Key Insights

The India Rail Freight Transport Market is poised for significant expansion, driven by accelerating industrialization, burgeoning e-commerce, and strategic government infrastructure investments. This dynamic sector is projected to achieve a Compound Annual Growth Rate (CAGR) of 5.72%, with the market size expected to reach 60.66 billion by 2024. Key market segments include containerized and non-containerized cargo, liquid bulk, and both domestic and international freight movements. Services range from core transportation to essential ancillary operations such as railcar maintenance, track infrastructure, cargo handling, and warehousing. Prominent industry leaders, including Indian Railways, Transvoy Logistics, and Freight Mart Logistics, are key contributors to market evolution, alongside a diverse array of logistics providers. The market exhibits strong geographical penetration across North, South, East, and West India, aligning with regional industrial strengths and transportation requirements. This robust growth trajectory is anticipated to persist through 2033, propelled by ongoing infrastructure enhancements and India's expanding economic landscape. However, challenges such as aging infrastructure in specific areas and the imperative for continuous operational efficiency and technological integration must be addressed to fully capitalize on market potential.

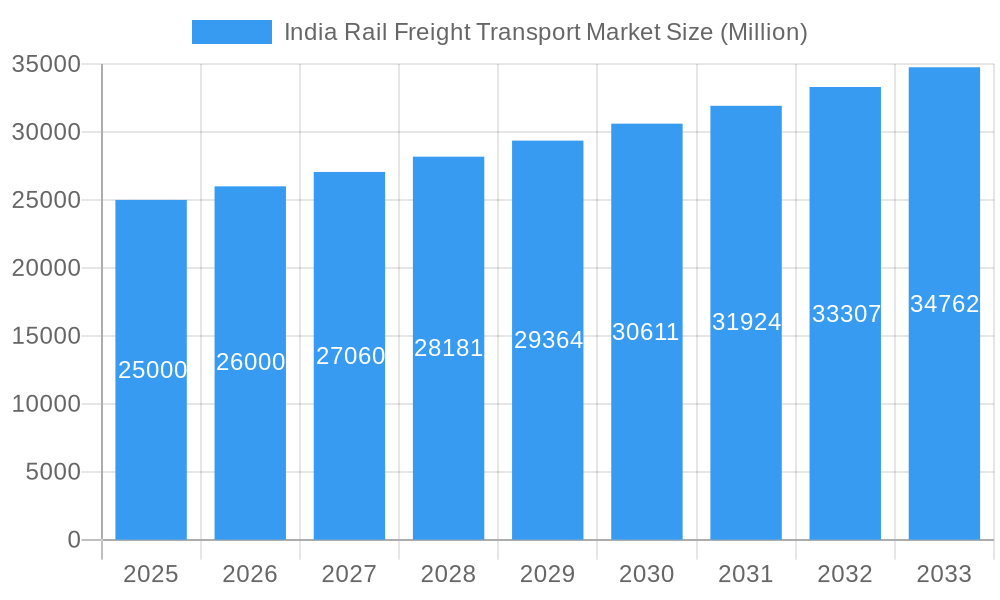

India Rail Freight Transport Market Market Size (In Billion)

Technological advancements are further accelerating growth within the India Rail Freight Transport Market. Innovations in track monitoring, real-time cargo visibility, and sophisticated logistics management systems are enhancing efficiency, reducing transit durations, and improving supply chain transparency. Government-led initiatives to modernize rail networks and promote multimodal logistics solutions are also pivotal to market expansion. The increasing demand for sustainable transportation options presents a compelling opportunity for rail freight, offering an eco-friendlier alternative to road-based logistics. The competitive arena remains active, with established players and emerging firms actively pursuing market share. Future market development will likely be shaped by strategic collaborations, technological innovation, and a persistent focus on meeting the evolving demands of India's rapidly growing economy.

India Rail Freight Transport Market Company Market Share

India Rail Freight Transport Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Rail Freight Transport Market, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on both the parent market (Freight Transportation) and child market (Rail Freight), this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with 2025 as the base year and a forecast period of 2025-2033. Market size is presented in million units.

India Rail Freight Transport Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Indian Rail Freight Transport sector. The market is characterized by a mix of established players like Indian Railways and emerging private companies.

- Market Concentration: The market exhibits a moderately concentrated structure, with Indian Railways holding a significant share, complemented by a growing number of private players. Indian Railways' market share is estimated at xx% in 2025, while the remaining share is distributed amongst private players.

- Technological Innovation: Digitalization, automation (e.g., automated switching systems), and the adoption of advanced analytics are key drivers of innovation. However, integration challenges and high initial investment costs pose barriers.

- Regulatory Framework: Government initiatives promoting rail freight and infrastructure development significantly influence market dynamics. However, bureaucratic processes and inconsistent regulatory frameworks can present challenges.

- Competitive Product Substitutes: Road freight remains a major competitor, particularly for shorter distances. However, increasing congestion and fuel costs are driving a shift towards rail for longer routes.

- End-User Demographics: The key end-users are diverse, spanning manufacturing, agriculture, energy, and retail sectors. Growth in these sectors directly impacts rail freight demand.

- M&A Trends: The market has witnessed xx M&A deals in the past five years, driven by consolidation efforts and expansion strategies. Further consolidation is anticipated in the coming years.

India Rail Freight Transport Market Growth Trends & Insights

The Indian Rail Freight Transport Market is experiencing significant growth, driven by increasing industrialization, infrastructure development, and government initiatives to promote rail freight over road transport. The market size is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by various factors, including increasing e-commerce activity, rising industrial production, and the government's focus on enhancing logistics efficiency. Technological advancements, such as the adoption of blockchain technology for improved supply chain transparency and real-time tracking, are also contributing to the market's expansion. However, challenges such as infrastructure limitations and operational inefficiencies need to be addressed to sustain this growth trajectory. Consumer behavior is shifting towards efficient and reliable logistics solutions, which favors the growth of the rail freight sector.

Dominant Regions, Countries, or Segments in India Rail Freight Transport Market

The domestic segment dominates the Indian Rail Freight Transport Market, accounting for xx% of the market share in 2025. This is primarily due to the vast size of the domestic market and the growing industrialization and manufacturing activities within India. However, the international segment holds significant potential for future growth, with increasing cross-border trade and investments in infrastructure.

- Key Drivers for Domestic Segment Growth:

- Robust growth in manufacturing and industrial sectors.

- Government initiatives focused on infrastructure development.

- Increasing demand for efficient logistics solutions.

- Key Drivers for International Segment Growth:

- Rise in cross-border trade.

- Investments in port and rail infrastructure.

- Strategic partnerships between Indian and international logistics players.

Within cargo types, containerized freight is the leading segment, due to the standardization and efficiency offered. The non-containerized segment also contributes significantly, especially for bulk commodities. Within services, transportation services remain the largest segment, followed by services allied to transportation. The northern and western regions of India show the highest growth due to higher industrial activity and efficient rail networks.

India Rail Freight Transport Market Product Landscape

The Indian Rail Freight Transport Market offers a range of services, from basic transportation to value-added services such as warehousing and specialized handling of various cargo types. Technological advancements have led to the introduction of high-capacity freight wagons, improved tracking systems, and data-driven optimization tools, enhancing efficiency and reducing transit times. These innovations provide unique selling propositions such as cost savings, improved delivery times, and enhanced security.

Key Drivers, Barriers & Challenges in India Rail Freight Transport Market

Key Drivers:

- Government initiatives aimed at modernizing rail infrastructure.

- Increasing demand for efficient and reliable transportation.

- Growth of e-commerce and related logistics needs.

- Technological advancements improving efficiency and transparency.

Key Challenges:

- Infrastructure bottlenecks and capacity constraints.

- Competition from road freight transportation.

- Operational inefficiencies and lack of standardization.

- High capital expenditure requirements for infrastructure upgrades. This translates to approximately xx million units of lost potential revenue annually.

Emerging Opportunities in India Rail Freight Transport Market

- Expansion into untapped markets, particularly in the eastern and southern regions.

- Development of specialized services for high-value goods.

- Integration of technology for real-time tracking and improved visibility.

- Strategic partnerships with international logistics players.

Growth Accelerators in the India Rail Freight Transport Market Industry

Long-term growth will be fueled by continued government investment in infrastructure, technological advancements such as the adoption of automation and AI, and strategic partnerships between public and private sector players. The focus on multimodal transportation integrating rail with road and waterways will also unlock significant growth potential.

Key Players Shaping the India Rail Freight Transport Market Market

- Indian Railways

- Transvoy Logistics India Limited

- Freight Mart Logistics

- BDG International India Pvt Ltd

- Anshika Express Cargo

- OM Logistics Limited

- Speedofreight Logistics Pvt Ltd

- Shiprocket

- V-Xpress

- Delhi Cargo Courier Services

Notable Milestones in India Rail Freight Transport Market Sector

- October 2022: Indian Railways finalizes a tender to procure 90,000 freight wagons by 2025, with an investment of approximately INR 1 trillion (approximately xx million units).

- June 2022: The World Bank approves a USD 245 million loan to modernize rail freight and logistics infrastructure, fostering private sector investment and efficiency improvements.

In-Depth India Rail Freight Transport Market Market Outlook

The future of the Indian Rail Freight Transport Market looks promising, driven by sustained government support, technological advancements, and the increasing demand for efficient logistics solutions. The market is poised for significant growth, presenting ample opportunities for both established players and new entrants. Strategic partnerships, investments in technology, and a focus on sustainability will be crucial for long-term success in this dynamic market. The market is expected to witness continued expansion, particularly in the areas of automation, digitalization, and improved infrastructure, leading to higher efficiency and increased market size in the coming years.

India Rail Freight Transport Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Services

-

2. Cargo Type

- 2.1. Containerized (Includes Intermodal)

- 2.2. Non-containerized

- 2.3. Liquid Bulk

-

3. Destination

- 3.1. Domestic

- 3.2. International

India Rail Freight Transport Market Segmentation By Geography

- 1. India

India Rail Freight Transport Market Regional Market Share

Geographic Coverage of India Rail Freight Transport Market

India Rail Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Cost Constraints4.; Infrastructure Accessibility

- 3.4. Market Trends

- 3.4.1. Digitization in Railways have increased the dependency on rail freight transport

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Rail Freight Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Containerized (Includes Intermodal)

- 5.2.2. Non-containerized

- 5.2.3. Liquid Bulk

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Transvoy Logistics India Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Indian Railways

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Freight Mart Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BDG International India Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Anshika Express Cargo

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 OM Logistics Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Speedofreight Logistics Pvt Ltd**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shiprocket

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 V-Xpress

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Delhi Cargo Courier Services

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Transvoy Logistics India Limited

List of Figures

- Figure 1: India Rail Freight Transport Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Rail Freight Transport Market Share (%) by Company 2025

List of Tables

- Table 1: India Rail Freight Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: India Rail Freight Transport Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 3: India Rail Freight Transport Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 4: India Rail Freight Transport Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: India Rail Freight Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 6: India Rail Freight Transport Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 7: India Rail Freight Transport Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 8: India Rail Freight Transport Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Rail Freight Transport Market?

The projected CAGR is approximately 5.72%.

2. Which companies are prominent players in the India Rail Freight Transport Market?

Key companies in the market include Transvoy Logistics India Limited, Indian Railways, Freight Mart Logistics, BDG International India Pvt Ltd, Anshika Express Cargo, OM Logistics Limited, Speedofreight Logistics Pvt Ltd**List Not Exhaustive, Shiprocket, V-Xpress, Delhi Cargo Courier Services.

3. What are the main segments of the India Rail Freight Transport Market?

The market segments include Service, Cargo Type, Destination.

4. Can you provide details about the market size?

The market size is estimated to be USD 60.66 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Digitization in Railways have increased the dependency on rail freight transport.

7. Are there any restraints impacting market growth?

4.; Cost Constraints4.; Infrastructure Accessibility.

8. Can you provide examples of recent developments in the market?

October 2022 - Indian Railways finalizes tender to procure 90,000 freight wagons by 2025. The investment will be around INR 1 trillion. The tender notice for the procurement of 90,000 wagons was floated in March 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Rail Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Rail Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Rail Freight Transport Market?

To stay informed about further developments, trends, and reports in the India Rail Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence