Key Insights

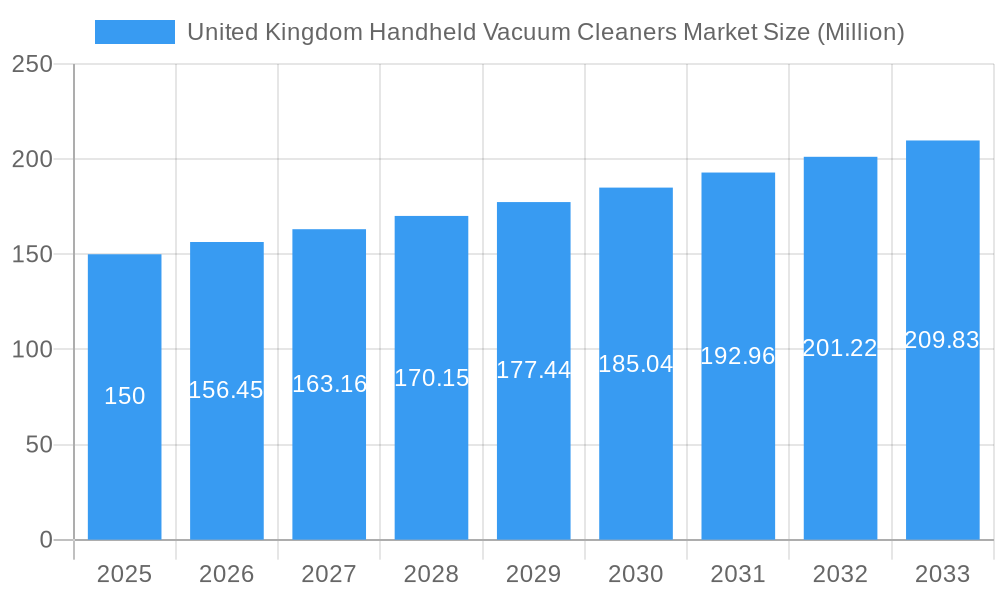

The United Kingdom handheld vacuum cleaner market is projected to reach £550.01 million by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of 5.1% from the base year 2024. This expansion is underpinned by increasing consumer demand for efficient and convenient cleaning solutions. Key growth drivers include the escalating popularity of cordless models, offering enhanced maneuverability, and technological advancements that improve suction power and reduce weight. The market is segmented by product type (corded, cordless), application (household, automotive, commercial), and distribution channel (online, offline). Cordless vacuums are anticipated to maintain market dominance due to their convenience and ongoing innovation. Online retail is also seeing significant uptake, aligning with modern consumer shopping behaviors. Major brands such as Dyson, Hoover, and Vax are expected to retain substantial market share, leveraging strong brand equity and established distribution networks. However, intensifying competition from new entrants and a growing emphasis on sustainability may reshape market dynamics.

United Kingdom Handheld Vacuum Cleaners Market Market Size (In Million)

Despite a positive outlook, the UK handheld vacuum cleaner market confronts certain challenges. Consumer price sensitivity, particularly in lower-income segments, may temper the growth of premium-priced products. Additionally, environmental concerns related to battery disposal and plastic usage could influence purchasing decisions. Initiatives focused on sustainable materials and battery recycling are crucial for mitigating these impacts and supporting continued market expansion. The competitive environment necessitates strategic differentiation through innovation, targeted marketing, and an elevated consumer experience to secure market positions. Future growth hinges on effectively addressing these challenges and capitalizing on evolving consumer preferences for both user-friendly and eco-conscious cleaning solutions.

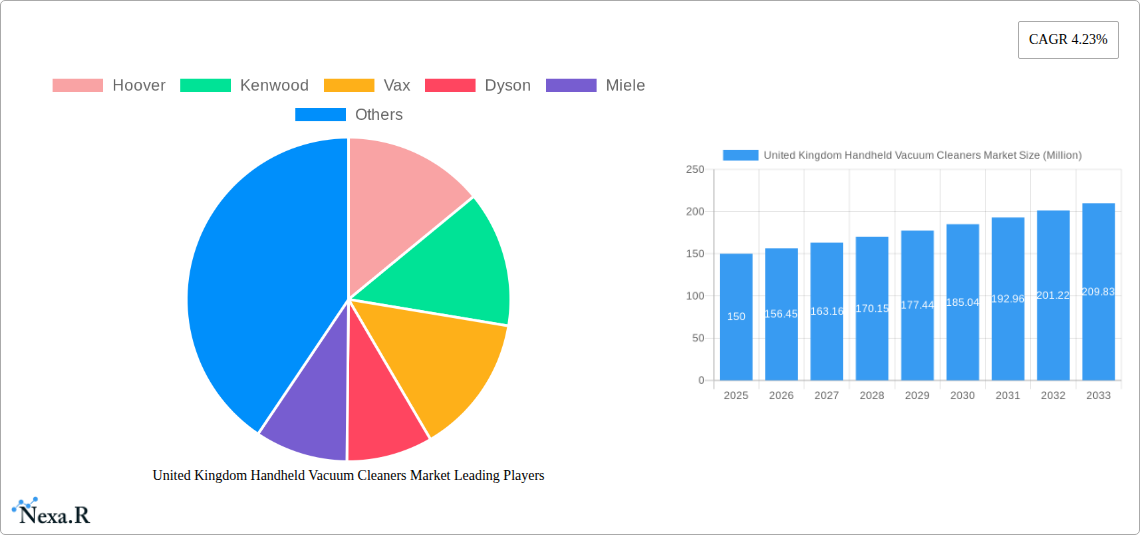

United Kingdom Handheld Vacuum Cleaners Market Company Market Share

United Kingdom Handheld Vacuum Cleaners Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United Kingdom handheld vacuum cleaner market, encompassing market dynamics, growth trends, key players, and future outlook. The study covers the period 2019-2033, with a focus on the 2025-2033 forecast period. The report segments the market by type (corded, cordless), application (household, automotive, commercial), and distribution channel (online, offline), offering granular insights into each segment’s performance and growth potential. Key players analyzed include Hoover, Kenwood, Vax, Dyson, Miele, Electrolux, Bissell, Dirt Devil, Shark, and Siemens. The report is designed for industry professionals, investors, and market researchers seeking a comprehensive understanding of this dynamic market.

United Kingdom Handheld Vacuum Cleaners Market Dynamics & Structure

The UK handheld vacuum cleaner market is characterized by a moderate level of concentration, with a few dominant players and a number of smaller niche players. Market growth is driven by technological innovations such as improved battery life in cordless models and enhanced suction power, coupled with increasing consumer awareness of hygiene and the convenience of handheld devices. The regulatory landscape, while not overly restrictive, impacts the materials used in manufacturing and energy efficiency standards. Competitive substitutes include other cleaning tools like handheld steam cleaners and specialized cleaning wipes. The end-user demographic skews towards households, with a growing segment of commercial users in sectors like hospitality and healthcare.

- Market Concentration: Moderately concentrated, with Dyson and other established brands holding significant market share. The exact market share distribution for 2024 is xx%, with Dyson holding a predicted xx%.

- Technological Innovation: Key drivers include improved battery technology, lightweight designs, and enhanced suction capabilities. Barriers include high R&D costs and maintaining affordability.

- Regulatory Framework: Compliance with energy efficiency standards and material safety regulations plays a significant role.

- Competitive Substitutes: Handheld steam cleaners and specialized cleaning wipes are major substitutes.

- End-User Demographics: Primarily households, with increasing adoption in commercial sectors.

- M&A Trends: The acquisition of Allegion by Stanley Black & Decker in July 2022 signifies potential consolidation within related industries, indirectly influencing the market. The volume of M&A deals in this sector during 2019-2024 was xx.

United Kingdom Handheld Vacuum Cleaners Market Growth Trends & Insights

The UK handheld vacuum cleaner market experienced significant growth during the historical period (2019-2024), driven by a combination of factors including rising disposable incomes, increasing awareness of hygiene, and the launch of innovative products. The cordless segment witnessed particularly strong growth due to its convenience and portability. Market penetration has increased steadily, but saturation remains a future challenge. Technological disruptions, such as the introduction of advanced filtration systems and smart features, continue to shape the market's trajectory. Consumer behaviour shifts are observed towards eco-friendly materials and increased focus on long-term product durability. The market size for 2024 is estimated at xx Million units and is projected to reach xx Million units by 2033, reflecting a CAGR of xx% during the forecast period. Adoption rates are highest amongst younger demographics.

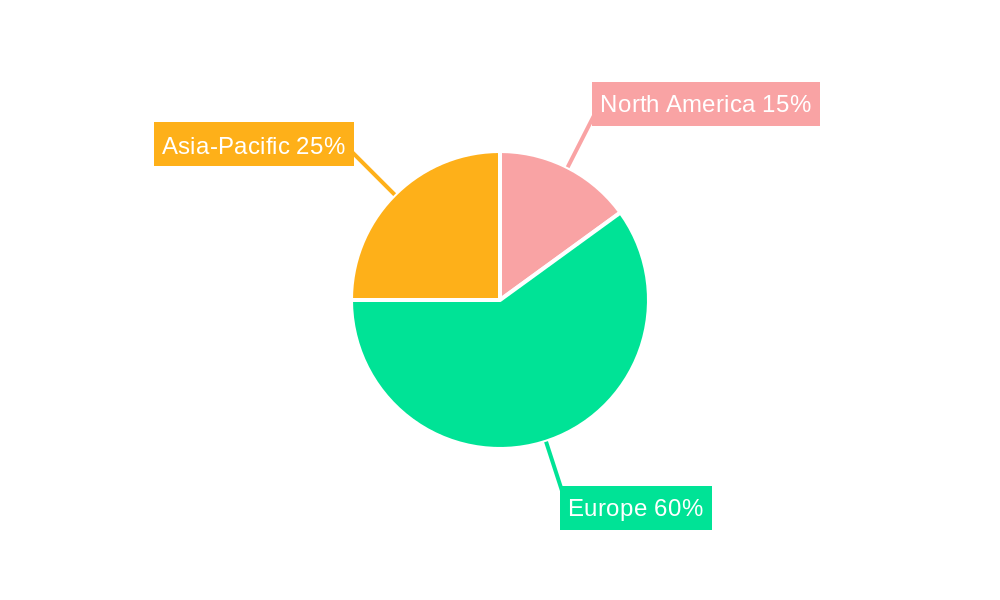

Dominant Regions, Countries, or Segments in United Kingdom Handheld Vacuum Cleaners Market

The household segment dominates the UK handheld vacuum cleaner market, driven by high demand among homeowners. London and other major cities demonstrate higher adoption rates due to smaller living spaces and increased consumer spending. Cordless models are growing at a faster rate compared to corded, owing to increased convenience and technological advancements in battery technology. Online channels are experiencing rapid growth due to their extensive reach and competitive pricing.

- Key Drivers for Household Segment: Increased homeownership rates, enhanced cleaning convenience, and technological advancements in cordless vacuums.

- Key Drivers for Cordless Segment: Improved battery technology, lightweight designs, and increased portability.

- Key Drivers for Online Channels: Wider reach, competitive pricing, and ease of comparison.

- Market Share: Household applications hold the largest market share (xx%), followed by cordless models (xx%) and online channels (xx%). Growth potential lies in commercial applications and continued online penetration.

United Kingdom Handheld Vacuum Cleaners Market Product Landscape

The market offers a wide range of handheld vacuum cleaners, varying in terms of power, features, and price points. Innovation is focused on improving suction power, extending battery life, and incorporating advanced filtration systems to capture allergens and smaller particles. Lightweight designs and ergonomic features enhance user experience. Key features that differentiate products include cyclonic technology, HEPA filters, and integrated tools for various cleaning tasks.

Key Drivers, Barriers & Challenges in United Kingdom Handheld Vacuum Cleaners Market

Key Drivers: Rising disposable incomes, increasing consumer awareness of hygiene, technological advancements, and the increasing popularity of cordless models are all major drivers. Government initiatives promoting energy efficiency also contribute positively.

Key Challenges: Intense competition, increasing raw material costs, and potential supply chain disruptions pose significant challenges. The market is also experiencing price pressure, especially from budget brands. The impact of supply chain disruptions in 2022-2024 led to a xx% increase in prices.

Emerging Opportunities in United Kingdom Handheld Vacuum Cleaners Market

Untapped markets exist within the commercial sector, particularly in industries like hospitality and healthcare. The integration of smart features and app connectivity offers significant potential for innovation. Growth in environmentally conscious consumers also presents opportunities for manufacturers to develop eco-friendly and sustainable models.

Growth Accelerators in the United Kingdom Handheld Vacuum Cleaners Market Industry

Technological breakthroughs in battery technology, motor design, and filtration systems are key growth drivers. Strategic partnerships with retailers and component suppliers can accelerate market penetration. Aggressive marketing strategies highlighting the convenience and efficacy of handheld vacuums will enhance market growth.

Key Players Shaping the United Kingdom Handheld Vacuum Cleaners Market Market

- Hoover

- Kenwood

- Vax

- Dyson

- Miele

- Electrolux

- Bissell

- Dirt Devil

- Shark

- Siemens

Notable Milestones in United Kingdom Handheld Vacuum Cleaners Market Sector

- May 2023: Dyson launched the Dyson Gen5detect vacuum cleaner, featuring a fifth-generation Hyperdymium motor and advanced filtration. This launch significantly impacted the high-end cordless segment.

- July 2022: Stanley Black & Decker's acquisition of Allegion indirectly influenced the market by strengthening a related industry’s supply chain and potentially influencing future product integrations.

In-Depth United Kingdom Handheld Vacuum Cleaners Market Market Outlook

The UK handheld vacuum cleaner market is poised for continued growth, driven by technological advancements, increasing consumer demand, and the expansion into new market segments. Strategic partnerships and innovative product launches will shape the future market landscape. The focus on sustainability and eco-friendly materials presents significant opportunities for companies to differentiate themselves and capture market share. The market is expected to witness a steady increase in adoption of cordless models and online sales channels over the next decade.

United Kingdom Handheld Vacuum Cleaners Market Segmentation

-

1. Type

- 1.1. Corded

- 1.2. Cordless

-

2. ByApplication

- 2.1. Household

- 2.2. Automotive

- 2.3. Commercial

-

3. Distribution Channel

- 3.1. Online

- 3.2. Offline

United Kingdom Handheld Vacuum Cleaners Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Handheld Vacuum Cleaners Market Regional Market Share

Geographic Coverage of United Kingdom Handheld Vacuum Cleaners Market

United Kingdom Handheld Vacuum Cleaners Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Works without any physical efforts

- 3.3. Market Restrains

- 3.3.1. High maintenance cost

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Cordless Vacuum cleaners

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Handheld Vacuum Cleaners Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Corded

- 5.1.2. Cordless

- 5.2. Market Analysis, Insights and Forecast - by ByApplication

- 5.2.1. Household

- 5.2.2. Automotive

- 5.2.3. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hoover

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kenwood

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vax

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dyson

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Miele

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Electrolux

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bissell

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dirt Devil

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shark

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Siemens

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hoover

List of Figures

- Figure 1: United Kingdom Handheld Vacuum Cleaners Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: United Kingdom Handheld Vacuum Cleaners Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Handheld Vacuum Cleaners Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: United Kingdom Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: United Kingdom Handheld Vacuum Cleaners Market Revenue million Forecast, by ByApplication 2020 & 2033

- Table 4: United Kingdom Handheld Vacuum Cleaners Market Volume K Unit Forecast, by ByApplication 2020 & 2033

- Table 5: United Kingdom Handheld Vacuum Cleaners Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 6: United Kingdom Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: United Kingdom Handheld Vacuum Cleaners Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: United Kingdom Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: United Kingdom Handheld Vacuum Cleaners Market Revenue million Forecast, by Type 2020 & 2033

- Table 10: United Kingdom Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: United Kingdom Handheld Vacuum Cleaners Market Revenue million Forecast, by ByApplication 2020 & 2033

- Table 12: United Kingdom Handheld Vacuum Cleaners Market Volume K Unit Forecast, by ByApplication 2020 & 2033

- Table 13: United Kingdom Handheld Vacuum Cleaners Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 14: United Kingdom Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: United Kingdom Handheld Vacuum Cleaners Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: United Kingdom Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Handheld Vacuum Cleaners Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the United Kingdom Handheld Vacuum Cleaners Market?

Key companies in the market include Hoover, Kenwood, Vax, Dyson, Miele, Electrolux, Bissell, Dirt Devil, Shark, Siemens.

3. What are the main segments of the United Kingdom Handheld Vacuum Cleaners Market?

The market segments include Type, ByApplication, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 550.01 million as of 2022.

5. What are some drivers contributing to market growth?

Works without any physical efforts.

6. What are the notable trends driving market growth?

Increasing Demand for Cordless Vacuum cleaners.

7. Are there any restraints impacting market growth?

High maintenance cost.

8. Can you provide examples of recent developments in the market?

May 2023: Dyson introduced the groundbreaking Dyson Gen5detect vacuum cleaner. This cordless marvel boasts the latest fifth-generation Hyperdymium motor, delivering unparalleled suction power. Its cutting-edge technology is capable of capturing even the smallest viruses lurking in your home.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Handheld Vacuum Cleaners Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Handheld Vacuum Cleaners Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Handheld Vacuum Cleaners Market?

To stay informed about further developments, trends, and reports in the United Kingdom Handheld Vacuum Cleaners Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence