Key Insights

India's carbon black market is poised for significant expansion, projected to reach $25.54 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.7% from 2025 to 2033. This growth is largely propelled by the expanding tire and industrial rubber products sector, driven by increased vehicle production and robust infrastructure development across India. The escalating demand for plastics in packaging and consumer goods further bolsters market growth. The widespread adoption of carbon black in toners, printing inks, and coatings across diverse industries also contributes significantly. Additionally, the textile industry's growth and emerging applications in insulation and construction are expected to fuel market expansion. However, market growth may be tempered by fluctuating raw material costs and stringent environmental regulations. Furnace black leads the process type segment, while tire and industrial rubber products dominate the application segment. Key industry players such as Birla Carbon, Phillips Carbon Black Limited (PCBL), and Cabot Corporation are actively enhancing production capabilities and advancing technology to meet escalating demand and maintain competitive positioning. Regional growth variations are expected, with heightened expansion anticipated in rapidly industrializing and developing regions like South and West India.

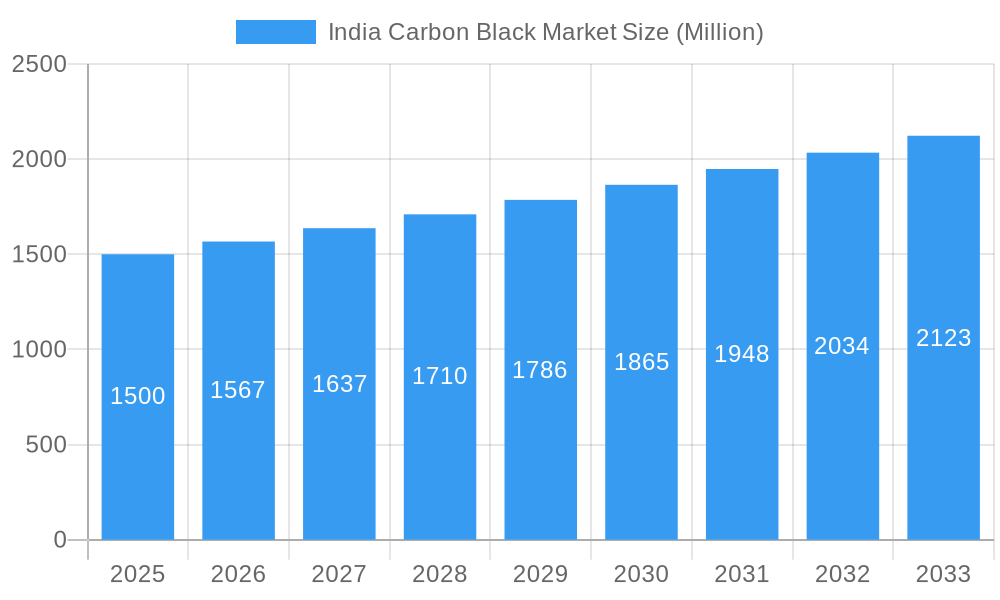

India Carbon Black Market Market Size (In Billion)

The competitive arena features a blend of established multinational corporations and domestic enterprises. Market expansion is influenced by government initiatives supporting infrastructure and industrial growth, innovations in carbon black production technology, and the evolving demands of various end-use industries. The long-term forecast for the Indian carbon black market is optimistic, indicating substantial expansion potential across multiple application segments. Strategic collaborations, technological advancements, and a proactive approach to environmental stewardship will be vital for sustained success in this dynamic and competitive market.

India Carbon Black Market Company Market Share

India Carbon Black Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India carbon black market, encompassing market dynamics, growth trends, regional analysis, product landscape, key players, and future outlook. The report covers the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033. The market is segmented by process type (Furnace Black, Gas Black, Lamp Black, Thermal Black) and application (Tires and Industrial Rubber Products, Plastics, Toners and Printing Inks, Coatings, Textile Fibers, Other Applications). This detailed analysis will equip industry professionals with actionable insights to navigate the evolving landscape of the Indian carbon black market. Market values are presented in Million units.

India Carbon Black Market Market Dynamics & Structure

The Indian carbon black market is characterized by a moderately consolidated structure, featuring a blend of established global and domestic leaders alongside a significant number of regional manufacturers. This dynamic landscape is shaped by several interconnected factors. Technological innovation is a primary catalyst, spurred by the relentless demand for enhanced performance characteristics across diverse applications, from advanced tire formulations to conductive plastics. However, the pursuit of innovation is tempered by the substantial R&D investment required and the complexities inherent in developing specialized grades. A pivotal influence is the evolving regulatory framework; increasingly stringent environmental standards are compelling producers to adopt cleaner, more sustainable production methods and invest in emission control technologies. Simultaneously, the market faces competitive pressures from the rise of substitute materials such as precipitated silica and various nanomaterials, which are finding traction in specific niche applications. The market's stability is also closely tied to the fluctuating prices of key raw materials, primarily derived from crude oil, and the prevailing trends within end-user industries. Recent merger and acquisition (M&A) activity has been notable, with approximately [Insert Number] significant deals recorded between 2019 and 2024. This consolidation has resulted in an estimated [Insert Percentage]% shift in market share among the leading entities.

- Market Concentration: Moderately Consolidated, with the top 5 players projected to hold approximately [Insert Percentage]% of the market share in 2025.

- Technological Innovation: A strong emphasis is placed on improving product properties such as electrical conductivity, dispersion characteristics, and UV resistance. The development of highly specialized grades tailored for advanced applications is a key focus. Innovation barriers include significant R&D expenditure and the intricate nature of material science.

- Regulatory Framework: Stringent emission norms and evolving environmental protection policies are actively driving the adoption of cleaner production processes and greener technologies.

- Competitive Substitutes: Precipitated silica and various nanomaterials are emerging as significant competitors, offering alternative solutions in specific application segments.

- End-User Demographics: The tire industry remains the dominant consumer of carbon black. However, there is a discernible and growing demand from the plastics, coatings, inks, and masterbatch sectors.

- M&A Trends: Moderate M&A activity is observed, with transactions predominantly centered on expanding production capacities, enhancing product portfolios, and strengthening market presence.

India Carbon Black Market Growth Trends & Insights

The Indian carbon black market is poised for robust and sustained growth over the forecast period spanning 2025 to 2033. This expansion is underpinned by a confluence of powerful economic and industrial forces. Rapid industrialization across various sectors, a burgeoning automotive sector driving increased vehicle production, and escalating demand from a multitude of downstream industries are the principal growth engines. The market size, estimated at [Insert Million Units] Million units in 2025, is projected to surge to approximately [Insert Million Units] Million units by 2033, representing a Compound Annual Growth Rate (CAGR) of [Insert Percentage]%. This upward trajectory is further fueled by rising disposable incomes, significant investments in infrastructure projects, and proactive government initiatives aimed at promoting industrial development and manufacturing excellence. Technological disruptions, including the adoption of advanced manufacturing techniques and the continuous development of specialized carbon black grades with superior performance attributes, are acting as significant accelerators for market expansion. A discernible shift in consumer and industrial preferences towards high-performance materials that offer enhanced durability, functionality, and sustainability is also positively influencing the market's trajectory. Market penetration in key application areas is expected to witness steady augmentation, with particularly strong growth anticipated in the plastics and coatings sectors, driven by their increasing reliance on advanced additive solutions.

Dominant Regions, Countries, or Segments in India Carbon Black Market

The Western and Southern regions of India are currently dominating the carbon black market, driven by strong industrial clusters and substantial infrastructure development. Furnace Black accounts for the largest segment share (xx%) due to its cost-effectiveness and widespread applicability. The Tires and Industrial Rubber Products segment represents the highest demand (xx%), fueled by the booming automotive industry and growth in related sectors.

- Key Drivers in Western & Southern Regions: Presence of major tire and rubber manufacturing hubs, robust infrastructure, and supportive government policies.

- Furnace Black Dominance: Cost-effectiveness, versatility, and suitability for a wide range of applications.

- Tire & Rubber Segment Leadership: Strong growth in the automotive sector and increasing demand for high-performance tires.

- Growth Potential: Significant untapped potential in the plastics, coatings, and other emerging applications.

India Carbon Black Market Product Landscape

The Indian carbon black market offers a diverse range of products, categorized by process type and tailored to specific application requirements. Continuous innovation focuses on enhancing performance characteristics, such as improved dispersion, conductivity, and abrasion resistance. Unique selling propositions include tailored particle size distribution, specialized surface treatments, and environmentally friendly production methods. Recent technological advancements encompass the use of advanced manufacturing techniques to improve product consistency and efficiency.

Key Drivers, Barriers & Challenges in India Carbon Black Market

Key Drivers: The Indian carbon black market's growth is propelled by a robust demand from the automotive industry, which is a primary consumer. The expanding plastics sector, particularly for applications requiring reinforcement and pigmentation, and the vibrant coatings industry, seeking advanced performance additives, are significant contributors. Furthermore, government-led infrastructure projects and the ongoing trends of increasing urbanization and industrialization are creating sustained demand across various applications.

Challenges: The market confronts several significant challenges that could impact its growth trajectory. Fluctuating raw material prices, especially the volatility of crude oil derivatives which are primary feedstocks, pose a considerable risk to cost stability. Increasingly stringent environmental regulations, while necessary for sustainability, are escalating production costs due to the need for advanced emission control systems and compliance measures. The market experiences intense competition, not only from well-established domestic players but also from international manufacturers with advanced technologies and economies of scale. Potential supply chain disruptions, arising from geopolitical factors, logistical issues, or raw material availability, could also pose a threat. These combined factors have the potential to negatively impact market growth by an estimated [Insert Percentage]% by 2030.

Emerging Opportunities in India Carbon Black Market

Emerging opportunities lie in specialized carbon black applications, including conductive inks for electronics, high-performance polymers, and advanced materials for renewable energy technologies. Untapped markets in rural areas and expanding applications in construction and infrastructure present further potential. The growing demand for sustainable and eco-friendly materials creates opportunities for carbon black producers to develop and market green products.

Growth Accelerators in the India Carbon Black Market Industry

Strategic partnerships between carbon black manufacturers and downstream industries are accelerating market growth. Technological breakthroughs in production processes are leading to cost reduction and increased efficiency. Expansion into new geographic markets and diversification of product portfolios are enabling companies to capitalize on emerging trends and strengthen their market presence.

Key Players Shaping the India Carbon Black Market Market

- Jiangxi Heimao Carbon Black Co Ltd

- OCI COMPANY Ltd

- Continental Carbon Company

- Cabot Corporation

- Epsilon Carbon Private Limited

- Himadri Speciality Chemical Ltd

- Atlas Organics Private Limited

- PCBL (Phillips Carbon Black Limited)

- BKT Carbon

- Birla Carbon

Notable Milestones in India Carbon Black Market Sector

- 2020: Birla Carbon introduced a new range of furnace black grades featuring enhanced conductivity and improved dispersion properties, catering to the growing demand for specialized materials.

- 2022: PCBL (Phillips Carbon Black Limited) undertook a significant expansion of its production capacity at its facilities to effectively meet the escalating market demands and strengthen its supply capabilities.

- 2023: The Indian government implemented a stricter set of emission norms and environmental standards for industrial processes, directly impacting carbon black production methodologies and necessitating further investment in cleaner technologies.

- [Insert Year]: [Insert Milestone Description - e.g., Introduction of a new sustainable production technology by [Company Name]]

- [Insert Year]: [Insert Milestone Description - e.g., Strategic partnership formed between [Company A] and [Company B] for R&D in advanced carbon black applications]

In-Depth India Carbon Black Market Market Outlook

The future outlook for the Indian carbon black market is exceptionally promising, underpinned by sustained industrial expansion, ongoing technological advancements, and a supportive governmental policy environment. Strategic investments in research and development (R&D) will be paramount for unlocking new applications and enhancing product performance, coupled with a strong and unwavering focus on sustainable and eco-friendly production methods, which will be crucial for long-term viability and market leadership. The market presents significant and attractive opportunities for both established industry giants and agile new entrants seeking to capitalize on the burgeoning demand for high-performance carbon black materials across a wide spectrum of applications. The potential for further market consolidation through mergers and acquisitions remains a significant strategic consideration for players aiming to expand their market share, technological capabilities, and geographical reach.

India Carbon Black Market Segmentation

-

1. Process Type

- 1.1. Furnace Black

- 1.2. Gas Black

- 1.3. Lamp Black

- 1.4. Thermal Black

-

2. Application

- 2.1. Tires and Industrial Rubber Products

- 2.2. Plastics

- 2.3. Toners and Printing Inks

- 2.4. Coatings

- 2.5. Textile Fibers

- 2.6. Other Application

India Carbon Black Market Segmentation By Geography

- 1. India

India Carbon Black Market Regional Market Share

Geographic Coverage of India Carbon Black Market

India Carbon Black Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Tire Industry; Increasing Market Penetration of Specialty Black; Growing Applications In the Batteries Segment

- 3.3. Market Restrains

- 3.3.1. Rising Prominence of Green Tires; Volatility In Prices of Raw Materials

- 3.4. Market Trends

- 3.4.1. Furnace Process Type to Dominate the Carbon Black Market in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Carbon Black Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 5.1.1. Furnace Black

- 5.1.2. Gas Black

- 5.1.3. Lamp Black

- 5.1.4. Thermal Black

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Tires and Industrial Rubber Products

- 5.2.2. Plastics

- 5.2.3. Toners and Printing Inks

- 5.2.4. Coatings

- 5.2.5. Textile Fibers

- 5.2.6. Other Application

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Jiangxi Heimao Carbon Black Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 OCI COMPANY Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Continental Carbon Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cabot Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Epsilon Carbon Private Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Himadri Speciality Chemical Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Atlas Organics Private Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PCBL (Phillips Carbon Black Limited)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BKT Carbon

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Birla Carbon

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Jiangxi Heimao Carbon Black Co Ltd

List of Figures

- Figure 1: India Carbon Black Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Carbon Black Market Share (%) by Company 2025

List of Tables

- Table 1: India Carbon Black Market Revenue billion Forecast, by Process Type 2020 & 2033

- Table 2: India Carbon Black Market Volume K Tons Forecast, by Process Type 2020 & 2033

- Table 3: India Carbon Black Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: India Carbon Black Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: India Carbon Black Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: India Carbon Black Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: India Carbon Black Market Revenue billion Forecast, by Process Type 2020 & 2033

- Table 8: India Carbon Black Market Volume K Tons Forecast, by Process Type 2020 & 2033

- Table 9: India Carbon Black Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: India Carbon Black Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: India Carbon Black Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: India Carbon Black Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Carbon Black Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the India Carbon Black Market?

Key companies in the market include Jiangxi Heimao Carbon Black Co Ltd, OCI COMPANY Ltd, Continental Carbon Company, Cabot Corporation, Epsilon Carbon Private Limited, Himadri Speciality Chemical Ltd, Atlas Organics Private Limited, PCBL (Phillips Carbon Black Limited), BKT Carbon, Birla Carbon.

3. What are the main segments of the India Carbon Black Market?

The market segments include Process Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.54 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Tire Industry; Increasing Market Penetration of Specialty Black; Growing Applications In the Batteries Segment.

6. What are the notable trends driving market growth?

Furnace Process Type to Dominate the Carbon Black Market in India.

7. Are there any restraints impacting market growth?

Rising Prominence of Green Tires; Volatility In Prices of Raw Materials.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Carbon Black Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Carbon Black Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Carbon Black Market?

To stay informed about further developments, trends, and reports in the India Carbon Black Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence