Key Insights

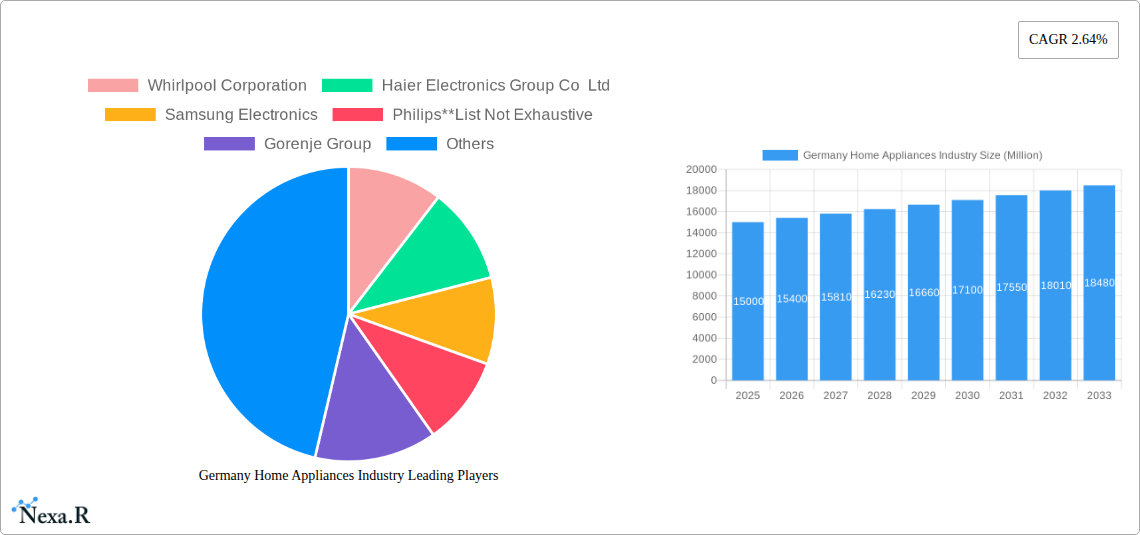

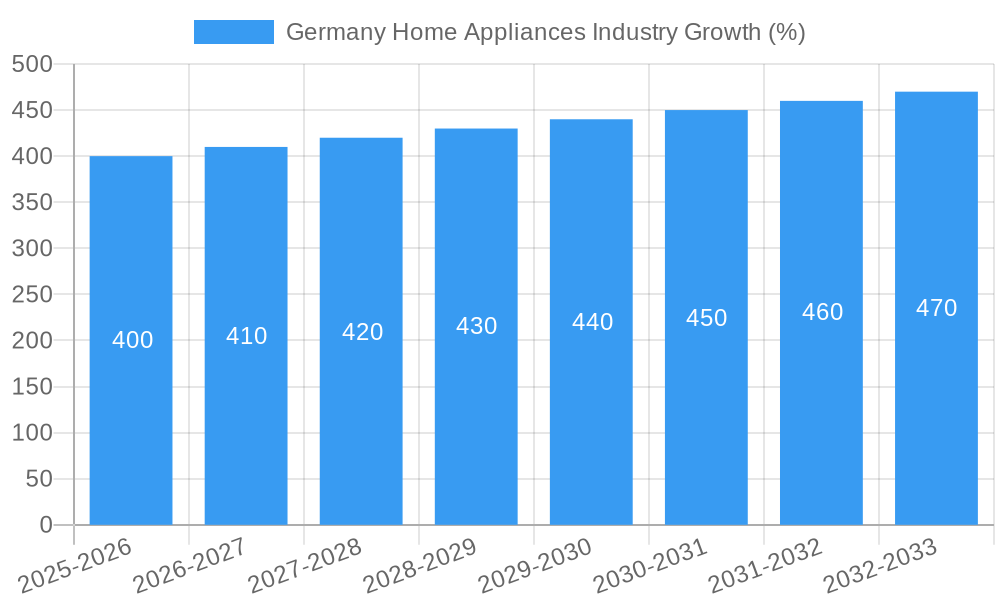

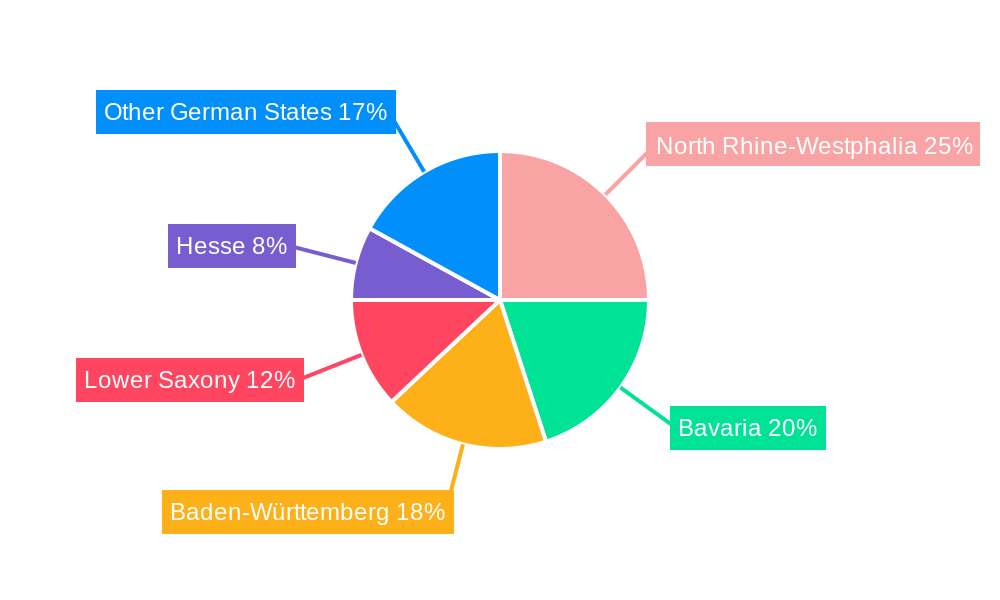

The German home appliances market, valued at approximately €XX million in 2025, is projected to experience steady growth, driven by a rising disposable income, increasing urbanization, and a growing preference for technologically advanced appliances. The 2.64% CAGR indicates a consistent, albeit moderate, expansion through 2033. Key segments driving this growth include major appliances like refrigerators, washing machines, and dishwashers, fueled by replacement demand and the desire for energy-efficient models. The small appliance segment, encompassing kitchen gadgets and personal care items, also contributes significantly, propelled by increasing consumer spending on convenience and lifestyle products. E-commerce continues to gain traction as a distribution channel, challenging traditional retailers like supermarkets and specialty stores. However, the market faces certain restraints, including potential economic slowdowns impacting consumer spending and increasing competition from both established international brands and emerging local players. The regional distribution within Germany shows strong performance in affluent states like Bavaria, Baden-Württemberg, and North Rhine-Westphalia, reflecting higher purchasing power in these areas. Furthermore, sustainability concerns are influencing consumer choices, leading to increased demand for eco-friendly and energy-efficient appliances. Manufacturers are responding by investing in research and development to improve the energy efficiency and longevity of their products.

The competitive landscape is intense, with global giants like Whirlpool, Samsung, and Bosch vying for market share alongside established European brands such as Electrolux and Miele. Successful players will need to effectively leverage both online and offline channels, offer innovative products catering to specific consumer needs, and maintain competitive pricing strategies. The forecast period (2025-2033) suggests opportunities for companies to capitalize on rising demand for smart appliances, integrating internet connectivity and automation features to enhance convenience and efficiency. Understanding consumer preferences for design, functionality, and brand reputation will be crucial for success in this dynamic market. The continued focus on energy efficiency, driven by government regulations and consumer awareness, presents a critical factor shaping the market's trajectory.

This comprehensive report provides an in-depth analysis of the German home appliances market, covering the period from 2019 to 2033. It examines market dynamics, growth trends, key players, and future opportunities across major and small appliances, offering crucial insights for industry professionals, investors, and strategists. The report utilizes data from 2019-2024 as the historical period, 2025 as the base year and estimated year, and 2025-2033 as the forecast period. Market values are presented in million units.

Germany Home Appliances Industry Market Dynamics & Structure

The German home appliance market is characterized by a moderately concentrated landscape, with key players like BSH Hausgeräte GmbH, Miele, and Bosch holding significant market share. Technological innovation, particularly in energy efficiency and smart home integration, is a major driver, propelled by government regulations promoting sustainable consumption. Competitive pressures from substitute products, such as shared economy services, exert influence, while end-user demographics, with an aging population and a growing preference for convenience, shape demand. Mergers and acquisitions (M&A) activity remains steady, with consolidation expected to continue, potentially leading to further market concentration.

- Market Concentration: BSH Hausgeräte GmbH holds an estimated xx% market share in 2025, followed by Miele (xx%) and Bosch (xx%).

- Technological Innovation: Focus on energy-efficient appliances (e.g., A+++ rated refrigerators) and smart home integration (Wi-Fi enabled appliances).

- Regulatory Framework: Stringent energy efficiency standards and eco-design directives influencing product development and consumer choices.

- M&A Activity: An average of xx M&A deals per year in the historical period (2019-2024).

- Competitive Substitutes: Growth of laundry and cleaning services impacting demand for certain appliance categories.

- End-user Demographics: Shifting household structures and increasing disposable incomes influencing appliance purchase patterns.

Germany Home Appliances Industry Growth Trends & Insights

The German home appliance market experienced steady growth during the historical period (2019-2024), with a CAGR of xx%. Market size is estimated to reach xx million units in 2025 and is projected to grow at a CAGR of xx% during the forecast period (2025-2033), driven by factors such as rising disposable incomes, technological advancements, and increasing urbanization. Consumer preference is shifting towards premium and smart appliances with enhanced features and connectivity. Technological disruptions, such as the introduction of AI-powered appliances and the increasing adoption of smart home ecosystems, are reshaping the market landscape.

The adoption rate of smart home appliances is growing rapidly, with penetration expected to reach xx% by 2033. This growth is propelled by factors such as increasing internet penetration and the rising demand for convenience and energy efficiency. However, concerns about data privacy and security may hinder broader adoption.

Dominant Regions, Countries, or Segments in Germany Home Appliances Industry

The major appliances segment, particularly refrigerators and washing machines, dominates the German home appliance market, accounting for approximately xx% of the total market value in 2025. Within distribution channels, supermarkets and hypermarkets continue to hold the largest market share, followed by e-commerce, reflecting changing consumer shopping habits. Urban areas exhibit higher demand due to higher population density and disposable incomes.

- Major Appliances: Refrigerators (xx million units in 2025), Washing Machines (xx million units in 2025).

- Small Appliances: Vacuum cleaners and small kitchen appliances are the leading segments within this category.

- Distribution Channels: Supermarkets & Hypermarkets (xx% market share in 2025), E-Commerce (xx% market share in 2025).

- Regional Dominance: Urban centers and affluent regions show higher per capita consumption.

- Growth Drivers: Increasing urbanization, rising disposable incomes, and government initiatives promoting energy efficiency.

Germany Home Appliances Industry Product Landscape

The German home appliance market showcases a diverse product range, characterized by increasing integration of smart technologies, energy efficiency features, and improved design aesthetics. Manufacturers are focusing on developing appliances with enhanced connectivity, enabling remote control and monitoring through smartphone apps. Innovative features such as AI-powered cleaning cycles and personalized settings are gaining traction. Key innovations include water-saving technologies in washing machines and energy-efficient compressors in refrigerators. Unique selling propositions (USPs) frequently center around durability, ease of use, and advanced features.

Key Drivers, Barriers & Challenges in Germany Home Appliances Industry

Key Drivers:

- Rising disposable incomes and improved living standards fuel demand.

- Technological advancements lead to energy-efficient and smart appliances.

- Government regulations promoting sustainable consumption drive innovation.

Key Challenges & Restraints:

- Increasing competition from international brands.

- Supply chain disruptions due to global events.

- Consumer concerns regarding data privacy with smart appliances (estimated impact: xx% reduction in sales of specific smart products).

Emerging Opportunities in Germany Home Appliances Industry

- Growing demand for sustainable and energy-efficient appliances.

- Expansion of smart home technology integration.

- Increased focus on personalized and customized appliances.

- Niche market opportunities within specific segments (e.g., elderly care appliances).

Growth Accelerators in the Germany Home Appliances Industry Industry

Technological breakthroughs in areas like AI, IoT, and energy efficiency are key growth catalysts. Strategic partnerships between appliance manufacturers and technology companies will accelerate innovation and market penetration. Market expansion strategies targeting underserved segments (e.g., rural areas) will drive future growth.

Key Players Shaping the Germany Home Appliances Industry Market

- Whirlpool Corporation

- Haier Electronics Group Co Ltd

- Samsung Electronics

- Philips

- Gorenje Group

- Mitsubishi Electric Corporation

- Midea Group Co Ltd

- BSH Hausgeräte GmbH

- Electrolux AB

- Arcelik A S

- Panasonic Corporation

- LG Electronics

Notable Milestones in Germany Home Appliances Industry Sector

- 2020: Introduction of stricter energy efficiency standards for refrigerators.

- 2021: Launch of several smart home appliance models by leading brands.

- 2022: Acquisition of a smaller appliance manufacturer by a major player.

- 2023: Significant market entry of a new international competitor.

In-Depth Germany Home Appliances Industry Market Outlook

The German home appliance market is poised for continued growth, driven by the confluence of technological innovation, evolving consumer preferences, and supportive government policies. Opportunities abound in the smart home segment, sustainable appliances, and specialized niche markets. Strategic partnerships, innovative product development, and effective marketing strategies will determine market leadership in the years to come. The overall market is expected to maintain a robust growth trajectory, presenting compelling investment prospects.

Germany Home Appliances Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Germany Home Appliances Industry Segmentation By Geography

- 1. Germany

Germany Home Appliances Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.64% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Household Disposable Income Drives The Market; Changing Lifestyles and Time Constraints Drives The Market

- 3.3. Market Restrains

- 3.3.1. High Initial Costs; Infrastructure and Space Limitations

- 3.4. Market Trends

- 3.4.1. Rising Electricity Costs And Increasing Technological Advancements is Driving the Demand for Energy-Efficient Home Appliances

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Home Appliances Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North Rhine-Westphalia Germany Home Appliances Industry Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany Home Appliances Industry Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany Home Appliances Industry Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany Home Appliances Industry Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany Home Appliances Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Whirlpool Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Haier Electronics Group Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Samsung Electronics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Philips**List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Gorenje Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mitsubishi Electric Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Midea Group Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BSH Hausgeräte GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Electrolux AB

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Arcelik A S

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Panasonic Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 LG Electronics

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Whirlpool Corporation

List of Figures

- Figure 1: Germany Home Appliances Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Home Appliances Industry Share (%) by Company 2024

List of Tables

- Table 1: Germany Home Appliances Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Home Appliances Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Germany Home Appliances Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Germany Home Appliances Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Germany Home Appliances Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Germany Home Appliances Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Germany Home Appliances Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Germany Home Appliances Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: North Rhine-Westphalia Germany Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Bavaria Germany Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Baden-Württemberg Germany Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Lower Saxony Germany Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Hesse Germany Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Germany Home Appliances Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 15: Germany Home Appliances Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 16: Germany Home Appliances Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 17: Germany Home Appliances Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 18: Germany Home Appliances Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 19: Germany Home Appliances Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Home Appliances Industry?

The projected CAGR is approximately 2.64%.

2. Which companies are prominent players in the Germany Home Appliances Industry?

Key companies in the market include Whirlpool Corporation, Haier Electronics Group Co Ltd, Samsung Electronics, Philips**List Not Exhaustive, Gorenje Group, Mitsubishi Electric Corporation, Midea Group Co Ltd, BSH Hausgeräte GmbH, Electrolux AB, Arcelik A S, Panasonic Corporation, LG Electronics.

3. What are the main segments of the Germany Home Appliances Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Household Disposable Income Drives The Market; Changing Lifestyles and Time Constraints Drives The Market.

6. What are the notable trends driving market growth?

Rising Electricity Costs And Increasing Technological Advancements is Driving the Demand for Energy-Efficient Home Appliances.

7. Are there any restraints impacting market growth?

High Initial Costs; Infrastructure and Space Limitations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Home Appliances Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Home Appliances Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Home Appliances Industry?

To stay informed about further developments, trends, and reports in the Germany Home Appliances Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence