Key Insights

The India home appliances market is projected to reach $64.29 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 7.33% from 2025 to 2033. This growth is propelled by increasing disposable incomes, rapid urbanization leading to smaller households, and a rising demand for technologically advanced appliances. The expansion of online sales channels is a significant growth catalyst, despite challenges such as inconsistent power supply and consumer price sensitivity.

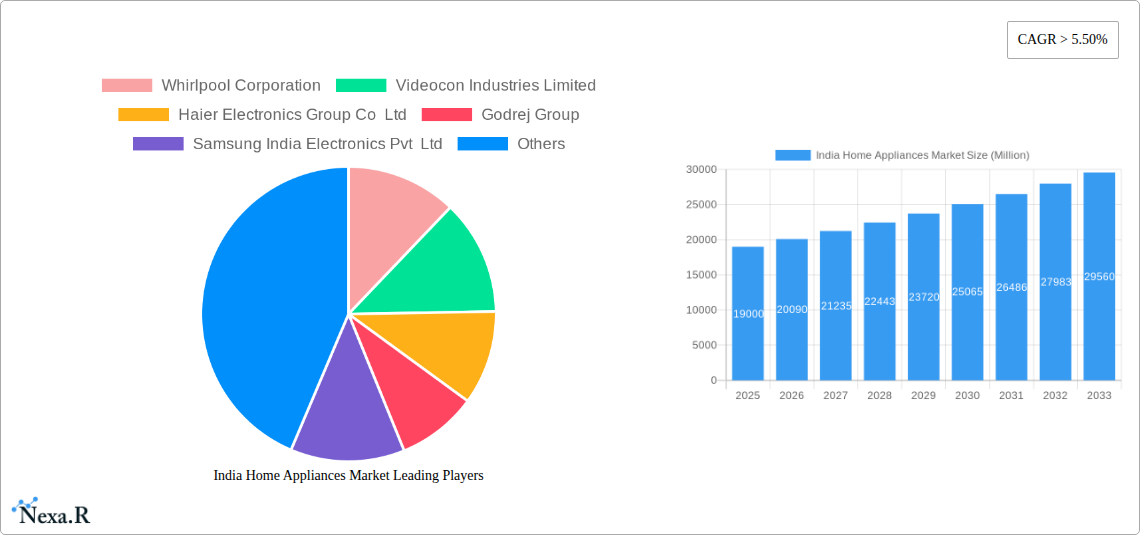

India Home Appliances Market Market Size (In Billion)

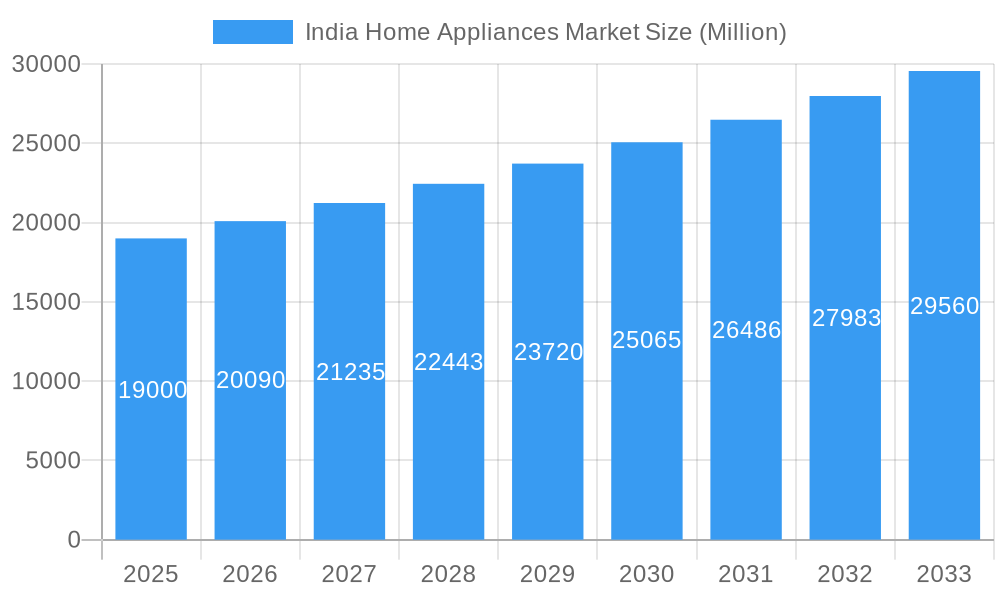

The market is segmented by product type, with cookers and ovens, particularly compact models for smaller homes, holding a dominant position. Distribution channels are evolving, with online platforms experiencing substantial growth alongside traditional multi-brand and exclusive retail outlets. Leading players, including Whirlpool, Samsung, LG, and Godrej, are engaged in fierce competition, driven by continuous innovation to cater to evolving consumer preferences. Growth opportunities are particularly strong in urbanized and economically developing regions. The forecast indicates significant market expansion across all segments by 2033, supported by sustained economic development and changing consumer lifestyles. Key strategies for success in this dynamic market will involve focusing on affordability, energy efficiency, and smart appliance features.

India Home Appliances Market Company Market Share

India Home Appliances Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the India home appliances market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033. It examines market dynamics, growth trends, key players, and emerging opportunities within the parent market (Home Appliances) and its child markets (Major Appliances, Small Appliances, Cookers and Ovens). The market size is presented in Million units.

India Home Appliances Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends shaping the Indian home appliances sector. The market is characterized by a mix of global and domestic players, exhibiting varying degrees of market concentration.

- Market Concentration: The market exhibits moderate concentration, with a few dominant players holding significant market share. The top 5 players account for approximately xx% of the market.

- Technological Innovation: Technological advancements, such as smart home integration, energy efficiency features, and improved durability, are driving market growth. However, barriers to innovation include high R&D costs and limited access to advanced technologies.

- Regulatory Framework: Government regulations concerning energy efficiency standards and product safety significantly influence the market.

- Competitive Product Substitutes: The market faces competition from substitute products, such as traditional methods of cooking and cleaning, particularly in rural areas.

- End-User Demographics: The growing middle class and increasing urbanization are key drivers, fuelling demand for modern appliances.

- M&A Trends: The Indian home appliance market witnessed xx M&A deals in the historical period (2019-2024), with xx% focused on expansion and market consolidation.

India Home Appliances Market Growth Trends & Insights

The India home appliances market experienced significant growth during the historical period (2019-2024). Driven by rising disposable incomes, increasing urbanization, and changing consumer lifestyles, the market is projected to maintain a robust growth trajectory during the forecast period (2025-2033). The market size, in million units, is estimated at xx million units in 2025, with a projected Compound Annual Growth Rate (CAGR) of xx% during 2025-2033. This growth is fueled by several factors, including rising disposable incomes, improved infrastructure, and increased consumer awareness of the benefits of modern home appliances. Technological disruptions, such as the introduction of smart appliances, are accelerating adoption rates. Consumer behavior is shifting towards premium appliances with enhanced features and energy-efficient models. Market penetration rates are expected to increase significantly, especially in rural markets as access to electricity and affordability improve.

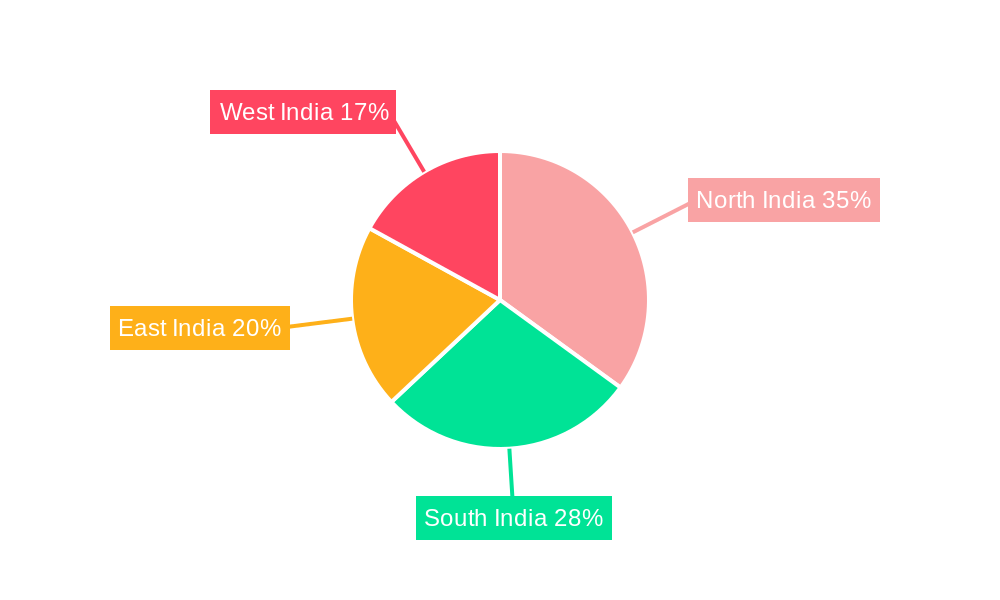

Dominant Regions, Countries, or Segments in India Home Appliances Market

The report identifies key regions and segments driving market growth. While detailed regional breakdowns require the full report, the urban areas of major states like Maharashtra, Tamil Nadu, and Karnataka, and Delhi consistently demonstrate high demand for home appliances.

- By Product: Major appliances (refrigerators, washing machines, etc.) hold a larger market share compared to small appliances (mixers, toasters, etc.) due to higher purchasing power. The segment is expected to grow at a CAGR of xx% during the forecast period.

- By Distribution Channel: Multi-branded stores currently dominate distribution, but online channels are growing rapidly due to increasing internet penetration and e-commerce adoption, with a projected growth of xx% annually. Exclusive brand stores maintain a niche for premium brands.

- By Segment (Cookers and Ovens): Within the small appliance segment, cookers and ovens are gaining popularity driven by evolving food preparation habits.

India Home Appliances Market Product Landscape

The market features a wide range of products, with continuous innovation in terms of features, technology, and design. Key innovations include smart appliances with Wi-Fi connectivity, energy-efficient models conforming to government standards, and appliances designed with user-friendly interfaces and enhanced durability. Unique selling propositions often focus on ease of use, energy savings, smart features, and improved aesthetics to meet evolving consumer preferences.

Key Drivers, Barriers & Challenges in India Home Appliances Market

Key Drivers:

- Rising disposable incomes and increasing urbanization

- Government initiatives promoting rural electrification and infrastructure development

- Technological advancements in energy efficiency and smart home integration

Key Challenges:

- Fluctuating raw material prices and supply chain disruptions impacting production costs. (Quantifiable impact: xx% increase in production costs in 2023)

- Intense competition among both domestic and international players

- Stringent regulatory requirements and compliance costs

Emerging Opportunities in India Home Appliances Market

- Growing demand for premium and smart appliances across tier-1 and tier-2 cities.

- Untapped potential in rural markets with rising disposable incomes and improved infrastructure.

- Opportunities for innovative product development catering to unique Indian consumer needs.

Growth Accelerators in the India Home Appliances Market Industry

Strategic partnerships between domestic and international players are key growth drivers. Technological breakthroughs, particularly in AI-powered appliances and connected home ecosystems, will significantly propel market expansion. Aggressive marketing strategies focused on consumer education and brand building are crucial, particularly in less penetrated markets.

Key Players Shaping the India Home Appliances Market Market

- Whirlpool Corporation

- Videocon Industries Limited

- Haier Electronics Group Co Ltd

- Godrej Group

- Samsung India Electronics Pvt Ltd

- iRobot

- Midea Group

- Koninklijke Philips

- Blue Star Ltd

- Electrolux AB

- IFB Home Appliances

- Voltas Ltd

- LG Electronics

- Hoover Candy Group

- Hitachi

- Panasonic

Notable Milestones in India Home Appliances Market Sector

- January 2023: Samsung launched its premium Side-by-Side Refrigerator range, manufactured in India.

- March 2023: Haier launched its new line-up of anti-scaling top load washing machines.

- May 2023: Samsung launched its 2023 range of semi-automatic washing machines with new features.

In-Depth India Home Appliances Market Market Outlook

The Indian home appliances market presents substantial long-term growth potential. Continuous technological advancements, rising consumer demand, and strategic investments by key players will drive market expansion. Strategic partnerships, focusing on localized product development and distribution networks, will be crucial for companies aiming to capture market share. The market's future growth is strongly linked to economic development, infrastructure improvements, and increasing access to electricity, particularly in rural areas.

India Home Appliances Market Segmentation

-

1. Product

-

1.1. By Major Appliances

- 1.1.1. Refrigerators

- 1.1.2. Freezers

- 1.1.3. Dishwashing Machines

- 1.1.4. Washing Machines

- 1.1.5. Cookers and Ovens

-

1.2. By Small Appliances

- 1.2.1. Vacuum Cleaners

- 1.2.2. Small Ki

- 1.2.3. Hair Clippers

- 1.2.4. Irons

- 1.2.5. Toasters

- 1.2.6. Grills and Roasters

- 1.2.7. Hair Dryers

- 1.2.8. Water Purifiers

-

1.1. By Major Appliances

-

2. Distribution Channel

- 2.1. Multi-Branded Stores

- 2.2. Exclusive Stores

- 2.3. Online

- 2.4. Other Distribution Channels

India Home Appliances Market Segmentation By Geography

- 1. India

India Home Appliances Market Regional Market Share

Geographic Coverage of India Home Appliances Market

India Home Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Disposable Income and Urbanization; E-commerce and Digital Transformation

- 3.3. Market Restrains

- 3.3.1. Increased household appliance costs are impeding market expansion.

- 3.4. Market Trends

- 3.4.1. The Refrigerators Segment Accounts for a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Home Appliances Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. By Major Appliances

- 5.1.1.1. Refrigerators

- 5.1.1.2. Freezers

- 5.1.1.3. Dishwashing Machines

- 5.1.1.4. Washing Machines

- 5.1.1.5. Cookers and Ovens

- 5.1.2. By Small Appliances

- 5.1.2.1. Vacuum Cleaners

- 5.1.2.2. Small Ki

- 5.1.2.3. Hair Clippers

- 5.1.2.4. Irons

- 5.1.2.5. Toasters

- 5.1.2.6. Grills and Roasters

- 5.1.2.7. Hair Dryers

- 5.1.2.8. Water Purifiers

- 5.1.1. By Major Appliances

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Multi-Branded Stores

- 5.2.2. Exclusive Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Whirlpool Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Videocon Industries Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Haier Electronics Group Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Godrej Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Samsung India Electronics Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IRobot

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Midea Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Koninklijke Philips

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Blue Star Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Electrolux AB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 IFB Home Appliances

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Voltas Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 LG Electronics

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Hoover Candy Group

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Hitachi

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Panasonic

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Whirlpool Corporation

List of Figures

- Figure 1: India Home Appliances Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Home Appliances Market Share (%) by Company 2025

List of Tables

- Table 1: India Home Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: India Home Appliances Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: India Home Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: India Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 5: India Home Appliances Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: India Home Appliances Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: India Home Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 8: India Home Appliances Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 9: India Home Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: India Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 11: India Home Appliances Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: India Home Appliances Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Home Appliances Market?

The projected CAGR is approximately 7.33%.

2. Which companies are prominent players in the India Home Appliances Market?

Key companies in the market include Whirlpool Corporation, Videocon Industries Limited, Haier Electronics Group Co Ltd, Godrej Group, Samsung India Electronics Pvt Ltd, IRobot, Midea Group, Koninklijke Philips, Blue Star Ltd, Electrolux AB, IFB Home Appliances, Voltas Ltd, LG Electronics, Hoover Candy Group, Hitachi, Panasonic.

3. What are the main segments of the India Home Appliances Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 64.29 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Disposable Income and Urbanization; E-commerce and Digital Transformation.

6. What are the notable trends driving market growth?

The Refrigerators Segment Accounts for a Significant Market Share.

7. Are there any restraints impacting market growth?

Increased household appliance costs are impeding market expansion..

8. Can you provide examples of recent developments in the market?

In May 2023, Samsung, launched its 2023 range of semi-automatic washing machines that come with new features such as Soft Closing Toughened Glass Lid and Dual Magic Filter. These added features make this latest range an ideal purchase for a seamless laundry experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Home Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Home Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Home Appliances Market?

To stay informed about further developments, trends, and reports in the India Home Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence