Key Insights

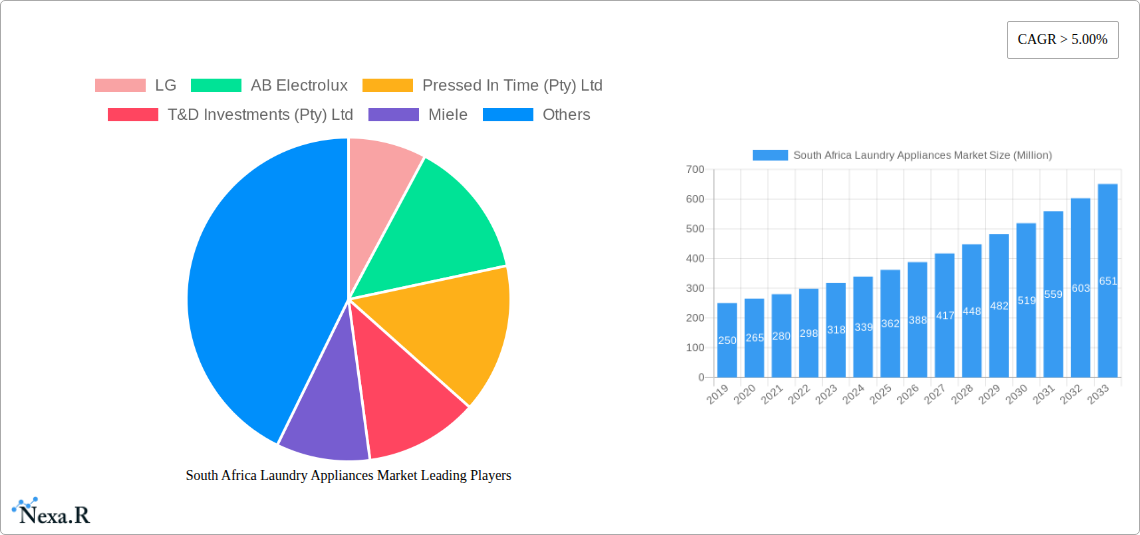

The South African laundry appliance market is projected for robust expansion, anticipating a Compound Annual Growth Rate (CAGR) of 5.6%. With a market size of 4.92 billion in the base year 2024, growth is propelled by increasing disposable incomes, urbanization, and a heightened demand for convenient, energy-efficient solutions in both residential and commercial settings. The integration of smart home technology and the pursuit of advanced washing machine and dryer features are significant growth drivers. Washing machines and dryers are expected to lead market segments, with a noticeable trend towards fully automatic and integrated models driven by consumer preference for sophisticated functionality and seamless home aesthetics.

South Africa Laundry Appliances Market Market Size (In Billion)

Technological innovation is a key catalyst, with manufacturers prioritizing appliances offering superior cleaning, water and energy efficiency, and intuitive user interfaces. Distribution channels are diversifying, with online retail experiencing notable growth alongside traditional offline sales. Potential challenges include the initial high cost of advanced appliances and economic volatility. Nevertheless, the ongoing modernization of households and continuous innovation from leading brands like LG, Samsung, and Bosch are expected to maintain a positive growth trajectory. Increased penetration in urban and peri-urban residences, alongside growing demand from the hospitality and healthcare sectors, reinforces the market's strong outlook.

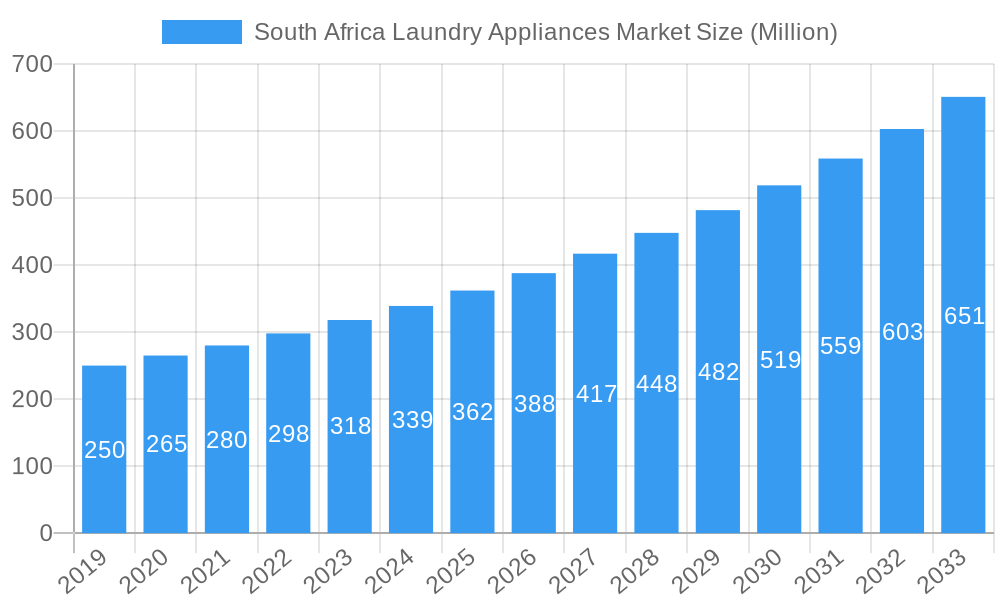

South Africa Laundry Appliances Market Company Market Share

This comprehensive report offers an in-depth analysis of the South African Laundry Appliances Market, covering historical data, current dynamics, and future forecasts from 2019 to 2033. Based on the 2024 base year, the study provides critical insights into market size evolution, technological advancements, competitive landscapes, and shifts in consumer behavior across segments such as built-in and free-standing appliances, washing machines, dryers, electric pressing machines, and related products. Extensive research identifies key drivers, restraints, opportunities, and emerging trends, delivering actionable intelligence for industry stakeholders.

Parent Market: Global Home Appliances Market Child Markets: South Africa Washing Machines Market, South Africa Dryers Market, South Africa Laundry Detergent Market

South Africa Laundry Appliances Market Dynamics & Structure

The South African laundry appliances market exhibits a moderate concentration, with leading global players like LG, Samsung, Bosch, and AB Electrolux dominating market share, often exceeding 60% of the total market value. This dominance is driven by continuous technological innovation, particularly in energy efficiency and smart features, which are increasingly sought after by South African consumers. Regulatory frameworks, such as energy efficiency standards, play a crucial role in shaping product development and consumer choices. While direct competitive product substitutes for core laundry appliances are limited, advancements in connected home technology and integrated laundry solutions are creating new competitive frontiers. End-user demographics reveal a growing middle class with increasing disposable income, particularly in urban centers, fueling demand for higher-end, technologically advanced appliances. Mergers and acquisitions (M&A) are less prevalent, but strategic partnerships, like the Samsung and OMO detergent collaboration, are emerging as key strategies for market penetration and enhancing consumer experience. Innovation barriers include the high cost of advanced manufacturing and the need for robust after-sales service networks across a geographically diverse country.

- Market Concentration: Dominated by a few global brands.

- Technological Innovation: Driven by energy efficiency, smart features, and IoT integration.

- Regulatory Impact: Energy efficiency standards and consumer protection laws are influential.

- Competitive Substitutes: Primarily indirect, related to cleaning services and alternative drying methods.

- End-User Demographics: Growing middle class, urbanization, and increased disposable income.

- M&A Trends: Limited direct acquisitions, with a rise in strategic collaborations.

- Innovation Barriers: High R&D costs, supply chain complexities.

South Africa Laundry Appliances Market Growth Trends & Insights

The South Africa Laundry Appliances Market is projected to witness a steady Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2025 to 2033, expanding from an estimated market size of USD 850 million in 2025 to over USD 1.3 billion by 2033. This growth is underpinned by several key trends. Firstly, increasing urbanization and a rising middle class are significantly boosting the adoption rate of both freestanding and built-in laundry appliances, with market penetration for washing machines reaching an estimated 75% in urban households by 2025. Secondly, technological disruptions are playing a pivotal role, with a growing consumer preference for automatic, high-efficiency washing machines and dryers that offer smart connectivity and advanced fabric care. The launch of Samsung's Bespoke AI Washer and Dryer, featuring A+++ energy ratings, exemplifies this trend, catering to the growing demand for sustainable and energy-conscious solutions. Consumer behavior is shifting towards a greater emphasis on convenience, durability, and the overall user experience, driving demand for feature-rich appliances. The "Others" product segment, which includes specialized laundry equipment and accessories, is also expected to see robust growth as consumers seek to optimize their laundry processes. The online distribution channel is gaining traction, expected to contribute over 25% of total sales by 2028, offering consumers greater choice and competitive pricing. The increasing adoption of smart home technologies further fuels the demand for connected laundry appliances, creating opportunities for brands that can integrate seamlessly into the modern connected household.

Dominant Regions, Countries, or Segments in South Africa Laundry Appliances Market

The South African laundry appliances market is primarily driven by urban centers, with Gauteng emerging as the dominant region due to its high population density, robust economic activity, and a larger proportion of middle to upper-income households. Within Gauteng, cities like Johannesburg and Pretoria are key consumption hubs.

- Dominant Product Segment: Washing Machines consistently lead the market, projected to account for over 55% of unit sales by 2025. This is attributed to the fundamental need for laundry care in both residential and commercial settings, and the continuous innovation in washing machine technology, including front-load, top-load, and smart-enabled models.

- Dominant Type Segment: Free Standing laundry appliances hold the majority market share, estimated at 70% of unit sales in 2025. This preference is largely due to their affordability, ease of installation, and flexibility in placement, making them more accessible to a wider consumer base. Built-in appliances are a growing segment, particularly in newer housing developments and among consumers seeking integrated kitchen and laundry solutions.

- Dominant Technology Segment: Automatic laundry appliances are the clear frontrunners, expected to capture over 80% of the market by 2025. The convenience, efficiency, and advanced features offered by automatic machines, including various wash cycles and digital controls, align with evolving consumer expectations for a seamless laundry experience. Semi-automatic and "Others" (e.g., manual washing devices) represent a declining share, primarily catering to niche markets or lower-income segments.

- Dominant Distribution Channel: The Offline distribution channel, encompassing major appliance retailers, department stores, and independent dealers, currently dominates the market, accounting for approximately 75% of sales in 2025. This is due to the consumer preference for physically inspecting appliances before purchase and the established retail infrastructure. However, the Online channel is experiencing significant growth, driven by e-commerce expansion and the increasing comfort of consumers with online purchasing, projected to capture a substantial share in the coming years.

- Dominant End Use Segment: The Residential sector is the largest consumer of laundry appliances, driven by household demand. However, the Commercial and Industry segments, including laundromats, hotels, hospitals, and hospitality businesses, represent a significant and growing market. This segment is characterized by the demand for high-capacity, durable, and efficient industrial-grade laundry equipment, contributing substantial revenue. The demand for energy-efficient industrial dryers and commercial washing machines is a key growth driver.

South Africa Laundry Appliances Market Product Landscape

The South African laundry appliances market is characterized by a diverse product landscape, with a strong emphasis on energy efficiency, advanced cleaning technologies, and smart connectivity. Washing machines are evolving with features like inverter technology for quieter operation and reduced energy consumption, alongside specialized wash programs for different fabric types. Dryers are increasingly adopting heat pump technology, offering significant energy savings compared to traditional vented or condenser dryers. Electric pressing machines are also seeing innovation in terms of steam generation and ergonomic designs for enhanced user experience. Companies are focusing on delivering intuitive interfaces, durable build quality, and sustainable manufacturing practices, with an increasing number of products achieving high energy ratings like A+++.

Key Drivers, Barriers & Challenges in South Africa Laundry Appliances Market

Key Drivers:

- Rising Disposable Income: A growing middle class with increased purchasing power is a primary driver for appliance upgrades and new purchases.

- Urbanization: Concentrated populations in urban areas lead to higher demand for household appliances.

- Technological Advancements: Innovations in energy efficiency, smart features, and convenience are attracting consumers.

- Growing Awareness of Energy Efficiency: Consumers are increasingly seeking appliances that reduce utility bills and environmental impact.

- Demand from Commercial & Industrial Sectors: Expansion in hospitality, healthcare, and service industries fuels demand for commercial laundry equipment.

Barriers & Challenges:

- High Initial Cost: Advanced and energy-efficient appliances can have a higher upfront cost, posing a barrier for some consumers.

- Supply Chain Disruptions: Global supply chain volatility can impact the availability and pricing of components and finished products.

- Economic Volatility: Fluctuations in the South African economy and currency can affect consumer spending on durable goods.

- Infrastructure Limitations: In some areas, inconsistent electricity supply or water availability can affect appliance performance and adoption.

- Competition from Informal Sector: Unbranded or lower-cost alternatives from the informal sector can pose a competitive challenge.

Emerging Opportunities in South Africa Laundry Appliances Market

Emerging opportunities in the South African laundry appliances market lie in the growing demand for smart, connected appliances that integrate with the Internet of Things (IoT). The increasing adoption of renewable energy solutions presents an opportunity for manufacturers to develop solar-powered or hybrid laundry appliances. Furthermore, the expansion of e-commerce platforms offers a significant avenue for reaching a wider customer base, particularly in underserved regions. There is also a burgeoning interest in compact and multi-functional appliances to cater to smaller living spaces in urban environments. Partnerships with utility providers to offer energy-efficient appliance subsidies could also unlock new market segments.

Growth Accelerators in the South Africa Laundry Appliances Market Industry

Several factors are accelerating growth in the South African laundry appliances industry. Strategic partnerships, such as the collaboration between Samsung and OMO detergent, are enhancing consumer value propositions and driving product adoption. Government initiatives promoting energy efficiency and appliance upgrades, coupled with increasing consumer awareness of sustainability, are powerful growth catalysts. The ongoing development of smart home ecosystems and the integration of AI-powered features in laundry appliances are creating new demand segments. Moreover, the expansion of the rental and leasing market for appliances, particularly for commercial use, is providing an alternative ownership model that can accelerate market penetration.

Key Players Shaping the South Africa Laundry Appliances Market Market

- LG

- AB Electrolux

- Pressed In Time (Pty) Ltd

- T&D Investments (Pty) Ltd

- Miele

- Desert Charm Trading 40 (Pty) Ltd

- Nannucci Dry Cleaners (Pty) Ltd

- Levingers Franchising (Pty) Ltd

- Bidvest Group Ltd (The)

- Hisense SA

- Bosch

- Combined Cleaners (Pty) Ltd

- Tullis Laundry Solutions Africa (Pty) Ltd

- Atlantic Cleaners

- Servworx Integrated Service Solutions (Pty) Ltd

- Unilever South Africa

- Samsung

- Midea

Notable Milestones in South Africa Laundry Appliances Market Sector

- August 2022: Samsung and OMO detergent partnered to offer a combination of Samsung's state-of-the-art washing machines and OMO Auto's incredible cleaning power, creating a seamless, stress-free, and sustainable laundry experience.

- July 2022: Samsung Electronics launched the Bespoke AI Washer and Dryer, delivering sustainable, efficient, and intelligent Samsung washer and dryer. With an energy rating of A+++, the Bespoke AI Dryer uses eco-conscious Digital Inverter Compressor technology to dry loads as quickly and efficiently as possible.

In-Depth South Africa Laundry Appliances Market Market Outlook

The outlook for the South African laundry appliances market remains positive, driven by persistent demand from both residential and commercial sectors. Growth accelerators such as increasing disposable incomes, a growing middle class, and a strong push towards energy-efficient and smart technologies will continue to fuel market expansion. The strategic partnerships and collaborations observed, like the one between Samsung and OMO, highlight a trend towards integrated solutions that enhance consumer value and drive brand loyalty. As e-commerce channels mature and consumers become more comfortable with online purchases, the distribution landscape will continue to evolve, offering new avenues for market penetration. Future opportunities will likely revolve around the development of highly connected and AI-enabled appliances, as well as sustainable and eco-friendly laundry solutions that cater to the evolving environmental consciousness of South African consumers. The commercial and industrial laundry segments are expected to remain robust, supported by the country's ongoing economic development and expansion in key service industries.

South Africa Laundry Appliances Market Segmentation

-

1. Type

- 1.1. Built-in

- 1.2. Free Standing

-

2. Product

- 2.1. Washing Machines

- 2.2. Dryers

- 2.3. Electric Pressing Machines

- 2.4. Others

-

3. Technology

- 3.1. Automatic

- 3.2. Semi-Automatic

- 3.3. Others

-

4. Distribution Channel

- 4.1. Offline

- 4.2. Online

-

5. End Use

- 5.1. Residential

- 5.2. Commercial

South Africa Laundry Appliances Market Segmentation By Geography

- 1. South Africa

South Africa Laundry Appliances Market Regional Market Share

Geographic Coverage of South Africa Laundry Appliances Market

South Africa Laundry Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in spending on washing machines in South Africa.; Rising share of Online Sales in Laundry Appliance products.

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Per Capita Income of South Africa Post Covid; Increasing market penetration by Global players affecting local manufacturers.

- 3.4. Market Trends

- 3.4.1. Automatic Washing Machines Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Laundry Appliances Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Built-in

- 5.1.2. Free Standing

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Washing Machines

- 5.2.2. Dryers

- 5.2.3. Electric Pressing Machines

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Automatic

- 5.3.2. Semi-Automatic

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Offline

- 5.4.2. Online

- 5.5. Market Analysis, Insights and Forecast - by End Use

- 5.5.1. Residential

- 5.5.2. Commercial

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AB Electrolux

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pressed In Time (Pty) Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 T&D Investments (Pty) Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Miele

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Desert Charm Trading 40 (Pty) Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nannucci Dry Cleaners (Pty) Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Levingers Franchising (Pty) Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bidvest Group Ltd (The)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hisense SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bosch

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Combined Cleaners (Pty) Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Tullis Laundry Solutions Africa (Pty) Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Atlantic Cleaners

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Servworx Integrated Service Solutions (Pty) Ltd

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Unilever South Africa

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Samsung

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Midea

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.1 LG

List of Figures

- Figure 1: South Africa Laundry Appliances Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Africa Laundry Appliances Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Laundry Appliances Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: South Africa Laundry Appliances Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: South Africa Laundry Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 4: South Africa Laundry Appliances Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 5: South Africa Laundry Appliances Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 6: South Africa Laundry Appliances Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 7: South Africa Laundry Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: South Africa Laundry Appliances Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 9: South Africa Laundry Appliances Market Revenue billion Forecast, by End Use 2020 & 2033

- Table 10: South Africa Laundry Appliances Market Volume K Unit Forecast, by End Use 2020 & 2033

- Table 11: South Africa Laundry Appliances Market Revenue billion Forecast, by Region 2020 & 2033

- Table 12: South Africa Laundry Appliances Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 13: South Africa Laundry Appliances Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: South Africa Laundry Appliances Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: South Africa Laundry Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 16: South Africa Laundry Appliances Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 17: South Africa Laundry Appliances Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 18: South Africa Laundry Appliances Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 19: South Africa Laundry Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 20: South Africa Laundry Appliances Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 21: South Africa Laundry Appliances Market Revenue billion Forecast, by End Use 2020 & 2033

- Table 22: South Africa Laundry Appliances Market Volume K Unit Forecast, by End Use 2020 & 2033

- Table 23: South Africa Laundry Appliances Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: South Africa Laundry Appliances Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Laundry Appliances Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the South Africa Laundry Appliances Market?

Key companies in the market include LG, AB Electrolux, Pressed In Time (Pty) Ltd, T&D Investments (Pty) Ltd, Miele, Desert Charm Trading 40 (Pty) Ltd, Nannucci Dry Cleaners (Pty) Ltd, Levingers Franchising (Pty) Ltd, Bidvest Group Ltd (The), Hisense SA, Bosch, Combined Cleaners (Pty) Ltd, Tullis Laundry Solutions Africa (Pty) Ltd, Atlantic Cleaners, Servworx Integrated Service Solutions (Pty) Ltd, Unilever South Africa, Samsung, Midea.

3. What are the main segments of the South Africa Laundry Appliances Market?

The market segments include Type, Product, Technology, Distribution Channel, End Use.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.92 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in spending on washing machines in South Africa.; Rising share of Online Sales in Laundry Appliance products..

6. What are the notable trends driving market growth?

Automatic Washing Machines Driving The Market.

7. Are there any restraints impacting market growth?

Fluctuation in Per Capita Income of South Africa Post Covid; Increasing market penetration by Global players affecting local manufacturers..

8. Can you provide examples of recent developments in the market?

On August 2022, Samsung and OMO detergent partnered to offer a combination of Samsung's state-of-the-art washing machines and OMO Auto's incredible cleaning power, creating a seamless, stress-free, and sustainable laundry experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Laundry Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Laundry Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Laundry Appliances Market?

To stay informed about further developments, trends, and reports in the South Africa Laundry Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence