Key Insights

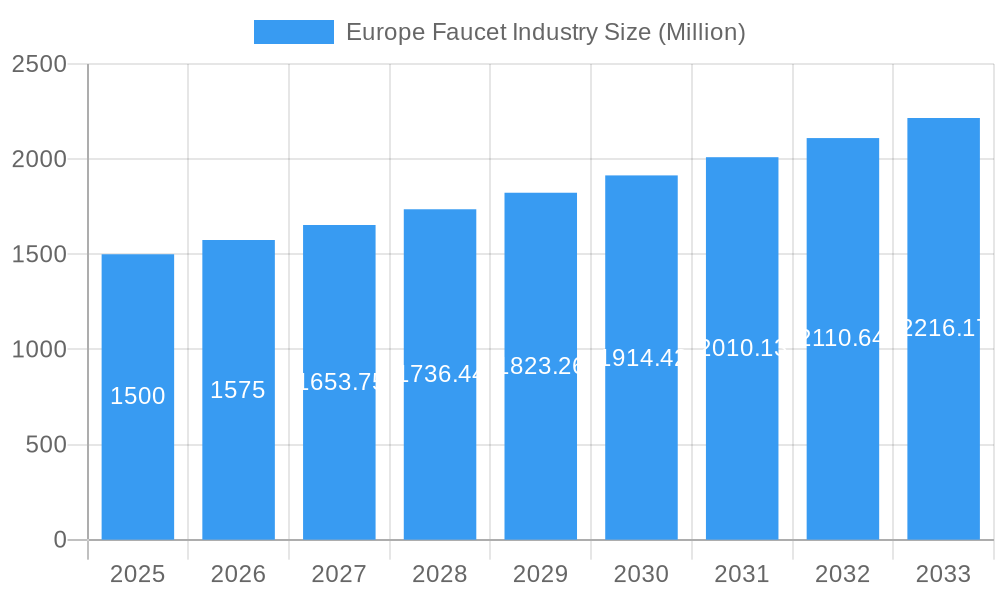

The European faucet market is poised for significant expansion, projected to reach $21.1 billion by 2025, with a compound annual growth rate (CAGR) of 8.3% through 2033. This robust growth is propelled by several key drivers. Increased investment in home renovation and construction across Germany, France, and the UK is stimulating demand for premium faucets. Concurrently, a growing consumer preference for aesthetically advanced and technologically integrated faucets, including smart fixtures, is a significant market influencer. The adoption of sustainable building practices and the rising popularity of water-efficient models further contribute to market buoyancy. Intense competition among leading brands like Grohe, LIXIL, and Kohler fosters innovation and competitive pricing.

Europe Faucet Industry Market Size (In Billion)

Despite a positive outlook, the market encounters challenges. Volatile raw material prices, especially for metals, can affect manufacturing costs. Economic slowdowns in specific European regions may temper consumer spending on non-essential, high-end faucets. Nevertheless, sustained urbanization, increasing disposable incomes in select areas, and the enduring demand for contemporary kitchen and bathroom fixtures indicate a favorable long-term trajectory. The market's segmentation by product type, technology, material, application, and end-use sector offers ample opportunities for specialized companies and innovative product strategies.

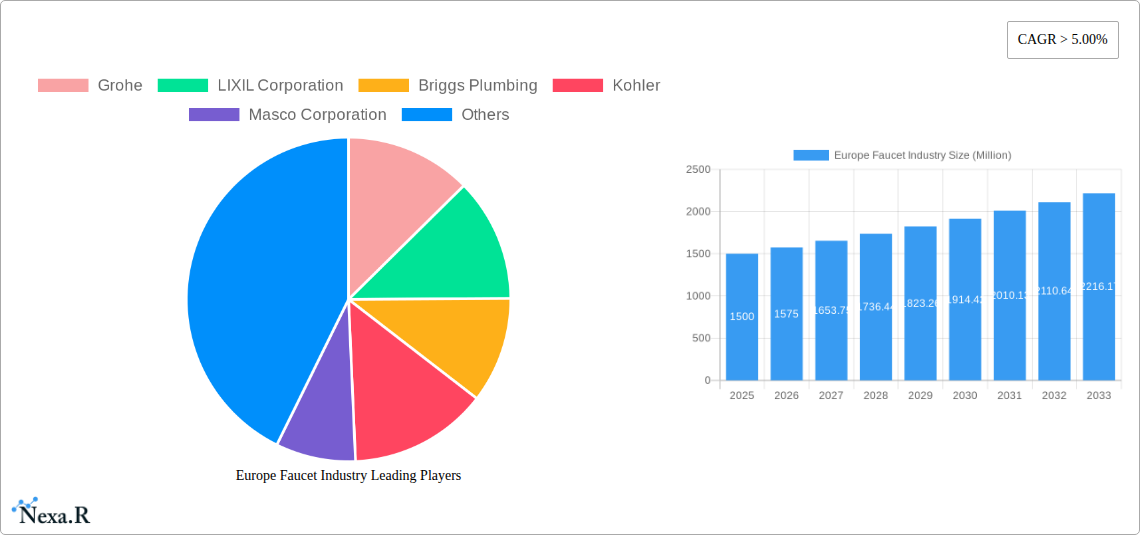

Europe Faucet Industry Company Market Share

Europe Faucet Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe faucet industry, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and forecast period 2025-2033. Market values are presented in million units.

Europe Faucet Industry Market Dynamics & Structure

The European faucet market is a dynamic landscape shaped by a confluence of factors. Market concentration is moderate, with several key players holding significant shares, while numerous smaller companies cater to niche segments. Technological innovation, particularly in water-saving and smart technology, is a primary driver, influencing product design and consumer preference. Stringent regulatory frameworks focusing on water conservation and sustainability exert pressure on manufacturers to adopt eco-friendly practices. Competitive substitutes, such as sensor-activated taps and alternative water dispensing systems, exert pressure on traditional faucet sales. The end-user demographics, specifically the increasing demand from both the residential and commercial construction sectors, are crucial factors shaping market growth. Furthermore, M&A activity within the industry influences market consolidation and technological advancement.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Strong focus on water-saving technologies (e.g., ECO CAP, SELFPOWER), smart faucets, and improved durability.

- Regulatory Framework: Stringent regulations on water efficiency driving adoption of low-flow faucets.

- Competitive Substitutes: Rise of sensor faucets and water-saving alternatives poses a challenge to traditional products.

- End-User Demographics: Growing residential and commercial construction activity boosts market demand.

- M&A Trends: xx M&A deals recorded in the last five years, indicating industry consolidation.

Europe Faucet Industry Growth Trends & Insights

The European faucet market experienced a growth trajectory over the historical period (2019-2024), with fluctuations influenced by economic conditions and construction activity. Adoption rates for advanced features like automatic faucets are steadily increasing, driven by consumer demand for convenience and water efficiency. Technological disruptions, such as the introduction of smart faucets with connectivity features, are reshaping the market landscape. Consumer behavior is shifting towards environmentally conscious purchasing decisions, favoring water-saving and sustainable products. The market is expected to register a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx million units by 2033. Market penetration of smart faucets is projected to increase from xx% in 2024 to xx% by 2033.

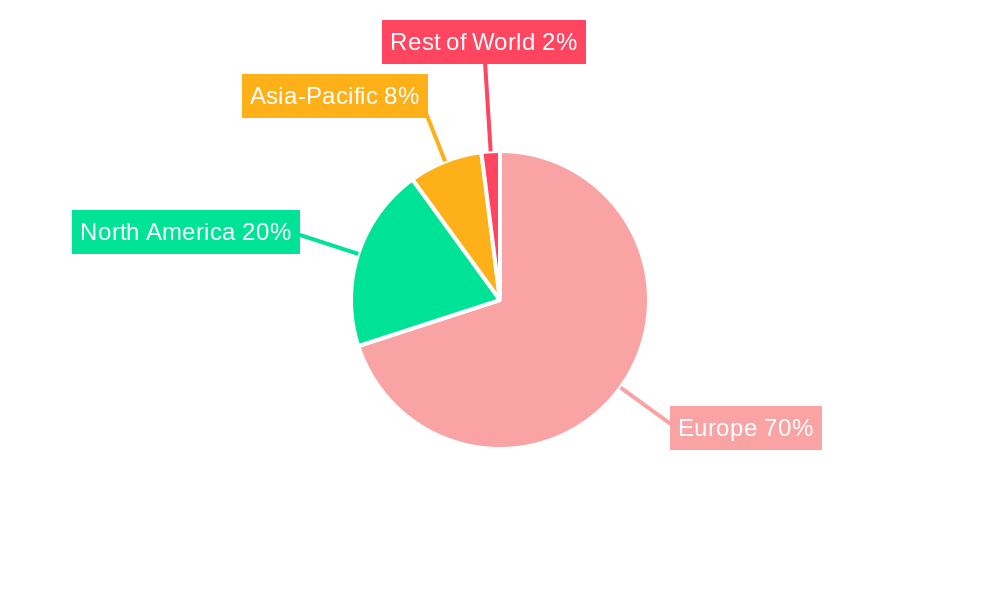

Dominant Regions, Countries, or Segments in Europe Faucet Industry

Western Europe, specifically countries like Germany, France, and the UK, dominate the European faucet market due to high construction activity, robust economies, and high consumer spending. The Bathroom application segment holds the largest market share, followed by Kitchen applications. Within product types, the Disc and Cartridge faucet segments are the most prevalent. The manual technology segment is more prominent in residential use while automatic is slowly taking over commercial and industrial applications. Stainless steel and Chrome are most commonly used materials.

- Key Drivers: Strong construction sector, high disposable incomes, preference for modern designs, and government support for water-efficient technologies.

- Dominance Factors: High market share of Western European countries driven by strong economies, established infrastructure, and consumer preferences.

- Growth Potential: Eastern European markets present substantial growth opportunities, albeit with varying levels of economic development.

Europe Faucet Industry Product Landscape

The European faucet market offers a wide array of products catering to diverse needs and preferences. Product innovations focus on improving water efficiency, enhancing durability, integrating smart technology, and offering diverse design aesthetics. Key performance metrics include flow rate, water pressure, durability, and ease of installation. Unique selling propositions often revolve around water-saving features, innovative designs, and smart functionalities.

Key Drivers, Barriers & Challenges in Europe Faucet Industry

Key Drivers:

- Increasing demand from construction and renovation projects.

- Growing consumer awareness of water conservation.

- Technological advancements in smart and water-efficient faucets.

- Favorable government regulations and incentives for water-saving products.

Key Barriers & Challenges:

- Fluctuations in raw material prices and supply chain disruptions.

- Intense competition among established players and new entrants.

- Stringent regulatory requirements related to water efficiency and safety.

- Economic downturns impacting construction activity and consumer spending. This resulted in a xx% decline in sales during [period of downturn].

Emerging Opportunities in Europe Faucet Industry

- Growing demand for smart home technology and integration with other smart devices.

- Increasing adoption of sensor-activated and touchless faucets in commercial and public spaces.

- Focus on sustainable and eco-friendly materials and manufacturing processes.

- Expansion into niche markets such as high-end luxury faucets and specialized industrial applications.

Growth Accelerators in the Europe Faucet Industry

The long-term growth of the European faucet market will be accelerated by continuous technological advancements, strategic partnerships between manufacturers and technology providers, and aggressive expansion into emerging markets. Innovation in smart home technology will play a key role, driving demand for connected faucets. Strategic collaborations will allow manufacturers to capitalize on technological advancements and expand their product portfolios. Market expansion into Eastern Europe and other developing regions will unlock new growth prospects.

Key Players Shaping the Europe Faucet Industry Market

- Grohe

- LIXIL Corporation

- Briggs Plumbing

- Kohler

- Masco Corporation

- Lota Corporation

- Elkay

- Roka

- Toto

- Fortune Brands

Notable Milestones in Europe Faucet Industry Sector

- March 2022: TOTO launches new automatic faucet sets with ECO CAP and SELFPOWER technologies, winning Red Dot and Green Design Awards.

- May 2020: TOTO introduces WASHLET models with optional automated flush, enhancing bathroom convenience and hygiene.

In-Depth Europe Faucet Industry Market Outlook

The future of the European faucet market looks promising, driven by sustained growth in construction, increasing consumer preference for advanced features, and technological advancements. Strategic opportunities exist in developing water-saving and smart technologies, expanding into emerging markets, and fostering partnerships to leverage technological expertise. The market is poised for significant growth, presenting lucrative prospects for both established players and new entrants.

Europe Faucet Industry Segmentation

-

1. product type

- 1.1. Ball

- 1.2. Disc

- 1.3. Cartridge

- 1.4. Compression

-

2. technology

- 2.1. Manual

- 2.2. Automatic

-

3. Material used

- 3.1. Stainless steel

- 3.2. Chrome

- 3.3. Bronze Plastic

- 3.4. Others

-

4. application

- 4.1. Bathroom

- 4.2. Kitchen

- 4.3. Others

-

5. end use

- 5.1. Residential

- 5.2. Commercial

- 5.3. Industrial

Europe Faucet Industry Segmentation By Geography

-

1. Europe

- 1.1. UK

- 1.2. Italy

- 1.3. France

- 1.4. Germany

- 1.5. Rest of Europe

Europe Faucet Industry Regional Market Share

Geographic Coverage of Europe Faucet Industry

Europe Faucet Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Convenient Kitchen Appliances

- 3.3. Market Restrains

- 3.3.1. Preference for Traditional Manual Methods of Food Preparation

- 3.4. Market Trends

- 3.4.1. Rising New Construction of Residential Apartment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Faucet Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by product type

- 5.1.1. Ball

- 5.1.2. Disc

- 5.1.3. Cartridge

- 5.1.4. Compression

- 5.2. Market Analysis, Insights and Forecast - by technology

- 5.2.1. Manual

- 5.2.2. Automatic

- 5.3. Market Analysis, Insights and Forecast - by Material used

- 5.3.1. Stainless steel

- 5.3.2. Chrome

- 5.3.3. Bronze Plastic

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by application

- 5.4.1. Bathroom

- 5.4.2. Kitchen

- 5.4.3. Others

- 5.5. Market Analysis, Insights and Forecast - by end use

- 5.5.1. Residential

- 5.5.2. Commercial

- 5.5.3. Industrial

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by product type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Grohe

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LIXIL Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Briggs Plumbing

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kohler

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Masco Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lota Corporation**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Elkay

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Roka

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Toto

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fortune Brands

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Grohe

List of Figures

- Figure 1: Europe Faucet Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Faucet Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Faucet Industry Revenue billion Forecast, by product type 2020 & 2033

- Table 2: Europe Faucet Industry Revenue billion Forecast, by technology 2020 & 2033

- Table 3: Europe Faucet Industry Revenue billion Forecast, by Material used 2020 & 2033

- Table 4: Europe Faucet Industry Revenue billion Forecast, by application 2020 & 2033

- Table 5: Europe Faucet Industry Revenue billion Forecast, by end use 2020 & 2033

- Table 6: Europe Faucet Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Europe Faucet Industry Revenue billion Forecast, by product type 2020 & 2033

- Table 8: Europe Faucet Industry Revenue billion Forecast, by technology 2020 & 2033

- Table 9: Europe Faucet Industry Revenue billion Forecast, by Material used 2020 & 2033

- Table 10: Europe Faucet Industry Revenue billion Forecast, by application 2020 & 2033

- Table 11: Europe Faucet Industry Revenue billion Forecast, by end use 2020 & 2033

- Table 12: Europe Faucet Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: UK Europe Faucet Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Faucet Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Europe Faucet Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Faucet Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Europe Faucet Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Faucet Industry?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Europe Faucet Industry?

Key companies in the market include Grohe, LIXIL Corporation, Briggs Plumbing, Kohler, Masco Corporation, Lota Corporation**List Not Exhaustive, Elkay, Roka, Toto, Fortune Brands.

3. What are the main segments of the Europe Faucet Industry?

The market segments include product type, technology, Material used, application, end use.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Convenient Kitchen Appliances.

6. What are the notable trends driving market growth?

Rising New Construction of Residential Apartment.

7. Are there any restraints impacting market growth?

Preference for Traditional Manual Methods of Food Preparation.

8. Can you provide examples of recent developments in the market?

In March 2022, TOTO introduces two new automatic faucet sets that include the water-saving ECO CAP and SELFPOWER technologies. These series, which are ideal for hotel bathrooms and public restrooms, have each won the international Red Dot Award and Green Design Award for their exceptional designs. There is a great faucet for every washbasin, from self-rim and undercounter washbasins to furniture washbasins and vessels, and they are all available in a variety of various forms.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Faucet Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Faucet Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Faucet Industry?

To stay informed about further developments, trends, and reports in the Europe Faucet Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence