmaceutical and food industries, offers significant opportunities. Expansion into underserved regions presents potential for market penetration. Developing specialized solutions for specific industries (e.g., automotive parts logistics) could create a niche market. Finally, leveraging technology for improved sustainability and transparency within supply chains is also a rapidly emerging opportunity.

Growth Accelerators in the Turkey 3PL Services Market Industry

Technological advancements, strategic partnerships between 3PL providers and technology companies, and government initiatives to improve logistics infrastructure are key catalysts for long-term growth. Expanding into new service offerings such as last-mile delivery optimization and enhanced supply chain visibility solutions are further fueling market expansion.

Key Players Shaping the Turkey 3PL Services Market Market

- DB Schenker

- Maersk

- Neta International Transportation

- United Parcel Service

- D B Deniz Nakliyati Ticaret

- GEFCO

- CEVA

- Istanbul Express

- GAC Turkey

- DHL Supply Chain

- DSV Panalpina

Notable Milestones in Turkey 3PL Services Market Sector

- 2021 Q4: DHL announces expansion of its warehousing capacity in Istanbul.

- 2022 Q2: Government launches initiative to improve port infrastructure.

- 2023 Q1: Several major 3PL providers implement new warehouse management systems.

In-Depth Turkey 3PL Services Market Market Outlook

The Turkish 3PL market is poised for continued growth, driven by technological innovation, evolving consumer demands, and increasing e-commerce penetration. Strategic partnerships and investment in infrastructure development will further enhance the market's competitiveness. The focus on value-added services and specialized solutions will attract new clients and create lucrative opportunities for existing players. This will contribute to sustained growth and higher market value over the forecast period.

Turkey 3PL Services Market Segmentation

-

1. Services

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. End-User

- 2.1. Manufacturing & Automotive

- 2.2. Oil, Gas & Chemicals

- 2.3. Distribu

- 2.4. Pharma & Healthcare

- 2.5. Construction

- 2.6. Other End Users

Turkey 3PL Services Market Segmentation By Geography

- 1. Turkey

Turkey 3PL Services Market Regional Market Share

Geographic Coverage of Turkey 3PL Services Market

Turkey 3PL Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 8.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Number of Partnerships among Automobile Manufacturers and Logistics Partners; Growth in international trade

- 3.3. Market Restrains

- 3.3.1. Nature of Supply Chain Business

- 3.4. Market Trends

- 3.4.1. Development in Railways Connectivity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Turkey 3PL Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Manufacturing & Automotive

- 5.2.2. Oil, Gas & Chemicals

- 5.2.3. Distribu

- 5.2.4. Pharma & Healthcare

- 5.2.5. Construction

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Turkey

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Maersk

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Neta International Transportation**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 United Parcel Service

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 D B Deniz Nakliyati Ticaret

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GEFCO

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CEVA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Istanbul Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GAC Turkey

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DHL Supply Chain

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DSV Panalpina

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Turkey 3PL Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Turkey 3PL Services Market Share (%) by Company 2025

List of Tables

- Table 1: Turkey 3PL Services Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Turkey 3PL Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Turkey 3PL Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Turkey 3PL Services Market Revenue Million Forecast, by Services 2020 & 2033

- Table 5: Turkey 3PL Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Turkey 3PL Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turkey 3PL Services Market?

The projected CAGR is approximately > 8.50%.

2. Which companies are prominent players in the Turkey 3PL Services Market?

Key companies in the market include DB Schenker, Maersk, Neta International Transportation**List Not Exhaustive, United Parcel Service, D B Deniz Nakliyati Ticaret, GEFCO, CEVA, Istanbul Express, GAC Turkey, DHL Supply Chain, DSV Panalpina.

3. What are the main segments of the Turkey 3PL Services Market?

The market segments include Services, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Number of Partnerships among Automobile Manufacturers and Logistics Partners; Growth in international trade.

6. What are the notable trends driving market growth?

Development in Railways Connectivity.

7. Are there any restraints impacting market growth?

Nature of Supply Chain Business.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turkey 3PL Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turkey 3PL Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turkey 3PL Services Market?

To stay informed about further developments, trends, and reports in the Turkey 3PL Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence