Key Insights

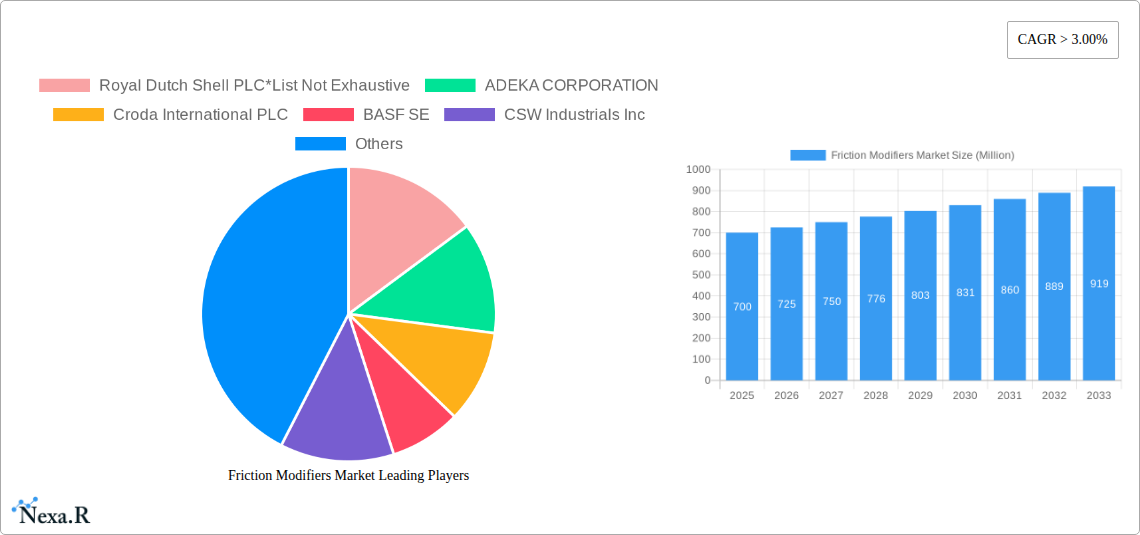

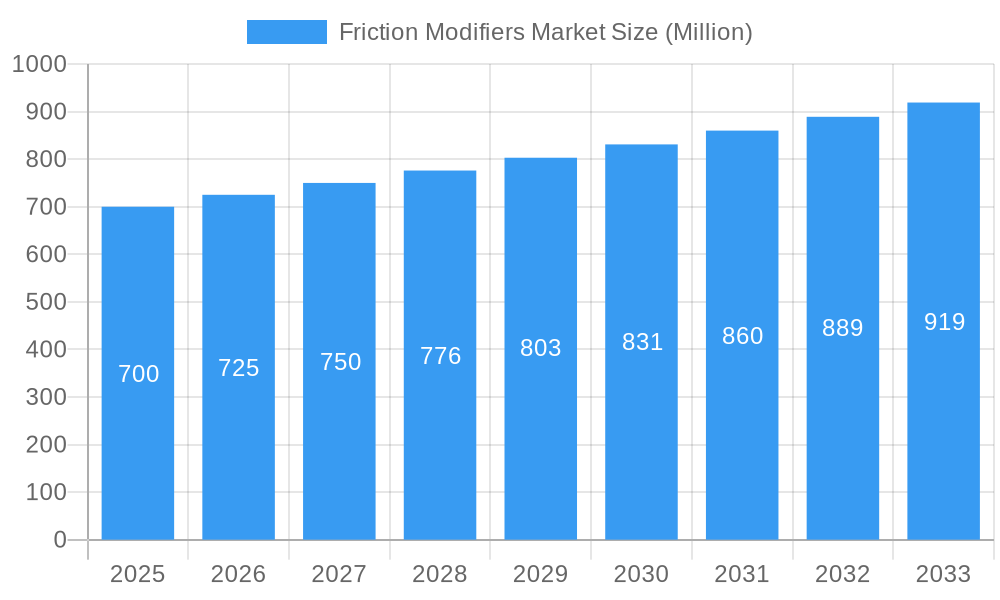

The global Friction Modifiers Market is poised for robust expansion, projected to reach an estimated market size of approximately $700 million by 2025 and continuing its upward trajectory. Driven by a Compound Annual Growth Rate (CAGR) exceeding 3.00%, this market demonstrates a sustained demand for advanced lubrication solutions across diverse industrial sectors. Key growth drivers include the escalating demand for enhanced fuel efficiency and reduced wear and tear in automotive applications, where friction modifiers play a crucial role in optimizing engine performance and extending component lifespan. Furthermore, the burgeoning industrial sector, encompassing manufacturing, heavy machinery, and power generation, is witnessing increased adoption of friction modifiers to improve operational efficiency, lower energy consumption, and enhance the durability of equipment. The marine industry is also contributing to market growth, driven by stringent environmental regulations and the need for specialized lubricants that can withstand demanding operating conditions. Emerging economies, particularly in the Asia Pacific region, are expected to be significant contributors to market growth due to rapid industrialization and increasing vehicle parc.

Friction Modifiers Market Market Size (In Million)

The market is segmented into organic and inorganic friction modifiers, with organic variants currently holding a dominant share due to their superior performance characteristics and broader applicability. However, ongoing research and development in inorganic friction modifiers, focusing on improved environmental profiles and cost-effectiveness, are likely to narrow this gap in the future. Leading companies such as Royal Dutch Shell PLC, ADEKA CORPORATION, Croda International PLC, BASF SE, and The Lubrizol Corporation are actively investing in innovation and strategic partnerships to capitalize on market opportunities. While the market exhibits strong growth potential, certain restraints such as the volatility of raw material prices and increasing environmental scrutiny on lubricant formulations could pose challenges. Nevertheless, the overarching trend towards sustainable and high-performance lubrication solutions, coupled with a growing awareness of the benefits of friction modification in reducing operational costs and environmental impact, underpins a positive outlook for the Friction Modifiers Market.

Friction Modifiers Market Company Market Share

Friction Modifiers Market: Comprehensive Report Analysis & Future Outlook

This in-depth report delivers an exhaustive analysis of the global friction modifiers market, examining its dynamics, growth trajectories, and future potential. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025 and a detailed forecast period from 2025 to 2033, this research provides critical insights for stakeholders in the lubricant additives and specialty chemicals sectors. The market is segmented by Types (Organic, Inorganic) and End-user Industry (Automotive, Industrial, Marine, Other End-user Industries).

The friction modifiers market size is projected to witness substantial expansion, driven by increasing demand for enhanced fuel efficiency, reduced wear and tear, and extended equipment lifespan across diverse industrial applications. With an estimated friction modifiers market value in Million units for the base year 2025, this report quantifies the current market standing and forecasts its future trajectory.

Companies analyzed include Royal Dutch Shell PLC, ADEKA CORPORATION, Croda International PLC, BASF SE, CSW Industrials Inc, Chevron Corporation, ABITEC, The Lubrizol Corporation, Multisol, BRB International, and Afton Chemical, among others. This report provides a granular understanding of the friction modifiers market trends, market share, and competitive landscape.

Friction Modifiers Market Market Dynamics & Structure

The friction modifiers market exhibits a moderately concentrated structure, characterized by the presence of a few major global players alongside a multitude of regional and specialized manufacturers. Technological innovation is a primary driver, with companies continuously investing in R&D to develop advanced formulations that offer superior performance, environmental compliance, and cost-effectiveness. Regulatory frameworks, particularly concerning emissions standards and material safety, are increasingly influencing product development and market access. Competitive product substitutes, such as different types of lubricant additives and alternative lubrication technologies, pose a constant challenge, necessitating ongoing innovation and differentiation. End-user demographics, spanning the rapidly evolving automotive sector and the robust industrial lubricants market, are shaping demand patterns and product requirements. Merger and acquisition (M&A) trends are notable, with strategic partnerships and acquisitions aimed at expanding product portfolios, geographical reach, and technological capabilities.

- Market Concentration: Dominated by a few key players, but with significant room for niche market participants.

- Technological Innovation Drivers: Focus on improving fuel economy, reducing friction and wear, and meeting stringent environmental regulations.

- Regulatory Frameworks: Strict emission standards and material safety regulations are shaping product formulations.

- Competitive Product Substitutes: Competition from alternative lubricant technologies and other additive types.

- End-User Demographics: Significant demand from the automotive and industrial sectors, with growing interest from marine applications.

- M&A Trends: Strategic acquisitions and joint ventures to enhance market presence and technological capabilities.

Friction Modifiers Market Growth Trends & Insights

The global friction modifiers market is poised for robust growth, propelled by a confluence of technological advancements, evolving industrial demands, and stringent regulatory mandates driving the need for enhanced performance and efficiency. The market size evolution is directly correlated with the increasing sophistication of machinery and vehicles, where reducing internal friction is paramount for optimizing energy consumption and extending operational lifespan. Adoption rates for advanced friction modifying additives are escalating across the automotive industry, as manufacturers strive to meet ambitious fuel economy targets and reduce CO2 emissions. Similarly, the industrial lubricants market is witnessing a surge in demand for high-performance friction modifiers to enhance the efficiency and durability of manufacturing equipment, turbines, and other heavy machinery.

Technological disruptions, such as the development of nano-lubricants and bio-based friction modifiers, are further reshaping the market landscape, offering novel solutions with improved environmental profiles and performance characteristics. Consumer behavior shifts, particularly a growing preference for sustainable and environmentally friendly products, are influencing ingredient selection and product formulation strategies within the specialty chemicals segment. The forecast period is expected to witness a significant CAGR, reflecting the sustained demand for solutions that minimize energy loss and operational costs. Market penetration is deepening across various sub-segments, with a particular emphasis on high-performance applications requiring specialized organic friction modifiers and inorganic friction modifiers. The growing awareness of the economic and environmental benefits associated with optimized lubrication is a key indicator of sustained market expansion.

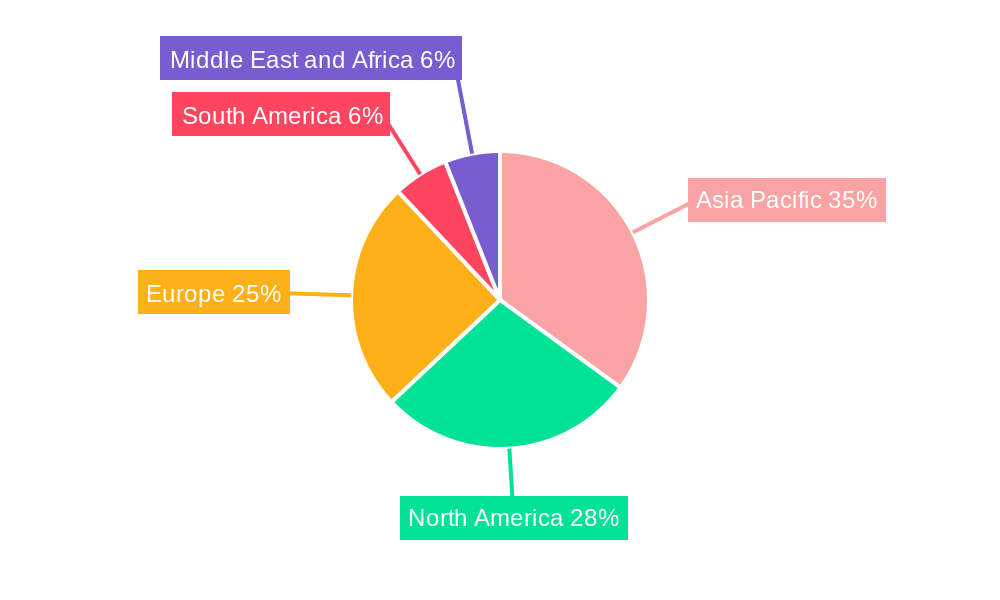

Dominant Regions, Countries, or Segments in Friction Modifiers Market

The Automotive segment stands as a dominant force within the friction modifiers market, propelled by stringent government regulations on fuel efficiency and emissions worldwide. The increasing production of vehicles, coupled with a growing consumer preference for fuel-conscious driving, directly translates into higher demand for friction modifiers that enhance engine performance and reduce energy loss. North America and Europe have historically led this segment due to established automotive manufacturing bases and rigorous environmental standards. However, the Asia-Pacific region is emerging as a significant growth engine, driven by a rapidly expanding automotive industry and increasing disposable incomes.

Within the Types segmentation, Organic friction modifiers currently hold a significant market share due to their versatile performance characteristics and compatibility with various lubricant formulations. They are favored for their ability to provide excellent friction reduction and wear protection in a wide range of operating conditions. However, Inorganic friction modifiers are gaining traction, particularly in high-temperature and high-pressure industrial applications where their superior thermal stability and extreme pressure properties offer distinct advantages.

The Industrial end-user industry is another major contributor to the friction modifiers market, encompassing sectors like manufacturing, power generation, and mining. The continuous operation of heavy machinery and equipment necessitates robust lubrication solutions to minimize wear and tear, reduce downtime, and enhance operational efficiency. Economic policies promoting industrial growth and infrastructure development, especially in emerging economies, directly fuel the demand for these specialized additives. Countries with strong manufacturing bases and significant industrial output are expected to continue driving growth in this segment.

- Dominant Segment (End-user Industry): Automotive, driven by fuel efficiency regulations and vehicle production.

- Key Drivers in Automotive: Stringent emission standards, growing vehicle parc, and consumer demand for fuel economy.

- Dominant Segment (Type): Organic friction modifiers, owing to their broad applicability and performance.

- Emerging Segment (Type): Inorganic friction modifiers, gaining traction in heavy-duty industrial applications.

- Growth Factors in Industrial Segment: Industrialization, infrastructure development, and the need for enhanced machinery lifespan.

- Regional Dominance: North America and Europe leading, with Asia-Pacific exhibiting strong growth potential.

Friction Modifiers Market Product Landscape

The friction modifiers market product landscape is characterized by continuous innovation focused on enhancing performance, sustainability, and cost-effectiveness. Key product innovations include the development of advanced organic compounds with superior film-forming capabilities and improved shear stability, leading to enhanced friction reduction and wear protection in demanding automotive and industrial applications. Inorganic friction modifiers, such as molybdenum disulfide and boron nitride derivatives, are also seeing advancements in particle size control and surface treatment, optimizing their dispersion and efficacy in lubricants for extreme pressure environments. Applications are broadening beyond traditional engine oils and industrial greases, with increasing use in specialized lubricants for gears, hydraulics, and metalworking fluids. The focus remains on developing products that offer a superior balance of friction reduction, wear resistance, and overall lubricant stability, meeting the evolving performance metrics demanded by end-users.

Key Drivers, Barriers & Challenges in Friction Modifiers Market

Key Drivers:

- Increasing Demand for Fuel Efficiency: Stringent regulations and consumer preference for better mileage are driving the adoption of friction modifiers in the automotive sector.

- Extended Equipment Lifespan: Reducing wear and tear through advanced friction modification technology leads to longer operational life for industrial machinery and vehicles, lowering maintenance costs.

- Technological Advancements: Ongoing R&D efforts are yielding more effective and environmentally friendly friction modifier formulations.

- Growing Industrialization: Expansion of manufacturing and infrastructure globally fuels the demand for high-performance lubricants containing friction modifiers.

Barriers & Challenges:

- Supply Chain Volatility: Fluctuations in the availability and cost of raw materials can impact production and pricing.

- Regulatory Hurdles: Evolving environmental regulations and chemical substance restrictions can necessitate costly product reformulation.

- Competitive Pressures: Intense competition among additive manufacturers can lead to price wars and reduced profit margins.

- Technical Performance Limitations: Achieving optimal friction reduction without compromising other critical lubricant properties, such as wear protection or oxidation stability, remains a challenge.

- Market Inertia: Resistance to adopting new technologies or formulations in certain established industrial sectors.

Emerging Opportunities in Friction Modifiers Market

Emerging opportunities within the friction modifiers market lie in the development of sustainable and bio-based friction modifiers to cater to the growing demand for eco-friendly solutions. The burgeoning electric vehicle (EV) market presents a unique opportunity for specialized friction modifiers designed for EV transmissions and drivelines, where different lubrication requirements exist compared to internal combustion engines. Furthermore, advancements in nanotechnology are opening avenues for nano-lubricants and nano-friction modifiers offering unparalleled performance enhancements. Untapped markets in emerging economies with rapidly growing industrial and automotive sectors also represent significant growth potential. Innovative applications in renewable energy sectors, such as wind turbines, and in specialized industrial processes requiring extreme lubrication conditions, are also poised to drive future market expansion.

Growth Accelerators in the Friction Modifiers Market Industry

Several catalysts are driving the long-term growth of the friction modifiers market. Technological breakthroughs in areas like tribology and material science are enabling the creation of novel friction modifying additives with unprecedented performance characteristics. Strategic partnerships and joint ventures, such as the one between Royal Dutch Shell PLC and CSW Industrials, Inc., are crucial for market expansion, enabling companies to leverage combined expertise and distribution networks. Market expansion strategies focused on emerging economies and specific high-growth application sectors will further accelerate growth. The continuous push for greater energy efficiency across all industries, driven by both economic imperatives and environmental concerns, will remain a fundamental growth accelerator, ensuring sustained demand for innovative friction modification solutions.

Key Players Shaping the Friction Modifiers Market Market

- Royal Dutch Shell PLC

- ADEKA CORPORATION

- Croda International PLC

- BASF SE

- CSW Industrials Inc

- Chevron Corporation

- ABITEC

- The Lubrizol Corporation

- Multisol

- BRB International

- Afton Chemical

Notable Milestones in Friction Modifiers Market Sector

- January 2021: Royal Dutch Shell PLC and Whitmore Manufacturing LLC (a wholly-owned subsidiary of CSW Industrials, Inc.) announced a definitive agreement to form a joint venture, Shell & Whitmore Reliability Solutions LLC. This collaboration aims to market, distribute, and sell lubricants, friction modifiers, greases, and other reliability products, along with related industrial services, specifically targeting the North American rail and US mining sectors.

- July 2019: Croda International Plc announced the acquisition of Rewitec GmbH. Rewitec GmbH is a manufacturer of friction and wear-reducing lubricant additives. This acquisition significantly enhances Croda's product portfolio and expands its additives business, strengthening its position in the specialty chemicals market.

In-Depth Friction Modifiers Market Market Outlook

The friction modifiers market is set for a period of sustained and robust growth, driven by an unwavering global emphasis on energy efficiency and reduced environmental impact. The automotive sector will continue to be a primary demand driver, propelled by evolving emission standards and the increasing adoption of advanced vehicle technologies. Industrial applications, encompassing manufacturing, power generation, and heavy machinery, will also contribute significantly, as businesses seek to optimize operational efficiency and minimize wear and tear. Strategic initiatives, including collaborations and targeted R&D investments in sustainable and high-performance friction modifiers, will be critical for players aiming to capture future market share. The growing demand for specialized solutions in emerging sectors and geographies presents substantial strategic opportunities for innovation and market penetration.

Friction Modifiers Market Segmentation

-

1. Types

- 1.1. Organic

- 1.2. Inorganic

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Industrial

- 2.3. Marine

- 2.4. Other End-user Industries

Friction Modifiers Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Friction Modifiers Market Regional Market Share

Geographic Coverage of Friction Modifiers Market

Friction Modifiers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Applications for Fuel Efficient Lubricants; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Declining Automotive Industry; Growing Electric Vehicles Usage; Negative Impact of COVID-; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Usage in the Industrial Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Friction Modifiers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Types

- 5.1.1. Organic

- 5.1.2. Inorganic

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Industrial

- 5.2.3. Marine

- 5.2.4. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Types

- 6. Asia Pacific Friction Modifiers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Types

- 6.1.1. Organic

- 6.1.2. Inorganic

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Industrial

- 6.2.3. Marine

- 6.2.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Types

- 7. North America Friction Modifiers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Types

- 7.1.1. Organic

- 7.1.2. Inorganic

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Industrial

- 7.2.3. Marine

- 7.2.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Types

- 8. Europe Friction Modifiers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Types

- 8.1.1. Organic

- 8.1.2. Inorganic

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Industrial

- 8.2.3. Marine

- 8.2.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Types

- 9. South America Friction Modifiers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Types

- 9.1.1. Organic

- 9.1.2. Inorganic

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Industrial

- 9.2.3. Marine

- 9.2.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Types

- 10. Middle East and Africa Friction Modifiers Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Types

- 10.1.1. Organic

- 10.1.2. Inorganic

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Automotive

- 10.2.2. Industrial

- 10.2.3. Marine

- 10.2.4. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Types

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Royal Dutch Shell PLC*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ADEKA CORPORATION

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Croda International PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BASF SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CSW Industrials Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Chevron Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ABITEC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Lubrizol Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Multisol

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BRB International

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Afton Chemical

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Royal Dutch Shell PLC*List Not Exhaustive

List of Figures

- Figure 1: Global Friction Modifiers Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Friction Modifiers Market Revenue (Million), by Types 2025 & 2033

- Figure 3: Asia Pacific Friction Modifiers Market Revenue Share (%), by Types 2025 & 2033

- Figure 4: Asia Pacific Friction Modifiers Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Friction Modifiers Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Friction Modifiers Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Friction Modifiers Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Friction Modifiers Market Revenue (Million), by Types 2025 & 2033

- Figure 9: North America Friction Modifiers Market Revenue Share (%), by Types 2025 & 2033

- Figure 10: North America Friction Modifiers Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: North America Friction Modifiers Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Friction Modifiers Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Friction Modifiers Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Friction Modifiers Market Revenue (Million), by Types 2025 & 2033

- Figure 15: Europe Friction Modifiers Market Revenue Share (%), by Types 2025 & 2033

- Figure 16: Europe Friction Modifiers Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Europe Friction Modifiers Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Friction Modifiers Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Friction Modifiers Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Friction Modifiers Market Revenue (Million), by Types 2025 & 2033

- Figure 21: South America Friction Modifiers Market Revenue Share (%), by Types 2025 & 2033

- Figure 22: South America Friction Modifiers Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: South America Friction Modifiers Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Friction Modifiers Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Friction Modifiers Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Friction Modifiers Market Revenue (Million), by Types 2025 & 2033

- Figure 27: Middle East and Africa Friction Modifiers Market Revenue Share (%), by Types 2025 & 2033

- Figure 28: Middle East and Africa Friction Modifiers Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Friction Modifiers Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Friction Modifiers Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Friction Modifiers Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Friction Modifiers Market Revenue Million Forecast, by Types 2020 & 2033

- Table 2: Global Friction Modifiers Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Friction Modifiers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Friction Modifiers Market Revenue Million Forecast, by Types 2020 & 2033

- Table 5: Global Friction Modifiers Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Friction Modifiers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Friction Modifiers Market Revenue Million Forecast, by Types 2020 & 2033

- Table 13: Global Friction Modifiers Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Friction Modifiers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Friction Modifiers Market Revenue Million Forecast, by Types 2020 & 2033

- Table 19: Global Friction Modifiers Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Friction Modifiers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Italy Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Friction Modifiers Market Revenue Million Forecast, by Types 2020 & 2033

- Table 27: Global Friction Modifiers Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Friction Modifiers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Brazil Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Friction Modifiers Market Revenue Million Forecast, by Types 2020 & 2033

- Table 33: Global Friction Modifiers Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Friction Modifiers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Friction Modifiers Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Friction Modifiers Market?

Key companies in the market include Royal Dutch Shell PLC*List Not Exhaustive, ADEKA CORPORATION, Croda International PLC, BASF SE, CSW Industrials Inc, Chevron Corporation, ABITEC, The Lubrizol Corporation, Multisol, BRB International, Afton Chemical.

3. What are the main segments of the Friction Modifiers Market?

The market segments include Types, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Applications for Fuel Efficient Lubricants; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Usage in the Industrial Sector.

7. Are there any restraints impacting market growth?

Declining Automotive Industry; Growing Electric Vehicles Usage; Negative Impact of COVID-; Other Restraints.

8. Can you provide examples of recent developments in the market?

In January 2021, Royal Dutch Shell PLC and Whitmore Manufacturing LLC, a wholly-owned subsidiary of CSW Industrials, Inc., announced a definitive agreement to form a joint venture, Shell & Whitmore Reliability Solutions LLC, to market, distribute, and sell lubricants, friction modifiers, greases, and other reliability products, and related industrial services to the North American rail and US mining sectors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Friction Modifiers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Friction Modifiers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Friction Modifiers Market?

To stay informed about further developments, trends, and reports in the Friction Modifiers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence