Key Insights

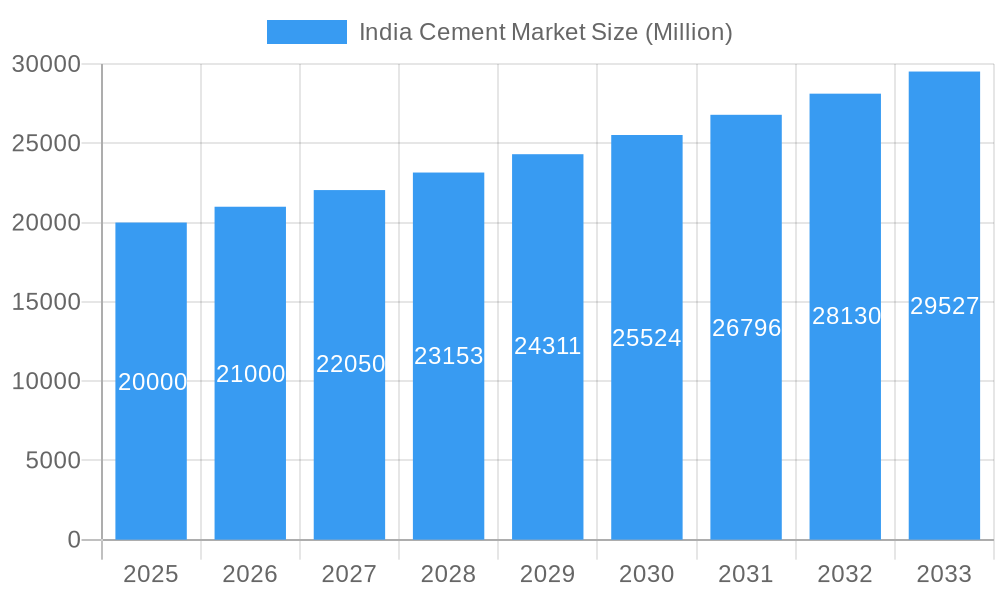

The Indian cement market, valued at $18.39 billion in the base year 2025, is poised for significant expansion, driven by a projected Compound Annual Growth Rate (CAGR) of 6.6% from 2025 to 2033. This growth is underpinned by robust infrastructure development initiatives, including extensive road construction, housing projects, and industrial expansion, which are substantial drivers of cement demand. Furthermore, rapid urbanization and a growing population are fueling consistent consumption within the residential sector. Government policies advocating for affordable housing and infrastructure enhancement further stimulate market growth. The increasing adoption of blended and innovative cement types, designed for specific construction requirements and improved sustainability, also contributes to market expansion. Despite challenges such as fluctuating raw material costs and stringent environmental regulations, the market's positive growth trajectory is expected to continue.

India Cement Market Market Size (In Billion)

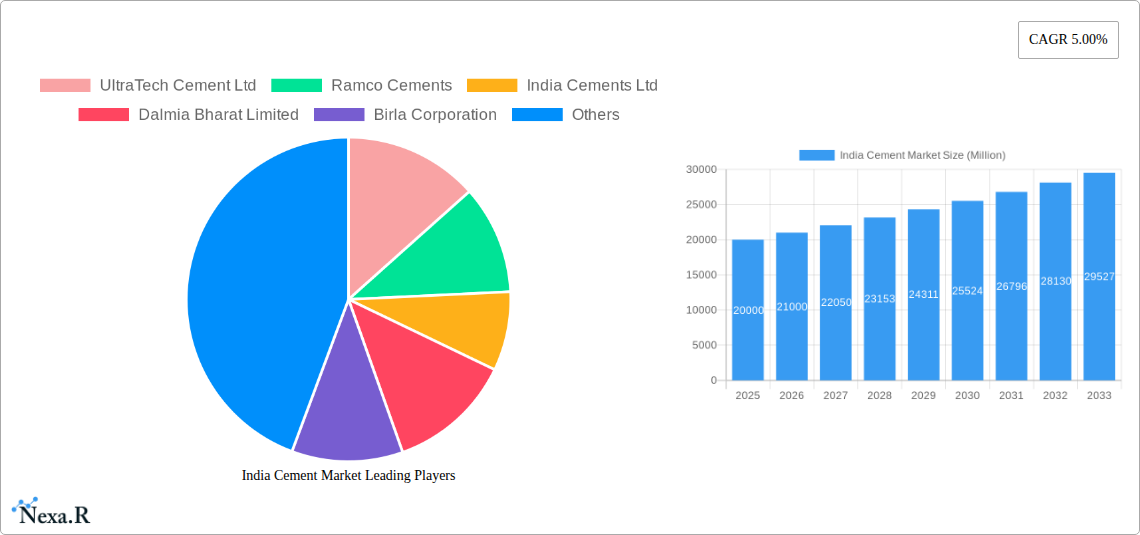

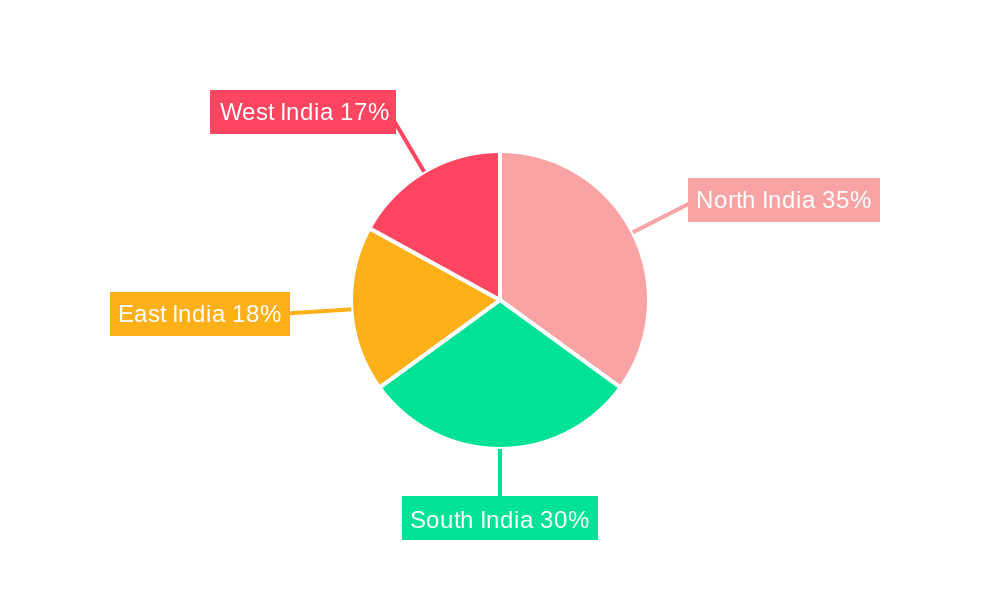

Regional market dynamics indicate that North and South India are anticipated to lead in market share due to their more developed infrastructure and housing markets. East and West India, while showing growth potential, may experience slower development influenced by disparities in infrastructure and economic activity. Intense competition among leading manufacturers, including UltraTech Cement, Ramco Cements, India Cements, Dalmia Bharat, Birla Corporation, Shree Cement, Nuvoco Vistas, Adani Group, JK Cement, and Heidelberg Materials, drives price competitiveness and product innovation. Market segmentation by product reveals that Ordinary Portland Cement currently dominates, with a steady increase in demand for blended and specialized cements driven by sustainability goals and evolving construction needs. Future market growth will be contingent upon the sustained momentum of infrastructure projects, supportive government policies, and ongoing industry innovation.

India Cement Market Company Market Share

India Cement Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India cement market, encompassing historical data (2019-2024), the current market landscape (Base Year: 2025), and future projections (Forecast Period: 2025-2033). The report delves into market dynamics, growth trends, regional dominance, product segmentation, key players, and emerging opportunities, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers parent market (Cement Industry in India) and child markets (Blended Cement, Ordinary Portland Cement, etc) for enhanced understanding.

India Cement Market Dynamics & Structure

The Indian cement market is characterized by a moderate level of concentration, with a few major players holding significant market share. Technological innovation, while present, faces barriers such as high initial investment costs and the need for skilled labor. Stringent regulatory frameworks concerning environmental protection and quality standards influence market operations. The market faces competition from alternative building materials, particularly in the residential sector. Mergers and acquisitions (M&A) activity is significant, reflecting consolidation efforts and expansion strategies within the sector.

- Market Concentration: UltraTech Cement Ltd holds approximately xx% market share, followed by Shree Cement Limited at xx%, and other major players each holding significant yet smaller percentages. The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, indicating a moderately concentrated market.

- Technological Innovation: Adoption of advanced technologies like waste heat recovery systems and alternative fuels is growing, driven by environmental concerns and cost efficiency. However, high capital expenditure and technological expertise remain barriers.

- Regulatory Framework: The Ministry of Environment, Forest and Climate Change (MoEFCC) regulations and Bureau of Indian Standards (BIS) quality standards directly impact production and distribution.

- Competitive Substitutes: Steel, timber, and other alternative building materials pose competitive pressure, particularly in the low-cost residential segment.

- M&A Activity: The past five years have witnessed xx major M&A deals, primarily focused on capacity expansion and market share consolidation. The average deal value has been approximately xx Million units.

India Cement Market Growth Trends & Insights

The Indian cement market has witnessed robust growth over the historical period (2019-2024), driven by sustained infrastructure development, urbanization, and rising construction activity. The market size expanded from xx Million units in 2019 to xx Million units in 2024, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This growth is expected to continue during the forecast period, albeit at a slightly moderated pace, influenced by factors such as government policies, economic cycles, and technological advancements. Market penetration is currently at xx%, with significant growth potential in under-served rural markets. Adoption of blended cements is gradually increasing, driven by environmental regulations and improved performance characteristics. Consumer behavior is shifting towards higher-quality, specialized cement products, fueled by rising disposable incomes and increased awareness of sustainable construction practices. Technological disruptions, such as the use of 3D printing in construction, are projected to create both opportunities and challenges for traditional cement manufacturers.

Dominant Regions, Countries, or Segments in India Cement Market

The Indian cement market demonstrates regional variations in growth and consumption patterns. Southern and Western regions display higher demand due to rapid urbanization and infrastructure development, while Northern and Eastern regions are experiencing increased growth potential with ongoing infrastructure projects. Within end-use sectors, infrastructure (driven by government spending) and residential construction (fueled by rising housing demand) are the dominant segments. In terms of product types, Ordinary Portland Cement (OPC) holds the largest market share, followed by blended cement.

- Key Drivers: Government initiatives like the National Infrastructure Pipeline (NIP) and affordable housing schemes significantly drive demand. Economic growth and rising urbanization further contribute to market expansion.

- Infrastructure Segment Dominance: Infrastructure projects account for xx% of total cement consumption, exhibiting significant growth potential with ongoing initiatives such as road construction, metro projects, and industrial complexes.

- Residential Segment Growth: The rising middle class and increased demand for housing are key drivers for growth within the residential segment. This segment accounts for approximately xx% of total cement consumption.

- OPC Market Leadership: OPC retains the largest market share due to its widespread availability, cost-effectiveness, and traditional use.

- Blended Cement Growth Potential: Blended cements are gaining traction due to their environmental benefits and performance characteristics, projecting xx% growth during the forecast period.

India Cement Market Product Landscape

The Indian cement market offers a range of products, including Ordinary Portland Cement (OPC), blended cement, white cement, and specialty cements. OPC remains the dominant product, but blended cements are gaining traction due to their superior performance and reduced environmental impact. White cement finds application in decorative purposes, while specialized cements cater to niche construction needs. Product innovation focuses on enhancing strength, durability, and sustainability. Key improvements include reduced carbon footprint, improved workability, and enhanced performance characteristics tailored to specific application requirements.

Key Drivers, Barriers & Challenges in India Cement Market

Key Drivers: Government infrastructure spending, rapid urbanization, rising housing demand, and industrial development significantly drive market growth. Economic growth and increased disposable incomes further fuel demand.

Challenges: The cement industry faces challenges from stringent environmental regulations, fluctuating raw material prices, and intense competition. Supply chain inefficiencies and logistics costs also affect profitability. Furthermore, inconsistent infrastructure and power availability can affect production efficiency.

Emerging Opportunities in India Cement Market

The India cement market presents several opportunities. Untapped potential exists in rural markets, requiring focused distribution strategies and tailored products. The rising demand for sustainable construction materials offers opportunities for green cement and alternative binders. Innovative applications, such as 3D printing technology in construction, offer further market expansion avenues.

Growth Accelerators in the India Cement Market Industry

Technological advancements, strategic partnerships, and government policies are key growth accelerators. Improvements in production efficiency and waste management will improve sustainability and lower production costs. Collaborations across the value chain and expansion into new geographic regions present significant growth potential.

Key Players Shaping the India Cement Market Market

- UltraTech Cement Ltd

- Ramco Cements

- India Cements Ltd

- Dalmia Bharat Limited

- Birla Corporation

- Shree Cement Limited

- Nuvoco Vistas Corp Ltd

- Adani Group

- JK Cement Ltd

- Heidelberg Materials

Notable Milestones in India Cement Market Sector

- June 2023: Shree Cement Limited expands cement production capacity to around 50 MTPA with a new greenfield plant.

- August 2023: Dalmia Bharat increases cement capacity by 2 million tons with a new grinding unit in Tamil Nadu.

- August 2023: Ambuja Cements (Adani Group) acquires a 57% stake in Sanghi Industries Ltd, significantly increasing its market presence.

In-Depth India Cement Market Market Outlook

The Indian cement market is poised for sustained growth, driven by the country's robust economic development and ongoing infrastructure projects. The forecast period will likely witness increased consolidation, with companies focusing on capacity expansion, technological upgrades, and sustainable practices. Strategic partnerships and innovations in product development will be crucial for maintaining market competitiveness. The market's long-term outlook remains positive, offering significant opportunities for players who can adapt to evolving market dynamics and consumer preferences.

India Cement Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Product

- 2.1. Blended Cement

- 2.2. Fiber Cement

- 2.3. Ordinary Portland Cement

- 2.4. White Cement

- 2.5. Other Types

India Cement Market Segmentation By Geography

- 1. India

India Cement Market Regional Market Share

Geographic Coverage of India Cement Market

India Cement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand from Paper and Packaging Industry; Shifting Consumer Preferences to Hot-melt Adhesives; Stringent Regulatory Policies

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Conditions Arising Due to COVID-19 Outbreak

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Cement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Blended Cement

- 5.2.2. Fiber Cement

- 5.2.3. Ordinary Portland Cement

- 5.2.4. White Cement

- 5.2.5. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 UltraTech Cement Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ramco Cements

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 India Cements Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dalmia Bharat Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Birla Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shree Cement Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nuvoco Vistas Corp Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Adani Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 JK Cement Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Heidelberg Materials

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 UltraTech Cement Ltd

List of Figures

- Figure 1: India Cement Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Cement Market Share (%) by Company 2025

List of Tables

- Table 1: India Cement Market Revenue billion Forecast, by End Use Sector 2020 & 2033

- Table 2: India Cement Market Revenue billion Forecast, by Product 2020 & 2033

- Table 3: India Cement Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Cement Market Revenue billion Forecast, by End Use Sector 2020 & 2033

- Table 5: India Cement Market Revenue billion Forecast, by Product 2020 & 2033

- Table 6: India Cement Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Cement Market?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the India Cement Market?

Key companies in the market include UltraTech Cement Ltd, Ramco Cements, India Cements Ltd, Dalmia Bharat Limited, Birla Corporation, Shree Cement Limited, Nuvoco Vistas Corp Ltd, Adani Group, JK Cement Ltd, Heidelberg Materials.

3. What are the main segments of the India Cement Market?

The market segments include End Use Sector, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.39 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand from Paper and Packaging Industry; Shifting Consumer Preferences to Hot-melt Adhesives; Stringent Regulatory Policies.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Unfavorable Conditions Arising Due to COVID-19 Outbreak.

8. Can you provide examples of recent developments in the market?

August 2023: The Adani Group's subsidiary, Ambuja Cements Ltd, announced the purchase of a 57% promoter stake in Indian cement manufacturer Sanghi Industries Ltd at an enterprise value of USD 606.5 million to expand its manufacturing capacity and market presence.August 2023: Dalmia Bharat commenced commercial production at its new Greenfield Cement Grinding unit in Sattur, Tamil Nadu, adding 2 million tons of cement capacity to the company’s overall installed capacity.June 2023: Shree Cement Limited's wholly owned subsidiary, Shree Cement East Pvt. Ltd completed a greenfield cement plant in the Purulia district of the Indian state of Bengal, increasing the group's cement production capacity to around 50 MTPA.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Cement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Cement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Cement Market?

To stay informed about further developments, trends, and reports in the India Cement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence