Key Insights

The European home organizers and storage market is poised for significant expansion, propelled by evolving consumer preferences and urban living trends. The growing adoption of minimalist lifestyles and the increasing prevalence of compact urban dwellings are driving demand for innovative, space-saving storage solutions. Consumers are actively seeking ways to optimize home organization and declutter, leading to a surge in the acquisition of diverse storage products, from basic containers to advanced shelving and multi-functional organizers. The market is comprehensively segmented by application (e.g., bedrooms, kitchens, garages), distribution channel (online and brick-and-mortar), and product type (e.g., baskets, boxes, bags), ensuring a wide array of choices to meet varied consumer requirements. The burgeoning e-commerce landscape is a key growth driver, facilitating easy access to an extensive selection of products from both prominent brands and specialized providers. Key international retailers such as Ikea and The Home Depot, alongside numerous niche enterprises, contribute to a highly competitive and dynamic market environment. Germany, France, and the United Kingdom currently lead the European market due to higher disposable incomes and mature home improvement sectors. The market is projected to experience a Compound Annual Growth Rate (CAGR) of 3%, reaching an estimated market size of $8.95 billion by 2025.

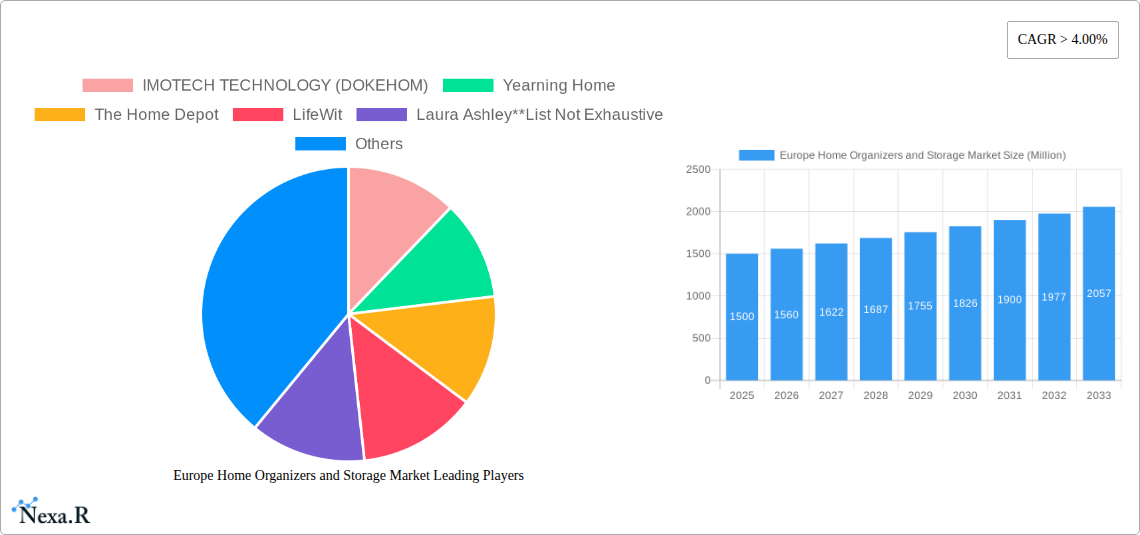

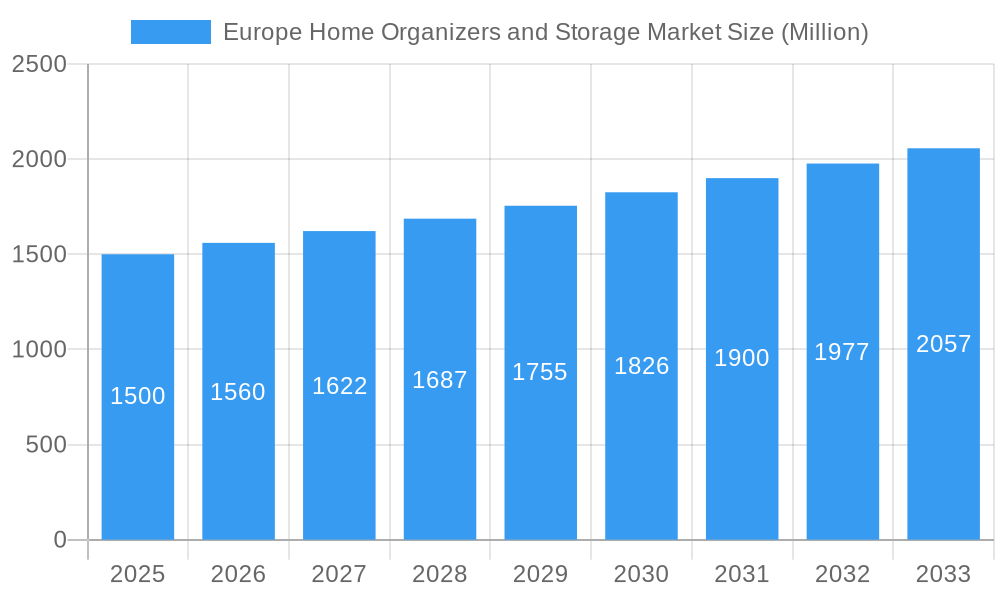

Europe Home Organizers and Storage Market Market Size (In Billion)

Future market development will be shaped by several emerging trends. A heightened consumer interest in sustainable and eco-friendly products will stimulate demand for organizers manufactured from recycled materials or designed with environmental consciousness. The integration of smart home technology, including intelligent storage solutions, is expected to enhance convenience and efficiency in home organization, presenting a significant market opportunity. Further market segmentation, addressing niche consumer preferences based on demographics and lifestyle, will foster innovation and intensify competition. While economic volatilities and potential supply chain disruptions may present challenges, the overarching market outlook remains robust, with sustained growth anticipated throughout the forecast period, driven by persistent demand for effective storage solutions in European households.

Europe Home Organizers and Storage Market Company Market Share

Europe Home Organizers and Storage Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Europe Home Organizers and Storage Market, encompassing market dynamics, growth trends, dominant segments, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report utilizes data from the historical period (2019-2024) and offers invaluable insights for industry professionals, investors, and strategic decision-makers. The market is segmented by application, distribution channel, country, and product type, providing granular market intelligence for targeted strategies. The report's market size estimations are presented in million units.

Europe Home Organizers and Storage Market Dynamics & Structure

The European home organizers and storage market is a dynamic landscape shaped by several key factors. Market concentration is moderate, with a few large players alongside numerous smaller, specialized businesses. Technological innovation, particularly in smart storage solutions and sustainable materials, is a significant driver. Regulatory frameworks, particularly concerning product safety and environmental standards, play a crucial role. Competitive pressure from substitute products like modular furniture impacts market growth. End-user demographics, with a growing emphasis on space optimization in smaller living spaces and an increasing awareness of minimalist lifestyles, influence demand. M&A activity in the sector is relatively modest, with approximately xx deals recorded between 2019 and 2024, representing a xx% market share consolidation.

- Market Concentration: Moderate, with a mix of large multinational corporations and smaller niche players.

- Technological Innovation: Strong driver, with smart storage solutions and sustainable materials gaining traction.

- Regulatory Framework: Compliance with safety and environmental regulations is crucial for market participation.

- Competitive Substitutes: Modular furniture and other space-saving solutions pose competitive pressure.

- End-User Demographics: Changing lifestyles and space constraints are key demand drivers.

- M&A Activity: Relatively low, with xx deals recorded (2019-2024), resulting in xx% market share consolidation.

Europe Home Organizers and Storage Market Growth Trends & Insights

The European home organizers and storage market experienced significant growth between 2019 and 2024, driven by factors such as increasing urbanization, a rise in disposable incomes, and a growing preference for organized living spaces. The market size expanded from xx million units in 2019 to xx million units in 2024, representing a CAGR of xx%. The adoption rate of innovative storage solutions, particularly those incorporating smart technology, has increased steadily. Consumer behavior has shifted towards seeking more sustainable and aesthetically pleasing storage products. The market is projected to continue its growth trajectory in the forecast period (2025-2033), with a projected CAGR of xx%, reaching xx million units by 2033. This growth will be driven by factors like increasing demand for customized storage solutions and the growing popularity of online shopping for home organization products.

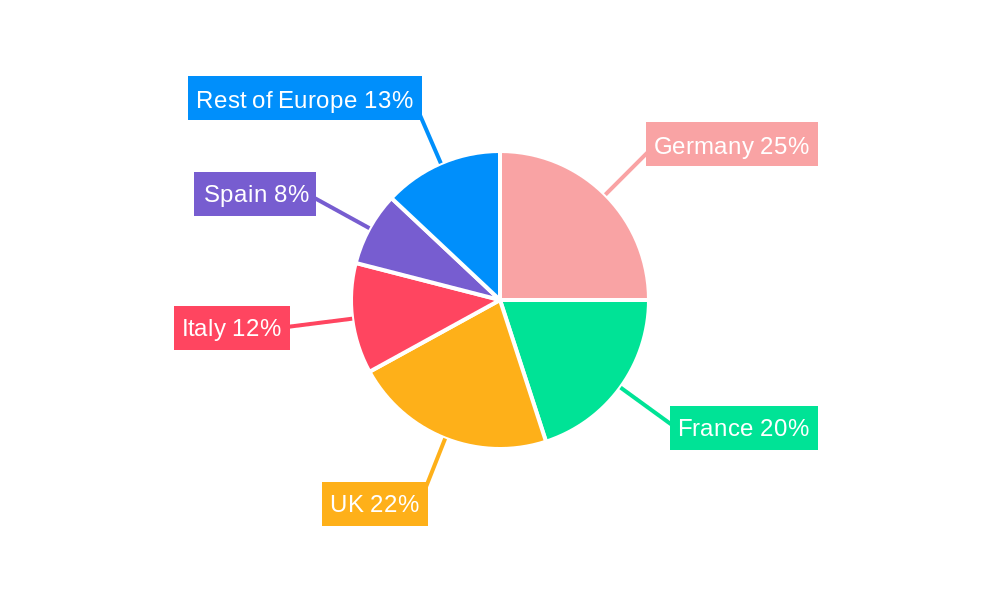

Dominant Regions, Countries, or Segments in Europe Home Organizers and Storage Market

The UK, Germany, and France represent the largest national markets within Europe for home organizers and storage, collectively accounting for approximately xx% of the total market value in 2024. This dominance is attributed to high disposable incomes, larger average home sizes compared to other European countries, and a greater awareness of the benefits of organized living.

By Application: The kitchen and pantry segment displays robust growth, driven by the increasing popularity of meal preparation and storage solutions. Bedroom closets maintain a considerable market share due to the universal need for efficient clothing storage.

By Distribution Channel: Online channels are experiencing significant growth, exceeding hypermarkets/supermarkets in market share in 2024, fuelled by the convenience and wide product selection offered by e-commerce platforms.

- Leading Countries: UK, Germany, France (xx% market share combined)

- High-Growth Applications: Kitchen/Pantry, Bedroom Closets

- Dominant Distribution Channel: Online (surpassing hypermarkets/supermarkets in 2024)

- Key Drivers: High disposable incomes, growing urbanization, increasing awareness of home organization benefits.

Europe Home Organizers and Storage Market Product Landscape

The product landscape is diverse, encompassing a wide range of storage solutions tailored to various needs and spaces. Product innovations focus on maximizing space utilization, incorporating sustainable materials, and integrating smart technology. Unique selling propositions often revolve around design aesthetics, functionality, and ease of use. Technological advancements include smart sensors for inventory management and modular designs allowing for customization.

Key Drivers, Barriers & Challenges in Europe Home Organizers and Storage Market

Key Drivers:

- Rising disposable incomes in many European countries.

- Growing urbanization and smaller living spaces driving demand for space-saving solutions.

- Increased awareness of the benefits of organized living spaces and minimalist lifestyles.

- Technological advancements leading to innovative and user-friendly storage solutions.

Challenges & Restraints:

- Fluctuations in raw material prices impacting production costs.

- Intense competition from established players and emerging brands.

- Supply chain disruptions, as evidenced by IKEA's 9% price hike in January 2022. This resulted in a xx% reduction in sales for some companies in 2022.

Emerging Opportunities in Europe Home Organizers and Storage Market

- Sustainable and eco-friendly storage solutions: Growing consumer preference for environmentally conscious products presents a significant opportunity.

- Smart storage solutions: Integration of smart technology for inventory management and space optimization offers high growth potential.

- Customization and personalization: Offering tailored storage solutions to meet specific customer needs is gaining traction.

- Expansion into niche markets: Targeting specific demographics (e.g., senior citizens, individuals with disabilities) presents untapped market opportunities.

Growth Accelerators in the Europe Home Organizers and Storage Market Industry

Long-term growth will be driven by the continued adoption of smart technologies, strategic partnerships between manufacturers and interior design firms, and market expansion into Eastern European countries. Focusing on sustainable materials and offering customizable storage solutions will further enhance market growth. Strategic acquisitions of smaller, innovative companies can provide a significant competitive advantage.

Key Players Shaping the Europe Home Organizers and Storage Market Market

- IMOTECH TECHNOLOGY (DOKEHOM)

- Yearning Home

- The Home Depot

- LifeWit

- Laura Ashley

- Childhome

- Awekris

- Amazon Basics

- Mamas & Papas

- Ikea

Notable Milestones in Europe Home Organizers and Storage Market Sector

- Jan 2022: IKEA hiked prices by an average of 9% due to supply chain disruptions, highlighting the impact of global economic conditions on the industry.

- Dec 2021: The Home Depot invested in a new flatbed distribution center to improve efficiency and compete in the professional contractor market, indicating a shift in market focus.

In-Depth Europe Home Organizers and Storage Market Market Outlook

The European home organizers and storage market exhibits strong growth potential, driven by sustained urbanization, increasing disposable incomes, and the ongoing demand for innovative, sustainable, and space-saving storage solutions. Strategic partnerships, technological advancements, and effective marketing strategies will be crucial for companies to capitalize on this expanding market. The market is predicted to continue its robust growth trajectory throughout the forecast period, offering significant opportunities for both established players and new entrants.

Europe Home Organizers and Storage Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Home Organizers and Storage Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Home Organizers and Storage Market Regional Market Share

Geographic Coverage of Europe Home Organizers and Storage Market

Europe Home Organizers and Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Residential and Commercial Construction Activities

- 3.3. Market Restrains

- 3.3.1 Alternative Water Heating Technologies

- 3.3.2 Such as Solar Water Heaters and Heat Pump Systems

- 3.4. Market Trends

- 3.4.1. Rise in Home Ownership Rate is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Home Organizers and Storage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 IMOTECH TECHNOLOGY (DOKEHOM)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Yearning Home

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Home Depot

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LifeWit

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Laura Ashley**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Childhome

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Awekris

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amazon Basics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mamas & Papas

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ikea

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 IMOTECH TECHNOLOGY (DOKEHOM)

List of Figures

- Figure 1: Europe Home Organizers and Storage Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Home Organizers and Storage Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Home Organizers and Storage Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Home Organizers and Storage Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Home Organizers and Storage Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Home Organizers and Storage Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Home Organizers and Storage Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Home Organizers and Storage Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Europe Home Organizers and Storage Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Home Organizers and Storage Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Home Organizers and Storage Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Home Organizers and Storage Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Home Organizers and Storage Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Home Organizers and Storage Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Europe Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Home Organizers and Storage Market?

The projected CAGR is approximately 3%.

2. Which companies are prominent players in the Europe Home Organizers and Storage Market?

Key companies in the market include IMOTECH TECHNOLOGY (DOKEHOM), Yearning Home, The Home Depot, LifeWit, Laura Ashley**List Not Exhaustive, Childhome, Awekris, Amazon Basics, Mamas & Papas, Ikea.

3. What are the main segments of the Europe Home Organizers and Storage Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.95 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Residential and Commercial Construction Activities.

6. What are the notable trends driving market growth?

Rise in Home Ownership Rate is Driving the Market.

7. Are there any restraints impacting market growth?

Alternative Water Heating Technologies. Such as Solar Water Heaters and Heat Pump Systems.

8. Can you provide examples of recent developments in the market?

Jan 2022 - IKEA hiked its prices by an average of 9% due to ongoing supply and transportation disruptions. The announcement came as pandemic-fuelled shortages and shipping challenges ramp up inflation and pinch economies globally, with consumers increasingly feeling the pinch.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Home Organizers and Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Home Organizers and Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Home Organizers and Storage Market?

To stay informed about further developments, trends, and reports in the Europe Home Organizers and Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence