Key Insights

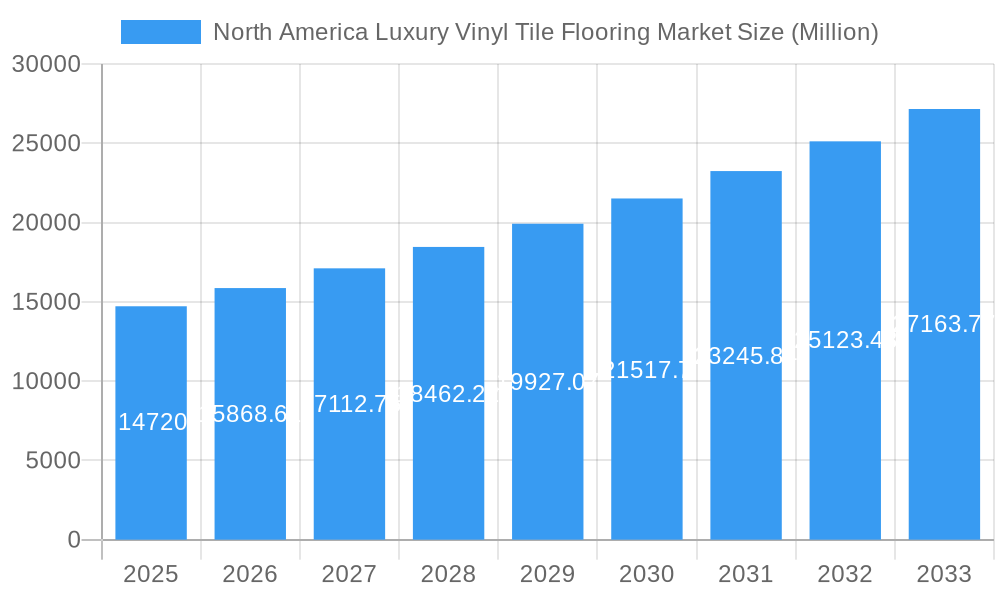

The North American luxury vinyl tile (LVT) flooring market is experiencing robust growth, projected to reach a market size of $14.72 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 7.89% from 2025 to 2033. This expansion is driven by several key factors. Increasing consumer preference for durable, water-resistant, and stylish flooring solutions is a primary driver. LVT offers a compelling alternative to traditional materials like hardwood and ceramic tile, appealing to both residential and commercial sectors. The rising popularity of luxury vinyl plank (LVP), a close cousin often grouped within the LVT category, further fuels this growth. Moreover, advancements in manufacturing technology have led to more realistic wood and stone imitations, enhancing the aesthetic appeal and expanding the market's reach. The segment is segmented by product type (rigid and flexible), end-user (residential and commercial), distribution channel (home centers, flagship stores, specialty stores, online stores, and others), and geographic location (United States, Canada, and the rest of North America). The strong performance of the US market, being the largest within North America, is expected to significantly influence the overall regional growth trajectory.

North America Luxury Vinyl Tile Flooring Market Market Size (In Billion)

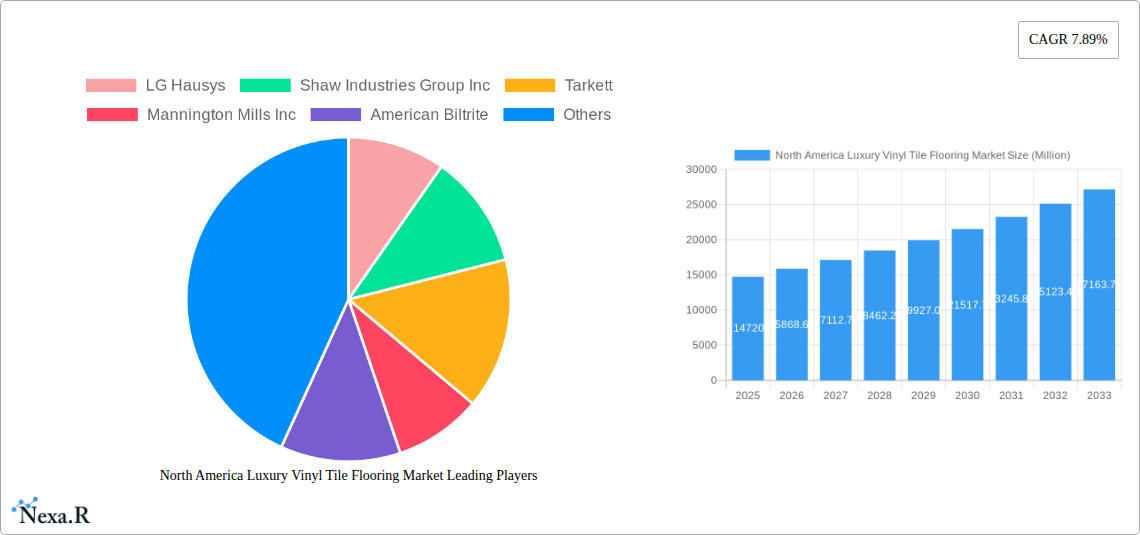

The competitive landscape is marked by established players like LG Hausys, Shaw Industries Group Inc., Tarkett, Mannington Mills Inc., and Mohawk Industries, alongside smaller, specialized brands. These companies are actively engaged in product innovation, focusing on improved durability, design variations, and eco-friendly manufacturing processes to cater to the evolving consumer demands. The increasing availability of LVT through various distribution channels, including online retailers, is fostering market accessibility and expanding its consumer base. However, potential restraints include fluctuations in raw material prices and increased competition from other flooring materials. Despite these challenges, the long-term outlook for the North American LVT flooring market remains positive, underpinned by strong demand and ongoing industry innovation. The market's continued growth is likely to be further fueled by new product developments and expansions into adjacent segments.

North America Luxury Vinyl Tile Flooring Market Company Market Share

North America Luxury Vinyl Tile (LVT) Flooring Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Luxury Vinyl Tile (LVT) flooring market, encompassing the historical period (2019-2024), base year (2025), and forecast period (2025-2033). It segments the market by product type (rigid, flexible), end-user (residential, commercial), distribution channel (home centers, flagship stores, specialty stores, online stores, other), and country (United States, Canada, Rest of North America). The report offers invaluable insights for manufacturers, distributors, investors, and industry professionals seeking to navigate this dynamic market. The market size is projected to reach xx Million units by 2033.

North America Luxury Vinyl Tile Flooring Market Dynamics & Structure

The North American LVT flooring market is characterized by moderate concentration, with key players like LG Hausys, Shaw Industries Group Inc, Tarkett, and Mohawk Industries holding significant market share. Technological innovation, particularly in design and material science, is a crucial driver, alongside evolving consumer preferences for durable, stylish, and water-resistant flooring. Regulatory frameworks concerning VOC emissions and sustainability are also influential. The market faces competition from alternative flooring materials like hardwood and ceramic tile. Recent M&A activity, such as Galleher's acquisition in December 2023, signifies consolidation and a push towards premium segments.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on realistic wood and stone visuals, enhanced durability, and eco-friendly materials.

- Regulatory Landscape: Increasing emphasis on sustainability and reduced VOC emissions.

- Competitive Substitutes: Hardwood, ceramic tile, laminate flooring.

- M&A Activity: xx deals recorded between 2019-2024, indicating a trend towards consolidation. (Example: Galleher acquisition).

- End-User Demographics: Growing demand from both residential and commercial sectors, particularly in renovations and new construction.

North America Luxury Vinyl Tile Flooring Market Growth Trends & Insights

The North American LVT market experienced robust growth between 2019 and 2024, driven by factors including rising disposable incomes, increasing preference for low-maintenance flooring, and the growing popularity of luxury vinyl planks. The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033), reaching xx Million units by 2033. Technological advancements, such as the introduction of thicker, more durable rigid core LVT, have fueled adoption rates. Consumer behavior shifts towards online purchasing and a preference for personalized flooring solutions are also impacting growth. The rise of eco-friendly LVT options contributes positively.

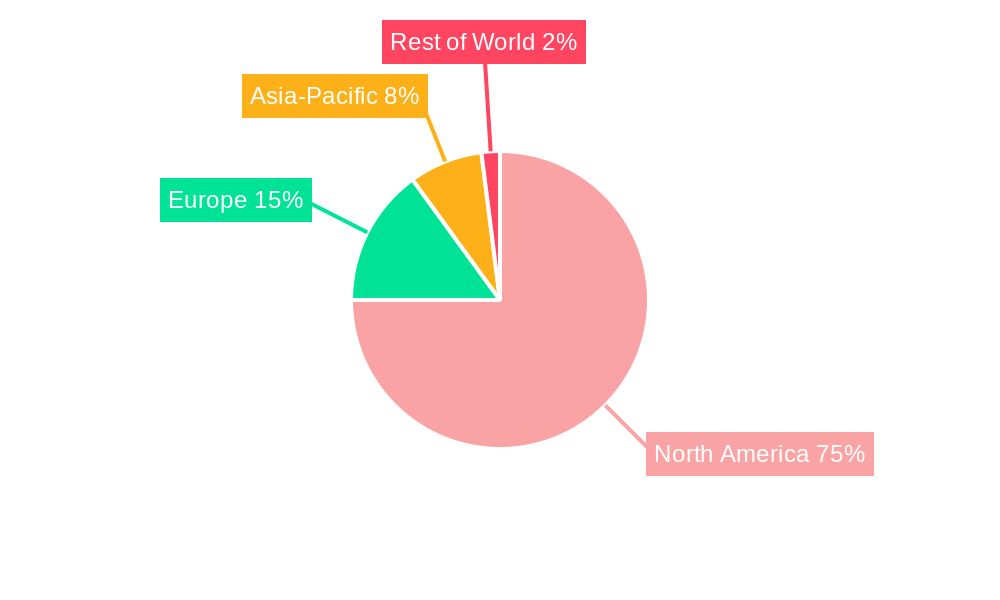

Dominant Regions, Countries, or Segments in North America Luxury Vinyl Tile Flooring Market

The United States dominates the North American LVT market, accounting for approximately xx% of the total market share in 2025. This dominance stems from a large housing market, high disposable incomes, and robust construction activity. The residential segment holds the largest share by end-user, fueled by homeowners' preference for LVT's durability and affordability. Within product types, rigid core LVT exhibits faster growth due to superior performance and water resistance. Home centers represent the leading distribution channel due to their widespread reach and accessibility.

- Key Drivers (United States): Strong housing market, high disposable incomes, robust construction activity.

- Key Drivers (Residential Segment): Durability, affordability, ease of maintenance, water resistance.

- Key Drivers (Rigid Core LVT): Superior performance characteristics.

- Key Drivers (Home Centers): Wide reach and accessibility.

North America Luxury Vinyl Tile Flooring Market Product Landscape

The LVT market showcases continuous product innovation, focusing on enhanced realism, durability, and water resistance. Rigid core LVT, with its superior stability and waterproof properties, is leading growth. Manufacturers are increasingly incorporating new designs, patterns, and textures to mimic natural materials like wood and stone. The focus on large format planks and tiles further enhances the aesthetic appeal and simplifies installation. Key features driving sales include advanced click-lock systems for easy installation, and enhanced scratch and dent resistance.

Key Drivers, Barriers & Challenges in North America Luxury Vinyl Tile Flooring Market

Key Drivers: Rising disposable incomes, increased home renovations, and growing preference for low-maintenance and water-resistant flooring solutions. Technological advancements such as rigid core LVT and improved designs are also significant drivers.

Key Challenges: Competition from other flooring types, fluctuating raw material prices, and potential supply chain disruptions. Sustainability concerns and regulatory compliance requirements also pose challenges for some manufacturers. The market experienced a xx% increase in raw material costs between 2021 and 2023.

Emerging Opportunities in North America Luxury Vinyl Tile Flooring Market

Emerging opportunities lie in expanding into untapped markets within the commercial sector, such as healthcare and education. The development of more sustainable and eco-friendly LVT products presents significant growth potential. Furthermore, exploring innovative application methods like self-adhesive LVT and incorporating smart technology into flooring offer promising avenues for expansion.

Growth Accelerators in the North America Luxury Vinyl Tile Flooring Market Industry

Strategic partnerships between manufacturers and distributors, coupled with technological breakthroughs in product design and manufacturing processes, are major growth accelerators. Market expansion strategies focusing on emerging markets and untapped segments, alongside increased marketing and brand building efforts, will further propel market growth. The development of more sustainable production processes will also attract environmentally conscious consumers.

Key Players Shaping the North America Luxury Vinyl Tile Flooring Market Market

- LG Hausys

- Shaw Industries Group Inc

- Tarkett

- Mannington Mills Inc

- American Biltrite

- Armstrong Flooring

- Gerflor

- Mohawk Industries

- Adore Floors Inc

- Interface

Notable Milestones in North America Luxury Vinyl Tile Flooring Market Sector

- December 2023: Galleher's acquisition by Transom Capital expands its reach into the premium flooring market.

- September 2023: AHF Products and Spartan Surfaces distribution agreement for Parterre flooring broadens market reach.

In-Depth North America Luxury Vinyl Tile Flooring Market Market Outlook

The North American LVT market is poised for continued growth, driven by persistent demand for durable, stylish, and water-resistant flooring. Strategic investments in research and development, coupled with expanding distribution networks and targeted marketing campaigns, will play a critical role in shaping future market dynamics. The focus on sustainability and eco-friendly products will also drive growth in the long term. Opportunities exist in expanding commercial applications and developing innovative products to cater to evolving consumer preferences.

North America Luxury Vinyl Tile Flooring Market Segmentation

-

1. Product Type

- 1.1. Rigid

- 1.2. Flexible

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Home Centers

- 3.2. Flagship Stores

- 3.3. Specialty Stores

- 3.4. Online Stores

- 3.5. Other Distribution Channels

North America Luxury Vinyl Tile Flooring Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Luxury Vinyl Tile Flooring Market Regional Market Share

Geographic Coverage of North America Luxury Vinyl Tile Flooring Market

North America Luxury Vinyl Tile Flooring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Real Estate Market is Driving the Market; Increasing Construction Industry is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Competition from Other Flooring Options; Rise in Raw Material Costs

- 3.4. Market Trends

- 3.4.1. The Residential Segment Leads the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Luxury Vinyl Tile Flooring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Rigid

- 5.1.2. Flexible

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Home Centers

- 5.3.2. Flagship Stores

- 5.3.3. Specialty Stores

- 5.3.4. Online Stores

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LG Hausys

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shaw Industries Group Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tarkett

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mannington Mills Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 American Biltrite

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Armstrong Flooring

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gerflor

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mohawk Industries

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Adore Floors Inc **List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Interface

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 LG Hausys

List of Figures

- Figure 1: North America Luxury Vinyl Tile Flooring Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Luxury Vinyl Tile Flooring Market Share (%) by Company 2025

List of Tables

- Table 1: North America Luxury Vinyl Tile Flooring Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: North America Luxury Vinyl Tile Flooring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: North America Luxury Vinyl Tile Flooring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Luxury Vinyl Tile Flooring Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Luxury Vinyl Tile Flooring Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: North America Luxury Vinyl Tile Flooring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 7: North America Luxury Vinyl Tile Flooring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: North America Luxury Vinyl Tile Flooring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Luxury Vinyl Tile Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Luxury Vinyl Tile Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Luxury Vinyl Tile Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Luxury Vinyl Tile Flooring Market?

The projected CAGR is approximately 7.89%.

2. Which companies are prominent players in the North America Luxury Vinyl Tile Flooring Market?

Key companies in the market include LG Hausys, Shaw Industries Group Inc, Tarkett, Mannington Mills Inc, American Biltrite, Armstrong Flooring, Gerflor, Mohawk Industries, Adore Floors Inc **List Not Exhaustive, Interface.

3. What are the main segments of the North America Luxury Vinyl Tile Flooring Market?

The market segments include Product Type, End User , Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Real Estate Market is Driving the Market; Increasing Construction Industry is Driving the Market.

6. What are the notable trends driving market growth?

The Residential Segment Leads the Market.

7. Are there any restraints impacting market growth?

Competition from Other Flooring Options; Rise in Raw Material Costs.

8. Can you provide examples of recent developments in the market?

In December 2023, Galleher, the third-biggest flooring distributor and the largest in the western United States was acquired by operations-focused middle market private equity company transom capital, allowing it to enter the premium flooring industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Luxury Vinyl Tile Flooring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Luxury Vinyl Tile Flooring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Luxury Vinyl Tile Flooring Market?

To stay informed about further developments, trends, and reports in the North America Luxury Vinyl Tile Flooring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence