Key Insights

The India concrete admixtures market is poised for substantial expansion, propelled by aggressive infrastructure development and a booming construction sector. With a current market size of 787.73 million in the base year 2024, the market is projected to witness a Compound Annual Growth Rate (CAGR) of 10.03%. Key growth catalysts include government-backed infrastructure projects, rapid urbanization driving residential and commercial construction, and increasing adoption of high-performance concrete solutions. Demand for water reducers, particularly superplasticizers, is a significant contributor, underscoring the need for enhanced concrete workability and durability. Restraints include volatile raw material prices and potential supply chain disruptions. The infrastructure sector leads market segmentation, followed by residential and commercial segments. Superplasticizers dominate the sub-product category. Leading global and domestic players are actively engaged in market expansion. Regional analysis indicates widespread growth across India, with accelerated development anticipated in rapidly urbanizing areas.

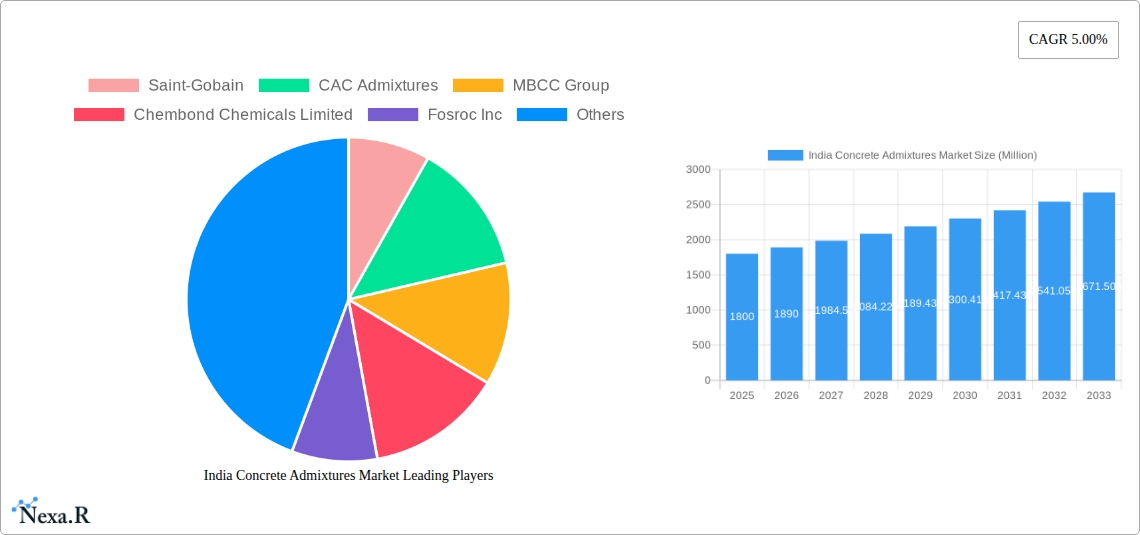

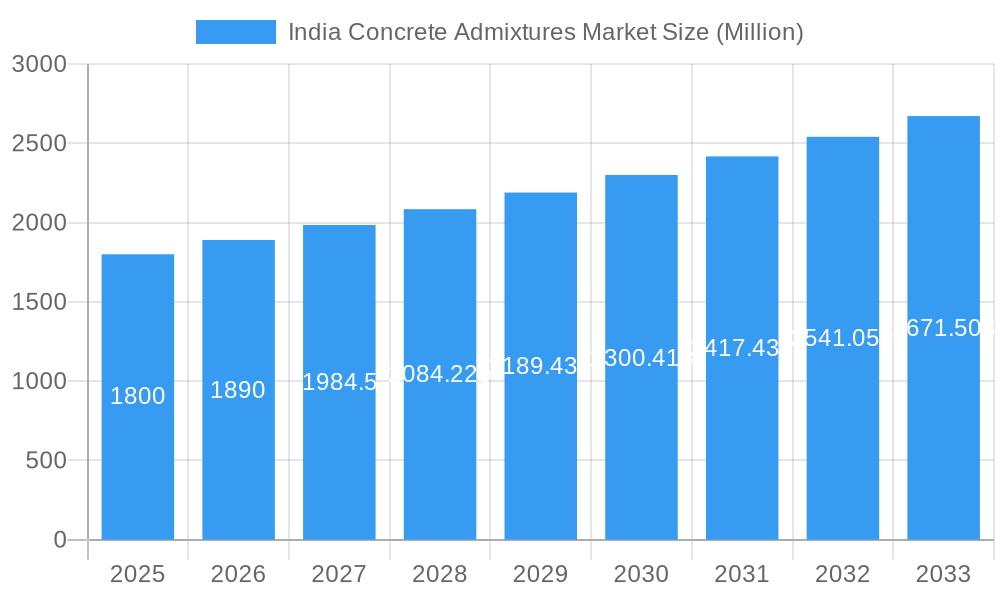

India Concrete Admixtures Market Market Size (In Million)

The competitive environment features a mix of established multinational corporations and agile domestic players. Multinational firms leverage advanced technology and global insights, while domestic companies are gaining traction through cost-effectiveness and localized understanding. Future growth is expected to be driven by technological innovations in admixture formulations, emphasizing sustainability and superior performance. The growing emphasis on green building practices will further stimulate demand for eco-friendly admixtures. Regulatory frameworks concerning concrete quality and sustainability will also significantly influence market dynamics. This expanding market presents considerable opportunities for established and emerging entities to capitalize on the escalating demand for advanced concrete admixtures within India's dynamic construction industry.

India Concrete Admixtures Market Company Market Share

India Concrete Admixtures Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the India Concrete Admixtures Market, covering the period 2019-2033. It offers invaluable insights into market dynamics, growth trends, regional performance, and the competitive landscape, equipping industry professionals with the knowledge to make informed strategic decisions. The report meticulously segments the market by end-use sector (Commercial, Industrial & Institutional, Infrastructure, Residential) and sub-product (Accelerator, Air Entraining Admixture, High Range Water Reducer (Super Plasticizer), Retarder, Shrinkage Reducing Admixture, Viscosity Modifier, Water Reducer (Plasticizer), Other Types), providing a granular understanding of market size and growth potential across various segments. Key players like Saint-Gobain, CAC Admixtures, MBCC Group, Chembond Chemicals Limited, Fosroc Inc, Don Construction Products Ltd, Sika A, MAPEI S p A, MC-Bauchemie, and ECMAS Group are analyzed in detail. The base year for the report is 2025, with the forecast period extending to 2033.

India Concrete Admixtures Market Market Dynamics & Structure

The India concrete admixtures market is characterized by moderate concentration, with a few major players holding significant market share. Technological innovation, particularly in developing sustainable and high-performance admixtures, is a key driver. Stringent regulatory frameworks focused on quality and environmental impact also shape market dynamics. The market experiences competitive pressure from substitute materials, and end-user demographics, including the growing construction sector, influence demand. M&A activity significantly impacts the market landscape. For example, Sika's acquisition of MBCC Group (excluding concrete admixture operations in select regions) and Saint-Gobain's acquisition of GCP Applied Technologies underscore the strategic importance of the sector.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on sustainable, high-performance admixtures like self-consolidating concrete additives.

- Regulatory Landscape: Increasing emphasis on quality standards and environmental regulations.

- Competitive Substitutes: Limited, but alternative methods exist for improving concrete properties.

- End-User Demographics: Driven by rapid urbanization and infrastructure development.

- M&A Activity: Significant consolidation observed in recent years, with xx major deals in the past five years.

India Concrete Admixtures Market Growth Trends & Insights

The India concrete admixtures market exhibits robust growth, driven by the nation's booming construction industry and expanding infrastructure projects. The market size, valued at xx Million units in 2024, is projected to reach xx Million units by 2033, registering a CAGR of xx% during the forecast period. Adoption rates are increasing due to rising awareness of the benefits of admixtures in enhancing concrete properties and durability. Technological disruptions, such as the development of advanced admixtures with improved performance characteristics, are accelerating market growth. Consumer behavior shifts toward prioritizing sustainability and cost-effectiveness further influence the demand for eco-friendly and high-value admixtures.

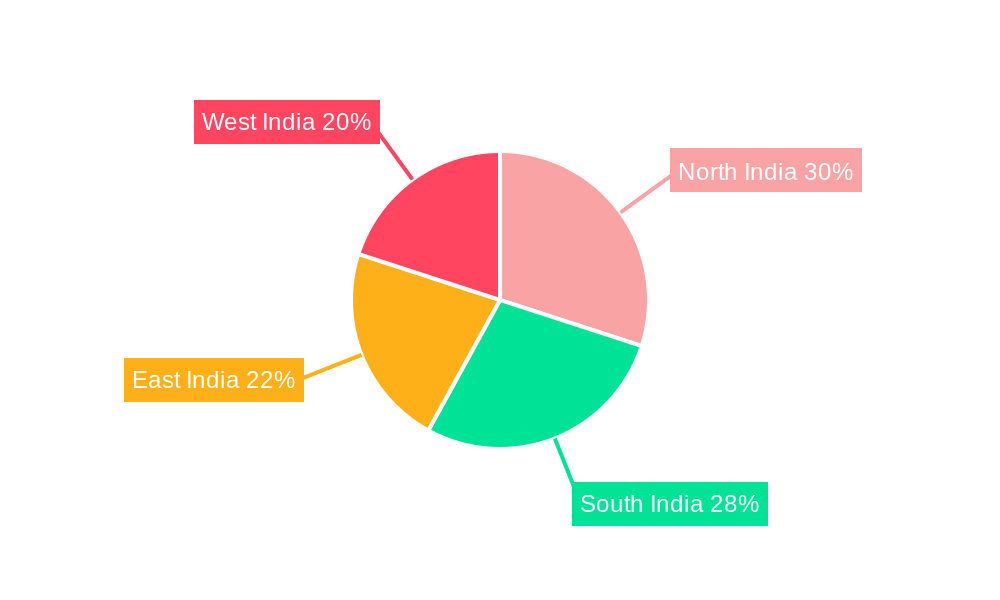

Dominant Regions, Countries, or Segments in India Concrete Admixtures Market

The Infrastructure segment holds the largest market share within the end-use sector, driven by massive government investments in infrastructure development initiatives such as the Bharatmala Pariyojana and Smart Cities Mission. The High Range Water Reducer (Super Plasticizer) sub-product segment dominates due to its widespread use in high-strength concrete applications. Geographically, major metropolitan areas and rapidly developing states exhibit the highest growth rates. The Southern and Western regions of India, witnessing significant infrastructure projects, show substantial market traction.

- Key Drivers:

- Government investments in infrastructure development.

- Rapid urbanization and construction activities.

- Rising demand for high-performance concrete.

- Dominance Factors:

- High construction activity in major cities.

- Government initiatives promoting infrastructure development.

- Increasing adoption of advanced concrete technologies.

India Concrete Admixtures Market Product Landscape

The India concrete admixtures market showcases a diverse product landscape, including accelerators, retarders, water reducers, and air-entraining admixtures. Continuous innovation focuses on developing high-performance admixtures with enhanced properties like improved workability, strength, durability, and sustainability. Unique selling propositions revolve around enhanced performance, cost-effectiveness, and environmentally friendly formulations. Technological advancements center on nanotechnology-based admixtures and self-healing concrete technologies.

Key Drivers, Barriers & Challenges in India Concrete Admixtures Market

Key Drivers:

- Government initiatives promoting infrastructure development.

- Rapid urbanization and industrialization.

- Growth in the construction sector.

Key Challenges & Restraints:

- Fluctuations in raw material prices.

- Supply chain disruptions.

- Intense competition from both domestic and international players.

Emerging Opportunities in India Concrete Admixtures Market

- Growing demand for sustainable and eco-friendly admixtures.

- Expansion into niche markets like precast concrete and 3D-printed concrete.

- Adoption of advanced technologies like nanotechnology in admixture development.

Growth Accelerators in the India Concrete Admixtures Market Industry

Technological advancements, strategic collaborations, and government support are key growth catalysts. Focus on developing high-performance, eco-friendly admixtures will further accelerate market growth. Expanding into rural markets and increasing awareness about the benefits of admixtures are also potential growth drivers.

Key Players Shaping the India Concrete Admixtures Market Market

- Saint-Gobain

- CAC Admixtures

- MBCC Group

- Chembond Chemicals Limited

- Fosroc Inc

- Don Construction Products Ltd

- Sika A

- MAPEI S p A

- MC-Bauchemie

- ECMAS Group

Notable Milestones in India Concrete Admixtures Market Sector

- September 2022: Saint-Gobain acquired GCP Applied Technologies Inc., strengthening its position in the cement additives and concrete admixtures market.

- April 2022: MC-Bauchemie India opened a new plant in Gujarat, expanding its manufacturing capacity.

- May 2023: Sika acquired MBCC Group (excluding concrete admixture operations in specific regions).

In-Depth India Concrete Admixtures Market Market Outlook

The India concrete admixtures market is poised for sustained growth, driven by robust infrastructure development and a flourishing construction sector. Strategic partnerships, technological innovation, and government initiatives will further propel market expansion. Companies focusing on sustainable and high-performance admixtures are expected to gain a competitive edge. The market holds significant potential for both domestic and international players.

India Concrete Admixtures Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Sub Product

- 2.1. Accelerator

- 2.2. Air Entraining Admixture

- 2.3. High Range Water Reducer (Super Plasticizer)

- 2.4. Retarder

- 2.5. Shrinkage Reducing Admixture

- 2.6. Viscosity Modifier

- 2.7. Water Reducer (Plasticizer)

- 2.8. Other Types

India Concrete Admixtures Market Segmentation By Geography

- 1. India

India Concrete Admixtures Market Regional Market Share

Geographic Coverage of India Concrete Admixtures Market

India Concrete Admixtures Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.03% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand from Paper and Packaging Industry; Shifting Consumer Preferences to Hot-melt Adhesives; Stringent Regulatory Policies

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Conditions Arising Due to COVID-19 Outbreak

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Concrete Admixtures Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Sub Product

- 5.2.1. Accelerator

- 5.2.2. Air Entraining Admixture

- 5.2.3. High Range Water Reducer (Super Plasticizer)

- 5.2.4. Retarder

- 5.2.5. Shrinkage Reducing Admixture

- 5.2.6. Viscosity Modifier

- 5.2.7. Water Reducer (Plasticizer)

- 5.2.8. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Saint-Gobain

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CAC Admixtures

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MBCC Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Chembond Chemicals Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fosroc Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Don Construction Products Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sika A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MAPEI S p A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MC-Bauchemie

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ECMAS Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Saint-Gobain

List of Figures

- Figure 1: India Concrete Admixtures Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Concrete Admixtures Market Share (%) by Company 2025

List of Tables

- Table 1: India Concrete Admixtures Market Revenue million Forecast, by End Use Sector 2020 & 2033

- Table 2: India Concrete Admixtures Market Revenue million Forecast, by Sub Product 2020 & 2033

- Table 3: India Concrete Admixtures Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: India Concrete Admixtures Market Revenue million Forecast, by End Use Sector 2020 & 2033

- Table 5: India Concrete Admixtures Market Revenue million Forecast, by Sub Product 2020 & 2033

- Table 6: India Concrete Admixtures Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Concrete Admixtures Market?

The projected CAGR is approximately 10.03%.

2. Which companies are prominent players in the India Concrete Admixtures Market?

Key companies in the market include Saint-Gobain, CAC Admixtures, MBCC Group, Chembond Chemicals Limited, Fosroc Inc, Don Construction Products Ltd, Sika A, MAPEI S p A, MC-Bauchemie, ECMAS Group.

3. What are the main segments of the India Concrete Admixtures Market?

The market segments include End Use Sector, Sub Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 787.73 million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand from Paper and Packaging Industry; Shifting Consumer Preferences to Hot-melt Adhesives; Stringent Regulatory Policies.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Unfavorable Conditions Arising Due to COVID-19 Outbreak.

8. Can you provide examples of recent developments in the market?

May 2023: Sika, a global leader in construction chemicals, acquired the MBCC Group, including its waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with the exception of its concrete admixture operations in Europe, North America, Australia, and New Zealand.September 2022: Saint-Gobain acquired GCP Applied Technologies Inc. to strengthen its market presence through a global platform with extensive expertise in cement additives, concrete admixtures, infrastructure, and commercial and residential building materials.April 2022: MC-Bauchemie India opened a new plant in Gujarat, India, to create a strong domestic manufacturing base and innovate and manufacture construction chemicals depending on the needs of its clients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Concrete Admixtures Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Concrete Admixtures Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Concrete Admixtures Market?

To stay informed about further developments, trends, and reports in the India Concrete Admixtures Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence