Key Insights

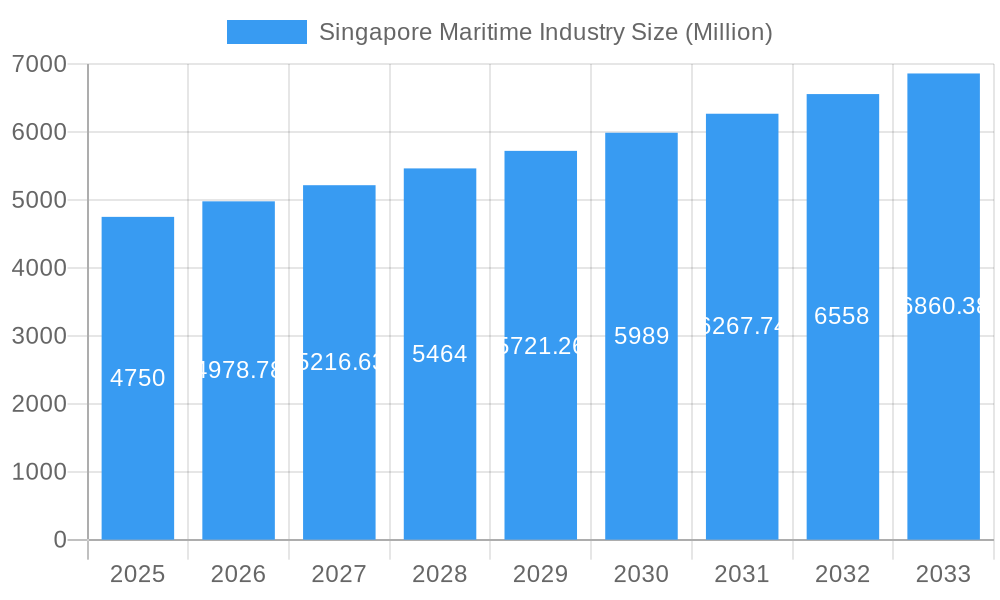

The Singapore maritime industry, valued at $4.75 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.79% from 2025 to 2033. This expansion is fueled by several key drivers. Singapore's strategic geographical location as a major transshipment hub in Asia, coupled with its world-class port infrastructure and supportive government policies, creates a highly attractive environment for maritime businesses. The increasing global trade volume, particularly within the Asia-Pacific region, further bolsters demand for port services, vessel chartering, and related support activities. Technological advancements, such as the adoption of digitalization and automation in port operations and shipping logistics, are streamlining processes, enhancing efficiency, and driving down costs, contributing positively to overall market growth. Furthermore, the growing focus on sustainable shipping practices and environmental regulations presents both opportunities and challenges for industry players, stimulating innovation and investment in greener technologies and operational methods.

Singapore Maritime Industry Market Size (In Billion)

Despite the positive outlook, the industry faces certain restraints. Fluctuations in global trade patterns, geopolitical instability, and the potential impact of economic downturns can influence demand for maritime services. Competition from other regional ports and the need for continuous investment in infrastructure upgrades to maintain competitiveness also pose challenges. The segmentation of the market, encompassing water transport, vessel leasing, cargo handling (container, crane, and stevedoring services), and supporting service activities (shipping agencies, ship brokerage, and ship management), indicates diverse growth trajectories within each sector. Leading players such as CMA CGM, ANL, PIL, PSA International, and NYK Group, along with other significant operators, are actively shaping the industry's competitive landscape through strategic investments, technological adoption, and expansion into new market segments. The continued focus on enhancing efficiency, sustainability, and technological innovation will be crucial for navigating these challenges and capitalizing on future growth opportunities within the dynamic Singapore maritime sector.

Singapore Maritime Industry Company Market Share

Singapore Maritime Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Singapore maritime industry, encompassing market dynamics, growth trends, key players, and future outlook. Covering the period 2019-2033, with a focus on 2025, this report is essential for industry professionals, investors, and strategic planners seeking to navigate this dynamic sector. The report segments the market by service type: Water Transport Services, Vessel Leasing and Rental Services, Cargo Handling, and Supporting Service Activities to Water Transport, providing a granular understanding of each sub-sector.

Singapore Maritime Industry Market Dynamics & Structure

The Singapore maritime industry exhibits a high degree of concentration, with major players like PSA International, CMA CGM, PIL (Pacific International Lines), and ONE (Ocean Network Express) commanding significant market share. The market size in 2025 is estimated at xx Million, with a projected CAGR of xx% from 2025-2033. Technological innovation, particularly in automation and digitalization, is a key driver, though high initial investment costs present a barrier to entry for smaller players. Stringent regulatory frameworks, including environmental regulations and safety standards, shape industry practices. Substitutes include alternative transportation modes like air freight, but the maritime industry maintains a dominant role due to cost-effectiveness for bulk cargo. M&A activity remains moderate, with approximately xx deals recorded between 2019 and 2024, reflecting consolidation trends within the sector.

- Market Concentration: High, with top 5 players holding an estimated xx% market share in 2025.

- Technological Innovation: Focus on automation, AI, and digital solutions for port operations and vessel management.

- Regulatory Framework: Stringent safety and environmental regulations drive operational efficiency and sustainability initiatives.

- Competitive Product Substitutes: Air freight and rail transport offer competition for specific cargo types.

- End-User Demographics: Diverse range encompassing importers, exporters, manufacturers, and logistics providers globally.

- M&A Trends: Moderate activity, driven by consolidation and expansion strategies.

Singapore Maritime Industry Growth Trends & Insights

The Singapore maritime industry has experienced consistent growth over the historical period (2019-2024), fueled by increasing global trade volumes and Singapore's strategic location. The market size expanded from xx Million in 2019 to xx Million in 2024. This growth is projected to continue during the forecast period (2025-2033), driven by technological advancements, infrastructure development, and increasing demand for efficient logistics solutions. The adoption rate of new technologies, such as autonomous vessels and digital twins, is steadily increasing, improving operational efficiency and reducing costs. Consumer behavior shifts towards faster delivery times and increased transparency in the supply chain are also impacting the industry. The industry is adapting to these changes by investing in advanced technologies and optimizing logistics networks.

Dominant Regions, Countries, or Segments in Singapore Maritime Industry

The Water Transport Services segment dominates the Singapore maritime industry, holding the largest market share at xx% in 2025, followed by Cargo Handling at xx% and Supporting Service Activities at xx%. Singapore's strategic geographical location as a major transshipment hub fuels this dominance. Strong government support, including infrastructure investments in port facilities and digitalization initiatives, further strengthens the sector's growth. The robust economic policies in Singapore attract significant foreign investment, further boosting the industry's development.

- Key Drivers: Strategic location, robust infrastructure, supportive government policies, and high volumes of global trade.

- Dominance Factors: High capacity ports, efficient logistics network, and a skilled workforce.

- Growth Potential: Strong growth potential driven by increasing regional and global trade.

Singapore Maritime Industry Product Landscape

The Singapore maritime industry showcases innovation in vessel design (e.g., larger container ships, LNG-powered vessels), port automation (e.g., automated guided vehicles, robotic cranes), and digital solutions (e.g., blockchain for supply chain transparency, AI for predictive maintenance). These advancements offer significant improvements in efficiency, safety, and environmental sustainability, enhancing the competitiveness of Singaporean maritime businesses.

Key Drivers, Barriers & Challenges in Singapore Maritime Industry

Key Drivers:

- Technological advancements: Automation, AI, and digitalization enhancing efficiency and reducing costs.

- Strategic location: Singapore’s position as a key transshipment hub.

- Government support: Investments in port infrastructure and pro-business policies.

Challenges:

- Geopolitical uncertainty: Trade wars and regional conflicts impact global shipping.

- Supply chain disruptions: Pandemics and other unforeseen events cause delays and bottlenecks.

- Environmental regulations: Stricter emission standards require significant investment in new technologies. This impacts profitability and could necessitate a xx Million investment across the sector by 2030.

Emerging Opportunities in Singapore Maritime Industry

- Growth in e-commerce: Increased demand for faster and more reliable shipping solutions.

- Sustainable shipping solutions: Demand for eco-friendly vessels and port operations.

- Digitalization: Adoption of AI, blockchain, and IoT technologies to enhance efficiency and transparency.

Growth Accelerators in the Singapore Maritime Industry

Long-term growth is accelerated by strategic partnerships between port operators and technology providers, leading to the adoption of innovative solutions and expansion into new markets. Technological breakthroughs in automation and AI are transforming port operations, boosting efficiency and reducing costs. Government initiatives to enhance connectivity and infrastructure further stimulate growth.

Key Players Shaping the Singapore Maritime Industry Market

- CMA CGM & ANL (Singapore) PTE LTD

- PIL (Pacific International Lines)

- PSA International

- NYK Group

- ONE (Ocean Network Express)

- Sea Consortium Private Ltd

- Evergreen Marine (Singapore) Pte Ltd

- Cosco Shipping (Singapore) Petroleum Pte Ltd

- Hin Leong Marine International

- AP Moller Singapore Pte Ltd

Notable Milestones in Singapore Maritime Industry Sector

- August 2023: PSA BDP and Dow India announced a sustainable transport solution in India using electric trucks powered by solar energy.

- February 2023: A.P. Moller established a new office in Singapore and committed over USD 750 million to infrastructure in South and Southeast Asia.

In-Depth Singapore Maritime Industry Market Outlook

The Singapore maritime industry is poised for continued growth, driven by technological advancements, strategic partnerships, and a supportive regulatory environment. The market’s expansion into new areas like sustainable shipping and digital solutions presents significant opportunities for both established players and new entrants. The continued focus on efficiency and resilience will shape the future of this vital sector.

Singapore Maritime Industry Segmentation

-

1. Services Type

- 1.1. Water Transport Services

- 1.2. Vessel Leasing and Rental Services

- 1.3. Cargo Ha

- 1.4. Supporti

Singapore Maritime Industry Segmentation By Geography

- 1. Singapore

Singapore Maritime Industry Regional Market Share

Geographic Coverage of Singapore Maritime Industry

Singapore Maritime Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity

- 3.3. Market Restrains

- 3.3.1. 4.; Logistics Integration In Last-mile Delivery

- 3.4. Market Trends

- 3.4.1. Development of Ports in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Maritime Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services Type

- 5.1.1. Water Transport Services

- 5.1.2. Vessel Leasing and Rental Services

- 5.1.3. Cargo Ha

- 5.1.4. Supporti

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Services Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CMA CGM & ANL (Singapore) PTE LTD

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PIL (Pacific International Lines)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PSA International

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NYK Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ONE (Ocean Network Express)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sea Consortium Private Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Evergreen Marine (Singapore) Pte Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cosco Shipping (Singapore) Petroleum Pte Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hin Leong Marine International**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AP Moller Singapore Pte Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 CMA CGM & ANL (Singapore) PTE LTD

List of Figures

- Figure 1: Singapore Maritime Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Singapore Maritime Industry Share (%) by Company 2025

List of Tables

- Table 1: Singapore Maritime Industry Revenue Million Forecast, by Services Type 2020 & 2033

- Table 2: Singapore Maritime Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Singapore Maritime Industry Revenue Million Forecast, by Services Type 2020 & 2033

- Table 4: Singapore Maritime Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Maritime Industry?

The projected CAGR is approximately 4.79%.

2. Which companies are prominent players in the Singapore Maritime Industry?

Key companies in the market include CMA CGM & ANL (Singapore) PTE LTD, PIL (Pacific International Lines), PSA International, NYK Group, ONE (Ocean Network Express), Sea Consortium Private Ltd, Evergreen Marine (Singapore) Pte Ltd, Cosco Shipping (Singapore) Petroleum Pte Ltd, Hin Leong Marine International**List Not Exhaustive, AP Moller Singapore Pte Ltd.

3. What are the main segments of the Singapore Maritime Industry?

The market segments include Services Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.75 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity.

6. What are the notable trends driving market growth?

Development of Ports in the Country.

7. Are there any restraints impacting market growth?

4.; Logistics Integration In Last-mile Delivery.

8. Can you provide examples of recent developments in the market?

August 2023: PSA BDP, a leading provider of globally integrated and port-centric supply chain, transportation, and logistics solutions, has signed a Memorandum of Understanding (MOU) with Dow Chemical International Pvt. Ltd. (Dow India) announcing a first-of-itskind sustainable transport solution in India. PSA BDP will deploy electric trucks for import and export container trucking via PSA International’s (PSA) Mumbai, Ameya, and additional terminals to Dow India’s facilities beginning in 2024. The trucks will be powered by PSA Mumbai’s 6.25MW Open Access Solar Plant, which is expected to be commissioned later in 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Maritime Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Maritime Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Maritime Industry?

To stay informed about further developments, trends, and reports in the Singapore Maritime Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence